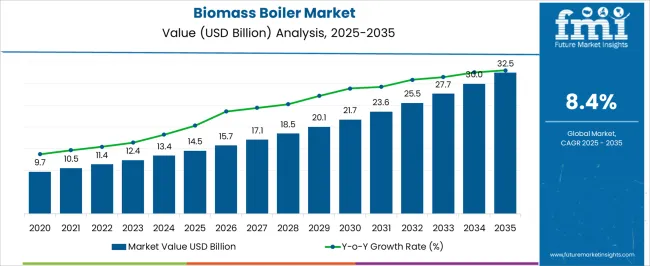

The biomass boiler market is projected to grow from USD 14.5 billion in 2025 to USD 32.5 billion in 2035, reflecting a CAGR of 8.4%. This growth represents an absolute dollar opportunity of USD 18.0 billion over the decade. Early expansion sees the market rise from USD 15.7 billion in 2026 to USD 18.5 billion in 2029, signaling steady incremental gains. By 2031, the market will reach USD 21.7 billion, highlighting mid-term growth momentum. These increments provide manufacturers and distributors with clear opportunities to scale production, optimize supply chains, and capture revenue across expanding applications and installations globally.

Later years deliver the most significant absolute gains, with the market increasing from USD 25.5 billion in 2032 to USD 32.5 billion in 2035. This late-stage growth contributes USD 7.0 billion in incremental revenue, with annual increases rising to USD 2.0–2.5 billion toward the end of the forecast. Intermediate benchmarks such as USD 27.7 billion in 2033 and USD 30.0 billion in 2034 act as bridging periods, sustaining momentum.

The cumulative USD 18.0 billion opportunity underscores strong long-term revenue potential. Strategic alignment of production, distribution, and operations with these growth milestones will allow stakeholders to capture maximum value in the biomass boiler market.

| Metric | Value |

|---|---|

| Biomass Boiler Market Estimated Value in (2025 E) | USD 14.5 billion |

| Biomass Boiler Market Forecast Value in (2035 F) | USD 32.5 billion |

| Forecast CAGR (2025 to 2035) | 8.4% |

In the biomass boiler market, the first breakpoint occurs between 2025 and 2027, when the market grows from USD 14.5 billion to USD 15.7 billion. This early phase reflects steady adoption with moderate annual increments of approximately USD 0.6 billion, laying the foundation for predictable growth. The next critical breakpoint is observed between 2029 and 2031, as the market advances from USD 18.5 billion to USD 21.7 billion. This period signifies faster expansion, with higher absolute dollar gains, highlighting opportunities for manufacturers and distributors to optimize production, strengthen supply chains, and capture incremental revenue during mid-stage market growth.

The final major breakpoint emerges between 2032 and 2035, when the market surges from USD 25.5 billion to USD 32.5 billion, representing the largest absolute dollar increase in the forecast period. Intermediate years, such as USD 27.7 billion in 2033 and USD 30.0 billion in 2034, act as bridging periods that sustain momentum before reaching peak market values.

The biomass boiler market is witnessing robust growth, driven by the increasing global emphasis on renewable energy and sustainable fuel sources. Current trends show a strong shift towards reducing carbon footprints and reliance on fossil fuels, encouraging widespread adoption of biomass boilers across residential, commercial, and industrial sectors.

Investments in green energy infrastructure and supportive government policies aimed at curbing emissions are further catalyzing market expansion. Technological advancements improving boiler efficiency and fuel flexibility are also enhancing the appeal of biomass boilers.

Future outlooks indicate continued growth fueled by rising energy demands, environmental regulations, and a growing preference for circular economy solutions that utilize organic waste and woody biomass as feedstock. The market is expected to benefit from innovations that reduce operational costs and increase reliability, thereby facilitating broader deployment across various applications.

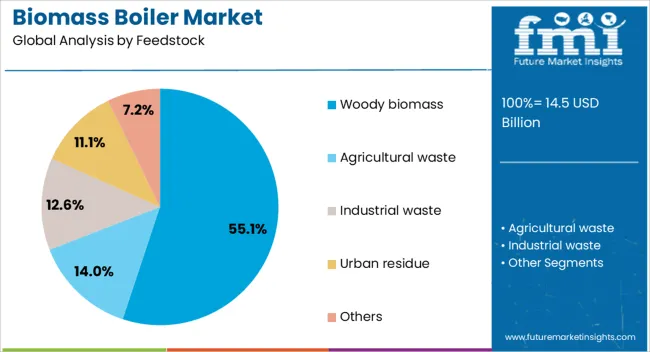

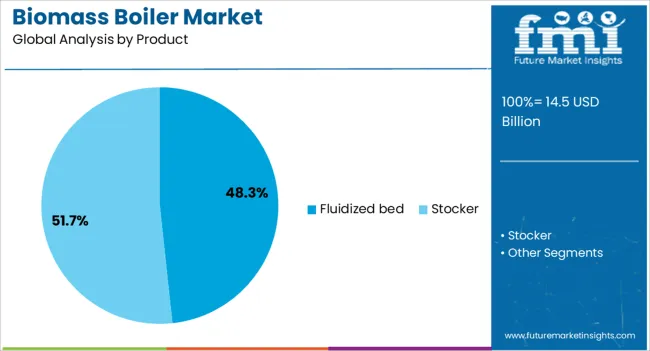

The biomass boiler market is segmented by feedstock, product, and geographic regions. By feedstock, biomass boiler market is divided into Woody biomass, Agricultural waste, Industrial waste, Urban residue, and Others. In terms of product, biomass boiler market is classified into Fluidized bed and Stocker. Regionally, the biomass boiler industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Woody biomass is projected to hold 55.1% of the total revenue share in the Biomass Boiler market in 2025, establishing it as the leading feedstock segment. This prominence is attributed to the widespread availability and renewability of wood-based materials, which provide a consistent and efficient energy source.

The high calorific value of woody biomass enhances combustion efficiency in boilers, making it a preferred choice for large-scale and industrial applications. Moreover, its utilization supports sustainable forestry practices and waste reduction initiatives, aligning with environmental regulations and corporate sustainability goals.

The segment’s growth is further supported by increasing efforts to convert agricultural residues and wood waste into energy, fostering a circular economy approach. The ability to integrate woody biomass with advanced combustion technologies has amplified its attractiveness in terms of emissions control and operational reliability.

The Fluidized Bed boiler product segment is expected to capture 48.3% of the overall market revenue share in 2025, making it the leading product category. The growth of this segment is primarily driven by its superior fuel flexibility and enhanced combustion efficiency, allowing effective processing of a wide range of biomass feedstocks, including woody biomass, agricultural residues, and other organic materials.

The technology’s capability to maintain stable combustion at lower temperatures results in reduced emissions of nitrogen oxides and sulfur oxides, which aligns with stringent environmental regulations. Additionally, fluidized bed boilers offer advantages in scalability and operational control, which have encouraged their adoption in both industrial and large commercial setups.

Their adaptability to handle fuels with varying moisture content and particle sizes contributes to their market leadership. Continuous innovation in fluidized bed designs has further optimized fuel utilization and lowered maintenance requirements, consolidating their dominant position in the biomass boiler market.

The biomass boiler market is growing due to increasing demand for renewable energy, carbon emission reduction, and sustainable heating solutions across industrial, commercial, and residential sectors. Europe and North America lead with advanced, high-efficiency boilers supported by regulatory incentives and strict emission standards. Asia-Pacific demonstrates rapid growth driven by rural energy needs, industrial applications, and government subsidies. Manufacturers differentiate through fuel flexibility, thermal efficiency, emissions compliance, and automation. Regional variations in fuel availability, climate, and infrastructure shape adoption, investment decisions, and competitive positioning globally.

Biomass boilers operate on various fuels including wood pellets, chips, agricultural residues, and energy crops, impacting combustion efficiency and operational costs. Europe and North America emphasize wood pellet and chip-fired boilers for residential and commercial heating, prioritizing consistent fuel quality, high thermal efficiency, and low emissions. Asia-Pacific markets adopt boilers compatible with locally available agricultural residues and biomass wastes, balancing affordability with functional reliability. Differences in fuel type and combustion efficiency affect installation planning, maintenance requirements, and energy output. Leading manufacturers offer multi-fuel boilers with optimized combustion technology, while regional producers focus on low-cost, single-fuel systems. These contrasts shape adoption patterns, operational performance, and competitiveness across global renewable heating markets.

Regulatory frameworks for emissions and renewable energy incentives strongly affect biomass boiler adoption. Europe and North America enforce strict emission standards and provide financial incentives, encouraging high-efficiency, low-emission installations for residential, commercial, and industrial users. Asia-Pacific policies vary; developed regions follow similar standards, while emerging markets emphasize cost-effective solutions with basic emission controls. Differences in regulations influence project approvals, technology selection, and long-term operating compliance. Suppliers offering emission-certified, high-efficiency boilers gain premium contracts and wider adoption, while regional manufacturers provide affordable units aligned with local regulations. Regulatory contrasts determine adoption speed, investment decisions, and market competitiveness globally.

Automation, monitoring, and control features improve biomass boiler reliability and efficiency. Europe and North America favor boilers with automated fuel feeding, combustion control, and integrated monitoring systems for minimal human intervention and consistent thermal output. Asia-Pacific markets adopt simpler automation solutions due to cost sensitivity, focusing on functional reliability rather than advanced control systems. Differences in automation affect energy efficiency, maintenance requirements, and user convenience. Leading suppliers provide fully automated, digitally monitored boilers, while regional manufacturers prioritize straightforward, low-cost operation. Automation contrasts shape adoption, operational performance, and long-term maintenance strategies across residential, commercial, and industrial sectors globally.

Distribution networks, installation flexibility, and after-sales support strongly impact adoption. Europe and North America rely on structured dealer networks, professional installation services, and long-term maintenance contracts to ensure optimal performance and reliability. Asia-Pacific markets utilize local distributors and service providers to address accessibility and affordability, especially in rural areas. Differences in service and installation support influence operational uptime, user confidence, and repeat purchases. Suppliers with comprehensive installation and service infrastructure gain competitive advantages, while regional players focus on accessible, cost-effective solutions. Service and distribution contrasts determine market penetration, adoption speed, and reliability perception globally.

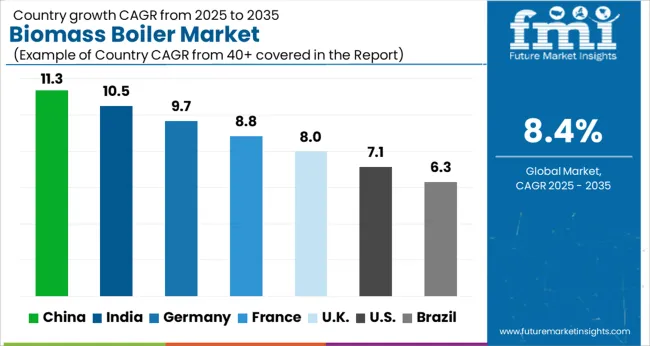

| Country | CAGR |

|---|---|

| China | 11.3% |

| India | 10.5% |

| Germany | 9.7% |

| France | 8.8% |

| UK | 8.0% |

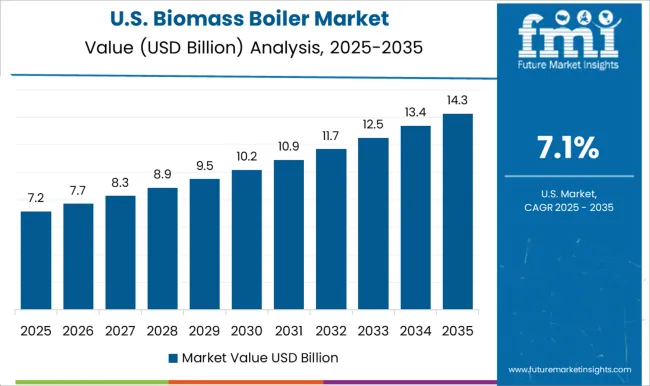

| USA | 7.1% |

| Brazil | 6.3% |

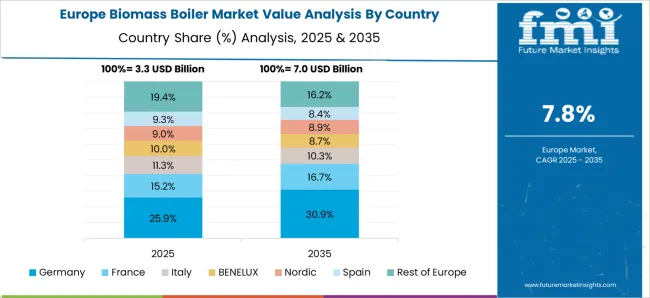

The global biomass boiler market was projected to grow at an 8.4% CAGR through 2035, driven by demand in industrial, commercial, and residential heating applications. Among BRICS nations, China recorded 11.3% growth as large-scale manufacturing and installation facilities were commissioned and compliance with industrial and safety standards was enforced, while India at 10.5% growth saw expansion of production units to meet rising regional demand. In the OECD region, Germany at 9.7% maintained substantial output under strict industrial and operational regulations, while the United Kingdom at 8.0% relied on moderate-scale operations for commercial and residential heating solutions. The USA, expanding at 7.1%, remained a mature market with steady demand across industrial and residential segments, supported by adherence to federal and state-level quality and safety standards. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The biomass boiler market in China is growing at a CAGR of 11.3% due to increasing adoption in industrial, commercial, and residential heating applications. Organizations and households are implementing biomass boilers to utilize agricultural residues, wood chips, and other renewable feedstocks for heat generation, reducing dependency on conventional fuels. Growth is supported by government incentives, rising focus on alternative energy, and expansion of industrial and commercial facilities requiring efficient heating solutions. Suppliers offer high-efficiency, low-emission, and reliable biomass boilers suitable for diverse applications, including industrial plants, commercial buildings, and large residential complexes. Distribution through equipment dealers, energy service providers, and direct sales ensures broad market accessibility. Adoption is further driven by the need for cost-effective energy, reduced carbon footprint, and sustainable heat generation. China remains a leading market due to large energy demand, biomass availability, and renewable energy policies.

India is witnessing growth at a CAGR of 10.5% in the biomass boiler market due to rising adoption in industrial, commercial, and residential heating applications. Industries, commercial facilities, and households are using biomass boilers to generate heat from agricultural residues, wood, and other renewable feedstocks. Growth is supported by government initiatives promoting renewable energy, rising energy costs, and increasing awareness of environmentally friendly heating solutions. Suppliers provide boilers with high efficiency, low emissions, and robust performance for industrial and commercial heating. Distribution through equipment dealers, energy solution providers, and online platforms ensures wide accessibility. Adoption is further driven by the need to reduce fossil fuel dependency, lower operational costs, and achieve sustainable heating practices. India continues to experience strong market growth due to increasing industrial energy demand and renewable energy adoption.

Germany is growing at a CAGR of 9.7% in the biomass boiler market due to rising demand from industrial plants, commercial buildings, and district heating projects. Organizations are adopting biomass boilers to generate heat using wood pellets, agricultural residues, and renewable feedstocks, reducing reliance on fossil fuels and meeting environmental targets. Growth is supported by regulatory frameworks encouraging renewable energy, government incentives, and increasing awareness of sustainable heating solutions. Suppliers offer high performance, low emission, and efficient biomass boilers suitable for industrial and commercial applications. Distribution is facilitated through equipment dealers, energy solution providers, and service networks, ensuring accessibility. Adoption is further driven by energy efficiency requirements, environmental compliance, and cost savings. Germany remains a key European market due to its focus on renewable energy, sustainable heating, and modern energy infrastructure.

The United Kingdom market is expanding at a CAGR of 8.0% due to increasing adoption in commercial, industrial, and residential heating applications. Organizations and households are implementing biomass boilers to generate heat from renewable feedstocks including wood pellets, agricultural residues, and other biomass materials. Government incentives, rising energy costs, and growing interest in sustainable heating solutions support growth. Suppliers provide high efficiency, low emission, and reliable boilers suitable for diverse industrial and commercial applications. Distribution through equipment dealers, energy service providers, and online platforms ensures wide accessibility. Adoption is further driven by the need for cost effective energy, carbon footprint reduction, and compliance with environmental regulations. The United Kingdom continues to see steady growth due to renewable energy policies and increasing demand for sustainable heating systems.

The United States market is growing at a CAGR of 7.1% supported by rising adoption in industrial, commercial, and residential heating applications. Organizations and households use biomass boilers to convert wood pellets, agricultural residues, and other renewable feedstocks into heat, reducing fossil fuel dependency. Growth is supported by government programs promoting renewable energy, increasing energy costs, and rising awareness of environmentally friendly heating solutions. Suppliers provide high-efficiency, low-emission, and durable boilers for diverse applications, including industrial plants, commercial facilities, and residential complexes. Distribution channels include equipment dealers, energy solution providers, and online platforms, ensuring broad market accessibility. Cost savings, operational efficiency, and compliance with environmental standards further drive adoption. The United States remains a key market due to its large industrial and commercial heating demand and growing focus on renewable energy solutions.

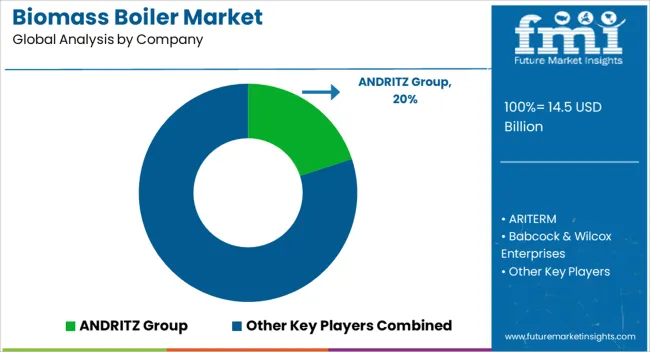

The biomass boiler market features a diverse lineup of suppliers, including ANDRITZ Group, ARITERM, Babcock & Wilcox Enterprises, Binder Energietechnik, Cheema Boiler, DP Cleantech, Forbes Marshall, Froling Boiler and Tank Construction, Guntamatic Heiztechnik, Hargassner, Hoval, Hurst Boiler & Welding, John Cockerill, John Wood Group, KWB Energiesysteme, Maxtherm Boilers, OkoFEN, Prime Thermals, Schmid Energy Solutions, Sofinter, Sugimat, Transparent Energy Systems, Thermax, Thermodyne Boiler, Treco, VIESSMANN, Walchandnagar Industries, Windhager, Woodco, and Zhengzhou Boiler (Group). These companies provide boilers designed to convert biomass materials such as wood chips, pellets, agricultural residues, and other organic waste into heat and energy for industrial, commercial, and residential applications. Biomass boilers are increasingly valued for their ability to utilize renewable feedstocks and support decentralized energy systems. Suppliers like ANDRITZ Group, Babcock & Wilcox, and VIESSMANN focus on large-scale, high-efficiency biomass boiler systems capable of serving industrial and district heating applications.

Mid-sized players such as Forbes Marshall, Hargassner, and OkoFEN specialize in modular and customizable solutions suitable for small and medium-scale commercial operations. Regional manufacturers like Cheema Boiler, Thermodyne Boiler, and Walchandnagar Industries cater to local energy needs, offering cost-effective and reliable biomass boiler systems with simplified operation and maintenance. Recent developments in the biomass boiler market emphasize fuel flexibility, efficiency optimization, and integration with advanced emission control technologies. Suppliers are innovating to support automated fuel feeding, intelligent combustion control, and remote monitoring systems that enhance performance while reducing environmental impact. Growth in the renewable energy sector, increasing demand for carbon-neutral heating solutions, and the expansion of biomass availability across agricultural and forestry sectors are driving adoption. Manufacturers are also strengthening after-sales service networks, technical support, and training programs to improve user experience and maximize system lifespan.

| Item | Value |

|---|---|

| Quantitative Units | USD 14.5 Billion |

| Feedstock | Woody biomass, Agricultural waste, Industrial waste, Urban residue, and Others |

| Product | Fluidized bed and Stocker |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ANDRITZ Group, ARITERM, Babcock & Wilcox Enterprises, Binder Energietechnik, Cheema Boiler, DP Cleantech, Forbes Marshall, Froling Boiler and Tank Construction, Guntamatic Heiztechnik, Hargassner, Hoval, Hurst Boiler & Welding, John Cockerill, John Wood Group, KWB Energiesysteme, Maxtherm Boilers, OkoFEN, Prime Thermals, Schmid Energy Solutions, Sofinter, Sugimat, Transparent Energy Systems, Thermax, Thermodyne Boiler, Treco, VIESSMANN, Walchandnagar Industries, Windhager, Woodco, and Zhengzhou Boiler (Group) |

| Additional Attributes | Dollar sales vary by boiler type, including fixed grate, fluidized bed, and pulverized fuel boilers; by fuel type, spanning wood pellets, agricultural residues, and energy crops; by application, such as power generation, district heating, and industrial processing; by region, led by Europe, North America, and Asia-Pacific. Growth is driven by renewable energy adoption, carbon reduction initiatives, and demand for sustainable heating solutions. |

The global biomass boiler market is estimated to be valued at USD 14.5 billion in 2025.

The market size for the biomass boiler market is projected to reach USD 32.5 billion by 2035.

The biomass boiler market is expected to grow at a 8.4% CAGR between 2025 and 2035.

The key product types in biomass boiler market are woody biomass, agricultural waste, industrial waste, urban residue and others.

In terms of product, fluidized bed segment to command 48.3% share in the biomass boiler market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Woody Biomass Boiler Market Size and Share Forecast Outlook 2025 to 2035

Biomass Hot Air Generator Furnace Market Size and Share Forecast Outlook 2025 to 2035

Biomass Pellets Market Size and Share Forecast Outlook 2025 to 2035

Biomass Gasification Market Size and Share Forecast Outlook 2025 to 2035

Europe Biomass Pellets Market Analysis & Forecast for 2025 to 2035

Demand for Biomass Pellets in EU Size and Share Forecast Outlook 2025 to 2035

Lignocellulosic Biomass Market Analysis - Size, Share, and Forecast Outlook for 2025 to 2035

Boiler Control Market Size and Share Forecast Outlook 2025 to 2035

Boiler Water Treatment Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Boiler Market Size and Share Forecast Outlook 2025 to 2035

Boiler Safety System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Egg Boiler Market Size and Share Forecast Outlook 2025 to 2035

Steam Boiler Market Size and Share Forecast Outlook 2025 to 2035

Combi Boiler Market Growth – Trends & Forecast 2025 to 2035

Office Boiler Market Size and Share Forecast Outlook 2025 to 2035

Marine Boiler Burner Market Size and Share Forecast Outlook 2025 to 2035

Brewing Boiler Market Analysis by Material Type, Application, Automation, and Region 2025 to 2035

Chemical Boiler Market Size and Share Forecast Outlook 2025 to 2035

Electric Boiler Market Size and Share Forecast Outlook 2025 to 2035

Gas Fired Boiler Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA