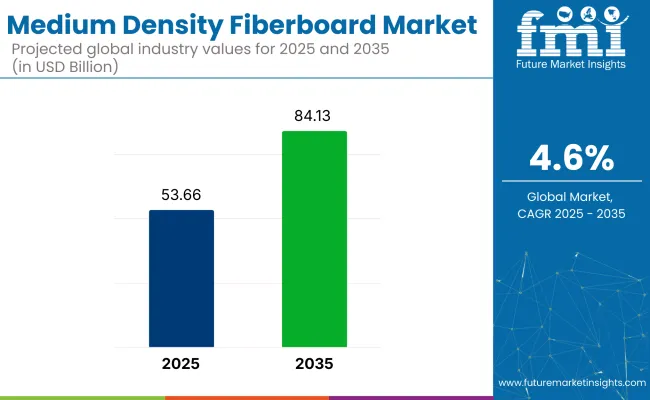

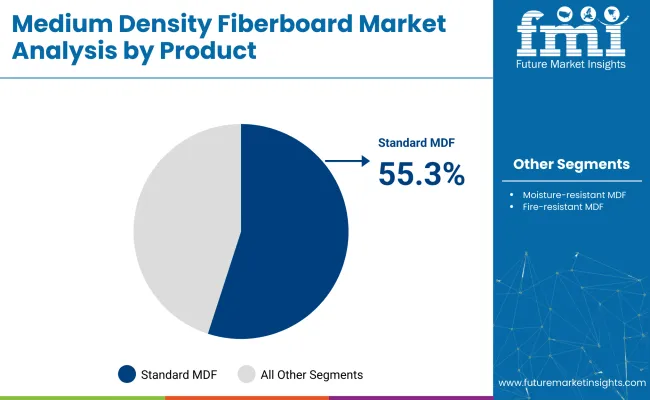

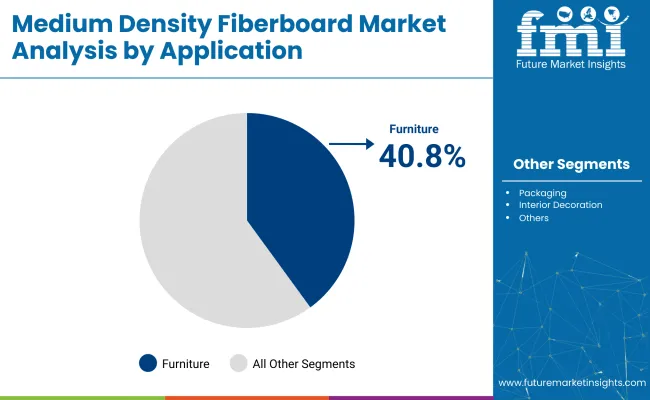

The medium density fiberboard (MDF) market is expected to register a valuation of USD 53.66 billion in 2025 and grow to USD 84.13 billion by 2035, accelerating at a CAGR of 4.6%. Standard MDF will dominate the product segment with a 55.3% share in 2025, while furniture applications will continue to lead the application segment with a 40.8% share of total demand.

As highlighted in a BBC-published overview on manufactured boards, medium-density fiberboard is produced using timber waste and adhesives, offering a smooth, light-brown surface that is easy to finish. These physical and working properties make MDF highly suitable for general carpentry and flat-pack furniture, although its moisture absorption characteristics limit its use in outdoor environments. This versatility in indoor applications significantly contributes to MDF’s widespread adoption across both residential and commercial sectors.

Key factors contributing to this growth include rising construction activities, particularly in the residential and commercial sectors, as well as a growing preference for sustainable and eco-friendly building materials. The ever-increasing demand for furniture, especially from emerging economies, and innovations in moisture-resistant and fire-resistant MDF products are also fueling market expansion.

By 2025, the standard medium-density fiberboard market is expected to hold a 55.3% market share, with furniture applications accounting for 40.8% of the total demand. The medium-priced MDF product market will be dominated by products within a price range of 40.2%, with offline distribution channels leading at 68.2%.

In regions such as the Asia-Pacific, particularly China and India, rapid urbanization and infrastructure development are expected to accelerate MDF demand further. Additionally, North America and Europe will continue to be major markets, driven by growing investments in renovation and construction projects that prioritize sustainable and durable materials.

The medium density fiberboard (MDF) market is witnessing steady growth, driven by demand from key applications in furniture, construction, and packaging. The market is segmented into product types, applications, price ranges, and distribution channels, with notable market shares across these categories.

Standard medium density fiberboard will dominate the product segment in 2025, accounting for 55.3% share of the global medium density fiberboard market.

Furniture applications are expected to capture a significant portion of the MDF market in 2025, holding a 40.8% share.

Medium-priced medium-density fiberboard is projected to remain the dominant price segment in 2025, accounting for an estimated 60% of the global MDF market.

Offline distribution channels are set to continue leading the MDF market in 2025, with an estimated 85% share of the total market.

The medium density fiberboard market is experiencing growth due to rising demand in furniture, construction, and sustainable packaging applications. However, challenges related to price fluctuations in raw materials and environmental concerns are presenting barriers to further expansion.

Rising demand for sustainable building materials is driving market growth.

The increasing demand for sustainable, eco-friendly materials in construction and furniture is accelerating the adoption of medium-density fiberboard. Companies are focusing on improving the environmental profile of their products through innovations in low-emission, formaldehyde-free MDF, further bolstering market growth. With governments and consumers prioritizing green construction, MDF’s role in eco-friendly building practices is becoming more significant, especially in developed markets like North America and Europe.

Raw material price volatility posing a challenge to manufacturers.

Fluctuating prices of wood pulp and fiber, essential components of MDF, are impacting market stability. The volatility in raw material costs is affecting manufacturers’ ability to maintain consistent pricing, pushing up production costs. As the medium density fiberboard market is primarily derived from wood-based resources, any changes in raw material prices due to supply chain disruptions or policy changes can significantly affect overall market profitability, especially in price-sensitive regions.

The medium density fiberboard market is driven by increasing demand for construction and furniture in both developed and emerging economies. The United States, China, India, the United Kingdom, and Brazil are major contributors to the market growth.

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 5.8% |

| United Kingdom | 5.4% |

| China | 7.1% |

| India | 8.2% |

| Brazil | 6.7% |

The medium density fiberboard sector in the U.S. is projected to grow at a CAGR of 5.8% from 2025 to 2035, fueled by steady demand in housing construction, home renovations, and the shift toward eco-conscious furniture manufacturing. Government initiatives promoting green buildings are further reinforcing market momentum.

Surging interest in sustainable materials, coupled with ongoing residential development and remodeling, is driving demand. Key manufacturers, such as Georgia-Pacific and West Fraser Timber, are increasing their production capacity to meet the growing needs. The push for sustainable practices in the construction and furniture sectors remains a significant growth catalyst.

The UK is witnessing a 5.4% CAGR in MDF-related products over the forecast period, driven by the rising adoption of moisture-resistant packaging and sustainable materials. Strict environmental policies and national low-carbon building initiatives are playing a crucial role.

The growing demand for eco-friendly interior décor and the increasing use of fire- and moisture-resistant boards in furniture and flooring are boosting sales. Leading players, such as the Egger Group, are investing in greener manufacturing processes to align with evolving regulations and consumer preferences.

In China, the MDF market is projected to grow at a robust 7.1% CAGR through 2035, driven by rapid urbanization and strong government support for affordable housing. The expanding domestic furniture industry also makes a significant contribution to growth.

With infrastructure development accelerating, MDF continues to gain popularity for its durability and cost-efficiency. Companies such as Dongwha Malaysia Holdings and Kronospan are expanding their operations to capitalize on the rising demand across the region.

India is poised to record the highest growth rate, with the MDF segment expected to grow at a CAGR of 8.2% over the next decade. Urban expansion, increased housing activity, and a booming middle-class population are major drivers.

Affordable furniture and decorative solutions are in high demand, prompting domestic firms like Greenply Industries to invest in production capacity. The growing emphasis on modern interiors and smart city projects is also generating new opportunities for MDF applications in flooring, wall panels, and cabinetry.

Brazil’s medium density fiberboard industry is on track for a 6.7% CAGR between 2025 and 2035, supported by government-led infrastructure programs and affordable housing development. The rising demand for durable, cost-effective materials in the local furniture sector is another key factor.

Manufacturers such as TRENOX Laminates are increasing output to meet domestic and regional needs. With MDF becoming a preferred choice in both residential and commercial construction, the country is experiencing steady upward demand across applications.

The MDF market is shaped by the strategies of dominant players, key players, and emerging players across global and regional landscapes. Dominant players such as ARAUCO, Century Plyboards, and Egger Group lead the market with extensive production capabilities and continuous innovation in moisture-resistant and fire-resistant MDF products.

Key players, such as Greenply Industries and Kastamonu Entegre, are expanding their footprint in emerging markets by offering cost-effective and high-quality MDF solutions tailored to local demands. Meanwhile, emerging players are entering the market by leveraging niche applications, competitive pricing, and regional distribution advantages.

Across all tiers, companies are focusing on R&D investments, sustainable product development, regulatory compliance, and technological advancements to expand product portfolios and optimize distribution networks.

Recent Industry News

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 53.66 billion |

| Projected Market Size (2035) | USD 84.13 billion |

| CAGR (2025 to 2035) | 4.6% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and million cubic meters for volume |

| Product Types Analyzed (Segment 1) | Standard MDF, Moisture Resistant MDF, Fire Resistant MDF |

| Application Segmentation (Segment 2) | Packaging, Construction & Flooring, Interior Decoration, Furniture, Others |

| Price Range Segmentation (Segment 3) | Low, Medium, High |

| Distribution Channel Segmentation (Segment 4) | Online, Offline |

| Regions Covered | North America, Latin America, Europe, Asia-Pacific, Middle East & Africa |

| Countries Covered | United States, Canada, Mexico, Brazil, Argentina, Germany, France, United Kingdom, Italy, Spain, Netherlands, China, India, Japan, South Korea, Australia, New Zealand, GCC Countries, South Africa |

| Key Players Influencing the Market | ARAUCO, Century Plyboards, Dare Panel Group, Dongwha Malaysia Holdings, Egger Group, Evergreen Fiberboard, Georgia-Pacific, Greenply Industries, Kastamonu Entegre, Kronospan, Nag Hamady Fiber Board, Norbord, TRENOX Laminates, Unilin, West Fraser Timber |

| Additional Attributes | Dollar sales by product type, application, and price range, increasing demand for eco-friendly materials, trends in the construction and furniture packaging industries, rise in online sales channels, and regional variations in MDF demand driven by construction activities. |

The market is segmented into Standard MDF, Moisture-resistant MDF, and Fire-resistant MDF.

The market is segmented into Packaging, Construction & Flooring, Interior Decoration, Furniture, and Others.

The market is segmented into Low, Medium, and High.

The market is segmented into Online and Offline.

The market is segmented into North America, Latin America, Europe, Asia-Pacific, and Middle East & Africa.

The global medium density fiberboard market is projected to reach USD 84.13 billion by 2035.

The market is expected to be valued at USD 53.66 billion in 2025.

Standard MDF is expected to lead the product segment in 2025, with 55.3% market share.

Furniture applications are expected to capture the largest demand for MDF, accounting for the 40.8% market share in 2025.

India, China, and Brazil are expected to exhibit strong growth, with respective CAGRs of 8.2%, 7.1%, and 6.7%.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Medium Voltage Transformer Industry Analysis in North America Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Cable and Accessory Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Transformer Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage AC Power Distribution Units (PDU) Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Utility Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Medium Duty Truck Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Commercial Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Residential Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Capacitor Bank Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Wire and Cable Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Digital Substation Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Circuit Breaker Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Distribution Substation Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Electric Capacitor Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Transmission Substation Market Size and Share Forecast Outlook 2025 to 2035

Medium-duty Engine Market Size and Share Forecast Outlook 2025 to 2035

Medium Earth Orbit (MEO) Satellite IoT Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Drives Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Medium Format Film Cameras Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA