The pre-book airport transfer market is showing steady expansion, driven by the resurgence of global tourism and increasing traveler preference for convenience and reliability in airport commutes. Industry updates, airline partnerships, and travel platform integrations have highlighted a significant shift toward pre-arranged transportation as travelers seek stress-free arrival and departure experiences.

Travel technology firms and mobility providers have strengthened digital booking ecosystems through mobile apps, real-time tracking, and dynamic pricing tools, which have made pre-booked transfers more accessible and predictable. Moreover, the need for personalized services, enhanced hygiene standards, and time efficiency post-pandemic has elevated the adoption of private and premium transport modes.

The market has also benefited from strategic collaborations between airlines, online travel agencies, and ride-hailing companies offering bundled transfer services. Future growth is expected to be supported by increased international travel frequency, mobile-first user behavior, and rising demand from younger age groups preferring seamless digital travel experiences. Segmental dominance is observed across international travelers, private transportation options, and adults aged 26–45 years, who prioritize both comfort and control in their mobility choices.

| Metric | Value |

|---|---|

| Pre-book Airport Transfer Market Estimated Value in (2025 E) | USD 13.4 billion |

| Pre-book Airport Transfer Market Forecast Value in (2035 F) | USD 38.8 billion |

| Forecast CAGR (2025 to 2035) | 11.2% |

The market is segmented by Traveler Type, Transportation Type, Age Group, Tourist Type, Booking Channel, and Tour Type and region. By Traveler Type, the market is divided into International Traveler and Domestic Traveler. In terms of Transportation Type, the market is classified into Private Transportation and Public Transportation. Based on Age Group, the market is segmented into 26-45 Years, 23-25 Years, 46-60 Years, and More Than 60 Years. By Tourist Type, the market is divided into Leisure, Business, Education, Visit Friends/Relatives, Conventions, Religious, and Health Treatment. By Booking Channel, the market is segmented into Online Booking, Phone Booking, and In Person Booking. By Tour Type, the market is segmented into Independent Traveler and Group Traveler. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

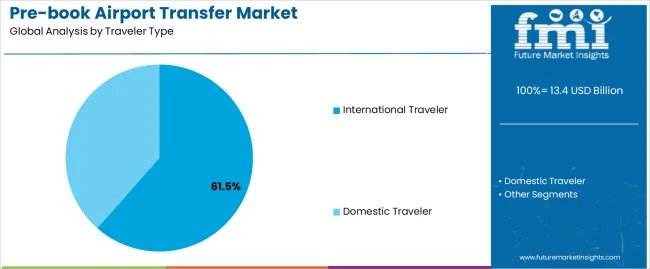

The International Traveler segment is projected to contribute 61.5% of the pre-book airport transfer market revenue in 2025, maintaining its position as the leading traveler type. This dominance has been driven by the heightened reliance of international passengers on scheduled ground transportation services due to unfamiliarity with local transit systems.

Travel trend reports and airline data have shown that international travelers prefer pre-booked transfers to avoid language barriers, currency exchange complexities, and navigation challenges. Additionally, international tourists and business travelers often prioritize time-sensitive itineraries, increasing their dependence on guaranteed, pre-arranged airport pickups.

The integration of airport transfer services into global travel booking platforms and the inclusion of multi-currency and multilingual support have further enhanced adoption. With international travel rebounding strongly and traveler expectations evolving toward premium, contactless service delivery, the International Traveler segment is expected to remain a key revenue driver in this market.

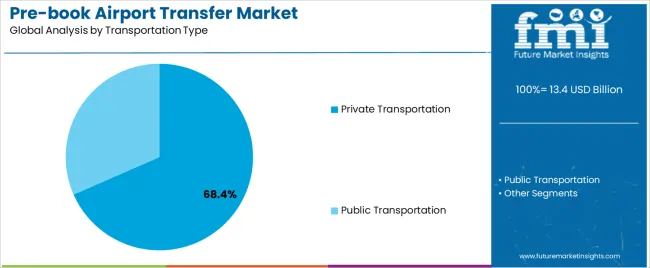

The Private Transportation segment is projected to hold 68.4% of the pre-book airport transfer market revenue in 2025, securing its place as the dominant transportation type. Growth in this segment has been driven by the rising preference for door-to-door mobility services that offer enhanced privacy, comfort, and flexibility.

Post-pandemic travel behaviors have further emphasized the importance of contactless, personalized transit solutions, reinforcing demand for private transfer bookings. Press releases from ride-hailing and chauffeur service providers have highlighted increased consumer engagement with premium car services and tailored pick-up options.

Furthermore, business travelers and families have shown a stronger inclination toward private vehicles due to convenience in managing luggage, travel schedules, and group movement. With mobile booking platforms offering tiered service options and real-time vehicle tracking, the Private Transportation segment is expected to sustain its leadership in the market, appealing to a wide range of traveler demographics.

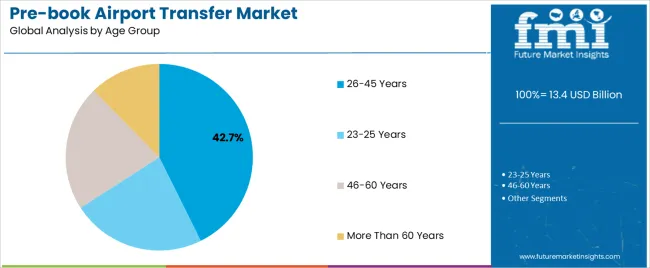

The 26–45 Years segment is projected to account for 42.7% of the pre-book airport transfer market revenue in 2025, establishing itself as the leading age group. This dominance has been influenced by the tech-savvy nature and travel frequency of this demographic, who represent a significant portion of both leisure and business travelers.

Behavioral insights from travel analytics firms have revealed that individuals in this age bracket prefer planning and booking their trips digitally, with a focus on seamless connectivity between air travel and ground transportation. Additionally, lifestyle patterns of this group include frequent international travel, remote work flexibility, and experience-driven tourism, all of which support demand for pre-booked transport services.

Marketing campaigns by travel platforms have specifically targeted this age segment through personalized mobile notifications, loyalty programs, and bundled travel deals. As digital natives with higher purchasing power and mobility needs, the 26–45 Years segment is expected to continue shaping demand patterns in the pre-book airport transfer ecosystem.

This table compares the expected pre-book airport transfer services market growth and trends in terms of numbers. It breaks down the CAGR into semi-annual periods from 2025 to 2035, allowing for a more detailed look at the industry's projected growth compared to the historical period for 2020 to 2025.

| Particular | Value CAGR |

|---|---|

| H1 | 14.3% (2020 to 2035) |

| H2 | 18.4% (2020 to 2035) |

| H1 | 18.2% (2025 to 2035) |

| H2 | 20.3% (2025 to 2035) |

In the first half (H1) of the period from 2020 to 2025, the industry surged at a CAGR of 14.3%, followed by a much higher rate of 18.4% in the second half (H2) of the same period. Moving into the forecast period, from H1 2025 to H2 2035, the CAGR is projected to decrease slightly to 18.2% in the first half and then spike significantly to 20.3% in the second half.

Millennials and Gen Z Adopt Pre-booked Airport Transfers for Stress-free Travel

New-generation travelers have a preference for taking frequent short trips over a single prolonged vacation to uphold a balanced lifestyle. This trend is appealing beyond Millennials and Gen Z, thereby increasing the demand for pre-booked airport transfer solutions.

To support this trend, smartphone penetration is essential in both developed and developing countries. Smartphone use and better connectivity are also boosting industry growth, as without these factors, pre-booked airport transfer booking would not be possible.

Pre-booked Airport Transfers Offer Transparent Pricing and Custom Options

Preference for pre-booking airport transportation is on the rise since there are other advantages beyond convenience. People ought to be aware of every aspect of the ride when they make reservations. With ride-sharing services, customers can stop worrying about unstated fees or haggling with local cab drivers. Travel budgeting has become easy and uncomplicated as one pays for what they see.

One of the key advantages of pre-booked airport transfer services that attract customers is the ability to customize the experience according to individual preferences. Passengers can choose from different vehicle options, including sedans, SUVs, and luxury cars. Plus, one can choose extras like Wi-Fi access, refreshments, child seats, and accessibility features, which makes passengers happy because it fits what they want. The growing demand for accessible pre-book airport transfer services for travelers with disabilities also supports this trend.

Customer-centric Innovation Drives Growth in Pre-book Airport Transfer Service Market

The industry is also growing because of new smart technologies and services focused on making travel easier. These developments lessen traveler stress by assisting passengers in planning and organizing their transfers ahead of time. Transfers go smoothly owing to sophisticated functions like real-time tracking and notifications.

Travelers with different demands are catered to by customer-centric services, including flexible booking choices and 24/7 assistance. An increasing number of passengers are pre-booking their airport transfers to ensure a seamless travel experience from beginning to end, as demonstrated by this industry trend.

Technology Revolutionizes Airport Transfers and User Experience with AI-powered Automation

Technology has changed how people book rides to and from the airport. Mobile applications, online booking platforms, and automated systems have simplified the reservation process. This makes it effortless for travelers to schedule, adjust, or cancel their transfers. Apart from enhancing user experience, this seamless integration of technology provides real-time updates, notifications, and communication channels for smoother coordination between passengers and service providers.

5.65 billion people owning smartphones globally are using apps to book airport transfers. They like how easy it is to use apps for booking, changing schedules, tracking rides, and getting updates right away. This helps the industry grow. Also, artificial intelligence (AI) and automation are becoming more common in these services.

Major players in the pre-book airport transfer market are incorporating Chatbots and automated systems with AI capabilities to improve consumer satisfaction and performance in general. The intention is to streamline client interactions, optimize booking procedures, and offer customized recommendations.

The global pre-book airport transfer market recorded a decent valuation of USD 9,262.1 million in 2025. Considering the CAGR of 16.4% from 2020 to 2025, it can be inferred that the pre-book airport transfer market investment and business potential have always been incremental. This is why the projected 19.3% CAGR in the next decade is expected to be validated.

Pre-booked airport transfer services can grow by reaching new markets with more people flying. Air travel demand in emerging countries is growing rapidly, especially in newly industrialized economies like Brazil, China, India, Indonesia, the Philippines, and Turkey. Getting into these markets early helps services become popular, get more customers, and meet the needs of travelers in these countries as they change. As these countries have vast coastlines, the potential of pre-booking airport transfer services for cruise ship passengers is huge.

Partnering with mobility platforms, super apps, and digital payment providers helps reach more customers, makes booking and paying easier, and makes things more convenient for travelers. For example, in July 2025, SmartRyde, an online airport transfer service in Japan, teamed up with Splyt, which helps super apps and travel companies. This partnership puts SmartRyde in Splyt's global network, making it simple for travelers to book stress-free airport transfers anytime, anywhere through their local travel app, e-wallet, or super app.

With increasing emphasis on environmental sustainability, there is a pre-book airport transfer market opportunity for innovation in eco-friendly transportation solutions. Investment in electric vehicles or hybrid options for eco-friendly airport transfers, carbon offset programs, and green initiatives can appeal to environmentally conscious travelers and align with global sustainability goals.

On top of that, focusing on luxury travelers can help them stand out and make more money. Giving them special cars, VIP treatment, personalized experiences, and top-notch services can bring in high-paying customers and make the brand more respected.

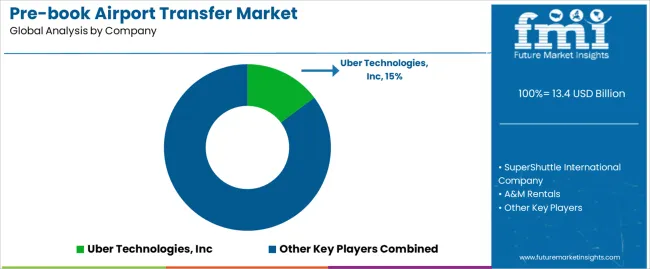

Tier 1 companies are top leaders in the pre-book airport transfer market, making around USD 6,071.8 million in revenue, which is about 54% of the global industry share. Large brands like Uber, Lyft, Blacklane, Gett, and Addison Lee dominate this sector with their strong industry presence and quality services.

Technology is the primary area where they hold their expertise, which helps them to gain an edge. They use advanced technologies and efficient operations to stay competitive and attract many customers. People who want a top-notch airport transfer experience are ready to pay more here to get better quality service.

Tier 2 companies include Jayride, Talixo, Carmel, Wingz, and GroundLink. Their strong standing comes from offering a blend of high quality and affordability. Tier 2 companies cover around 33% of the value share of global industries. Although they may not have the same industry reach as Tier 1 companies, Tier 2 companies are known for their reliable services and cost-effectiveness.

With a valuation of USD 3,710.6 million, these companies offer a range of transportation options and competitive pricing. People in middle to low-income groups prefer these companies as they are known for striking a balance between performance and price.

Prominent companies in Tier 3 include Mozio, Suntransfers, HolidayTaxis, City Airport Taxis, and Shuttle Direct. These companies hold revenue of USD 1,461.7 million, as there is room for them to improve and compete with companies from the other two tiers in the future. They cover around 13% of the share of the industry sector worldwide.

Companies in this section are known for providing reliable services. Individuals from the lower-income group who have to rush to the airport more frequently prefer these companies for their regular commute. However, they typically need to improve their offerings and competitiveness.

The following section discusses the research reports on the global pre-book airport transfer market across various countries. It includes insights on prominent countries in different regions such as North America, Asia Pacific, Europe, and other regions. In North America, the United States is expected to lead with a CAGR of 10.3% through 2035.

Meanwhile, India in the South Asia and Pacific region is forecasted to experience a CAGR of 19.7% through 2035, slightly surpassing China's projected CAGR of 18.4%. However, among other countries, Australia is set to witness a win-win situation in the industry, with a 27.3% CAGR through 2035.

| Countries | CAGR 2025 to 2035 |

|---|---|

| United States | 10.3% |

| China | 18.4% |

| Germany | 15.3% |

| India | 19.7% |

| Australia | 27.3% |

The pre-book airport transfer market in the United States is expected to rise at a 10.3% CAGR over the forecast period. The country is dominant in North America and is expected to continue to do so as its competitor market, Canada, grows more slowly than the United States economy.

The United States is a popular destination for visitors and tourists from throughout the globe. This is accelerating the national rollout of scheduled airport transfers. Demand for pre-booked airport transfers is running parallel to the increasing travel and tourism activities. With the surging tourism industry, the craze for pre-booking airport transfers inflates as well.

In addition to luxury choices like limousines, airport transfer companies in this country provide multiple private transfers and shuttles. These include taxis for smaller groups and minibusses for larger ones. At the same time, many individuals travel the United States for business purposes which increases the appeal of pre-booked private transfers in the country. The impact of mega-events and conferences on the pre-book airport transfer market is also apparent.

The pre-book airport transfer market in India is projected to expand at a CAGR of 19.7% over the forecast period. Stakeholders and investors are eyeing India for their development owing to the rushing consumer appetite for pre-booked airport transfer experiences.

Owners of pre-booked airport transfers are listing their properties on travel sites to increase visibility and trust among potential customers. These sites promote service providers by offering cab reviews, guest ratings, special offers, and online bookings. Companies like WTI Cabs offer services across 130+ cities of India with 6000+ cars.

Growing tourist attractions in India and aggressive promotion of the hospitality industry to stimulate economic activity within the country are fueling the pre-book airport transfer industry expansion. Also, pre-book airport transfer services market competitive landscape shows several airlines are launching their own airport transfer services in the country. For instance, in January 2025, Air India announced its plan to introduce the first rollout of value-added services across its network, starting with ''Book-A-Car'' for passengers traveling to and from domestic airports.

The pre-book airport transfer market in Australia is forecasted to expand at a CAGR of 27.3% through 2035. This category of airport transfer is increasingly preferred among today's travelers due to many reasons, including their one-of-a-kind convenience.

Millions of travelers visit Australia each year, drawn by its wonderful beaches and exciting underwater activities like scuba diving and snorkeling along the Great Barrier Reef, which is home to an incredible array of marine life. The trend of reserving airport transportation in advance is growing along with the tourism business.

Investors and stakeholders are expected to flock to Australia, a hub for investments. Through dependable, high-caliber effort, players are grabbing the country's new possibilities. To ingrain the brand's identity in the minds of the customers they serve, they are going above and beyond to personalize their offerings to their exact needs.

This section provides details about the industry's leading segments. In terms of traveler type, the independent segment is estimated to account for a share of 34.2% in 2025. By transportation type, the private transportation category is projected to dominate by holding a share of 45.3% in 2025.

Independent travelers prefer pre-booked airport transfers because they can choose their own schedule and plan their trip the way they want. They like having a comfortable and customized experience during their journey, which they can get through pre-booked airport transfers.

| Segment | Independent (Traveler Type) |

|---|---|

| Value Share (2025) | 34.2% |

Independent travelers prefer booking private pre-book airport transportation as it offers a sense of privacy and security. They feel safer and more secure because they get direct, private rides without sharing with others or dealing with unfamiliar routes. This is especially crucial for business travelers or those with specific security concerns. It reduces the risk of exposure to crowded spaces and provides a direct, secure route to the destination.

Many independent travelers travel alone including female travelers. Pre-booked airport transfers provide a reliable and comfortable way for them to get from the airport to their accommodation. While group travelers can save money by sharing costs, independent travelers are willing to pay more for the convenience and personalized service of pre-booked airport transfers.

Previously, public transportation was popular among customers as in a shared-ride shuttle, one gets to travel with other people heading to the same airport or destination. This was preferred as it was a budget-friendly transfer option, good for especially frequent travelers who don’t mind spending extra time traveling to the airport to save some extra bucks.

With surging income levels, however, people are now tending more toward private transportation like express rides. These offer a non-stop and uninterrupted transport service straight from one’s place to an airport.

| Segment | Private Transportation (Transportation Type) |

|---|---|

| Value Share (2025) | 45.3% |

One can book this service from an airport to a specific destination without sharing a ride with other people or stopping between multiple places till the destination is reached. It also allows travelers to schedule pickups and drop-offs according to their own timetable

Private transportation often provides a more comfortable and personalized experience, with options for luxury vehicles, ample space for luggage, and amenities like Wi-Fi and refreshments, which may not be available in public transport.

Pre-book airport transfer services business opportunity analysis indicates that companies compete based on the quality and range of services they offer. Airport transfer service providers are tapping into the demand for affordable yet comfortable services by providing accessible pre-booked airport transfer options tailored to individual preferences.

Key players are also integrating the latest technologies and developing new products and services according to consumer behavior in the industry. The integration of advanced technologies is a key battleground for competitors. Competitors strive to expand their industry reach through strategic partnerships with travel agencies, airlines, hotels, mobility platforms, and digital payment providers.

The role of travel agencies in promoting pre-book airport transfer services is unavoidable. Many new entrants with a focus on luxury travel are replicating the luxury travel experience with advanced features in their cabs.

Industry Updates

Based on traveler type, the industry is bifurcated into independent traveler and group traveler.

In terms of transportation type, the industry is divided into private transportation and public transportation. The private transportation segment is further categorized into taxis and shuttles, car rentals, ride shares, and others. The public transportation segment is further divided into inter-city shuttles, inter-terminal shuttles and others.

Depending on age group, the industry is categorized into 23-25 years, 26-45 years, 45-60 years, and more than 60 years.

Based on purpose/tourist type, the industry is branched into business, leisure, visit friends/relatives, education, conventions, religious, and health treatment.

In terms of booking type, the industry is trifurcated into phone booking, online booking, and in-person booking.

Pre-book airport transfer services market regional analysis is conducted across North America, Latin America, Europe, Asia Pacific, and the Middle East and Africa.

The global pre-book airport transfer market is estimated to be valued at USD 13.4 billion in 2025.

The market size for the pre-book airport transfer market is projected to reach USD 38.8 billion by 2035.

The pre-book airport transfer market is expected to grow at a 11.2% CAGR between 2025 and 2035.

The key product types in pre-book airport transfer market are international traveler and domestic traveler.

In terms of transportation type, private transportation segment to command 68.4% share in the pre-book airport transfer market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Airport Ground Transportation Market Forecast and Outlook 2025 to 2035

Airport Quick Service Restaurant Market Size and Share Forecast Outlook 2025 to 2035

Airport Bus Market Analysis - Size, Share, and Forecast Outlook (2025 to 2035)

Airport Runway Lighting Market Size and Share Forecast Outlook 2025 to 2035

Airport Robots Market Size and Share Forecast Outlook 2025 to 2035

Airport Passenger Boarding Bridge Market Size and Share Forecast Outlook 2025 to 2035

Airport Moving Walkways Market Size and Share Forecast Outlook 2025 to 2035

Airport Cabin Baggage Scanner Market Size and Share Forecast Outlook 2025 to 2035

Airport Sleeping Pods Market Analysis - Trends, Growth & Forecast 2025 to 2035

Market Share Breakdown of Airport Security Solutions

Airport Retailing Market Trends - Growth & Forecast 2025 to 2035

Airport Security Market Trends - Growth & Forecast 2025 to 2035

Airport Lighting Market

Airport Information Display System Market

Smart Airport Market Size and Share Forecast Outlook 2025 to 2035

Advanced Airport Technologies Market Size and Share Forecast Outlook 2025 to 2035

Transfer Paper Market Size and Share Forecast Outlook 2025 to 2035

Transfer Switch Market Size and Share Forecast Outlook 2025 to 2035

Heat Transfer Film Market Size and Share Forecast Outlook 2025 to 2035

Mass Transfer Trays Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA