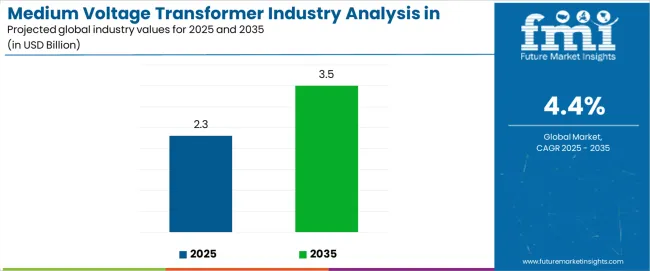

North America's medium voltage transformer demand is projected to grow from USD 2.3 billion in 2025 to approximately USD 3.5 billion by 2035, recording an absolute increase of USD 1.2 billion over the forecast period. This translates into total growth of 52.2%, with demand forecast to expand at a compound annual growth rate (CAGR) of 4.4% between 2025 and 2035. Overall sales are expected to grow by nearly 1.52X during the same period, supported by accelerating grid modernization initiatives, expanding renewable energy interconnections, and growing demand for distribution infrastructure across utility, industrial, and commercial applications. North America, led by the United States, Canada, and Mexico, continues to demonstrate strong growth potential driven by infrastructure replacement cycles, electrification mandates, and reliability enhancement programs.

Between 2025 and 2030, medium voltage transformer industry in North America is projected to expand from USD 2.3 billion to USD 2.8 billion, resulting in a value increase of USD 0.5 billion, which represents 41.7% of the total forecast growth for the decade. This phase of growth will be shaped by accelerating utility distribution substation construction, expanding renewable energy interconnection requirements for wind and solar projects, and increasing replacement cycles for aging transformer fleets installed during previous infrastructure buildout periods. Growing adoption of EV charging infrastructure, data center construction activity, and industrial facility expansions continue to drive transformer adoption. Equipment suppliers are expanding manufacturing capacity to address infrastructure timelines and supply chain reliability requirements, with particular emphasis on mineral-oil insulated pad-mounted configurations serving utility distribution applications.

From 2030 to 2035, demand is forecast to grow from USD 2.8 billion to USD 3.5 billion, adding another USD 0.7 billion, which constitutes 58.3% of the overall ten-year expansion. This period is expected to be characterized by maturation of grid modernization programs incorporating advanced monitoring capabilities, widespread adoption of natural ester insulating fluids for environmental compliance and fire safety, and expansion of microgrid and distributed energy resource interconnections requiring flexible transformer solutions. The growing emphasis on grid resilience, particularly in hurricane-prone coastal regions and wildfire-vulnerable areas, will drive demand for ruggedized and quick-replacement transformer designs across utility and critical infrastructure applications.

Between 2020 and 2025, medium voltage transformer industry in North America experienced steady expansion, growing from USD 1.9 billion to USD 2.3 billion. This growth was driven by utility distribution system reinforcement programs, recovery from pandemic-related project delays, and acceleration of renewable energy interconnections supporting decarbonization commitments. The sector developed as electric utilities, industrial operators, and commercial developers recognized the need for modern distribution infrastructure supporting electrification trends while meeting contemporary efficiency and environmental standards.

| Metric | Value |

|---|---|

| North America Medium Voltage Transformer Sales Value (2025) | USD 2.3 billion |

| North America Medium Voltage Transformer Forecast Value (2035) | USD 3.5 billion |

| North America Medium Voltage Transformer Forecast CAGR (2025-2035) | 4.4% |

Demand expansion is being supported by the fundamental transformation of electric distribution infrastructure across North America, driven by grid modernization mandates addressing aging equipment populations, renewable energy integration requirements creating new substation and interconnection needs, and electrification trends including EV charging networks and industrial process conversions from fossil fuels to electricity. Modern electric distribution systems rely on medium voltage transformers as critical infrastructure stepping down transmission voltages to distribution levels suitable for commercial, industrial, and residential consumption. These transformers serve as essential components in utility substations, pad-mounted installations serving underground distribution networks, and pole-mounted configurations supporting overhead distribution systems across diverse geographic and climatic conditions.

The accelerating pace of renewable energy development is creating substantial transformer demand for interconnecting wind farms, solar installations, and battery storage facilities to electric distribution and transmission networks. Each utility-scale renewable project requires dedicated step-up transformers converting generator output voltages to distribution or transmission levels, with distributed solar installations and community renewable projects adding numerous smaller transformer installations across service territories. The simultaneous expansion of EV charging infrastructure, particularly DC fast charging stations and depot charging facilities serving commercial fleets, creates concentrated electrical loads requiring new distribution transformers or upgrades to existing installations supporting increased capacity requirements.

The North America medium voltage transformer sector stands at a critical infrastructure inflection point where utility modernization imperatives, renewable energy expansion, and electrification trends converge to drive sustained demand growth. With demand projected to grow from USD 2.3 billion in 2025 to USD 3.5 billion by 2035-a robust 52.2% increase-the sector is being fundamentally reshaped by infrastructure replacement cycles, environmental compliance requirements, and the pursuit of grid resilience and reliability enhancement.

The confluence of aging infrastructure requiring systematic replacement, regulatory mandates for improved efficiency and environmental performance, and load growth from electrification trends creates sustained procurement activity across utility, industrial, and commercial segments. Electric utilities managing thousands of distribution transformers face simultaneous pressures to maintain reliability standards, integrate distributed energy resources, and prepare for load growth from transportation and building electrification while managing capital budgets and regulatory cost recovery constraints.

Strategic pathways encompassing natural ester insulating fluids, smart transformer monitoring systems, rapid-deployment solutions, and specialized application designs offer substantial margin enhancement opportunities for manufacturers and suppliers positioned at the technology and service frontier.

Pathway A - Natural Ester Insulating Fluid Solutions. Environmental regulations and utility sustainability commitments are accelerating adoption of biodegradable natural ester insulating fluids offering superior fire safety, reduced environmental impact from spills, and extended insulation life. Transformers incorporating natural ester fluids command 10-20% price premiums while addressing regulatory compliance and corporate environmental objectives. Expected revenue pool: USD 165-285 million.

Pathway B - Smart Transformer Monitoring & Diagnostics. Integration of IoT sensors, dissolved gas analysis, thermal monitoring, and predictive analytics enables utilities to transition from time-based maintenance to condition-based strategies reducing failures and extending asset life. Connected transformer solutions with comprehensive monitoring capabilities create recurring software and service revenue streams. Potential: USD 145-245 million.

Pathway C - Rapid-Deployment Modular Solutions. Supply chain disruptions and extended lead times drive utility interest in pre-configured transformer solutions enabling faster installation and reduced on-site construction requirements. Modular designs with factory-installed accessories and simplified foundation requirements address deployment urgency during grid emergencies and capacity expansion programs. Revenue opportunity: USD 185-310 million.

Pathway D - Renewable Energy Interconnection Transformers. Wind, solar, and battery storage interconnections require specialized transformer designs accommodating variable generation profiles, power electronics harmonics, and outdoor installation conditions. Application-specific solutions optimized for renewable integration capture growing segment driven by decarbonization mandates. Addressable opportunity: USD 220-375 million.

Pathway E - EV Charging Infrastructure Transformers. DC fast charging stations and fleet depot charging facilities create concentrated electrical loads requiring dedicated distribution transformers with designs accommodating high utilization factors and power quality requirements. Specialized solutions for EV infrastructure serve rapidly expanding segment. Expected uplift: USD 125-215 million.

Pathway F - Data Center & Mission-Critical Solutions. Hyperscale data center expansion and edge computing deployments require highly reliable transformers with redundant configurations, comprehensive monitoring, and rapid service restoration capabilities. Premium solutions for mission-critical applications command substantial margins in growing segment. Potential: USD 195-330 million.

Pathway G - Grid Resilience & Storm-Hardened Designs. Hurricane, wildfire, and extreme weather events drive utility investments in ruggedized transformer designs, rapid-replacement programs, and strategic inventory positioning. Solutions specifically engineered for disaster resilience and rapid restoration address utility priority objectives. Revenue opportunity: USD 155-265 million.

Pathway H - Comprehensive Service & Lifecycle Management. Utilities value suppliers providing installation services, preventive maintenance programs, oil processing, repair capabilities, and asset management support throughout transformer lifecycles. Integrated service offerings create differentiation and recurring revenue beyond equipment sales. Addressable opportunity: USD 175-295 million.

Pathway I - Industrial Process Electrification. Manufacturing facilities converting thermal processes to electric alternatives, refineries expanding electrical infrastructure, and industrial decarbonization initiatives create demand for transformers supporting increased electrical loads and specialized industrial requirements. Market potential: USD 165-280 million.

Pathway J - Central America & Caribbean Growth. Mexico, Dominican Republic, Panama, and other regional markets demonstrate above-average growth rates driven by infrastructure development, tourism expansion, and industrial corridor buildouts. Targeted positioning in high-growth regional markets captures accelerated demand. Revenue opportunity: USD 205-350 million.

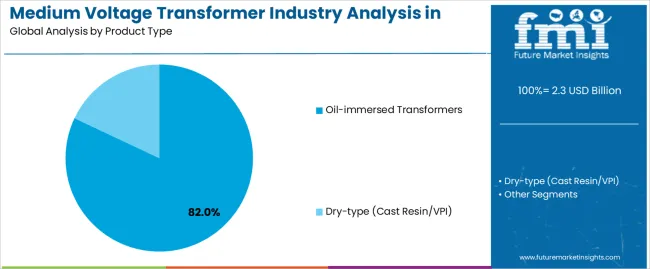

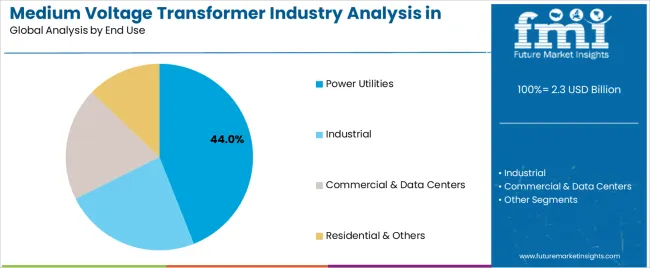

Demand is segmented by product type, end use, and mounting/supply configuration. By product type, sales are divided into oil-immersed transformers and dry-type transformers. Based on end use, demand is categorized into power utilities, industrial applications, commercial and data centers, and residential and other applications. In terms of mounting/supply, sales are segmented into pad-mounted and pole-mounted configurations.

Oil-immersed transformers are projected to account for 82% of medium voltage transformer industry in North America in 2025, making this product type the dominant segment across utility and industrial applications. This overwhelming dominance reflects the fundamental advantages of liquid insulation for medium voltage applications, including superior cooling efficiency enabling higher power densities, proven long-term reliability across diverse operating conditions, and cost-effectiveness for installations above approximately 500 kVA capacity. The segment encompasses mineral-oil insulated transformers (68.0% subsegment share) representing the established technology with lowest initial cost and extensive service experience across utility fleets, natural ester biodegradable insulating fluids (9.0%) offering environmental advantages and improved fire safety performance, and synthetic ester fluids (5.0%) providing high-temperature capability and extended insulation life for specialized applications.

Power utilities are projected to account for 44% of medium voltage transformer industry in North America in 2025, making this end user category the leading segment driven by extensive distribution infrastructure networks serving residential, commercial, and small industrial customers across service territories. The segment encompasses distribution substations (28.0% subsegment share) stepping down transmission voltages to distribution levels and serving as primary delivery points for urban and suburban load centers, renewable interconnects (10.5%) connecting wind farms, solar installations, and battery storage to distribution or transmission networks, and EV charging hubs and microgrids (5.5%) supporting transportation electrification and distributed energy systems.

Distribution substations represent the largest subsegment, with investor-owned utilities, public power districts, municipal utilities, and rural electric cooperatives operating thousands of substations across North America requiring ongoing capacity additions, equipment replacements, and system reinforcements. Typical utility distribution planning establishes substation capacities sized for projected load growth with transformer additions or replacements programmed as load densities increase or equipment reaches retirement age. Utilities face increasing pressure to maintain reliability while integrating distributed energy resources, accommodating load growth from electrification, and managing aging infrastructure requiring systematic replacement programs.

Medium voltage transformer industry in North America is advancing steadily due to grid modernization initiatives addressing aging infrastructure, renewable energy expansion requiring interconnection transformers, and electrification trends including EV charging and industrial process conversions. However, the sector faces challenges including extended manufacturing lead times constraining project timelines, skilled labor shortages affecting installation and maintenance capabilities, and supply chain complexity for electrical steel and specialized components. Smart grid integration and advanced monitoring capabilities continue to influence equipment specifications and create service opportunities.

North America's medium voltage transformer installed base includes substantial equipment populations installed during infrastructure buildout periods in 1960s-1980s, with many units approaching or exceeding typical 30-40 year service life expectations based on utility asset management standards. Electric utilities operate systematic replacement programs identifying aging transformers through combination of service age, condition assessment results, maintenance history, and reliability performance. These programs establish multi-year equipment procurement requirements providing demand visibility and enabling suppliers to plan production capacity and maintain inventory positions aligned with utility replacement schedules. Utilities balance replacement timing considerations including remaining equipment life assessment through oil analysis and diagnostic testing, load growth projections indicating capacity adequacy, and capital budget constraints requiring prioritization of highest-risk assets.

Wind, solar, and battery storage capacity additions across North America require dedicated transformers converting generator output voltages to distribution or transmission levels for grid interconnection. Each utility-scale wind turbine typically employs 690V to 34.5kV step-up transformers, with wind farms requiring additional collector substation transformers aggregating multiple turbine outputs for transmission delivery. Solar installations utilize combiner transformers collecting outputs from multiple inverters plus main step-up transformers delivering power to interconnection points, with transformer quantities and capacities determined by project size and electrical design configurations. The renewable segment demonstrates strong growth trajectories driven by state renewable portfolio standards, corporate power purchase agreements, and economic competitiveness of wind and solar generation compared to fossil alternatives. Interconnection transformer specifications differ from utility distribution standards through requirements for outdoor installation in remote locations, designs accommodating power electronics harmonics from inverter-based generation, and delivery timelines aligned with construction schedules rather than utility fleet replacement cycles.

.webp)

| Country | CAGR (2025-2035) |

|---|---|

| Mexico | 5.4% |

| Dominican Republic | 5.6% |

| Panama | 5.2% |

| Guatemala | 5.1% |

| Costa Rica | 5.0% |

| Canada | 4.8% |

| United States | 4.1% |

Medium voltage transformer industry in North America demonstrates significant country-level variation in growth patterns, driven by diverse factors including infrastructure development stages, electrification rates, economic growth trajectories, and regulatory environments. Mexico leads growth at 5.4% CAGR through 2035, reflecting grid expansion for industrial corridors and renewable energy projects combined with substation densification in growing metropolitan areas. Dominican Republic follows at 5.6% CAGR, driven by tourism-led load growth, utility modernization initiatives, and hurricane-resilient infrastructure rebuilds. Panama exhibits 5.2% growth supported by canal-zone industrial loads, port electrification, and expanding data center investments serving regional connectivity requirements.

Demand for medium voltage transformers in Mexico is projected to grow at 5.4% CAGR through 2035, the highest among major North American markets, driven by grid expansion supporting industrial corridor development along United States border regions, substantial renewable energy capacity additions including wind and solar projects, and substation densification in metropolitan areas experiencing rapid population growth and economic development. Mexico's position as a manufacturing hub serving North American supply chains creates concentrated electrical infrastructure requirements in industrial parks and production facilities requiring reliable distribution transformer installations.

Mexico's ambitious renewable energy targets and supporting regulatory framework drive continuing project development requiring transformers specifically designed for renewable applications. Additionally, urban growth in Monterrey, Guadalajara, Mexico City, and other metropolitan areas generates ongoing distribution infrastructure expansion with transformer requirements supporting residential, commercial, and industrial load growth.

Demand for medium voltage transformers in Dominican Republic is expanding at 5.6% CAGR, the highest rate across analyzed countries, driven by tourism-led load growth supporting resort development and hospitality infrastructure expansion, utility modernization programs upgrading aging distribution systems, and hurricane-resilient infrastructure rebuilds following storm damage events. The country's tourism sector creates concentrated electrical loads in coastal resort areas requiring robust distribution infrastructure supporting hotels, entertainment complexes, and supporting commercial development.

Dominican Republic's electric utilities are implementing systematic modernization programs replacing aging equipment, expanding substation capacity in high-growth regions, and improving system reliability through infrastructure hardening initiatives. Hurricane exposure drives specifications favoring rapid-replacement transformer designs, strategic spare inventory positioning, and ruggedized construction withstanding severe weather conditions.

Demand for medium voltage transformers in Panama is growing at 5.2% CAGR, driven by canal-zone industrial loads supporting expanded shipping operations and logistics facilities, port electrification initiatives modernizing cargo handling infrastructure, and data center investments serving regional connectivity and cloud services requirements. The Panama Canal expansion and associated industrial development create concentrated electrical infrastructure requirements in canal-adjacent areas supporting expanded operations and supporting logistics activities.

Panama's strategic position as a logistics hub connecting Atlantic and Pacific shipping routes drives port infrastructure modernization incorporating electrified cargo handling equipment, refrigerated container storage facilities, and expanded warehouse operations requiring substantial distribution transformer installations.

Demand for medium voltage transformers in Guatemala is expanding at 5.1% CAGR, driven by rural electrification initiatives extending electrical service to previously unserved communities, distribution system upgrades improving reliability in existing service territories, and multilateral funding support from development banks financing infrastructure improvements. Guatemala's rural electrification programs create distributed transformer demand across geographic areas requiring new distribution infrastructure connecting remote communities to electrical grids.

The country's electric utilities operate under regulatory mandates to expand service coverage and improve system reliability, with transformer procurement supported by international development financing enabling systematic infrastructure investments. Distribution system upgrades in urban areas address load growth, equipment obsolescence, and reliability improvement objectives through substation capacity additions and transformer replacements.

Demand for medium voltage transformers in Costa Rica is growing at 5.0% CAGR, supported by renewable energy integration requirements connecting hydroelectric, wind, geothermal, and solar generation to distribution networks, eco-industrial park development incorporating sustainable manufacturing practices and comprehensive infrastructure, and continuing electrification supporting economic development objectives. Costa Rica's commitment to renewable energy generation creates substantial interconnection transformer demand as diverse generation resources deliver power to electrical grids.

The country's emphasis on sustainable development and environmental stewardship drives specifications favoring natural ester insulating fluids, high-efficiency designs, and transformers incorporating environmental protection features exceeding standard utility requirements. Eco-industrial parks incorporating renewable energy, district cooling systems, and sustainable infrastructure practices create concentrated transformer demand with specifications emphasizing efficiency, environmental compliance, and integration with distributed energy systems.

Demand for medium voltage transformers in Canada is projected to expand at 4.8% CAGR, driven by mining sector infrastructure supporting resource extraction in remote northern regions, transmission system upgrades connecting renewable generation and load centers, and cold-region reliability programs ensuring equipment performance in extreme temperature environments. Canada's extensive mining operations in British Columbia, Ontario, Quebec, and northern territories create substantial transformer demand serving mine sites, processing facilities, and supporting infrastructure in challenging climatic conditions.

The country's emphasis on hydroelectric generation and expanding wind capacity requires transmission infrastructure connecting generation resources to population centers, with transformer installations at switching stations, interconnection points, and distribution substations. Cold-region specifications require specialized designs accommodating extreme low temperatures, thermal cycling stresses, and equipment de-rating considerations ensuring reliable operation during winter conditions.

Demand for medium voltage transformers in United States is growing at 4.1% CAGR through 2035, driven by utility grid modernization programs addressing aging infrastructure and integrating distributed energy resources, EV charging corridor development supporting transportation electrification policies, and data center buildouts serving cloud computing and digital services expansion. The United States represents the largest absolute demand volume in North America, with investor-owned utilities, public power systems, and rural electric cooperatives operating extensive distribution infrastructure requiring ongoing equipment additions and systematic replacements.

Grid modernization initiatives incorporate advanced monitoring capabilities, distribution automation systems, and infrastructure supporting distributed solar, storage, and demand response programs. These programs drive specifications favoring smart transformers with monitoring sensors, communications interfaces, and designs optimized for integration with utility management systems.

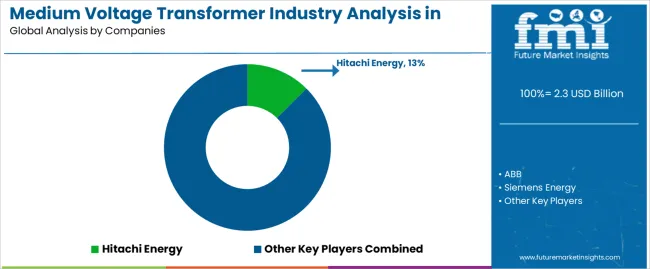

Medium voltage transformer industry in North America is defined by competition among global transformer manufacturers, regional specialists, and vertically integrated electrical equipment suppliers. Manufacturers are investing in expanded production capacity addressing extended lead times, natural ester fluid technologies meeting environmental requirements, smart monitoring capabilities supporting utility asset management programs, and comprehensive service networks delivering installation, maintenance, and repair capabilities. Strategic partnerships between transformer manufacturers and utility customers, technology development in monitoring and diagnostics systems, and geographic manufacturing expansion optimizing logistics and service support are central to strengthening competitive positioning across diverse utility, industrial, and commercial applications.

Hitachi Energy, operating globally with significant North America manufacturing presence, leads with approximately 13% share through comprehensive transformer portfolios, advanced monitoring technologies, and substantial capacity expansion investments supporting grid modernization and renewable energy requirements. ABB, headquartered in Switzerland with extensive North American operations, provides complete distribution transformer solutions emphasizing digital integration, natural ester technologies, and utility standardization programs serving investor-owned and public power customers.

Siemens Energy delivers advanced transformer technologies with focus on efficiency optimization, modular designs, and manufacturing capacity expansion supporting United States grid reliability initiatives. Schneider Electric offers comprehensive medium voltage solutions integrating transformers with distribution automation, monitoring systems, and utility management platforms serving utility and industrial applications. Eaton provides distribution transformers emphasizing utility standardization, pad-mounted configurations, and North American manufacturing capacity serving utility fleet requirements and commercial applications.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.5 billion |

| Product Type | Oil-immersed transformers (mineral-oil insulated, natural ester biodegradable, synthetic ester), dry-type (cast resin/VPI) |

| End Use | Power utilities (distribution substations, renewable interconnects wind/solar, EV charging hubs and microgrids), industrial (refining, oil and gas, metals, pharma), commercial and data centers, residential and others |

| Mounting/Supply | Pad-mounted (three-phase, single-phase), pole-mounted (three-phase, single-phase) |

| Countries Covered | Mexico, Dominican Republic, Panama, Guatemala, Costa Rica, Canada, United States |

| Key Companies Profiled | Hitachi Energy, ABB, Siemens Energy, Schneider Electric, Eaton, Mitsubishi Electric, GE Vernova (Grid Solutions), Virginia Transformer, Hammond Power Solutions, Howard Industries |

| Additional Attributes | Dollar sales by product type, end use segment, and mounting configuration, country-level demand trends across United States, Canada, Mexico, and Central America/Caribbean nations, competitive landscape with global manufacturers and regional specialists, insulating fluid technology dynamics including natural ester adoption, integration with smart grid monitoring and distribution automation systems, innovations in rapid-deployment designs and modular configurations, and adoption of IoT sensors, predictive analytics, and condition monitoring for enhanced asset management and reliability optimization across utility, industrial, and commercial applications |

The medium voltage transformer industry in North America is estimated to be valued at USD 2.3 billion in 2025.

The market size for the medium voltage transformer industry in North America is projected to reach USD 3.5 billion by 2035.

The medium voltage transformer industry in North America is expected to grow at a 4.4% CAGR between 2025 and 2035.

The key product types in medium voltage transformer industry in North America are oil-immersed transformers and dry-type (cast resin/vpi).

In terms of end use, power utilities segment to command 44.0% share in the medium voltage transformer industry in North America in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Medium Duty Truck Market Size and Share Forecast Outlook 2025 to 2035

Medium Earth Orbit (MEO) Satellite IoT Market Size and Share Forecast Outlook 2025 to 2035

Medium Format Film Cameras Market Size and Share Forecast Outlook 2025 to 2035

Medium Density Fiberboard (MDF) Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Medium Carbon Steel Market

Medium-Chain Triglycerides Market Growth -Functional Fats & Industry Demand 2025 to 2035

Medium-duty Engine Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Cable and Accessory Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage AC Power Distribution Units (PDU) Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Utility Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Commercial Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Residential Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Capacitor Bank Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Wire and Cable Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Digital Substation Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Circuit Breaker Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Distribution Substation Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Electric Capacitor Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Transmission Substation Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA