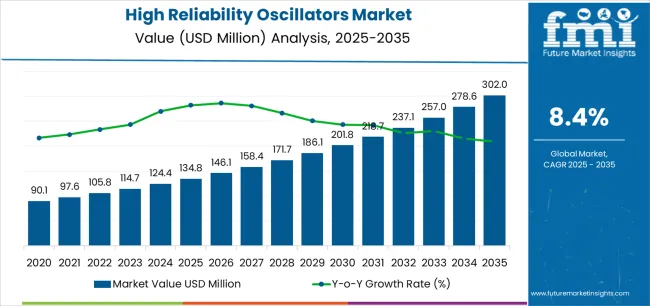

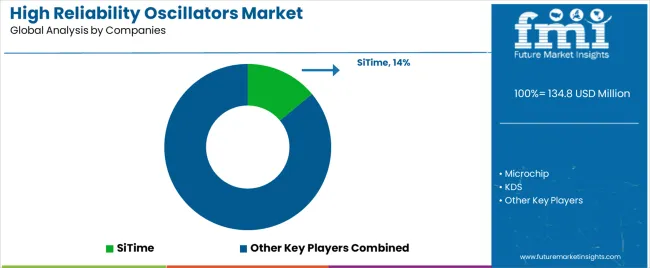

The global high reliability oscillators market, valued at USD 134.8 million in 2025, is projected to reach USD 302.0 million by 2035, expanding at a CAGR of 8.4%, driven by increasing demand for precision timing components in aerospace, defense, and satellite communication systems, rising adoption of vibration-resistant oscillators in harsh environments, and the growing need for frequency stability and signal integrity in mission-critical electronic applications. The global high-reliability oscillators market is positioned for substantial expansion over the next decade, driven by the increasing demand for precision timing solutions across defense, space, and mission-critical electronic applications worldwide. The market's growth trajectory reflects the critical role of ultra-stable frequency control components in addressing stringent reliability requirements, enabling advanced electronic systems, and supporting next-generation technologies in environments where component failure is not an option. As defense and aerospace sectors worldwide embrace advanced electronic warfare systems, satellite communications, and space exploration initiatives, the adoption of high reliability oscillators has accelerated, particularly in applications requiring extreme temperature tolerance, shock resistance, and long-term frequency stability.

The forecast period from 2025 to 2035 will witness significant technological advancements in oscillator design, including enhanced frequency stability characteristics, improved phase noise performance, and integration with miniaturized electronic systems for space-constrained applications. Defense contractors and aerospace manufacturers are increasingly recognizing the operational advantages of high reliability oscillator technology, including extended operational lifecycles, reduced system failure rates, and enhanced mission success probabilities through consistent timing performance. The space sector's expansion, particularly in satellite constellation deployments and deep space exploration missions, is creating substantial demand for radiation-hardened oscillator solutions capable of maintaining precise frequency references in harsh space environments.

Defense sector investments in advanced radar systems, secure communications infrastructure, and electronic warfare capabilities are further strengthening market prospects, as military applications, avionics systems, and missile guidance platforms require ultra-reliable timing components that perform consistently across extreme environmental conditions. The commercial space industry's growth, combined with the expansion of satellite-based communication networks, is driving adoption of high reliability oscillator technology for navigation systems, telecommunications satellites, and space exploration equipment. Regional defense modernization programs, particularly in emerging military powers, are creating new opportunities for high reliability oscillator deployment across diverse defense and aerospace applications.

The market's development is supported by continuous innovation in crystal resonator technologies, MEMS-based oscillator designs, and radiation-hardening techniques that enhance operational reliability and environmental resilience. Manufacturers are focusing on developing specialized oscillator configurations that offer superior performance across different frequency ranges and environmental specifications, enabling mission-critical solutions for varied defense and space requirements. Quality assurance considerations and mission success objectives are influencing product development, with focus on extended qualification testing, heritage component validation, and long-term reliability assurance that ensure consistent performance throughout operational lifecycles. The increasing complexity of military electronic systems and the critical nature of space missions are positioning high reliability oscillators as essential components of modern defense and aerospace infrastructure.

Between 2025 and 2030, the market is projected to expand from USD 134.8 million to USD 201.8 million, resulting in a value increase of USD 67.0 million, which represents 40.0% of the total forecast growth for the decade. This phase of development will be shaped by increasing defense electronics modernization programs, growing satellite constellation deployments, and rising demand for radiation-hardened components in space applications. Defense contractors and aerospace manufacturers are expanding their high reliability component capabilities to address the growing demand for mission-critical timing solutions that ensure system reliability and operational success.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 134.8 million |

| Forecast Value in (2035F) | USD 302.0 million |

| Forecast CAGR (2025 to 2035) | 8.4% |

From 2030 to 2035, the market is forecast to grow from USD 201.8 million to USD 302.0 million, adding another USD 100.2 million, which constitutes 60.0% of the overall ten-year expansion. This period is expected to be characterized by the expansion of commercial space activities with mega-constellation deployments, the development of next-generation military communication systems with advanced timing requirements, and the growth of specialized applications in hypersonic weapons systems and quantum communication networks. The growing adoption of advanced defense technologies and space exploration initiatives will drive demand for high reliability oscillators with enhanced radiation tolerance and ultra-stable frequency characteristics.

Between 2020 and 2025, the market experienced steady growth, driven by increasing defense modernization expenditures and growing recognition of precision timing components as essential elements for ensuring mission success and system reliability across diverse military and space applications. The market developed as systems engineers and reliability specialists recognized the potential for high reliability oscillator technology to reduce system failures, improve operational performance, and support mission-critical objectives while meeting stringent qualification requirements. Technological advancement in MEMS oscillator designs and radiation-hardening processes began emphasizing the critical importance of maintaining frequency stability and operational reliability in extreme environmental conditions.

Market expansion is being supported by the increasing global demand for mission-critical timing solutions driven by defense electronics proliferation and space industry expansion, alongside the corresponding need for ultra-reliable frequency control components that can enhance system reliability, enable advanced functionality, and maintain precise timing performance across various defense, space, and critical infrastructure applications. Modern defense systems and satellite platforms are increasingly focused on implementing high reliability oscillator solutions that can withstand extreme temperatures, resist radiation effects, and provide consistent performance in demanding operational environments.

The growing focus on mission success and system reliability is driving demand for high reliability oscillators that can support extended operational lifecycles, enable fault-tolerant system architectures, and ensure comprehensive performance assurance. Defense contractors' preference for timing components that combine exceptional reliability with environmental resilience and long-term stability is creating opportunities for innovative high reliability oscillator implementations. The rising influence of commercial space adoption and advanced military technology development is also contributing to increased adoption of high reliability oscillators that can provide superior timing accuracy without compromising operational dependability or mission success probability.

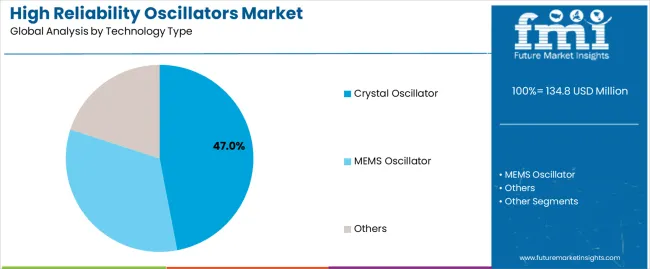

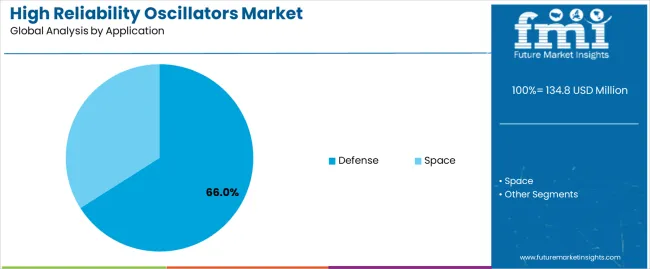

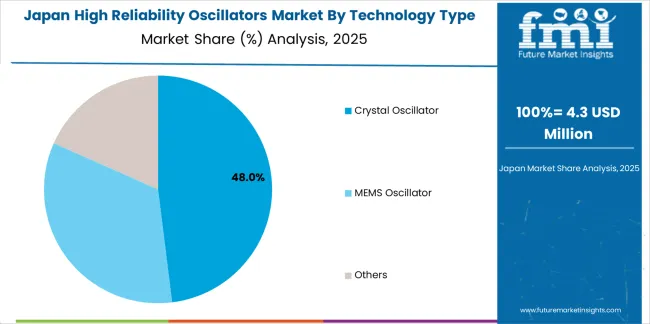

The market is segmented by technology type, application, and region. By technology type, the market is divided into crystal oscillator, MEMS oscillator, and others. Based on application, the market is categorized into defense and space. Regionally, the market is divided into East Asia, Europe, North America, South Asia, Latin America, Middle East & Africa, and Eastern Europe.

The crystal oscillator segment is projected to maintain its leading position in the market with 47% market share in 2025, reaffirming its role as the preferred technology for mission-critical timing applications across diverse defense and space systems. Defense contractors and aerospace manufacturers increasingly utilize crystal oscillators for their superior long-term stability, excellent temperature characteristics, and proven heritage in critical applications. Crystal oscillator technology's proven effectiveness and reliability heritage directly address industry requirements for mission-assured timing solutions and component qualification across diverse military platforms and space missions.

This technology segment forms the foundation of mission-critical timing systems, as it represents the technology with the greatest maturity level and established performance record across multiple defense applications and space programs. Defense and aerospace sector investments in reliable electronic components continue to strengthen adoption among systems integrators and platform manufacturers. With mission criticality requiring exceptional reliability and proven performance, crystal oscillators align with both qualification objectives and risk mitigation requirements, making it the central component of comprehensive mission-critical timing strategies.

The defense application segment is projected to represent the 66% market share of high reliability oscillators demand in 2025, highlighting its critical role as the primary driver for high reliability oscillator adoption across military communications, radar systems, electronic warfare equipment, and precision-guided munitions. Defense contractors prefer high reliability oscillators for military systems due to their exceptional frequency stability, environmental resilience, and ability to maintain precise timing performance while supporting mission success objectives and system qualification requirements. Positioned as essential components for modern defense electronics, high reliability oscillators offer both performance advantages and mission assurance benefits.

The segment is supported by continuous innovation in military technology and the growing availability of advanced oscillator designs that enable superior timing performance with enhanced reliability features and reduced size-weight-power characteristics. Defense organizations are investing in comprehensive component qualification programs to support increasingly stringent reliability requirements and mission-critical operational demands. As defense electronics complexity accelerates and mission requirements increase, the defense application will continue to dominate the market while supporting advanced timing solutions and system reliability optimization strategies.

The high reliability oscillators market is advancing steadily due to increasing demand for mission-critical timing components driven by defense modernization programs and growing adoption of satellite-based systems that require specialized frequency control technologies providing enhanced reliability characteristics and environmental resilience benefits across diverse defense and space applications. The market faces challenges, including stringent qualification requirements and extended certification timelines, high unit costs compared to commercial-grade oscillators, and supply chain constraints related to specialized materials availability and limited production capacity for space-qualified components. Innovation in MEMS-based oscillator technologies and advanced packaging techniques continues to influence product development and market expansion patterns.

The growing deployment of satellite mega-constellations is driving demand for cost-effective high reliability oscillators that address unique space application requirements including radiation tolerance, thermal cycling resistance, and long-term frequency stability for communication satellites. Space applications require advanced oscillator solutions that deliver superior reliability across multiple orbital environments while maintaining cost-effectiveness for large-scale constellation deployments. Satellite manufacturers are increasingly recognizing the competitive advantages of proven high reliability oscillator integration for mission success assurance and operational longevity, creating opportunities for innovative oscillator designs specifically engineered for new space economy applications.

Modern high reliability oscillator manufacturers are incorporating MEMS technology and advanced packaging approaches to enhance shock resistance, reduce size-weight-power consumption, and support comprehensive miniaturization objectives through optimized resonator designs and integrated circuit technologies. Leading companies are developing MEMS-based oscillator solutions with radiation hardening, implementing hermetic packaging technologies, and advancing manufacturing processes that improve environmental resilience and operational performance. These technologies improve reliability characteristics while enabling new application opportunities, including small satellite platforms, miniaturized defense systems, and space-constrained avionics installations. Advanced technology integration also allows manufacturers to support comprehensive mission assurance objectives and performance optimization beyond traditional crystal oscillator capabilities.

The expansion of deep space exploration missions and advanced military systems is driving demand for ultra-high-reliability oscillators with enhanced radiation tolerance, extreme temperature operation, and specialized qualification for harsh environment applications. These demanding applications require specialized oscillator technologies with stringent performance specifications that exceed standard military requirements, creating premium market segments with differentiated value propositions. Manufacturers are investing in radiation hardening capabilities and environmental testing facilities to serve emerging space exploration and advanced defense applications while supporting innovation in extreme environment electronics and mission-critical systems.

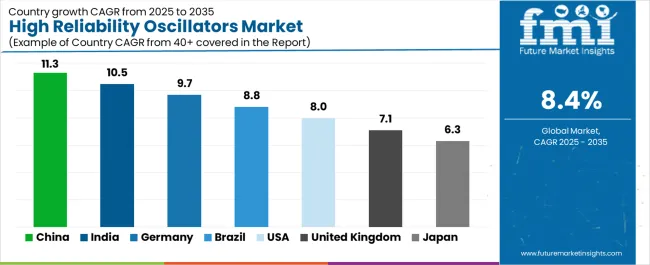

| Country | CAGR (2025-2035) |

|---|---|

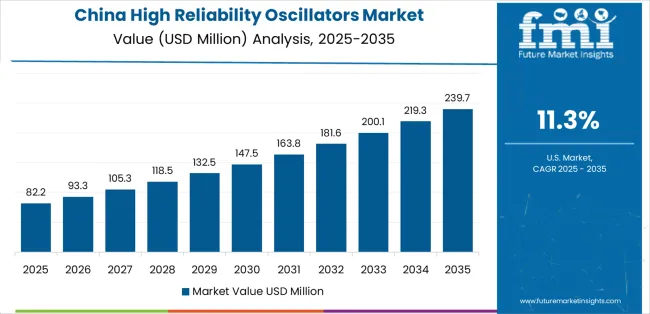

| China | 11.3% |

| India | 10.5% |

| Germany | 9.7% |

| Brazil | 8.8% |

| United States | 8.0% |

| United Kingdom | 7.1% |

| Japan | 6.3% |

The market is experiencing solid growth globally, with China leading at an 11.3% CAGR through 2035, driven by ambitious space program expansion, growing defense electronics modernization, and increasing domestic production capabilities for critical electronic components. India follows at 10.5%, supported by expanding space launch capabilities, growing defense electronics manufacturing, and increasing focus on indigenous component production for strategic applications. Germany shows growth at 9.7%, emphasizing aerospace technology excellence, defense electronics innovation, and advanced manufacturing capabilities for mission-critical components. Brazil demonstrates 8.8% growth, supported by growing satellite program investments, defense modernization initiatives, and space technology development. The United States records 8.0%, focusing on defense electronics leadership, commercial space industry growth, and advanced military systems development. The United Kingdom exhibits 7.1% growth, emphasizing space industry participation and defense electronics capabilities. Japan shows 6.3% growth, supported by space exploration programs and advanced electronics manufacturing excellence.

The report covers an in-depth analysis of 40+ countries, top-performing countries are highlighted below.

China is projected to exhibit exceptional growth with a CAGR of 11.3% through 2035, driven by ambitious space program expansion and rapidly growing defense electronics capabilities supported by government strategic initiatives and technology self-sufficiency programs. The country's comprehensive space infrastructure development and increasing military modernization investments are creating substantial demand for high reliability oscillator solutions. Major defense electronics manufacturers and space technology companies are establishing comprehensive high reliability component production capabilities to serve both domestic markets and reduce import dependencies.

India is expanding at a CAGR of 10.5%, supported by expanding space launch capabilities, growing defense electronics manufacturing infrastructure, and increasing focus on indigenous component production driven by government self-reliance initiatives and strategic autonomy objectives. The country's comprehensive space program development and defense manufacturing expansion are driving sophisticated high reliability oscillator capabilities throughout technology sectors. Leading defense electronics companies and space technology organizations are establishing production and qualification facilities to address growing domestic requirements.

Germany is expanding at a CAGR of 9.7%, supported by the country's aerospace technology excellence, advanced defense electronics capabilities, and strong focus on precision manufacturing and quality assurance. The nation's aerospace industry leadership and defense technology innovation are driving sophisticated high reliability oscillator capabilities throughout defense and space sectors. Leading aerospace companies and defense electronics manufacturers are investing extensively in advanced component technologies and qualification programs.

Brazil is expanding at a CAGR of 8.8%, supported by the country's growing satellite program investments, defense modernization initiatives, and increasing space technology development driven by strategic autonomy objectives and regional leadership ambitions. The nation's space program expansion and defense technology development are driving demand for reliable electronic components. Space agencies and defense organizations are investing in technology qualification capabilities to support program requirements.

The United States is expanding at a CAGR of 8.0%, supported by the country's defense electronics technological leadership, thriving commercial space industry, and growing focus on advanced military systems and space exploration capabilities. The nation's comprehensive defense sector and commercial space ecosystem are driving demand for sophisticated high reliability oscillator solutions. Defense contractors and space companies are investing in advanced component technologies to support system performance requirements.

The United Kingdom is expanding at a CAGR of 7.1%, driven by the country's space industry participation, defense electronics capabilities, and focus on advanced technology development for aerospace and military applications. The UK's aerospace sector presence and defense technology innovation are driving high reliability oscillator adoption throughout defense and space programs. Aerospace companies and defense contractors are establishing comprehensive component qualification capabilities for program excellence.

Japan is expanding at a CAGR of 6.3%, supported by the country's space exploration programs, advanced electronics manufacturing excellence, and strong focus on quality standards and technological innovation. Japan's technological sophistication and aerospace capabilities are driving demand for high-precision high reliability oscillator products. Leading aerospace companies and electronics manufacturers are investing in specialized component capabilities for space and defense applications.

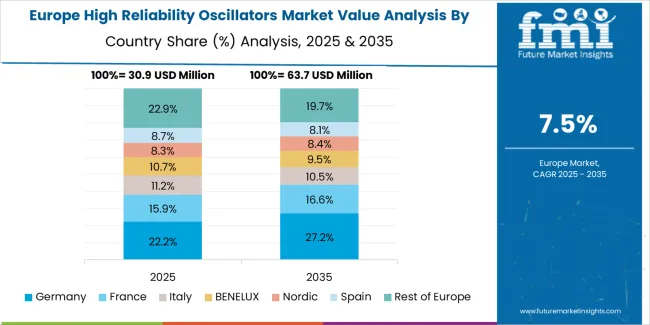

The high reliability oscillators market in Europe is projected to grow from USD 28.4 million in 2025 to USD 62.8 million by 2035, registering a CAGR of 8.3% over the forecast period. Germany is expected to maintain leadership with a 29.6% market share in 2025, moderating to 28.9% by 2035, supported by aerospace technology excellence, defense electronics capabilities, and advanced component manufacturing infrastructure.

France follows with 21.4% in 2025, projected at 22.1% by 2035, driven by space program leadership, defense electronics innovation, and satellite technology development initiatives. The United Kingdom holds 17.8% in 2025, reaching 17.4% by 2035 on the back of space industry participation and defense capability investments. Italy commands 12.9% in 2025, rising slightly to 13.3% by 2035, while Spain accounts for 8.6% in 2025, reaching 9.1% by 2035 aided by growing space sector participation and defense electronics development. The Netherlands maintains 4.2% in 2025, up to 4.5% by 2035 due to aerospace technology contributions and electronics manufacturing capabilities. The Rest of Europe region, including Nordics, Central & Eastern Europe, and other markets, is anticipated to hold 5.5% in 2025 and 4.7% by 2035, reflecting steady development in space technology programs and defense electronics initiatives.

The market is characterized by competition among established frequency control manufacturers, specialized military-grade component producers, and advanced electronics companies. Companies are investing in radiation hardening technology development, MEMS oscillator innovation, qualification program expansion, and application-specific engineering services to deliver high-performance, ultra-reliable, and mission-assured oscillator solutions. Innovation in extreme environment packaging, advanced resonator technologies, and comprehensive qualification methodologies is central to strengthening market position and competitive advantage.

SiTime leads the market with innovative MEMS-based oscillator solutions offering enhanced shock resistance, reduced size-weight-power characteristics, and comprehensive qualification for defense and space applications across diverse mission-critical systems. Microchip provides comprehensive timing solutions with focus on military-qualified oscillators and space-grade frequency control products. KDS offers crystal oscillator technologies with focus on high reliability applications and environmental resilience. Kyocera delivers advanced crystal devices with focus on quality and reliability for demanding applications. Epson specializes in precision crystal oscillators with comprehensive qualification heritage.

TXC provides frequency control solutions for industrial and military applications. Murata offers advanced oscillator technologies with focus on miniaturization and reliability. Renesas delivers integrated timing solutions with semiconductor expertise. NDK specializes in crystal oscillator technologies with extensive aerospace and defense application experience.

High reliability oscillators represent a specialized frequency control component segment within defense and aerospace electronics, projected to grow from USD 134.8 million in 2025 to USD 302.0 million by 2035 at an 8.4% CAGR. These mission-critical timing components—primarily comprising crystal and MEMS oscillator technologies—serve as essential frequency references in defense and space applications where exceptional reliability, environmental resilience, and long-term stability are essential. Market expansion is driven by increasing defense electronics modernization, growing satellite constellation deployments, expanding commercial space activities, and rising demand for radiation-hardened components across diverse military and aerospace segments.

How Defense and Space Regulators Could Strengthen Component Standards and Quality Assurance?

How Industry Associations Could Advance Technology Standards and Market Development?

How High Reliability Oscillator Manufacturers Could Drive Innovation and Market Leadership?

How Defense and Space Organizations Could Optimize Component Performance and Mission Assurance?

How Research Institutions Could Enable Technology Advancement?

How Investors and Financial Enablers Could Support Market Growth and Innovation?

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 134.8 million |

| Technology Type | Crystal Oscillator, MEMS Oscillator, Others |

| Application | Defense, Space |

| Regions Covered | East Asia, Europe, North America, South Asia, Latin America, Middle East & Africa, Eastern Europe |

| Countries Covered | China, India, Germany, Brazil, United States, United Kingdom, Japan, and 40+ countries |

| Key Companies Profiled | SiTime, Microchip, KDS, Kyocera, Epson, TXC, Murata, Renesas, NDK |

| Additional Attributes | Dollar sales by technology type and application category, regional demand trends, competitive landscape, technological advancements in oscillator technologies, reliability enhancement development, radiation hardening innovation, and mission assurance optimization |

The global high reliability oscillators market is estimated to be valued at USD 134.8 million in 2025.

The market size for the high reliability oscillators market is projected to reach USD 302.0 million by 2035.

The high reliability oscillators market is expected to grow at a 8.4% CAGR between 2025 and 2035.

The key product types in high reliability oscillators market are crystal oscillator, MEMS oscillator and others.

In terms of application, defense segment to command 66.0% share in the high reliability oscillators market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

High-performance Dual-core Processor Market Size and Share Forecast Outlook 2025 to 2035

High Purity Magnesium Citrate Market Size and Share Forecast Outlook 2025 to 2035

High Performance Magnet Market Size and Share Forecast Outlook 2025 to 2035

High-frequency RF Evaluation Board Market Size and Share Forecast Outlook 2025 to 2035

High Viscosity Mixer Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Ionising Air Gun Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Equipment Market Forecast and Outlook 2025 to 2035

High Clear Film Market Size and Share Forecast Outlook 2025 to 2035

High Performance Random Packing Market Forecast Outlook 2025 to 2035

High Precision Microfluidic Pump Market Size and Share Forecast Outlook 2025 to 2035

High Performance Composites Market Forecast Outlook 2025 to 2035

High Performance Medical Plastic Market Forecast Outlook 2025 to 2035

High Temperature Heat Pump Dryers Market Size and Share Forecast Outlook 2025 to 2035

High Temperature Fiberglass Filter Media Market Size and Share Forecast Outlook 2025 to 2035

High Purity Tungsten Hexachloride Market Size and Share Forecast Outlook 2025 to 2035

High Purity Nano Aluminum Oxide Powder Market Size and Share Forecast Outlook 2025 to 2035

High Mast Lighting Market Forecast and Outlook 2025 to 2035

High-Protein Pudding Market Forecast and Outlook 2025 to 2035

High Voltage Ceramic Zinc Oxide Surge Arrester Market Size and Share Forecast Outlook 2025 to 2035

High-Power Microwave Source Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA