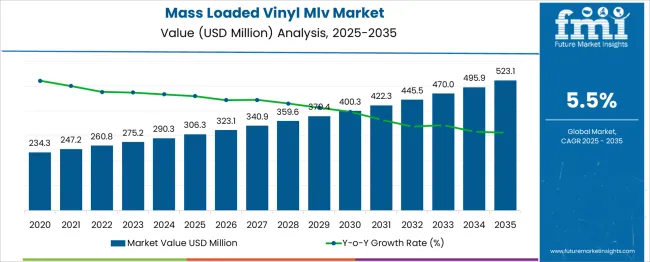

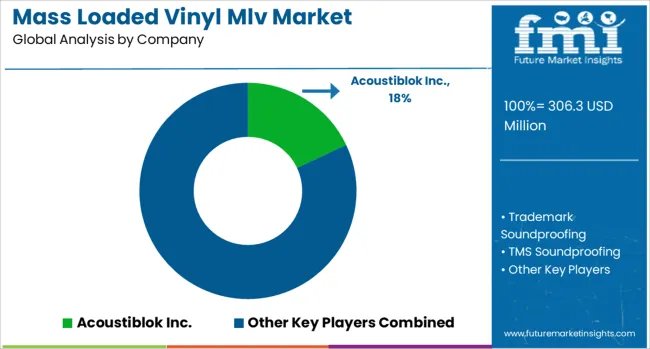

The Mass Loaded Vinyl (MLV) Market is estimated to be valued at USD 306.3 million in 2025 and is projected to reach USD 523.1 million by 2035, registering a compound annual growth rate (CAGR) of 5.5% over the forecast period. Between 2025 and 2030, the market is expected to increase from USD 306.3 million to USD 400.3 million, driven by rising demand for effective soundproofing solutions in residential, commercial, and automotive sectors.

Year-on-year analysis shows a steady growth trend, with the market reaching USD 323.1 million in 2026 and USD 340.9 million in 2027, supported by the expansion of building acoustic standards and growing consumer preference for noise reduction. By 2028, the market is anticipated to reach USD 359.6 million, advancing to USD 379.4 million in 2029 and USD 400.3 million by 2030.

Increasing applications of MLV in industrial environments, recording studios, and high-performance vehicles will further enhance adoption. Manufacturers are focusing on lightweight formulations and eco-friendly material innovations to meet performance and sustainability demands. These dynamics position mass-loaded vinyl as a critical material for modern acoustic insulation solutions, offering durability, flexibility, and high-density sound barriers for a wide range of noise control applications globally.

| Metric | Value |

|---|---|

| Mass Loaded Vinyl (MLV) Market Estimated Value in (2025 E) | USD 306.3 million |

| Mass Loaded Vinyl (MLV) Market Forecast Value in (2035 F) | USD 523.1 million |

| Forecast CAGR (2025 to 2035) | 5.5% |

The Mass Loaded Vinyl MLV market is experiencing strong growth as industries and consumers increasingly seek high-performance soundproofing solutions across residential, commercial, and industrial spaces. Demand is being driven by rising noise pollution concerns, more stringent building codes, and heightened awareness of acoustic health. MLV’s versatility in structure-borne and airborne noise reduction is supporting its adoption across sectors such as construction, automotive, and manufacturing.

Enhanced product availability in customizable formats and thicknesses is enabling broader usage across both retrofit and new-build projects. The shift toward non-fibrous, flexible acoustic barriers with higher mass density has positioned MLV as a preferred alternative to traditional insulation materials. With improvements in manufacturing techniques and an expanding base of environmentally conscious consumers, the market is poised for continued expansion.

Growth opportunities are also being unlocked through strategic collaborations among manufacturers, contractors, and architects seeking lightweight, durable, and effective sound attenuation solutions. The increasing integration of acoustic performance into design standards is expected to sustain long-term market momentum..

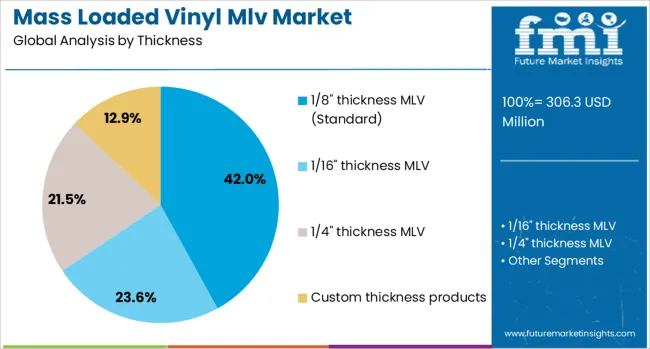

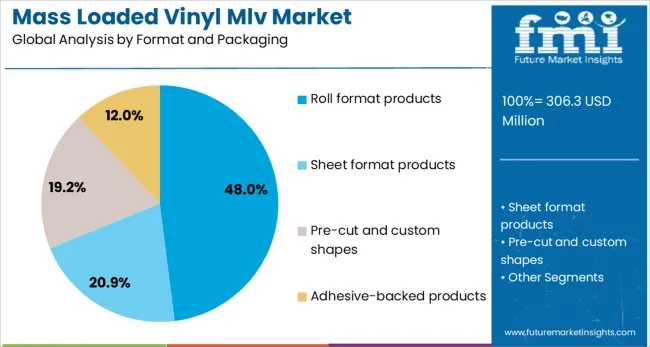

The mass-loaded vinyl (MLV) market is segmented by thickness, format and packaging, application, end-use industry, and geographic regions. By thickness, the mass-loaded vinyl (MLV) market is divided into 1/8" thickness MLV (Standard), 1/16" thickness MLV, 1/4" thickness MLV, and custom thickness products. In terms of format and packaging, the mass-loaded vinyl (MLV) market is classified into Roll format products, Sheet format products, Pre-cut and custom shapes, and Adhesive-backed products.

Based on application, the mass loaded vinyl (MLV) market is segmented into Building and construction, Automotive and transportation, Industrial and equipment, and Consumer and specialty applications. By end-use industry, the mass-loaded vinyl (MLV) market is segmented into the Construction industry, the Automotive industry, Industrial manufacturing, entertainment, and media. Regionally, the mass loaded vinyl (MLV) industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The 1/8" thickness Mass Loaded Vinyl segment is projected to account for 42% of the market’s revenue share in 2025, marking it as the leading thickness category. Growth in this segment has been attributed to its ideal balance of mass, flexibility, and ease of installation, which allows it to deliver effective sound attenuation in both residential and commercial applications. The 1/8" variant has been widely adopted due to its compatibility with walls, ceilings, floors, and ducts without significantly increasing structural weight or requiring design alterations.

This thickness has been preferred in projects where both acoustic performance and space efficiency are priorities. The ability of this format to reduce transmission of mid to high-frequency sounds has further reinforced its value in modern building acoustics.

Its adaptability for use behind drywall or under flooring systems has led to widespread acceptance by contractors and acoustical consultants. With increasing regulatory emphasis on noise reduction and energy efficiency, this segment is expected to retain its leadership position..

The roll format products segment is expected to hold 48% of the Mass Loaded Vinyl market share in 2025, emerging as the dominant format and packaging preference. The convenience, efficiency are driving this leadership, and reduced waste associated with roll-based solutions. Rolls have been adopted widely due to their suitability for continuous application over large surfaces, minimizing seams and enhancing acoustic performance.

The flexibility of roll format products has allowed easier handling during transport and on-site installation, making them especially suitable for contractors seeking time and labor savings. The uniform density and thickness consistency in roll format ensure predictable soundproofing performance, which has become critical in meeting evolving building standards.

Additionally, this packaging format supports streamlined storage and distribution logistics, further improving its appeal across various end-use sectors. As building and renovation projects increasingly incorporate pre-engineered and modular acoustic elements, roll-based MLV products are expected to maintain their significant presence in the global market..

The building and construction segment is projected to contribute 44% of the Mass Loaded Vinyl market revenue share in 2025, making it the leading application. Demand in this segment has been strengthened by growing construction activity in urban environments where acoustic comfort and compliance with sound regulations are critical. Builders and developers have increasingly specified MLV in residential complexes, hotels, office buildings, and educational institutions to meet sound transmission class (STC) requirements.

MLV’s ease of integration with existing drywall systems and its ability to enhance privacy and comfort without bulky structures have made it highly effective in modern building design. The segment has further benefited from the shift toward sustainable construction practices, as MLV offers non-toxic and low-VOC options that support green building certifications.

Adoption has been facilitated by architectural firms and acoustic consultants promoting its use in mixed-use developments. With the increasing incorporation of acoustics into building performance standards, this application segment is positioned to lead market growth through continued specification and deployment across new projects..

The mass loaded vinyl market is witnessing steady growth driven by its extensive adoption in soundproofing across residential, commercial, and industrial spaces. Increased construction activity, acoustic comfort in workspaces, and demand for automotive noise control are key growth factors. Opportunities have emerged from the expansion of premium home studios, electric vehicle interiors, and marine noise reduction solutions. Trends such as multilayer composite designs and eco-friendly additives are reshaping product portfolios. However, restraints include high material costs, labor-intensive installation, and limited awareness in developing economies. The overall outlook suggests consistent demand in noise-critical environments globally.

The major growth driver for the MLV market is the rising requirement for noise attenuation in buildings and vehicles. In 2024 and 2025, acoustic barriers made from mass loaded vinyl were integrated into high-rise constructions, luxury apartments, and modular office spaces to enhance comfort. Automotive manufacturers adopted these sheets to reduce cabin noise and vibration, especially in electric vehicles where mechanical noise sources differ from traditional engines. This adoption underscores the effectiveness of MLV in meeting stringent noise standards while offering flexibility in application across architectural, industrial, and transportation sectors.

Significant opportunities have been identified in niche markets where acoustic management is critical. In 2025, rising installation of MLV in marine vessels, aerospace panels, and industrial machinery enclosures showcased its adaptability. Premium home theaters and recording studios also created fresh demand for MLV solutions due to performance consistency and durability. Suppliers investing in lightweight formulations and customized roll sizes have been favored for complex installation needs. These opportunities indicate that sectors emphasizing high acoustic precision, combined with aesthetics and minimal thickness, are expected to contribute meaningfully to future market share.

Emerging trends in the market point toward the development of laminated and composite mass loaded vinyl solutions. In 2024, multilayer sheets combining MLV with foam or fiberglass were adopted in HVAC systems, demonstrating improvements in thermal and acoustic performance. Automotive interior suppliers integrated custom-colored vinyl sheets to maintain design consistency without compromising noise control. Roll-to-roll processing methods for modular assemblies gained traction among large-scale construction contractors. These evolving patterns indicate that manufacturers emphasizing innovation in functionality and customization will secure a stronger position in the premium acoustic materials segment.

High material cost has remained a key restraint for MLV adoption across price-sensitive regions. In 2024 and 2025, several small-scale builders opted for alternative acoustic solutions due to the premium pricing of vinyl-based barriers. Installation complexity in irregular architectural layouts further limited usage in mid-range projects. Additionally, limited awareness of MLV benefits compared to traditional insulation materials hindered demand penetration in emerging markets. These limitations are compelling manufacturers to offer cost-efficient variants and simplify application methods, ensuring the material remains competitive while preserving its superior acoustic properties.

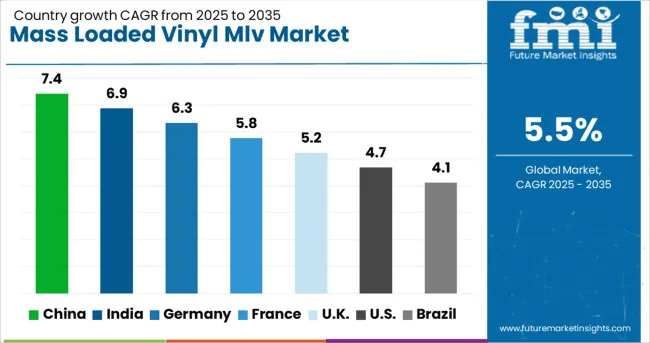

| Country | CAGR |

|---|---|

| China | 7.4% |

| India | 6.9% |

| Germany | 6.3% |

| France | 5.8% |

| UK | 5.2% |

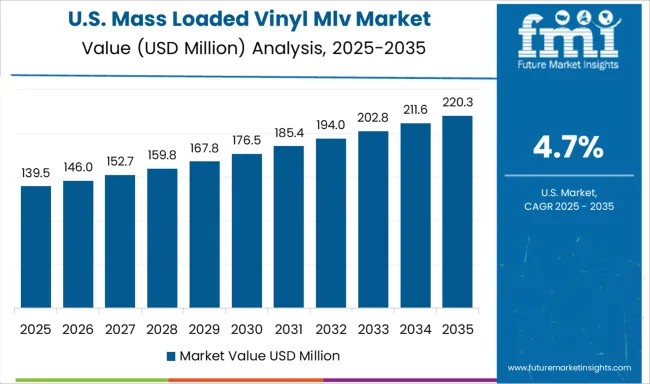

| USA | 4.7% |

| Brazil | 4.1% |

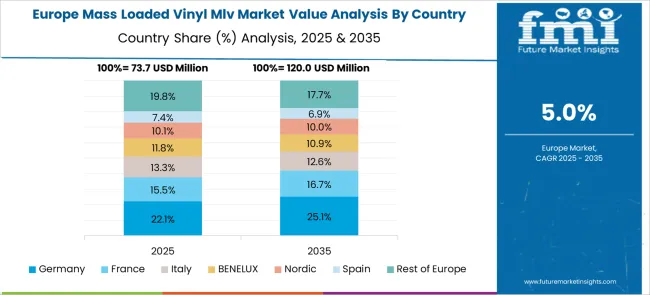

The global mass loaded vinyl (MLV) market is projected to grow at a 5.5% CAGR during 2025–2035. China leads with 7.4% CAGR, driven by large-scale construction projects and automotive acoustic insulation adoption. India follows at 6.9%, benefiting from rapid infrastructure growth and demand for soundproofing in commercial real estate. Germany records 6.3%, supported by industrial noise control requirements and automotive sector innovations. The UK posts 5.2%, while the United States grows at 4.7%, reflecting a mature but stable market focused on renovation and premium acoustic systems. Asia-Pacific dominates global demand, leveraging cost advantages and rising awareness about acoustic comfort, whereas Western markets prioritize compliance-driven and sustainable noise control solutions.

China remains the largest growth hub for MLV, expected to reach 7.4% CAGR by 2035. Rising demand for high-performance noise control materials in commercial construction and luxury residential projects boosts adoption. Rapid urbanization and expansion of mixed-use developments amplify the need for acoustic solutions in office complexes, entertainment venues, and hospitality infrastructure. Automotive manufacturers are increasingly using MLV for lightweight soundproofing in electric vehicles, improving cabin acoustics without compromising energy efficiency. Domestic suppliers focus on competitive pricing and volume production, while global players introduce advanced fire-rated and eco-compliant variants to target premium segments.

India’s MLV market is forecast to grow at 6.9% CAGR, driven by infrastructure expansion, metro projects, and acoustic retrofitting in urban buildings. Increasing investment in educational institutions, healthcare facilities, and corporate offices drives usage of MLV for soundproofing walls, floors, and HVAC systems. The surge in premium home construction, combined with rising consumer focus on acoustic comfort, further strengthens demand. Additionally, the automotive sector contributes significantly through adoption in passenger vehicles and high-end buses. Domestic producers emphasize affordable solutions, while imports cater to specialized applications requiring high thermal and fire resistance.

Germany posts a 6.3% CAGR, supported by stringent EU noise control regulations across commercial, industrial, and transportation sectors. Automotive OEMs lead adoption, particularly for luxury vehicles requiring advanced sound insulation. MLV is widely used in machinery enclosures and HVAC duct systems for industrial noise reduction. Architectural projects prioritize acoustic solutions to meet building code requirements for energy and noise efficiency. Leading German companies invest in eco-friendly, lightweight MLV alternatives with recycled content to align with sustainability goals. The rise of EV manufacturing further drives innovation in compact and thermally stable MLV grades.

The United Kingdom is anticipated to grow at 5.2% CAGR, primarily supported by demand for noise control solutions in retrofitting projects across educational institutions and healthcare facilities. The hospitality sector and office fit-out projects increasingly incorporate MLV to enhance occupant comfort. Automotive manufacturers also utilize MLV in performance vehicles to maintain superior acoustic characteristics. Supply chain optimization remains a focus area, with suppliers introducing pre-cut and self-adhesive variants for easier installation. Sustainability considerations prompt innovation in recyclable and low-emission MLV products to comply with green building certification requirements.

The United States market is expected to grow at 4.7% CAGR, reflecting moderate expansion in mature construction and automotive sectors. Demand centers on premium noise control applications in high-end residential and commercial spaces. Strict noise abatement standards in industrial facilities support usage in equipment enclosures and HVAC duct systems. The shift toward EV adoption provides opportunities for lightweight MLV solutions with superior thermal resistance. Major manufacturers are investing in advanced lamination technologies to combine acoustic performance with moisture resistance for outdoor and marine applications.

The mass loaded vinyl (MLV) market is moderately consolidated, with Acoustiblok Inc. recognized as a leading player due to its extensive range of soundproofing solutions designed for residential, commercial, and industrial applications. The company is known for high-density, flexible MLV products that offer superior noise reduction and vibration control while maintaining ease of installation.

Key players include Trademark Soundproofing, TMS Soundproofing, Soundsulate, Soundproof Cow, Saint-Gobain, Audimute, Auralex Acoustics, and Johns Manville. These companies focus on developing MLV products for applications such as walls, ceilings, floors, and machinery enclosures, addressing the need for effective sound isolation in construction, automotive, and manufacturing sectors. Their offerings include standard rolls, adhesive-backed variants, and composite barriers with enhanced acoustic performance. Market growth is driven by increasing awareness of noise control in residential and commercial spaces, stringent building codes for sound insulation, and demand from industrial environments where machinery noise reduction is critical. Leading manufacturers are investing in lightweight, fire-resistant formulations, eco-friendly MLV materials, and custom thickness options to improve versatility and sustainability. Emerging trends include the integration of MLV with thermal insulation systems and hybrid acoustic panels for multi-functional performance. North America and Europe dominate the market due to advanced construction practices and noise regulation policies, while Asia-Pacific is experiencing rapid growth fueled by urban development and infrastructure expansion.

| Item | Value |

|---|---|

| Quantitative Units | USD 306.3 Million |

| Thickness | 1/8" thickness MLV (Standard), 1/16" thickness MLV, 1/4" thickness MLV, and Custom thickness products |

| Format and Packaging | Roll format products, Sheet format products, Pre-cut and custom shapes, and Adhesive-backed products |

| Application | Building and construction, Automotive and transportation, Industrial and equipment, and Consumer and specialty applications |

| End Use Industry | Construction industry, Automotive industry, Industrial manufacturing, and Entertainment and media |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Acoustiblok Inc., Trademark Soundproofing, TMS Soundproofing, Soundsulate, Soundproof Cow, Saint-Gobain, Audimute, Auralex Acoustics, and Johns Manville |

| Additional Attributes | Dollar sales by product type (standard, reinforced, self-adhesive, specialty MLV) and application (residential, commercial, industrial, automotive, marine). North America led in 2023 with \~35% share, while Asia-Pacific remains fastest-growing. Buyers prioritize lightweight, high-STC soundproofing materials for regulatory compliance. Innovations include fire-retardant hypoallergenic formulations, eco-friendly fillers, and enhanced flexibility for complex installations. |

The global mass loaded vinyl (MLV) market is estimated to be valued at USD 306.3 million in 2025.

The market size for the mass loaded vinyl (MLV) market is projected to reach USD 523.1 million by 2035.

The mass loaded vinyl (MLV) market is expected to grow at a 5.5% CAGR between 2025 and 2035.

The key product types in mass loaded vinyl (MLV) market are 1/8" thickness mlv (standard), 1/16" thickness mlv, 1/4" thickness mlv and custom thickness products.

In terms of format and packaging, roll format products segment to command 48.0% share in the mass loaded vinyl (MLV) market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Massoia Bark Essential Oil Market Size and Share Forecast Outlook 2025 to 2035

Mass Transfer Trays Market Size and Share Forecast Outlook 2025 to 2035

Mass Notification System in Healthcare Market Size and Share Forecast Outlook 2025 to 2035

Mass Finishing Consumables Market Size and Share Forecast Outlook 2025 to 2035

Massage Therapy Service Market - Growth & Forecast 2025 to 2035

Massage Guns Market Analysis – Demand, Growth & Forecast 2025–2035

Massive Open Online Course Market Analysis – Growth, Trends & Forecast 2025 to 2035

Industry Share Analysis for Massage Therapy Service Providers

Mass Notification Systems Market Analysis by Component, Solution, Application, and Industry, and Region Through 2035

Massive MIMO Market

Massage Equipment Market

Biomass Pellets Market Size and Share Forecast Outlook 2025 to 2035

Biomass Gasification Market Size and Share Forecast Outlook 2025 to 2035

Biomass Boiler Market Size and Share Forecast Outlook 2025 to 2035

Hand Massager Market Size and Share Forecast Outlook 2025 to 2035

Europe Massage Therapy Service Market Size and Share Forecast Outlook 2025 to 2035

Spatial Mass Spectrometry Market Size and Share Forecast Outlook 2025 to 2035

Woody Biomass Boiler Market Size and Share Forecast Outlook 2025 to 2035

Electric Massagers Market Analysis - Size, Share, and Forecast 2025 to 2035

Europe Biomass Pellets Market Analysis & Forecast for 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA