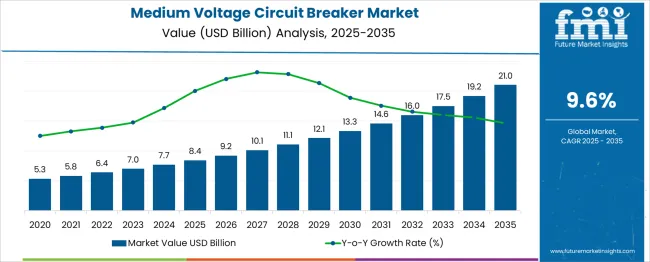

The Medium Voltage Circuit Breaker Market is estimated to be valued at USD 8.4 billion in 2025 and is projected to reach USD 21.0 billion by 2035, registering a compound annual growth rate (CAGR) of 9.6% over the forecast period. Between 2020 and 2025, the market expands from USD 5.3 billion to USD 8.4 billion, generating an absolute dollar opportunity of USD 3.1 billion. Increasing power distribution infrastructure projects and upgrades in industrial electrical systems fuel this growth.

The early phase shows consistent annual gains, with rising demand for reliable circuit protection solutions supporting steady revenue expansion across regions. From 2025 to 2035, the market experiences a stronger surge, adding USD 12.6 billion in absolute dollar opportunity. By 2030, the value reaches USD 13.3 billion, marking a critical midpoint where modernization initiatives, grid expansion, and adoption of smart electrical systems drive accelerated growth.

The largest revenue increments occur in the latter half of the forecast period, as renewable energy integration and urban electrification projects multiply. The cumulative absolute dollar opportunity over 2020 to 2035 totals USD 15.7 billion, indicating significant potential for manufacturers to capture value through product innovation, enhanced operational reliability, and regional market diversification. This sustained expansion highlights a promising decade ahead for the sector.

| Metric | Value |

|---|---|

| Medium Voltage Circuit Breaker Market Estimated Value in (2025 E) | USD 8.4 billion |

| Medium Voltage Circuit Breaker Market Forecast Value in (2035 F) | USD 21.0 billion |

| Forecast CAGR (2025 to 2035) | 9.6% |

The Medium Voltage Circuit Breaker market is experiencing notable growth, driven by rising investments in power infrastructure modernization and increasing demand for reliable electrical distribution systems. The current market scenario reflects growing emphasis on grid stability, energy efficiency, and the integration of renewable energy sources which has strengthened the adoption of advanced circuit protection technologies.

Industry publications and corporate disclosures highlight how aging transmission and distribution networks, particularly in emerging economies, are being upgraded with medium voltage solutions to minimize outages and ensure operational safety. The market outlook remains positive as industrial expansion, urbanization, and regulatory mandates for electrical safety continue to create new deployment opportunities.

Furthermore, press releases and annual reports from manufacturers emphasize the role of digital monitoring and predictive maintenance features in supporting the transition toward smart grids and sustainable power delivery. These factors collectively are fostering a robust foundation for sustained growth across diverse end use industries globally.

The medium voltage circuit breaker market is segmented by productend use, and geographic regions. By product, the medium voltage circuit breaker market is divided into VCB, ACB, and others. In terms of end use, the medium voltage circuit breaker market is classified into Industrial, Residential, Commercial, and Utility.

Regionally, the medium voltage circuit breaker industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

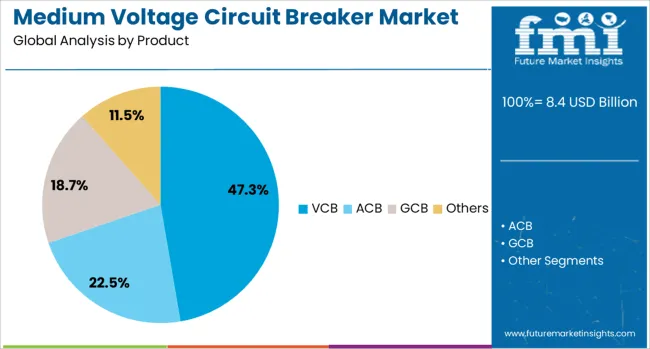

The VCB product segment is projected to account for 47.3% of the Medium Voltage Circuit Breaker market revenue share in 2025, securing its position as the leading product type. This dominance has been attributed to the superior arc quenching capability and operational reliability of vacuum circuit breakers, as described in technical papers and investor presentations.

VCBs are being increasingly adopted due to their compact design, minimal maintenance requirements, and long service life, which align with the evolving needs of modern electrical infrastructure. Industry journals report that VCBs offer enhanced environmental performance since they avoid the use of greenhouse gases, making them compliant with stringent environmental regulations.

Manufacturers have emphasized through press releases that the segment’s growth is further strengthened by its suitability for both indoor and outdoor installations in diverse climates. These advantages, combined with cost efficiency over the product lifecycle and proven performance in medium voltage applications, have contributed to the segment’s leading share in the market.

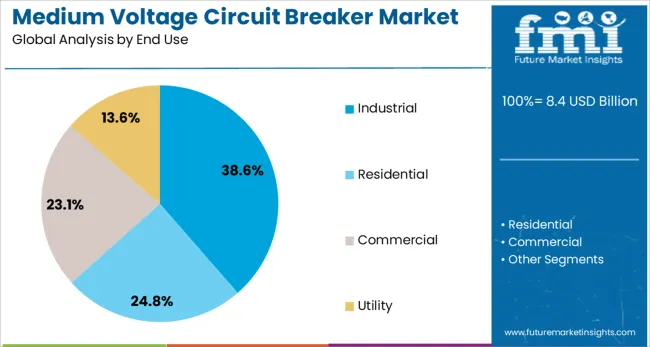

The industrial end-use segment is anticipated to contribute 38.6% of the Medium Voltage Circuit Breaker market revenue share in 2025, establishing it as the largest end-use segment. This leadership has been driven by rising demand for dependable power distribution in manufacturing, mining, oil and gas, and heavy engineering industries, as reflected in corporate sustainability reports and technology news articles.

The segment’s growth has been supported by the need for uninterrupted operations, protection of sensitive equipment, and compliance with workplace safety standards. Technical documentation from leading companies indicates that medium voltage circuit breakers are being widely implemented in industrial facilities to address fluctuating load conditions and prevent equipment damage during faults.

Additionally, press announcements have underlined that the growing focus on energy efficiency and automation in industrial operations is fostering greater adoption of advanced circuit protection solutions. These factors collectively have established the industrial sector as the foremost end-use industry for medium voltage circuit breakers in 2025.

The medium voltage circuit breaker market is experiencing robust growth, driven by rising electricity consumption, expansion of industrial facilities, and ongoing upgrades to power distribution infrastructure. These devices, typically rated between 1 kV and 72 kV, are essential for ensuring electrical safety by interrupting fault currents and enabling maintenance work without power interruptions. They find applications in utilities, manufacturing plants, transportation systems, and commercial buildings. Demand is further supported by the integration of renewable energy sources, where breakers must handle fluctuating load conditions and protect sensitive grid components. Asia-Pacific dominates consumption due to rapid industrialization and urban development, while North America and Europe lead in replacement demand for aging infrastructure. Manufacturers are increasingly offering compact, modular, and low-maintenance designs to meet the operational needs of modern grids. Growing attention to environmental impact and regulatory compliance is also influencing product development and adoption patterns globally.

Medium voltage circuit breakers are available in several configurations, including vacuum, air, SF₆ gas-insulated, and hybrid types, each serving distinct operational needs. Vacuum circuit breakers are widely used for their reliability, long service life, and minimal maintenance requirements, making them popular in industrial and utility applications. SF₆ gas-insulated breakers provide compact designs and high arc-quenching capabilities, suitable for installations where space is limited. Air-insulated models offer a cost-effective solution for less demanding environments, while hybrid designs combine benefits from multiple technologies. Applications span across utility substations, industrial switchgear, and commercial facility distribution systems. Selection depends on parameters such as voltage rating, load conditions, switching frequency, and environmental factors. The ability to integrate with protection relays, remote monitoring systems, and automation platforms enhances operational efficiency. As power networks evolve to accommodate decentralized generation, breaker designs are adapting to provide greater flexibility, higher fault tolerance, and simplified installation processes.

Medium voltage circuit breakers play a central role in maintaining the stability, safety, and reliability of electrical systems. Their primary function is to detect and interrupt fault currents, preventing damage to equipment, minimizing downtime, and safeguarding personnel. In utility networks, they isolate faulty sections quickly, allowing unaffected areas to continue operation. Industrial facilities rely on them to protect sensitive machinery and ensure uninterrupted production. Breakers are often paired with intelligent monitoring systems that provide real-time diagnostics, enabling predictive maintenance and reducing unexpected failures. This is increasingly important as grids incorporate variable renewable energy sources, which introduce fluctuating loads and potential instability. High-performance breakers must also withstand frequent switching operations in industrial processes. By ensuring controlled disconnection and rapid fault clearing, these devices reduce the risk of catastrophic failures, extend the life of connected equipment, and contribute to overall grid resilience in both centralized and distributed energy environments.

Medium voltage circuit breakers must adhere to rigorous international and regional standards, including IEC 62271 and IEEE C37, which govern design, safety, and performance. Compliance ensures reliability under demanding conditions and facilitates global market acceptance. Environmental considerations are increasingly shaping the market, particularly regarding SF₆ gas, a potent greenhouse gas commonly used for insulation. Many regions are introducing restrictions or phase-out schedules for SF₆, prompting manufacturers to develop vacuum and compressed air alternatives that meet both performance and environmental goals. Product certification, type testing, and adherence to eco-compliance regulations are critical for procurement decisions in utility and industrial projects. Manufacturers are also exploring recyclable materials and designs that minimize lifecycle environmental impact. These changes require investment in research, testing, and supply chain adjustments. Companies that successfully align with evolving environmental policies while maintaining operational excellence are well-positioned to secure long-term contracts in a competitive global market.

The medium voltage circuit breaker market is characterized by competition between multinational electrical equipment manufacturers and regional suppliers, each focusing on performance, cost-effectiveness, and service capabilities. Key competitive factors include product customization, delivery speed, technical support, and integration with digital monitoring systems. Supply chain resilience is critical, as essential components—such as vacuum interrupters, control electronics, and insulating materials—must meet stringent quality standards. Fluctuations in raw material prices, especially copper and specialty metals, can impact production costs. Global shipping delays and geopolitical uncertainties also affect availability and lead times. To address these challenges, some manufacturers are investing in localized production facilities and long-term supplier agreements. Building strong after-sales service networks and offering training for maintenance personnel strengthen customer loyalty. In addition, collaborations with utilities and industrial clients for co-development of tailored breaker solutions enable companies to differentiate themselves, ensuring competitive positioning in both established and emerging markets.

| Country | CAGR |

|---|---|

| China | 13.0% |

| India | 12.0% |

| Germany | 11.0% |

| France | 10.1% |

| UK | 9.1% |

| USA | 8.2% |

| Brazil | 7.2% |

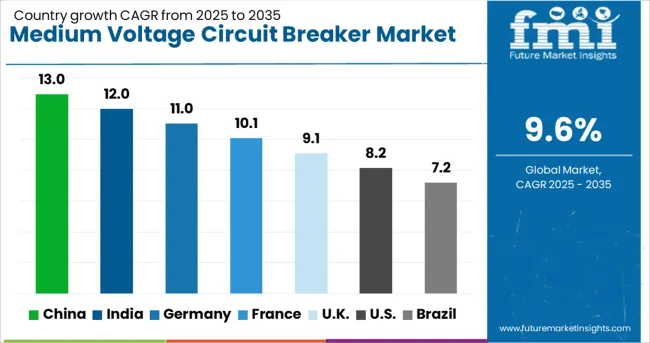

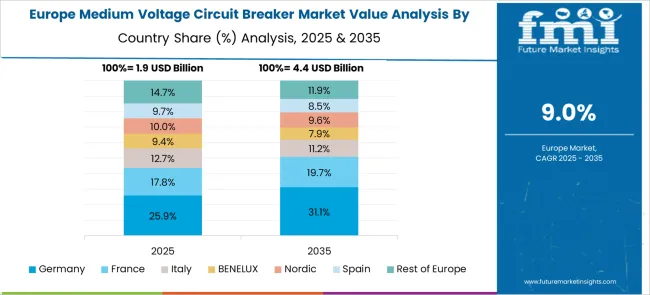

The medium voltage circuit breaker market is advancing at a 9.6% CAGR, propelled by grid modernization and infrastructure upgrades. Among BRICS nations, China leads with 13.0% growth, driven by rapid electrification and extensive domestic manufacturing. India follows at 12.0%, supported by expanding power generation capacity and rural grid expansion. In the OECD group, Germany posts 11.0% growth, capitalizing on engineering expertise and export strength. The UK grows at 9.1% with ongoing utility network refurbishments, while the USA records 8.2%, benefitting from replacement demand and industrial applications. This analysis focuses on 40+ countries, highlighting the strongest performers here.

China records a strong 13.0% growth rate in the medium voltage circuit breaker market. Expanding electricity demand from industrial, commercial, and residential sectors drives consistent adoption. Compared to India, China benefits from large-scale infrastructure projects that require reliable circuit protection systems. Ongoing grid modernization initiatives enhance the need for medium voltage breakers across provinces. Manufacturers focus on producing breakers with higher operational efficiency and extended service life. Integration of remote monitoring capabilities further strengthens market acceptance. The rapid pace of electrification in rural and urban areas ensures steady demand for these systems.

India achieves a 12.0% growth rate in the medium voltage circuit breaker market. Rapid urban development and industrial expansion increase the requirement for efficient circuit protection solutions. Compared to Germany, India’s market benefits from government-led power distribution upgrades in multiple states. Investments in renewable energy projects also add to demand for reliable breakers. Manufacturers are working on cost-effective solutions tailored to diverse operational environments. The increasing electrification of rural regions creates new opportunities for market players. Continuous improvements in production technology support local manufacturing competitiveness.

Germany posts an 11.0% growth rate in the medium voltage circuit breaker market. The country focuses on enhancing electrical safety across industrial and utility networks. Compared to the United Kingdom, Germany’s manufacturing base allows for steady production of high-quality breakers. Upgrades in aging power distribution infrastructure fuel additional demand. Export opportunities in Europe strengthen the country’s market position. Manufacturers emphasize reliability, compact design, and low maintenance in their product offerings. Partnerships between engineering firms and utility companies support market growth.

The United Kingdom achieves a 9.1% growth rate in the medium voltage circuit breaker market. Expansion of commercial facilities and industrial plants drives higher demand for breaker systems. Compared to the United States, the UK places a stronger focus on compact breaker designs for space optimization. Utility providers continue upgrading networks to improve energy efficiency. Manufacturers prioritize offering flexible installation options to meet varied project needs. Market growth is also supported by replacement demand for older systems. Collaboration with engineering contractors ensures wider product adoption.

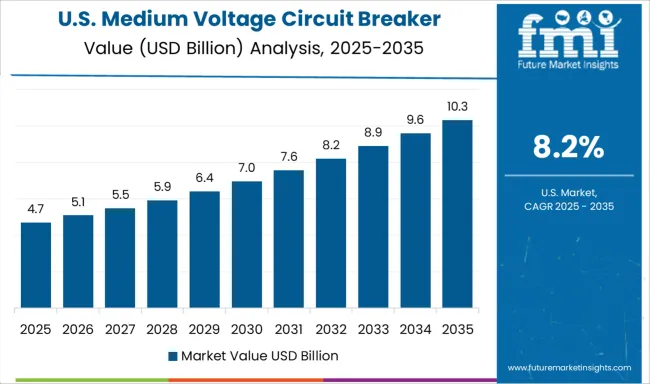

The United States records an 8.2% growth rate in the medium voltage circuit breaker market. The rise in renewable energy integration into the power grid drives demand for advanced breakers. Compared to China, the US market focuses heavily on incorporating smart grid-compatible technologies. Replacement of outdated equipment across utilities contributes to steady sales. Industrial sector growth in manufacturing and data centers creates further opportunities. Manufacturers work on improving energy efficiency and lifespan of products. Supportive regulations encourage investment in high-performance circuit protection systems.

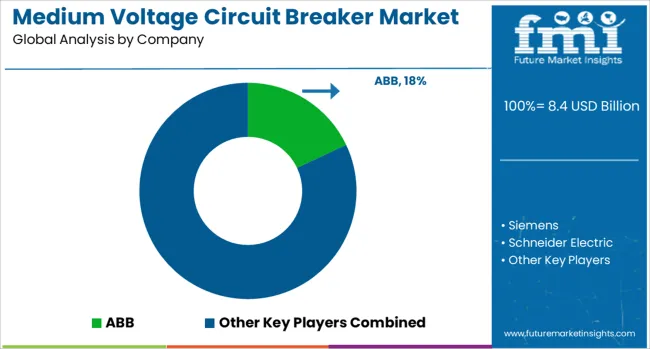

The medium voltage circuit breaker market is dominated by multinational electrical equipment manufacturers offering advanced protection solutions for industrial, utility, and commercial applications. ABB and Siemens are front-runners, leveraging decades of engineering expertise to deliver air, vacuum, and SF₆ circuit breakers with high reliability and digital monitoring capabilities. Schneider Electric and Eaton provide modular breaker designs that integrate seamlessly into smart grids, emphasizing energy efficiency and predictive maintenance features.

Mitsubishi Electric Corporation and Toshiba International Corporation hold strong positions in Asia-Pacific, supplying high-performance breakers for demanding power distribution environments, particularly in utility-scale projects. General Electric and Fuji Electric FA Components & Systems Co., Ltd. focus on compact designs and hybrid technologies that improve operational safety and reduce lifecycle costs. WEG, LS ELECTRIC Co., Ltd, and HD Hyundai Electric Co., Ltd. are expanding their global footprint through competitive pricing, robust after-sales support, and strong regional manufacturing networks.

L&T Electrical & Automation maintains a leading role in India and the Middle East with localized production and turnkey solutions, while Powell Industries specializes in custom-engineered switchgear systems for the oil, gas, and heavy industrial sectors. Competition is increasingly shaped by innovations in eco-friendly insulation alternatives, digital diagnostics, and extended service life, aligning with the shift toward sustainable, smart power infrastructure.

In October 2024, Schneider Electric launched the MasterPacT MTZ Active circuit breaker, featuring real-time power monitoring, Energy Reduction Maintenance Settings (ERMS) for arc-flash risk reduction, and smart diagnostics via NFC. Designed for industrial and critical infrastructure, it enhances operator safety, energy efficiency, and sustainability while supporting business continuity in power distribution systems.

| Item | Value |

|---|---|

| Quantitative Units | USD 8.4 Billion |

| Product | VCB, ACB, GCB, and Others |

| End Use | Industrial, Residential, Commercial, and Utility |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ABB, Siemens, Schneider Electric, Eaton, Mitsubishi Electric Corporation, Toshiba International Corporation, General Electric, Fuji Electric FA Components & Systems Co., Ltd, WEG, LS ELECTRIC Co., Ltd, HD HYUNDAI ELECTRIC CO., LTD, L&T Electrical & Automation, and Powell Industries |

| Additional Attributes | Dollar sales in the Medium Voltage Circuit Breaker Market vary by type including air, vacuum, and SF6 circuit breakers, application across industrial, commercial, and utility sectors, and region covering North America, Europe, and Asia-Pacific. Growth is driven by increasing power distribution needs, grid modernization, and rising demand for reliable electrical protection systems. |

The global medium voltage circuit breaker market is estimated to be valued at USD 8.4 billion in 2025.

The market size for the medium voltage circuit breaker market is projected to reach USD 21.0 billion by 2035.

The medium voltage circuit breaker market is expected to grow at a 9.6% CAGR between 2025 and 2035.

The key product types in medium voltage circuit breaker market are vcb, acb, gcb and others.

In terms of end use, industrial segment to command 38.6% share in the medium voltage circuit breaker market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Low Voltage Circuit Breakers Market

High Voltage Circuit Breaker Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Transformer Industry Analysis in North America Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Cable and Accessory Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Transformer Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage AC Power Distribution Units (PDU) Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Utility Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Commercial Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Residential Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Capacitor Bank Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Wire and Cable Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Digital Substation Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Distribution Substation Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Electric Capacitor Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Transmission Substation Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Drives Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Market Share Insights of Leading Medium Voltage Transformer Providers

Circuit Breaker Test Devices Market Size and Share Forecast Outlook 2025 to 2035

Circuit Breaker Based Transfer Switch Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA