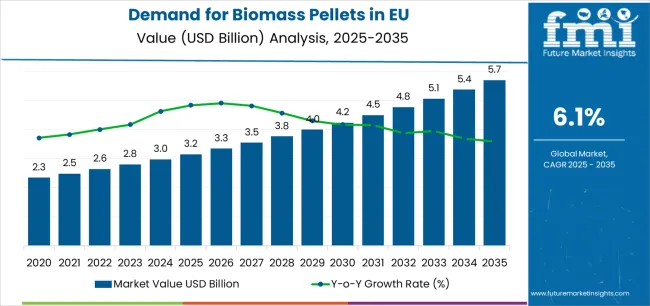

The demand for biomass pellets in the European Union is projected to grow from USD 3.2 billion in 2025 to USD 5.7 billion by 2035, at a CAGR of 6.1%. This represents an absolute increase of USD 2.5 billion, with the industry expected to expand by nearly 1.8X during the forecast period. Growth will be supported by rising demand for renewable heating solutions, wider applications in utility power generation and co-firing, and expanding adoption across industrial heat and district heating systems as part of Europe’s energy transition and decarbonization objectives. The industry is benefiting from EU renewable energy mandates, growing energy security concerns encouraging domestic renewable fuel production, and wider use of certified biomass pellets as carbon-neutral alternatives to coal and natural gas across residential, industrial, and utility markets.

Between 2025 and 2030, sales are forecast to expand from USD 3.2 billion to USD 4.2 billion, an increase of USD 1.1 billion or 42.6% of the total decade-long growth. This phase will be shaped by increased adoption of residential pellet heating systems replacing oil and gas boilers, higher co-firing activity at utility power plants requiring ecological feedstocks, and stronger mainstream demand for ENplus-certified pellets in European heating markets. Manufacturers are expected to scale production of premium ENplus A1 pellets, agricultural residue-based pellets supporting circular economy practices, and torrefied black pellets designed for industrial co-firing while ensuring compliance with RED II and RED III ecological standards.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 3.2 billion |

| Forecast Value in (2035F) | USD 5.7 billion |

| Forecast CAGR (2025 to 2035) | 6.1% |

From 2030 to 2035, EU biomass pellet demand is projected to increase from USD 4.2 billion to USD 5.7 billion, adding USD 1.5 billion or 57.4% of the ten-year growth. As reported in Future Market Insights (FMI)’s authoritative research on specialty and bulk chemicals., this phase will likely feature faster adoption of certified ecological biomass, wider use of agricultural waste-based pellets in rural energy systems, and development of torrefied pellet technologies supporting biomass gasification and carbon capture integration. Stronger emphasis on energy independence and government investments in domestic bioenergy infrastructure will reinforce demand for advanced biomass pellets that combine high energy density with low carbon intensity, supporting the EU Green Deal’s net-zero goals and fossil fuel replacement commitments.

Between 2020 and 2025, demand grew steadily from USD 2.5 billion to USD 3.2 billion at a CAGR of 4.5%. This period was driven by residential heating conversions from fossil fuels, utility co-firing mandates during coal phase-outs, and greater recognition of biomass pellets’ carbon-neutral benefits. Producers and energy firms capitalized on the potential of certified wood pellets for residential boilers, industrial heat systems, and utility-scale power generation. Product quality improvements through ENplus certification, expanded logistics capacity, and production scaling helped establish strong market acceptance and customer confidence, paving the way for broader adoption across residential, industrial, and utility applications.

EU biomass pellets sales are advancing rapidly due to increasing renewable energy mandates across European countries and the corresponding demand for carbon-neutral, domestically sourced, and cost-competitive heating and power fuels with proven effectiveness in residential heating systems, utility co-firing applications, and industrial process heat operations. Modern homeowners and utility operators rely on biomass pellets as essential renewable energy sources for consistent heating performance, regulatory compliance, and operational reliability, driving demand for products that deliver superior energy density, low moisture content, and combustion efficiency compared to alternative biomass fuels including wood chips and briquettes offering lower energy content and handling challenges.

The growing awareness of ecological forestry practices and increasing recognition of certified biomass pellets' quality advantages are driving demand for biomass pellets from certified producers with appropriate ecological credentials and ENplus quality documentation. Regulatory authorities are increasingly establishing clear guidelines for biomass ecological criteria, carbon accounting methodologies, and quality certification requirements to maintain fuel quality and ensure environmental integrity throughout European bioenergy operations under RED II and RED III frameworks. Scientific research studies and lifecycle assessment are providing evidence supporting biomass pellets' carbon neutrality and environmental benefits, requiring ecological forest management certification, supply chain traceability systems, and quality specifications including moisture content below 10%, ash content below 0.7%, and energy density exceeding 4.6 kWh/kg for optimal combustion performance, appropriate appliance compatibility, and consistent heating output across diverse residential, industrial, and utility biomass applications.

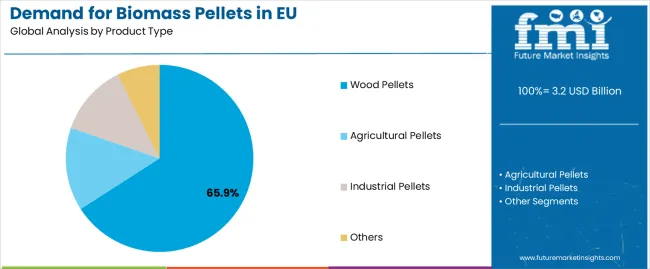

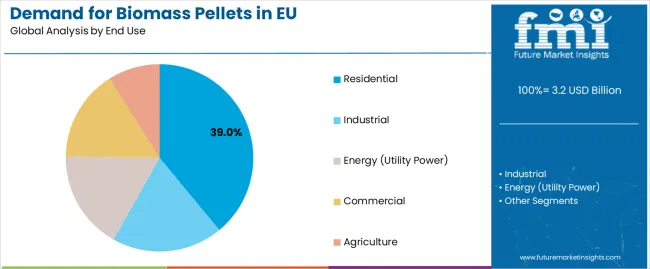

Sales are segmented by product type, end use, distribution channel, nature, and country. By product type, demand is divided into wood pellets, agricultural pellets, industrial pellets, and others. Based on end use, sales are categorized into residential, industrial, energy (utility power), commercial, and agriculture. In terms of distribution channel, demand is segmented into distributors/wholesale for heating systems, utilities and independent power producers with long-term offtake agreements, and retail/online channels. By nature, sales are classified into certified (ENplus/SBP/FSC) and non-certified products. Regionally, demand is focused on Germany, France, Italy, Spain, the Netherlands, and the Rest of Europe.

The wood pellets segment is projected to account for 65.9% of EU biomass pellets sales in 2025, declining slightly to 63% by 2035, establishing itself as the dominant product category across European residential heating and utility power applications. This commanding position is fundamentally supported by wood pellets' superior energy density, consistent quality through ENplus certification, and proven suitability for residential pellet stoves and boilers requiring standardized fuel specifications. The wood pellets format delivers exceptional functional appeal, providing homeowners and utility operators with a product category that facilitates automated feeding systems, reliable combustion performance, and low ash content essential for appliance longevity and heating efficiency. This segment benefits from mature production technologies utilizing sawdust and wood processing residues, well-established supply chains across Scandinavia and Baltic regions. The wood pellets segment's slight declining share reflects growing adoption of agricultural pellets, which expand from 18% in 2025 to 21% in 2035, capturing market share through circular economy initiatives and diversified feedstock strategies throughout the forecast period.

Key advantages:

Residential applications are strategically positioned to represent 39% of total European biomass pellets sales in 2025, declining slightly to 37% by 2035, reflecting the segment's dominance as the primary consumption category within the overall market. This substantial share directly demonstrates that residential heating represents the dominant application, with biomass pellets utilized extensively in automatic pellet stoves, pellet boilers, and hybrid heating systems replacing oil, gas, and coal for home heating throughout European households. Modern homeowners increasingly view biomass pellets as essential renewable heating fuel, driving demand for products optimized for automated delivery, consistent heat output, and cost competitiveness that supports energy independence and carbon footprint reduction. The segment benefits from continuous government incentive programs including the UK Renewable Heat Incentive, expanding pellet stove and boiler installations, and homeowner preference for renewable heating solutions delivering lower operating costs compared to fossil fuel systems.

Success factors:

Energy (utility power) applications are strategically estimated to control 22% of total European biomass pellets sales in 2025, expanding to 24% by 2035, reflecting the critical importance of biomass pellets for utility-scale electricity generation and coal co-firing operations. European utility operations consistently demonstrate strong biomass pellets consumption delivering essential renewable generation capacity for coal-to-biomass conversions, co-firing applications, and dedicated biomass power plants supporting EU decarbonization targets. The segment provides critical renewable energy capabilities through consistent baseload power generation, grid stability support, and emissions reduction supporting utility compliance with carbon pricing and coal phase-out mandates. Major utilities including Drax systematically utilize imported and domestic biomass pellets for power generation, often requiring long-term supply contracts, ecological certification through SBP or FSC, and consistent fuel quality that facilitate reliable power generation and environmental compliance.

Development factors:

Distributors and wholesale channels serving heating equipment suppliers are strategically estimated to control 46% of total European biomass pellets sales in 2025, declining to 44% by 2035, reflecting the critical importance of specialized pellet distributors for residential and commercial heating markets. European pellet distribution operations consistently demonstrate strong customer relationships delivering local delivery services, bulk storage solutions, and seasonal inventory management to homeowners, businesses, and heating contractors requiring reliable pellet supply. The segment provides essential logistics services through regional distribution networks, automated delivery systems, and quality assurance supporting residential and commercial heating operations throughout heating seasons. Major pellet distributors systematically supply ENplus certified pellets through bag and bulk delivery, often providing value-added services including appliance support, fuel quality guarantees, and flexible delivery scheduling that facilitate consumer adoption and heating system reliability.

Growth enablers:

Certified biomass pellets featuring ENplus, SBP, or FSC ecological credentials are strategically positioned to contribute 82% of total European sales in 2025, expanding dramatically to 88% by 2035, representing products meeting stringent quality and ecological specifications. These certified products successfully deliver proven heating performance and environmental credentials while ensuring broad market acceptance across all distribution channels that prioritize fuel quality and ecological verification over cost minimization. Certified formulations serve quality-conscious homeowners, environmentally responsible utilities, and regulatory-compliant industrial operators that require certified biomass pellets meeting ENplus A1 specifications or SBP ecological standards without compromise on environmental integrity. The segment derives significant competitive advantages from established certification infrastructure through ENplus certification bodies, quality validation through third-party testing, and the ability to meet substantial volume requirements from major utility customers and residential distributors without quality variation limiting supply reliability.

Competitive advantages:

EU biomass pellets sales are advancing rapidly due to increasing residential heating system conversions in European households, growing utility coal-to-biomass transitions, and rising government support for renewable heating and power generation. The industry faces challenges, including ecological concerns regarding forest biomass sourcing, supply chain logistics requiring significant investment, and price volatility affected by energy market dynamics and production costs. Continued innovation in agricultural waste pellets and torrefied pellet technologies remains central to industry development throughout the forecast period.

The rapidly accelerating development of agricultural residue and alternative feedstock pellets is fundamentally transforming biomass energy from traditional forest-based wood pellets to diversified feedstock alternatives enabling effective energy production with reduced pressure on forestry resources, delivering ecological credentials and circular economy benefits previously unattainable through conventional wood pellet production. Advanced pellet platforms featuring agricultural waste including straw, corn stover, and husks, combined with innovative feedstocks including miscanthus and algae biomass allow producers to create ecological pellets with comparable energy content, improved combustion characteristics, and regional production potential meeting EU circular economy and waste reduction objectives. These feedstock innovations prove particularly transformative for agricultural regions including France, Poland, and Spain where agricultural waste availability proves essential for rural energy independence and waste valorization supporting ecological bioenergy development.

Major biomass pellet producers invest heavily in agricultural pellet technology, torrefaction processes improving agricultural biomass properties, and feedstock diversification programs, recognizing that alternative pellets represent breakthrough solutions for ecological demands driving bioenergy sector transformation and resource diversification. Producers collaborate with agricultural cooperatives, waste management organizations, and research institutions to develop commercially viable agricultural pellets that achieve competitive combustion performance while maintaining cost competitiveness and supply ecological supporting mainstream adoption across residential heating and industrial energy applications throughout European markets.

Modern biomass pellet manufacturers systematically incorporate torrefaction technologies, black pellet production methods, and hydrothermal carbonization processes that deliver superior energy density, reduced moisture absorption, and coal-equivalent combustion properties comparable to traditional coal for utility co-firing applications. Strategic integration of torrefied biomass with energy densities exceeding 5.5 kWh/kg, hydrophobic surface properties preventing moisture uptake, and grindability matching coal characteristics optimized for power plant operations enables producers to position advanced black pellets as legitimate coal replacement solutions where direct coal substitution determines utility acceptance and infrastructure compatibility. Companies implement extensive torrefaction plant development programs, black pellet production facilities in Scandinavia and the Netherlands, and performance validation testing targeting superior energy density, including 20-25% higher calorific value, improved storage stability through reduced biological degradation, and enhanced shipping economics through lower moisture and higher energy concentration throughout production and logistics operations.

European biomass pellet consumers and utility buyers increasingly prioritize certification schemes featuring ENplus quality standards, SBP ecological verification, and FSC forest management certification that differentiate responsible biomass production through transparent supply chains and environmental stewardship. This certification trend enables producers to drive market differentiation through quality assurance including moisture content verification, ash content testing, and energy density validation resonating with quality-conscious residential customers seeking appliance protection without compromising heating performance. ENplus certification proves particularly important for residential segments where appliance warranty and heating reliability drive fuel selection, with ENplus A1 certification serving as recognized quality standard for premium pellet stoves and boilers requiring low-ash, high-energy fuel. The development of comprehensive certification infrastructure, traceability systems tracking pellets from forest to consumer, and ecological sourcing protocols expands producers' abilities to create certified products delivering consistent quality with validated ecologically through third-party auditing and chain-of-custody documentation supporting environmental claims.

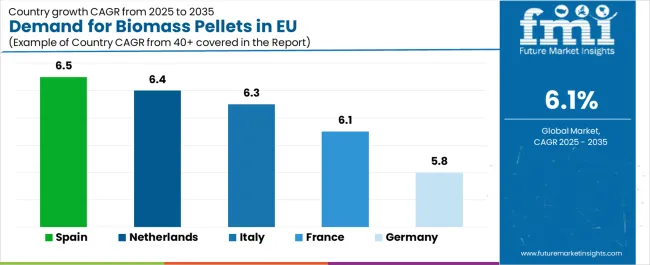

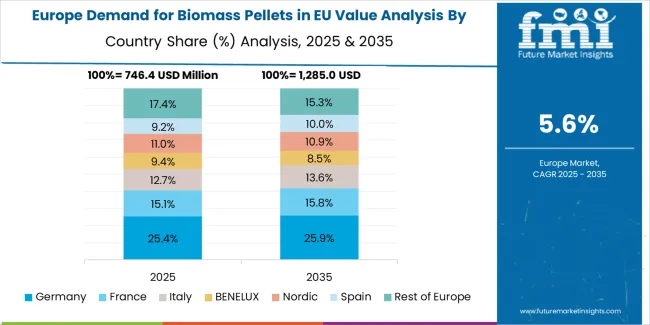

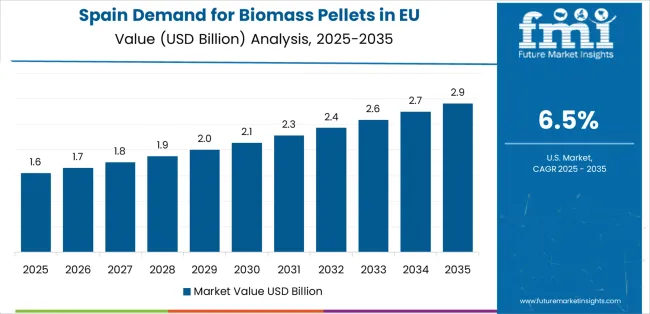

EU biomass pellets sales are projected to grow from USD 3.2 billion in 2025 to USD 5,698 million by 2035, registering a CAGR of 6.1% over the forecast period. The rest of Europe is expected to demonstrate the strongest growth trajectory with a 7.3% CAGR, supported by emerging biomass heating markets and expanding pellet production capacity in Central and Eastern European countries. Spain follows with a 6.5% CAGR attributed to growing residential pellet heating adoption and agricultural pellet development. The Netherlands shows a 6.4% CAGR, reflecting utility biomass co-firing expansion and biomass import hub positioning. Germany maintains the largest share at 40.6% in 2025, driven by residential heating leadership and industrial bioenergy adoption supporting extensive biomass pellet utilization.

| Country | CAGR 2025-2035 |

|---|---|

| Spain | 6.5% |

| Netherlands | 6.4% |

| Italy | 6.3% |

| France | 6.1% |

| Germany | 5.8% |

EU biomass pellets sales demonstrate robust growth across major European economies, with Rest of Europe leading expansion at 7.3% CAGR through 2035, driven by emerging pellet heating markets and production capacity development. Spain shows strong growth at 6.5% CAGR through residential heating conversions and agricultural biomass utilization. Netherlands demonstrates 6.4% CAGR with utility co-firing growth and biomass logistics hub development. Italy records 6.3% CAGR reflecting residential pellet stove adoption and renewable heating incentives. France demonstrates 6.1% CAGR with steady residential demand and agricultural pellet expansion. Germany shows 5.8% CAGR with mature market characteristics and consistent bioenergy utilization. Overall, sales show strong regional development reflecting EU-wide trends toward renewable heating systems and fossil fuel phase-out initiatives.

Revenue from biomass pellets in Germany is projected to exhibit steady growth with a CAGR of 5.8% through 2035, driven by well-developed pellet heating infrastructure, comprehensive residential adoption, and strong commitment to renewable energy throughout the country. Germany's sophisticated bioenergy market and internationally recognized ecological standards are creating substantial demand for certified biomass pellets across residential and industrial applications. Major pellet distributors and industrial users, combined with extensive residential pellet heating installations throughout German regions, systematically utilize ENplus certified pellets for heating, often prioritizing premium A1 grades to maintain appliance performance. German demand benefits from established pellet distribution networks, substantial heating system subsidies, and environmental consciousness that naturally supports renewable heating adoption across residential operations.

Growth drivers:

Demand for biomass pellets in Spain is projected to grow at a CAGR of 6.5%, substantially supported by expanding residential pellet heating installations, growing agricultural pellet production utilizing crop residues, and increasing renewable heating incentives throughout Spanish regions. Spanish residential market development and agricultural biomass potential positions biomass pellets as essential for heating strategies supporting rural energy independence. Major pellet producers and heating system distributors systematically expand biomass pellet utilization, with residential conversions from oil heating and agricultural waste pellet production proving particularly successful in driving mainstream adoption supporting Spanish bioenergy sector development. Spain's substantial agricultural sector supports pellet demand through crop residue availability providing feedstock for agricultural pellet production serving domestic and export markets.

Success factors:

Demand for biomass pellets in the Netherlands is expanding at a CAGR of 6.4%, fundamentally driven by utility-scale biomass co-firing operations, biomass import hub infrastructure in Rotterdam port, and renewable energy mandates supporting bioenergy adoption. Dutch utility operations demonstrate strong receptivity to large-scale biomass utilization and torrefied black pellet technologies meeting coal replacement requirements. Netherlands sales significantly benefit from well-developed biomass logistics infrastructure, utility power generation biomass co-firing requiring millions of tonnes annually, and import capabilities facilitating North American and Baltic pellet supply supporting Dutch and broader European demand. The country's utility biomass leadership and port infrastructure support substantial pellet demand across power generation applications.

Innovation drivers:

Revenue from biomass pellets in Italy is growing at a robust CAGR of 6.3%, fundamentally driven by expanding residential pellet stove market, government heating incentives, and quality-focused bioenergy practices. Italy's traditionally design-conscious consumer culture naturally accommodates premium pellet heating appliances as homeowners recognize cost benefits and environmental advantages. Major pellet distributors and stove manufacturers strategically invest in biomass pellet promotion for heating quality and energy independence supporting Italian residential market excellence standards. Italian sales particularly benefit from pellet stove aesthetic appeal creating adoption among renovation-minded homeowners, combined with substantial residential heating demand in northern regions contributing to expansion through volume-driven consumption.

Development factors:

Revenue from biomass pellets in France is expanding at a CAGR of 6.1%, supported by France's substantial residential pellet heating sector, agricultural pellet production development, and established renewable energy policies throughout major French regions. France's strong environmental commitment and heating system modernization are driving steady demand for quality biomass pellets across residential and agricultural applications. Major pellet producers and heating equipment suppliers maintain comprehensive biomass pellet utilization to serve residential heating demand across rural and suburban markets. French sales particularly benefit from agricultural pellet development utilizing crop residues and government support for renewable heating installations driving pellet adoption within the residential heating category.

Development factors:

EU biomass pellets sales are defined by competition among integrated pellet producers, forest product companies, and international pellet suppliers serving diverse residential, industrial, and utility applications. Companies are investing in ENplus certification systems, ecological forestry management, agricultural feedstock development, and logistics infrastructure to deliver high-quality, ecologically-certified, and reliably supplied biomass pellet solutions meeting stringent European sustainability criteria. Strategic partnerships with utility power generators and distribution network expansion initiatives, along with certification programs emphasizing quality assurance and ecological verification are central to strengthening competitive position throughout European bioenergy markets.

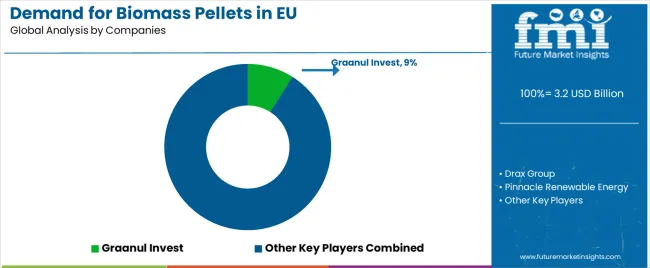

Major participants include Graanul Invest with an estimated 9% share, leveraging its large EU pellet production capacity across Estonia and other Baltic locations, comprehensive forest resource integration, and established presence through residential and utility supply networks across multiple countries. Graanul benefits from vertical integration capabilities, deep forestry expertise supporting ecological sourcing, and ability to serve diverse segments from residential bags to utility bulk, supporting customer requirements through ENplus certification and comprehensive pellet production infrastructure. Drax holds approximately 7.5% share through utility offtake arrangements, emphasizing long-term EU utility supply contracts, North American production assets, and power generation integration supporting biomass power positioning. Pinnacle/Drax accounts for roughly 6% share through its position as certified Canadian pellet supplier with strong EU utility relationships, providing SBP-certified biomass through production scale and transatlantic logistics expertise.

Other companies collectively hold 77.5% share, reflecting competitive dynamics within European biomass pellets sales, where numerous regional pellet producers across Germany, Scandinavia, and Eastern Europe, international pellet exporters from North America, emerging agricultural pellet manufacturers, and specialized torrefied pellet developers serve specific customer requirements, local markets, and niche applications. This competitive environment provides opportunities for differentiation through ENplus A1 premium certification, agricultural waste pellets, black torrefied pellets, and sustainability-verified products resonating with residential consumers, utility operators, and industrial users seeking high-quality biomass pellets aligned with heating requirements, environmental objectives, and regulatory compliance.

| Item | Value |

|---|---|

| Quantitative Units | USD 5,698 million |

| Product Type | Wood Pellets, Agricultural Pellets, Industrial Pellets, Others |

| End Use | Residential, Industrial, Energy (Utility Power), Commercial, Agriculture |

| Distribution Channel | Distributors/Wholesale, Utilities & IPPs, Retail/Online |

| Nature | Certified (ENplus/SBP/FSC), Non-certified |

| Countries Covered | Germany, France, Italy, Spain, the Netherlands, and the Rest of Europe |

| Key Companies Profiled | Graanul Invest, Drax, Pinnacle, Enviva, Specialized pellet producers |

| Additional Attributes | Dollar sales by product type, end use, distribution channel, and nature; regional demand trends across major European economies; competitive landscape analysis with established pellet producers and international biomass suppliers; customer preferences for various certification standards and fuel specifications; integration with ecological forestry management and agricultural waste valorization; innovations in torrefied pellet technologies and feedstock diversification; adoption across residential heating, utility power generation, and industrial energy channels; regulatory framework analysis for RED II/III ecological criteria, carbon accounting methodologies, and certification requirements. |

Product Type

The global demand for biomass pellets in EU is estimated to be valued at USD 3.2 billion in 2025.

The market size for the demand for biomass pellets in EU is projected to reach USD 5.7 billion by 2035.

The demand for biomass pellets in EU is expected to grow at a 6.1% CAGR between 2025 and 2035.

The key product types in demand for biomass pellets in EU are wood pellets, agricultural pellets, industrial pellets and others.

In terms of end use, residential segment to command 39.0% share in the demand for biomass pellets in EU in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Europe Biomass Pellets Market Analysis & Forecast for 2025 to 2035

Biomass Pellets Market Size and Share Forecast Outlook 2025 to 2035

Black & Wood Pellets Industry Analysis in Europe Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Demand for Black & Wood Pellets in Europe Size and Share Forecast Outlook 2025 to 2035

Europe Radiotherapy Patient Positioning Market Size and Share Forecast Outlook 2025 to 2035

Biomass Hot Air Generator Furnace Market Size and Share Forecast Outlook 2025 to 2035

Europe Polyvinyl Alcohol Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Europe Cruise Market Forecast and Outlook 2025 to 2035

Europium Market Forecast and Outlook 2025 to 2035

Eucommia Leaf Extract Market Size and Share Forecast Outlook 2025 to 2035

Europe Massage Therapy Service Market Size and Share Forecast Outlook 2025 to 2035

Biomass Gasification Market Size and Share Forecast Outlook 2025 to 2035

Europe Cement Market Analysis Size and Share Forecast Outlook 2025 to 2035

European Union Tourism Industry Size and Share Forecast Outlook 2025 to 2035

Europe Injection Molding Machines Market Size and Share Forecast Outlook 2025 to 2035

Europe Injection Moulders Market Size and Share Forecast Outlook 2025 to 2035

Europe and MENA Generic Oncology Drug Market Size and Share Forecast Outlook 2025 to 2035

Europe Masking Tapes Market Size and Share Forecast Outlook 2025 to 2035

Europe Liners Market Size and Share Forecast Outlook 2025 to 2035

Europe Dermal Fillers Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA