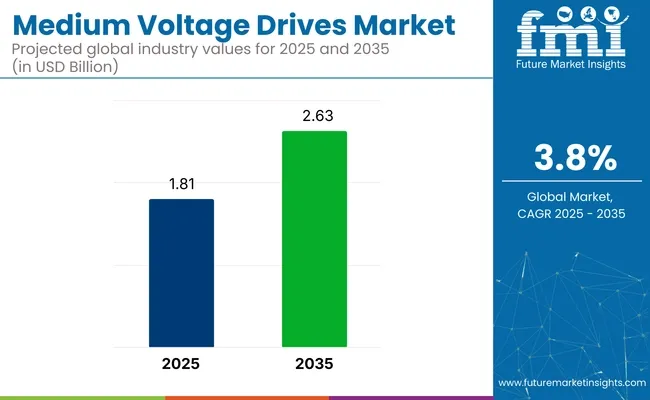

The medium voltage drives market is likely to be valued at USD 1.81 billion in 2025 and is projected to reach USD 2.63 billion by 2035, at a CAGR of 3.8% during the forecast period.

Medium voltage drives (MVDs) are crucial for controlling the speed and torque of motors in industrial applications, contributing to improved energy efficiency, reduced operational costs, and enhanced performance. The market is experiencing significant growth due to the increasing demand for energy-efficient systems, the rise in industrial automation, and the growing need for reliable and sustainable power solutions.

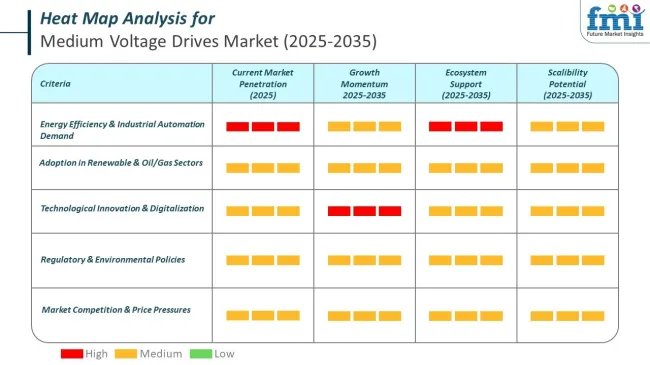

A key driver of the market’s growth is the increasing demand for energy efficiency across various industries, including manufacturing, oil and gas, water treatment, and power generation. MVDs offer substantial energy savings by precisely controlling motor speed and adjusting power output, which can significantly reduce electricity consumption.

As industries worldwide seek to minimize energy costs and meet stringent environmental regulations, the adoption of MVDs is becoming more widespread. Additionally, the rising focus on reducing greenhouse gas emissions and promoting sustainability in industrial operations is contributing to the market's expansion.

Recent developments in the medium voltage drives market highlight advancements in digitalization and smart technologies. Manufacturers are integrating advanced features such as IoT connectivity, predictive maintenance, and remote monitoring into MVDs, providing industries with real-time performance data and insights. These innovations are enhancing the efficiency and reliability of medium voltage drives, making them more attractive for businesses looking to optimize their operations and prevent costly downtime.

On November 19, 2024, ABB introduced the ACS8080 medium-voltage air-cooled drive aimed at enhancing industrial performance and reliability-as per ABB’s official PR Newswire release . This next-gen drive delivers up to 98% efficiency, reduces harmonic distortion by approximately 50% with its MP3C motor-control tech, and provides enhanced diagnostics-reportedly delivering 10× faster troubleshooting through advanced condition monitoring.

| Attribute | Value |

|---|---|

| Market Size in 2025 | USD 1.81 Billion |

| Market Size in 2035 | USD 2.63 Billion |

| CAGR (2025 to 2035) | 3.8% |

“We invest in R&D to deliver new solutions that enhance productivity while reducing emissions,” said Chris Poynter, President of ABB’s Systems Drives Division. Built for diverse industrial applications and retrofitting, the ACS8080 reinforces ABB’s leadership in energy-efficient medium-voltage drive systems for the evolving industrial market.

As the market for medium voltage drives continues to grow, ongoing advancements in motor control technologies and energy efficiency solutions are expected to further drive adoption across various sectors. The continued push for automation and sustainability in industrial operations will further accelerate the demand for MVDs, contributing to the market’s long-term expansion.

The medium voltage drives market is increasingly influenced by national and regional government policies focused on energy efficiency, emission reductions, and industrial modernization. Regulatory bodies across major economies are pushing industries to adopt high-efficiency motor control systems, including medium voltage drives, as part of broader environmental compliance frameworks. These regulations are shaping procurement decisions, especially in sectors like manufacturing, utilities, and transport infrastructure.

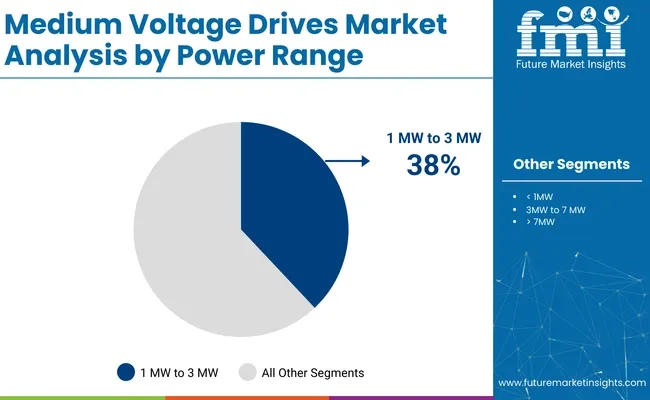

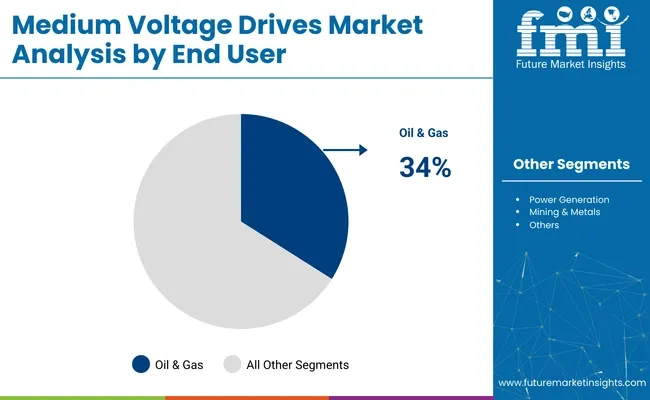

The global medium voltage drives market is poised for consistent growth from 2025 to 2035, fueled by rising demand for energy efficiency and motor control across heavy industries. In 2025, the 1 MW to 3 MW power range segment is projected to hold 38% market share, while the oil & gas segment is expected to capture 34% of the end user segment. Key players include ABB, Siemens, and Rockwell Automation.

The 1 MW to 3 MW drives segment is projected to command 38% of the market share in 2025. This power range is ideal for medium-scale industrial applications where optimizing motor performance, reducing energy consumption, and improving process reliability are critical. Sectors such as mining, cement, and water & wastewater treatment increasingly rely on drives in this range to enhance operational efficiency.

Leading manufacturers like ABB and Siemens are focusing on modular drive systems that deliver greater flexibility, high torque performance, and seamless integration with industrial automation platforms. Advanced features, such as predictive maintenance and smart monitoring capabilities, are also gaining traction.

Additionally, tightening global energy efficiency regulations are prompting industries to adopt medium voltage drives to meet sustainability targets and reduce operational costs. The segment is also benefitting from trends in digitalization and Industry 4.0, where intelligent drive solutions contribute to smarter, more adaptive industrial ecosystems. This dynamic landscape ensures robust growth prospects for the 1 MW to 3 MW segment.

The oil & gas segment is projected to hold 34% of the end user segment market share in 2025. Medium voltage drives play a vital role in upstream, midstream, and downstream oil & gas operations, where reliable control of pumps, compressors, and drilling equipment is paramount. The sector’s focus on improving operational efficiency, reducing energy consumption, and ensuring equipment longevity is a key growth driver.

Major players such as Rockwell Automation and Schneider Electric are providing advanced drive solutions tailored for harsh and hazardous oilfield environments. Recent innovations include explosion-proof enclosures, enhanced motor control algorithms, and remote monitoring capabilities to ensure uninterrupted performance.

The shift towards automation and digital oilfield concepts is further accelerating demand for intelligent drive systems. Additionally, as oil & gas companies prioritize sustainability and seek to lower their carbon footprint, medium voltage drives offer an effective means to optimize energy use. With continued investment in exploration and production activities globally, the oil & gas segment will remain a key growth engine for the medium voltage drives market.

Obligations to control energy consumption by reducing the demand for electricity supply in electrical motors are optimized by the use of appropriate voltage-regulating drives.

Existing technologies across all levels of enterprises undergoing the necessary refurbishment and replacement. They are poised to obtain new upgraded versions of medium voltage variable frequency drives that are projected to obtain higher revenues in the market.

In recent times, there has been a growing requirement for introducing full-time monitoring control of various processing units. Due to a shortage of labor, particularly in developed economies, industries are resorting to the utilization of medium-voltage drives as well as high-voltage drives.

North America is the dominant region in the manufacturing and production of medium voltage. With the presence of several top brands of medium voltage drives in the region, some brand names have become synonymous with the product. Siemens mv drives, weg medium voltage drives, and ABB medium voltage VFD are some common names mistakenly used instead of medium voltage drives.

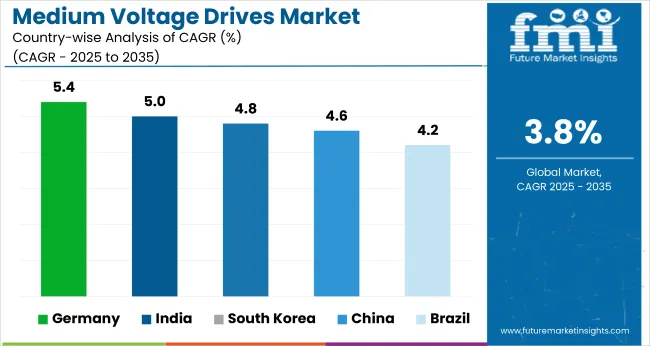

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 4.6% |

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 5.0% |

Medium voltage drive manufacturers with lower labor costs are setting up factories in the Asia Pacific region. This is done to lessen their need for cross-border transportation for raw materials.

Due to its quick economic expansion and governmental prohibitions on excessive energy use, Japan is likely to increase adequately, with a market share of 6% in 2025. Moreover, the presence of key manufacturers in these regions, particularly China and India, is likely to provide a conducive environment for the rapid adoption of MV drives in industries.

Medium voltage drives are now widely used across many industries due to rapid technological advancements. High reliability and cost-effective energy reduction are the main goals of progress.

Europe is also a prominent region, having huge growth potential for the medium voltage drives sector being present for a very long time.

Medium voltage drives manufacturers to focus on providing an easy way to program the interface. For instance, medium voltage AC drives with touch screen Human Machine Interfaces are being developed by manufacturers in a bid to give operators a simple way to interface with the drives, access the settings, and program them.

Due to the fact that medium voltage AC drives enable consistent torque over a broad speed range and significant torque increments, manufacturers in this industry are using value-grab opportunities for these applications.

Manufacturers in the medium voltage AC drive market are making systems that accurately manage the rolling mill operations in the metals industry more broadly accessible.

The use of high-power speed drives recently developed by technological advancements requires provisions for the accurate supply of voltage and current specifications. Medium voltage VFD manufacturers are increasingly targeting this necessity to escalate product deployment.

To remain competitive, medium voltage drive manufacturers are producing drives according to the requirements of several industries. By creating medium voltage VFD specs that reflect consumer preferences, this change in business approach is anticipated to aid manufacturers in attracting new customers.

For instance: Fuji Electric is a key player in the Asia Pacific region that produces competitive medium voltage drives in the range starting from 0.1 kW and going up to 2400 kW as required by different applications in modern industries.

Recent Development:

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 1.81 billion |

| Projected Market Size (2035) | USD 2.63 billion |

| CAGR (2025 to 2035) | 3.8% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for dollar sales |

| Power Range Analyzed (Segment 1) | < 1MW, 1MW to 3 MW, 3MW to 7 MW, > 7MW |

| End-users Analyzed (Segment 2) | Oil & Gas, Power Generation, Mining & Metals, Pulp & Paper, Marine, Others |

| Drive Types Analyzed (Segment 3) | AC, DC, Servo |

| Applications Analyzed (Segment 4) | Pump, Fan, Conveyor, Compressor, Extruder, Others |

| Regions Covered | North America, Latin America, Europe, Asia Pacific, Middle East and Africa (MEA) |

| Key Players influencing the Medium Voltage Drives Market | ABB, Schneider Electric, Hitachi, Ltd., Rockwell Automation, Inc., Nidec Industrial Solutions, Toshiba Mitsubishi-Electric Industrial Systems Corporation, Honeywell International Inc., Siemens, Fuji Electric Co., Ltd., Spartan Controls, Amtech, Danfoss |

| Additional Attributes | dollar sales, CAGR trends, power range segmentation, end-user distribution, drive type demand, application growth, competitor dollar sales & market share, regional trends |

The market is valued to hit USD 1.81 Billion by 2035.

The market is forecast to register a CAGR of 3.8% through 2035.

The market is estimated to secure a valuation of USD 2.63 Billion in 2035.

During 2025 to 2035, the market grew at a CAGR of 3.8%.

In 2025, the United States to possess a market share of 21.6%.

With a CAGR of 38% in 2025, 1 MW to 3MW to take the lead in the market.

The oil and gas segment to command 34% of the market share in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA