The cable cleaning equipment market is projected to expand from USD 620.1 million in 2025 to USD 991 million by 2035, registering a CAGR of 4.8% during the forecast period. The market is undergoing a transformation as utilities, telecom operators, and industrial OEMs push for stricter maintenance standards to reduce risks of insulation breakdown and signal loss.

There is a rising preference for high-pressure pneumatic units and solvent-based systems compliant with IEC 61340-5-1, especially in high-voltage corridors and deep-sea cable installations.

Leading OEMs are now collaborating with specialty chemical providers to engineer biodegradable, low-residue cleaning solutions tailored for fiber optic and HV applications. On the supply chain front, top-tier manufacturers are focusing on modular equipment and AI-enabled robotic systems designed for unmanned substations. Distributors are shifting toward value-added models, offering predictive diagnostics and field servicing within integrated contracts. This evolving market is increasingly centered around precision, regulatory compliance, and lifecycle efficiency across smart grid, aerospace, and hyperscale data infrastructure sectors.

As of 2025, the cable cleaning equipment market occupies a small yet essential share within its broader parent markets. In the global cable management market, it contributes approximately 2-3%, supporting maintenance and operational efficiency in high-voltage and data cabling systems. Within the industrial cleaning equipment market, its share is about 1-2%, as it represents a specialized category focused solely on electrical applications.

In the electrical maintenance tools market, cable cleaning solutions account for 3-4%, given their widespread use in substations and power plants. In the power transmission and distribution market, the share stands at around 1.5-2.5%, used during routine servicing of overhead and underground lines. In the utility maintenance equipment market, cable cleaning equipment holds roughly 2-3%, helping ensure safety and performance compliance.

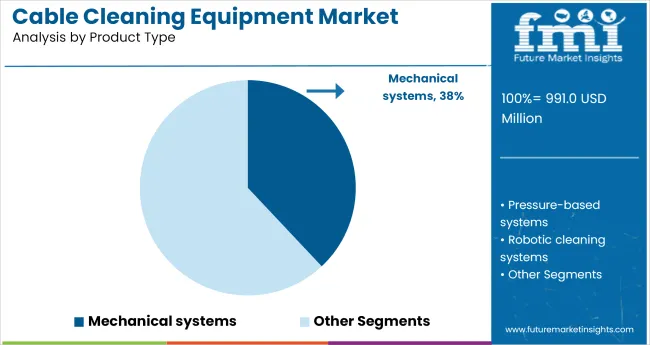

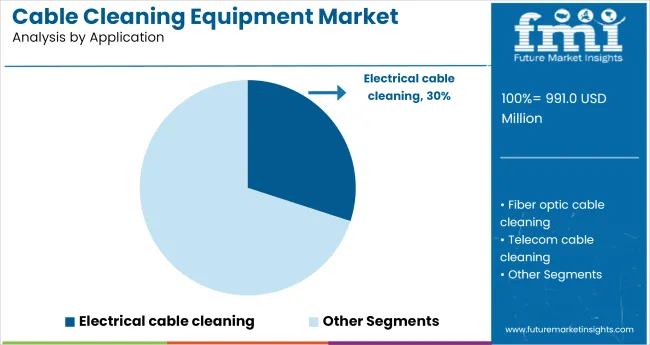

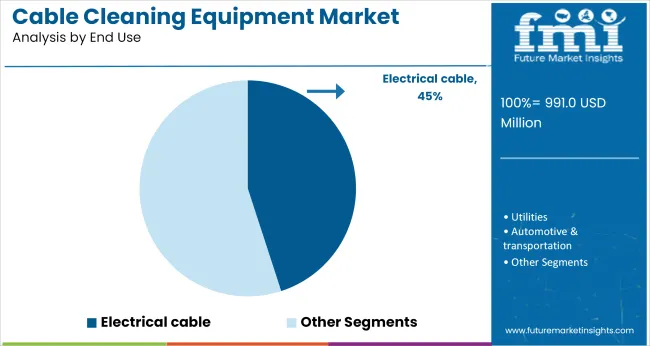

Mechanical systems are anticipated to lead the product type segment with 38% market share by 2025. Electrical cable cleaning is projected to dominate the application segment with 30%, while electrical cables are expected to account for 45% of end-use share, driven by increased maintenance demand in energy infrastructure.

Mechanical cable cleaning equipment is projected to command 38% of the product type segment by 2025, as industries seek efficient solutions for large-scale cable maintenance. Manual and semi-automated tools are widely adopted in sectors where continuous cable reliability is essential, such as telecom and energy.

Electrical cable cleaning is forecasted to hold 30% share in the application segment by 2025, due to growing preventive maintenance needs in power and industrial grids. Contaminant buildup on high-voltage cables can degrade performance, prompting routine cleaning operations across substations and plants.

Electrical cables are set to dominate the end use segment, accounting for 45% of market share by 2025, supported by global power infrastructure upgrades. Rising investment in renewable energy, urban electrification, and transmission modernization is increasing demand for clean, operationally sound cables.

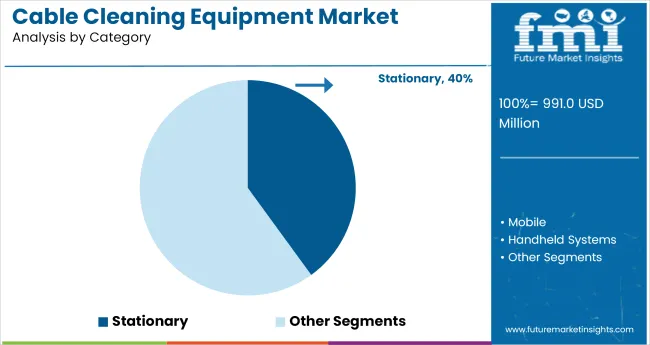

Stationary units are anticipated to commands the category segment with a 40% market share by 2025, favored for high-volume and continuous cleaning in fixed facilities. Utility depots and service centers rely on stationary machines to clean batches of cables with precision and consistency.

The market is gaining traction amid rising investments in smart grids, telecom infrastructure, and industrial automation. By 2024, over 7 million kilometers of new power and fiber cables were installed globally, pushing the demand for specialized cleaning solutions that ensure signal integrity and reduce unplanned downtime.

Increased Demand for Non-Abrasive and Lint-Free Cleaning Tools

OEMs are developing dry-wipe and foam-tipped applicators for environments that prohibit chemical use. In 2024, over 42% of cable cleaning kits sold featured biodegradable components and solvent-free formulas. Technicians favor lint-free cloths and anti-static brushes for maintenance in confined electrical panels and high-voltage enclosures.

Product Innovation Driven by Miniaturization and Automation Needs

Automated cable cleaning heads are being adopted in robotic maintenance units for offshore wind farms and tunnel electrification. Compact tools have been engineered for EV battery assembly lines, where cable connections are increasingly dense and inaccessible. In 2025, the miniaturized cleaning segment is forecast to grow by 8.3%, led by demand from semiconductor fabrication.

The report provides insights across 40+ countries. The five below are highlighted for their strategic influence and growth trajectory.

| Country | CAGR (2025-2035) |

|---|---|

| India | 5.1% |

| China | 4.5% |

| United States | 4.1% |

| Germany | 3.8% |

| Japan | 3.5% |

The global cable cleaning equipment market is forecast to grow at a 4.8% CAGR from 2025 to 2035. India, a BRICS nation, surpasses this benchmark with 5.1% growth, backed by national electrification targets, smart grid rollout, and localized production of modular cleaning systems. Public-sector procurement and distribution reforms are pushing volumes across state-run utilities.

China trails slightly at 4.5%, where rising automation in substations offsets a slowdown from metro grid saturation. The United States, part of the OECD, posts 4.1%, reflecting aging but stable infrastructure and retrofit demand in older urban cores.

Germany lags at 3.8%, constrained by labor-intensive equipment certification processes and flat industrial capex. Japan, the lowest among profiled nations at 3.5%, faces demand compression due to market consolidation and slow replacement of underground systems. ASEAN countries are outperforming the global average, driven by grid expansions and growing import of cost-effective BRICS-built cleaning modules across Vietnam, Indonesia, and Thailand.

India’s cable cleaning equipment market is projected to grow at a CAGR of 5.1% through 2035. This growth is tied to the central government’s ₹2.4 lakh crore PM Gati Shakti plan and rural electrification push, which includes over 100,000 km of new transmission and distribution lines by 2030. Cleaning equipment is being standardized in public tenders to reduce fault rates and downtime. Power Grid Corporation and REC are encouraging inclusion of cleaning kits for 33-132 kV substations, particularly in tier-2 cities. Local manufacturers are meeting demand with BIS-compliant solvent-free cleaning systems.

China is expected to grow at a CAGR of 4.5% through 2035, underpinned by its 14th Five-Year Plan which targets underground power line expansion in 65% of urban zones. The State Grid Corporation has mandated annual maintenance protocols that include cable prep and cleaning for 110 kV and above. In EV battery plants across Guangdong and Zhejiang, demand for residue-free tools is rising as cable integrity affects robotic automation cycles. OEMs like Chint and Delixi Electric are bundling cable cleaning kits with new switchgear installations.

The USA market is forecast to grow at a CAGR of 4.1% through 2035. This is largely driven by the USD 65 billion Broadband Equity and Access Deployment (BEAD) Program and USD 10 billion in grid resilience funding. Utilities such as PG&E and Florida Power & Light are adding solvent-free cable cleaners to FEMA-approved storm repair kits. Fiber-optic deployments across 21 states now include equipment for moisture barrier prep. Growth is also strong in data center cable bays, where static-neutral pads and dielectric cleaners reduce outage risks.

Germany’s cable cleaning equipment market is projected to grow at a CAGR of 3.8% through 2035, driven by grid digitization and EV charging corridor expansion across 6,000+ locations. German TSOs like TenneT are investing €16 billion in onshore upgrades, including HV cable maintenance integration. The market is also shaped by DIN VDE standards, which specify surface cleanliness for joints in 400 kV installations. Demand for non-toxic, biodegradable solutions is growing due to environmental restrictions on chemical solvents.

Japan’s market is projected to grow at a CAGR of 3.5% through 2035. Space constraints in Shinkansen rail tunnels and Tokyo’s underground substations are accelerating the shift to compact, low-emission cable cleaning units. Tokyo Electric Power is trialing robotic applicators for underground vaults that rely on fast-evaporating, non-flammable cleaners. With the Ministry of Land, Infrastructure and Transport targeting 50% cable rerouting underground by 2032, demand for precision cleaning tools is becoming a core requirement in utility maintenance packages.

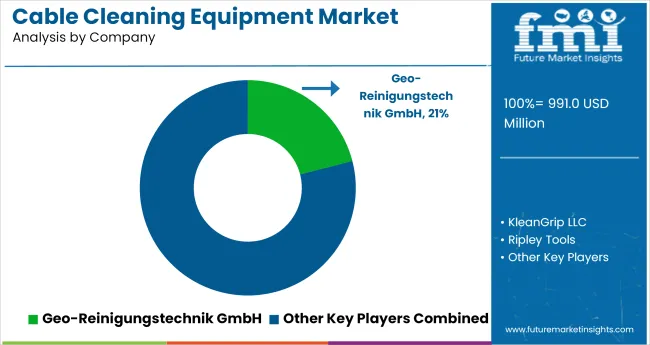

The industry is moderately fragmented, with several specialized players catering to utilities, telecom, and industrial maintenance sectors. Companies like Geo-Reinigungstechnik GmbH and Ripley Tools are recognized for their durable and ergonomically designed cleaning systems tailored for different cable diameters and environments. Geo-Reinigungstechnik GmbH focuses on automated cleaning systems suitable for high-voltage power lines, while Ripley Tools offers manual and semi-automatic solutions trusted by telecommunications professionals. KleanGrip LLC and FEINTECHNIK R. Rittmeyer GmbH emphasize innovative, handheld devices that improve user safety and efficiency during field operations. Virax supports the market with multi-functional tools that combine cable cleaning with cutting and stripping capabilities.

Recent Cable Cleaning Equipment Industry News

In August 2024, Ripley Tools introduced the MAX series of cable preparation tools for conductors up to 1000 MCM. Built for high-voltage renewable projects, this product line targets the growing utility-scale segment, offering enhanced efficiency and safety to meet rising infrastructure demands across wind, solar, and grid modernization initiatives.

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 620.1 million |

| Projected Market Size (2035) | USD 991.0 million |

| CAGR (2025 to 2035) | 4.8% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD million for market value |

| Product Types Analyzed (Segment 1) | Mechanical Systems, Pressure-Based Systems, Robotic Cleaning Systems |

| Applications Analyzed (Segment 2) | Electrical Cable Cleaning, Fiber Optic Cable Cleaning, Telecom Cable Cleaning, Control Cable Cleaning |

| End Uses Analyzed (Segment 3) | Utilities, Automotive & Transportation, Aerospace, Construction & Infrastructure, Industrial Plants, Machine MRO Centres, Others |

| Categories Analyzed (Segment 4) | Stationary, Mobile, Handheld Systems |

| Regions Covered | North America, Latin America, Eastern Europe, Western Europe, South Asia & Pacific, East Asia, Middle East & Africa |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Japan, China, India, South Korea, Brazil |

| Key Players | Geo- Reinigungstechnik GmbH, KleanGrip LLC, Ripley Tools, FEINTECHNIK R. Rittmeyer GmbH, Virax |

| Additional Attributes | Dollar sales by product and application, growing demand for maintenance automation, rising complexity in fiber and control cabling, and sustained adoption in the utility and aerospace sectors. |

The market is segmented by product type into mechanical systems, pressure-based systems, and robotic cleaning systems.

Based on application, the industry includes electrical cable cleaning, fiber optic cable cleaning, telecom cable cleaning, and control cable cleaning.

Key end-use sectors comprise electrical cable, utilities, automotive & transportation, aerospace, construction and infrastructure, industrial plants, machine MRO centres, and others.

By category, the market includes stationary, mobile, and handheld systems.

Geographically, the market spans North America, Latin America, Eastern Europe, Western Europe, South Asia & Pacific, East Asia, and the Middle East & Africa.

The market is valued at USD 620.1 million in 2025.

The market is forecast to reach USD 991 million by 2035.

The market is projected to grow at a CAGR of 4.8% from 2025 to 2035.

Mechanical systems lead with a 38% share in 2025.

India is projected to grow the fastest with a 5.1% CAGR through 2035.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cable Cleaning Solutions Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Wafer Cleaning Equipment Market Growth - Trends & Forecast 2025 to 2035

Drain Cleaning Equipment Market Growth - Trends & Forecast 2025 to 2035

USA Drain Cleaning Equipment Market Analysis – Size, Share & Trends 2025-2035

Japan Drain Cleaning Equipment Market Report – Trends, Demand & Outlook 2025-2035

China Drain Cleaning Equipment Market Analysis – Size, Trends & Innovations 2025-2035

India Drain Cleaning Equipment Market Report – Demand, Innovations & Forecast 2025-2035

Germany Drain Cleaning Equipment Market Analysis – Size, Share & Outlook 2025-2035

Grain And Seed Cleaning Equipment Market

Cleaning Robot Market Size and Share Forecast Outlook 2025 to 2035

Cable Line Fault Indicator Market Size and Share Forecast Outlook 2025 to 2035

Cable Tray Market Size and Share Forecast Outlook 2025 to 2035

Cable Granulator Market Size and Share Forecast Outlook 2025 to 2035

Cable Distribution Cabinets Market Size and Share Forecast Outlook 2025 to 2035

Equipment Management Software Market Size and Share Forecast Outlook 2025 to 2035

Equipment cases market Size and Share Forecast Outlook 2025 to 2035

Cable Accessories Market Growth - Trends & Forecast 2025 to 2035

Cable Material Market Growth - Trends & Forecast 2025 to 2035

Cleaning In Place Market Growth - Trends & Forecast 2025 to 2035

Cable Fault Locator Market Size, Share, and Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA