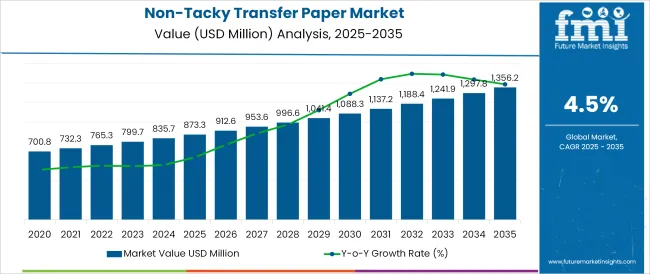

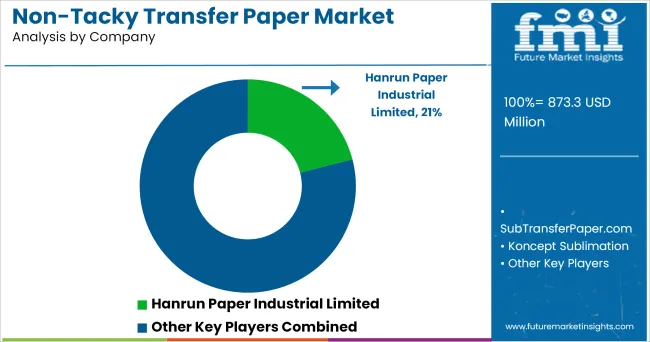

The Non-Tacky Transfer Paper Market is estimated to be valued at USD 873.3 million in 2025 and is projected to reach USD 1356.2 million by 2035, registering a compound annual growth rate (CAGR) of 4.5% over the forecast period.

The non-tacky transfer paper market is experiencing stable expansion, supported by increased consumption of digitally printed textiles across sportswear, home décor, soft signage, and promotional goods. The growing preference for lightweight, quick-drying sublimation papers has enhanced efficiency in large-format printing setups, particularly where precision and color vibrancy are critical.

Demand is being reinforced by advancements in heat transfer technology and printhead compatibility, allowing for smoother ink release and higher transfer rates. With reduced risk of ghosting or misalignment during transfer, non-tacky variants are being favored over traditional tacky substrates in continuous production environments.

Additionally, sustainability initiatives in the printing industry are encouraging the adoption of low-GSM, recyclable paper options that align with green manufacturing goals. Future growth will be shaped by the continued shift toward fast-fashion production cycles, expansion of dye-sublimation in industrial textile printing, and innovations in ink-paper interaction to support sharper, high-resolution outputs.

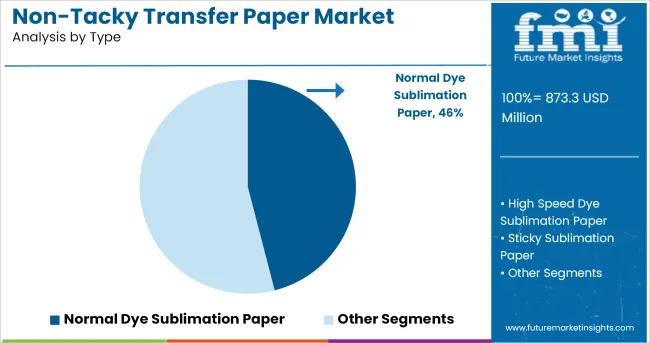

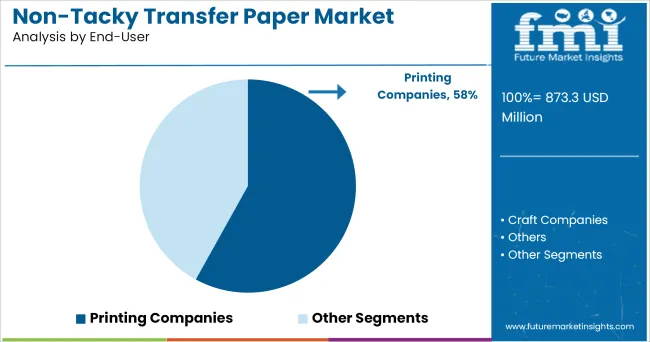

The market is segmented by Type and End-User and region. By Type, the market is divided into Normal Dye Sublimation Paper, High Speed Dye Sublimation Paper, and Sticky Sublimation Paper. In terms of End-User, the market is classified into Printing Companies, Craft Companies, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Normal dye sublimation paper is projected to account for 46.0% of the total revenue share in the non-tacky transfer paper market by 2025, making it the dominant type segment. This leadership is being driven by the cost-efficiency, high transfer rate, and ease of handling associated with standard sublimation grades. These papers are widely preferred in commercial and industrial printing operations that focus on polyester-based textiles, signage, and rigid substrates.

The lightweight structure and compatibility with high-speed printers make them suitable for roll-to-roll production environments where throughput and consistency are essential. Normal sublimation papers allow for rapid ink drying, minimal paper curl, and smooth transfer without the need for adhesive coatings, which simplifies the operational workflow.

Additionally, their adaptability to different ink formulations and press temperatures has supported broad market applicability. As end-users prioritize efficiency and reliability in digital textile printing, the use of normal dye sublimation paper continues to expand across diverse production environments.

Printing companies are expected to hold a leading 58.0% revenue share in the non-tacky transfer paper market by 2025. This segment’s dominance is being shaped by the increasing demand for customized, short-run, and high-quality sublimation printing services across various sectors including fashion, sportswear, promotional products, and interior décor.

Non-tacky transfer papers offer operational advantages such as reduced press downtime, minimized ink bleeding, and compatibility with advanced digital printers, which makes them ideal for commercial print houses. Printing companies are leveraging these papers to maintain quick turnaround times while ensuring sharp image reproduction and reduced media waste.

Furthermore, the ability to seamlessly integrate non-tacky paper into automated workflows enhances production scalability and cost control. As the printing industry continues to shift toward sustainable, high-performance substrates, the reliance on non-tacky sublimation solutions is expected to increase, reinforcing the segment’s leadership across regional and global markets.

Due to excellent transfer yields, fast dry times and superior ink absorption, non-tacky transfer papers are high in demand. In the most demanding dye sublimation applications, non-tacky transfer paper is uniformly coated product and of high quality, which is engineered to improve overall image quality.

The papers are used in the production of banners, flags, home decor, gaming table felt, athletic apparel and other applications. Either soft or rigid surfaces, including t-shirts, mouse pads, and ceramics are used in a variety of transfer applications. Such need is further driving the growth of non-tacky transfer paper.

Roland, Epson, Mutoh, Mimaki and other wide format dye sub printers are compatible with non-tacky transfer paper. Non-tacky is sandwiched and then printed with a fabric and run through a high heat calendar. The same process is of the tacky version but it is when, it is the requirement of precise registration. As this paper is ideal for a variety of transfer applications, this reason will fuel the market growth.

Those days are gone, when people used to print custom designs on items such as t-shirts, mugs and other clothing material. Now a days, there are companies that specialize in creating and printing these products, who are fulfilling such needs of customers.

There are companies behind those creative companies, who are supporting and supplying them with the tools necessary to led in the industry. There is an increase in manufacturers worldwide for the non-tacky transfer paper and ink, they are growing in number and producing transfer paper for a good number of years.

It can be either a type of paper or printer, referring to eco-solvent. A material that stretches a lot such as nylon, polyester, and spandex, uses the type of heat transfer paper. As there are different types of eco-solvent transfer paper in the market, it will widen the options for t-shirt printing companies. Such trend is further driving the growth of non-tacky transfer paper.

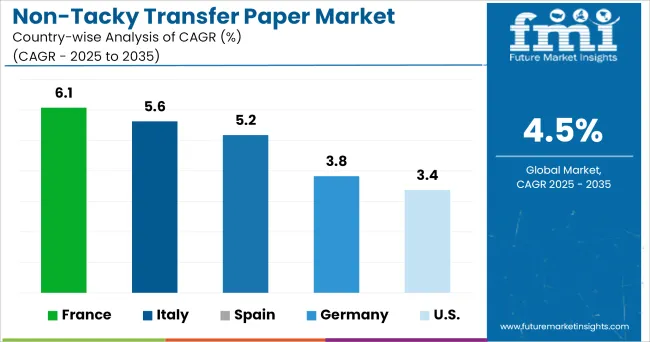

The Europe region is going to hold a significant share of the non-tacky transfer paper market from 2024 to 2035 due to the rapid adoption of non-sticky sublimation paper by printing and craft industries. Various papers, such as sticky, non-sticky and heat transfer paper are opted by organizations and customers in the region.

The craft vertical is adopting the non-tacky transfer paper solutions at a great rate in the region. Due to this factor, the demand for non-tacky transfer paper solutions will continue to grow in the Europe region.

East Asia is going to witness the highest growth during the forecast period 2024 to 2035 as there is an increase in adoption of non-tacky transfer papers in the region. Growing economy countries Japan and China are implementing the latest high speed dye sublimation paper solutions, this too will contribute to the growth of the non-tacky transfer paper market in the East Asia region.

Customers in Japan and China are shifting towards the use of non-tacky transfer paper, this is one of the major factor fueling the growth of non-tacky transfer paper in the region.

Some of the leading vendors of non-tacky transfer paper include

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain.

The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

The global non-tacky transfer paper market is estimated to be valued at USD 873.3 million in 2025.

The market size for the non-tacky transfer paper market is projected to reach USD 1,356.2 million by 2035.

The non-tacky transfer paper market is expected to grow at a 4.5% CAGR between 2025 and 2035.

The key product types in non-tacky transfer paper market are normal dye sublimation paper, high speed dye sublimation paper and sticky sublimation paper.

In terms of end-user, printing companies segment to command 58.0% share in the non-tacky transfer paper market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Competitive Breakdown of Non-Tacky Transfer Paper Providers

Transfer Switch Market Size and Share Forecast Outlook 2025 to 2035

Transfer Paper Market Size and Share Forecast Outlook 2025 to 2035

Heat Transfer Film Market Size and Share Forecast Outlook 2025 to 2035

Mass Transfer Trays Market Size and Share Forecast Outlook 2025 to 2035

Market Share Distribution Among Heat Transfer Film Manufacturers

Heat Transfer Paper Market Analysis - Growth & Demand 2024 to 2034

Human Transferrin Detection Kit Market Size and Share Forecast Outlook 2025 to 2035

Fluid Transfer Solutions Market – Demand & Forecast 2024-2034

Lipid Transfer Proteins Market

Tacky Transfer Paper Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Transfer Case Market Size and Share Forecast Outlook 2025 to 2035

Thermal Transfer Roll Market Size and Share Forecast Outlook 2025 to 2035

Thermal Transfer Ribbon Market Growth - Demand & Forecast 2025 to 2035

Thermal Transfer Tapes Market

Textile Transfer Paper Market Size and Share Forecast Outlook 2025 to 2035

Adhesive Transfer Tape Market Growth, Trends, Forecast 2025 to 2035

IV Fluid Transfer Drugs Devices Market Trends – Growth & Forecast 2025 to 2035

Assessing Adhesive Transfer Tape Market Share & Industry Insights

Emergency Transfer Vacuum Mattress Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA