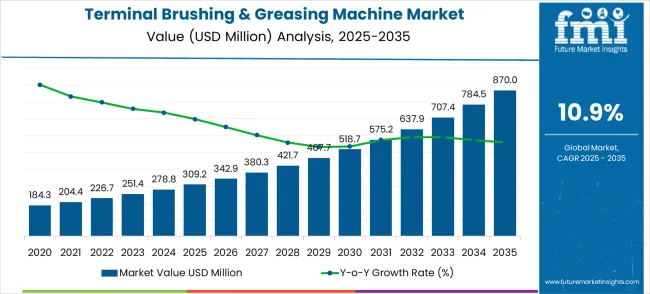

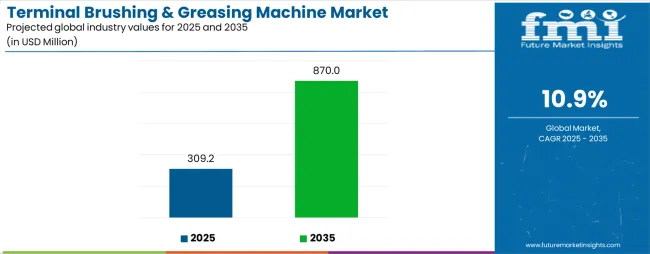

The terminal brushing and greasing machine market is forecasted to expand strongly between 2025 and 2035, moving from USD 309.2 million to USD 870.0 million, at a CAGR of 11%. This translates into a compound absolute increase of USD 560.8 million across the ten-year span, representing a growth multiple of about 2.8X. The magnitude of this rise demonstrates a consistent alignment of demand with evolving maintenance automation practices in electrical and industrial applications. The compounding effect of this absolute growth underscores the sustained relevance of terminal cleaning and lubrication solutions in enhancing operational reliability and reducing downtime.

Over successive years, the accumulation of this absolute growth is distributed in a manner that reflects strong early adoption, followed by steady scaling across industrial sectors. The market’s compounding pattern shows not only year-over-year expansion but also the cumulative strength of continuous adoption. Innovations in automated systems, integration with smart maintenance technologies, and expanding applications in high-volume industries further reinforce this growth trajectory. By 2035, the total compound absolute growth positions terminal brushing and greasing machines as an indispensable asset in equipment care, ensuring longevity and improved safety standards across electrical and mechanical systems. The compounded accumulation highlights the enduring market momentum.

The terminal brushing and greasing machine market is divided into automotive component manufacturing (39%), electrical and electronic assemblies (26%), heavy machinery maintenance (17%), aerospace and defense systems (10%), and specialized industrial equipment (8%). Automotive manufacturing leads demand as these machines ensure clean, corrosion-free terminals that improve battery life and electrical performance. Electrical and electronic assemblies adopt them for precision cleaning and lubrication of connectors, enhancing conductivity and reliability. Heavy machinery relies on these machines for long-term protection of power terminals under high load conditions. Aerospace and defense sectors prioritize them for safety-critical operations, while specialized industries use them to maintain performance in challenging environments.

Key trends include automation-enabled terminal processing, precision-controlled greasing systems, and eco-friendly lubrication materials. Manufacturers are focusing on compact, high-speed, and programmable machines to streamline large-scale production. Adoption is expanding in EV battery manufacturing, high-performance electronics, and renewable energy equipment. Strategic collaborations between machine manufacturers and end-use industries support customized solutions that enhance efficiency, durability, and performance reliability. Global market growth continues to be shaped by quality assurance, long-term maintenance benefits, and compliance with safety standards.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 309.2 million |

| Forecast Value in (2035F) | USD 870.0 million |

| Forecast CAGR (2025 to 2035) | 11% |

Market expansion is being supported by the rapid growth of electric vehicle manufacturing and the corresponding increase in battery production requirements that demand precise terminal finishing processes. Modern lithium-ion and advanced battery technologies require meticulous terminal preparation including surface cleaning, oxide removal, and protective grease application to ensure optimal electrical conductivity, prevent corrosion, and maintain long-term performance reliability. Terminal brushing and greasing processes have become critical quality control steps in battery manufacturing as they directly impact battery safety, efficiency, and operational lifespan.

The increasing automation of battery manufacturing processes is driving demand for sophisticated terminal finishing equipment that can deliver consistent results at high production volumes while meeting stringent quality standards. Battery manufacturers are implementing automated terminal brushing and greasing systems to eliminate human error, reduce processing time, and ensure uniform application of protective materials across diverse battery types and configurations. The growing focus on battery safety and reliability in electric vehicles and energy storage applications is creating demand for advanced terminal finishing technologies that support enhanced performance requirements and extended operational life.

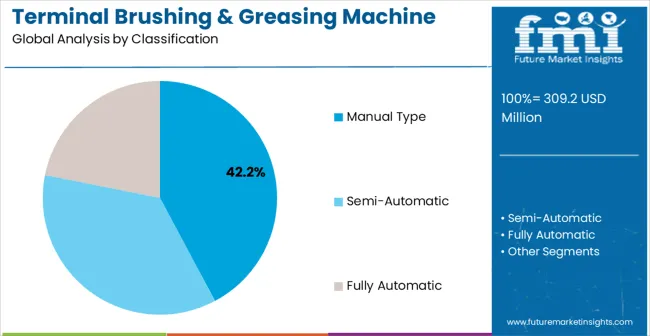

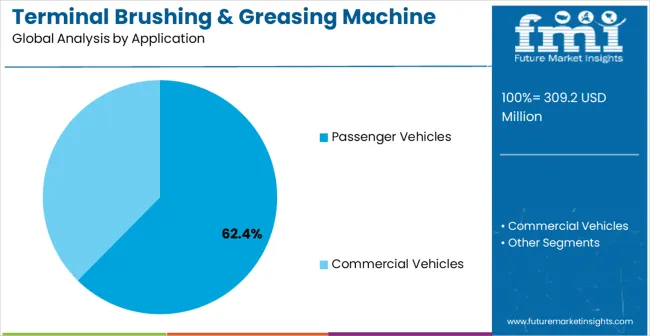

The market is segmented by machine type, vehicle type, and region. By machine type, the market is divided into manual type, semi-automatic, and fully automatic. Based on vehicle type, the market is categorized into passenger vehicles and commercial vehicles. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

Manual type terminal brushing & greasing machines are projected to account for 43.2% of the terminal brushing & greasing machine market in 2025. This leading share is supported by the cost-effectiveness and operational flexibility that manual systems provide for small to medium-scale battery manufacturing operations and specialized applications requiring customized processing approaches. Manual machines offer precise operator control over terminal finishing processes while maintaining lower capital investment requirements compared to fully automated alternatives. The segment benefits from widespread adoption in emerging markets, retrofit applications, and production environments where batch processing and product variety require human oversight and adjustment capabilities.

Manual terminal finishing equipment continues advancing through integration of ergonomic improvements, precision tooling, and enhanced safety features that optimize operator productivity while maintaining the fundamental advantages of human-controlled processing. The segment growth reflects ongoing demand from diverse battery manufacturers who require flexible terminal finishing solutions that can accommodate varying production volumes, multiple battery types, and changing processing requirements without significant capital investment in automated systems.

Passenger vehicles are expected to represent 62.4% of terminal brushing & greasing machine demand in 2025. This dominant share reflects the extensive battery requirements for electric passenger cars, plug-in hybrid vehicles, and advanced automotive electrical systems that require reliable terminal finishing processes. Modern passenger vehicle batteries feature complex terminal configurations and demanding performance requirements that benefit from specialized brushing and greasing equipment designed for automotive applications.

Passenger vehicle battery manufacturing involves diverse terminal finishing requirements including different battery chemistries, form factors, and performance specifications that require versatile terminal processing capabilities. The segment expansion reflects increasing automotive electrification, growing consumer acceptance of electric vehicles, and expanding production capacity among automotive battery manufacturers who implement advanced terminal finishing technologies to meet automotive quality and safety standards while supporting high-volume manufacturing requirements.

The terminal brushing & greasing machine market is advancing rapidly due to electric vehicle market expansion and growing battery manufacturing capacity requirements. The market faces challenges including high equipment costs for advanced automated systems, need for skilled technical personnel, and varying terminal finishing requirements across different battery technologies. Technological advancement efforts and cost optimization initiatives continue to influence equipment development and market expansion patterns.

The growing implementation of intelligent automation and digital connectivity in terminal brushing & greasing machines is enabling enhanced process control, quality monitoring, and predictive maintenance capabilities that improve overall equipment effectiveness and production reliability. Smart terminal finishing systems provide real-time process feedback, automated parameter adjustment, and integrated quality control that support advanced manufacturing requirements and comprehensive traceability. These technological advances enable battery manufacturers to achieve higher levels of process consistency and quality assurance while reducing operational costs and improving equipment utilization.

Equipment manufacturers are developing advanced terminal finishing systems that accommodate diverse battery chemistries including lithium-ion, solid-state, and next-generation technologies with varying terminal configurations and processing requirements. Next-generation terminal brushing and greasing equipment provides flexible processing capabilities, modular tooling systems, and programmable parameter control that enable manufacturers to process multiple battery types on single production lines while maintaining optimal finishing quality and throughput efficiency.

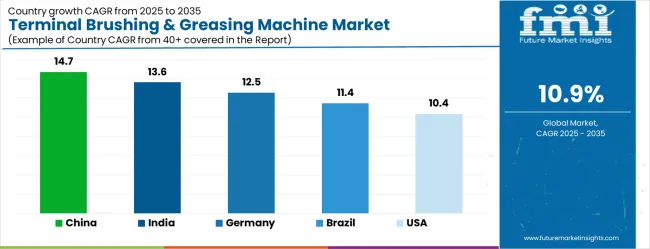

| Country | CAGR (2025-2035) |

|---|---|

| China | 14.7% |

| India | 13.6% |

| Germany | 12.5% |

| Brazil | 11.4% |

| United States | 10.4% |

| United Kingdom | 9.3% |

| Japan | 8.2% |

The terminal brushing & greasing machine market demonstrates strong growth patterns across key countries, with China leading at a 14.7% CAGR through 2035, driven by massive electric vehicle manufacturing expansion, comprehensive battery production capacity development, and government support for automotive electrification initiatives. India follows at 13.6%, supported by growing electric vehicle adoption, expanding battery manufacturing investments, and increasing automation requirements in emerging industrial sectors. Germany records 12.5% growth, prioritizing advanced manufacturing technologies, precision equipment development, and comprehensive automotive industry support for electric vehicle production. Brazil shows robust growth at 11.4%, driven by expanding automotive sector electrification and growing battery manufacturing capacity. The United States maintains 10.4% growth, focusing on advanced battery technologies, automated manufacturing systems, and comprehensive supply chain development. The United Kingdom demonstrates 9.3% expansion, supported by electric vehicle market development and advanced manufacturing initiatives. Japan records 8.2% growth, leveraging technological innovation, precision manufacturing expertise, and comprehensive automotive industry transformation toward electrification.

The report covers an in-depth analysis of 40+ countries, Top-performing countries are highlighted below.

The terminal brushing & greasing machines market in China is projected to expand at the highest growth rate with a CAGR of 14.7% through 2035, driven by massive electric vehicle manufacturing capacity expansion, comprehensive battery production development, and government initiatives supporting automotive electrification across domestic and export markets. The country's extensive manufacturing infrastructure includes significant investments in battery production facilities, terminal finishing equipment, and automated assembly systems that require advanced terminal processing solutions. Major automotive manufacturers and battery companies are implementing sophisticated terminal finishing technologies to support high-volume production requirements while meeting international quality and safety standards for electric vehicle applications.

The terminal brushing & greasing machines market in India is projected to grow at a CAGR of 13.6%, supported by expanding electric vehicle adoption, growing battery manufacturing investments, and increasing industrial automation requirements across diverse manufacturing sectors. The country's prioritizing on automotive sector development and clean energy initiatives is driving demand for advanced terminal finishing equipment that supports domestic battery production capabilities while meeting international quality standards. Government programs promoting manufacturing excellence and technology advancement are creating favorable conditions for terminal processing equipment adoption across battery manufacturing and automotive assembly operations.

The terminal brushing & greasing machines market in Germany is projected to expand at a CAGR of 12.5%, supported by the country's leadership in advanced manufacturing technologies, precision engineering capabilities, and comprehensive automotive industry transformation toward electric vehicle production. German manufacturers and battery companies are implementing sophisticated terminal finishing solutions that meet stringent quality standards while supporting advanced battery technologies and demanding automotive applications. The country's extensive automotive manufacturing infrastructure is driving significant terminal processing equipment demand for precision applications and flexible production systems.

The terminal brushing & greasing machines market in Brazil is projected to grow at a CAGR of 11.4%, driven by expanding automotive sector electrification, growing battery manufacturing capacity, and increasing industrial automation adoption across diverse manufacturing applications. Brazilian manufacturers and automotive companies are investing in terminal finishing solutions to enhance production capabilities and quality standards while supporting domestic electric vehicle market development. Government programs supporting industrial modernization are facilitating access to advanced terminal processing technologies and technical expertise.

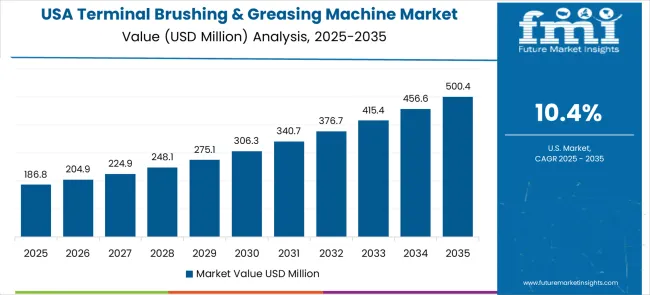

The terminal brushing & greasing machines market in the United States is projected to expand at a CAGR of 10.4%, driven by advanced battery technology development, expanding electric vehicle manufacturing capacity, and ongoing manufacturing innovation initiatives across automotive and energy storage sectors. American manufacturers and battery companies are implementing sophisticated terminal finishing solutions to maintain technological leadership and production efficiency while supporting diverse battery applications including automotive, grid storage, and specialty technologies. The automotive industry is driving significant terminal processing equipment demand for advanced manufacturing and quality assurance applications.

The terminal brushing & greasing machines market in the United Kingdom is projected to grow at a CAGR of 9.3%, supported by advanced manufacturing development, electric vehicle market expansion, and comprehensive industrial modernization initiatives across automotive and energy sectors. British manufacturers and automotive companies are investing in terminal finishing solutions to support advanced battery technologies and demanding applications while maintaining competitive manufacturing capabilities. The country's established automotive industry is facilitating terminal processing equipment adoption through comprehensive manufacturing support and technical expertise development.

The terminal brushing & greasing machines market in Japan is projected to grow at a CAGR of 8.2%, supported by technological innovation capabilities, precision manufacturing expertise, and comprehensive automotive industry transformation toward advanced electric vehicle technologies. Japanese manufacturers and automotive companies are implementing sophisticated terminal finishing solutions that demonstrate superior performance characteristics while supporting diverse battery applications requiring precision and reliability. The country's advanced manufacturing sectors are driving demand for high-quality terminal processing equipment that supports advanced operations and comprehensive quality assurance.

The terminal brushing & greasing machine market is witnessing strong traction, with China leading at 14.7% CAGR through 2035, powered by robust investment in electric vehicle manufacturing, battery assembly lines, and automation upgrades across battery and powertrain facilities. India follows with a 13.6% CAGR, fueled by rising EV adoption, domestic battery cell production, and tooling upgrades in manufacturing clusters. Germany is projected to grow at 12.5%, driven by automotive OEM modernization and integration of precision greasing/brush finishing in high-end battery and e-mobility plants. Brazil records 11.4% CAGR, supported by expanding electric vehicle and battery infrastructure investments. The United States shows solid growth at 10.4%, aided by EV incentives, battery gigafactory expansion, and automation upgrades in existing manufacturing lines.

China is projected to grow at a 14.7% CAGR through 2035, fueled by rapid EV and battery manufacturing build-outs, powertrain remanufacturing, and aggressive plant automation. Precision terminal finishing is becoming standard in high-throughput battery lines for consistency, conductivity, and corrosion control, lifting demand for integrated brushing/greasing stations.

India is expected to advance at a 13.6% CAGR, underpinned by domestic EV programs, electronics assembly growth, and rising standards for connector reliability in automotive and industrial equipment. Tier-1s are upgrading lines with modular brushing and micro-dose greasing to reduce failure rates and warranty costs.

Germany will grow at 12.5% CAGR as OEMs and Tier-1s modernize e-mobility and energy systems production. Emphasis on precision, process capability (Cp/Cpk), and clean manufacturing raises the bar for servo-controlled brushing and metered micro-lubrication with data logging.

Brazil is set to expand at 11.4% CAGR, supported by automotive localization, grid modernization, and growing battery/renewables supply chains. Plants prioritize rugged, serviceable systems that tolerate variable utilities while delivering consistent terminal finish quality.

The United States will grow at 10.4% CAGR, driven by EV incentives, grid hardware upgrades, and the expansion of battery gigafactories. Manufacturers value digital traceability and closed-loop QC (torque, force, vision) to meet compliance and warranty requirements.

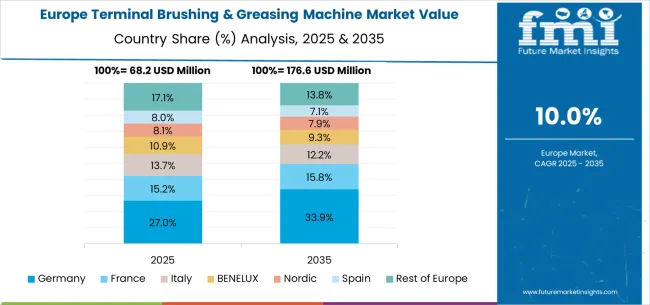

The terminal brushing & greasing machine market in Europe is projected to grow from USD 83.6 million in 2025 to USD 198.4 million by 2035, registering a CAGR of 9.0% over the forecast period. Germany is expected to maintain its leadership with 34.2% market share in 2025, projected to grow to 35.8% by 2035, supported by its advanced automotive manufacturing sector, precision engineering capabilities, and comprehensive electric vehicle production development. France follows with 18.7% market share in 2025, expected to reach 19.3% by 2035, driven by automotive sector modernization and battery manufacturing investments.

The Rest of Europe region is projected to maintain stable share at 16.4% throughout the forecast period, attributed to growing industrial automation in Eastern European countries and expanding battery manufacturing capabilities. United Kingdom contributes 15.2% in 2025, projected to reach 14.8% by 2035, supported by advanced manufacturing initiatives and electric vehicle market development. Italy maintains 15.5% share in 2025, expected to grow to 15.3% by 2035, while other European countries demonstrate steady growth patterns reflecting regional automotive electrification and manufacturing automation trends.

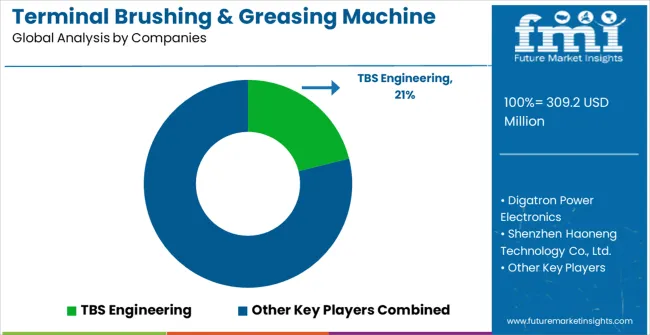

The terminal brushing & greasing machine market is characterized by competition among specialized battery manufacturing equipment providers, automation system integrators, and precision machinery manufacturers. Companies are investing in advanced automation technologies, precision processing capabilities, multi-chemistry compatibility, and comprehensive system integration to deliver efficient, reliable, and cost-effective terminal finishing solutions. Strategic partnerships, technological innovation, and global market expansion initiatives are central to strengthening product portfolios and market presence.

TBS Engineering, specializing in battery manufacturing equipment, offers comprehensive terminal brushing & greasing solutions with focus on precision, reliability, and process optimization for diverse battery applications. Digatron Power Electronics provides advanced terminal finishing systems prioritizing automation, quality control, and integration capabilities for high-volume manufacturing operations. Shenzhen Haoneng Technology Co., Ltd. delivers cost-effective terminal processing equipment with focus on efficiency and operational flexibility for emerging market applications.

Wirtz Manufacturing Co. prioritizing on robust terminal finishing systems with focus on durability and performance for demanding industrial applications. MAC Engineering & Equipment Co. provides specialized terminal processing solutions with focus on customization and technical support for diverse battery manufacturing requirements. Manz AG offers comprehensive automation solutions including advanced terminal finishing capabilities with focus on Industry 4.0 integration and process optimization. Other key players including Cubic Battery Automation, Tmax Battery Equipments, Chuanghe Automation, KUKA, Zesar Accumation GmbH, and MOOJIN service contribute specialized expertise and diverse product offerings across global and regional markets.

Terminal brushing & greasing machines represent critical quality control equipment in battery manufacturing processes, enabling precise terminal surface preparation and protective coating application for optimal battery performance and longevity. With the market expanding from USD 309.2M to USD 870.0M at 11% CAGR, driven by electric vehicle manufacturing growth, battery production capacity expansion, and increasing automation requirements, this specialized equipment segment requires coordinated stakeholder action to address technology advancement, manufacturing capacity, and market accessibility challenges.

Electric Vehicle Manufacturing Incentives: Implement comprehensive incentive programs for domestic battery manufacturing that include terminal finishing equipment investments, recognizing the critical role of terminal processing in battery quality and safety standards.

Technical Training and Workforce Development: Invest in specialized training programs for battery manufacturing technicians and engineers that include terminal processing equipment operation, maintenance, and quality control procedures essential for advanced manufacturing operations.

Research and Development Funding: Provide targeted funding for terminal processing technology advancement, automation development, and Industry 4.0 integration that enhances domestic battery manufacturing capabilities and competitiveness.

Manufacturing Infrastructure Support: Develop specialized industrial zones and technical support facilities for battery equipment manufacturers that provide access to testing facilities, technical expertise, and comprehensive manufacturing support services.

Standards and Certification Development: Establish comprehensive quality standards and certification programs for terminal finishing equipment that ensure consistent performance, safety compliance, and international market acceptance.

Technical Standards Development: Lead initiatives to develop standardized terminal processing protocols across different battery chemistries and applications, ensuring consistent quality and performance across manufacturers and equipment suppliers.

Technology Transfer Programs: Facilitate knowledge sharing and technology transfer between equipment manufacturers, battery companies, and research institutions to accelerate terminal processing innovation and capability development.

Training and Certification Coordination: Develop comprehensive training programs and certification standards for terminal processing equipment operators, maintenance technicians, and quality control personnel to ensure skilled workforce availability.

Market Intelligence and Research: Create shared databases tracking terminal processing requirements, equipment performance data, and technology trends to guide industry-wide development priorities and investment decisions.

Safety and Best Practices Guidelines: Establish comprehensive safety protocols and best practices for terminal brushing & greasing operations including equipment safety, process optimization, and quality assurance procedures.

Multi-Chemistry Processing Capabilities: Develop advanced terminal finishing systems that accommodate diverse battery chemistries including lithium-ion, solid-state, and emerging technologies with varying terminal configurations and processing requirements.

Automation and Integration Excellence: Focus on comprehensive automation solutions that integrate terminal brushing and greasing with upstream and downstream processes, providing complete terminal finishing cells that optimize production efficiency and quality control.

Precision Engineering and Quality Control: Invest in advanced precision technologies and quality monitoring systems that ensure consistent terminal finishing performance across diverse battery types and production volumes while maintaining stringent quality standards.

Industry 4.0 Integration: Incorporate advanced connectivity, data analytics, and predictive maintenance capabilities that provide battery manufacturers with comprehensive process monitoring, optimization insights, and proactive equipment management.

Flexible Manufacturing Solutions: Develop modular equipment designs that enable rapid reconfiguration for different battery types, production volumes, and processing requirements while maintaining optimal performance and cost-effectiveness.

Comprehensive Process Integration: Implement terminal brushing & greasing equipment as integral components of complete battery manufacturing lines with optimized workflow, quality control, and production efficiency that maximizes overall manufacturing performance.

Advanced Quality Management: Develop sophisticated quality control protocols that utilize terminal finishing equipment capabilities for comprehensive process monitoring, defect prevention, and performance optimization across diverse battery applications.

Operator Training and Development: Invest in comprehensive training programs for equipment operators and maintenance personnel that ensure optimal terminal processing performance, equipment longevity, and consistent quality results.

Preventive Maintenance Excellence: Implement systematic maintenance programs that maximize terminal finishing equipment availability, performance consistency, and operational life while minimizing downtime and maintenance costs.

Process Optimization and Continuous Improvement: Utilize equipment data and performance feedback to continuously optimize terminal processing parameters, improve quality outcomes, and enhance production efficiency across diverse battery manufacturing applications.

Advanced Automation Components: Supply sophisticated control systems, precision actuators, and monitoring technologies that enable terminal brushing & greasing equipment to deliver consistent performance and comprehensive process control.

Specialized Tooling and Consumables: Develop advanced brushing tools, greasing systems, and precision application technologies that optimize terminal finishing quality while minimizing material consumption and process time.

Sensor and Monitoring Technologies: Provide comprehensive sensing and monitoring solutions that enable real-time process control, quality verification, and predictive maintenance for optimal terminal finishing equipment performance.

Materials and Chemistry Solutions: Supply advanced greasing materials, surface treatments, and protective coatings specifically formulated for diverse battery terminal applications and processing requirements.

Integration and Connectivity Solutions: Develop communication protocols, data management systems, and integration technologies that enable terminal finishing equipment to operate effectively within comprehensive manufacturing execution systems.

Equipment Financing Programs: Develop specialized financing solutions for battery manufacturers investing in terminal finishing equipment that recognize the critical role of these systems in overall production capability and quality assurance.

Technology Development Investment: Support research and development initiatives focused on next-generation terminal processing technologies, automation advancement, and Industry 4.0 integration that differentiate equipment offerings in competitive markets.

Manufacturing Capacity Expansion: Finance equipment manufacturing facility development and production capacity expansion that supports growing demand for terminal brushing & greasing machines across global battery manufacturing markets.

Market Expansion Capital: Back companies expanding terminal finishing equipment distribution into emerging markets where electric vehicle adoption and battery manufacturing capacity are growing rapidly.

Innovation Ecosystem Development: Support venture investments in complementary technologies including advanced materials, precision sensors, and intelligent control systems that enhance terminal processing equipment capabilities and market value.

Comprehensive Equipment Selection: Evaluate terminal brushing & greasing machines based on total cost of ownership including equipment cost, operating expenses, maintenance requirements, and quality outcomes rather than initial purchase price alone.

Integration Planning Excellence: Develop comprehensive integration plans that optimize terminal finishing equipment placement within overall production lines while maximizing workflow efficiency and quality control effectiveness.

Performance Monitoring and Optimization: Implement systematic performance tracking and optimization programs that utilize equipment capabilities to continuously improve terminal processing quality, efficiency, and cost-effectiveness.

Maintenance Excellence Programs: Establish comprehensive maintenance protocols that ensure consistent terminal finishing equipment performance while minimizing downtime and extending operational life through proactive care and component replacement.

Quality Management Integration: Utilize terminal brushing & greasing equipment as integral components of comprehensive quality management systems that ensure consistent battery performance and regulatory compliance across diverse applications.

The terminal brushing & greasing machine market's continued expansion requires addressing the fundamental challenges of delivering consistent terminal finishing quality across diverse battery chemistries and applications while managing the complexity of automated processing systems, quality control requirements, and the need for skilled technical personnel capable of operating sophisticated battery manufacturing equipment.

| Item | Value |

|---|---|

| Quantitative Units (2025) | USD 309.2 million |

| Machine Type | Manual Type, Semi-Automatic, Fully Automatic |

| Vehicle Type | Passenger Vehicles, Commercial Vehicles |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | TBS Engineering, Digatron Power Electronics, Shenzhen Haoneng Technology Co., Ltd., Wirtz Manufacturing Co., MAC Engineering & Equipment Co., Manz AG, Cubic Battery Automation, Tmax Battery Equipments, Chuanghe Automation, KUKA, Zesar Accumation GmbH, MOOJIN service |

| Additional Attributes | Dollar sales by machine type and vehicle type segments, regional demand trends across North America, Europe, and Asia-Pacific, competitive landscape with specialized battery manufacturing equipment providers and automation system integrators, buyer preferences for different automation levels and processing capabilities, integration with comprehensive battery manufacturing lines and quality control systems, innovations in multi-chemistry processing capabilities and Industry 4.0 technologies, and adoption of advanced automation and predictive maintenance systems for enhanced performance and operational efficiency |

The global high-precision confocal sensor market is estimated to be valued at USD 182.3 million in 2025.

The market size for the high-precision confocal sensor market is projected to reach USD 468.7 million by 2035.

The high-precision confocal sensor market is expected to grow at a 9.9% CAGR between 2025 and 2035.

The key product types in high-precision confocal sensor market are point sensors and line sensors.

In terms of application, semiconductors segment to command 41.0% share in the high-precision confocal sensor market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Terminal Sterilization Services Market Size and Share Forecast Outlook 2025 to 2035

Terminal Management System Market Size, Share, and Forecast 2025 to 2035

Terminal Sterilization Market - Demand & Forecast 2025 to 2035

Terminal Automation Market Growth - Trends, Analysis & Forecast by Offerings, End-User and Region through 2035

LEO Terminal Market Size and Share Forecast Outlook 2025 to 2035

LNG Terminal Market Size and Share Forecast Outlook 2025 to 2035

POS Terminal Market Insights – Growth & Trends 2024-2034

Bulk Terminal Market Forecast and Outlook 2025 to 2035

SatCom Terminal Market Analysis - Growth, Demand & Forecast 2025 to 2035

Mini POS Terminals Market Size and Share Forecast Outlook 2025 to 2035

Oil & Gas Terminal Automation Market Growth – Trends & Forecast 2025-2035

Wireless POS Terminal Market Growth – Trends & Industry Forecast 2025 to 2035

Biometric PoS Terminals Market by Technology, End-Use, and Region - Growth, Trends, and Forecast through 2025 to 2035

Restaurant POS Terminals Market Size and Share Forecast Outlook 2025 to 2035

Outdoor Payment Terminal Market Size and Share Forecast Outlook 2025 to 2035

Copper and Aluminum Terminal Blocks Market Size and Share Forecast Outlook 2025 to 2035

Very Small Aperture Terminal (VSAT) Market Size and Share Forecast Outlook 2025 to 2035

Automated Container Terminal Market Analysis by Automation, Product, Project, and Region: Forecast for 2025 to 2035

Contactless Payment Terminals Market

Bromodomain and Extraterminal Domain (BET) Inhibitors Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA