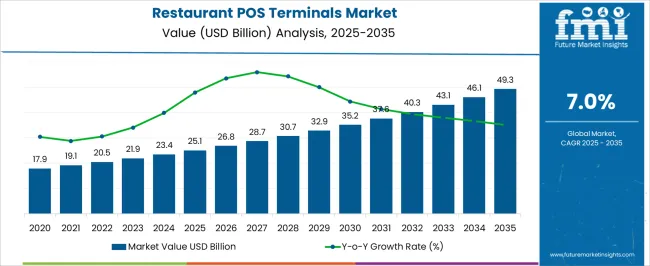

The restaurant POS terminals market is estimated to be valued at USD 25.1 billion in 2025 and is projected to reach USD 49.3 billion by 2035, registering a compound annual growth rate (CAGR) of 7.0% over the forecast period.

This lift of about USD 9.9 billion implies an approximate 6.9% CAGR across the block and signals durable momentum. The year on year rise from USD 25.1 billion in 2025 to USD 32.9 billion in 2029 shows steady acceleration supported by cloud subscriptions, EMV and PCI upgrades, and replacement of legacy cash registers. Contactless acceptance, QR ordering, and tighter links to kitchen display systems and inventory are reinforcing the curve. With franchise rollouts scaling and multi location chains standardizing devices and software, terminal demand is being underpinned by compliance, payments breadth, and unified ordering workflows. Between 2025 and 2030, the pattern highlights the role of feature depth and rising deployments in driving terminal refresh.

As restaurant groups target longer hardware life and faster throughput per hour, the choice of POS architecture becomes decisive. Vendors are responding with compact devices, offline resilience, tokenization, chargeback mitigation, and real time analytics that improve order accuracy and margin capture. The transition from USD 28.7 billion in 2027 to USD 35.0 billion in 2030 illustrates a firm adoption curve, with opportunities spreading across quick service, fast casual, full service, delivery first kitchens, and kiosk fleets. Integrations with aggregators, automated tip management, and payment facilitation models are raising recurring revenue density per location. The trajectory points to a clear pathway of expansion, with stakeholders positioned to benefit from higher card present acceptance, richer software attach rates, and disciplined total cost of ownership in enterprise scale rollouts.

| Metric | Value |

|---|---|

| Restaurant POS Terminals Market Estimated Value in (2025 E) | USD 25.1 billion |

| Restaurant POS Terminals Market Forecast Value in (2035 F) | USD 49.3 billion |

| Forecast CAGR (2025 to 2035) | 7.0% |

The restaurant POS terminals market secures a focused yet influential share across several technology and service-driven domains, reflecting its integration into foodservice operations and customer engagement. Within the overall point-of-sale systems market, restaurant POS terminals account for about 18%, showing their importance as a major end-use segment alongside retail and entertainment. In the hospitality technology market, their share is close to 14%, since POS terminals are a central element in streamlining order management and enhancing service in dining establishments. Within the retail technology solutions market, the contribution is more modest at nearly 6%, as restaurants represent a smaller but significant subset compared with large retail chains and e-commerce. In the foodservice equipment and technology market, restaurant POS terminals hold around 12%, given their role in combining hardware and software to support kitchen integration, inventory, and billing.

Finally, in the payment processing and fintech solutions market, restaurant POS terminals contribute approximately 7%, reflecting their growing adoption for contactless, digital wallet, and integrated payment systems within dining environments. Collectively, these percentages demonstrate that restaurant POS terminals are most impactful within POS systems and hospitality technology markets, while maintaining smaller yet meaningful shares in retail and fintech ecosystems. Their positioning highlights both their specialized role in restaurants and their broader influence as digital transformation reshapes how businesses interact with consumers in service-driven industries.

The restaurant POS terminals market is witnessing significant expansion, driven by increasing demand for automation in foodservice operations, rising adoption of contactless payment technologies, and a shift toward omnichannel ordering systems. As dining establishments face mounting labor costs and evolving customer expectations, POS systems have emerged as essential tools for streamlining order management, improving accuracy, and enhancing the dining experience.

Growth is further bolstered by government initiatives promoting digital transactions, especially in emerging economies. Integration with CRM, loyalty programs, and analytics has elevated the strategic importance of POS terminals beyond billing functions.

The push toward cloud-based infrastructure and mobile payment capabilities is also enabling scalable deployment across independent restaurants, chains, and quick service formats.

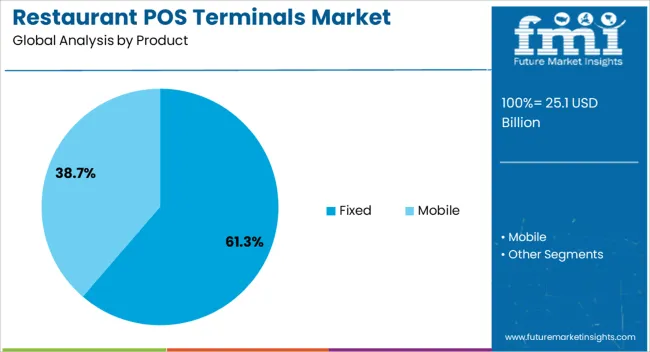

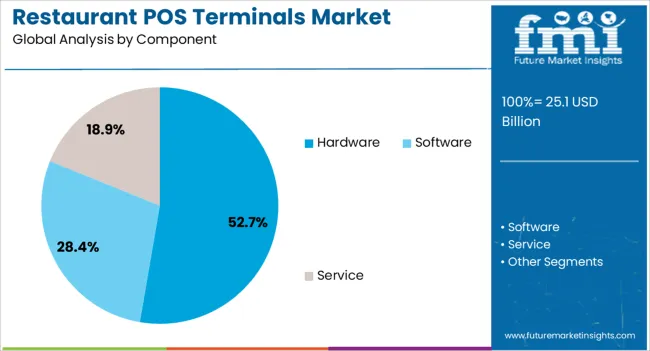

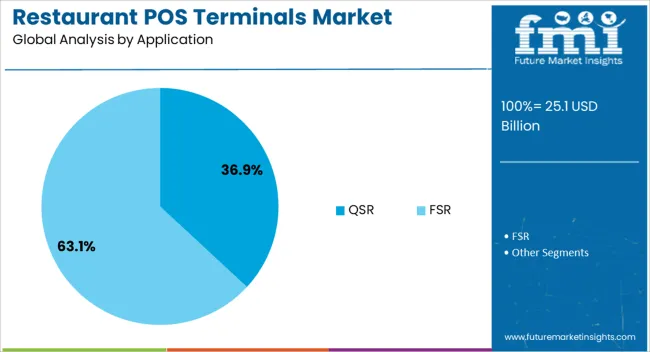

The restaurant POS terminals market is segmented by product, component, application, and geographic regions. By product, restaurant POS terminals market is divided into Fixed and Mobile. In terms of component, restaurant POS terminals market is classified into hardware, software, and service. Based on application, restaurant POS terminals market is segmented into QSR and FSR. Regionally, the restaurant POS terminals industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Fixed POS terminals are projected to lead the market with a 61.30% share in 2025, owing to their widespread adoption in full-service and high-volume restaurants. These systems offer greater hardware robustness, seamless integration with kitchen display systems, and enhanced multi-user support, which are critical in fast-paced dining environments. Their reliability in high-traffic conditions and ability to connect with peripheral devices like receipt printers, barcode scanners, and card readers further solidify their role in restaurant operations. Despite the rising appeal of mobile POS, fixed terminals continue to dominate due to their proven stability and centralized management capabilities. Upgrades with touchscreen interfaces, improved UI/UX, and cloud compatibility are expected to sustain their leadership.

The hardware segment is anticipated to command 52.70% of the market share by 2025, making it the leading component type. Growth in this segment is fueled by increasing replacement demand for outdated systems and a shift toward more durable, sleek, and compact POS units tailored for modern restaurant layouts. Advanced hardware features such as integrated biometric authentication, RFID-enabled devices, and spill-resistant touchscreens are driving operator interest. Vendors are also offering modular systems that allow customization based on restaurant type and scale. As restaurants prioritize durability and performance, the hardware segment is poised to remain critical, especially in offline-first and hybrid business models.

Quick Service Restaurants (QSRs) are expected to account for 36.90% of the market share in 2025, emerging as the dominant application area. The need for speed, order accuracy, and operational consistency in QSRs has made POS terminals indispensable. The segment's growth is also supported by the rapid proliferation of chain outlets and franchises that require uniform technology stacks across locations. POS systems in QSRs are being enhanced with AI-driven upselling features, mobile ordering integration, and digital kitchen workflows, enabling faster turnaround times. With rising footfall in urban areas and evolving customer expectations around convenience, the QSR segment is projected to remain a key revenue driver in the restaurant POS landscape.

The restaurant POS terminals market is growing as foodservice operators adopt advanced systems for payment integration, inventory control, and customer engagement. Opportunities are emerging in mobile and cloud-based POS solutions, particularly in expanding dining markets, while trends emphasize contactless payments, self-service, and multi-channel integration. Challenges persist in high costs, cybersecurity risks, and technical support requirements. In my opinion, vendors that deliver secure, affordable, and scalable systems tailored to diverse restaurant formats will gain a competitive edge, driving long-term adoption in the global foodservice industry.

Demand for restaurant POS terminals has been reinforced by the increasing need for efficient order management, accurate billing, and faster transactions. Full-service restaurants, quick-service outlets, and cafes are adopting advanced POS systems to integrate payments with inventory, loyalty programs, and kitchen operations. The rise of digital payment preferences and delivery platforms has further accelerated deployment. In my opinion, demand will continue to strengthen as restaurants prioritize convenience, customer satisfaction, and operational efficiency, making POS terminals an indispensable backbone of modern foodservice management.

Opportunities are increasing in combined-cycle and cogeneration applications, where heavy duty gas turbines deliver higher efficiency and reduced fuel consumption. Power producers are investing in upgrading existing plants with advanced turbines to maximize output and improve lifecycle economics. Opportunities are also visible in emerging markets where industrial growth fuels demand for distributed and large-scale power solutions. I believe manufacturers who tailor turbines for diverse grid needs and offer aftermarket services such as maintenance, upgrades, and digital performance monitoring will capture significant opportunities in this evolving energy landscape.

Trends in the restaurant POS terminals market highlight the shift toward contactless payments, self-order kiosks, and tablet-based ordering. Integration with customer loyalty systems, AI-driven analytics, and digital menus is also gaining traction, helping restaurants enhance customer engagement and optimize workflows. Another visible trend is the adoption of POS systems that support multiple payment options, from QR codes to mobile wallets. In my opinion, these shifts indicate a decisive move toward customer-centric dining experiences, where convenience, speed, and integration define competitive advantage for restaurants.

Challenges arise from high upfront costs of POS hardware, licensing, and training, which limit adoption among smaller independent restaurants. Data security risks and vulnerability to cyberattacks remain major concerns as systems integrate with online platforms and payment gateways. Maintenance costs and software updates also add to operational burdens. In my assessment, success will depend on vendors offering affordable, secure, and easy-to-use solutions with strong support networks. Without addressing these issues, restaurants may hesitate to adopt or upgrade POS systems at scale.

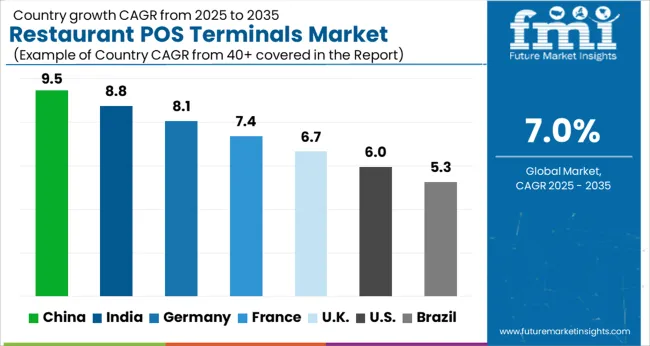

| Country | CAGR |

|---|---|

| China | 9.5% |

| India | 8.8% |

| Germany | 8.1% |

| France | 7.4% |

| UK | 6.7% |

| USA | 6.0% |

| Brazil | 5.3% |

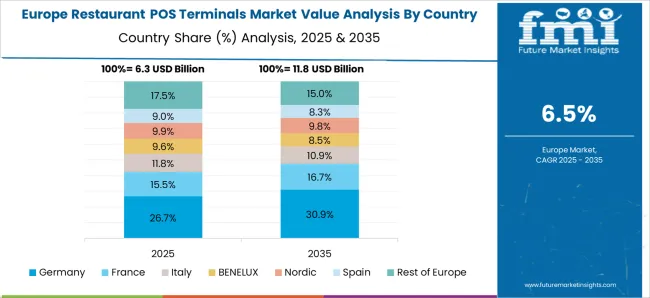

The global restaurant POS terminals market is projected to grow at a CAGR of 7% from 2025 to 2035. China leads with a growth rate of 9.5%, followed by India at 8.8%, and France at 7.4%. The United Kingdom records a growth rate of 6.7%, while the United States shows the slowest growth at 6%. Expansion is being driven by rising adoption of digital payments, demand for efficient order management systems, and integration of cloud-based POS platforms. Emerging markets such as China and India are witnessing faster adoption through smartphone-based ordering and fintech-driven ecosystems, while developed economies like the USA, UK, and France emphasize omnichannel integration, data analytics, and advanced customer engagement tools. This report includes insights on 40+ countries; the top markets are shown here for reference.

The restaurant POS terminals market in China is projected to grow at a CAGR of 9.5%. Widespread adoption of digital wallets, QR-based payments, and mobile ordering platforms is driving strong demand for advanced POS systems. Chinese restaurants, ranging from quick-service to fine dining, are integrating cloud-based POS solutions to enhance operational efficiency. Domestic tech companies are offering AI-enabled POS systems with real-time analytics, loyalty management, and automated ordering. With the growth of online food delivery services, demand for integrated POS platforms continues to expand rapidly across urban and semi-urban regions.

The restaurant POS terminals market in India is expected to grow at a CAGR of 8.8%. Rising digital payment penetration, driven by UPI and mobile wallets, is fueling demand for modern POS systems. Quick-service restaurants, cafes, and delivery-focused outlets are adopting POS terminals to streamline operations and reduce transaction errors. Cloud-enabled POS systems are gaining traction due to their affordability and scalability for small and medium-sized enterprises. Government support for digital transactions and the rapid rise of app-based food delivery services are also enhancing market potential.

The restaurant POS terminals market in France is projected to grow at a CAGR of 7.4%. Growth is driven by rising use of contactless payments and the expansion of restaurant chains that rely on advanced POS systems. French restaurants are increasingly adopting integrated POS platforms offering data-driven analytics, loyalty program management, and real-time reporting. Demand is also supported by compliance requirements with EU regulations on digital payment security. With growing consumer preference for quick and seamless payment experiences, adoption of mobile-enabled POS systems continues to expand.

The restaurant POS terminals market in the UK is projected to grow at a CAGR of 6.7%. Demand is shaped by the expansion of quick-service chains, rising digital ordering volumes, and strong consumer preference for contactless transactions. Restaurants are adopting POS systems with advanced features such as inventory tracking, integration with online ordering, and customer relationship management tools. Growth of delivery-focused business models and partnerships with fintech firms are also supporting steady market expansion. The UK market, while mature, remains competitive with strong focus on digital-first solutions.

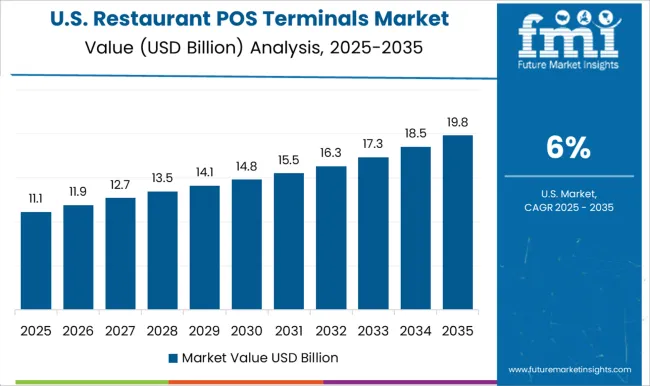

The restaurant POS terminals market in the USA is projected to grow at a CAGR of 6%. While growth is slower than in Asia, the USA remains a hub for innovation in POS solutions. Cloud-based platforms, AI-driven analytics, and mobile-enabled ordering systems are shaping adoption. Large restaurant chains are focusing on omnichannel integration, linking dine-in, takeout, and delivery channels through unified POS systems. Consumer demand for fast, secure, and contactless payments continues to influence adoption. Despite market maturity, technological innovation ensures steady demand for next-generation POS platforms.

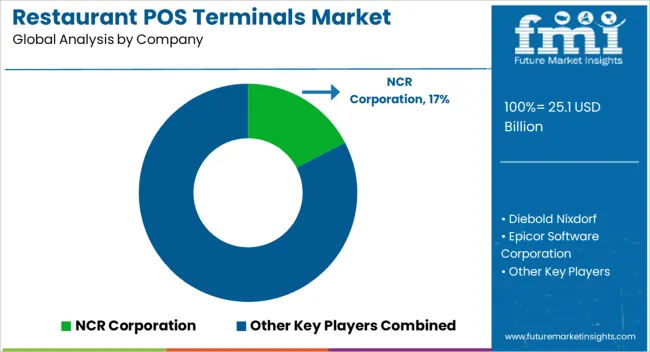

Competition in the restaurant POS terminals market is shaped by software integration, payment security, and hardware versatility. NCR Corporation and Diebold Nixdorf dominate with enterprise-grade POS ecosystems deployed across quick-service and full-service chains, offering centralized control and data analytics. Square and VeriFone bring strong fintech positioning, focusing on mobile-enabled and cloud-driven POS systems tailored for small and medium operators. Panasonic, Samsung, and NEC highlight hardware durability and integration with kitchen display systems, while Ingenico and PAX Technology strengthen their presence through secure payment terminals and EMV compliance.

Epicor Software Corporation differentiates with end-to-end restaurant management solutions, combining POS with inventory and workforce modules. This blend of fintech innovators, hardware specialists, and enterprise solution providers creates a competitive market where scalability and payment innovation drive adoption. Strategies emphasize cloud-based platforms, contactless payments, and customer experience optimization. NCR and Diebold Nixdorf focus on multi-location management, loyalty integration, and predictive analytics. Square and VeriFone highlight speed of deployment, subscription-based pricing, and mobile-first acceptance to attract independent restaurants. Panasonic, Samsung, and NEC market ruggedized touch terminals and seamless connectivity with kitchen and back-office systems. Ingenico and PAX emphasize security certifications and omnichannel acceptance, aligning with rising regulatory and consumer expectations.

Epicor positions itself as a full-suite provider, ensuring efficiency from order taking to supply chain integration. Product brochures highlight ease of use, scalability, customizable interfaces, and secure payment processing. Visuals showcase touchscreen terminals, mobile ordering, and integration with apps and delivery platforms. Messaging stresses faster table turns, real-time reporting, and improved guest satisfaction. By combining operational efficiency with cutting-edge payment capability, brochures position restaurant POS terminals as essential enablers of competitive advantage in modern foodservice environments.

| Item | Value |

|---|---|

| Quantitative Units | USD 25.1 billion |

| Product | Fixed and Mobile |

| Component | Hardware, Software, and Service |

| Application | QSR and FSR |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | NCR Corporation, Diebold Nixdorf, Epicor Software Corporation, Ingenico Group, NEC Corporation, Panasonic Corporation, PAX Technology, Samsung Electronic Co. Ltd, Square, Inc., and VeriFone Systems, Inc. |

| Additional Attributes | Dollar sales by product type (fixed vs mobile terminals), Dollar sales by application (quick service restaurants, full service dining, cafes, bars), Trends in contactless payment adoption and cloud integration, Use in order management, billing, and inventory control, Growth of digital dining and delivery platforms, Regional adoption patterns across North America, Europe, and Asia-Pacific. |

The global restaurant POS terminals market is estimated to be valued at USD 25.1 billion in 2025.

The market size for the restaurant POS terminals market is projected to reach USD 49.3 billion by 2035.

The restaurant POS terminals market is expected to grow at a 7.0% CAGR between 2025 and 2035.

The key product types in restaurant POS terminals market are fixed and mobile.

In terms of component, hardware segment to command 52.7% share in the restaurant POS terminals market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Restaurant Fryers Market Size and Share Forecast Outlook 2025 to 2035

Restaurant Equipment Market Size and Share Forecast Outlook 2025 to 2035

Restaurant Griddle Market Size and Share Forecast Outlook 2025 to 2035

Restaurant Glassware Market Size and Share Forecast Outlook 2025 to 2035

Evaluating Market Share in Restaurants & Mobile Food Services

Restaurants & Mobile Food Services Market Trends – Forecast 2025 to 2035

Analysis and Growth Projections for Restaurant Takeout Business

POS Restaurant Management System Market Size and Share Forecast Outlook 2025 to 2035

Used Restaurant Equipment Market Size and Share Forecast Outlook 2025 to 2035

Commercial Restaurant Rangers Market

Full-Service Restaurants Market Analysis by Model, Service, Location, and Region Through 2035

Commercial Gas Restaurant Ranges Market Size and Share Forecast Outlook 2025 to 2035

Commercial Electric Restaurant Ranges Market Size and Share Forecast Outlook 2025 to 2035

Airport Quick Service Restaurant Market Size and Share Forecast Outlook 2025 to 2035

Fast Food & Quick Service Restaurant Market Trends – Growth & Forecast 2025 to 2035

Post Porcelain Insulator Market Size and Share Forecast Outlook 2025 to 2035

Position Servo System Market Size and Share Forecast Outlook 2025 to 2035

Post-Operative Wound Treatment Market Size and Share Forecast Outlook 2025 to 2035

Post Harvesting Technologies Market Size and Share Forecast Outlook 2025 to 2035

Positive Patient Identification Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA