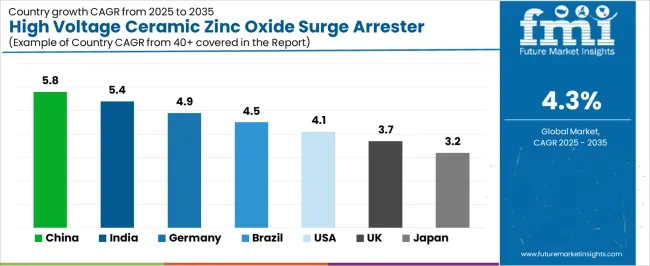

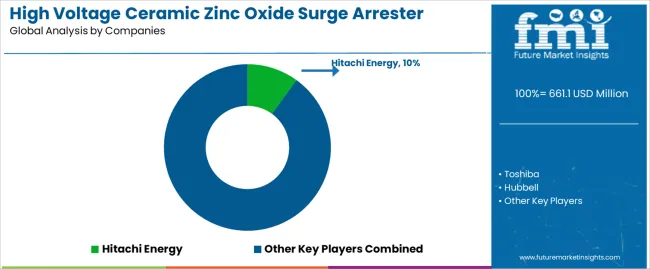

The global high voltage ceramic zinc oxide surge arrester industry is forecast to expand from USD 661.1 million in 2025 to USD 1,007.1 million by 2035, recording an absolute increase of USD 346.0 million at a CAGR of 4.3%. Growth, which represents a 1.5X expansion of market size, is shaped by regional variations in power grid modernization, renewable energy adoption, and investment in high-voltage transmission infrastructure. In North America, steady demand is driven by grid reinforcement projects in the United States and Canada. The replacement of aging transmission lines, coupled with rising investments in renewable integration and smart grid technologies, sustains the need for advanced surge arresters. North America is expected to maintain moderate but consistent growth as utilities prioritize reliability and protection standards across transmission and distribution systems.

In Europe, demand is concentrated in countries modernizing grid networks to meet renewable energy targets and decarbonization mandates. Germany, France, and the UK are expected to lead adoption, as they expand wind and solar integration into high-voltage networks. EU regulations promoting grid stability and safety standards push utilities toward premium-grade zinc oxide surge arresters with superior reliability. Market growth remains supported by strong regulatory backing and technology partnerships within the European power sector. In Asia-Pacific, the fastest growth is expected, with China, India, Japan, and South Korea as primary contributors. China leads through massive grid expansion projects, state-backed renewable integration, and extensive transmission capacity upgrades. India’s rural electrification programs and investments in renewable energy corridors add significant demand, while Japan and South Korea drive adoption through high-quality standards and replacement of legacy systems. Asia-Pacific is projected to account for the largest share of incremental market value by 2035, reflecting both scale and speed of adoption.

In the Middle East, demand is shaped by power grid expansion in Saudi Arabia, the UAE, and Qatar, where large-scale industrialization and renewable energy diversification require stable high-voltage systems. Surge arrester demand is supported by government-backed infrastructure development and the integration of solar and wind projects into national grids. Africa, though smaller in scale, shows potential in South Africa and parts of East Africa, where electrification programs and regional transmission projects increase procurement. In Latin America, grid modernization in Brazil, Mexico, and Chile drives incremental demand. Investments in hydroelectric and solar projects increase the requirement for surge protection in transmission lines and substations. Growth is moderate but steady, as regional utilities adopt ceramic zinc oxide surge arresters to improve reliability under fluctuating weather and load conditions.

| Item | Value / Description |

|---|---|

| Market Value (2025) | USD 661.1 million |

| Forecast Value (2035) | USD 1,007.1 million |

| Forecast CAGR (2025–2035) | 4.3% |

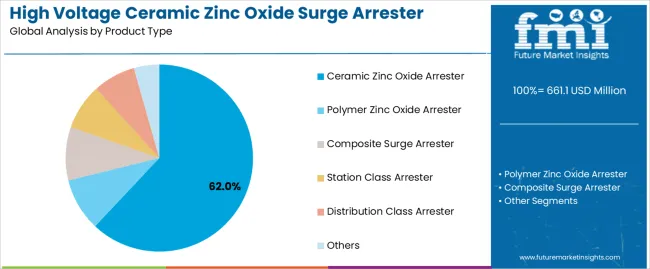

| Leading Product Type (2025) | Ceramic Zinc Oxide Arrester - 62% share |

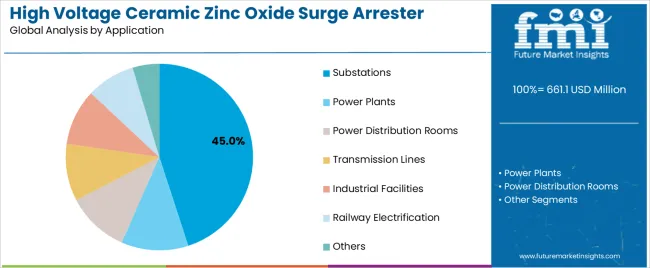

| Leading Application (2025) | Substations - 45% share |

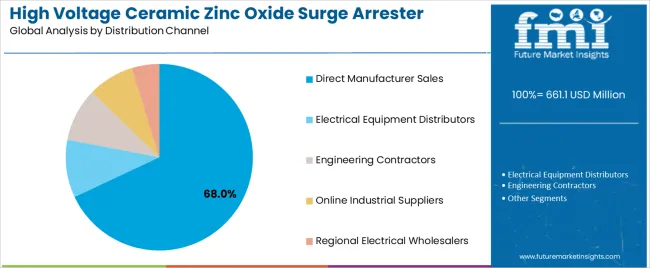

| Leading Distribution Channel (2025) | Direct Manufacturer Sales - 68% share |

| Key Growth Regions | China; India; Germany |

| Top Companies by Market Share | Hitachi Energy; Toshiba; Hubbell |

| Metric | Value |

|---|---|

| Market Value (2025) | USD 661.1 million |

| Market Forecast Value (2035) | USD 1,007.1 million |

| Forecast CAGR (2025–2035) | 4.3% |

| GRID MODERNIZATION TRENDS | INFRASTRUCTURE PROTECTION REQUIREMENTS | TECHNOLOGY & QUALITY STANDARDS |

|---|---|---|

| Renewable Energy Integration - Continuous expansion of wind and solar power generation across established and emerging markets driving demand for high-quality surge protection solutions. | Power Grid Reliability - Modern electrical systems require precision surge arresters delivering accurate voltage protection and enhanced grid stability. | Electrical Safety Standards - Industry requirements establishing performance benchmarks favoring high-precision ceramic zinc oxide components. |

| Smart Grid Development - Growing emphasis on intelligent electrical distribution and grid automation creating demand for premium surge protection devices. | Substation Protection Demands - Power substations investing in premium arresters offering precise voltage clamping and superior fault current handling while maintaining system reliability. | Voltage Clamping Optimization - Quality standards requiring optimal voltage protection and minimal equipment degradation in critical electrical applications. |

| Grid Expansion Programs - Superior voltage protection and electrical reliability capabilities making surge arresters essential for high-voltage power transmission applications. | Power Quality Requirements - Certified arresters with proven specifications required for professional electrical protection applications. | Ceramic Technology Requirements - Advanced ceramic formulations and zinc oxide specifications driving need for precision manufacturing capabilities. |

| Category | Segments / Values |

|---|---|

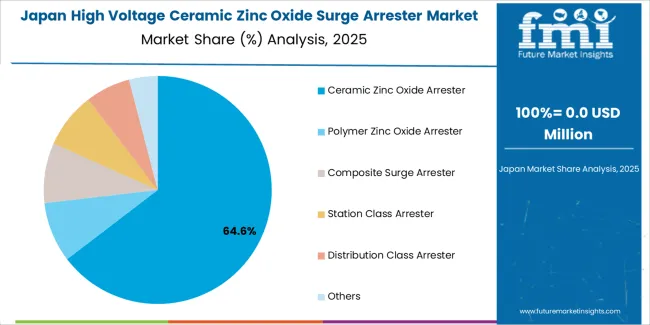

| By Product Type | Ceramic Zinc Oxide Arrester; Polymer Zinc Oxide Arrester; Composite Surge Arrester; Station Class Arrester; Distribution Class Arrester; Others |

| By Application | Substations; Power Plants; Power Distribution Rooms; Transmission Lines; Industrial Facilities; Railway Electrification; Others |

| By Voltage Rating | Medium Voltage (1-35kV); High Voltage (36-138kV); Extra High Voltage (Above 138kV) |

| By Installation Type | Indoor Installation; Outdoor Installation |

| By Distribution Channel | Direct Manufacturer Sales; Electrical Equipment Distributors; Engineering Contractors; Online Industrial Suppliers; Regional Electrical Wholesalers |

| By Region | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Segment | 2025–2035 Outlook |

|---|---|

| Ceramic Zinc Oxide Arrester | Leader in 2025 with 62.0% market share; likely to maintain strong position through 2035. Superior electrical performance, proven reliability in harsh environments, and cost-effective manufacturing. Momentum: steady growth. Watchouts: competition from polymer alternatives in specific applications. |

| Polymer Zinc Oxide Arrester | Premium segment with 24.5% share, benefiting from utility demand for lightweight construction and enhanced contamination resistance. Momentum: rising in coastal and polluted environments. Watchouts: higher costs and specialized installation requirements. |

| Composite Surge Arrester | Advanced technology offering combined benefits of ceramic and polymer designs for specific applications. Momentum: moderate growth in specialized installations. |

| Station Class Arrester | High-voltage applications requiring maximum protection capabilities for critical substation equipment. Momentum: strong growth in grid modernization projects. |

| Distribution Class Arrester | Cost-effective solutions for medium voltage applications and distribution networks. Momentum: steady growth with infrastructure expansion. |

| Others | Includes specialized arresters for railway, industrial, and marine applications. High performance requirements, niche market. Momentum: selective growth in specialized industrial segments. |

| Segment | 2025–2035 Outlook |

|---|---|

| Substations | Largest application segment in 2025 at 45.0% share, supported by grid modernization and established utility infrastructure. Driven by power system reliability requirements and substation equipment protection needs. Momentum: strong growth from renewable energy integration and grid expansion projects. Watchouts: budget constraints in developing markets and maintenance scheduling challenges. |

| Power Plants | Key segment for generation facilities requiring comprehensive surge protection. Requires high-performance arresters for generator protection and auxiliary systems. Momentum: steady growth through renewable energy expansion. Watchouts: shift toward distributed generation reducing centralized plant requirements. |

| Power Distribution Rooms | Critical segment for industrial and commercial facilities requiring reliable electrical protection. Momentum: moderate growth in industrial expansion. Watchouts: space constraints and standardization requirements. |

| Transmission Lines | Specialized segment for overhead line protection requiring specific voltage ratings and environmental resistance. Momentum: strong growth from grid interconnection projects. Watchouts: right-of-way limitations and environmental regulations. |

| Industrial Facilities | Manufacturing and processing plants demand reliable arresters for equipment protection and process continuity. Momentum: selective growth in industrial automation and facility expansion. Watchouts: industry-specific requirements and budget cycles. |

| Distribution Channel | Status & Outlook (2025–2035) |

|---|---|

| Direct Manufacturer Sales | Dominant channel in 2025 with 68% share for high-voltage arresters. Offers technical consultation, custom engineering, and comprehensive project support. Momentum: steady growth driven by utility relationships and large-scale projects. Watchouts: increased competition and margin pressure from alternative channels. |

| Electrical Equipment Distributors | Growing channel serving regional utilities and contractors with inventory management and technical support. Momentum: strong growth as utilities seek local partnerships and faster delivery times. |

| Engineering Contractors | Project-based channel for turnkey electrical installations and grid modernization projects. Momentum: rising with infrastructure development and EPC project growth. |

| Online Industrial Suppliers | Emerging channel for smaller voltage ratings and standard specifications. Momentum: moderate growth in standardized products and replacement components. |

| Regional Electrical Wholesalers | Traditional channel for distribution-level arresters and maintenance supplies. Momentum: stable growth in established markets, declining for premium applications. Focus shifting toward value-added services and local inventory management. |

| DRIVERS | RESTRaiNTS | KEY TRENDS |

|---|---|---|

| Expanding renewable energy infrastructure across established and emerging markets is driving demand for advanced surge protection systems. | High initial investment costs and complex installation requirements limit adoption for smaller utilities and industrial facilities. | Development of smart arrester technologies, condition monitoring capabilities, and predictive maintenance systems are enabling superior grid protection. |

| Grid Modernization Programs - Increasing investment in smart grid infrastructure and transmission system upgrades is creating demand for precision surge protection components. | Technical Complexity - Installation requirements and system integration challenges affect project timelines and maintenance capabilities. | Ceramic Technology Innovation - Enhanced zinc oxide formulations, improved housing designs, and optimized electrical characteristics are advancing performance capabilities. |

| Power System Reliability Requirements - Rising demand for uninterrupted power supply in critical applications fuels steady arrester adoption across utility and industrial sectors. | Regulatory Compliance Costs - Stringent electrical safety standards and certification requirements increase development and testing expenses. | Specialized Application Development - Emerging demand for arresters tailored to renewable energy systems, railway electrification, and marine environments. |

| Infrastructure Development - Expanding electrical grid networks in developing countries create substantial demand for surge protection equipment. | Competition from Alternative Technologies - Gas-filled arresters and other protection technologies compete in specific voltage ranges and applications. | Ongoing R&D Focus - Continuous improvement in voltage clamping characteristics, thermal stability, and environmental resistance to meet evolving utility standards. |

| Country | CAGR (2025–2035) |

|---|---|

| China | 5.8% |

| India | 5.4% |

| Germany | 4.9% |

| Brazil | 4.5% |

| United States | 4.1% |

| United Kingdom | 3.7% |

| Japan | 3.2% |

Revenue from High Voltage Ceramic Zinc Oxide Surge Arresters in China is projected to exhibit strong growth with a market value of USD 285.4 million by 2035, driven by expanding power grid infrastructure and comprehensive renewable energy integration creating substantial opportunities for component suppliers across utility operations, industrial facilities, and transmission system contractors. The country's established electrical equipment manufacturing tradition and expanding high-voltage capabilities are creating significant demand for both ceramic and polymer surge arrester systems. Major electrical companies and grid operators including State Grid Corporation and China Southern Power Grid are establishing comprehensive local component production facilities to support large-scale grid modernization operations and meet growing demand for efficient protection solutions.

Revenue from High Voltage Ceramic Zinc Oxide Surge Arresters in India is expanding to reach USD 248.6 million by 2035, supported by extensive power sector expansion and comprehensive grid reliability improvement creating demand for reliable surge protection solutions across diverse utility categories and industrial power segments. The country's growing electricity demand and expanding manufacturing sector are driving demand for protection solutions that provide consistent electrical performance while supporting cost-effective system requirements. Equipment distributors and electrical contractors are investing in local market development to support growing utility operations and industrial power demand.

Demand for High Voltage Ceramic Zinc Oxide Surge Arresters in Germany is projected to reach USD 152.8 million by 2035, supported by the country's leadership in electrical engineering and advanced power system technologies requiring sophisticated surge protection for renewable energy integration and grid stability applications. German utilities and engineering companies are implementing high-precision protection systems that support advanced grid management capabilities, operational reliability, and comprehensive quality protocols. The market is characterized by focus on engineering excellence, component precision, and compliance with stringent electrical safety and performance standards.

Revenue from High Voltage Ceramic Zinc Oxide Surge Arresters in Brazil is growing to reach USD 138.7 million by 2035, driven by power sector expansion programs and increasing grid reliability requirements creating opportunities for component suppliers serving both utility operations and industrial power contractors. The country's extensive power generation capacity and expanding transmission infrastructure are creating demand for surge protection components that support diverse electrical requirements while maintaining performance standards. Electrical contractors and utility service providers are developing procurement strategies to support operational efficiency and system reliability.

Demand for High Voltage Ceramic Zinc Oxide Surge Arresters in United States is projected to reach USD 125.3 million by 2035, expanding at a CAGR of 4.1%, driven by electrical grid modernization excellence and specialized utility capabilities supporting advanced power system protection and comprehensive reliability applications. The country's established electrical infrastructure and mature utility market segments are creating demand for high-quality surge protection components that support operational performance and electrical standards. Component manufacturers and electrical equipment suppliers are maintaining comprehensive development capabilities to support diverse utility requirements.

Revenue from High Voltage Ceramic Zinc Oxide Surge Arresters in United Kingdom is growing to reach USD 118.9 million by 2035, supported by electrical system reliability programs and established utility networks driving demand for premium surge protection solutions across traditional grid systems and renewable energy integration applications. The country's commitment to clean energy transition and established electrical engineering capabilities create demand for surge protection components that support both conventional power systems and modern renewable energy installations.

Demand for High Voltage Ceramic Zinc Oxide Surge Arresters in Japan is projected to reach USD 112.4 million by 2035, driven by precision electrical engineering tradition and established power system technology leadership supporting both domestic utility markets and export-oriented component production. Japanese companies maintain sophisticated surge arrester development capabilities, with established manufacturers continuing to lead in ceramic technology innovation and precision manufacturing standards.

European High Voltage Ceramic Zinc Oxide Surge Arrester operations are increasingly concentrated between German precision engineering and Scandinavian grid modernization excellence. German facilities dominate premium station-class arrester production for transmission and high-voltage applications, leveraging advanced ceramic technologies and strict quality protocols that command price premiums in global markets. Nordic manufacturers maintain leadership in outdoor arrester designs and cold-weather performance specifications, with companies like ABB and Schneider Electric driving technical requirements that smaller suppliers must meet to access utility infrastructure contracts.

Eastern European operations in Czech Republic and Poland are capturing volume-oriented production contracts through skilled labor advantages and EU regulatory compliance, particularly in distribution-class arresters for medium-voltage applications. These facilities increasingly serve as manufacturing capacity for Western European brands while developing their own engineering expertise in ceramic formulation and zinc oxide processing.

The regulatory environment presents both opportunities and constraints. CE marking requirements create quality standards that favor established European manufacturers over imports while ensuring consistent electrical performance specifications. Brexit has created complexity for UK component sourcing from EU suppliers, driving opportunities for direct relationships between manufacturers and utility procurement departments.

Supply chain consolidation accelerates as manufacturers seek economies of scale to absorb rising ceramic material costs and precision manufacturing expenses. Vertical integration increases, with major electrical equipment manufacturers acquiring surge arrester production facilities to secure component supplies and quality control. Smaller manufacturers face pressure to specialize in niche voltage ranges or risk displacement by larger, more efficient operations serving mainstream utility infrastructure requirements.

South Korean High Voltage Ceramic Zinc Oxide Surge Arrester operations reflect the country's advanced electrical infrastructure and export-oriented manufacturing model. Major industrial conglomerates including Hyundai Heavy Industries and Doosan drive component procurement strategies for their electrical equipment divisions, establishing direct relationships with specialized arrester suppliers to secure consistent quality and pricing for their transmission equipment and power system products targeting both domestic and international markets.

The Korean market demonstrates particular strength in integrating surge protection technologies into smart grid systems, with companies developing products that incorporate digital monitoring capabilities and communication protocols. This integration approach creates demand for specific performance specifications that differ from traditional applications, requiring suppliers to adapt voltage clamping characteristics and environmental resistance capabilities.

Regulatory frameworks emphasize electrical safety and grid reliability standards, with Korea Electric Power Corporation (KEPCO) requirements often exceeding international specifications. This creates barriers for smaller component suppliers but benefits established manufacturers who can demonstrate compliance capabilities and comprehensive testing documentation. The regulatory environment particularly favors suppliers with Korean certification and extensive quality management systems.

Supply chain efficiency remains critical given Korea's technological advancement focus and competitive electrical equipment market dynamics. Companies increasingly pursue development contracts with suppliers in Japan, Germany, and specialized manufacturers to ensure access to advanced ceramic technologies while managing cost pressures. Investment in research and development supports quality advancement during extended product qualification cycles.

Profit pools are consolidating upstream in precision ceramic manufacturing and downstream in application-specific arrester designs for transmission, substation, and renewable energy markets where certification, voltage clamping precision, and consistent electrical performance command premiums. Value is migrating from basic distribution-class arrester production to specification-driven, application-ready components where engineering expertise, ceramic technology, and reliable protection characteristics create competitive advantages. Several archetypes define market leadership: established global electrical equipment manufacturers defending share through engineering excellence and utility relationships; specialized surge protection companies leveraging ceramic technology intellectual property and application expertise; regional manufacturers pursuing cost-competitive production while developing technical capabilities; and emerging technology providers with smart arrester solutions and condition monitoring capabilities. Switching costs - utility qualification, performance certification, grid integration requirements - provide stability for established suppliers, while technological advancement and grid modernization create opportunities for innovative manufacturers. Consolidation continues as companies seek manufacturing scale; direct sales channels grow for large utility projects while distribution remains relationship-driven for smaller installations. Focus areas: secure transmission utility and substation market positions with application-specific performance specifications and technical support; develop ceramic technology capabilities and precision manufacturing systems; explore smart grid applications including condition monitoring and predictive maintenance requirements.

| Stakeholder Type | Primary Advantage | Repeatable Plays |

|---|---|---|

| Global Electrical Equipment Manufacturers | Established utility relationships; comprehensive product portfolios; global manufacturing scale | Utility partnerships; technical certification; integrated solutions |

| Specialized Surge Protection Companies | Application expertise; advanced ceramic technology; focused engineering capabilities | Technical innovation; performance optimization; specialized applications |

| Regional Manufacturing Leaders | Local market knowledge; cost-effective production; regulatory compliance | Regional partnerships; manufacturing efficiency; market penetration strategies |

| Smart Grid Technology Providers | Digital monitoring capabilities; condition assessment systems; predictive maintenance solutions | Technology integration; data analytics; value-added services |

| Component Distributors | Technical distribution networks; inventory management; installation support | Technical expertise; supply chain efficiency; customer education programs |

| Item | Value |

|---|---|

| Quantitative Units | USD 661.1 million |

| Product Types | Ceramic Zinc Oxide Arrester; Polymer Zinc Oxide Arrester; Composite Surge Arrester; Station Class Arrester; Distribution Class Arrester; Others |

| Applications | Substations; Power Plants; Power Distribution Rooms; Transmission Lines; Industrial Facilities; Railway Electrification |

| Voltage Ratings | Medium Voltage (1-35kV); High Voltage (36-138kV); Extra High Voltage (Above 138kV) |

| Installation Types | Indoor Installation; Outdoor Installation |

| Distribution Channels | Direct Manufacturer Sales; Electrical Equipment Distributors; Engineering Contractors; Online Industrial Suppliers; Regional Electrical Wholesalers |

| Regions Covered | North America; Latin America; Europe; Asia Pacific; Middle East & Africa |

| Key Countries | China; India; Germany; Brazil; United States; United Kingdom; Japan (+35 additional countries) |

| Key Companies Profiled | Hitachi Energy; Toshiba; Hubbell; Eaton; siemens; Meidensha; GE Grid Solutions; Ximeilei; Shreem Electric; Ensto; CG Power; Tridelta Meidensha; Pinggao Group; JinGuan Electric; Evergrande Electric; NANYANG JINNIU ELECTRIC; ABB; Schneider Electric; Crompton Greaves |

| Additional Attributes | Dollar sales by product type and distribution channel; Regional demand trends (NA, EU, APAC); Competitive landscape; Direct sales vs. distributor adoption patterns; Manufacturing and assembly integration; Precision engineering innovations driving electrical protection, grid reliability, and technical excellence |

The global high voltage ceramic zinc oxide surge arrester market is estimated to be valued at USD 661.1 million in 2025.

The market size for the high voltage ceramic zinc oxide surge arrester market is projected to reach USD 1,007.1 million by 2035.

The high voltage ceramic zinc oxide surge arrester market is expected to grow at a 4.3% CAGR between 2025 and 2035.

The key product types in high voltage ceramic zinc oxide surge arrester market are ceramic zinc oxide arrester, polymer zinc oxide arrester, composite surge arrester, station class arrester, distribution class arrester and others.

In terms of application, substations segment to command 45.0% share in the high voltage ceramic zinc oxide surge arrester market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

High Mast Lighting Market Forecast and Outlook 2025 to 2035

High-Protein Pudding Market Forecast and Outlook 2025 to 2035

High-Power Microwave Source Market Size and Share Forecast Outlook 2025 to 2035

High Performance Epoxy Coating Market Size and Share Forecast Outlook 2025 to 2035

High Temperature Fiberglass Filter Media Market Size and Share Forecast Outlook 2025 to 2035

High Molecular Ammonium Polyphosphate Market Size and Share Forecast Outlook 2025 to 2035

High Performance Fluoropolymer Market Size and Share Forecast Outlook 2025 to 2035

High Throughput Screening Market Size and Share Forecast Outlook 2025 to 2035

High Barrier Packaging Films for Pharmaceuticals Market Size and Share Forecast Outlook 2025 to 2035

High Barrier Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

High Purity Carbonyl Iron Powder (CIP) Market Size and Share Forecast Outlook 2025 to 2035

High-Performance Fiber Market Size and Share Forecast Outlook 2025 to 2035

High Temperature Grease Market Size and Share Forecast Outlook 2025 to 2035

High Frequency Chest-Wall Oscillation Devices Market Size and Share Forecast Outlook 2025 to 2035

High-purity Fluoropolymer Valves Market Size and Share Forecast Outlook 2025 to 2035

High Barrier Pharmaceutical Packaging Films for Blister Market Size and Share Forecast Outlook 2025 to 2035

High Current Ion Implanter Market Size and Share Forecast Outlook 2025 to 2035

High Rate Discharge Test Machine Market Size and Share Forecast Outlook 2025 to 2035

High-precision Confocal Sensor Market Size and Share Forecast Outlook 2025 to 2035

High Performance Carbon Fiber Precursor Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA