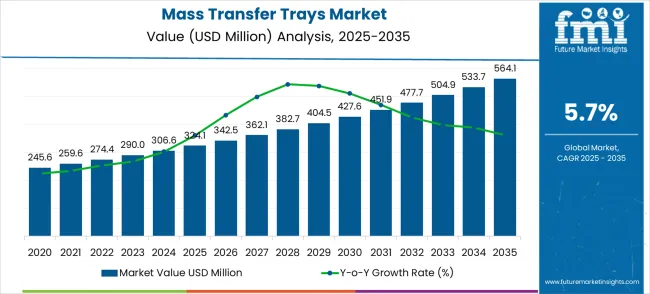

The global mass transfer trays market is valued at USD 324.1 million in 2025. It is slated to reach USD 564.1 million by 2035, recording an absolute increase of USD 240.0 million over the forecast period. This translates into a total growth of 74.1%, with the market forecast to expand at a compound annual growth rate (CAGR) of 5.7% between 2025 and 2035. The overall market size is expected to grow by nearly 1.74X during the same period, supported by increasing demand for efficient separation processes, growing adoption of advanced distillation technologies in chemical processing, and rising emphasis on operational efficiency across diverse petrochemical and industrial applications.

Between 2025 and 2030, the mass transfer trays market is projected to expand from USD 324.1 million to USD 427.6 million, resulting in a value increase of USD 103.5 million, which represents 43.1% of the total forecast growth for the decade. This phase of development will be shaped by increasing chemical processing capacity expansion, rising adoption of advanced separation technologies, and growing demand for energy-efficient distillation systems that optimize mass transfer efficiency and reduce operational costs. Chemical plant operators and process engineers are expanding their mass transfer tray installations to address the growing demand for improved separation performance and process optimization.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 324.1 million |

| Forecast Value in (2035F) | USD 564.1 million |

| Forecast CAGR (2025 to 2035) | 5.7% |

The mass transfer trays market has been recognized as an integral part of various industrial processes, particularly in sectors where separation and filtration are critical. Within the chemical processing equipment market, this segment contributes approximately 9.4%, as mass transfer trays are widely used in distillation columns for separating components in chemical reactions. The industrial separation equipment market records a share of about 10.2%, with mass transfer trays playing a key role in separation processes across industries like petrochemicals and pharmaceuticals. In the process filtration equipment market, the contribution stands at 8.6%, reflecting their application in filtration and separation technologies. The oil and gas equipment market accounts for around 7.9%, as mass transfer trays are essential in refining processes for crude oil and gas separation. In the water treatment equipment market, the share is approximately 6.8%, due to the need for separation processes in wastewater treatment. These parent markets collectively contribute 42.9%, emphasizing the mass transfer trays market’s role in optimizing efficiency, enhancing separation processes, and supporting the reliability of key industrial operations. The market is regarded as fundamental in industries that rely on precise and effective separation technologies.

Why is the Mass Transfer Trays Market Growing?

Market expansion is being supported by the increasing global demand for efficient chemical processing and the corresponding need for advanced separation technologies that can optimize mass transfer efficiency, reduce energy consumption, and enhance product purity across various petrochemical, oil & gas, and fine chemical processing applications. Modern chemical plant operators and process engineers are increasingly focused on implementing separation solutions that can improve process efficiency, reduce operational costs, and provide consistent performance in demanding processing environments. Mass transfer trays' proven ability to deliver enhanced separation efficiency, optimize energy utilization, and support process intensification makes them essential components for contemporary chemical processing and industrial separation operations.

The growing emphasis on energy efficiency and process optimization is driving demand for mass transfer trays that can support advanced separation processes, reduce energy consumption, and enable comprehensive process control. Chemical processing facilities' preference for separation equipment that combines high efficiency with operational reliability and maintenance simplicity is creating opportunities for innovative mass transfer tray implementations. The rising influence of sustainable chemistry and green processing technologies is also contributing to increased adoption of mass transfer trays that can provide efficient separation without compromising environmental performance or process sustainability.

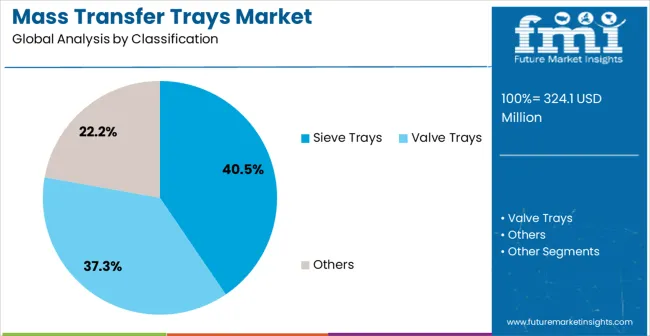

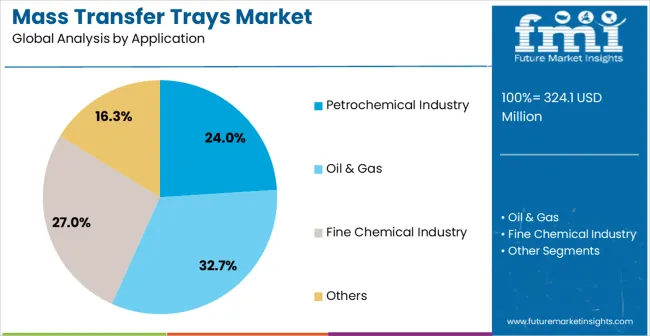

The market is segmented by tray type, application, and region. By tray type, the market is divided into sieve trays, valve trays, and others. Based on application, the market is categorized into the petrochemical industry, oil & gas, fine chemical industry, and others. Regionally, the market is divided into Asia Pacific, North America, Europe, Latin America, and the Middle East & Africa.

The sieve trays segment is projected to maintain its leading position in the mass transfer trays market in 2025, reaffirming its role as the preferred tray configuration category for general distillation and separation applications. Chemical process engineers and plant operators increasingly utilize sieve trays for their simple design characteristics, cost-effective manufacturing, and reliable performance across various separation scenarios and operating conditions. Sieve tray technology's proven effectiveness and operational simplicity directly address the processing requirements for efficient mass transfer and consistent separation performance in diverse chemical processing applications.

This tray-type segment forms the foundation of modern distillation column installations, as it represents the tray configuration with the greatest versatility and established performance record across multiple separation processes and chemical processing applications. Chemical plant investments in sieve tray systems continue to strengthen adoption among process engineers and operations teams. With separation applications requiring reliable mass transfer and operational consistency, sieve trays align with both performance objectives and cost-effectiveness requirements, making them the central component of comprehensive distillation strategies.

The petrochemical industry application segment is projected to represent the largest share of mass transfer trays demand in 2025, underscoring its critical role as the primary driver for separation equipment adoption across refining operations, chemical synthesis facilities, and petrochemical processing plants. Petrochemical operators prefer mass transfer trays for separation processes due to their high-volume processing capabilities, reliable separation performance, and ability to handle diverse chemical mixtures while supporting continuous operations and product quality requirements. Positioned as essential equipment for modern petrochemical operations, mass transfer trays offer both efficiency advantages and operational benefits.

The segment is supported by continuous innovation in petrochemical processing technologies and the growing availability of specialized tray systems that enable effective separation with enhanced efficiency and operational reliability. Additionally, petrochemical operators are investing in advanced separation programs to support large-scale production requirements and product quality objectives. As petrochemical processing becomes more complex and efficiency requirements increase, the petrochemical industry application will continue to dominate the market while supporting advanced tray utilization and process optimization strategies.

The mass transfer trays market is advancing steadily due to increasing demand for efficient chemical processing and growing adoption of advanced separation technologies that provide enhanced mass transfer efficiency and process optimization across diverse petrochemical and industrial applications. However, the market faces challenges, including high capital investment costs for advanced tray systems, technical complexity in design optimization and installation, and competition from alternative separation technologies such as structured packing. Innovation in computational fluid dynamics and advanced materials continues to influence product development and market expansion patterns.

The growing adoption of computational fluid dynamics modeling and advanced tray design optimization is enabling process engineers to achieve superior mass transfer efficiency, reduced pressure drop, and enhanced separation performance for demanding chemical processing applications. Advanced design systems provide improved separation effectiveness while allowing more precise optimization and consistent performance across various operating conditions and chemical systems. Manufacturers are increasingly recognizing the competitive advantages of CFD-optimized design capabilities for performance differentiation and process optimization.

Modern mass transfer tray manufacturers are incorporating digital monitoring technologies and process optimization systems to enhance separation performance, enable predictive maintenance, and provide comprehensive process control through integrated monitoring and data analysis platforms. These technologies improve operational efficiency while enabling new applications, including real-time optimization and automated process control. Advanced digital integration also allows operators to support comprehensive process management and performance optimization beyond traditional manual operation approaches.

| Country | CAGR (2025-2035) |

|---|---|

| China | 7.7% |

| India | 7.1% |

| Germany | 6.6% |

| Brazil | 6.0% |

| USA | 5.4% |

| UK | 4.8% |

| Japan | 4.3% |

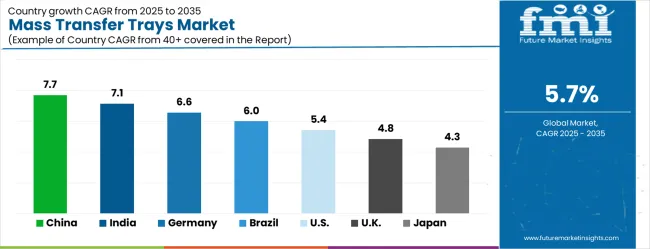

The mass transfer trays market is experiencing solid growth globally, with China leading at a 7.7% CAGR through 2035, driven by the expanding chemical processing industry, growing petrochemical capacity, and significant investment in industrial separation technology advancement and chemical plant modernization. India follows at 7.1%, supported by rapid industrial development, increasing chemical manufacturing capacity, and growing adoption of advanced process technologies in the petrochemical and fine chemical industries. Germany shows growth at 6.6%, emphasizing precision engineering and advanced separation technology development. Brazil records 6.0%, focusing on petrochemical industry expansion and chemical processing modernization initiatives. The USA demonstrates 5.4% growth, supported by established chemical processing infrastructure and emphasis on process optimization. The UK exhibits 4.8% growth, emphasizing chemical industry efficiency and advanced processing technologies. Japan shows 4.3% growth, supported by advanced chemical technologies and precision process equipment manufacturing. The report covers an in-depth analysis of 40+ countries; seven top-performing countries are highlighted below.

The mass transfer trays market in China is expanding at a CAGR of 7.7%, fueled by the country’s booming industrial sectors, particularly in chemicals, petrochemicals, and energy production. China’s growing chemical manufacturing base and energy consumption drive the demand for efficient separation technologies like mass transfer trays in distillation columns and other separation units. The government’s focus on improving industrial efficiency and environmental sustainability further supports the adoption of advanced mass transfer systems in both existing and new plants. China’s massive infrastructure development and manufacturing capabilities continue to fuel the market.

The mass transfer trays market in India is projected to grow at a CAGR of 7.1%, driven by industrial expansion, particularly in the oil and gas, chemical, and pharmaceutical sectors. India’s growing demand for energy and chemicals drives the adoption of mass transfer trays in separation and purification processes. The country’s ongoing investments in refinery upgrades, wastewater treatment infrastructure, and chemical manufacturing technologies further support market growth. As industries seek to optimize production efficiency and reduce energy consumption, the demand for advanced mass transfer systems continues to rise.

The mass transfer trays market in Germany is growing at a CAGR of 6.6%, driven by the demand for high-efficiency separation systems in chemical, petrochemical, and environmental industries. Germany’s focus on sustainable energy, emissions control, and industrial automation strengthens the adoption of advanced mass transfer systems in its manufacturing base. The country’s commitment to reducing carbon footprints and improving operational efficiency in chemical and energy production contributes to the steady growth of mass transfer trays.

The mass transfer trays market in Brazil is projected to grow at a CAGR of 6.0%, supported by the growth of industries such as oil and gas, chemicals, and food processing. Brazil’s expanding infrastructure and investment in energy production, especially renewable energy and oil refining, are fueling the adoption of efficient separation systems. As Brazil modernizes its industrial sector and strengthens environmental standards, the demand for high-performance mass transfer trays in various separation processes continues to grow.

The mass transfer trays market in the United States is growing at a CAGR of 5.4%, fueled by the demand for high-efficiency separation technologies in the chemical, petrochemical, and environmental sectors. As the USA focuses on increasing energy efficiency, reducing emissions, and enhancing production processes, the adoption of advanced mass transfer trays continues to rise. Strong investments in upgrading chemical processing plants, along with the rising need for more sustainable operations, support the steady market growth.

The mass transfer trays market in the United Kingdom is growing at a CAGR of 4.8%, driven by demand from industries such as chemicals, pharmaceuticals, and energy. The UK’s focus on reducing industrial emissions and improving production efficiency supports the adoption of advanced mass transfer technologies in various manufacturing sectors. As the country invests in sustainable energy solutions and modernizes industrial infrastructure, the demand for high-efficiency separation systems like mass transfer trays continues to rise.

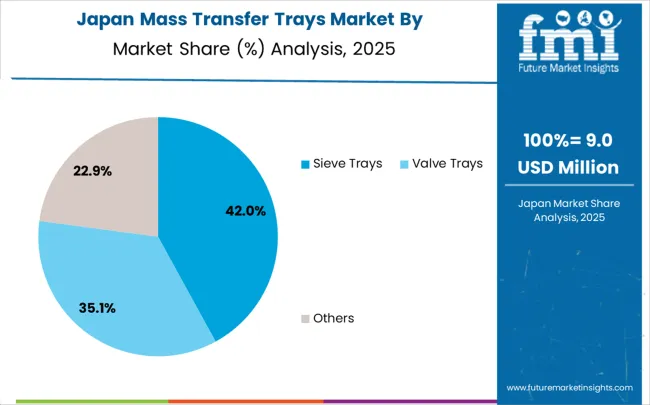

The mass transfer trays market in Japan is expanding at a CAGR of 4.3%, supported by increasing demand for efficient separation systems in petrochemical, food, and environmental industries. Japan’s focus on operational excellence and sustainability, along with its highly developed industrial sector, continues to drive market demand for mass transfer trays. The need for reducing energy consumption and optimizing production processes in chemical and oil refining operations further accelerates the adoption of advanced separation technologies.

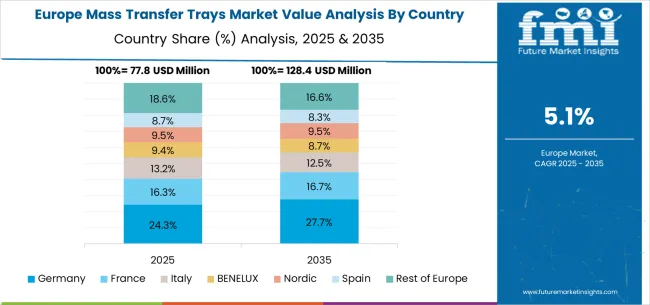

The mass transfer trays market in Europe is projected to grow from USD 117.7 million in 2025 to USD 191.8 million by 2035, registering a CAGR of 5.0% over the forecast period. Germany is expected to maintain its leadership position with a 28.0% market share in 2025, moderating slightly to 27.8% by 2035, supported by its strong chemical industry, advanced process engineering sector, and comprehensive separation technology infrastructure serving major European markets.

The United Kingdom follows with 21.0% in 2025, projected to reach 20.8% by 2035, driven by established chemical industry efficiency focus, comprehensive process optimization framework, and advanced separation technology programs. France holds 18.5% in 2025, rising to 18.7% by 2035, supported by chemical industry leadership and growing adoption of advanced process technologies. Italy commands 13.5% in 2025, projected to reach 13.6% by 2035, while Spain accounts for 8.5% in 2025, expected to reach 8.6% by 2035. The Netherlands maintains a 4.0% share in 2025, growing to 4.1% by 2035. The Rest of Europe region, including Nordic countries, Eastern Europe, and other markets, is anticipated to maintain its position, holding its collective share at 6.5% by 2035, attributed to increasing chemical industry modernization and growing advanced separation technology adoption across emerging process markets implementing modern separation standards.

The mass transfer trays market is characterized by competition among established process equipment manufacturers, specialized separation technology companies, and integrated chemical processing solution providers. Companies are investing in advanced tray design research, computational fluid dynamics optimization, manufacturing excellence, and comprehensive product portfolios to deliver efficient, reliable, and high-performance mass transfer tray solutions. Innovation in advanced materials, tray geometry optimization, and digital process integration is central to strengthening market position and competitive advantage.

Koch-Glitsch leads the market with comprehensive separation technology solutions, offering advanced mass transfer trays with a focus on separation efficiency and process optimization across diverse chemical processing applications. RVT Process Equipment provides specialized process equipment with an emphasis on custom separation solutions and process engineering support. Sulzer delivers innovative process technologies with a focus on the chemical and petrochemical industries, with comprehensive separation capabilities. Raschig specializes in process internals and separation technologies with emphasis on mass transfer optimization and process efficiency. Saiptech focuses on separation equipment with emphasis on advanced design and process integration. Honeywell offers comprehensive process solutions with an emphasis on automation and process optimization.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 324.1 million |

| Tray Type | Sieve Trays, Valve Trays, Others |

| Application | Petrochemical Industry, Oil & Gas, Fine Chemical Industry, Others |

| Regions Covered | Asia Pacific, North America, Europe, Latin America, Middle East & Africa |

| Countries Covered | China, India, Germany, Brazil, the United States, the United Kingdom, Japan, and 40+ countries |

| Key Companies Profiled | Koch-Glitsch, RVT Process Equipment, Sulzer, Raschig, Saiptech, and Honeywell |

| Additional Attributes | Dollar sales by tray type and application category, regional demand trends, competitive landscape, technological advancements in separation systems, CFD optimization development, process integration innovation, and mass transfer efficiency optimization |

Asia Pacific

North America

Europe

Latin America

Middle East & Africa

The global mass transfer trays market is estimated to be valued at USD 324.1 million in 2025.

The market size for the mass transfer trays market is projected to reach USD 564.1 million by 2035.

The mass transfer trays market is expected to grow at a 5.7% CAGR between 2025 and 2035.

The key product types in mass transfer trays market are sieve trays, valve trays and others.

In terms of application, petrochemical industry segment to command 24.0% share in the mass transfer trays market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Massoia Bark Essential Oil Market Size and Share Forecast Outlook 2025 to 2035

Mass Loaded Vinyl (MLV) Market Size and Share Forecast Outlook 2025 to 2035

Mass Notification System in Healthcare Market Size and Share Forecast Outlook 2025 to 2035

Mass Finishing Consumables Market Size and Share Forecast Outlook 2025 to 2035

Massage Therapy Service Market - Growth & Forecast 2025 to 2035

Massage Guns Market Analysis – Demand, Growth & Forecast 2025–2035

Massive Open Online Course Market Analysis – Growth, Trends & Forecast 2025 to 2035

Industry Share Analysis for Massage Therapy Service Providers

Mass Notification Systems Market Analysis by Component, Solution, Application, and Industry, and Region Through 2035

Massive MIMO Market

Massage Equipment Market

Biomass Hot Air Generator Furnace Market Size and Share Forecast Outlook 2025 to 2035

Biomass Pellets Market Size and Share Forecast Outlook 2025 to 2035

Biomass Gasification Market Size and Share Forecast Outlook 2025 to 2035

Biomass Boiler Market Size and Share Forecast Outlook 2025 to 2035

Hand Massager Market Size and Share Forecast Outlook 2025 to 2035

Europe Massage Therapy Service Market Size and Share Forecast Outlook 2025 to 2035

Vending Massage Chair Payment Solution Market Size and Share Forecast Outlook 2025 to 2035

Spatial Mass Spectrometry Market Size and Share Forecast Outlook 2025 to 2035

Woody Biomass Boiler Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA