The Airport Cabin Baggage Scanner Market is estimated to be valued at USD 3.3 billion in 2025 and is projected to reach USD 8.3 billion by 2035, registering a compound annual growth rate (CAGR) of 9.5% over the forecast period. Market Share Erosion or Gain Analysis indicates significant growth potential for advanced technology providers, while legacy system manufacturers risk share erosion if upgrades are delayed.

From 2025 to 2030, the market will rise from USD 3.3 billion to 4.8 billion, contributing USD 1.5 billion or nearly 30% of the total increase, as airports adopt computed tomography (CT) scanners and automated threat detection solutions to comply with evolving security regulations. During this phase, vendors introducing AI-enabled screening, faster throughput systems, and integration with biometric platforms are likely to gain market share.

The second half (2030-2035) delivers USD 3.5 billion, or 70% of the growth, with values reaching 8.3 billion by 2035, signaling acceleration driven by next-generation cabin baggage systems, global airport expansion projects, and replacement cycles of outdated X-ray scanners. Players failing to transition toward advanced CT-based and fully automated screening solutions will face rapid market share erosion, while those investing in innovation, predictive maintenance, and integration with smart airport ecosystems will capture the dominant share of this high-growth segment.

| Metric | Value |

|---|---|

| Airport Cabin Baggage Scanner Market Estimated Value in (2025 E) | USD 3.3 billion |

| Airport Cabin Baggage Scanner Market Forecast Value in (2035 F) | USD 8.3 billion |

| Forecast CAGR (2025 to 2035) | 9.5% |

The airport cabin baggage scanner market occupies a crucial yet focused position within the broader security technology landscape. In the aviation security screening systems market, cabin baggage scanners represent 20-22%, as they are essential for passenger checkpoints alongside body scanners and explosive detection units. Within the baggage handling and screening equipment market, their share is 15-17%, given the presence of hold baggage scanners, conveyors, and sorting systems.

In the airport security equipment market, cabin baggage scanners contribute 10-12%, as overall investment also spans surveillance cameras, biometric systems, and perimeter security. In the homeland security and public safety solutions market, their share is modest at 3-4%, since this category covers diverse areas including critical infrastructure, border control, and law enforcement. For the transportation security systems market, which includes airports, ports, and transit hubs, cabin baggage scanners account for 6-8%, reflecting their airport-specific focus.

Although the shares appear moderate, adoption is increasing rapidly due to rising global air travel, strict regulatory mandates, and the need for faster throughput. Integration of computed tomography (CT) imaging, AI-powered threat detection, and automated tray return systems is transforming scanning efficiency and accuracy, positioning cabin baggage scanners as a vital component in next-generation airport security frameworks.

The airport cabin baggage scanner market is experiencing consistent growth as airports worldwide prioritize security upgrades and passenger throughput optimization. Adoption has been influenced by rising global air traffic, stringent regulatory requirements for threat detection, and the need to reduce passenger wait times without compromising safety.

Hardware advancements and software integration have enhanced detection accuracy and operational efficiency, encouraging airports to invest in next-generation screening systems. Future growth is expected to be driven by regulatory mandates for advanced screening technologies, increasing passenger expectations for seamless travel, and airport modernization projects.

Continuous innovations in imaging capabilities, automation, and integration with airport IT infrastructure are paving the way for widespread deployment of more effective scanning solutions. Sustainability considerations and operational cost efficiency are also emerging as key factors shaping future procurement decisions.

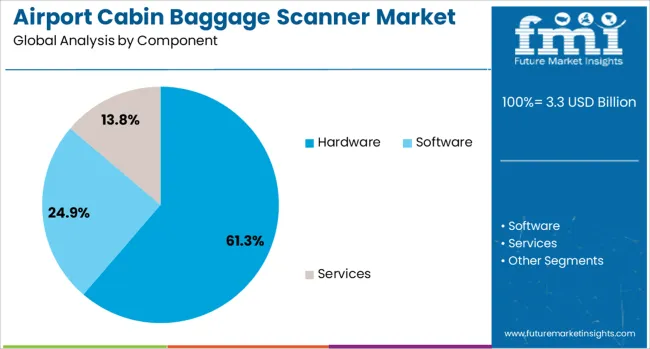

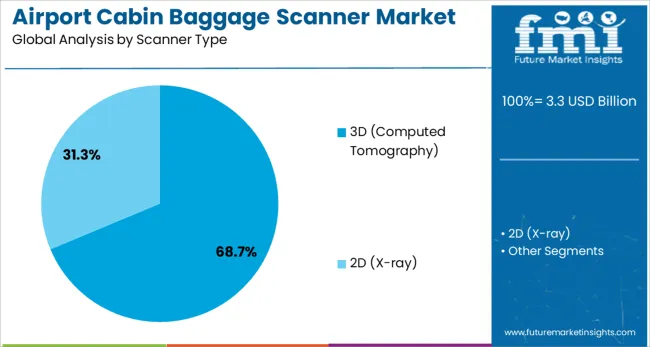

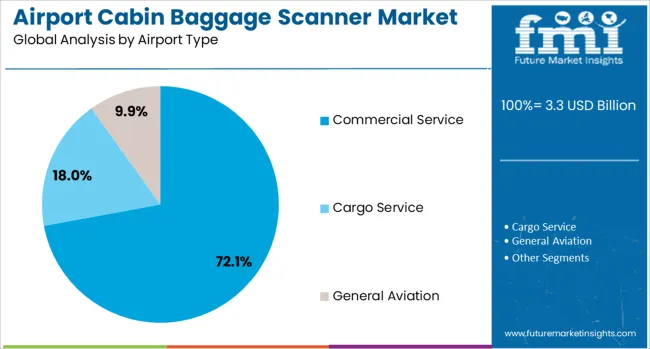

The airport cabin baggage scanner market is segmented by component, scanner type, airport type, and geographic regions. The airport cabin baggage scanner market is divided into Hardware, Software, and Services. In terms of scanner type, the airport cabin baggage scanner market is classified into 3D (Computed Tomography) and 2D (X-ray). Based on the airport type, the airport cabin baggage scanner market is segmented into Commercial Service, Cargo Service, and General Aviation. Regionally, the airport cabin baggage scanner industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by component, the hardware segment is projected to account for 61.30% of the market revenue in 2025, establishing itself as the leading segment. This dominance has been supported by the necessity for robust, high-performance physical equipment capable of delivering precise threat detection and high passenger throughput.

Hardware systems have remained the most capital-intensive part of security infrastructure, with airports prioritizing investments in durable and reliable machines that comply with regulatory standards. Advancements in sensor technology, material durability, and energy efficiency have enhanced the appeal of hardware solutions, ensuring consistent performance under demanding airport environments.

The scalability of hardware installations and their ability to integrate with upgraded software modules have further reinforced their critical role in airport security operations.

When analyzed by scanner type, the 3D computed tomography segment is expected to hold 68.7% of the market revenue in 2025, making it the most prominent scanner type. Its leadership has been driven by superior imaging capabilities that enable more accurate and faster threat detection, meeting the evolving standards of aviation security authorities.

The technology’s ability to generate detailed three-dimensional images of cabin baggage has reduced the need for manual intervention and secondary screening, thereby improving passenger flow. Airports have favored 3D CT scanners for their compliance with the latest regulatory mandates, which increasingly require advanced imaging systems for enhanced detection of explosives and prohibited items.

Operational efficiency has been improved as these scanners allow passengers to keep electronics and liquids inside their bags, reducing queues and increasing satisfaction. This combination of regulatory compliance, performance, and passenger convenience has firmly positioned 3D CT as the preferred technology.

When segmented by airport type, the commercial service segment is projected to dominate with a 72.1% revenue share in 2025, maintaining its leading position. The high passenger volumes and rigorous security requirements characteristic of commercial service airports have primarily influenced this.

The need to process thousands of passengers daily while ensuring compliance with national and international security protocols has made investment in advanced baggage scanning systems indispensable. Commercial service airports have been allocating significant budgets for security modernization to enhance both safety and operational efficiency.

The visibility of these airports and their role in maintaining public confidence in air travel have further underscored the importance of adopting state-of-the-art screening technologies. Their ability to scale deployment across multiple terminals and handle fluctuating passenger loads effectively has solidified the dominance of the commercial service segment within the market.

Airport cabin baggage scanners are screening devices used to inspect hand‑carried luggage at security checkpoints through X‑ray imaging, CT technology, or millimeter‑wave systems. Deployment occurs across airports, airline terminals, and checkpoints to identify prohibited or dangerous items. Demand is influenced by evolving security requirements, increasing passenger volumes, and the need for reliable threat detection. Providers offering high-resolution imaging, fast scan cycles, and accurate threat recognition have been well positioned. Scanners that deliver minimal false positives, simplified user interface, and flexible installation continue to guide procurement decisions by airport operators and security integrators.

Deployment of cabin baggage scanners has been supported by tightening security protocols and mandatory screening standards across aviation authorities. Passenger volume growth and route expansion have increased baggage throughput demands at checkpoints. Advanced scanners capable of rapid imaging and automated threat detection have been favored to balance security and operational flow. Investments have been directed toward reducing queue times and improving checkpoint efficiency without compromising screening quality. Development of portable or modular units suitable for temporary or smaller terminals has further supported adoption. Emphasis has been placed on early threat identification and seamless passenger experience at high-volume gates and transit hubs.

Adoption has been challenged by high procurement and installation costs associated with advanced scanner systems such as CT or millimeter-wave technologies. Complex acquisition procedures and lengthy procurement cycles have delayed deployment in many airports. Staff training requirements and technical expertise for operating high-resolution imaging systems have introduced additional overhead. Power and infrastructure limitations at smaller or regional airports have hindered hardware integration. Incorrect calibration or software error has caused occasional false alarms or detection misses, affecting system trust. Maintenance accessibility and replacement of key imaging components in difficult-to-reach locations have added logistical complexity and elevated lifecycle costs.

Opportunities have been identified in upgrading existing checkpoint infrastructure with newer scanner models offering enhanced detection and faster imaging. New facilities and airport terminals have created demand for installation of modern screening units. Portable scanner systems and handheld variants offer flexibility for mobile or remote installations such as temporary checkpoints, VIP lanes, or heliport operations. Partnerships with security integrators and systems providers around maintenance services, software updates, and operator training have enabled recurring service opportunities. Innovations in detection algorithms and modular hardware upgrades support smoother transition paths for airport operators. Stronger demand is being seen for scalable systems that support phased expansion of screening capacity at hub and regional airports.

The shift toward advanced imaging technologies such as CT scanning and three‑dimensional visualization has gained momentum for improved threat recognition. Artificial intelligence-enabled software has increasingly been integrated to automate threat detection and reduce manual image review. Smaller and compact scanner designs have become more common in security lanes with limited space. Remote management features, including cloud-based software updates and centralized monitoring, are being adopted. Integration of sophisticated classification systems supporting machine learning has improved accuracy while decreasing alarm rates. Demand has grown for systems that permit capability enhancements via software upgrades or plug‑and‑play hardware modules, enabling longevity in procurement and operations.

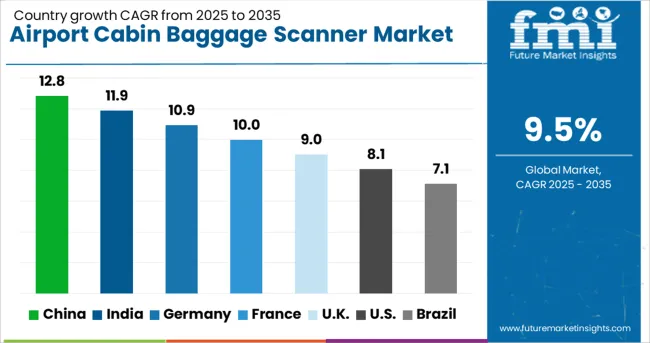

| Country | CAGR |

|---|---|

| China | 12.8% |

| India | 11.9% |

| Germany | 10.9% |

| France | 10.0% |

| UK | 9.0% |

| USA | 8.1% |

| Brazil | 7.1% |

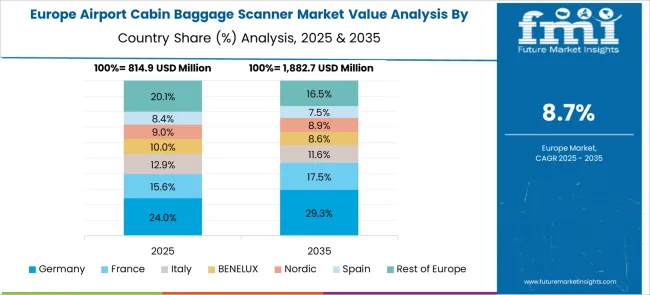

The airport cabin baggage scanner market is projected to grow at a CAGR of 9.5% between 2025 and 2035, driven by increasing air passenger traffic, advanced security regulations, and rapid integration of AI-based screening technologies. China leads at 12.8% CAGR, supported by major airport expansions and advanced security upgrades. India follows at 11.9%, fueled by aviation infrastructure development and government investments in security modernization. Among OECD economies, Germany posts 10.9%, emphasizing compliance with EU security standards and advanced threat detection capabilities. France records 10.0%, driven by smart airport projects and system upgrades ahead of global events. The United Kingdom grows at 9.0%, supported by regulatory mandates for CT-based scanners and expansion of self-screening systems. The report covers over 40 countries, with detailed insights for five profiled below.

China is projected to grow at 12.8% CAGR, the highest among key markets, supported by rapid airport infrastructure development and security system modernization. Increased passenger volumes across tier-one and regional airports have accelerated demand for next-generation baggage scanners equipped with computed tomography (CT) technology. Government programs prioritizing smart airport projects and international compliance have encouraged large-scale deployment of automated scanning systems. Leading domestic manufacturers are integrating AI-based threat detection, real-time analytics, and 3D imaging capabilities to enhance accuracy and reduce false alarms. Strategic partnerships with global security firms are also contributing to innovation and technology transfer, positioning China as a significant exporter of advanced screening solutions in Asia-Pacific markets.

India is forecast to achieve 11.9% CAGR, driven by the expansion of greenfield airports, privatization of terminals, and strict compliance with global security standards. Rising domestic air traffic and international connectivity have increased demand for automated baggage screening systems with high detection efficiency. Indian airports are investing in computed tomography scanners that provide clear 3D imaging and automated threat identification. Government-led initiatives such as the UDAN program and modernization plans under the Airports Authority of India are accelerating procurement of advanced scanners. Local system integrators are collaborating with global OEMs to deliver cost-effective installations while reducing dependency on imports.

Germany is expected to grow at 10.9% CAGR, supported by strong regulatory enforcement under EU aviation security directives. Major airports are prioritizing installation of computed tomography scanners to meet ECAC Standard 3 certification, replacing conventional X-ray systems. Increased investment in self-service lanes and automated tray return systems is creating demand for integrated baggage scanners that ensure faster throughput without compromising security standards. German manufacturers are focusing on advanced software-driven solutions with automated image interpretation and real-time networking capabilities. Growing partnerships with airport operators to deploy predictive maintenance and remote diagnostics further strengthen operational efficiency. Rising adoption of biometric verification integrated with baggage scanners represents another growth dimension for German airports.

France is projected to expand at a 10.0% CAGR, fueled by security upgrades aligned with EU regulations and preparation for major global events, including international sports tournaments. French airports are deploying advanced CT-based baggage scanners featuring automated explosives detection and AI-assisted image recognition. Integration of screening systems with centralized security checkpoints ensures enhanced operational efficiency while reducing passenger wait times. Manufacturers and system integrators are focusing on compact scanner designs suited for space-constrained terminals. Strategic collaborations with airport authorities for predictive analytics and remote monitoring solutions support reliability and performance optimization.

The United Kingdom is expected to grow at 9.0% CAGR, slightly below the global average, yet supported by rapid adoption of computed tomography scanners across major airports. Government mandates requiring full CT-based implementation by mid-decade are driving accelerated procurement and deployment. UK airports are prioritizing automated threat detection technologies that minimize manual intervention and improve accuracy. Manufacturers are emphasizing systems with high-speed image processing and low-maintenance requirements to reduce operational downtime. Investments in AI-powered self-service screening lanes and remote monitoring platforms are transforming security operations. Rising passenger traffic at regional airports further supports adoption of compact baggage scanning units.

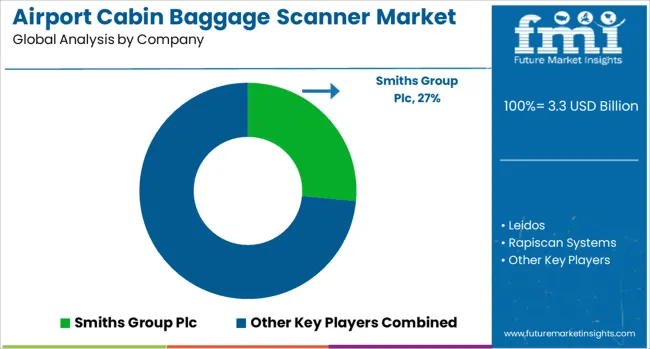

The airport cabin baggage scanner market is highly specialized and dominated by leading security technology providers such as Smiths Group Plc, Leidos, Rapiscan Systems, Nuctech Company Limited, L3Harris Technologies, Safeway Inspection System Limited, and Astrophysics Inc. These companies develop advanced X-ray and computed tomography (CT) screening systems to meet stringent global aviation security standards.

Smiths Group and Leidos hold strong positions with wide adoption of their CT-based scanning solutions that enable real-time 3D imaging and automatic threat detection, reducing manual checks and improving passenger throughput. Rapiscan Systems and Astrophysics Inc. specialize in compact and high-speed scanning units suitable for airports with varying traffic volumes. Nuctech leads in Asia-Pacific with cost-competitive solutions integrated with AI-driven detection algorithms, while L3Harris Technologies emphasizes dual-energy imaging systems for enhanced material discrimination.

Safeway Inspection System focuses on developing high-capacity scanning platforms tailored for emerging market airports, ensuring compliance with global security regulations at competitive pricing. Competitive differentiation relies on imaging resolution, detection accuracy, speed, and compliance with aviation authorities such as TSA, ECAC, and ICAO. Entry barriers remain high due to rigorous certification requirements, significant R&D costs, and the integration of advanced software for automated detection of explosives and contraband.

Market rivalry is intense as vendors compete for large-scale contracts from airport authorities and government security agencies. Future growth will be driven by the deployment of CT-based scanners capable of eliminating the need for liquid and electronics removal, AI-powered threat detection, and integration with biometric and automated passenger processing systems to enhance security and operational efficiency.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.3 Billion |

| Component | Hardware, Software, and Services |

| Scanner Type | 3D (Computed Tomography) and 2D (X-ray) |

| Airport Type | Commercial Service, Cargo Service, and General Aviation |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Smiths Group Plc, Leidos, Rapiscan Systems, Nuctech Company Limited, L3Harris Technologies, Safeway Inspection System Limited, and Astrophysics Inc. |

| Additional Attributes | Dollar sales by technology type (X-ray scanners, CT-based scanners, dual-view systems) and application (international airports, domestic airports, cargo terminals), with demand fueled by increasing air traffic and regulatory mandates for enhanced baggage screening. Regional dynamics highlight strong adoption in North America and Europe due to early CT technology implementation, while Asia-Pacific leads in installations at new airport projects. Innovation trends focus on AI-enabled threat detection, real-time data analytics, remote screening capabilities, and systems designed for seamless integration into automated passenger handling infrastructure. |

The global airport cabin baggage scanner market is estimated to be valued at USD 3.3 billion in 2025.

The market size for the airport cabin baggage scanner market is projected to reach USD 8.3 billion by 2035.

The airport cabin baggage scanner market is expected to grow at a 9.5% CAGR between 2025 and 2035.

The key product types in airport cabin baggage scanner market are hardware, software, services, _consulting and _installation & maintenance.

In terms of scanner type, 3d (computed tomography) segment to command 68.7% share in the airport cabin baggage scanner market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Airport Ground Transportation Market Forecast and Outlook 2025 to 2035

Airport Quick Service Restaurant Market Size and Share Forecast Outlook 2025 to 2035

Airport Bus Market Analysis - Size, Share, and Forecast Outlook (2025 to 2035)

Airport Runway Lighting Market Size and Share Forecast Outlook 2025 to 2035

Airport Robots Market Size and Share Forecast Outlook 2025 to 2035

Airport Passenger Boarding Bridge Market Size and Share Forecast Outlook 2025 to 2035

Airport Moving Walkways Market Size and Share Forecast Outlook 2025 to 2035

Airport Sleeping Pods Market Analysis - Trends, Growth & Forecast 2025 to 2035

Market Share Breakdown of Airport Security Solutions

Airport Retailing Market Trends - Growth & Forecast 2025 to 2035

Airport Security Market Trends - Growth & Forecast 2025 to 2035

Airport Lighting Market

Airport Information Display System Market

Smart Airport Market Size and Share Forecast Outlook 2025 to 2035

Pre-book Airport Transfer Market Size and Share Forecast Outlook 2025 to 2035

Advanced Airport Technologies Market Size and Share Forecast Outlook 2025 to 2035

Cabin Air Heater Market Size and Share Forecast Outlook 2025 to 2035

Crane Cabin Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Banquet Cabinets Market – Storage & Heating Solutions 2025-2035

Display Cabinets Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA