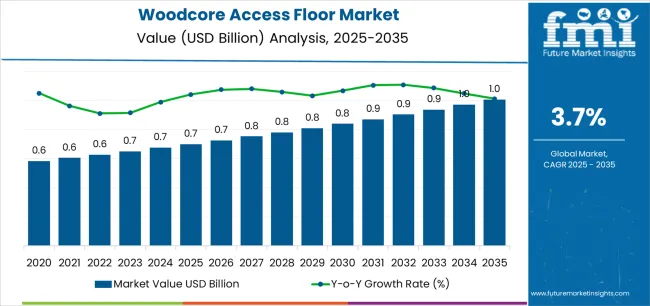

The woodcore access floor market is expected to grow from USD 0.7 billion in 2025 to USD 1.0 billion by 2035, supported by rising demand for integrated cable management solutions and flexible interior infrastructure planning. In the first half of the forecast period, the market is expected to increase to approximately USD 894.6 million by 2030, adding USD 148.6 million and accounting for 46 percent of total growth. This stage is driven by expanding commercial construction activity, increased data center development, and office environments prioritizing reconfigurable underfloor power and networking layouts. Woodcore access floors are gaining adoption for their balance of load-bearing capability, acoustic comfort, and cost efficiency relative to steel-based systems.

In the latter phase (2030–2035), growth momentum continues as modular flooring platforms achieve wider standardization across smart building designs and retrofit projects. The market adds an additional USD 178.2 million, representing 54% of the decade's growth, with emphasis on integration of raised floors into HVAC distribution, IoT sensor placement, and adaptable workspace layouts. Developers and facility planners increasingly prefer access floors that enable future reconfiguration without structural disruption. Performance factors such as panel stability, surface finish durability, moisture resistance, and hybrid wood–steel design optimization will continue to shape competitive positioning across global project specifications.

| Period | Primary Revenue Buckets | Share | Notes |

|---|---|---|---|

| Today | New floor installations (HPL, PVC, steel) | 48% | Capex-led, construction-driven purchases |

| Replacement panels and materials | 22% | Panel replacement, covering materials | |

| Installation and integration services | 18% | Professional installation, structural support | |

| Accessories and components | 12% | Pedestals, stringers, fasteners | |

| Future (3-5 yrs) | Modular flooring systems | 42-46% | Quick installation, sustainable materials |

| Smart floor integration | 16-20% | Sensor integration, building management | |

| Service-as-a-subscription | 14-18% | Maintenance programs, performance guarantees | |

| Replacement panels | 12-16% | Sustainable materials, specialized coverings | |

| Installation and certification | 8-12% | Technical training, compliance support | |

| Data services (space utilization, maintenance) | 4-6% | Analytics for facility managers |

| Metric | Value |

|---|---|

| Market Value (2025) | USD 0.7 billion |

| Market Forecast (2035) | USD 1 billion |

| Growth Rate | 3.7% CAGR |

| Leading Technology | HPL Covering |

| Primary Application | Commercial Segment |

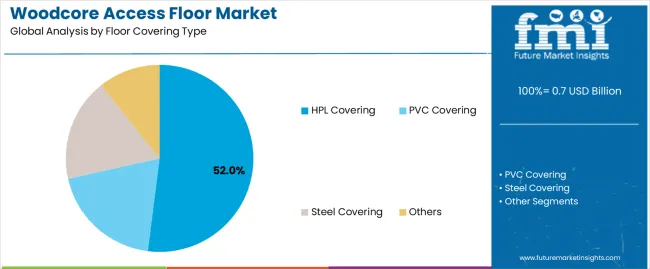

The market demonstrates strong fundamentals with HPL covering systems capturing a dominant share through advanced durability features and commercial construction optimization. Commercial applications drive primary demand, supported by increasing office development and infrastructure capacity requirements. Geographic expansion remains concentrated in developed markets with established construction infrastructure, while emerging economies show accelerating adoption rates driven by commercial building initiatives and rising quality standards.

Primary Classification: The market segments by floor covering type into HPL covering, PVC covering, steel covering, and others, representing the evolution from basic flooring materials to sophisticated construction solutions for comprehensive building infrastructure optimization.

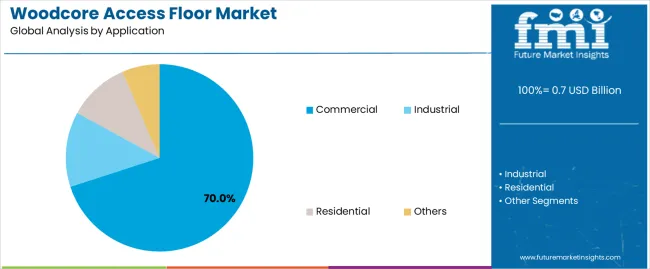

Secondary Classification: Application segmentation divides the market into commercial, industrial, residential, and others sectors, reflecting distinct requirements for building types, operational functionality, and facility standards.

Regional Classification: Geographic distribution covers North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, and Middle East & Africa, with developed markets leading adoption while emerging economies show accelerating growth patterns driven by construction expansion programs.

The segmentation structure reveals technology progression from standard flooring materials toward sophisticated building systems with enhanced durability and sustainability capabilities, while application diversity spans from commercial offices to industrial facilities requiring advanced access flooring solutions.

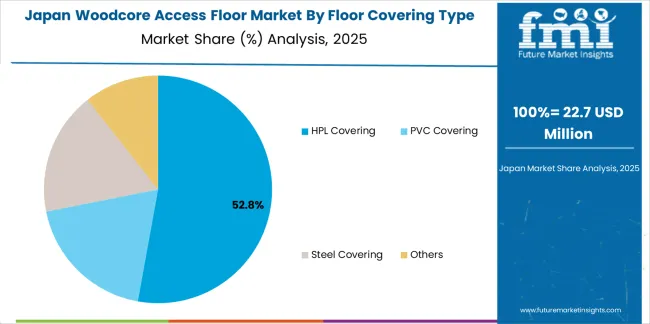

Market Position: HPL Covering systems command the leading position in the woodcore access floor market with 52% market share through advanced durability features, including superior wear resistance, design flexibility, and commercial construction optimization that enable building developers to achieve optimal performance consistency across diverse commercial and institutional environments.

Value Drivers: The segment benefits from construction industry preference for reliable flooring systems that provide consistent aesthetic performance, reduced maintenance requirements, and installation efficiency optimization without requiring significant infrastructure modifications. Advanced design features enable customizable surface finishes, structural integrity, and integration with existing building systems, where operational performance and sustainability compliance represent critical facility requirements.

Competitive Advantages: HPL Covering systems differentiate through proven durability, consistent finish characteristics, and integration with modular construction systems that enhance building effectiveness while maintaining optimal quality standards suitable for diverse commercial and institutional applications.

Key market characteristics:

PVC Covering systems maintain a 28% market position in the woodcore access floor market due to their balanced cost properties and installation advantages. These systems appeal to facilities requiring moderate durability with competitive pricing for mid-scale commercial applications. Market growth is driven by construction expansion, emphasizing reliable flooring solutions and installation efficiency through optimized system designs.

Steel Covering systems capture 14% market share through specialized requirements in industrial facilities, data centers, and heavy-duty applications. These facilities demand robust flooring systems capable of handling concentrated loads while providing effective cable management capabilities and structural reliability.

Other covering materials account for 6% market share, including specialty finishes, custom materials, and application-specific solutions requiring unique performance characteristics for specialized building requirements.

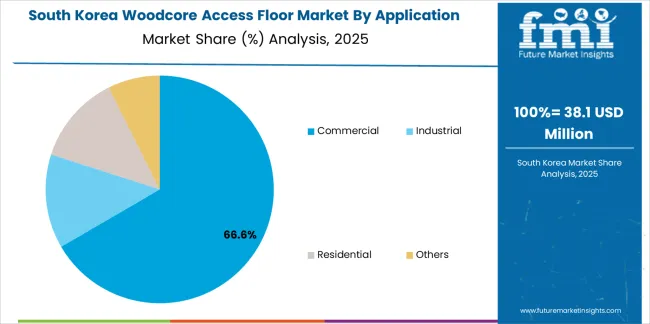

Market Context: Commercial applications accounts for 70% market share demonstrate the highest growth rate in the woodcore access floor market with 4.2% CAGR due to widespread adoption of flexible workspace systems and increasing focus on building infrastructure optimization, operational cost efficiency, and facility flexibility applications that maximize space utilization while maintaining quality standards.

Appeal Factors: Commercial building operators prioritize system versatility, cable management capabilities, and integration with existing building infrastructure that enables coordinated facility operations across multiple tenant configurations. The segment benefits from substantial office development investment and building modernization programs that emphasize the acquisition of access flooring systems for workspace optimization and infrastructure efficiency applications.

Growth Drivers: Office development programs incorporate access flooring as standard equipment for commercial operations, while flexible workspace growth increases demand for modular capabilities that comply with building standards and minimize reconfiguration complexity.

Market Challenges: Varying tenant requirements and installation complexity may limit system standardization across different buildings or lease scenarios.

Application dynamics include:

Industrial applications capture market share through specialized requirements in manufacturing facilities, warehouse operations, and production environments. These facilities demand heavy-duty flooring systems capable of operating with equipment loads while providing effective cable routing and operational reliability capabilities.

Residential applications account for market share, including high-end residential construction, luxury apartments, and custom homes requiring access flooring capabilities for infrastructure management and space optimization.

| Category | Factor | Impact | Why It Matters |

|---|---|---|---|

| Driver | Office construction and flexible workspace growth (coworking, hybrid offices) | ★★★★★ | Demand for reconfigurable spaces requires access flooring with cable management and infrastructure flexibility across commercial installations. |

| Driver | Data center expansion and infrastructure requirements (cloud computing) | ★★★★★ | Turns access flooring from optional to mandatory; vendors providing technical specifications and load capacity gain competitive advantage. |

| Driver | Green building certifications and sustainability standards (LEED, BREEAM) | ★★★★☆ | Building owners need sustainable materials; demand for recycled content and low-emission products expanding addressable market. |

| Restraint | High installation costs and specialized labor requirements | ★★★★☆ | Small projects defer installations; increases price sensitivity and slows adoption in cost-sensitive markets. |

| Restraint | Competition from alternative flooring solutions | ★★★☆☆ | Traditional flooring and cable raceways provide alternatives, limiting market penetration in certain applications. |

| Trend | Modular construction and prefabrication | ★★★★★ | Quick installation systems, standardized components, and factory integration transform construction; speed becomes core value proposition. |

| Trend | Smart building integration and IoT sensors | ★★★★☆ | Sensor-enabled floors for occupancy detection; space utilization analytics and building management drive competition toward connected solutions. |

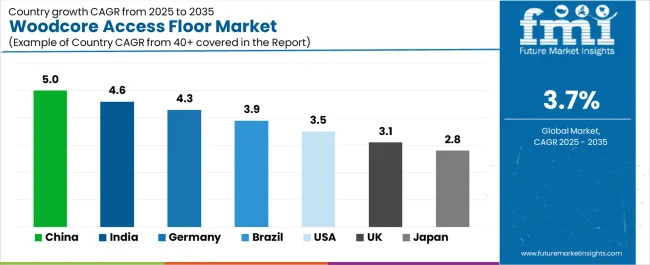

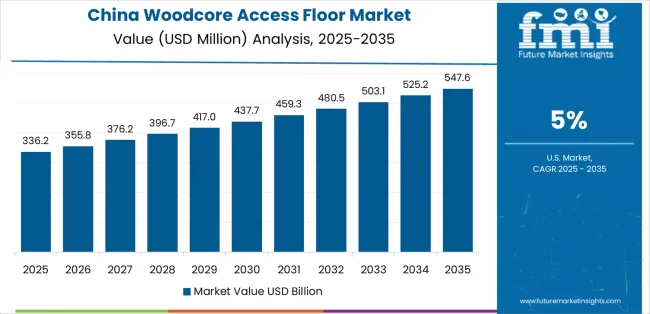

The woodcore access floor market demonstrates varied regional dynamics with Growth Leaders including China (5.0% growth rate) and India (4.6% growth rate) driving expansion through commercial construction initiatives and infrastructure development. Steady Performers encompass Germany (4.3% growth rate), United States (3.5% growth rate), and developed regions, benefiting from established construction industries and advanced building technology adoption. Emerging Markets feature Brazil (3.9% growth rate) and developing regions, where construction initiatives and building modernization support consistent growth patterns.

Regional synthesis reveals East Asian markets leading adoption through commercial expansion and construction development, while North American countries maintain steady expansion supported by building technology advancement and green building standardization requirements. European markets show moderate growth driven by commercial applications and sustainability integration trends.

| Region/Country | 2025-2035 Growth | How to win | What to watch out |

|---|---|---|---|

| China | 5.0% | Lead with cost-effective modular systems | Building code changes; price competition |

| India | 4.6% | Focus on commercial partnerships | Infrastructure limitations; skilled labor |

| Germany | 4.3% | Offer premium sustainable systems | Certification complexity; lengthy approvals |

| USA | 3.5% | Provide green building support | Building code variations; labor costs |

| Brazil | 3.9% | Value-oriented models | Import duties; economic volatility |

| UK | 3.1% | Push sustainability integration | Brexit impacts; market uncertainty |

| Japan | 2.8% | Focus on quality and precision | Conservative adoption; high standards |

China establishes fastest market growth through aggressive commercial construction programs and comprehensive infrastructure development, integrating advanced woodcore access flooring as standard components in office building and data center installations. The country's 5.0% growth rate reflects government initiatives promoting commercial development and domestic construction capabilities that mandate the use of advanced flooring systems in commercial and technology facilities. Growth concentrates in major construction hubs, including Shanghai, Beijing, and Shenzhen, where building technology development showcases integrated access flooring systems that appeal to developers seeking advanced infrastructure capabilities and space management applications.

Chinese manufacturers are developing cost-effective access flooring solutions that combine domestic production advantages with advanced structural features, including modular designs and quick installation capabilities. Distribution channels through construction material suppliers and building service distributors expand market access, while government support for commercial construction supports adoption across diverse office and technology segments.

Strategic Market Indicators:

In Bangalore, Mumbai, and Delhi, commercial buildings and technology parks are implementing advanced woodcore access flooring as standard equipment for infrastructure management and space optimization applications, driven by increasing government construction investment and building modernization programs that emphasize the importance of flexible workspace capabilities. The market holds a 4.6% growth rate, supported by government construction initiatives and commercial infrastructure development programs that promote advanced access flooring for office and technology facilities. Indian operators are adopting access flooring systems that provide consistent structural performance and building compliance features, particularly appealing in urban regions where space efficiency and infrastructure standards represent critical operational requirements.

Market expansion benefits from growing commercial construction capabilities and international technology partnerships that enable domestic production of advanced access flooring systems for office and technology applications. Technology adoption follows patterns established in building materials, where reliability and performance drive procurement decisions and construction deployment.

Market Intelligence Brief:

Germany establishes construction leadership through comprehensive building programs and advanced commercial infrastructure development, integrating woodcore access flooring across office and institutional applications. The country's 4.3% growth rate reflects established construction industry relationships and mature building technology adoption that supports widespread use of access flooring in commercial and educational facilities. Growth concentrates in major commercial centers, including Frankfurt, Munich, and Hamburg, where building technology showcases mature access flooring deployment that appeals to developers seeking proven infrastructure capabilities and sustainability applications.

German equipment providers leverage established distribution networks and comprehensive technical support capabilities, including certification programs and installation support that create customer relationships and operational advantages. The market benefits from mature building standards and sustainability requirements that mandate access flooring use while supporting technology advancement and construction optimization.

Market Intelligence Brief:

United States establishes market leadership through comprehensive commercial construction programs and advanced building infrastructure development, integrating woodcore access flooring across office and data center applications. The country's 3.5% growth rate reflects established construction industry relationships and mature building technology adoption that supports widespread use of access flooring in commercial and technology facilities. Growth concentrates in major commercial regions, including New York, California, and Texas, where building technology showcases mature access flooring deployment that appeals to developers seeking proven infrastructure capabilities and LEED compliance applications.

American equipment providers leverage established distribution networks and comprehensive technical support capabilities, including green building certification programs and installation support that create customer relationships and operational advantages. The market benefits from mature building codes and sustainability requirements that mandate access flooring use while supporting technology advancement and construction optimization.

Market Intelligence Brief:

Brazil's market expansion benefits from diverse construction demand, including commercial development in Sao Paulo and Rio de Janeiro, office building upgrades, and government infrastructure programs that increasingly incorporate access flooring solutions for space management applications. The country maintains a 3.9% growth rate, driven by rising commercial construction activity and increasing recognition of access flooring technology benefits, including flexible infrastructure and enhanced space utilization.

Market dynamics focus on cost-effective access flooring solutions that balance advanced structural performance with affordability considerations important to Brazilian construction operators. Growing commercial industrialization creates continued demand for modern access flooring systems in new building infrastructure and facility modernization projects.

Strategic Market Considerations:

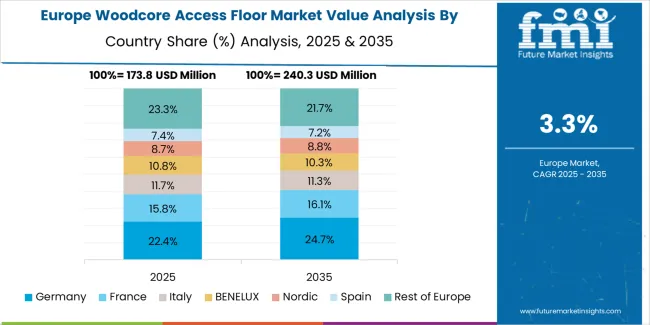

The woodcore access floor market in Europe is projected to grow from USD 273.6 million in 2025 to USD 386.4 million by 2035, registering a CAGR of 3.5% over the forecast period. Germany is expected to maintain its leadership position with a 34.2% market share in 2025, supported by its advanced construction infrastructure and major commercial centers.

United Kingdom follows with a 23.6% share in 2025, driven by comprehensive office development programs and green building initiatives. France holds a 19.8% share through specialized commercial applications and building compliance requirements. Italy commands a 13.1% share, while Spain accounts for 9.3% in 2025. The rest of Europe region is anticipated to gain momentum, expanding its collective share from 5.8% to 6.4% by 2035, attributed to increasing access flooring adoption in Nordic countries and emerging commercial facilities implementing building modernization programs.

Japan's woodcore access floor market benefits from established commercial construction practices and comprehensive building quality standards. The country maintains a 2.8% growth rate, supported by government initiatives promoting sustainable construction and building technology advancement. Major commercial centers in Tokyo, Osaka, and Nagoya showcase advanced access flooring deployment for office applications and technology facilities. Japanese manufacturers prioritize system precision and seismic compliance, creating demand for premium systems with structural integrity and disaster resilience. Distribution channels through established construction material networks enable broad market access across office and institutional segments.

South Korea's market expansion reflects advanced construction technology infrastructure and comprehensive smart building programs. The country demonstrates strong adoption of integrated access flooring systems in commercial buildings across Seoul, Busan, and Incheon. Growth is driven by construction modernization initiatives and increasing focus on building efficiency standards. Korean construction facilities emphasize modular flooring solutions with building management system compatibility and space optimization capabilities. Market development benefits from government construction technology investment programs and established building material manufacturing capabilities supporting domestic production of advanced access flooring systems.

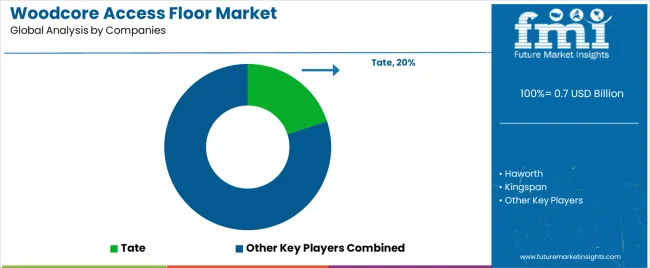

The woodcore access floor market maintains a moderately fragmented structure with 25-30 credible players, where the top 5-7 companies hold approximately 52-58% by revenue. Market leadership is maintained through distribution networks, technical support capabilities, and product innovation encompassing load capacity, surface finishes, and modular design integration. Competition centers on installation efficiency, structural performance, and integration with building workflows including cable management systems and facility infrastructure.

Basic panel construction and standard pedestal systems are commoditizing, shifting competitive advantage toward advanced features such as sustainable materials, quick installation systems, and comprehensive technical specifications. Margin opportunities concentrate in installation services, custom configurations, and integration into construction workflows with green building certifications and facility management systems. Leading manufacturers differentiate through extensive product testing certifications supporting structural reliability, comprehensive technical documentation for architects and engineers, and responsive delivery networks reducing project timelines.

The competitive landscape features global building material manufacturers leveraging broad distribution networks and established construction relationships, specialized access flooring companies focusing on product innovation and application expertise, regional construction suppliers providing localized support and competitive pricing, and emerging sustainable material providers introducing recycled content and low-emission products. Strategic partnerships between access flooring manufacturers and construction technology platforms are increasing, enabling integrated building solutions and expanding addressable markets beyond traditional commercial applications into data centers and residential construction sectors.

Market dynamics favor participants with proven load capacity certifications, comprehensive distribution networks, and ability to meet green building requirements. Product refresh cycles accelerate as sustainability features and modular designs become standard expectations, while building code compliance and testing certifications create barriers to entry protecting established players. Pricing pressure emerges in commodity panel segments, while premium positioning remains viable for manufacturers offering comprehensive technical solutions with demonstrated structural performance and integration capabilities supporting sustainable construction initiatives.

| Item | Value |

|---|---|

| Quantitative Units | USD million |

| Floor Covering Type | HPL Covering, PVC Covering, Steel Covering, Others |

| Application | Commercial, Industrial, Residential, Others |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, Middle East & Africa |

| Countries Covered | United States, China, Germany, India, United Kingdom, Japan, Brazil, France, South Korea, Australia, and 20+ additional countries |

| Key Companies Profiled | Tate, Haworth, Kingspan, SENQCIA, Topwelltech, AVAYO, COMXM, HK International, Changzhou Huateng Access Floor |

| Additional Attributes | Dollar sales by floor covering type and application categories, regional adoption trends across East Asia, South Asia Pacific, and North America, competitive landscape with building material manufacturers and construction suppliers, developer preferences for structural capacity and installation efficiency, integration with building management platforms and facility systems, innovations in sustainable materials and modular design, and development of quick-installation solutions with enhanced performance and construction optimization capabilities. |

The global woodcore access floor market is estimated to be valued at USD 0.7 billion in 2025.

The market size for the woodcore access floor market is projected to reach USD 1.0 billion by 2035.

The woodcore access floor market is expected to grow at a 3.7% CAGR between 2025 and 2035.

The key product types in woodcore access floor market are hpl covering, pvc covering, steel covering and others.

In terms of application, commercial segment to command 70.0% share in the woodcore access floor market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Access Control as a Service Market Size and Share Forecast Outlook 2025 to 2035

Access Control Market Analysis - Size, Share, and Forecast 2025 to 2035

Access Control and Authentication Market Analysis & Forecast by Technology, Component, Application and Region through 2035

Access Control Readers Market

Car Accessories Market Size and Share Forecast Outlook 2025 to 2035

Lab Accessory Market Analysis – Size, Share & Forecast 2024-2034

Bar Accessories Market

Jack Accessories Market Size and Share Forecast Outlook 2025 to 2035

Dock Accessories Market Size and Share Forecast Outlook 2025 to 2035

Golf Accessories Market Size and Share Forecast Outlook 2025 to 2035

Cloud Access Security Brokers Market Size and Share Forecast Outlook 2025 to 2035

Multi-Access Edge Computing Market Size and Share Forecast Outlook 2025 to 2035

Apple Accessories Market Report – Demand, Trends & Forecast 2025–2035

Cable Accessories Market Growth - Trends & Forecast 2025 to 2035

Camera Accessories Market Size and Share Forecast Outlook 2025 to 2035

Laptop Accessories Market Size and Share Forecast Outlook 2025 to 2035

Spinal Access Systems Market Size and Share Forecast Outlook 2025 to 2035

E-Bike Accessories Market Size and Share Forecast Outlook 2025 to 2035

Travel Accessories Market Analysis by Product Type, Material, Distribution Channel, End-User and Region 2025 to 2035

Key Players & Market Share in Laptop Accessories Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA