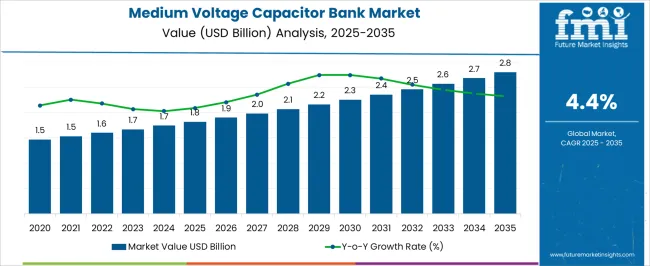

The medium voltage capacitor bank market is estimated to be valued at USD 1.8 billion in 2025 and is projected to reach USD 2.8 billion by 2035, registering a compound annual growth rate (CAGR) of 4.4% over the forecast period.

Regulatory frameworks play a critical role in shaping this market, influencing installation standards, operational efficiency, and safety compliance. National and regional electrical safety standards mandate rigorous testing, certification, and adherence to insulation, voltage, and fault-current specifications. Compliance with these standards ensures that capacitor banks meet reliability and performance requirements, which can affect adoption timelines and deployment costs across industrial, commercial, and utility applications. Energy efficiency regulations also impact market dynamics. Many countries have introduced incentives or mandates for reactive power compensation and voltage stabilization, driving the deployment of capacitor banks to reduce transmission losses and improve overall power quality.

Environmental regulations further influence the market by restricting the use of certain dielectric fluids and materials, requiring manufacturers to innovate with low-toxicity or non-PCB alternatives. Utility grid codes and harmonization requirements enforce standardized integration with existing power distribution infrastructure, particularly for medium voltage systems, ensuring that capacitor banks do not adversely affect system stability or create resonance issues. Penalties for non-compliance or delayed adoption of regulatory-mandated technologies can also influence project planning and procurement decisions. The regulatory impact on the market governs technology selection, design compliance, and deployment strategy, contributing to steady yet controlled market growth throughout the forecast period.

| Metric | Value |

|---|---|

| Medium Voltage Capacitor Bank Market Estimated Value in (2025 E) | USD 1.8 billion |

| Medium Voltage Capacitor Bank Market Forecast Value in (2035 F) | USD 2.8 billion |

| Forecast CAGR (2025 to 2035) | 4.4% |

The medium voltage capacitor bank market represents a specialized segment within the power management and electrical distribution industry, emphasizing reactive power compensation, voltage stabilization, and energy efficiency. Within the overall capacitor market, it accounts for about 5.6%, driven by demand from utilities, industrial facilities, and commercial establishments. In the industrial electrical equipment segment, it holds nearly 6.1%, reflecting use in process industries, manufacturing plants, and heavy machinery operations. Across the renewable energy integration and grid support market, the segment captures 4.3%, supporting stable power delivery from variable sources. Within the smart grid and energy automation category, it represents 3.7%, highlighting monitoring, control, and optimization capabilities.

In the electrical infrastructure and distribution systems sector, it secures 4.2%, emphasizing network reliability, loss reduction, and power quality improvement. Recent developments in this market have focused on digital monitoring, modular designs, and hybrid capacitor technologies. Innovations include smart capacitor banks integrated with IoT sensors, remote monitoring, and automated switching for optimized reactive power management. Key players are collaborating with utilities and industrial operators to enhance reliability, energy efficiency, and predictive maintenance capabilities. Hybrid solutions combining power factor correction with harmonic filtering are gaining traction to improve grid performance and reduce operational costs. Additionally, environmental and safety considerations are driving adoption of low-loss, maintenance-free capacitor technologies. These trends demonstrate how digitalization, efficiency, and operational resilience are shaping the medium voltage capacitor bank market.

The medium voltage capacitor bank market is growing steadily, supported by the rising demand for efficient power management solutions across utility and industrial sectors. Industry reports and utility infrastructure updates have pointed to increased adoption of capacitor banks to improve voltage stability, enhance grid efficiency, and minimize power losses.

Aging grid infrastructure in developed regions and ongoing electrification projects in emerging economies have further encouraged investments in medium voltage systems. Technological advancements, such as automated control systems and real-time monitoring, have enhanced operational efficiency, driving higher installation rates.

In addition, regulatory mandates promoting reactive power compensation and energy efficiency are accelerating market uptake. The market’s future growth will be shaped by grid modernization programs, renewable energy integration, and expanding industrial loads that require reliable power factor management.

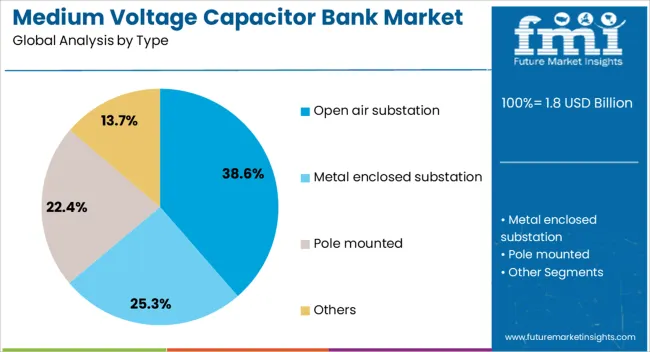

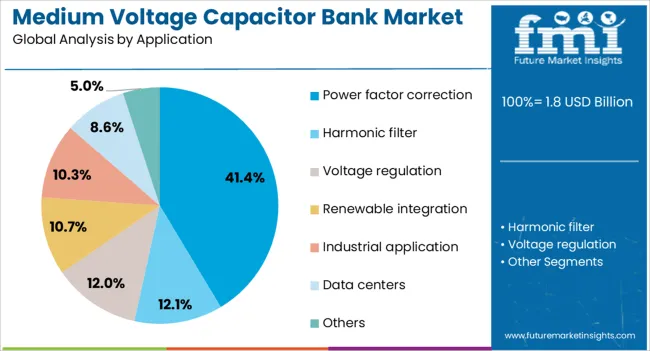

The medium voltage capacitor bank market is segmented by type, application, and geographic regions. By type, medium voltage capacitor bank market is divided into open air substation, metal enclosed substation, pole mounted, and others. In terms of application, medium voltage capacitor bank market is classified into power factor correction, harmonic filter, voltage regulation, renewable integration, industrial application, data centers, and others. Regionally, the medium voltage capacitor bank industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The open air substation segment is projected to account for 38.6% of the medium voltage capacitor bank market revenue in 2025, maintaining its lead in the type category. This dominance is driven by its cost-effectiveness, ease of maintenance, and suitability for outdoor installation in large-scale utility applications. Open air substations are preferred in projects where space availability is not a constraint, allowing for flexible configuration and scalability. Their robust design enables effective handling of high-voltage operations in varying climatic conditions. Utilities have increasingly deployed open air capacitor banks for grid stabilization, particularly in transmission and distribution networks that require large reactive power compensation. With ongoing investments in utility-scale power infrastructure, the Open Air Substation segment is expected to retain its strong market position.

The power factor correction segment is projected to contribute 41.4% of the medium voltage capacitor bank market revenue in 2025, establishing itself as the leading application area. Growth in this segment is fueled by the critical role of power factor correction in reducing electrical losses, optimizing equipment performance, and avoiding penalties from utility providers. Industrial facilities, commercial complexes, and utility operators have increasingly adopted capacitor banks to maintain efficient power usage and ensure grid compliance. Technological enhancements in automatic power factor correction systems have further improved operational efficiency, enabling real-time adjustments to fluctuating load conditions. As industries continue to expand production capacity and utilities modernize their networks, demand for power factor correction solutions is expected to grow, solidifying this segment’s market leadership.

The market has been witnessing steady growth due to increasing demand for energy efficiency, voltage regulation, and power factor correction across industrial, commercial, and utility sectors. These capacitor banks are used to improve power quality, reduce energy losses, and stabilize electrical distribution networks. Applications span manufacturing plants, renewable energy integration, data centers, and large commercial facilities. Growth has been driven by rising electricity costs, government incentives for energy efficiency, and the expansion of electrical infrastructure in developing regions. Technological improvements, such as digital monitoring, modular design, and enhanced dielectric materials, have increased operational reliability and safety.

Industrial and commercial facilities have been major adopters of medium voltage capacitor banks to ensure stable voltage and improve power factor. Large-scale manufacturing plants with heavy inductive loads, such as motors, compressors, and conveyors, benefit from reduced energy losses and lower utility penalties. Commercial complexes, including malls, hospitals, and office buildings, integrate capacitor banks to maintain consistent power supply and prevent voltage dips affecting sensitive equipment. Advanced capacitor bank configurations with automatic switching and digital monitoring allow precise control of reactive power, mitigating harmonics and improving network stability. Integration with energy management systems facilitates real-time optimization, ensuring operational efficiency. The growth of electricity-intensive operations and expansion of industrial zones has reinforced the critical role of medium voltage capacitor banks in maintaining energy efficiency and operational reliability.

The integration of renewable energy sources, such as solar and wind, has increased the importance of medium voltage capacitor banks for grid stability. Intermittent generation patterns from renewables can cause voltage fluctuations and reactive power imbalances. Capacitor banks are used to compensate for reactive power, stabilize voltage, and enhance the reliability of distribution networks. In microgrids and hybrid energy systems, modular and digital capacitor banks provide flexibility to adapt to varying load conditions. Utilities and independent power producers deploy these banks to maintain compliance with grid codes and improve overall power quality. The capacitor banks reduce transmission losses and support efficient utilization of distributed energy resources, making them an essential component for modern energy networks integrating renewable generation.

Technological advancements have improved the efficiency, safety, and versatility of medium voltage capacitor banks. Digital monitoring systems allow remote diagnostics, fault detection, and real-time performance tracking, reducing maintenance requirements and operational downtime. Modular designs enable easier scalability and faster installation in evolving electrical networks. Innovations in dielectric materials and overvoltage protection improve reliability and extend equipment lifespan. Safety features, such as pressure relief devices and arc-resistant enclosures, have enhanced operational security in industrial environments. Research into hybrid capacitor technologies and integration with smart grids has expanded the functional capabilities of capacitor banks. These technological strides are enabling manufacturers and utilities to deploy reliable, high-performance solutions while meeting evolving energy efficiency and regulatory requirements.

Despite growth, the market faces challenges linked to regulatory compliance, harmonics management, and maintenance costs. Utilities must adhere to stringent grid codes for power factor correction, voltage stability, and reactive power compensation. Capacitor banks can introduce harmonic distortion if not properly filtered, necessitating additional equipment and technical expertise. Upfront capital investment for high-capacity, digitally monitored capacitor banks can be a barrier for small and medium enterprises. Moreover, fluctuations in raw material prices, including aluminum and dielectric components, impact manufacturing costs. To overcome these challenges, market participants are focusing on advanced design, modular systems, and harmonics mitigation technologies. These measures are expected to improve adoption rates while maintaining operational reliability and regulatory compliance.

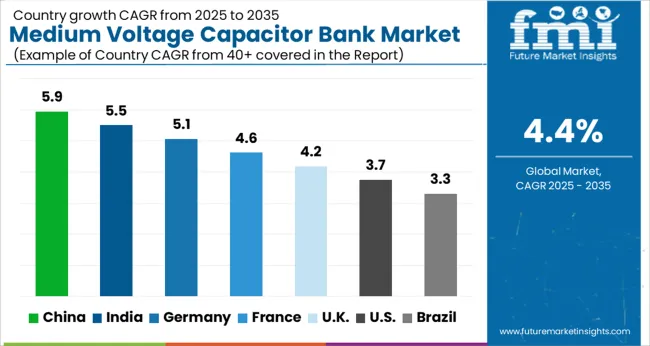

| Country | CAGR |

|---|---|

| China | 5.9% |

| India | 5.5% |

| Germany | 5.1% |

| France | 4.6% |

| UK | 4.2% |

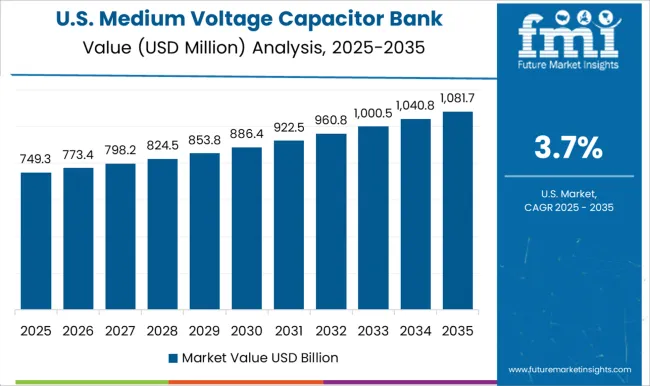

| USA | 3.7% |

| Brazil | 3.3% |

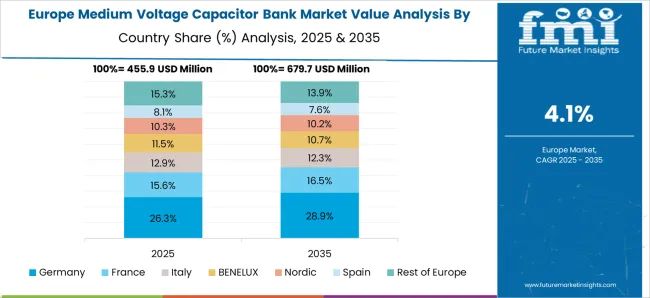

China leads the market with a forecast growth rate of 5.9%, driven by widespread deployment in power distribution networks and industrial automation. India follows at 5.5%, supported by increasing investments in grid modernization and reactive power compensation solutions. Germany records 5.1%, where integration of smart grid technologies and energy-efficient systems sustains market activity. The United Kingdom reaches 4.2%, backed by government initiatives in electrical infrastructure upgrades. The United States maintains 3.7%, with consistent adoption in industrial and commercial power systems. Collectively, these countries illustrate the global trends in production, scaling, and technological integration of medium voltage capacitor banks. This report includes insights on 40+ countries; the top markets are shown here for reference.

The market in China is expected to grow at a CAGR of 5.9%, supported by increasing investments in power distribution networks and industrial electrification projects. Growth is driven by rising adoption of capacitor banks for reactive power compensation, energy efficiency, and voltage stabilization in commercial and industrial facilities. The market benefits from government initiatives to modernize grid infrastructure and reduce transmission losses. Integration of advanced capacitor technologies in manufacturing plants and renewable energy facilities is gaining traction. The expanding industrial base, along with modernization of electric utilities, is contributing to steady demand. China’s emphasis on improving power quality and reducing energy costs is further fueling market expansion.

India’s Medium Voltage Capacitor Bank Market is projected to grow at a CAGR of 5.5%, driven by the need for improved energy efficiency and voltage control across industrial and commercial sectors. Expansion of industrial zones and the ongoing modernization of electrical grids are creating opportunities for capacitor bank adoption. Market growth is supported by increasing investments in renewable energy integration, particularly solar and wind, which require reactive power compensation. Indian manufacturers are increasingly implementing advanced capacitor technologies to enhance energy reliability. Government policies promoting energy efficiency and sustainable power distribution are encouraging uptake. The focus on minimizing losses and stabilizing power systems is boosting market adoption across the country.

Germany is expected to expand at a CAGR of 5.1%, supported by industrial modernization and the transition toward smart grids. The market is driven by increased use of capacitor banks for maintaining voltage stability, reducing power losses, and enhancing energy efficiency in manufacturing plants and commercial facilities. Growth is further fueled by integration with renewable energy sources and smart grid solutions to optimize reactive power management. German utilities and industrial players are adopting advanced capacitor technologies to meet stringent power quality standards. Focus on reducing carbon emissions and improving energy reliability is encouraging investment in medium voltage capacitor banks. Research and development in power electronics is also enhancing market potential.

The market in the United Kingdom is projected to grow at a CAGR of 4.2%, influenced by the need to improve power reliability and support industrial electrification. Capacitor banks are increasingly deployed to manage reactive power, stabilize voltage, and reduce losses in commercial and industrial electrical networks. The market is supported by the adoption of smart grid technologies and renewable energy integration, which necessitate efficient reactive power solutions. Investments in upgrading grid infrastructure and ensuring energy efficiency in industrial facilities are further fueling demand. The UK’s regulatory environment emphasizing power quality, low-carbon energy, and energy cost reduction is promoting market growth, with both utilities and industrial players actively adopting medium voltage capacitor solutions.

The United States is expected to grow at a CAGR of 3.7%, driven by modernization of electrical distribution systems and increasing energy efficiency initiatives. Adoption is fueled by industrial demand for voltage stabilization, reactive power compensation, and reduction of transmission losses. The market is further supported by renewable energy integration, particularly solar and wind farms, requiring advanced capacitor technologies to manage variable loads. Utilities and industrial players are upgrading infrastructure to meet reliability and power quality standards. Government programs promoting smart grid deployment and energy-efficient solutions are enhancing market expansion. Focus on maintaining stable power systems while reducing operational costs is encouraging broader adoption of medium voltage capacitor banks across commercial and industrial applications.

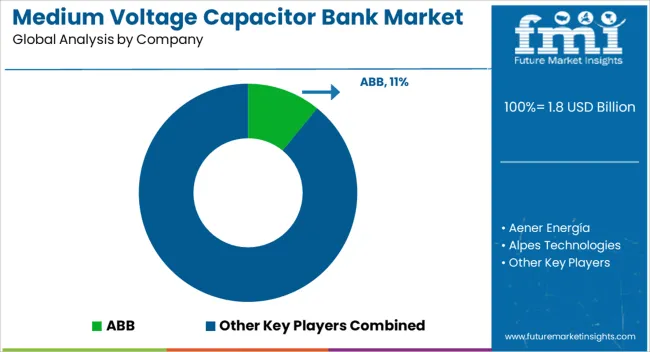

The market is expanding as power utilities and industrial sectors increasingly adopt solutions to improve power factor, reduce energy losses, and enhance grid stability. ABB and General Electric are prominent players, providing advanced capacitor bank systems with high reliability and scalable designs suitable for diverse industrial and utility applications. Eaton and Schneider Electric focus on integrated solutions combining medium voltage capacitor banks with monitoring and control systems to optimize energy efficiency and reduce operational costs. Siemens and Hitachi Energy offer smart capacitor banks with automated switching capabilities, enabling real-time reactive power compensation and voltage regulation in medium voltage networks.

Bharat Heavy Electricals Limited and Larsen & Toubro deliver customized solutions for large-scale industrial setups and renewable integration projects, ensuring system robustness and compliance with grid codes. ARTECHE, CIRCUTOR, and ZEZ SILKO specialize in compact and modular capacitor bank solutions suitable for urban and industrial installations, supporting seamless installation and maintenance. These providers are driving innovation in reactive power management, enhancing grid reliability, and contributing to energy-efficient medium voltage power distribution systems.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.8 billion |

| Type | Open air substation, Metal enclosed substation, Pole mounted, and Others |

| Application | Power factor correction, Harmonic filter, Voltage regulation, Renewable integration, Industrial application, Data centers, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ABB, Aener Energía, Alpes Technologies, ARTECHE, Bharat Heavy Electricals Limited, CIRCUTOR, Eaton, Enerlux Power, General Electric, Hitachi Energy, Larsen & Toubro, Nissin Electric Co., Ltd., Powerside, Schweitzer Engineering Laboratories, Inc., Schneider Electric, Siemens, The Legrand Group, and ZEZ SILKO |

| Additional Attributes | Dollar sales by capacitor type and application, demand dynamics across industrial, commercial, and utility sectors, regional trends in reactive power compensation adoption, innovation in energy efficiency, compact design, and fault tolerance, environmental impact of material usage and disposal, and emerging use cases in power quality management, smart grid integration, and renewable energy systems. |

The global medium voltage capacitor bank market is estimated to be valued at USD 1.8 billion in 2025.

The market size for the medium voltage capacitor bank market is projected to reach USD 2.8 billion by 2035.

The medium voltage capacitor bank market is expected to grow at a 4.4% CAGR between 2025 and 2035.

The key product types in medium voltage capacitor bank market are open air substation, metal enclosed substation, pole mounted and others.

In terms of application, power factor correction segment to command 41.4% share in the medium voltage capacitor bank market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Medium Duty Truck Market Size and Share Forecast Outlook 2025 to 2035

Medium-duty Engine Market Size and Share Forecast Outlook 2025 to 2035

Medium Earth Orbit (MEO) Satellite IoT Market Size and Share Forecast Outlook 2025 to 2035

Medium Format Film Cameras Market Size and Share Forecast Outlook 2025 to 2035

Medium Density Fiberboard (MDF) Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Medium-Chain Triglycerides Market Growth -Functional Fats & Industry Demand 2025 to 2035

Medium Carbon Steel Market

Medium Voltage Transformer Industry Analysis in North America Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Cable and Accessory Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Transformer Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage AC Power Distribution Units (PDU) Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Utility Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Commercial Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Residential Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Wire and Cable Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Digital Substation Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Circuit Breaker Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Distribution Substation Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Transmission Substation Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA