The automotive micro motors market is projected to grow from USD 18.4 billion in 2025 to USD 27.3 billion in 2035, reflecting a CAGR of 4.0%. This represents an absolute dollar opportunity of USD 8.9 billion over the decade. The market is expected to expand steadily, with values reaching USD 19.2 billion in 2026, USD 20.8 billion in 2029, USD 22.4 billion in 2031, and USD 26.3 billion in 2034. This steady growth underscores consistent demand for automotive micro motors across vehicle applications, offering manufacturers and investors the potential to capture incremental revenue and strengthen their presence in this growing segment.

From an absolute dollar perspective, the yearly incremental opportunity ranges from USD 0.6 billion in the early years to approximately USD 1.0 billion in the later years, culminating in USD 8.9 billion by 2035. Intermediate market values, such as USD 17.7 billion in 2025, USD 21.6 billion in 2030, and USD 25.2 billion in 2034, illustrate a predictable growth trajectory. This steady expansion enables stakeholders to plan production, distribution, and market penetration strategies efficiently, ensuring they can leverage both incremental annual growth and the cumulative opportunity within the automotive micro motors market over the ten-year period.

| Metric | Value |

|---|---|

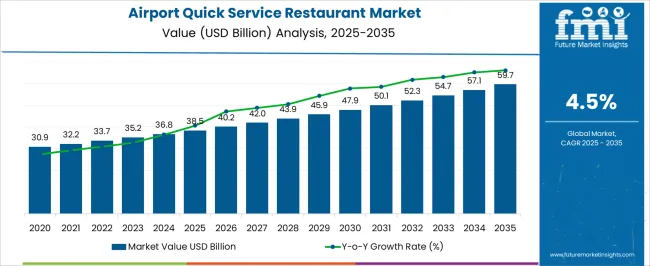

| Airport Quick Service Restaurant Market Estimated Value in (2025 E) | USD 38.5 billion |

| Airport Quick Service Restaurant Market Forecast Value in (2035 F) | USD 59.7 billion |

| Forecast CAGR (2025 to 2035) | 4.5% |

Continuing with the automotive micro motors market, a breakpoint analysis identifies key periods where growth accelerates or shifts notably. Between 2025 and 2027, the market increases from USD 18.4 billion to USD 19.2 billion, representing the early growth phase where initial adoption strengthens market presence. Another critical breakpoint occurs around 2029–2031, as the market rises from USD 20.8 billion to USD 22.4 billion, reflecting a period of faster expansion. These stages are pivotal for manufacturers and investors to optimize production, manage inventory, and capture incremental revenue. Recognizing these breakpoints allows strategic actions to align resources with periods of accelerated market growth. The final major breakpoint is observed between 2033 and 2035, when the market climbs from USD 26.3 billion to USD 27.3 billion, representing the largest absolute dollar growth over a short span.

The intermediate years, such as 2030–2032, exhibit steady increases from USD 23.3 billion to USD 25.2 billion, serving as transitional periods that sustain momentum. Identifying these critical points enables stakeholders to strategically plan investments, scale operations efficiently, and maximize revenue potential.

The airport quick service restaurant (QSR) market is growing steadily, driven by rising global air passenger traffic, evolving traveler dining preferences, and ongoing upgrades to airport infrastructure. Industry news and hospitality sector updates have highlighted increased investments in modernizing food courts, expanding menu diversity, and integrating digital ordering systems to enhance passenger convenience.

Airports are positioning QSRs as revenue-generating anchors, offering travelers faster service without compromising on food quality. The adoption of contactless payment solutions, mobile pre-ordering, and self-service kiosks has further streamlined operations and reduced wait times.

Additionally, changing passenger demographics, including a higher proportion of leisure travelers and younger flyers, has led to greater demand for affordable, recognizable, and convenient dining options. Strategic partnerships between airport authorities and established QSR brands have also improved brand presence and service consistency. Over the forecast period, market growth is expected to be driven by the expansion of branded fast food concepts, the dominance of franchise-based operations, and the preference for eat-in dining among travelers seeking comfort during layovers and transit times.

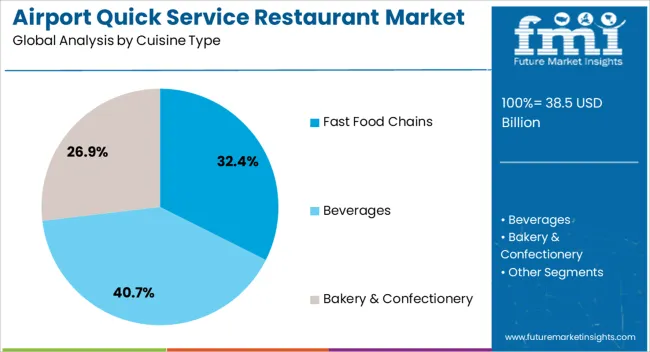

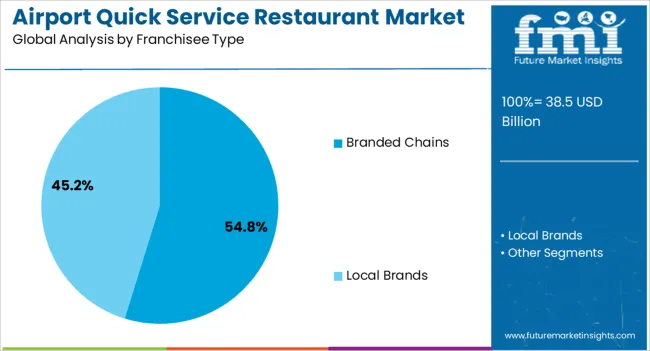

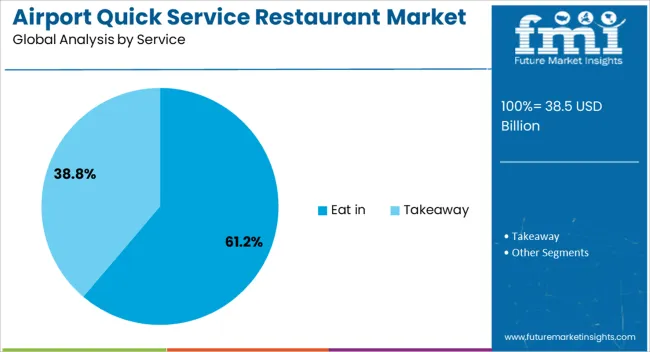

The airport quick service restaurant market is segmented by cuisine type, franchisee type, service, and geographic regions. By cuisine type, airport quick service restaurant market is divided into Fast Food Chains, Beverages, Bakery & Confectionery, and International Cuisine. In terms of franchisee type, airport quick service restaurant market is classified into Branded Chains and Local Brands. Based on service, airport quick service restaurant market is segmented into Eat in and Takeaway.

Regionally, the airport quick service restaurant industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Fast Food Chains segment is projected to account for 32.4% of the airport quick service restaurant market revenue in 2025, maintaining a strong presence due to the global recognition and operational efficiency of leading brands. This segment’s growth has been supported by travelers’ preference for familiar menus, quick preparation times, and consistent quality standards, regardless of location.

Airport environments, where time is often limited, have proven ideal for fast food operations that can deliver meals within minutes. Additionally, fast food chains have been able to adapt their offerings to cater to varying dietary needs and regional tastes, ensuring appeal to both domestic and international passengers.

The strong marketing power and brand loyalty of major chains have also driven sustained foot traffic, while streamlined supply chain agreements with airport operators have helped maintain service speed and cost efficiency. These factors are expected to keep fast food chains as a key revenue driver in airport QSR operations.

The Branded Chains segment is projected to contribute 54.8% of the airport quick service restaurant market revenue in 2025, leading the market due to established brand trust and operational consistency. Branded chains benefit from high brand visibility, which attracts travelers seeking reliability in food quality and service standards while on the move.

Franchise agreements with well-known restaurant brands allow airports to leverage existing consumer loyalty, while standardized training programs ensure staff deliver consistent service across locations.

Furthermore, branded chains often have the resources to invest in airport-specific store designs, digital ordering platforms, and marketing campaigns that appeal to transient customers. Their ability to offer menu familiarity and operational efficiency in high-traffic airport terminals has cemented their dominance over independent or lesser-known operators. As passenger volumes continue to rise globally, branded chains are expected to remain the preferred choice for airport QSR partnerships.

The Eat in segment is projected to hold 61.2% of the airport quick service restaurant market revenue in 2025, reflecting travelers’ preference for dining comfort during waiting periods. Airport passengers, especially those with layovers or early arrivals, often opt for dine-in experiences to relax, access amenities, and enjoy a more leisurely meal.

This segment’s growth has been supported by the integration of comfortable seating areas, enhanced interior designs, and views of runways or terminal activity to improve the dining atmosphere.

Additionally, dine-in services allow operators to offer a wider menu selection, including freshly prepared meals and customizable options, which are more challenging to provide in purely takeaway formats. Airports have also invested in expanding and upgrading dining spaces to encourage longer dwell times, which in turn increases per-customer spending. With rising expectations for quality and comfort in travel-related dining, the Eat in segment is expected to maintain its leadership position in the airport QSR market.

The automotive micro motors market is growing as vehicles increasingly integrate compact, precision-controlled components for applications such as power seats, mirrors, infotainment systems, and fuel pumps. Miniaturized electric motors provide high performance in limited spaces while supporting efficiency and comfort features. North America and Europe lead adoption due to advanced automotive manufacturing and stricter vehicle quality standards, while Asia Pacific shows rapid growth fueled by expanding vehicle production and adoption of electric and hybrid models. Manufacturers emphasize precision engineering, energy efficiency, and reliability, while component cost, thermal management, and regulatory compliance shape market development.

Automotive micro motors must deliver consistent performance despite small form factors and harsh operating conditions. Variations in rotor design, winding materials, or bearings can affect torque, speed, and lifespan. Motors must withstand vibration, temperature fluctuations, and prolonged operational cycles without performance degradation. Suppliers focus on rigorous testing, quality assurance protocols, and material traceability to ensure reliability for critical automotive functions. Companies providing proven durability and low failure rates build trust with original equipment manufacturers, whereas inconsistent performance can lead to recalls or customer dissatisfaction. Maintaining uniform quality in miniature motors is essential to meet automotive standards and secure long-term contracts.

Improvements in micro motor engineering enable higher efficiency, smoother motion, and precise control in automotive systems. Optimized electromagnetic designs, reduced friction components, and advanced control electronics allow motors to operate at variable speeds with minimal energy loss. Integration with vehicle electronic control units enhances responsiveness for applications such as seat adjustment, climate control, and mirror positioning. Suppliers offering advanced feedback mechanisms and compact designs enable manufacturers to reduce overall vehicle weight and energy consumption. These enhancements support adoption in both internal combustion and electric vehicle platforms, increasing the appeal of micro motors in next-generation automotive designs.

The scope of automotive micro motors is broadening to include safety systems, infotainment components, and autonomous vehicle technology. Motors are increasingly used in adaptive lighting, power windows, electronic braking systems, and smart driver-assist features. Growing demand for electric and hybrid vehicles also increases the need for efficient miniature motors in battery management, cooling systems, and energy recovery components. Manufacturers providing customizable solutions for diverse automotive functions can capture multiple application segments. Expansion of vehicle production in emerging markets further boosts demand. The combination of space efficiency, precise control, and energy savings positions micro motors as an essential element in modern automotive architecture.

Regulatory standards and raw material availability significantly influence market dynamics. Motors must meet safety and electromagnetic compatibility standards, as well as environmental regulations on materials and energy efficiency. Sourcing of high-grade copper, permanent magnets, and precision bearings affects production timelines and costs. Market competition arises from global suppliers and local manufacturers offering competitive pricing or tailored solutions. Companies that manage compliance, maintain secure supply chains, and provide engineering support gain a competitive advantage. Conversely, regulatory delays or shortages in key materials can hinder production schedules and slow adoption across the automotive sector.

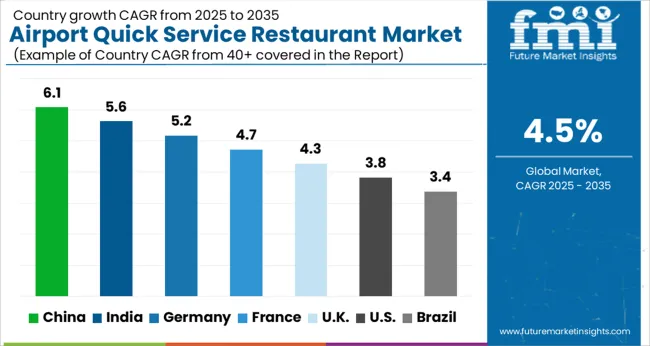

| Country | CAGR |

|---|---|

| China | 6.1% |

| India | 5.6% |

| Germany | 5.2% |

| France | 4.7% |

| UK | 4.3% |

| USA | 3.8% |

| Brazil | 3.4% |

The global automotive micro motors market was projected to grow at a 4.0% CAGR through 2035, driven by demand in passenger vehicles, commercial automobiles, and electronic automotive components. Among BRICS nations, China recorded 5.4% growth as large-scale production units were commissioned and industry quality standards were enforced, while India at 5.0% growth saw expansion of manufacturing facilities to support rising regional adoption. In the OECD region, Germany at 4.6% maintained significant output under strict automotive and electrical regulations, while the United Kingdom at 3.8% relied on moderate-scale manufacturing for vehicle electronics and auxiliary systems. The USA, expanding at 3.4%, remained a mature market with steady replacement and installation demand, supported by adherence to federal and state-level automotive quality and safety standards. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The automotive micro motors market in China is expanding at a 5.4% CAGR, driven by increasing vehicle production, rising adoption of electric and hybrid vehicles, and growing demand for advanced automotive components. Applications such as power windows, seat adjustments, mirrors, and HVAC systems are boosting adoption. Manufacturers are developing energy-efficient and compact micro motors suitable for various vehicle types. Smart vehicle technologies, including automated systems and intelligent interiors, are further supporting market growth. Both passenger and commercial vehicles are contributing to rising demand. Technological innovations, such as low-power and long-life micro motors, are improving vehicle efficiency and performance. Collaborations between OEMs and component suppliers are ensuring reliable and cost-effective solutions. Urbanization and growing consumer preference for comfort and automation are expected to continue driving market expansion.

The automotive micro motors market in India is growing at a 5.0% CAGR, supported by rising vehicle production, electrification initiatives, and demand for comfort features. Applications such as power seats, mirrors, windows, and HVAC systems are driving adoption. Manufacturers are offering reliable, compact, and energy-efficient solutions suitable for local conditions. Both passenger and commercial vehicles are contributing to market growth. Government policies promoting electric vehicles and energy-efficient automotive technologies are supporting adoption. Collaboration between OEMs and component suppliers ensures product availability and quality. Technological advancements, including long-life micro motors and low-power designs, are enhancing market appeal. The combination of increasing vehicle production and rising consumer preference for advanced features is expected to sustain steady growth in the Indian market.

The automotive micro motors market in Germany is expanding at a 4.6% CAGR, driven by advanced automotive technologies, high vehicle production, and growing adoption of electric and hybrid vehicles. Applications such as seat adjustments, HVAC systems, mirrors, and windows are widely adopted. Manufacturers are providing low-noise, energy-efficient, and durable micro motors to meet strict European standards. Integration with smart vehicle systems and automated features is increasing adoption in both passenger and commercial vehicles. Focus on energy-efficient and sustainable vehicles is driving demand for innovative micro motor designs. Renovation of commercial fleets also contributes to growth. Suppliers emphasize reliability, performance, and lifecycle support to meet industry requirements. Market expansion is expected to continue as Germany continues to adopt advanced and sustainable automotive technologies.

The automotive micro motors market in the United Kingdom is expanding at a 4.3% CAGR, supported by growing vehicle production, adoption of electric and hybrid vehicles, and rising demand for comfort and automated features. Applications such as HVAC systems, power seats, mirrors, and windows are driving market growth. Manufacturers are providing energy-efficient, compact, and reliable solutions suitable for UK vehicles. OEMs are integrating micro motors into smart vehicle systems for improved performance and passenger comfort. Government initiatives promoting electric mobility and energy-efficient automotive technologies are supporting adoption. Both passenger vehicles and commercial fleets contribute to market expansion. Technological innovations, including long-life micro motors with low power consumption, are enhancing market appeal. Steady growth is expected as electrification and smart automotive technologies continue to expand across the country.

The automotive micro motors market in the United States is growing at a 3.4% CAGR, driven by demand for electric and hybrid vehicles, comfort systems, and automated features. Applications such as power windows, HVAC systems, mirrors, and seat adjustments are widely adopted. Manufacturers are developing energy-efficient, durable, and compact micro motors to meet automotive standards. Integration with intelligent vehicle systems enhances functionality and passenger comfort. Government programs promoting vehicle electrification and energy efficiency support market expansion. Both passenger and commercial vehicles contribute to adoption. Technological advancements, including low-power and long-life designs, are improving market acceptance. The market is expected to continue growing steadily as smart automotive technologies and electrification gain wider adoption.

NIDEC Corporation, AMETEK Inc., and Buhler Motor GmbH supply automotive micro motors for power windows, seat adjustment, mirror control, and small actuation applications, with brochures highlighting torque ratings, voltage ranges, and rotational speed. Johnson Electric Holdings Limited, Mabuchi Motor, and Maxon Motors AG focus on precision micro motors for steering assist, fuel pumps, and HVAC systems, with datasheets detailing efficiency, noise levels, duty cycles, and thermal performance. Mitsuba Corporation provides high-reliability micro motors for wiper systems, door locks, and actuator modules, with technical literature presenting compact form factors, vibration resistance, and integration flexibility. Other regional suppliers compete with cost-effective, standardized micro motors, with brochures emphasizing manufacturing tolerances, operational lifespan, and compliance with automotive electrical standards (ISO/TS 16949, observed industry pattern). Market strategies focus on reliability, miniaturization, and integration flexibility. Leading suppliers such as NIDEC and Johnson Electric emphasize high-precision windings, low-friction bearings, and long-life brushes for continuous duty applications. AMETEK and Maxon Motors differentiate through high-efficiency designs, low-noise operation, and compatibility with electronic control units for hybrid and electric vehicles. Observed industry patterns indicate investment in brushless DC micro motors, smart motor modules with embedded sensors, and scalable production lines for mass automotive assembly. Product roadmaps frequently include high-torque, compact micro motors for emerging autonomous and electrified vehicle systems, alongside modules designed for rapid assembly in tight vehicle spaces. Differentiation is achieved through verified torque, efficiency, noise control, and detailed technical guidance provided in brochures. Brochures and datasheets are used to communicate rated voltage, torque, rotational speed, dimensions, duty cycle, operating temperature range, noise level, and integration options. NIDEC, AMETEK, and Johnson Electric literature emphasizes torque performance, efficiency, and thermal tolerance. Mabuchi, Maxon, and Buhler brochures highlight miniature form factors, vibration resistance, and durability under continuous operation. Mitsuba datasheets provide wiper and actuator-specific specifications, noise ratings, and integration compatibility. Other suppliers’ materials present standardized modules, mass-production readiness, and automotive quality compliance. Tables, diagrams, and performance charts are consistently included to allow automotive engineers, procurement specialists, and OEMs to evaluate micro motor suitability efficiently. Market adoption is determined not only by mechanical and electrical performance but also by the clarity and technical depth of brochures, making documentation essential for competitive positioning.

| Item | Value |

|---|---|

| Quantitative Units | USD 38.5 Billion |

| Cuisine Type | Fast Food Chains, Beverages, Bakery & Confectionery, and International Cuisine |

| Franchisee Type | Branded Chains and Local Brands |

| Service | Eat in and Takeaway |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

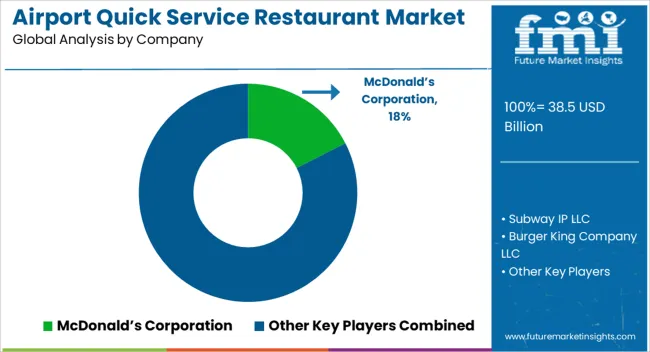

| Key Companies Profiled | McDonald’s Corporation, Subway IP LLC, Burger King Company LLC, Yum! Brands, Inc., Starbucks Corporation, JUBILANT FOODWORKS LIMITED, Inspire Brands, Inc., The Wendy’s Company, Chick-fil-A, Inc., Haldiram Foods International Pvt. Ltd, Costa Limited, and Wow! Momo Foods Private Limited |

| Additional Attributes | Dollar sales vary by restaurant type, including fast food chains, coffee shops, and snack kiosks; by service model, such as dine-in, takeaway, and self-service; by cuisine, spanning global, regional, and specialty offerings; by region, led by North America, Europe, and Asia-Pacific. Growth is driven by rising air passenger traffic, airport expansions, and increasing demand for convenient, quick dining options. |

The global airport quick service restaurant market is estimated to be valued at USD 38.5 billion in 2025.

The market size for the airport quick service restaurant market is projected to reach USD 59.7 billion by 2035.

The airport quick service restaurant market is expected to grow at a 4.5% CAGR between 2025 and 2035.

The key product types in airport quick service restaurant market are fast food chains, burger & fries, pizza, chicken products, sandwich & wraps, others, beverages, coffee, smoothies, milkshakes, others, bakery & confectionery, cakes & pastries, cookies, pies and tarts, muffins, others, international cuisine, italian, chinese, mexican, indian and others.

In terms of franchisee type, branded chains segment to command 54.8% share in the airport quick service restaurant market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Airport Ground Transportation Market Forecast and Outlook 2025 to 2035

Airport Bus Market Analysis - Size, Share, and Forecast Outlook (2025 to 2035)

Airport Runway Lighting Market Size and Share Forecast Outlook 2025 to 2035

Airport Robots Market Size and Share Forecast Outlook 2025 to 2035

Airport Passenger Boarding Bridge Market Size and Share Forecast Outlook 2025 to 2035

Airport Moving Walkways Market Size and Share Forecast Outlook 2025 to 2035

Airport Cabin Baggage Scanner Market Size and Share Forecast Outlook 2025 to 2035

Airport Sleeping Pods Market Analysis - Trends, Growth & Forecast 2025 to 2035

Market Share Breakdown of Airport Security Solutions

Airport Retailing Market Trends - Growth & Forecast 2025 to 2035

Airport Security Market Trends - Growth & Forecast 2025 to 2035

Airport Lighting Market

Airport Information Display System Market

Smart Airport Market Size and Share Forecast Outlook 2025 to 2035

Pre-book Airport Transfer Market Size and Share Forecast Outlook 2025 to 2035

Advanced Airport Technologies Market Size and Share Forecast Outlook 2025 to 2035

Individual Quick Freezing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Individual Quick Freezing Market Size and Share Forecast Outlook 2025 to 2035

Fast Food & Quick Service Restaurant Market Trends – Growth & Forecast 2025 to 2035

Restaurant POS Terminals Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA