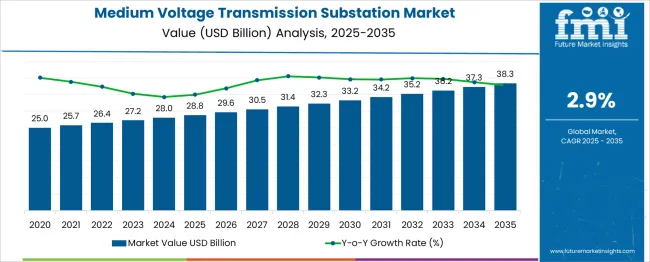

The medium voltage transmission substation market is estimated to be valued at USD 28.8 billion in 2025 and is projected to reach USD 38.3 billion by 2035, registering a compound annual growth rate (CAGR) of 2.9% over the forecast period. From 2025 to 2030, the market is expected to expand from USD 28.8 billion to USD 33.2 billion, reflecting a steady rise driven by the modernization of electrical infrastructure and the integration of renewable energy sources into the grid. Year-on-year analysis shows consistent gains, with values reaching USD 29.6 billion in 2026 and USD 30.5 billion in 2027, supported by grid reliability initiatives and load management programs.

By 2028, the market is anticipated to reach USD 31.4 billion, increasing to USD 32.3 billion in 2029 and USD 33.2 billion by 2030. Growth is likely to be influenced by investments in smart grid technologies, digital monitoring systems, and substation automation to improve efficiency and minimize downtime. Demand will also be reinforced by rising electricity consumption across industrial and urban regions, requiring enhanced transmission capabilities. These factors position medium voltage substations as a crucial component in maintaining grid stability, ensuring energy security, and enabling efficient power transmission in evolving energy landscapes globally.

| Metric | Value |

|---|---|

| Medium Voltage Transmission Substation Market Estimated Value in (2025 E) | USD 28.8 billion |

| Medium Voltage Transmission Substation Market Forecast Value in (2035 F) | USD 38.3 billion |

| Forecast CAGR (2025 to 2035) | 2.9% |

The medium voltage transmission substation market occupies a key position within several power infrastructure and utility-related sectors. In the power transmission and distribution market, its share is approximately 8–10%, as high-voltage substations and distribution systems dominate overall investments. Within the electrical substation market, medium voltage substations account for nearly 18–20%, driven by their role in stepping down voltages for regional and industrial power distribution. In the medium voltage equipment market, their share is significant at 25–28%, as substations integrate switchgear, transformers, and protective devices for reliable grid operations. For the grid infrastructure development market, the share is about 6–7%, considering the extensive scope of transmission lines and grid modernization projects.

In the energy and utility infrastructure market, the contribution is around 4–5%, since this category also includes generation and large-scale renewable projects. Growth in this segment is driven by increasing electricity demand, urban grid expansion, and integration of renewable energy sources. Additionally, advancements such as digital substations, smart monitoring systems, and gas-insulated designs are enhancing operational reliability and reducing space requirements. With utilities focusing on grid resilience and automation, medium voltage substations are expected to maintain a strong and growing presence across these parent markets globally.

The medium voltage transmission substation market is undergoing steady advancement as utilities and industrial sectors prioritize modernization of grid infrastructure and resilience. Growing electricity consumption, increased renewable integration, and the global push toward energy efficiency have collectively driven the demand for flexible and modular substation technologies.

Governments and utilities are investing in grid automation and electrification of transport and industry, creating a fertile ground for medium voltage substations that offer scalability, compactness, and faster deployment timelines. The market is further benefiting from the replacement demand of aging infrastructure and the need to ensure consistent voltage stability across urban and rural networks.

Vendors are increasingly offering solutions that combine digital control systems with traditional electrical equipment, aligning with national smart grid mandates and reliability standards. The transition to digital substations and remote monitoring capabilities is expanding revenue opportunities across developed and emerging markets, ensuring long-term value generation and operational sustainability for stakeholders involved in transmission and distribution..

The medium voltage transmission substation market is segmented by technology, component, category, end use, and geographic regions. The technology of the medium voltage transmission substation market is divided into Conventional and Digital. In terms of components, the medium voltage transmission substation market is classified into Electrical system, Substation automation system, Communication network, Monitoring & control system, and Others. The medium voltage transmission substation market is segmented into New and Refurbished. The end use of the medium voltage transmission substation market is segmented into Utility and Industrial. Regionally, the medium voltage transmission substation industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

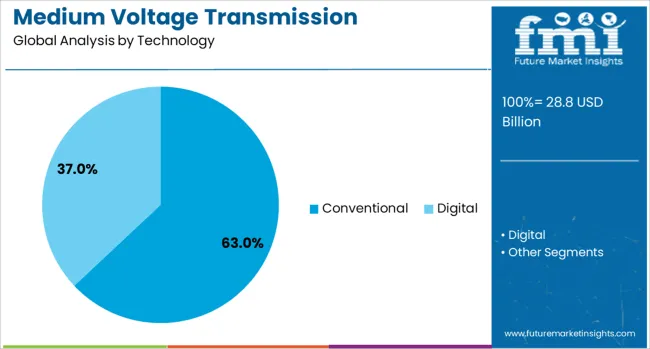

The conventional segment within the technology classification is anticipated to hold 63% of the Medium Voltage Transmission Substation market revenue share in 2025, making it the dominant technology. This leadership has been supported by the long-standing reliability and proven performance of conventional substation designs in handling medium voltage transmission requirements. Utility companies and infrastructure developers have continued to rely on traditional configurations due to their cost-effectiveness, robust safety standards, and ease of integration with legacy grid systems.

Additionally, well-established supply chains and existing technical expertise across maintenance teams have reinforced the preference for conventional technologies. Despite rising interest in digital substations, the conventional segment remains attractive in regions where grid modernization is incremental or funding is limited.

The ability of conventional substations to deliver uninterrupted service under a variety of environmental and load conditions has contributed significantly to their continued relevance. These factors, combined with consistent regulatory compliance and operational familiarity, have maintained conventional solutions as the most adopted technology in medium voltage transmission substations..

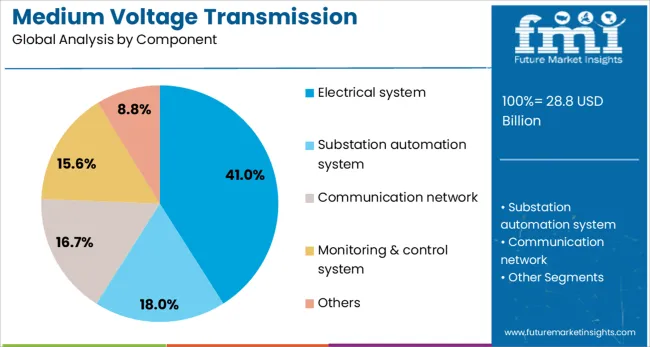

The electrical system subsegment within the component category is projected to account for 41% of the Medium Voltage Transmission Substation market revenue share in 2025, making it the leading component group. The segment's growth has been driven by the fundamental role of electrical systems in ensuring safe, stable, and efficient power transmission across substation networks. These systems encompass key infrastructure such as transformers, circuit breakers, switchgear, and busbars, which collectively form the backbone of any substation's operational capability.

Their dominance has been sustained by the critical need for load balancing, fault management, and voltage regulation. As grid networks become more complex with the integration of renewable sources and distributed energy systems, demand for reliable electrical components has intensified.

This segment has also benefited from advancements in insulation, thermal performance, and real-time diagnostics, which have improved efficiency and reduced downtime. As utilities continue to prioritize resilience and stability, electrical systems will remain central to the structure and functionality of medium voltage substations..

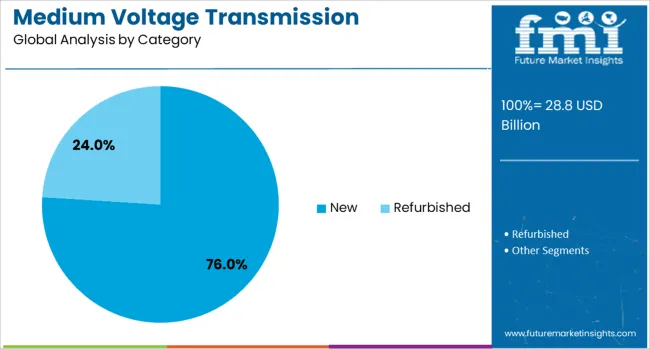

The new subsegment within the category classification is expected to dominate with a 76% revenue share in the Medium Voltage Transmission Substation market in 2025. The growth of this segment has been influenced by the increasing construction of new substations to accommodate expanding urbanization, industrialization, and grid extensions into remote or underserved regions. Governments and private energy developers are investing heavily in new substation projects as part of electrification drives and capacity expansions, particularly in Asia Pacific, the Middle East, and Africa.

The preference for new over retrofit installations has been driven by the ease of incorporating modern technologies, compliance with updated safety and environmental standards, and long-term asset reliability. Unlike upgrades or replacements, new substation projects offer a clean slate for integrating intelligent monitoring systems, advanced protection devices, and modular configurations that support future scalability.

In addition, the availability of international funding and public-private partnerships has made capital more accessible for greenfield projects. These trends are collectively positioning the new category as the growth engine within the medium voltage transmission substation landscape..

The medium voltage transmission substation market is expanding rapidly due to grid modernization initiatives, renewable integration, and rising electricity demand from industrial and commercial sectors. Growth is supported by government programs for upgrading transmission networks in 2024 and 2025. Opportunities exist in modular substation solutions, digital automation, and integrated monitoring systems for smart grids. Key trends include GIS adoption, advanced protection relays, and cloud-based remote control technologies. However, challenges such as high capital costs, extended approval timelines, and supply chain disruptions for critical components remain. The outlook signals consistent growth driven by infrastructure upgrades and industrial expansion.

The primary growth driver for the medium voltage transmission substation market is the increasing requirement for reliable power distribution and grid stability. In 2024 and 2025, investments in network expansion projects across Asia-Pacific and North America surged as utilities aimed to meet industrial and commercial load growth. Large-scale renewable integration programs further accelerated demand for substations capable of managing intermittent power flows. These installations prioritize safety, fault tolerance, and optimized voltage regulation. This trajectory confirms that rising energy demand and transmission reinforcement programs will remain key growth drivers globally.

Significant opportunities are emerging in modular substation designs and automation solutions. In 2025, prefabricated substations gained prominence for quick deployment in mining, oil and gas, and remote industrial zones. Digital automation systems incorporating real-time diagnostics and predictive maintenance were adopted to enhance operational efficiency. Growing preference for advanced SCADA integration and IoT-based monitoring has opened new revenue streams for substation solution providers. These opportunities indicate that suppliers focusing on modularity and smart control capabilities are positioned to lead as utilities prioritize speed, scalability, and operational reliability in modern grid systems.

Emerging trends highlight the increasing use of Gas Insulated Switchgear (GIS) and advanced digital monitoring tools. In 2024, GIS installations were prioritized in urban and space-constrained projects due to their compact design and low maintenance requirements. Cloud-enabled platforms supporting remote supervision and fault detection became standard for utilities seeking enhanced network visibility. Enhanced protection relays and automated fault isolation mechanisms gained traction to reduce outage risks. These trends reflect a market pivot toward compact, technology-enhanced substations designed to deliver higher efficiency, faster commissioning, and improved resilience against grid disturbances.

Market restraints are shaped by high upfront capital requirements and lengthy project approval cycles. In 2024 and 2025, utilities in cost-sensitive regions delayed substation upgrades due to budgetary constraints and uncertain tariff recovery mechanisms. Regulatory hurdles linked to environmental clearances and land acquisition added further delays to large-scale deployments. Supply chain volatility for components such as transformers and protection systems also impacted project timelines. These challenges underscore the need for cost-effective designs, financial assistance models, and streamlined regulatory frameworks to support wider adoption of modern transmission substation solutions.

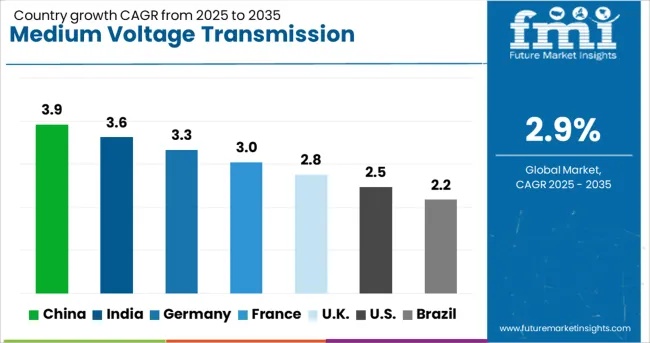

| Country | CAGR |

|---|---|

| China | 3.9% |

| India | 3.6% |

| Germany | 3.3% |

| France | 3.0% |

| UK | 2.8% |

| USA | 2.5% |

| Brazil | 2.2% |

China leads with a 3.9% CAGR, supported by large-scale power infrastructure upgrades and urban grid expansion. India follows at 3.6%, driven by rural electrification programs and industrial corridor developments. Germany (3.3%) and France (3.0%) benefit from renewable integration and aging infrastructure replacement, while the UK (2.8%) focuses on offshore wind connectivity and urban load management. The USA (2.5%) and Brazil (2.2%) record steady growth through grid reliability projects and energy diversification efforts.

China is forecasted to grow at a 3.9% CAGR, maintaining its lead in global substation deployment through extensive grid upgrades. Integration of renewable power sources such as wind and solar into the transmission network drives the need for robust medium voltage substations with enhanced capacity. Urbanization and industrialization trends create additional demand for substations in metropolitan and industrial zones. Domestic manufacturers supply cost-effective switchgear and transformer units, while international suppliers deliver digitalized and automated substation solutions for advanced applications. The adoption of SCADA systems and predictive maintenance tools continues to rise, improving grid reliability.

The market in India is projected to grow at 3.6% CAGR, driven by rural electrification programs and rapid development of renewable energy corridors. The expansion of smart grids and large-scale infrastructure projects fuels demand for modular, factory-assembled substations to reduce on-site installation time. State utilities invest in automated systems integrated with digital monitoring for real-time performance analytics. EPC players are partnering with technology providers to offer hybrid substations that combine conventional systems with modern automation. Private developers also invest in substations for industrial parks and metro rail projects.

France is expected to post 3.0% CAGR, with strong emphasis on decarbonization and transition to smart grids. Deployment of substations supporting renewable energy plants such as offshore wind and solar farms drives demand for advanced designs. Digital-ready substations integrated with cybersecurity solutions are prioritized to meet EU regulatory standards. Utilities adopt compact, gas-insulated systems to optimize land use and reduce environmental impact. Advanced protection relays and remote diagnostics are increasingly incorporated to ensure network stability and minimize downtime.

The United Kingdom market is forecasted to grow at 2.8% CAGR, driven by grid modernization projects aligned with renewable integration goals. Offshore wind and distributed generation sources require advanced substations with remote monitoring and control features. EPC contractors focus on compact substation designs for urban installations, where space optimization is critical. Government investment in smart energy networks accelerates the adoption of IoT-enabled automation for enhanced operational control. Digital twins and AI-based asset health monitoring are gaining traction among utility operators seeking predictive analytics.

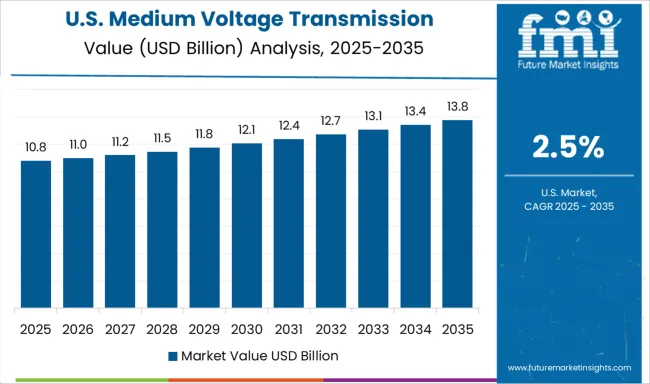

The United States market is projected to grow at 2.5% CAGR, reflecting slow but steady demand for replacement and automation upgrades in a mature grid infrastructure. Federal initiatives supporting grid resilience and energy transition drive modernization of legacy substations. Deployment of smart substations with digital relays, IoT sensors, and advanced SCADA platforms is becoming common across utility networks. Investments in wildfire prevention technologies and climate-resilient substation designs strengthen market potential. EPC providers increasingly offer turnkey services, including automation integration and predictive diagnostics, for aging substations.

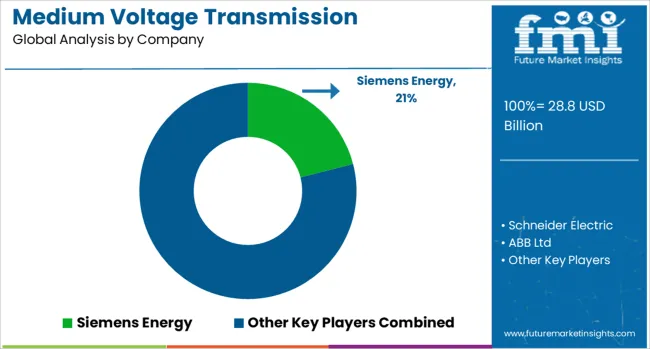

The medium voltage transmission substation market is moderately consolidated, with Siemens Energy recognized as a leading player due to its extensive portfolio of substation solutions, including gas-insulated and air-insulated switchgear, transformers, and digital control systems. The company’s strong focus on automation and reliability ensures its leadership in modern grid infrastructure projects. Key players include Schneider Electric, ABB Ltd, General Electric, and Mitsubishi Electric. These companies deliver comprehensive substation systems designed to support efficient power transmission, grid stability, and integration of renewable energy sources. Their offerings include advanced protection systems, modular substation designs, and IoT-enabled monitoring platforms for predictive maintenance and real-time performance optimization.

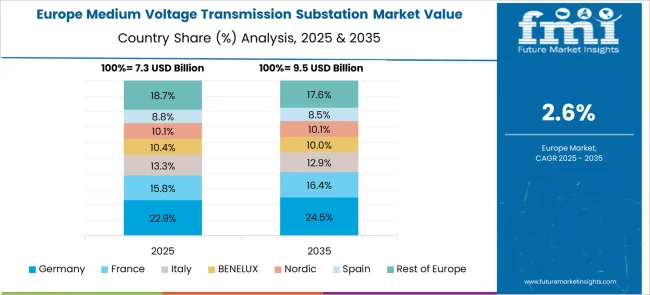

Market growth is driven by increasing demand for grid modernization, expansion of renewable energy capacity, and rising electricity consumption in developing regions. Leading manufacturers are investing in eco-efficient technologies such as SF₆-free gas-insulated switchgear, compact modular designs for urban applications, and digital substations integrated with advanced communication protocols. Emerging trends include hybrid substations, enhanced cyber-security solutions, and smart sensors for data-driven asset management. Asia-Pacific dominates the market due to large-scale infrastructure projects and electrification initiatives, while North America and Europe focus on upgrading aging grid assets and improving grid resiliency.

| Item | Value |

|---|---|

| Quantitative Units | USD 28.8 Billion |

| Technology | Conventional and Digital |

| Component | Electrical system, Substation automation system, Communication network, Monitoring & control system, and Others |

| Category | New and Refurbished |

| End Use | Utility and Industrial |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Siemens Energy, Schneider Electric, ABB Ltd, General Electric, and Mitsubishi Electric |

| Additional Attributes | Dollar sales by voltage class (1 kV–36 kV) and enclosure type (pad, pole, underground; indoor vs outdoor). Asia‑Pacific dominates (~USD 67 B in 2024), North America steady (~USD 5.5 B). Buyers seek compact, smart-grid-ready substations with remote diagnostics and renewable integration. Innovations include hybrid AIS/GIS, IEC 61850-based automation, and digital twin-enabled predictive maintenance. |

The global medium voltage transmission substation market is estimated to be valued at USD 28.8 billion in 2025.

The market size for the medium voltage transmission substation market is projected to reach USD 38.3 billion by 2035.

The medium voltage transmission substation market is expected to grow at a 2.9% CAGR between 2025 and 2035.

The key product types in medium voltage transmission substation market are conventional and digital.

In terms of component, electrical system segment to command 41.0% share in the medium voltage transmission substation market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Medium Duty Truck Market Size and Share Forecast Outlook 2025 to 2035

Medium-duty Engine Market Size and Share Forecast Outlook 2025 to 2035

Medium Earth Orbit (MEO) Satellite IoT Market Size and Share Forecast Outlook 2025 to 2035

Medium Format Film Cameras Market Size and Share Forecast Outlook 2025 to 2035

Medium Density Fiberboard (MDF) Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Medium-Chain Triglycerides Market Growth -Functional Fats & Industry Demand 2025 to 2035

Medium Carbon Steel Market

Medium Voltage Transformer Industry Analysis in North America Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Cable and Accessory Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Transformer Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage AC Power Distribution Units (PDU) Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Utility Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Commercial Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Residential Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Capacitor Bank Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Wire and Cable Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Circuit Breaker Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Electric Capacitor Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Drives Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA