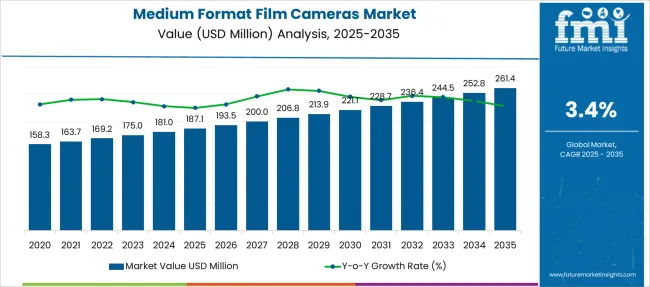

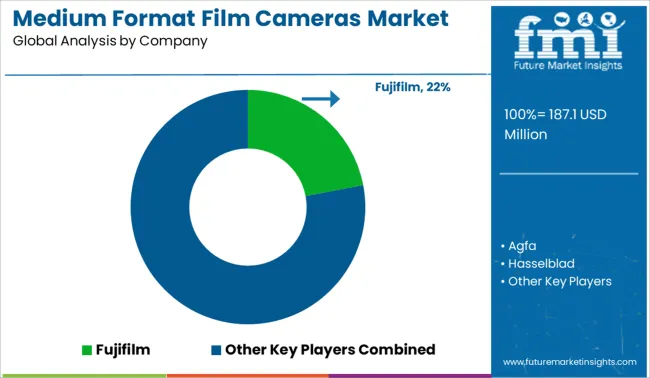

The Medium Format Film Cameras Market is estimated to be valued at USD 187.1 million in 2025 and is projected to reach USD 261.4 million by 2035, registering a compound annual growth rate (CAGR) of 3.4% over the forecast period.

| Metric | Value |

|---|---|

| Medium Format Film Cameras Market Estimated Value in (2025 E) | USD 187.1 million |

| Medium Format Film Cameras Market Forecast Value in (2035 F) | USD 261.4 million |

| Forecast CAGR (2025 to 2035) | 3.4% |

The medium format film cameras market is experiencing renewed interest driven by the resurgence of analog photography among enthusiasts, professionals, and collectors. A growing appreciation for tactile image creation and film aesthetics has led to increased demand for medium format equipment that delivers superior resolution, tonal depth, and image latitude.

Technological preservation by niche manufacturers and third-party lens makers is supporting continued availability and functionality of vintage models. Additionally, the rise of hybrid workflows-where film negatives are digitized for editing-has bridged traditional and digital photography, boosting adoption.

Collector communities, social media-driven film photography culture, and educational content creation are further contributing to market expansion. Going forward, the segment is likely to benefit from elevated resale values, improved access to refurbished components, and limited-edition reissues tailored to experienced users and creative professionals

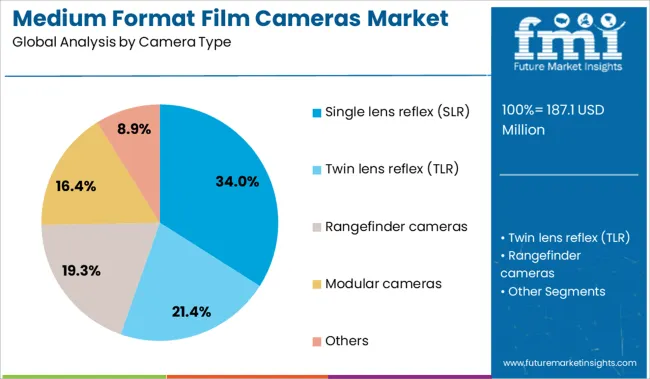

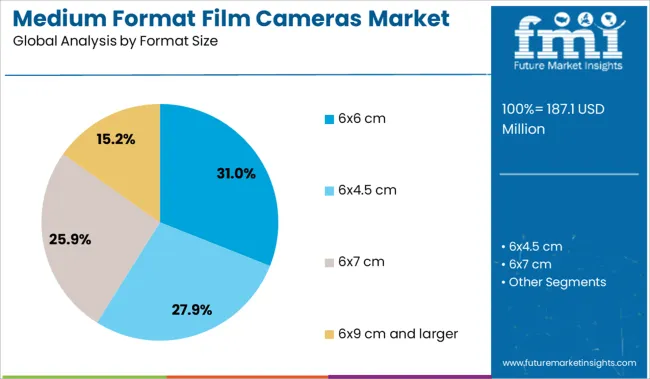

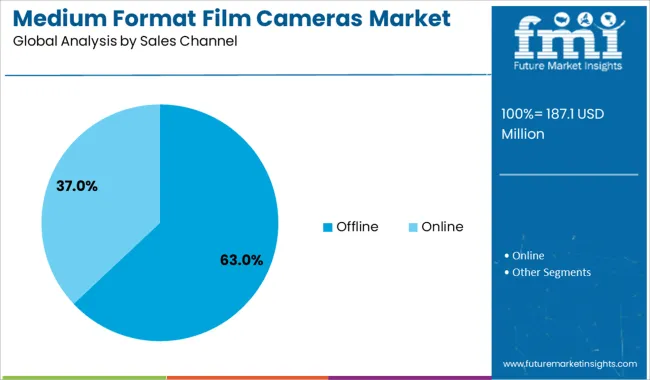

The market is segmented by Camera Type, Format Size, Sales Channel, and Application and region. By Camera Type, the market is divided into Single lens reflex (SLR), Twin lens reflex (TLR), Rangefinder cameras, Modular cameras, and Others. In terms of Format Size, the market is classified into 6x6 cm, 6x4.5 cm, 6x7 cm, and 6x9 cm and larger. Based on Sales Channel, the market is segmented into Offline and Online. By Application, the market is divided into Portrait photography, Landscape photography, Commercial photography, Fine art photography, Studio photography, Documentary photography, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Single lens reflex (SLR) models are projected to contribute 34.0% of total revenue in the medium format film cameras market by 2025, establishing this as the leading camera type. Their continued preference is being shaped by their optical precision, reliable build quality, and compatibility with interchangeable lenses, which offer photographers greater creative control.

The mirror-based viewing mechanism has allowed accurate composition through the lens, making them favored among professionals and serious hobbyists. Their robust mechanical construction has supported long-term use, while a steady supply of legacy units through secondhand markets has kept the segment active.

As analog photography gains cultural traction, SLR systems are being retained for their classic functionality and visual feedback during shooting

The 6x6 cm format is expected to capture 31.0% of the market share in 2025, ranking it as the dominant medium format size. This segment’s leadership is being driven by its balanced frame proportions, which offer both compositional flexibility and efficient film usage.

The square format has become aesthetically iconic, especially in portrait and editorial work, contributing to its sustained appeal. Improved scanning technology has enhanced digital reproduction of 6x6 negatives, further strengthening its integration into hybrid photography workflows.

Additionally, the availability of high-quality lenses and accessories compatible with this format has preserved its relevance. Its enduring use in both creative projects and archival applications underscores its centrality in the analog photography resurgence

Offline sales are anticipated to account for 63.0% of total revenue in the medium format film cameras market by 2025, securing their position as the leading distribution channel. This dominance is being reinforced by the specialized nature of analog equipment, which often requires in-person evaluation, testing, and expert consultation.

Camera stores, vintage equipment dealers, and repair shops provide critical guidance and after-sales support that online channels may lack. Physical outlets also facilitate equipment trade-ins and restoration services, encouraging long-term engagement among photographers.

The tactile inspection of used gear and assurance of authenticity are major purchase drivers in this niche category. As a result, offline networks remain vital to sustaining trust and continuity in the analog camera ecosystem

Educational and artistic interest is reviving medium format film usage, with growing demand from students, artists, and galleries. However, supply constraints, rising costs, and lab closures are limiting accessibility and eroding the analog experience.

Photography schools in Canada, the UK, and Scandinavia have reintroduced film coursework, creating seasonal spikes in camera rentals and film purchases. Film labs report that 120-roll processing volumes grew 17% in Q2 2025, led by independent artists and students. Curated “slow photography” workshops, often bundled with refurbished gear kits, sold out across eight European cities by May 2025. Analog galleries in Berlin and Tokyo now commission medium format portraiture, reviving multi-shoot workflows and increasing demand for expired but premium emulsions like Fuji Pro 400H.

Global availability of 120 roll film has declined due to rising production costs and factory consolidations, with only three active manufacturers supplying the format as of mid-2025. Shipping delays have pushed retail prices up by 23% in regions like Southeast Asia and South America. In Australia and Eastern Europe, film processing labs are closing or shifting to digital-only services, increasing average lead times by 12 days. Lack of local development capacity is driving mail-order dependency, reducing spontaneous usage, and weakening the experiential appeal that medium format typically offers.

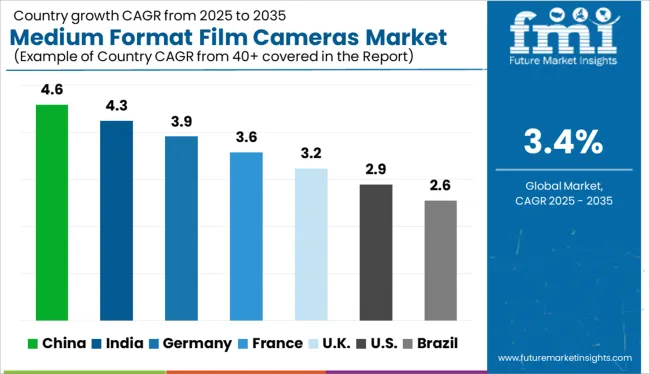

| Country | CAGR |

|---|---|

| China | 4.6% |

| India | 4.3% |

| Germany | 3.9% |

| France | 3.6% |

| UK | 3.2% |

| USA | 2.9% |

| Brazil | 2.6% |

The medium format film cameras market is projected to expand at a global CAGR of 3.4% from 2025 to 2035, as analog photography experiences a revival among professionals, collectors, and luxury camera enthusiasts. BRICS countries are showing encouraging signs of growth, led by China at 4.6% and India at 4.3%. In China, demand is rising from art schools, analog hobbyists, and boutique camera brands, while India’s niche camera collector community and vintage camera resellers are gradually expanding. Among OECD economies, Germany stands out with a 3.9% CAGR due to its strong legacy in precision optics and revived interest in domestic analog production. The UK (3.2%) and the US (2.9%) are seeing moderate growth driven by fashion photographers, luxury photo labs, and social media-fueled retro aesthetics. ASEAN countries are emerging as component suppliers, particularly for mechanical parts and lenses used in limited-edition or refurbished medium-format models.

The UK market posted a CAGR of 2.1% from 2020 to 2024, reflecting post-Brexit import frictions and limited accessibility to analog repair and processing labs. However, the CAGR for 2025-2035 is forecast to rise to 3.2%, aided by growing artistic demand, darkroom culture revival, and niche analog retail support. A reintroduction of analog modules in university photography courses has expanded the user base beyond hobbyists. In Q2 2025, London-based analog stores reported a 29% YoY rise in refurbished camera sales, while film lab reopenings in Glasgow and Brighton improved regional accessibility. Rising interest in premium emulsions, such as Kodak Portra and Ilford FP4, has also driven value growth, despite volume limitations.

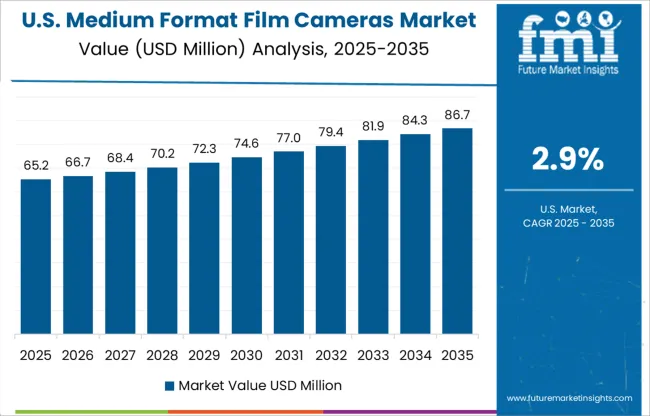

The USA market expanded at a modest CAGR of 2.4% between 2020 and 2024, reflecting pandemic-era disruptions, retail closures, and a pivot to digital. However, the CAGR is expected to climb to 2.9% for 2025-2035, supported by collector demand, student-driven analog adoption, and thriving secondary markets. Camera rental companies in cities like New York, San Francisco, and Portland now report 40% higher demand for medium format models like the Pentax 67 and Mamiya 645. Independent repair services have scaled up capacity through apprenticeship-based training, reducing turnaround times. The USA also leads in analog photography influencer engagement, encouraging first-time users to experiment with 120 film.

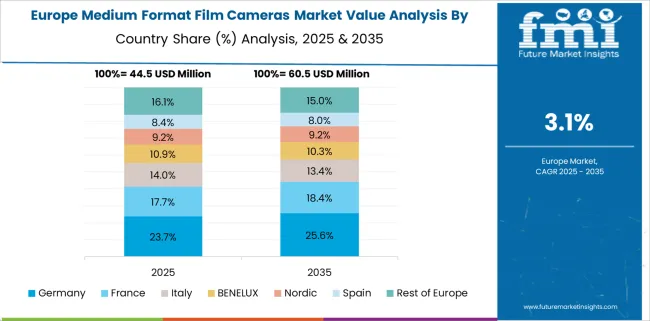

Germany’s CAGR for medium-format film cameras stood at 2.8% from 2020 to 2024. It is now projected to accelerate to 3.9% during 2025-2035, driven by robust analog subcultures in Berlin, Leipzig, and Munich. Enthusiast groups and photography clubs continue to preserve usage traditions, while workshops supported by art schools and galleries are creating fresh cycles of interest. The return of photo exhibitions featuring silver gelatin prints has also helped elevate the perceived value of film photography. In 2025, refurbished sales of Rolleiflex and Kiev 88 cameras increased 26%, driven by collectors and street photographers.

India’s CAGR for medium format film cameras was 2.9% from 2020 to 2024, constrained by supply limitations and a relatively small analog ecosystem. However, growth is set to reach 4.3% from 2025 to 2035, fueled by youth-led artistic movements and renewed film culture in Tier 1 cities. Student photo clubs in Mumbai, Bengaluru, and Delhi are promoting analog usage through subsidized gear access and darkroom workshops. In 2025, refurbished Bronica and Seagull TLR cameras gained traction on resale platforms, where pricing remains favorable relative to Western markets. India's growing film lab ecosystem, particularly in Chennai and Pune, is also reducing dependency on overseas processing.

China’s market expanded at a CAGR of 3.7% from 2020 to 2024 and is set to reach 4.6% from 2025 to 2035, outpacing the global average. The expansion is being driven by increasing disposable income among Gen Z consumers, interest in visual heritage, and the growth of analog content on platforms like Xiaohongshu and Bilibili. Shanghai and Shenzhen lead in medium format gear rentals, while domestic refurbishment firms are reviving Seagull TLR and Great Wall camera bodies. Film importers in Guangdong report a 41% increase in Kodak and Ilford 120 film orders in Q1 2025. Urban photo cafes and analog training hubs are also creating immersive learning spaces.

In the global medium format film cameras market, estimated at between USD 750-800 million in 2024, Fujifilm remains the leading player due to its popular GFX series and enduring legacy in 120 film manufacturing. The brand bridges analog-digital convergence, appealing to professionals and enthusiasts alike. Other notable brands include Mamiya, Hasselblad, and Pentax (Ricoh Imaging), all known for producing iconic medium format systems used in studio, landscape, and editorial photography. Agfa, Rollei, and Linhof cater to niche and heritage-driven users, offering a mix of collectible models and large-format compatibility. Holga and Horseman remain popular for experimental and educational use. Kamera Store, a key refurbisher and reseller, supports aftermarket circulation, especially across the EU and Japan.

| Item | Value |

|---|---|

| Quantitative Units | USD 187.1 Million |

| Camera Type | Single lens reflex (SLR), Twin lens reflex (TLR), Rangefinder cameras, Modular cameras, and Others |

| Format Size | 6x6 cm, 6x4.5 cm, 6x7 cm, and 6x9 cm and larger |

| Sales Channel | Offline and Online |

| Application | Portrait photography, Landscape photography, Commercial photography, Fine art photography, Studio photography, Documentary photography, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Fujifilm, Agfa, Hasselblad, Holga, Horseman, Kamera Store, Linhof, Mamiya, Pentax (Ricoh Imaging), and Rollei |

| Additional Attributes | Dollar sales, share by region, aftermarket demand trends, user demographics (artists, collectors), film processing access, resale values, and repair-part availability. |

The global medium format film cameras market is estimated to be valued at USD 187.1 million in 2025.

The market size for the medium format film cameras market is projected to reach USD 261.4 million by 2035.

The medium format film cameras market is expected to grow at a 3.4% CAGR between 2025 and 2035.

The key product types in medium format film cameras market are single lens reflex (slr), twin lens reflex (tlr), rangefinder cameras, modular cameras and others.

In terms of format size, 6x6 cm segment to command 31.0% share in the medium format film cameras market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Medium Voltage Transformer Industry Analysis in North America Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Cable and Accessory Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Transformer Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage AC Power Distribution Units (PDU) Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Utility Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Medium Duty Truck Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Commercial Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Residential Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Capacitor Bank Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Wire and Cable Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Digital Substation Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Circuit Breaker Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Distribution Substation Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Electric Capacitor Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Transmission Substation Market Size and Share Forecast Outlook 2025 to 2035

Medium-duty Engine Market Size and Share Forecast Outlook 2025 to 2035

Medium Earth Orbit (MEO) Satellite IoT Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Drives Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Medium Density Fiberboard (MDF) Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA