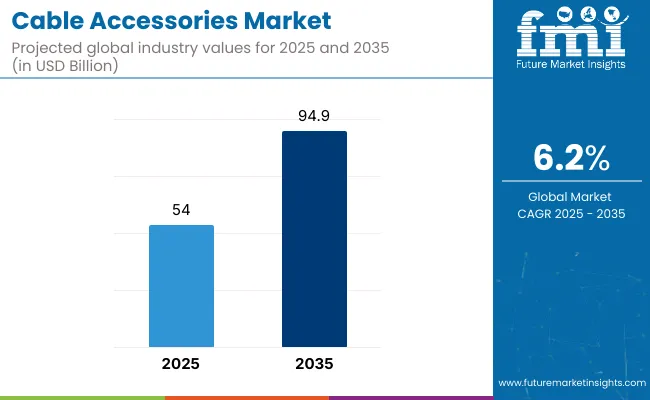

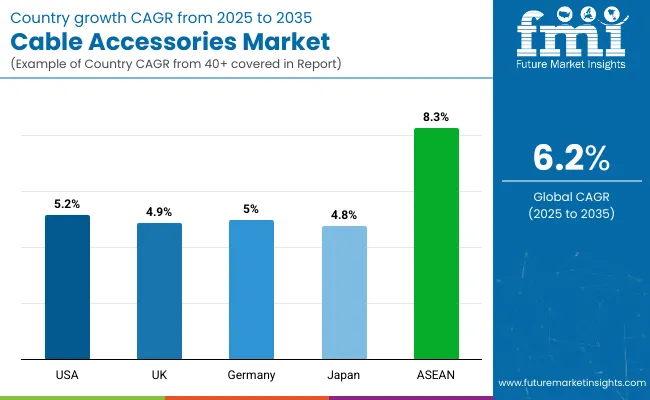

The global cable accessories market is projected to reach USD 52.0 billion in 2025 and is expected to grow to USD 94.9 billion by 2035, registering a CAGR of 6.2% during the forecast period. Market expansion is supported by rapid industrialization, growing electricity infrastructure, and advancements in cable technology, alongside the integration of renewable energy sources and modernization of transmission and distribution networks.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 52.0 billion |

| Industry Value (2035F) | USD 94.9 billion |

| CAGR (2025 to 2035) | 6.2% |

Cable accessories play a critical role in ensuring the safe and reliable operation of power systems. They include joints, terminations, connectors, and insulation components that facilitate installation, maintenance, and protection of power cables. Their use prevents unauthorized current leakage, enhances system efficiency, and ensures uninterrupted power supply across residential, commercial, and industrial sectors.

The demand for high-performance cable accessories is accelerating due to the increasing adoption of underground cabling systems and smart grids. Governments in emerging economies are prioritizing infrastructure upgrades and grid modernization to address growing energy demand, reduce transmission losses, and improve reliability.

The development of underground networks is also driven by urbanization and the need to enhance aesthetics while minimizing environmental exposure, particularly in developed markets.

Renewable energy integration is another significant growth driver. Wind and solar power projects require durable and weather-resistant cable accessories to ensure safe and efficient energy transmission in harsh conditions. Climate variability and extreme weather events are further pushing demand for robust accessories capable of withstanding mechanical stress and temperature fluctuations.

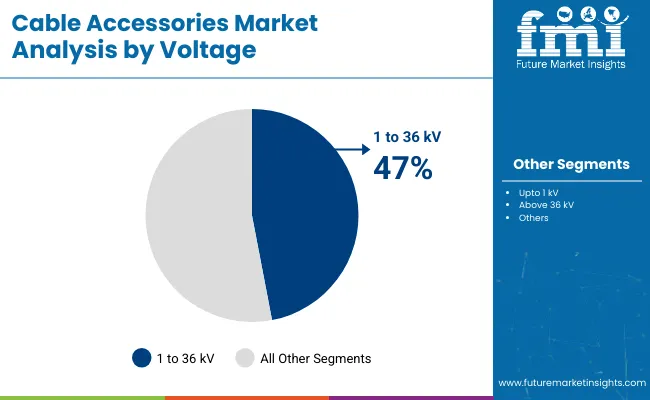

The 1 to 36 kV segment is estimated to account for 47% share of the cable accessories market in 2025 and is expected to grow at a CAGR of 6.3% through 2035. This dominance is attributed to the rising deployment of medium-voltage power distribution systems in urban infrastructure, industrial complexes, and renewable energy projects.

Governments are investing in grid modernization and underground cabling projects to improve power reliability, which is further supporting the use of accessories suited for this voltage range. The growing demand for medium-voltage networks in wind farms and solar parks reinforces the segment’s strong outlook over the next decade.

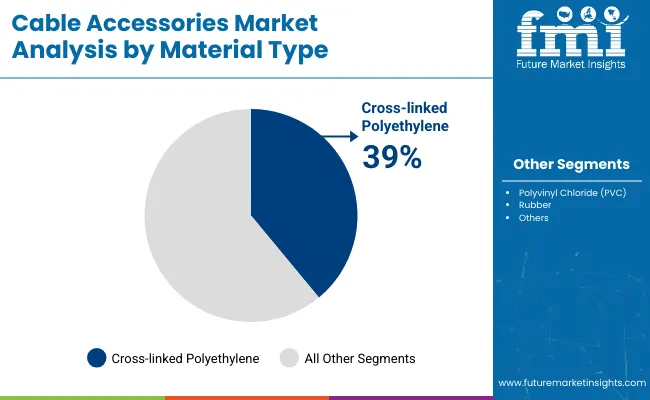

Cross-linked polyethylene (XLPE) is projected to hold 39% share of the cable accessories market in 2025 and is forecast to expand at a CAGR of 6.4% through 2035. Its widespread adoption has been driven by superior thermal resistance, electrical strength, and durability under mechanical stress.

XLPE-based cable joints and terminations are being widely utilized in power transmission and distribution networks, particularly in high-load and temperature-sensitive environments. Continuous investment in renewable energy and underground cabling projects, where enhanced insulation performance is critical, further supports the dominance of XLPE as a preferred material in cable accessories.

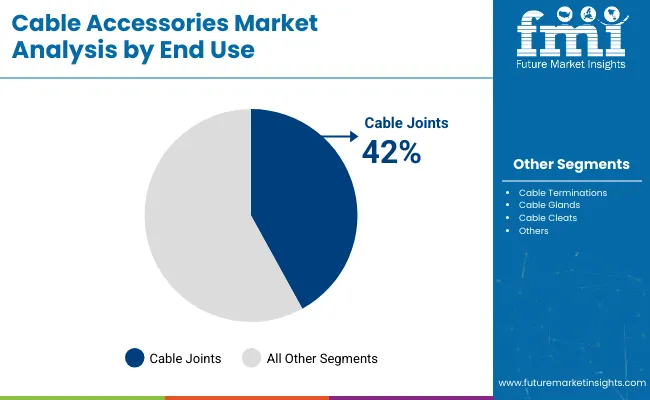

Cable joints are expected to represent 42% share of the cable accessories market in 2025 and are projected to grow at a CAGR of 6.1% through 2035. Their role in maintaining electrical integrity during the connection of cables across long transmission routes has sustained strong demand.

The segment’s growth is supported by increasing investments in underground and submarine cabling systems, where jointing reliability is essential to minimize outages. Technological advancements, including pre-molded and heat-shrink joint solutions, are further enhancing installation efficiency and system longevity across utility and industrial applications.

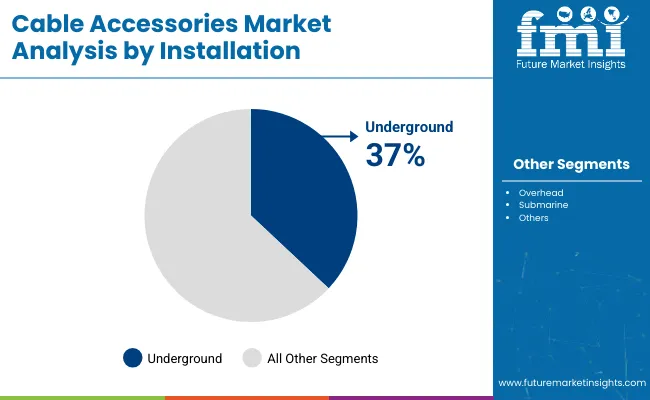

Underground cable installations are estimated to account for 37% share of the market in 2025 and are forecast to grow at a CAGR of 6.5% through 2035. The shift toward underground networks has been driven by the need to improve grid resilience, minimize exposure to environmental hazards, and meet aesthetic considerations in urban areas.

Governments across Europe and Asia-Pacific are allocating significant budgets for underground power line projects to reduce outage risks and enhance safety. The rising adoption of underground cables in renewable energy interconnections, metro rail systems, and smart city projects further accelerates the demand for related accessories.

Durability and Performance Limitations in Harsh Environments

One of the major challenges in the cable accessories market is ensuring durability and performance in extreme operating conditions. Cable accessories joints, connectors, and terminations are used in harsh environments with extreme temperature cycles, moisture, UV radiation and mechanical stress.

This is especially true for industrial applications such as energy transmission, offshore installations, and underground networks where robust insulation and resistance to environmental degradation are paramount. Corrosion, electrical stress, thermal expansion and other factors can affect long-term reliability, causing expensive power outages and maintenance expenses. They need new high-performance materials, improved insulation technologies, and protective coatings to optimize durability with minimal boost in cost of production.

Growing Complexity of High-Voltage and Smart Grid Requirements

As high-voltage power transmission and intelligent grid technologies have gained momentum, cable accessories are coming up against increasingly complex performance and regulatory needs. Power lines are being developed for renewable power integration, improved productivity, and real-time monitoring; thus, cable accessories with better insulation, better conductivity, and digital interaction are required.

Technical challenges arise as the industry moves to extra-high-voltage (EHV) and ultra-high-voltage (UHV) networks, supported by rigorous testing and certification processes. Furthermore, incorporating both legacy as well as present-day smart grid may result in compatibility issues, further adding to the design complexity & increasing the development efforts. Power distribution manufacturers must keep up with changing electrical standards, they should also ensure compatibility with existing systems without interruptions.

Advancements in Smart and Self-Healing Cable Accessories

The development of smart and self-healing cable accessories is opening new growth opportunities in the market. Fiber optics and smart sensors are helping improve grid reliability with advanced cable accessories with integrated real-time monitoring capabilities, IoT connectivity and predictive maintenance capabilities. In these critical infrastructure applications, self-healing materials can repair minor insulation damage autonomously, lowering failure rates and maintenance downtime.

The increasing adoption of digital substations and other intelligent power distribution networks has also increased the demand for next generation cable accessories with capabilities for remote diagnostics and automated fault detection. The need for performance, technology-oriented smart cable accessories gives a fair opportunity for companies investing in smart cable accessories.

Rising Demand for Cable Accessories in Renewable Energy Projects

The global shift toward renewable energy sources, such as wind and solar power, is driving demand for specialized cable accessories. High-performance cable joints, terminations, and connectors that can accommodate variable loads and extreme environmental conditions are the basis for offshore wind farms, large-scale solar installations, and hybrid energy grids. The global investment of the government in clean energy infrastructure is leading to the lucrative opportunity for manufacturing cable accessories.

Moreover, the growing deployment of energy storage systems and interconnecting infrastructure between national grids we're driving demand for high-performance cable accessories with enhanced insulation, conductivity and life-cycle reliability. In this fast-growing market, businesses that specialize in customized solutions for renewable energy use will stand to benefit.

| Country/Region | Estimated CAGR |

|---|---|

| USA | 5.2% |

| UK | 4.9% |

| Germany | 5.0% |

| Japan | 4.8% |

| ASEAN | 8.3% |

USA Cable Accessories Market is growing at a high CAGR during the forecast period of 2025 to 2035. Increased investments in underground and high-voltage power transmission systems are expected to drive the need for cable joints, terminations, and connectors.

The increasing demand for high-speed data rate transmission owing to the expansion of 5G deployment is further supporting the growth of this market. This is supported by strict regulatory policies related to the grid modernization and energy efficiency; this is driving growth of the cable accessories market.

The United Kingdom cable accessories market conveys a moderate growth with investments increasing in renewable energy, offshore wind farms and urban infrastructure. A strong focus in the country on modernizing aging power networks and underground power networks drives demand for high-quality cable accessories.

The exponential growth of data centers and 5G networks is also driving the demand for advanced fiber-optic accessories. Furthermore, regulatory mandates for energy efficiency and sustainability in electrical installations are boosting the market growth.

The European Union cable accessories market is witnessing steady growth, driven by increased investments in renewable energy projects, grid modernization, and smart city developments. Rigorous regulatory landscape regarding electrical safety and energy efficiency in the EU is driving the demand for high-performance cable accessories.

Market growth is further propelled by the development of advanced power transmission systems led by Germany, France, and Italy. Another driving force behind the demand is the movement towards underground cabling solutions and the expansion of high-speed broadband networks.

Japan’s cable accessories market is experiencing moderate growth due to the country’s emphasis on energy efficiency, advanced power transmission networks, and smart factory initiatives. With the growth of underground power infrastructure and renewable energy projects, the demand for high-performance cable accessories is increasing.

The growing demand for robust cable terminations and connectors is also being driven by developments in robotics, the rollout of 5G and high speed rail networks. The fact that the country pays a lot of attention to electrical systems resistant to area movement action is also responsible for changing market trends.

South Korea's cable accessories market is expanding due to rapid developments in 5G, smart manufacturing, and renewable energy projects. Demand for quality cable accessories is being driven by the country leader in electronics, semiconductors, and high-tech industries.

Market growth is also expected to be fueled by investments in underground power networks and smart grid technology. South Korea's emphasis on sustainable energy solutions means demand for cable terminations, joints and connectors in solar and wind power projects is growing.

Technological innovations are transforming the product landscape, with advanced polymer-based insulation, corrosion-resistant materials, and improved shielding extending cable life and enhancing safety. Manufacturers are also focusing on sustainable production and recyclable materials to meet environmental and corporate sustainability goals.

Market opportunities are growing through the adoption of high-voltage transmission lines, fiber-optic installations, and smart monitoring solutions. The integration of digitalization and condition-monitoring systems into cable networks is enabling predictive maintenance and reducing downtime. These trends highlight the increasing role of cable accessories in supporting resilient, future-proof power infrastructure and long-term energy security.

The global cable accessories market is projected to reach USD 52,028.8 million by the end of 2025.

The market is anticipated to grow at a CAGR of 6.2% over the forecast period.

By 2035, the cable accessories market is expected to reach USD 94,948.7 million.

The Joint & Terminations segment is expected to dominate due to its critical role in high-voltage power transmission and increased adoption in railway and utility infrastructure.

Key players in the cable accessories market include Nexans S.A., Prysmian Group, TE Connectivity, Sumitomo Electric Industries, and 3M Company.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cable Line Fault Indicator Market Size and Share Forecast Outlook 2025 to 2035

Cable Tray Market Size and Share Forecast Outlook 2025 to 2035

Cable Granulator Market Size and Share Forecast Outlook 2025 to 2035

Cable Distribution Cabinets Market Size and Share Forecast Outlook 2025 to 2035

Cable Cleaning Solutions Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Cable Cleaning Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Cable Material Market Growth - Trends & Forecast 2025 to 2035

Cable Fault Locator Market Size, Share, and Forecast 2025 to 2035

Cable Connectors and Adapters Market Analysis by Application, Product, Type and Region: Forecast from 2025 to 2035

Cable Cars and Ropeways Market Growth - Trends & Forecast 2025 to 2035

Cable Wrapping Tape Market

Cable Racks Market

Cable Testing Market

Cable Assemblies Market

Cable Carrier Market

Cable Detector Market

Cable Flange Market

Car Accessories Market Size and Share Forecast Outlook 2025 to 2035

Bar Accessories Market

LED Cable Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA