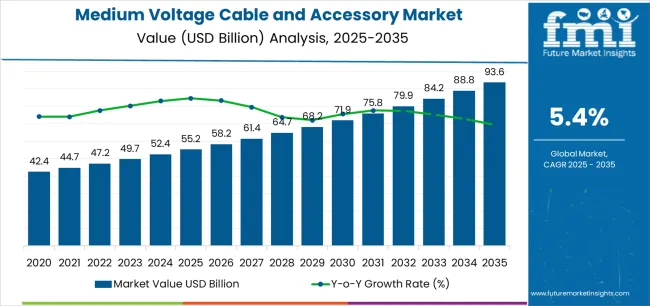

The Medium Voltage Cable and Accessory Market is estimated to be valued at USD 55.2 billion in 2025 and is projected to reach USD 93.6 billion by 2035, registering a compound annual growth rate (CAGR) of 5.4% over the forecast period.

The Medium Voltage Cable and Accessory market is experiencing steady growth driven by the increasing demand for reliable and efficient power transmission and distribution infrastructure. The future outlook for this market is shaped by ongoing investments in energy networks, urbanization, and industrial expansion, which necessitate robust medium voltage systems. Rising adoption of renewable energy sources and smart grid technologies has accelerated the need for advanced cabling solutions that can handle higher loads and improve grid stability.

The market is further supported by stringent safety regulations and the push for minimizing power losses, which has enhanced the adoption of modern medium voltage cables and accessories. Continuous advancements in materials and insulation technologies are providing greater durability, thermal performance, and operational reliability.

Additionally, the shift toward underground installations in urban and industrial areas is promoting the use of medium voltage cables with superior insulation and protective accessories As global energy demands rise and infrastructure projects expand, the medium voltage cable and accessory market is anticipated to sustain its growth trajectory, offering long-term opportunities across industrial, commercial, and utility sectors.

| Metric | Value |

|---|---|

| Medium Voltage Cable and Accessory Market Estimated Value in (2025 E) | USD 55.2 billion |

| Medium Voltage Cable and Accessory Market Forecast Value in (2035 F) | USD 93.6 billion |

| Forecast CAGR (2025 to 2035) | 5.4% |

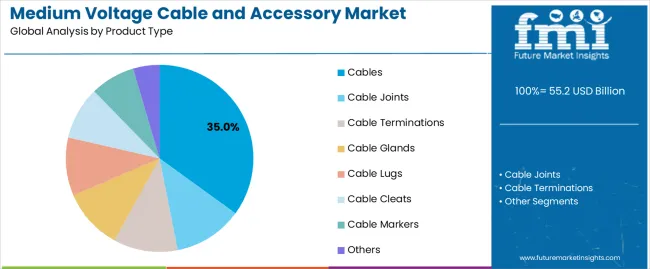

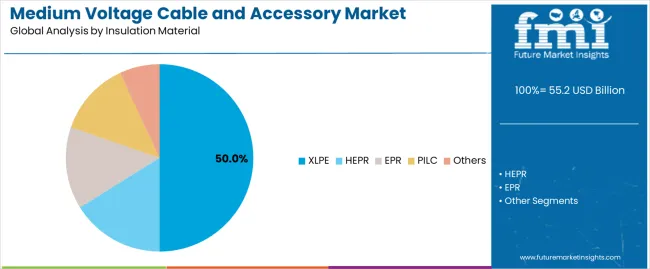

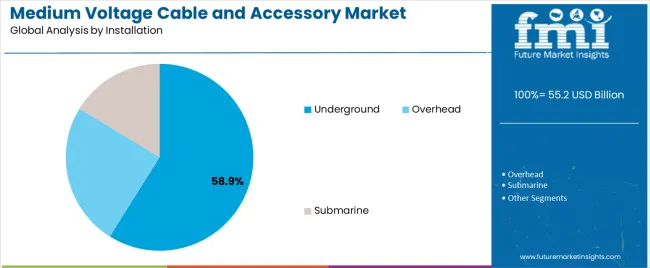

The market is segmented by Product Type, Insulation Material, Installation, End-Use Industry, and Industrial Segment and region. By Product Type, the market is divided into Cables, Cable Joints, Cable Terminations, Cable Glands, Cable Lugs, Cable Cleats, Cable Markers, and Others. In terms of Insulation Material, the market is classified into XLPE, HEPR, EPR, PILC, and Others. Based on Installation, the market is segmented into Underground, Overhead, and Submarine. By End-Use Industry, the market is divided into Residential, Commercial, and Industrial. By Industrial Segment, the market is segmented into Energy And Power, Building And Construction, Oil And Gas, Data Centers, Marine, Chemical And Petrochemical, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The cables product type segment is projected to hold 35.00% of the Medium Voltage Cable and Accessory market revenue share in 2025, establishing it as the leading product type. This segment has been driven by the critical role cables play in power transmission and distribution, providing reliable and continuous energy flow across industrial, commercial, and residential applications.

The growth is further supported by increasing urbanization, which requires extensive cabling networks to meet rising electricity demands. Advancements in manufacturing technologies have enhanced cable performance, including improved current carrying capacity, mechanical strength, and thermal resistance.

The need for long-lasting and low-maintenance cabling solutions has reinforced the adoption of this segment Moreover, integration with modern energy systems, such as smart grids and renewable energy installations, has boosted demand for high-quality medium voltage cables, solidifying the segment’s leading position in the market.

The XLPE insulation material segment is expected to account for 50.00% of the Medium Voltage Cable and Accessory market revenue share in 2025, highlighting its dominance in insulation technology. The growth of this segment is driven by XLPE’s excellent electrical properties, thermal resistance, and long-term reliability under diverse environmental conditions.

Its ability to withstand high voltage stress and provide low dielectric losses makes it highly suitable for medium voltage applications. The segment has benefited from advancements in manufacturing processes, which have improved cable flexibility and reduced the overall operational maintenance.

Rising demand for underground cabling and stringent safety standards have further reinforced the preference for XLPE-insulated cables The widespread adoption of XLPE insulation is supported by its compatibility with modern power systems and the growing need for efficient, durable, and cost-effective cabling solutions in urban and industrial installations.

The underground installation segment is anticipated to account for 58.90% of the Medium Voltage Cable and Accessory market revenue in 2025, establishing it as the leading installation method. The growth is primarily driven by the rising demand for urban infrastructure development, which requires underground deployment to optimize space and ensure public safety.

Underground installations provide enhanced protection against environmental factors, mechanical damage, and vandalism, improving the reliability and longevity of medium voltage networks. Additionally, regulatory mandates and city planning initiatives increasingly favor underground cabling to reduce visual clutter and minimize hazards associated with overhead lines.

The segment has also benefited from advancements in trenching, conduit technologies, and cable jointing methods, which simplify installation and reduce operational costs Growing awareness about the resilience and low maintenance requirements of underground cabling solutions continues to drive adoption, securing its dominant position in the market.

The table below showcases the projected CAGRs for the global medium voltage cable and accessory industry over semi-annual periods ranging between 2025 and 2025. The examination provides companies with a better understanding of the growth rate over the year by divulging crucial shifts in performance and growth patterns. The first half (H1) of 2025 spans from January to June. The second half or H2 includes July to December.

Figures showcased in the table exhibit the growth rate for each half between 2025 and 2025. The market was projected to grow at a CAGR of 10.8% in the first half (H1) of 2025. The second half of the same year shows a surge in the growth rate at a CAGR of 11.7%.

| Particular | Value CAGR |

|---|---|

| H1 | 10.8% (2025 to 2035) |

| H2 | 11.7% (2025 to 2035) |

| H1 | 11.1% (2025 to 2035) |

| H2 | 12% (2025 to 2035) |

Preceding in the following period, from H1 2025 to H2 2035, the CAGR is estimated to slightly decrease to 11.1% in the first half (H1) and then substantially surge to 12% in the second half (H2).

Digital Transformation in the Industry Assists in Increasing Productivity

The integration of the Internet of Things (IoT) is a prime trend in the industry. Prominent companies, including Siemens AG and Schneider Electric, are spearheading digital transformation initiatives in the market.

Siemens AG is progressively integrating Internet of Things (IoT) technologies in its cable accessories to enable remote and predictive maintenance. The company’s cloud-based tools analyze real-time data from medium-voltage networks to improve performance and reliability.

Schneider Electric, on the other hand, develops smart solutions to increase operational efficiency and decrease long-term expenses for medium-voltage facilities. Renowned companies deploy predictive analytics and artificial intelligence (AI) systems to anticipate equipment failures and optimize maintenance schedules.

Digital innovations as such hasten the adoption of smart grid technology and increased grid resilience. This further helps in assisting utilities and industrial sectors to achieve high productivity and complete their sustainability targets.

Rising Trend toward Underground Cabling is Accelerating Demand Worldwide

Medium voltage cables and accessories are set to be used to deliver electricity to consumers from the distribution networks. This distribution can either be done through overhead electric cable lines or underground electric cable lines. Rising demand for electricity has resulted in the rapid growth rate of electric supply, thereby increasing the requirement for medium-voltage electric cables.

Medium voltage electric cables are primarily used for the supply of electricity to residential and commercial buildings. The utilization of medium voltage electric cables is expanding as a core technology in distribution networks to provide support to smart grid solutions. Cables up to 36 kV are generally used to connect low-voltage networks to the principal distribution network.

Medium voltage electric cables are increasingly being used owing to their easy maintenance as they assist in reducing overall operational costs. The single-core and multi-core medium voltage electric cables are increasingly used to connect transformers or substations. These cables are available in 1,000-meter lengths and 500-meter lengths, suiting various needs.

There is a rising trend to switch overhead distribution lines to underground cabling for electricity distribution. This shift is likely to assist in achieving high reliability and safety, reduced environmental impact, and improved installation cost.

Regulatory Compliance Can Create a Challenge for Expansion

Regulatory standards and compliance are one of the key barriers to growth in the medium voltage cable and accessory market. Government authorities across the globe are enforcing severe regulations to guarantee the safety, reliability, and environmental sustainability of the electric infrastructure. These standards establish specifications and performance requirements for medium voltage cables and accessories, including couplings, terminations, and other accessories, further creating challenges for suppliers and manufacturers.

For instance, the International Electrotechnical Commission (IEC) along with the national regulatory agencies set criteria for insulation materials, fire resistance, voltage ratings, and environmental effects. Compliance with these regulations necessitates extensive testing, continuous quality assurance procedures, and certifications that increase the cost and complexity of product development and manufacturing.

The global medium voltage cable and accessory industry was valued at USD 45,227 million in 2020. It grew at a CAGR of 2.4% during the historical period spanning from 2020 to 2025. It attained a value of USD 49,786 million in 2025.

The COVID-19 pandemic caused a slowdown in production and supply chain activities owing to the continuous lockdowns and travel restrictions across the globe. The pandemic had a significant impact on the global economy, including medium voltage cable and accessories. The market experienced a notable drop in demand in 2024.

The effect of the pandemic was especially severe on the supply side. Supply capabilities, however, surged steadily from 2025 with the ease of lockdown and travel restrictions. Manufacturers are planning to ramp up their production processes in the coming decade.

The industry is projected to reach a value of USD 52,266.9 million by 2025 and is further likely to rise at a CAGR of 5.7% through 2035. The overall market is estimated to reach a size of USD 90,953.8 million by 2035.

The high growth rate during the assessment period is prominently attributed to the electrification initiatives across the globe. Government authorities in several countries are promoting electrification in transportation and various industrial sectors, thereby stimulating the demand for medium-voltage cables and accessories.

Nations worldwide are rapidly adopting high electricity consumption and charging infrastructure requirements. They are accommodating this raised demand through the deployment of medium voltage cables and accessories in their grid systems.

The industry is projected to witness an increased demand for modular and flexible solutions. This is further anticipated to lead to the rising demand for these cables and accessories as they enable easy installation, maintenance, and scalability.

Tier 1 primarily consists of companies with annual revenues exceeding USD 500 million. These companies capture a significant share ranging from 30% to 35% in the global market. The industry leaders are characterized by high production capacity and a wide product portfolio.

The organizations are distinguished by their expertise in manufacturing and a broad geographical reach that is underpinned by a robust consumer base. These enterprises provide a wide range of products and services as well as utilize modern technology to meet regulatory standards. Prominent companies in Tier 1 include PRYSMIAN S.p.A., Sumitomo Electric Industries, Ltd., Nexans SA, EL Sewedy Electric Company, LS Cable & System Ltd., Marmon Industrial Energy & Infrastructure, and NKT A/S.

Tier 2 is primarily made up of mid-sized companies operating at the local level. These firms serve niche medium voltage vendors with low revenue. These companies are notably oriented toward fulfilling local demands. They may not have access to cutting-edge technologies like companies in Tier 1 but use good technology and ensure regulatory compliance.

The section provides businesses with an overview of the industry. It consists of a detailed analysis of the emerging trends and opportunities on a country-by-country basis. This country-specific examination of the dynamics is projected to help companies understand the complex nature of the market.

The examination consists of key factors, potential challenges, and forecasts influencing the demand, production, and consumption of the product within each country. It aims to assist organizations make informed decisions and develop effective strategies customized to individual countries.

China is projected to emerge as a dominating country during the forecast period with an anticipated CAGR of 6.6% through 2035. Russia, India, and Japan are estimated to follow closely behind to become the key countries with expected CAGRs of 6.4%, 6%, and 5.8%, respectively.

| Countries | CAGR 2025 to 2035 |

|---|---|

| China | 6.6% |

| Russia | 6.4% |

| India | 6% |

| Japan | 5.8% |

| United States | 5.1% |

India is experiencing rapid urbanization, with its towns and cities anticipated to house 600 million people, or 40% of the population, by 2036. These figures are up from 31% in 2011. Urban areas are projected to contribute around 70% of the GDP. This urban transformation requires effective management for India’s ambition to become a developed country by 2047.

By 2036, India will likely be required to invest USD 840 billion in infrastructure, averaging USD 55 billion or 1.2% of GDP per annum. Between 2011 and 2020, however, the country’s total capital expenditure on urban infrastructure averaged only 0.6% of its GDP, highlighting the need for increased investment.

According to the World Bank, the country saw an 8.7% GDP growth in 2025, signifying a strong recovery after the COVID-19 pandemic. Rapid expansion of infrastructure in India is anticipated to push the need for medium-voltage cables and accessories. Increasing residential and commercial construction in the country is also likely to boost the requirement for sub-meters to manage energy consumption and billing in densely populated areas.

As of early 2025, China’s GDP stands at about USD 17.79 trillion, with a projected growth rate of 5% for the year. It follows a stronger-than-expected growth rate of 5.3% in the first quarter. The expansion of industries and commercial buildings requires detailed energy monitoring to manage consumption and enhance efficiency, accelerating the need for medium-voltage cables and accessories.

Rapid development of smart cities in China is a key factor driving demand for medium-voltage cables. Constant development and implementation of smart city technologies in metropolitan areas pose the need for effective energy management.

Estimates for smart city solutions in China vary, with some local enterprises estimating a USD 1.1 trillion market in 2020 and a 33% compound annual growth rate between 2020 and 2025. Medium voltage cables and accessories are an essential component of smart city infrastructure, as these enable efficient energy distribution and consumption monitoring while encouraging sustainable and intelligent urban life.

The United States medium voltage cable and accessory market size is projected to reach USD 5,034.0 million by 2035. The demand for electric submeters in the country is set to rise at a CAGR of 6% through 2035.

The Grid Resilience and Innovation Partnerships (GRIP) Program, run by the Department of Energy (DOE) under the Bipartisan Infrastructure Law in the United States has significantly impacted the medium voltage cable and accessory technology. As of November 14, 2025, the Biden-Harris Administration has pledged up to USD 55.2 billion in funding to broaden grid infrastructure and encourage private sector engagement for fiscal years 2025 and 2025.

On October 18, 2025, the DOE pledged USD 3.46 billion to 58 projects across 44 states to increase grid resilience and reliability. These investments aim to increase the medium voltage cable and accessories business by promoting contemporary energy management and smart grid technology, ensuring reliable and efficient electricity access in American communities.

The section provides businesses with insightful data and analysis of the two leading segments. Segmentation of these categories assists organizations in understanding the dynamics and investing in the beneficial zones.

Examination of the growth helps companies gain a thorough understanding of the trends, opportunities, and challenges. This analysis is likely to help organizations in navigating the complex business environment and make informed decisions.

Cables are anticipated to dominate the product type segment with a value CAGR of 5% from 2025 to 2035. In terms of installation, underground installation is set to lead with a value share of 58.9% in 2025.

| Segment | Cables (Product Type) |

|---|---|

| Value CAGR (2025 to 2035) | 5% |

Based on product type, the cables segment is anticipated to dominate by showcasing a CAGR of 5% through 2035. Cables have a lengthy track record of reliable performance, making them an excellent choice for high-voltage applications. Their robust design provides considerable mechanical strength and resistance to external forces, ensuring lifespan and safety.

Medium voltage cables are usually less expensive compared to cross-linked polyethylene (XLPE) cables, particularly over short transmission distances. These cables operate well in high-temperature environments, making them suitable for demanding industrial applications. Medium voltage cables are employed in a range of applications, including industrial power distribution, wind farms, and substations, resulting in their widespread adoption.

| Segment | Underground (Installation) |

|---|---|

| Value Share (2025) | 58.9% |

The underground installation segment is estimated to account for the leading share of 58.9% in the medium voltage cable and accessory market in 2025. Underground cables are mainly utilized to deliver power to populous regions.

Renovation projects in developed countries are adopting the trend of switching to underground cabling for electricity distribution, thereby driving the demand for underground installations. They provide several advantages, including minimal transmission losses, the ability to absorb emergency power loads, cheap maintenance costs, and reduced vulnerability to changing weather conditions.

Key players in the industry include Marmon Industrial Energy & Infrastructure, Prysmian Group, Nexans, NKT A/S, ABB, Brugg Cables, Riyadh Cables Group Company, and ZTT. The global market is highly competitive with the presence of several leading players. These leaders are striving to engage in partnerships and collaborations with local cable and accessories providers to enhance their presence in emerging countries. The market is an important part of the electrical infrastructure industry as these accessories are essential for electricity distribution systems, industrial uses, and commercial buildings.

Prominent players like ABB and Siemens AG are promoting technological innovation in the industry. ABB is working on creating new insulating materials, such as cross-linked polyethylene (XLPE) with better electrical properties and thermal stability. These materials also incorporate smart grid technology that will likely assist in enhancing cable monitoring and management capabilities.

Siemens AG uses IoT to deliver predictive maintenance solutions for medium-voltage networks. The firm’s digital platforms support real-time data analytics that improve operational efficiency and reduce downtime through proactive maintenance scheduling. These innovations not only improve reliability but also help reduce energy consumption and promote sustainability.

Industry Updates

In terms of product type, the industry is segregated into cables (1 kV to 5Kv, 6 kV to 15 kV, and 16 kV to 35 kV), cable joints, cable terminations, cable glands, cable lugs, cable cleats, cable markers, and others.

By insulation material, the industry is divided into XLPE, HEPR, EPR, PILC, and others.

By installation, the industry is segmented into underground, overhead, and submarine.

By end-use industry, the industry is segmented into residential, commercial, and industrial. The industrial segment is further classified into energy and power, building and construction, oil and gas, data centers, marine, chemical and petrochemical, and others.

North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, and the Middle East and Africa are the main regions covered in the report.

The global medium voltage cable and accessory market is estimated to be valued at USD 55.2 billion in 2025.

The market size for the medium voltage cable and accessory market is projected to reach USD 93.6 billion by 2035.

The medium voltage cable and accessory market is expected to grow at a 5.4% CAGR between 2025 and 2035.

The key product types in medium voltage cable and accessory market are cables, _1 kv to 5kv, _6 kv to 15 kv, _16 kv to 35 kv, cable joints, cable terminations, cable glands, cable lugs, cable cleats, cable markers and others.

In terms of insulation material, xlpe segment to command 50.0% share in the medium voltage cable and accessory market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Medium Duty Truck Market Size and Share Forecast Outlook 2025 to 2035

Medium-duty Engine Market Size and Share Forecast Outlook 2025 to 2035

Medium Earth Orbit (MEO) Satellite IoT Market Size and Share Forecast Outlook 2025 to 2035

Medium Format Film Cameras Market Size and Share Forecast Outlook 2025 to 2035

Medium Density Fiberboard (MDF) Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Medium-Chain Triglycerides Market Growth -Functional Fats & Industry Demand 2025 to 2035

Medium Carbon Steel Market

Medium Voltage Transformer Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage AC Power Distribution Units (PDU) Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Utility Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Commercial Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Residential Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Capacitor Bank Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Digital Substation Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Circuit Breaker Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Distribution Substation Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Electric Capacitor Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Transmission Substation Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Drives Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA