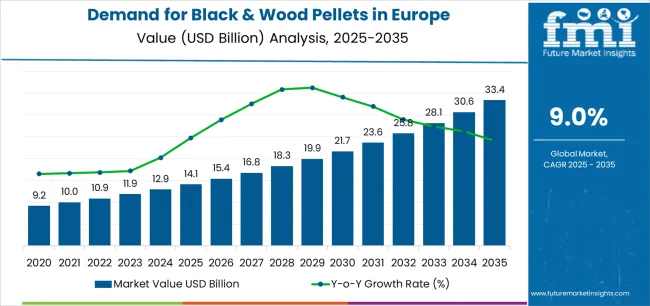

Global Europe black & wood pellets demand is projected to grow from USD 14.1 billion in 2025 to approximately USD 33.4 billion by 2035, recording an absolute increase of USD 19.1 billion over the forecast period. This translates into total growth of 135.5%, with demand forecast to expand at a compound annual growth rate (CAGR) of 9% between 2025 and 2035. FMI’s verified research on advanced composites and performance materials indicates that overall sales are expected to grow by nearly 2.35X during the same period, supported by rising Europe renewable heating activities, increasing electrification and decarbonization mandates, and growing demand for efficient biomass fuel solutions across residential, commercial, and utility-scale power generation operations. Europe, led by Poland, Italy, Germany, and the United Kingdom, continues to demonstrate strong growth potential driven by stringent climate policy frameworks and heating modernization initiatives.

Between 2025 and 2030, Europe black & wood pellets demand is projected to expand from USD 14.1 billion to USD 21.2 billion, resulting in a value increase of USD 7.1 billion, which represents 37.2% of the total forecast growth for the decade. This phase of growth will be shaped by rising Europe biomass heating operations globally, particularly across Poland, Italy, and Germany where renewable heating mandates and residential subsidy programs are accelerating pellet boiler adoption. Increasing mechanization of district heating networks and growing adoption of automated pellet heating systems continue to drive demand. Pellet suppliers are expanding their production capabilities to address the growing complexity of modern Europe biomass operations and sustainability requirements, with European operations leading investments in advanced production technologies and certified sustainable sourcing.

From 2030 to 2035, demand is forecast to grow from USD 21.2 billion to USD 33.4 billion, adding another USD 12 billion, which constitutes 62.8% of the overall ten-year expansion. This period is expected to be characterized by expansion of black pellets and torrefied biomass equipment, integration of advanced quality certification and ENplus® A1 compliance technologies, and development of standardized pellet protocols across different heating and power generation operations. The growing adoption of sustainable forestry practices and agricultural residue utilization initiatives, particularly in Poland, France, and Eastern Europe, will drive demand for more sophisticated production capabilities and specialized technical capabilities.

Between 2020 and 2025, Europe black & wood pellets demand experienced steady expansion, driven by increasing Europe residential heating activities in pellet stove and boiler adoption and growing awareness of biomass benefits for carbon neutrality and energy security. The sector developed as heating operations, especially in Germany and Italy, recognized the need for specialized pellet quality and advanced certification systems to improve performance while meeting stringent emission and sustainability regulations. Pellet producers and district heating operators began emphasizing proper fuel quality management and technological upgrades to maintain operational efficiency and regulatory compliance.

| Metric | Value |

|---|---|

| Europe Black & Wood Pellets Sales Value (2025) | USD 14.1 billion |

| Europe Black & Wood Pellets Forecast Value (2035) | USD 33.4 billion |

| Europe Black & Wood Pellets Forecast CAGR (2025–2035) | 9% |

Demand expansion is being supported by the rapid increase in Europe biomass heating operations worldwide, with Europe maintaining its position as a sustainability and quality leadership region, and the corresponding need for specialized pellet fuel for heating, power generation, and combined heat and power activities. Modern heating operations rely on certified biomass pellets to ensure efficient thermal energy production, carbon emission reduction, and optimal heating system performance. Europe biomass heating requires comprehensive pellet supply systems including ENplus® A1 certified residential grades, industrial CHP pellets, torrefied black pellets, and district heating fuel to maintain operational safety and emission compliance.

The growing complexity of Europe renewable energy operations and increasing sustainability regulations, particularly stringent requirements in Germany, Netherlands, and Sweden, are driving demand for advanced pellet grades from certified producers with appropriate sustainability credentials and engineering expertise. Heating system operators are increasingly investing in premium pellet grades and quality certification technologies to improve combustion efficiency, reduce maintenance costs, and enhance emission performance in challenging Europe residential and industrial environments. Regulatory requirements and heating operation specifications are establishing standardized pellet quality procedures that require specialized production capabilities and certified supply chains, with European operations often setting benchmark standards for global biomass heating practices.

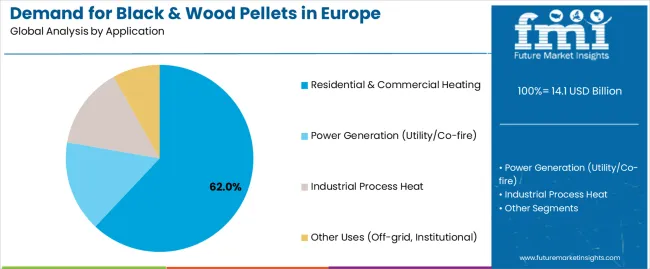

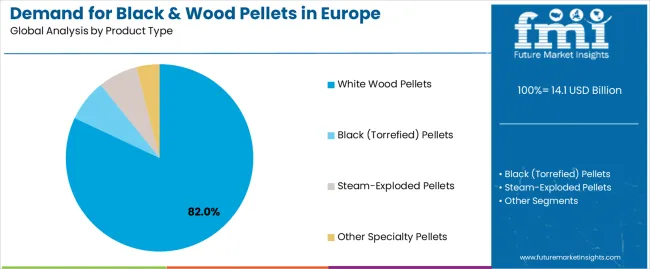

Demand is segmented by application, end-use/pellet class, product type, raw material, and country. By application, sales are divided into residential heating, commercial heating, power generation (utility/co-fire), industrial process heat, and other uses (off-grid, institutional). Based on end-use/pellet class, demand is categorized into CHP, district heating, premium residential pellets, commercial-grade pellets, and utility power-only pellets. In terms of product type, sales are segmented into white wood pellets, black (torrefied) pellets, steam-exploded pellets, and other specialty pellets. By raw material, demand is divided into softwood, hardwood, forest residues, sawmill residues, and agricultural waste. By country, demand is divided into Poland, Italy, Germany, United Kingdom, Netherlands, France, and Sweden, with Poland representing a key growth and innovation hub for Europe biomass pellet heating technologies.

Residential and commercial heating is projected to account for 62% of Europe black & wood pellets demand in 2025, making it the leading application across the sector. This dominance reflects the critical importance of decarbonized heating solutions and renewable energy adoption in European buildings, where fossil fuel heating systems face increasing regulatory restrictions and carbon pricing mechanisms. In Europe, renewable heating directives mandate stringent emission reduction requirements, ensuring the widespread adoption of pellet boilers, pellet stoves, and automated pellet heating systems. Continuous innovations are improving the efficiency of combustion, reliability of supply systems, and cost-effectiveness, enabling building owners to maintain compliance while optimizing heating costs. Additionally, advancements in smart pellet heating systems and remote monitoring technologies are enhancing convenience by enabling automated fuel management and real-time performance optimization. The segment's strong position is reinforced by the rising costs of natural gas and heating oil, which require increasingly attractive economic alternatives that pellet heating provides.

White wood pellets are projected to contribute 82% of demand in 2025, making it the single largest product type segment for Europe biomass fuel. The white pellet sector requires standardized production systems with ENplus® A1 certification, DINplus quality compliance, and comprehensive sustainability verification to sustain efficient and certified operations. In Europe and globally, white pellets remain the mainstream biomass fuel component of residential and commercial heating systems, sustaining steady demand for certified pellet production even amid long-term development of advanced torrefied alternatives. Premium white pellet production relies heavily on certified sawmill residues, forest management byproducts, and quality control technologies that integrate moisture testing, ash measurement, and durability verification to maintain ENplus® standards. The segment also benefits from established supply chain infrastructure in Baltic states, Central Europe, and Scandinavia and ongoing demand from residential heating markets reliant on pellet stove and boiler installations. In Europe, while black pellets and torrefied alternatives gain attention, white pellet demand is sustained by residential heating system compatibility, established quality standards, and the need for affordable certified biomass fuel in existing heating infrastructure.

Europe black & wood pellets demand is advancing steadily due to increasing Europe renewable heating activities and growing recognition of biomass carbon neutrality benefits, with Europe serving as a key driver of quality certification innovation and sustainability standards. However, the sector faces challenges including feedstock availability constraints, need for continuous quality verification and sustainability certification, and varying pellet specifications across different heating system types and national standards. ENplus® certification initiatives and black pellet development programs, particularly advanced in European operations, continue to influence pellet specifications and supply chain patterns.

The growing adoption of district heating modernization, gaining particular traction in Poland, Germany, and Nordic countries, is enabling heating operators to access reliable biomass fuel supply without carbon-intensive fossil fuel dependency, providing decarbonization pathways and reduced heating costs. District heating operators equipped with comprehensive pellet handling infrastructure offer automated fuel management and emission monitoring while allowing municipal heating networks to scale biomass utilization based on seasonal heating requirements. These systems are particularly valuable for urban heating networks and municipal energy companies that require reliable renewable fuel access without long-term fossil fuel price exposure.

Modern pellet producers, led by European and Baltic innovators, are incorporating advanced quality management systems and torrefied black pellet production that improve energy density, reduce logistics costs, and enhance fuel handling characteristics. Integration of ENplus® A1 certification capabilities, automated quality testing systems, and real-time moisture monitoring technologies enables more consistent pellet quality and comprehensive traceability tracking. Advanced production also supports next-generation biomass applications including utility-scale co-firing operations and zero-emission district heating systems that minimize fossil fuel combustion, with European pellet operations increasingly adopting these technologies to meet sustainability and quality objectives.

| Country | CAGR (2025-2035) |

|---|---|

| Poland | 9.3% |

| Italy | 9.1% |

| Germany | 8.6% |

| United Kingdom | 8.4% |

| Netherlands | 8.2% |

| France | 8% |

| Sweden | 7.8% |

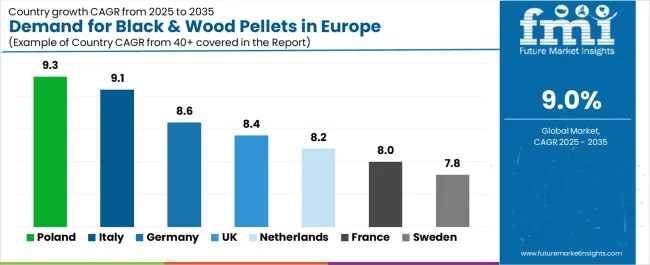

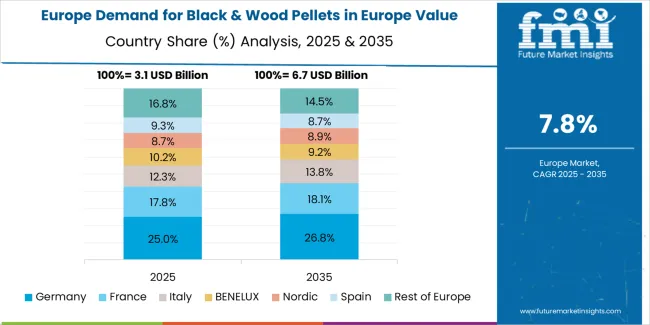

The Europe black & wood pellets demand is witnessing strong growth, supported by rising renewable heating standards, decarbonization initiatives, and the integration of advanced pellet quality systems across heating operations. Poland leads the region with a 9.3% CAGR, reflecting strong investments in district heating retrofits, compliance with biomass incentives, and expansion of domestic pellet production capacity. Italy follows with a 9.1% CAGR, driven by dominant residential pellet stove installations and Conto Termico subsidy support that enhance residential adoption. Germany grows at 8.6%, as building heat law requirements increasingly mandate renewable heating solutions and ENplus® quality enforcement strengthens pellet supply chain standards.

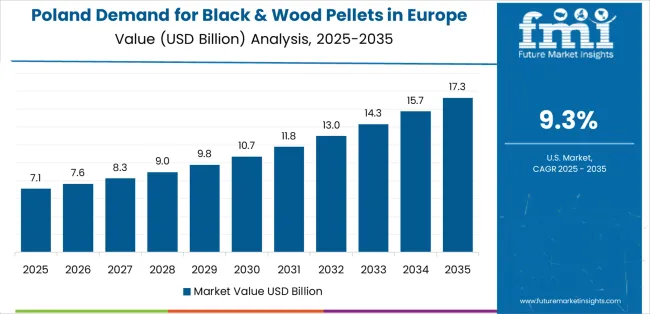

Demand for Europe black & wood pellets in Poland is projected to exhibit strong growth with a CAGR of 9.3% through 2035, driven by ongoing Europe district heating network retrofits, expanding residential pellet boiler adoption, and increasing domestic pellet production capacity development. As a leading European growth market, the country's emphasis on coal heating phase-out and renewable heating incentives is creating significant demand for certified pellets with enhanced quality specifications and sustainable sourcing verification. Major pellet producers and district heating operators are establishing comprehensive supply networks to support heating modernization and regulatory compliance across European operations.

Demand for Europe black & wood pellets in Italy is expanding at a CAGR of 9.1%, supported by extensive Europe residential pellet stove installations, established pellet supply infrastructure, and government subsidy programs including Conto Termico renewable heating incentives. The country's heating sector, representing a crucial component of European residential biomass consumption, is increasingly adopting premium ENplus® A1 certified pellets for optimal combustion performance and emission compliance. Pellet suppliers and residential heating system installers are gradually implementing comprehensive quality verification programs to serve expanding Europe pellet heating activities throughout Italy and broader Southern Europe.

Demand for Europe black & wood pellets in Germany is growing at a CAGR of 8.6%, driven by building heating law requirements mandating renewable heating systems, ENplus® quality enforcement ensuring supply chain integrity, and district heating grid modernization supporting biomass integration. The country's heating sector, an integral part of European renewable heating leadership, is systematically integrating certified pellet heating technologies to meet stringent building emission standards. Heating system operators and pellet producers are investing in quality management infrastructure and sustainability certification to address growing regulatory requirements and align with European biomass quality standards.

Demand for Europe black & wood pellets in United Kingdom is expanding at a CAGR of 8.4%, supported by utility-scale co-firing operations, biomass power purchase agreements supporting renewable electricity generation, and net-zero policy frameworks driving decarbonization investments. The country's power generation sector represents significant industrial pellet consumption, with dedicated biomass power stations and coal-to-biomass conversion projects consuming substantial pellet volumes. Import terminal infrastructure and strategic pellet sourcing partnerships enable reliable fuel supply for large-scale power generation operations. The UK biomass sector provides approximately 5.5 GW of firm power capacity, supporting grid stability during renewable energy intermittency periods. Port facilities including Liverpool, Tyne, and Hull handle millions of tonnes of imported pellets annually, establishing comprehensive logistics capabilities.

Demand for Europe black & wood pellets in Netherlands is growing at a CAGR of 8.2%, driven by SDE++ renewable energy subsidy program incorporating stringent sustainability verification requirements, large-scale co-firing operations in existing power plants, and strategic port logistics infrastructure supporting international pellet trade. The country's industrial pellet sector emphasizes certified sustainable sourcing and comprehensive supply chain traceability to meet demanding regulatory frameworks. Netherlands has implemented Europe's most rigorous biomass sustainability criteria, requiring lifecycle carbon accounting and forest management verification for subsidy-eligible operations. Rotterdam pellet terminals represent Europe's largest biomass import gateway, handling millions of tonnes annually with advanced bulk storage and distribution networks. Co-firing facilities operated by RWE and Engie consume substantial industrial pellet volumes, supporting national carbon reduction objectives.

Demand for Europe black & wood pellets in France is expanding at a CAGR of 8%, supported by tax credit programs for pellet boiler installations, energy diversification initiatives reducing nuclear heating dependency, and rural heating modernization supporting biomass adoption. The country's residential heating sector is gradually transitioning toward pellet-based systems in rural and peri-urban areas lacking natural gas infrastructure. France represents Europe's second-largest residential pellet heating installation base, with approximately 1.5-2 million pellet stoves and boilers deployed nationwide. MaPrimeRénov' renovation subsidies and Crédit d'Impôt programs provide substantial financial incentives for fossil fuel heating system replacement. Domestic forest resources covering 31% of national territory support local pellet production capacity development alongside imported fuel supplies.

Demand for Europe black & wood pellets in Sweden is growing at a CAGR of 7.8%, driven by municipal district heating optimization programs, biomass CHP facility refurbishment projects, and cold-climate heating load requirements supporting year-round biomass consumption. The country's mature biomass heating infrastructure represents established operational practices and technical expertise in large-scale pellet utilization. Approximately 75% of Swedish multi-family buildings and commercial facilities connect to district heating networks predominantly fueled by biomass and waste-to-energy systems. Sweden's pioneering biomass heating development since the 1980s established advanced technical standards and sophisticated fuel procurement strategies serving as European benchmarks. Swedish district heating operations consume approximately 1.5-2 million tonnes of wood pellets annually, with additional volumes supporting industrial CHP applications.

Europe black & wood pellets demand is defined by competition among specialized pellet producers, sustainable forestry operators, and international biomass trading companies, with Baltic and Nordic manufacturers maintaining significant European influence. Producers are investing in advanced production technologies, quality certification systems, sustainability verification capabilities, and comprehensive supply chain networks to deliver reliable, certified, and sustainable pellet solutions across Europe and export operations. Strategic partnerships, quality certification excellence, and production capacity expansion are central to strengthening product portfolios and presence across European and international markets.

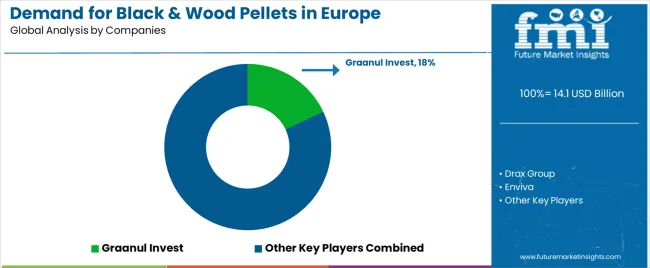

Graanul Invest, Estonia-based and a European industry leader with 18% estimated share, operates comprehensive Europe pellet production infrastructure including 12 modern production facilities with 2.7 million tonnes annual capacity, offering industrial and premium ENplus® A1 certified pellets with focus on supply reliability, sustainability certification, and operational scale across European and global export operations. Drax Group, operating from United Kingdom with significant biomass power generation operations, provides large-scale industrial pellet supply through long-term offtake agreements and strategic sourcing partnerships. Enviva, following successful Chapter 11 restructuring completion in December 2024 that eliminated approximately USD 1 billion debt, is positioned for operational ramp-up of Epes, Alabama production facility targeting 2025 commercial start-up. German Pellets serves Central European residential and commercial heating markets with established distribution networks.

SBE Latvia offers certified sustainable pellet production from Baltic forestry resources serving European district heating and residential heating applications. Pellet producers are establishing comprehensive ENplus® certification programs throughout European operations, developing black pellet and torrefied biomass production alternatives, and integrating advanced sustainability verification technologies to meet evolving heating operation requirements and regulatory standards across European and international biomass heating and power generation operations.

Europe black & wood pellets represent a specialized renewable biomass fuel within heating and power generation applications, projected to grow from USD 14.1 billion in 2025 to USD 33.4 billion by 2035 at a 9% CAGR. This critical renewable heating fuel, primarily supplied in certified white pellet and advanced torrefied black pellet forms for residential heating, district heating, and utility-scale power generation, serves as essential infrastructure for decarbonization compliance in residential & commercial heating, power generation, industrial process heat, and CHP applications across European building and energy sectors. Demand expansion is driven by stringent renewable heating regulations in Germany and Poland, growing adoption of ENplus® A1 quality certification systems, expanding black pellet production for enhanced energy density applications, and rising emphasis on sustainable forestry verification in diverse biomass heating and power generation applications.

How Renewable Energy Regulators Could Strengthen Sustainability Standards and Quality Verification?

Biomass Sustainability Standards: Establish comprehensive technical standards for wood pellet production systems, including sustainable forestry specifications, carbon accounting methodologies, quality certification requirements, and lifecycle emission criteria that ensure consistent carbon reduction performance in heating and power applications.

Renewable Heating Policy Integration: Develop regulatory frameworks that link pellet quality specifications to renewable heating subsidies and building permits, requiring verified ENplus® certification compliance that meets emission standards, supports decarbonization objectives, and ensures overall heating system performance targets.

Supply Chain Traceability Protocols: Implement mandatory sustainability verification standards for pellet production, forestry sourcing, and international trade in biomass fuel markets, including forest management certification systems, deforestation prevention measures, and supply chain documentation procedures that ensure environmental protection and sustainable resource management.

Quality Assurance Guidelines: Create specialized guidelines for pellet quality verification systems addressing moisture content limits, ash specifications, and durability requirements specific to European heating appliance compatibility and emission performance standards.

Carbon Accounting Programs: Provide regulatory frameworks and calculation methodologies for pellet lifecycle carbon assessment that improve emission transparency, enhance climate policy effectiveness, and support comprehensive carbon neutrality claims in biomass heating applications.

How Biomass Industry Associations Could Advance Quality Excellence and Technical Standards?

Quality Certification Best Practices: Develop comprehensive technical guidelines for ENplus® certification implementation, quality testing protocols, and production control systems that maximize pellet performance reliability, minimize combustion issues, and ensure consistent heating system compatibility across different appliance types and operational conditions.

Sustainability Verification Protocols: Establish standardized forest management assessment procedures, agricultural residue sourcing guidelines, and supply chain documentation systems specifically designed for pellet production sustainability verification in diverse forestry and agricultural feedstock environments with varying certification frameworks.

Performance Benchmarking Systems: Create industry-wide metrics for pellet quality performance, sustainability compliance, and production efficiency that enable comparative analysis, identify manufacturing best practices, and drive continuous improvement across European pellet production facilities.

Professional Training and Certification: Develop specialized training programs for pellet production operators, quality control technicians, and sustainability auditors covering pellet manufacturing principles, ENplus® certification requirements, and forest management verification in biomass fuel production.

Technology Innovation Partnerships: Facilitate collaboration between pellet producers, heating equipment manufacturers, and research institutions to advance black pellet development and address emerging challenges in district heating applications and sustainable feedstock utilization systems.

How Pellet Producers Could Drive Production Quality and Supply Reliability?

Advanced Production Technology Development: Invest in research and development of black pellet torrefaction systems, steam explosion processing technologies, and optimized pellet specifications that enable superior energy density and handling characteristics while reducing moisture sensitivity concerns and logistics costs.

Feedstock Supply Diversification: Develop geographically distributed sourcing strategies with certified sustainable forestry partnerships, agricultural residue collection networks, and strategic sawmill residue procurement that ensure raw material availability while minimizing supply disruption risks and sustainability compliance concerns.

Quality Management Excellence: Engineer comprehensive ENplus® A1 certification capabilities with real-time quality monitoring systems, automated testing protocols, and validated measurement methods that ensure consistent pellet specifications while reducing batch variation and customer quality complaints.

Sustainability Certification Integration: Create extensive forest management verification support with FSC/PEFC certification compliance, carbon accounting capabilities, and supply chain traceability assistance that enhance environmental credibility while addressing diverse regulatory requirements.

Production Capacity Innovation: Establish responsible capacity expansion programs, advanced manufacturing systems, and circular economy initiatives that increase production output while maintaining quality consistency and cost competitiveness.

How District Heating and CHP Operators Could Optimize Fuel Management Performance?

Strategic Pellet Sourcing: Conduct comprehensive assessments of pellet suppliers, quality certifications, and supply reliability to optimize procurement strategies while ensuring fuel consistency and heating system performance.

Advanced Combustion Control: Implement real-time monitoring systems, automated fuel handling equipment, and data analytics capabilities to optimize biomass combustion processes, reduce emission levels, and improve overall heating production efficiency.

Emission Compliance Integration: Utilize comprehensive emission monitoring, combustion optimization, and fuel quality verification to ensure consistent regulatory compliance while minimizing environmental impacts and air quality concerns.

Supply Diversification Planning: Develop systematic supplier qualification strategies that incorporate multiple certified pellet sources, regional supply options, and strategic fuel inventory management to enhance fuel security while managing heating costs effectively.

Technology Modernization Investment: Adopt systematic upgrade strategies that incorporate advanced pellet handling technologies, improved combustion systems, and enhanced emission control while maintaining heating reliability and managing capital investments effectively.

How Residential and Commercial Building Owners Could Enable Heating Decarbonization?

Comprehensive Heating System Selection: Provide detailed specifications for pellet heating requirements, building heating loads, and performance expectations that enable heating system suppliers to optimize pellet boiler configurations for specific building applications and climate conditions.

Quality Fuel Procurement: Conduct rigorous ENplus® A1 certification verification, supplier reliability assessment, and fuel quality testing that ensure heating system performance while supporting appliance longevity and emission compliance objectives.

Heating System Collaboration: Establish strategic partnerships with certified pellet suppliers and heating equipment installers to ensure fuel availability, support system optimization, and maintain consistent heating performance throughout seasonal heating cycles.

Regulatory Incentive Utilization: Develop comprehensive subsidy application documentation, renewable heating compliance records, and certification support that access available financial incentives while meeting applicable building codes, renewable heating regulations, and emission standards.

Sustainability Integration: Incorporate carbon footprint reduction considerations, renewable heating certification, and lifecycle emission assessment into heating system selection and fuel procurement to enhance environmental performance while maintaining heating comfort requirements.

How Investment and Financial Enablers Could Support Demand Growth and Capacity Development?

Production Capacity Financing: Provide capital for new pellet production facilities, torrefaction technology development, and capacity expansion initiatives that drive demand growth while supporting regional supply security and fuel availability.

Feedstock Security Investment: Finance sustainable forestry development, agricultural residue collection infrastructure, and feedstock supply diversification projects that reduce raw material availability risks while enhancing European and regional supply independence.

Technology Innovation Support: Support pellet producers in implementing advanced torrefaction systems, establishing ENplus® certification capabilities, and developing black pellet grades that improve competitiveness while ensuring production quality.

Green Infrastructure Financing: Fund district heating network expansion, biomass boiler retrofits, and emission reduction technologies that enhance decarbonization outcomes while maintaining heating economics and system reliability.

Emerging Application Development: Provide financing and technical assistance for utility co-firing conversion in emerging markets, creating new pellet consumption applications while supporting power sector decarbonization and renewable energy transition initiatives.

| Item | Value |

|---|---|

| Quantitative Units | USD 33.4 billion |

| Application | Residential heating, commercial heating, power generation (utility/co-fire), industrial process heat, other uses (off-grid, institutional) |

| End Use/Pellet Class | CHP, district heating, premium residential pellets, commercial-grade pellets, utility power-only pellets |

| Product Type | White wood pellets, black (torrefied) pellets, steam-exploded pellets, other specialty pellets |

| Raw Material | Softwood, hardwood, forest residues, sawmill residues, agricultural waste |

| Countries Covered | Poland, Italy, Germany, United Kingdom, Netherlands, France, Sweden |

| Key Companies Profiled | Graanul Invest, Drax Group, Enviva, German Pellets, SBE Latvia, Stora Enso, Binderholz, Pfeifer Group, Verdo, Arbaflame |

| Additional Attributes | Dollar sales by application, end-use segment, product type, and raw material category, country demand trends across Poland, Italy, Germany, United Kingdom, Netherlands, France, and Sweden, competitive landscape with established European and Baltic producers and technology innovators, heating operator preferences for certified ENplus® A1 versus industrial-grade pellet specifications, integration with district heating networks and automated pellet handling systems particularly advanced in Nordic countries, innovations in black pellet torrefaction and steam explosion processing, and adoption of sustainable forestry certification. |

The global demand for black & wood pellets in europe is estimated to be valued at USD 14.1 billion in 2025.

The market size for the demand for black & wood pellets in europe is projected to reach USD 33.4 billion by 2035.

The demand for black & wood pellets in europe is expected to grow at a 9.0% CAGR between 2025 and 2035.

The key product types in demand for black & wood pellets in europe are residential & commercial heating, power generation (utility/co-fire), industrial process heat and other uses (off-grid, institutional).

In terms of product type, white wood pellets segment to command 82.0% share in the demand for black & wood pellets in europe in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Black & Wood Pellets Industry Analysis in Europe Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Wood Pellets Market Size and Share Forecast Outlook 2025 to 2035

Europe Wood Vinegar Market Analysis – Demand, Size & Forecast 2025–2035

Europe Woodworking Power Tools Market Growth - Trends & Forecast 2025 to 2035

Europe Biomass Pellets Market Analysis & Forecast for 2025 to 2035

Europe Wood Pellet Heating System Market Growth – Trends & Forecast 2024-2034

Wood Awning Window Market Size and Share Forecast Outlook 2025 to 2035

Woodcore Access Floor Market Size and Share Forecast Outlook 2025 to 2035

Woodworm Treatment Service Market Size and Share Forecast Outlook 2025 to 2035

Europe Radiotherapy Patient Positioning Market Size and Share Forecast Outlook 2025 to 2035

Blackout Fabric Laminate Market Size and Share Forecast Outlook 2025 to 2035

Wood Plastic Composite Market Size and Share Forecast and Outlook 2025 to 2035

Wooden Pallet Rental Service Market Size and Share Forecast Outlook 2025 to 2035

Wood Recycling Equipment Market Size and Share Forecast Outlook 2025 to 2035

Europe Polyvinyl Alcohol Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Woodfree Paper Market Size and Share Forecast Outlook 2025 to 2035

Wooden Crate Market Forecast and Outlook 2025 to 2035

Europe Cruise Market Forecast and Outlook 2025 to 2035

Wood-Polymer Bottle Molders Market Size and Share Forecast Outlook 2025 to 2035

Woodworking CNC Tools Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA