In the period from 2025 to 2035, it is expected to become figuratively one of today's most enduring practical tricks for living well. Medium-Chain Triglycerides Market (MCT) will therefore see much growth and expansion, benefitting the real economy around the world.

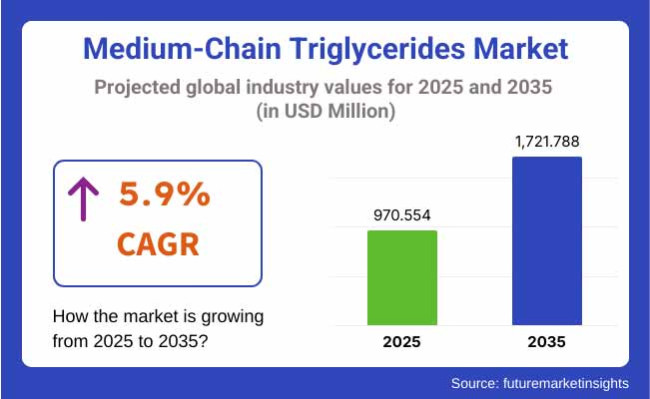

Medium-Chain Triglycerides Market, which are made from coconut oil, red palm kernel oil a wide variety of plant origins including wool yeast or soybeans Grapes uniform congregate on the face of the lighthouse fog horn blowing across the water sounds pleasant. The market is projected to surpass USD 1,721.788 Million by 2035, growing at a CAGR of 5.9% during the forecast period.

North America is the largest market for medium-chain triglycerides (MCTs). The rising popularity of ketogenic and low-carbohydrate diet plans in the sector has pushed this trend even further last year. The USA is the top region, with increased demands on MCT is being used as a dietary supplement or for tea drinks. The further expansion of e-commerce platforms able to offer MCT products, along with the steady influx of health-conscious consumers into this category, is helping to push market growth upwards.

Europe's MCT market is on the rise, thanks to more consumer awareness of health and wellness trends. Germany, France and the UK in particular are being encouraged to eat MCT oil, MCT powder or other forms of high-energy fats as part of such foods as functional foods like breakfast drinks, sports nutrition and personal care products.

The development of a vegan and plant-based movement in addition has also had an impact on demand for MCTs derived from coconut. Regulatory incentives for "clean" or pure foods further boost market expansion, with emphasis being placed on ecological and ethical sourcing.

Asia-Pacific will be the fastest-growing region for the MCT market in the future, driven by a rapidly increasing health-aware population and rising disposable incomes. Leading countries in the number of MCT consumers have come to include China, India, Japan and South Korea, with a growing demand for them in health potions such as dietary supplements and weight control products.

Challenge

High Production Costs and Supply Chain Constraints

Market The biggest threat facing the MCT market is the high production costs, which come from tracking raw materials such as coconut oil and palm kernel oil. Policy makers will also require that markets remain stable when forces of nature strike. The ongoing supply chain disruptions (rising and falling raw material availability, transportation delays) upset the applecart, not only in terms of pricing but also for market stability.

Regulatory and Health Concerns

Because of heavy regulatory measures and labelling requirements, there are difficulties for production personnel. As MCTs are widely used in foods, supplements and pharmaceutical making it essential to abide by regional or international regulatory standards, because once you get up to that level the market will expand accordingly.

Opportunity

Rising Demand for Functional and Healthy Ingredients

Consumer preferences are moving towards functional foods and healthy dietary ingredients, and the market demand for MCTs is taking off. The soaring popularity of ketogenic diets, sports nutrition and weight loss programs explains what consumers want nowadays even in fast growing markets like China is MCT.

Expansion of E-Commerce and Nutraceuticals Market

The increasing penetration of Ecommerce platforms and the rapid development of the nutraceutical industry has given MCT makers a worldwide audience. Brands sold at retail help businesses increase their market share and now direct-to consumer is coming on stream.

Between 2020 and 2024, market of MCT developed rapidly due to consumers more and better understand the health benefits. Cell metabolism & cognitive function will become hot issues. On the other hand, clean-label and plant-based nutrition trends serve to further ratchet up both consumer demand for high quality MCTs as well as their actual realisation in the marketplace.

From 2025 to 2035, the market will show more innovation and change. Sustainable sourcing methods are introduced as well as formula improvements for products. The industry moves towards organic and non-GMO-certified MCTs, while also talking about how new delivery formats such as encapsulated powders and ready-to-drink methodologies bring greater convenience-and therefore more users

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035.

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with food and supplement regulations |

| Market Demand | Growth in ketogenic and sports nutrition |

| Industry Adoption | Dominated by health and fitness enthusiasts |

| Supply Chain and Sourcing | Dependence on traditional coconut and palm sources |

| Market Competition | Presence of niche health brands |

| Market Growth Drivers | Rising consumer awareness of MCT benefits |

| Sustainability and Energy Efficiency | Limited focus on environmental impact |

| Integration of Digital Innovations | social media-driven product promotions |

| Advancements in Product Design | Traditional oil and capsule formats |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter global safety and sustainability standards |

| Market Demand | Expansion into mainstream health and wellness markets |

| Industry Adoption | Broad adoption across general consumers and medical nutrition |

| Supply Chain and Sourcing | Diversification into sustainable and regenerative agriculture |

| Market Competition | Entry of major food and pharmaceutical companies |

| Market Growth Drivers | Increased demand for functional and cognitive-enhancing ingredients |

| Sustainability and Energy Efficiency | Adoption of carbon-neutral sourcing and eco-friendly packaging |

| Integration of Digital Innovations | AI-based consumer trend analysis and personalized nutrition |

| Advancements in Product Design | New delivery systems, including powders and ready-to-consume drinks |

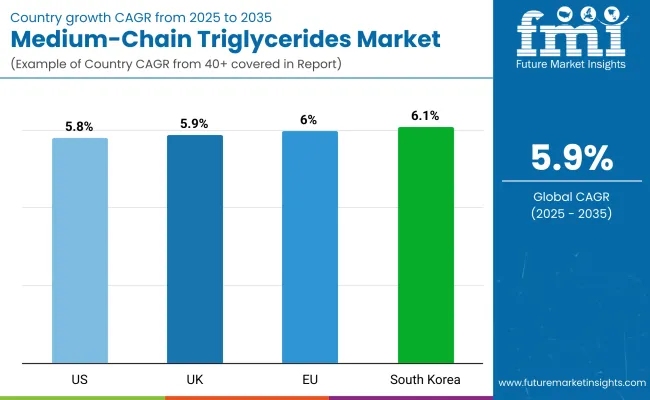

Growing attention to MCT products from American consumers has resulted in slow but firm growth for the MCT market in the United States. Keto and low-carb diets quickly followed suit, Along with functional foods and dietary supplements driving market expansion Major supplement Brands and e-commerce platforms further add to market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 5.8% |

In the United Kingdom, the MCT market has been helped by mounting concern for good health and weight control. People there are putting MCT-based products in their daily diets as a metabolism aid and way of maintaining good brain function. Health-conscious consumers and an expanding retail environment featuring specialty health food stores fuel demand.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 5.9% |

In the European Union, consumers are increasingly viewing dietary health and nutritional supplements as essential to support good health. With our rising standard of living as well, the market for MCT products (Medium-Chain Triglycerides) has been booming in such countries as Germany, France and Italy -particularly in sports nutrition and weight-loss applications. Strong support at government level for functional foods and dietary supplements keeps on pushing market expansion.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 6.0% |

South Korea's MCT market is expanding fast because of people's strong interest in health and wellness. The rapidly mounting demand for ketogenic diets and functional foods has extended the market. High popularity and product innovation contribute to a very active user community interested in performance nutrition together with sales growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.1% |

Liquid Medium-Chain Triglycerides (MCTs) Lead the Market Due to High Solubility and Versatile Applications

| Form | Market Share (2025) |

|---|---|

| Medium-Chain Triglycerides in Liquid Form | 58.2% |

The global market for medium-chain triglycerides (MCTs) is growing swiftly. Due mainly to the rapid metabolism and energy-boosting properties they provide, medium-chain triglycerides from coconut oil and palm oil are situated to soar.

In addition, these effects can help people with high blood sugar levels or poor digestion-for example athletes suffering from bonking due to taking glucose too late. The market for MCTs is divided according to form, source, application, and product type. Among them, liquid MCTs account for the bulk of share in today’s market; this is expected to reach 58.2% by 2025. Liquid MCTs are more accessible simply because they possess a high water solubility.

They can be easily mixed into functional beverages sports nutrition products dietary supplements and many other product forms. Consequently, they have become a must-have choice of manufacturers for producing their products.

The way that they can mix with oils, emulsions and other cosmetic forms extends their usage beyond useful references in the field of food formulation alone. As keto diets rise in popularity, consumers are demanding clean-label nutrition, and want their energy-enhancing supplements to contain MCT oils.

They hope to manage weight, improve their brain health, make progress energetically-and it is natural that these customers will go from taking MCTs-based supplements to consuming MCTs-based food products on an increasing scale Millions of years ago some people started to realize that horses treated with horses.

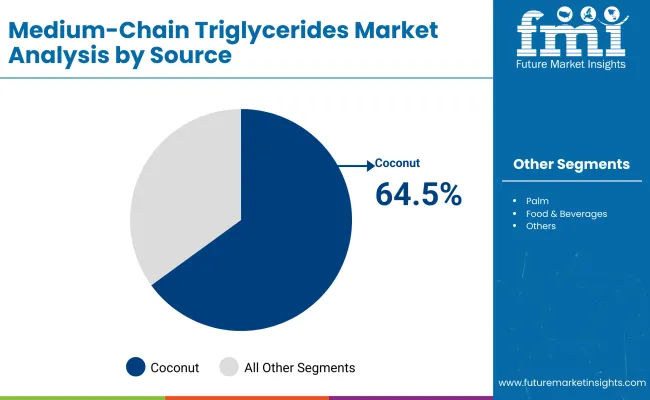

Coconut-Derived MCTs Dominate Due to Purity and Nutritional Benefits

| Source | Market Share (2025) |

|---|---|

| Medium-Chain Triglycerides from Coconut | 64.5% |

MCTs are mainly from coconuts and palm oil, with more people projected to choose coconut-based MCTs as their first preference (projecting a 64.5% market share in 2025). Coconut-based MCTs are a popular commercial choice for several reasons.

Coconut-derived MCTs are most pure, possess a superior fatty acid than palm oil-based alternatives and have less of an environmental impact too. As consumers become increasingly health-conscious and environmentally aware, trends are shifting decisively towards non-GMO, organic and sustainably sourced coconut-based MCT oils. With the advent of vegan, ketogenic, paleo eating styles Goodbye, the demand for coconut-derived MCTs has risen greatly, as they are completely plant-based, gluten-free and easily digestible.

These mct are broadly used in the field of functional foods, coffee creamers, slimming supplements and brain health products. They focus on cold compression of coconuts and the refining process without chemical is originally made to enhance the quality of coconut-based MCT oils.

It is not only that but excluding palm oil as an ingredient has also grown in importance due to worries about deforestation and sustainability in the palm oil industry. The popularity of coconut-derived MCTs in personal care and cosmetics is growing, since they have moist, light texture and quick absorption properties. This makes them ideal for skincare formulations, massage oil and hair treatment. With an increasing focus on natural and organic beauty products, the use of coconut-based MCTs in cosmetics and therapeutic applications is expected to grow steadily.

Consumers' interest in health and wellness products is growing and this has helped the mid-chain triglycerides market to grow. Derived mainly from coconut or palm oil MCTs are widely used in dietary supplements, sports nutrition and ketogenic diets. Major companies are focused on expanding product offerings, optimizing production efficiency and using R&D to establish innovative mid-chain triglyceride formulations with added functional health benefits.

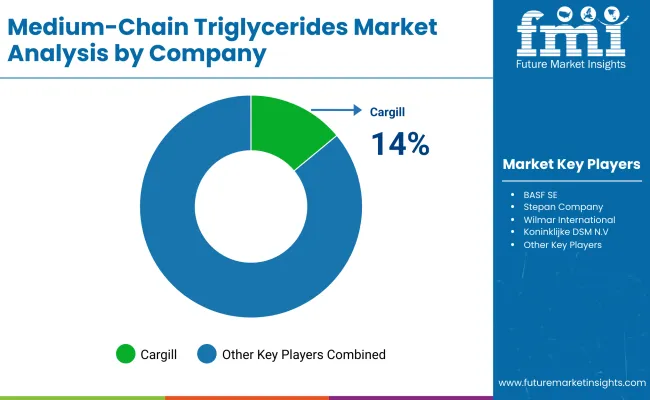

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Cargill | 14-18% |

| BASF SE | 12-16% |

| Stepan Company | 10-14% |

| Wilmar International | 8-12% |

| Koninklijke DSM N.V. | 6-10% |

| Other Companies (combined) | 35-45% |

| Company Name | Key Offerings/Activities |

|---|---|

| Cargill | In 2024, they launched a high-purity MCT oil targeted at sports nutrition and ketogenic diet consumers. In January, 2025, it expanded production facilities to meet the increasing demand for functional MCT products. |

| BASF SE | In 2024, it launched an innovative MCT-based lipid formulation for medical nutrition. In February 2025, it joined hands with supplement brands to develop next-generation, high-quality MCT powders targeted at enhanced energy metabolism. |

| Stepan Company | In 2024, the development of a new kind of sustainable-source MCT oils, derived from coconut. In March 2025, it announced increased investment in advanced processing technology in the interests of purer, more efficient MCT production. |

| Wilmar International | In 2024, palm-based MCT oil production was extended to ensure greater sustainability and cost-effectiveness throughout the whole supply chain. In January 2025, it introduced a series of MCT flavoured oils for the food and beverage industries. |

| Koninklijke DSM N.V. | In 2024, it launched an MCT-infused nutritional supplement focused on improving cognitive function. In February 2025, the project in the use of a proprietary mixture of MCTs from growing plants continued as a direction for comprehensive wellness products. |

Key Company Insights

Cargill (14-18%)

A global leader in food and nutrition, Cargill focuses on high-purity MCTs for sports nutrition and functional food applications.

BASF SE (12-16%)

BASF SE leverages its expertise in lipid science to develop innovative MCT formulations, particularly in medical and dietary applications.

Stepan Company (10-14%)

A pioneer in MCT production, Stepan Company emphasizes sustainability and advanced processing techniques to deliver high-quality MCT oils.

Wilmar International (8-12%)

Wilmar International specializes in palm-derived MCTs and focuses on scalable, sustainable production methods for global distribution.

Koninklijke DSM N.V. (6-10%)

This Dutch multinational integrates MCTs into health-focused nutritional products, targeting cognitive and metabolic benefits.

Other Key Players (35-45% Combined)

The overall market size for Medium-Chain Triglycerides market was USD 970.554 Million in 2025.

The Medium-Chain Triglycerides market is expected to reach USD 1,721.788 Million in 2035.

The demand for medium-chain triglycerides will be driven by rising health consciousness, increasing use in dietary supplements, growing applications in pharmaceuticals and personal care, expanding demand for natural energy sources, and the rising popularity of ketogenic and functional food products.

The top 5 countries which drives the development of Medium-Chain Triglycerides market are USA, European Union, Japan, South Korea and UK.

Liquid Medium-Chain Triglycerides (MCTs) demand supplier to command significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (MT) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 4: Global Market Volume (MT) Forecast by Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 6: Global Market Volume (MT) Forecast by Source, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 8: Global Market Volume (MT) Forecast by Application, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 12: North America Market Volume (MT) Forecast by Type, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 14: North America Market Volume (MT) Forecast by Source, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 16: North America Market Volume (MT) Forecast by Application, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 20: Latin America Market Volume (MT) Forecast by Type, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 22: Latin America Market Volume (MT) Forecast by Source, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 24: Latin America Market Volume (MT) Forecast by Application, 2018 to 2033

Table 25: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Europe Market Volume (MT) Forecast by Country, 2018 to 2033

Table 27: Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 28: Europe Market Volume (MT) Forecast by Type, 2018 to 2033

Table 29: Europe Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 30: Europe Market Volume (MT) Forecast by Source, 2018 to 2033

Table 31: Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 32: Europe Market Volume (MT) Forecast by Application, 2018 to 2033

Table 33: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Asia Pacific Market Volume (MT) Forecast by Country, 2018 to 2033

Table 35: Asia Pacific Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 36: Asia Pacific Market Volume (MT) Forecast by Type, 2018 to 2033

Table 37: Asia Pacific Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 38: Asia Pacific Market Volume (MT) Forecast by Source, 2018 to 2033

Table 39: Asia Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 40: Asia Pacific Market Volume (MT) Forecast by Application, 2018 to 2033

Table 41: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: MEA Market Volume (MT) Forecast by Country, 2018 to 2033

Table 43: MEA Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 44: MEA Market Volume (MT) Forecast by Type, 2018 to 2033

Table 45: MEA Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 46: MEA Market Volume (MT) Forecast by Source, 2018 to 2033

Table 47: MEA Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 48: MEA Market Volume (MT) Forecast by Application, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Source, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (MT) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 10: Global Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 14: Global Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 18: Global Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 21: Global Market Attractiveness by Type, 2023 to 2033

Figure 22: Global Market Attractiveness by Source, 2023 to 2033

Figure 23: Global Market Attractiveness by Application, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Type, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Source, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 34: North America Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 38: North America Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 42: North America Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 45: North America Market Attractiveness by Type, 2023 to 2033

Figure 46: North America Market Attractiveness by Source, 2023 to 2033

Figure 47: North America Market Attractiveness by Application, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Type, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Source, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 58: Latin America Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 62: Latin America Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 66: Latin America Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Type, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Source, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 74: Europe Market Value (US$ Million) by Source, 2023 to 2033

Figure 75: Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 76: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Europe Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 79: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 82: Europe Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 83: Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 84: Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 85: Europe Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 86: Europe Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 87: Europe Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 88: Europe Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 89: Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 90: Europe Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 91: Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 92: Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 93: Europe Market Attractiveness by Type, 2023 to 2033

Figure 94: Europe Market Attractiveness by Source, 2023 to 2033

Figure 95: Europe Market Attractiveness by Application, 2023 to 2033

Figure 96: Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Asia Pacific Market Value (US$ Million) by Type, 2023 to 2033

Figure 98: Asia Pacific Market Value (US$ Million) by Source, 2023 to 2033

Figure 99: Asia Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 100: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Asia Pacific Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 103: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Asia Pacific Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 106: Asia Pacific Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 107: Asia Pacific Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 108: Asia Pacific Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 109: Asia Pacific Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 110: Asia Pacific Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 111: Asia Pacific Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 112: Asia Pacific Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 113: Asia Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 114: Asia Pacific Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 115: Asia Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 116: Asia Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 117: Asia Pacific Market Attractiveness by Type, 2023 to 2033

Figure 118: Asia Pacific Market Attractiveness by Source, 2023 to 2033

Figure 119: Asia Pacific Market Attractiveness by Application, 2023 to 2033

Figure 120: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 121: MEA Market Value (US$ Million) by Type, 2023 to 2033

Figure 122: MEA Market Value (US$ Million) by Source, 2023 to 2033

Figure 123: MEA Market Value (US$ Million) by Application, 2023 to 2033

Figure 124: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: MEA Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 127: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: MEA Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 130: MEA Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 131: MEA Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 132: MEA Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 133: MEA Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 134: MEA Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 135: MEA Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 136: MEA Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 137: MEA Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 138: MEA Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 139: MEA Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 140: MEA Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 141: MEA Market Attractiveness by Type, 2023 to 2033

Figure 142: MEA Market Attractiveness by Source, 2023 to 2033

Figure 143: MEA Market Attractiveness by Application, 2023 to 2033

Figure 144: MEA Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA