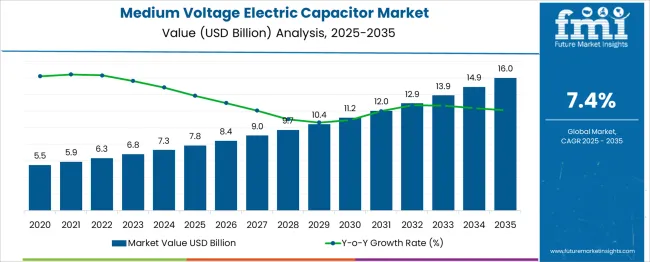

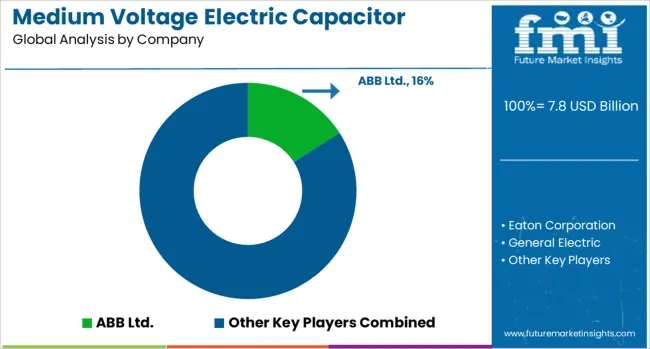

The Medium Voltage Electric Capacitor Market is estimated to be valued at USD 7.8 billion in 2025 and is projected to reach USD 16.0 billion by 2035, registering a compound annual growth rate (CAGR) of 7.4% over the forecast period. From 2025 to 2030, expansion from USD 7.8 billion to USD 10.4 billion will be supported by grid reinforcement projects, replacement of outdated components, and the scaling of manufacturing operations requiring reliable medium-voltage solutions.

In the 2030 to 2035 phase, growth momentum strengthens, with the market adding over USD 5.6 billion in value as large-scale infrastructure developments, interconnection of regional grids, and increased cross-border electricity flows drive procurement of advanced capacitor banks. Throughout the decade, recurring demand from industries with heavy electrical loads, combined with replacement cycles for aging equipment, ensures a sustained upward trajectory in both capacity deployment and market revenues.

| Metric | Value |

|---|---|

| Medium Voltage Electric Capacitor Market Estimated Value in (2025 E) | USD 7.8 billion |

| Medium Voltage Electric Capacitor Market Forecast Value in (2035 F) | USD 16.0 billion |

| Forecast CAGR (2025 to 2035) | 7.4% |

The medium voltage electric capacitor market is progressing steadily as global energy infrastructure continues to modernize and expand. Demand is being influenced by the growing need for reactive power compensation, voltage regulation, and efficient energy transmission in both industrial and utility-grade networks. Emphasis on energy efficiency policies and grid reliability initiatives by governments and utility operators has further accelerated market adoption.

As renewable energy installations grow, capacitors are being deployed widely to stabilize fluctuating power input and maintain grid performance. The market is also supported by investments in transmission and distribution upgrades, particularly in emerging economies experiencing rapid industrialization and urban expansion.

Technological advancements in dielectric materials and improved thermal stability are making modern capacitor solutions more reliable and durable. The ability to integrate these components into intelligent grid systems and smart substations continues to pave the way for future growth, positioning medium voltage electric capacitors as a critical enabler of resilient, sustainable power networks..

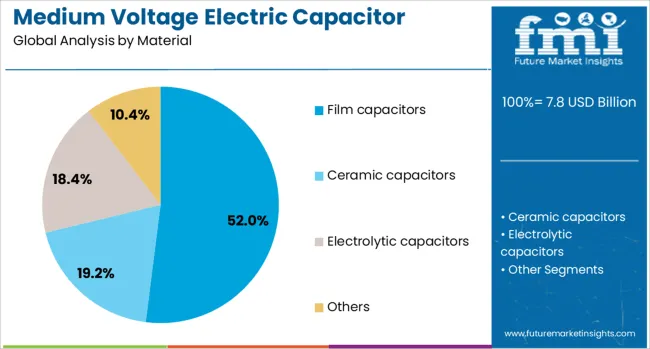

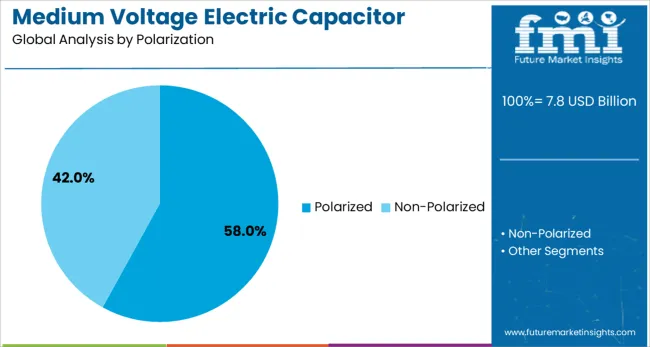

The medium voltage electric capacitor market is segmented by material, polarization, end use, and geographic regions. The material of the medium voltage electric capacitor market is divided into Film capacitors, Ceramic capacitors, Electrolytic capacitors, and others. In terms of polarization, the medium voltage electric capacitor market is classified into polarized and non-polarized.

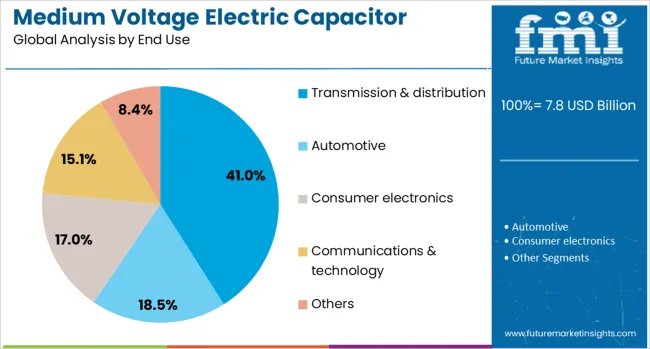

Based on end use, the medium voltage electric capacitor market is segmented into Transmission & distribution, Automotive, Consumer electronics, Communications & technology, and others. Regionally, the medium voltage electric capacitor industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The film capacitors subsegment within the material segment is expected to hold 52% of the medium voltage electric capacitor market revenue share in 2025, making it the dominant material choice. This leadership position has been supported by the superior electrical characteristics of film capacitors, including low dielectric loss, high insulation resistance, and excellent thermal stability. These attributes have made film capacitors suitable for medium voltage applications requiring long life cycles and operational reliability.

Their ability to withstand harsh environmental conditions without significant degradation has contributed to widespread adoption in utility substations and industrial power factor correction systems. Additionally, film capacitors offer enhanced safety, reduced maintenance requirements, and ease of integration into compact and modular power systems.

The evolution of metallized polypropylene and polyester films has further improved the energy density and operational performance of these capacitors. As power networks demand more robust and adaptable components, film capacitors have continued to gain prominence as the preferred material choice across multiple regions..

The polarized subsegment in the polarization segment is projected to account for 58% of the medium voltage electric capacitor market revenue share in 2025. This segment's dominance has been attributed to its high energy efficiency and precise charge storage capabilities, which are essential in high-performance electrical circuits and power control systems. Polarized capacitors have been widely integrated into systems where directional current flow and stable voltage regulation are critical.

Their application in medium voltage circuits has been reinforced by their compact design, high capacitance-to-volume ratio, and enhanced electrical reliability. These characteristics have allowed for optimized space usage within substations and power distribution cabinets. Furthermore, the use of advanced dielectric materials in polarized capacitors has improved operational safety and reduced failure rates.

Their compatibility with smart grid architectures and renewable integration systems has also elevated their importance in evolving power infrastructure. This consistent demand across industrial, utility, and renewable sectors has positioned polarized capacitors as the leading choice in the polarization segment..

The transmission and distribution subsegment in the end use segment is projected to hold 41% of the medium voltage electric capacitor market revenue share in 2025, making it the largest application area. This leadership has been driven by the essential role capacitors play in supporting grid stability, enhancing power quality, and minimizing transmission losses. Capacitors have been extensively utilized in substations and distribution networks to provide reactive power compensation and improve power factor, thereby reducing energy losses and ensuring reliable supply to end users.

As global power demand rises and renewable energy penetration increases, utilities have prioritized the modernization of transmission and distribution infrastructure. The incorporation of medium voltage capacitors has supported these objectives by enabling voltage stabilization and improving the dynamic response of the grid.

Additionally, growing investments in smart grid technologies and rural electrification programs have contributed to the rising deployment of capacitors in this segment. These trends have firmly positioned transmission and distribution as the leading end-use area in the medium voltage capacitor market..

The medium voltage electric capacitor market is expanding as utilities and industrial facilities focus on improving power factor correction, voltage stability, and energy efficiency. These capacitors are widely used in power distribution networks, renewable energy integration, and large-scale industrial operations. The shift toward grid modernization and increased electricity demand is supporting market adoption. However, challenges such as fluctuating raw material costs, installation complexities, and maintenance needs remain. Vendors offering durable, low-loss, and application-specific capacitor solutions are gaining competitive advantages.

Medium voltage electric capacitors are essential components in maintaining efficient and stable power distribution systems. Utilities deploy them for reactive power compensation, which helps reduce line losses, improve voltage regulation, and enhance overall grid reliability. As electricity consumption rises and distribution networks expand, the demand for these capacitors increases in both urban and rural regions. Integration of renewable energy sources such as wind and solar creates additional reactive power challenges, prompting utilities to adopt capacitors for voltage stabilization and load balancing. Industrial consumers also use these capacitors to improve their power factor, thereby lowering electricity bills and avoiding utility penalties. The growing number of electrification projects in emerging economies further drives adoption. Suppliers that provide capacitors with enhanced durability, low dielectric loss, and compact designs can better meet the evolving needs of utilities and industrial operators, securing long-term partnerships in the competitive market.

The production of medium voltage electric capacitors relies heavily on materials such as aluminum, polypropylene films, and high-grade insulating substances. Fluctuations in the prices of these materials significantly affect manufacturing costs and profit margins. Global supply chain disruptions can lead to extended lead times, impacting project schedules for utilities and industrial buyers. Additionally, sourcing high-quality materials that meet stringent electrical and thermal performance requirements remains a challenge for many manufacturers. Producers must maintain strict quality control to ensure long operational life, especially for outdoor and high-load applications. Companies that diversify their supplier base, adopt lean manufacturing techniques, and invest in material-efficient designs can reduce cost volatility and improve resilience. Competitive pricing, without compromising reliability, is increasingly important as buyers evaluate long-term operational value rather than just upfront costs. This makes strategic supply chain management a key factor in maintaining a competitive position in the market.

The rapid growth of renewable energy generation presents significant opportunities for medium voltage electric capacitors. Wind farms, solar plants, and other distributed energy resources can cause voltage fluctuations and reactive power imbalances in the grid. Capacitors help mitigate these effects, enabling smoother power flow and reducing strain on transformers and other equipment. As governments encourage renewable deployment through incentives and infrastructure investments, demand for capacitors capable of operating in fluctuating load conditions is expected to rise. Projects integrating energy storage systems alongside renewable plants also benefit from capacitor-based voltage support. Manufacturers that design capacitors with high tolerance to environmental stress, low maintenance needs, and compatibility with smart grid technologies can address the specialized demands of renewable operators. Collaborations with EPC contractors and renewable developers further enhance market reach. By aligning product development with the needs of renewable energy integration, suppliers can position themselves for sustained growth in this sector.

Installing medium voltage electric capacitors requires careful consideration of system configuration, grounding, and protective devices. Improper installation can lead to failures such as dielectric breakdown, overheating, or harmonic resonance issues. Maintenance is equally important, as dust accumulation, moisture ingress, and insulation degradation can reduce performance over time. For many industrial and utility users, skilled personnel and specialized tools are necessary to ensure safe and effective operation. This can increase total project costs and slow deployment, particularly in regions with limited technical expertise. Manufacturers offering pre-assembled capacitor banks, modular designs, and comprehensive installation guides can help reduce complexity. Remote monitoring features also enable predictive maintenance, minimizing downtime and avoiding costly repairs. As grids become more dynamic and equipment utilization increases, easy-to-install, low-maintenance capacitor solutions will be critical for meeting operational demands while ensuring long service life and consistent performance.

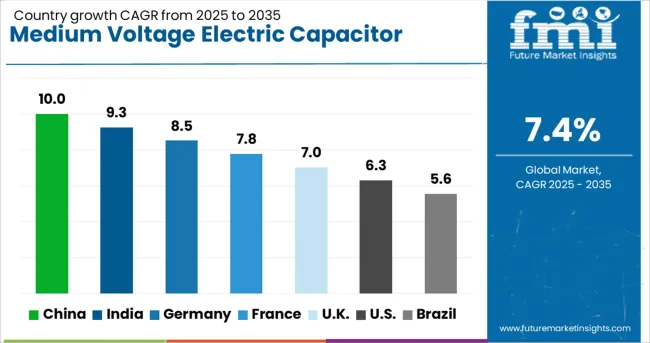

| Country | CAGR |

|---|---|

| China | 10.0% |

| India | 9.3% |

| Germany | 8.5% |

| France | 7.8% |

| UK | 7.0% |

| USA | 6.3% |

| Brazil | 5.6% |

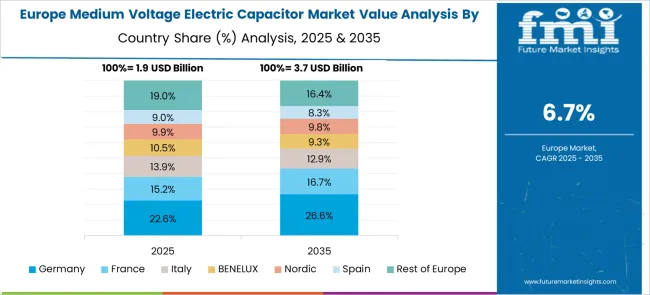

The global medium voltage electric capacitor market is growing at a CAGR of 7.4%, driven by rising electricity demand, grid modernization projects, and the integration of renewable energy sources. China leads with 10.0% growth, supported by large-scale power infrastructure development and expansion of industrial manufacturing. India follows at 9.3%, fueled by rural electrification programs and increasing investments in transmission and distribution networks. Germany records 8.5% growth, reflecting advancements in energy-efficient capacitor technology and strict quality standards. The United Kingdom shows steady growth at 7.0%, focusing on grid stability and renewable integration. The United States, at 6.3%, remains a mature yet evolving market, shaped by smart grid deployment and replacement of aging power equipment. Market dynamics are influenced by dielectric material innovations, voltage stability requirements, and regulatory efficiency targets. This report includes insights on 40+ countries; the top countries are shown here for reference.

China is leading the medium voltage electric capacitor market with a 10.0% CAGR, supported by rapid industrialization and large-scale infrastructure projects. Expanding power generation capacity and the integration of renewable energy sources are driving demand for capacitors that enhance grid stability and efficiency. Utilities are investing in smart grid technologies, where medium voltage capacitors play a critical role in reactive power compensation. Domestic manufacturers are focusing on high-performance, long-life products that meet both local and international standards. The shift toward electric mobility and charging infrastructure is also boosting capacitor deployment in distribution networks.

India is recording a 9.3% CAGR in the medium voltage electric capacitor market, driven by rising electricity demand from urbanization and industrial growth. Power utilities are investing in capacitor banks to improve voltage regulation and reduce transmission losses. The expansion of solar and wind power capacity is creating additional requirements for reactive power management. Local producers are introducing cost-effective solutions suited for diverse climatic conditions. Government initiatives to modernize the power grid, including rural electrification programs, are also boosting market growth.

Germany is seeing an 8.5% CAGR in the medium voltage electric capacitor market, supported by the country's strong renewable energy adoption and grid modernization programs. Capacitors are being used to ensure voltage stability in grids with high shares of intermittent wind and solar power. Manufacturers are focusing on eco-friendly dielectric materials and advanced monitoring systems for predictive maintenance. The industrial sector, especially manufacturing and automotive production, is also contributing to demand by installing capacitors to improve power factor and reduce operational costs.

The United Kingdom is registering a 7.0% CAGR in the medium voltage electric capacitor market, driven by the expansion of offshore wind energy and the need for improved grid efficiency. Power distribution companies are installing capacitor banks to manage reactive power and reduce energy losses. Smart monitoring capabilities are being integrated to track performance and predict maintenance needs. The commercial and industrial segments are also increasing adoption to meet energy efficiency targets and reduce electricity costs.

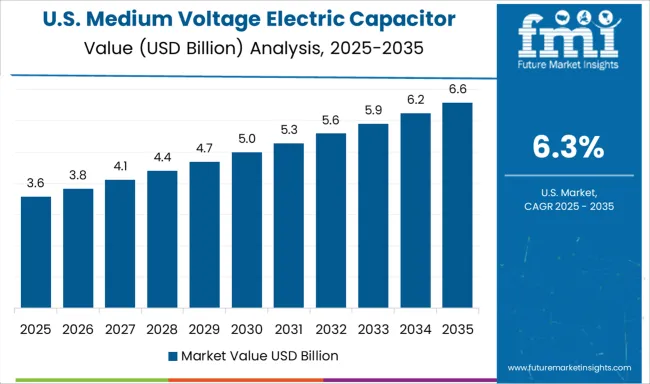

The United States is posting a 6.3% CAGR in the medium voltage electric capacitor market, supported by investments in grid resilience and renewable integration. Utilities are deploying capacitors to optimize voltage profiles and manage reactive power in distribution systems. The aging power infrastructure is prompting modernization projects where capacitors are key components. Growth in electric vehicle charging infrastructure is also driving demand for capacitors in distribution networks. Manufacturers are offering advanced designs with higher thermal stability and improved energy efficiency.

The medium voltage electric capacitor market is growing steadily, driven by the increasing demand for efficient power distribution, grid stability, and renewable energy integration. Medium voltage capacitors are essential for improving power factor, reducing transmission losses, and enhancing voltage regulation in industrial, commercial, and utility-scale applications.

As global electricity consumption rises and grids modernize, these components are playing a critical role in smart grid deployments and energy-efficient infrastructure. Key players in this market are advancing both performance and durability. ABB Ltd. provides a broad range of capacitors designed for reactive power compensation and harmonic filtering, suitable for utilities and heavy industries.

Eaton Corporation offers solutions with enhanced safety, reliability, and compact design for diverse electrical networks. General Electric delivers medium voltage capacitor banks that improve grid efficiency while integrating monitoring and control features for predictive maintenance. Schneider Electric focuses on energy-efficient capacitor systems that align with sustainability goals and digital grid transformation.

Vishay Intertechnology and TDK Corporation both contribute high-performance capacitor technologies with optimized dielectric materials, ensuring long service life and stable operation in demanding environments. With the shift toward renewable integration, electric vehicle infrastructure, and industrial automation, the medium voltage electric capacitor market is expected to benefit from growing investments in grid modernization and power quality improvement initiatives.

On May 16, 2025, Optimal Dynamics announced in an official press release that it had secured USD 40 million in Series C funding, led by Koch Disruptive Technologies, to expand its AI-driven logistics decision-making platform for fleet optimization.

| Item | Value |

|---|---|

| Quantitative Units | USD 7.8 Billion |

| Material | Film capacitors, Ceramic capacitors, Electrolytic capacitors, and Others |

| Polarization | Polarized and Non-Polarized |

| End Use | Transmission & distribution, Automotive, Consumer electronics, Communications & technology, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ABB Ltd., Eaton Corporation, General Electric, Schneider Electric, Vishay Intertechnology, and TDK Corporation |

| Additional Attributes | Dollar sales vary by capacitor type, including film, ceramic, and electrolytic variants; by application, such as power factor correction, reactive power compensation, and harmonic filtering; and by region, led by Asia-Pacific, North America, and Europe. Growth is driven by renewable energy integration, smart grid modernization, and power quality mandates. |

The global medium voltage electric capacitor market is estimated to be valued at USD 7.8 billion in 2025.

The market size for the medium voltage electric capacitor market is projected to reach USD 16.0 billion by 2035.

The medium voltage electric capacitor market is expected to grow at a 7.4% CAGR between 2025 and 2035.

The key product types in medium voltage electric capacitor market are film capacitors, ceramic capacitors, electrolytic capacitors and others.

In terms of polarization, polarized segment to command 58.0% share in the medium voltage electric capacitor market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Medium Voltage Capacitor Bank Market Size and Share Forecast Outlook 2025 to 2035

Low Voltage Electric Capacitor Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Electric Capacitor Market Size and Share Forecast Outlook 2025 to 2035

Automotive High Voltage Electric Capacitor Market Size and Share Forecast Outlook 2025 to 2035

Consumer Electronics High Voltage Electric Capacitor Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Transformer Industry Analysis in North America Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Cable and Accessory Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Transformer Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage AC Power Distribution Units (PDU) Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Utility Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Commercial Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Residential Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Wire and Cable Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Digital Substation Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Circuit Breaker Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Distribution Substation Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Transmission Substation Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Drives Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Market Share Insights of Leading Medium Voltage Transformer Providers

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA