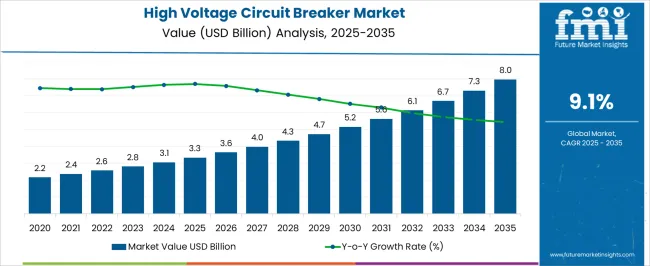

The high voltage circuit breaker market is estimated to be valued at USD 3.3 billion in 2025 and is projected to reach USD 8.0 billion by 2035, registering a compound annual growth rate (CAGR) of 9.1% over the forecast period.

The high voltage circuit breaker market is expected to grow from USD 3.3 billion in 2025 to USD 8 billion by 2035, with an absolute dollar opportunity of USD 4.7 billion. This growth is driven by the increasing demand for reliable electrical infrastructure in power transmission and distribution systems. The market expansion reflects the need for circuit breakers that ensure safety, prevent electrical faults, and maintain grid stability. Analysts suggest that the absolute dollar opportunity underscores the essential role of high voltage circuit breakers in modernizing electrical grids and supporting industrial growth, making it an attractive segment for long-term investment.

The steady increase in demand for high voltage circuit breakers can be attributed to ongoing infrastructure projects, particularly in emerging markets where energy consumption is on the rise. Replacement cycles and upgrading of existing equipment in mature markets are also expected to contribute significantly to the opportunity. In my view, the consistent demand for high voltage circuit breakers driven by safety standards, regulatory compliance, and grid reliability will offer substantial returns for manufacturers. The market’s trajectory reflects both growth and resilience, with continued investments being made in reliable and durable circuit breakers that meet modern energy needs.

| Metric | Value |

|---|---|

| High Voltage Circuit Breaker Market Estimated Value in (2025 E) | USD 3.3 billion |

| High Voltage Circuit Breaker Market Forecast Value in (2035 F) | USD 8.0 billion |

| Forecast CAGR (2025 to 2035) | 9.1% |

The high voltage circuit breaker market plays a pivotal role within the power transmission and electrical equipment sectors. It accounts for approximately 8-10% of the power transmission equipment market, driven by the necessity for reliable protection in high-voltage systems. In the broader electrical equipment market, its share is about 4-5%, reflecting its niche nature among a wider array of products such as transformers and cables. The energy infrastructure market sees a more considerable contribution from high voltage circuit breakers, with a share of around 6-7%, as they are essential components in ensuring grid stability and reliability.

Within the industrial equipment market, the share is approximately 2-3%, as circuit breakers are typically used in large-scale industrial operations but in smaller quantities compared to other equipment. In the smart grid market, the high voltage circuit breaker market holds a smaller share of 3-4%, as the focus on smart grids primarily revolves around data and automation technologies, with circuit breakers playing a supportive role. The growing demand for renewable energy integration and the need for enhanced grid reliability are key drivers of the high voltage circuit breaker market, pushing its importance within these parent sectors. These market shares highlight the evolving role of high voltage circuit breakers in modernizing energy infrastructure and securing reliable power transmission networks.

The high voltage circuit breaker market is experiencing steady growth driven by rising investments in transmission and distribution infrastructure, modernization of aging power grids, and the integration of renewable energy sources. Increasing electricity demand in developing economies and the need for reliable grid protection mechanisms are fueling adoption.

Advances in arc extinguishing technologies, monitoring systems, and smart grid compatibility are enhancing operational efficiency and safety. Regulatory emphasis on energy efficiency and system reliability is further boosting deployment across various end use sectors.

The market outlook remains positive as utilities and industries focus on upgrading grid resilience to support higher loads, distributed generation, and long distance power transmission.

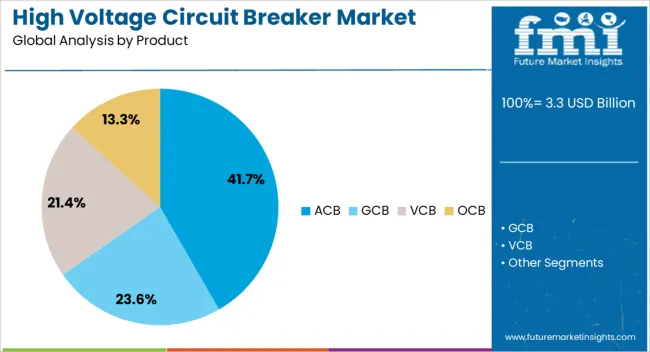

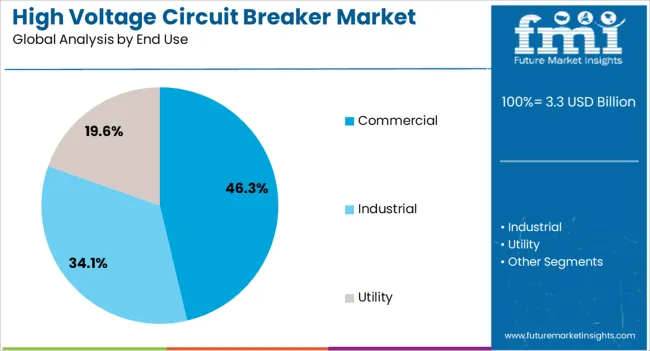

The high voltage circuit breaker market is segmented by product, end use, and geographic regions. By product, high voltage circuit breaker market is divided into ACB, GCB, VCB, and OCB. In terms of end use, high voltage circuit breaker market is classified into commercial, industrial, and utility. Regionally, the high voltage circuit breaker industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The ACB segment is expected to hold 41.7% of the total market revenue by 2025, making it the leading product category. Growth in this segment is being driven by its capability to handle high current ratings, provide enhanced safety features, and allow easier maintenance compared to alternative solutions.

ACBs are widely deployed in high capacity systems where precise fault interruption and operational reliability are critical. Their adaptability to various installation environments, combined with integration into smart monitoring systems, has further increased their adoption in high voltage applications.

The demand is also reinforced by grid expansion projects and industrial facility upgrades that prioritize durable and efficient circuit protection solutions.

The commercial segment is projected to account for 46.3% of the total market revenue by 2025, positioning it as the dominant end use category. This leadership is attributed to the rising need for uninterrupted power supply and robust protection systems in commercial complexes, data centers, hospitals, and large office infrastructures.

The integration of advanced power management systems and the growth of high load commercial facilities have increased the reliance on high voltage circuit breakers. Additionally, the commercial sector’s focus on energy efficiency, safety compliance, and minimizing downtime has reinforced investment in reliable circuit protection devices.

This sustained demand continues to position the commercial segment as a key driver of growth within the high voltage circuit breaker market.

The high voltage circuit breaker market is set to grow steadily as the demand for grid reliability, renewable energy integration, and urban infrastructure expansion increases. Demand is driven by the need for efficient power distribution, fault protection, and system stability in utility networks. Opportunities are opening in the integration of SF6-free technologies, smart grids, and advanced monitoring solutions. Trends focus on compact designs, increased fault interruption capacity, and eco-friendly alternatives. Challenges persist around high operational costs, regulatory constraints, and the long lifecycle of power plants.

Demand in the high voltage circuit breaker market is reinforced by the ongoing push for grid reliability and the increasing integration of renewable energy sources. As wind and solar energy generation grows, the need for more robust, efficient fault protection systems is rising. High voltage circuit breakers play a crucial role in ensuring the stability of electrical grids by isolating faults, maintaining supply quality, and protecting equipment. In our opinion, the strongest demand will come from regions expanding their renewable energy capacity, where grid modernization is essential to managing intermittent power flow.

Opportunities are emerging in the shift toward SF6-free circuit breakers, driven by both regulatory pressures and environmental concerns. Manufacturers are introducing eco-friendly alternatives using gases like vacuum and dry air to replace the greenhouse gas SF6, which is harmful to the environment. Smart grid systems that integrate advanced monitoring and control are further boosting the need for high voltage circuit breakers with communication capabilities. In our view, the most lucrative growth will be in regions adopting smart grids and prioritizing environmental regulations, where advanced, eco-friendly breakers provide a competitive advantage.

Trends in the market are focusing on compact, efficient designs and higher fault interruption capacities. As space becomes more limited in urban settings and energy demands increase, manufacturers are developing smaller yet more powerful circuit breakers that can deliver the same or better performance in a more compact form. Another key trend is the move towards breakers capable of handling higher fault currents, reflecting the increasing power demands of modern electrical grids. From an opinionated standpoint, the demand for these compact and high-capacity systems will increase as cities and industries grow, making efficient power distribution crucial.

Challenges in the high voltage circuit breaker market include the high operational and maintenance costs, particularly for traditional SF6-based units. Regulatory constraints around the use of SF6 and the increasing pressure for sustainable solutions are forcing companies to invest in more expensive alternatives. Furthermore, the long lifecycle of power plants creates hesitation in adopting new technology, as plant owners often delay upgrades to avoid substantial capital expenditures. In our view, the biggest challenge lies in balancing the cost of innovation with the need for reliable, long-term performance in aging power infrastructure.

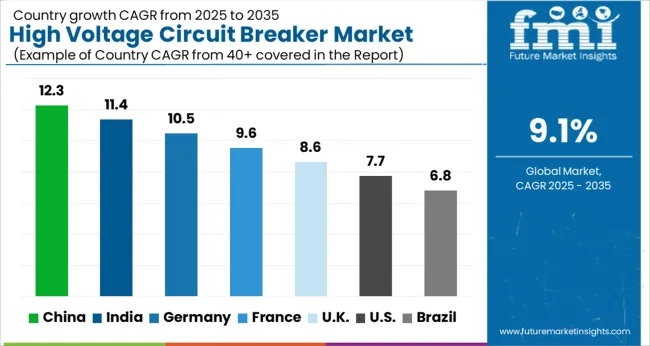

| Country | CAGR |

|---|---|

| China | 12.3% |

| India | 11.4% |

| Germany | 10.5% |

| France | 9.6% |

| UK | 8.6% |

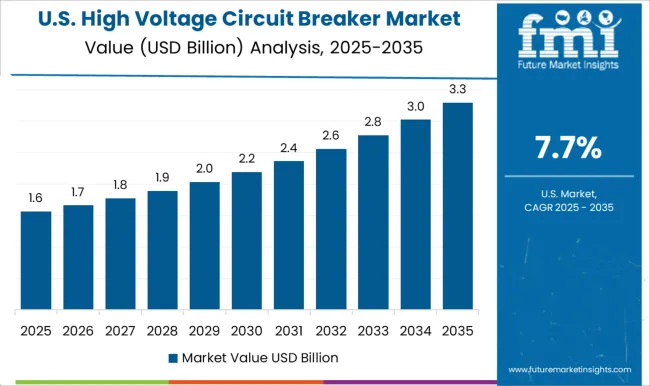

| USA | 7.7% |

| Brazil | 6.8% |

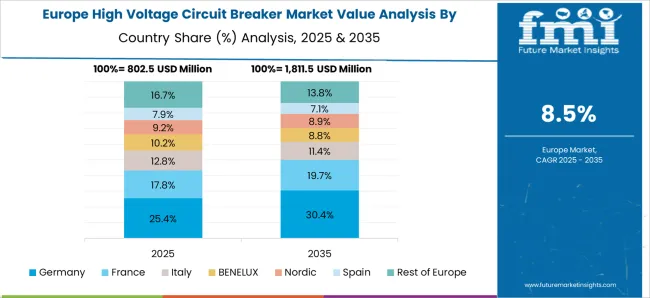

TThe global high voltage circuit breaker market is projected to grow at 9.1% from 2025 to 2035. China leads at 12.3%, followed by India 11.4% and Germany 10.5%; the United Kingdom 8.6% and United States 7.7% follow. Demand is driven by the need for reliable grid protection as power networks expand, especially in high-density urban areas and industrial zones. The increasing shift towards renewable energy sources, such as solar and wind, is also driving the adoption of high voltage circuit breakers to ensure system stability. With advancements in SF6-free technology and digital monitoring systems, the market is moving towards more environmentally friendly and efficient solutions. Asia is expected to lead in production volume, while Europe and North America are focusing on regulatory compliance and the integration of advanced protection features. This report includes insights on 40+ countries; the top markets are shown here for reference.

The high voltage circuit breaker market in China is expected to expand at 12.3%. The rapid expansion of China’s electrical grid to meet the increasing demand for power in urban, industrial, and rural areas is a major factor driving market growth. The growing adoption of renewable energy sources, such as solar and wind, is increasing the demand for reliable and efficient protection solutions, with high voltage circuit breakers playing a crucial role in ensuring grid stability. Additionally, the Chinese government’s push for infrastructure development and upgrades, particularly in smart grid technology, is fostering further demand. China’s large manufacturing base and cost-effective production capabilities make it a dominant force in the global market.

The high voltage circuit breaker market in India is projected to grow at 11.4%. India’s rapidly expanding power infrastructure, along with the increasing shift towards renewable energy, is driving demand for high voltage circuit breakers. The Indian government’s initiatives to enhance power distribution in rural and remote areas, combined with growing industrialization, are further contributing to market growth. Additionally, the adoption of smart grid technology is creating the need for more efficient and reliable circuit breakers that can handle increased loads and provide protection against electrical faults. As India moves toward a more sustainable and resilient energy system, the demand for high voltage circuit breakers is expected to continue rising.

The high voltage circuit breaker market in Germany is forecast to grow at 10.5%. As Europe’s leading industrial hub, Germany’s robust energy infrastructure, particularly in high-voltage networks, is a key driver of demand for high voltage circuit breakers. The country’s transition towards renewable energy sources, including wind and solar, is pushing for grid upgrades, necessitating reliable and efficient protection systems. German regulations, which are among the strictest in Europe, ensure that circuit breakers meet high safety and environmental standards, driving the adoption of advanced, eco-friendly technologies such as SF6-free breakers. Germany’s commitment to a green energy transition and smart grid integration is expected to support continued growth in this sector.

The high voltage circuit breaker market in the UK is expected to rise at 8.6%. The UK’s transition to cleaner and more reliable power networks, especially through increased renewable energy integration, is fueling the demand for high voltage circuit breakers. Additionally, the growing investment in infrastructure upgrades, smart grid technologies, and the need for more resilient grid systems are pushing for advanced protection solutions. The UK’s commitment to reducing carbon emissions and expanding its renewable energy capacity is driving the market for SF6-free and environmentally friendly circuit breakers. It is anticipated that the UK will continue to adopt cutting-edge technologies and smart solutions to address increasing grid complexity and load management.

The high voltage circuit breaker market in the United States is projected to grow at 7.7%. The demand for high voltage circuit breakers in the USA is driven by the ongoing expansion of the electrical grid, especially to accommodate renewable energy generation and distribution. The increasing focus on grid resilience, reliability, and efficiency in the wake of climate change and extreme weather events is further driving the market. The USA is also adopting more sustainable and eco-friendly technologies in the energy sector, including SF6-free breakers. As grid modernization continues and electric vehicles (EVs) become more common, there will be a higher need for reliable, advanced circuit breakers to support these developments.

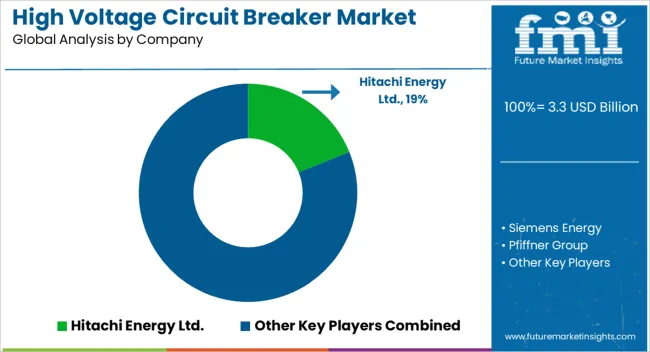

Competition in the high voltage circuit breaker market has been shaped by how companies present reliability, safety, and innovation in their brochures. Hitachi Energy Ltd., Siemens Energy, and General Electric lead with brochures that highlight advanced insulating technologies, such as SF6 and vacuum interrupters, and high fault current withstand capabilities. Mitsubishi Electric Corporation, Toshiba International Corporation, and CG Power & Industrial Solutions emphasize their robust circuit breakers designed for grid reliability, featuring detailed data on operational endurance, mechanical life, and rapid tripping mechanisms.

Pfiffner Group and Powell Industries present specialized solutions for substation applications, with brochures focusing on compact designs, low maintenance requirements, and high-speed switching. TE Connectivity and Liyond promote their medium and high-voltage circuit breakers, highlighting features like real-time monitoring, remote control integration, and fault diagnostics. Zhejiang Zhegui Electric and Zhejiang Tengen Electric focus on cost-effective solutions with high performance, emphasizing compliance with international standards, energy efficiency, and extended service intervals. ZHIYUE GROUP offers unique, customized solutions tailored to specific grid requirements, showcased through detailed technical documentation.

Strategy has been executed through brochures that emphasize critical specifications, including dielectric strength, breaking capacity, operating voltage, and interrupting time. Buyers compare circuit breaker types, such as air, vacuum, and SF6-insulated, based on fault clearing times, maintenance cycles, and environmental impact. Brochures also feature system integration details, compatibility with digital monitoring, and compliance with IEC, ANSI, and other international standards.

Manufacturers gain a competitive edge by clearly documenting their product's performance under extreme conditions and offering long-term warranty and service options. Technical support, ease of installation, and software tools for remote diagnostics and real-time monitoring are also highlighted to reassure customers. In this market, the brochure serves as a decisive tool for buyers, providing clear, detailed, and accurate information on reliability, performance, and safety to ensure the right product choice for high-voltage applications.

| Items | Values |

|---|---|

| Quantitative Units | USD 3.3 billion |

| Product | ACB, GCB, VCB, and OCB |

| End Use | Commercial, Industrial, and Utility |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Hitachi Energy Ltd., Siemens Energy, Pfiffner Group, CG Power & Industrial Solutions Ltd., Mitsubishi Electric Corporation, Toshiba International Corporation, General Electric, TE Connectivity, Zhejiang Zhegui Electric Co., Ltd., Liyond, ZHIYUE GROUP CO.,LTD, Zhejiang Tengen Electric Co., Ltd., and Powell Industries |

| Additional Attributes | Dollar sales by insulation type (SF6, vacuum, air, oil), Dollar sales by voltage class (100–250 kV, 250–500 kV, >500 kV), Dollar sales by application (utility, industrial, renewable energy, transportation), Trends in eco-friendly alternatives and smart grid integration, Role in grid stability and fault protection, Growth driven by renewable energy adoption and infrastructure modernization, Regional demand across North America, Europe, Asia Pacific. |

The global high voltage circuit breaker market is estimated to be valued at USD 3.3 billion in 2025.

The market size for the high voltage circuit breaker market is projected to reach USD 8.0 billion by 2035.

The high voltage circuit breaker market is expected to grow at a 9.1% CAGR between 2025 and 2035.

The key product types in high voltage circuit breaker market are acb, gcb, vcb and ocb.

In terms of end use, commercial segment to command 46.3% share in the high voltage circuit breaker market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

High Reliability Oscillators Market Size and Share Forecast Outlook 2025 to 2035

High-performance Dual-core Processor Market Size and Share Forecast Outlook 2025 to 2035

High Purity Magnesium Citrate Market Size and Share Forecast Outlook 2025 to 2035

High Performance Magnet Market Size and Share Forecast Outlook 2025 to 2035

High-frequency RF Evaluation Board Market Size and Share Forecast Outlook 2025 to 2035

High Viscosity Mixer Market Size and Share Forecast Outlook 2025 to 2035

High Clear Film Market Size and Share Forecast Outlook 2025 to 2035

High Performance Random Packing Market Forecast Outlook 2025 to 2035

High Precision Microfluidic Pump Market Size and Share Forecast Outlook 2025 to 2035

High Performance Composites Market Forecast Outlook 2025 to 2035

High Performance Medical Plastic Market Forecast Outlook 2025 to 2035

High Temperature Heat Pump Dryers Market Size and Share Forecast Outlook 2025 to 2035

High Temperature Fiberglass Filter Media Market Size and Share Forecast Outlook 2025 to 2035

High Purity Tungsten Hexachloride Market Size and Share Forecast Outlook 2025 to 2035

High Purity Nano Aluminum Oxide Powder Market Size and Share Forecast Outlook 2025 to 2035

High Mast Lighting Market Forecast and Outlook 2025 to 2035

High-Protein Pudding Market Forecast and Outlook 2025 to 2035

High-Power Microwave Source Market Size and Share Forecast Outlook 2025 to 2035

High Performance Epoxy Coating Market Size and Share Forecast Outlook 2025 to 2035

High Molecular Ammonium Polyphosphate Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA