The high mast lighting market is experiencing steady expansion driven by rapid urban infrastructure development, increasing investments in roadway illumination projects, and the growing emphasis on energy-efficient lighting solutions. Market growth is being supported by government-led smart city initiatives and the modernization of public lighting systems across both developed and emerging economies. Current demand trends are favoring advanced, durable, and low-maintenance systems that ensure optimal visibility and operational safety.

Manufacturers are focusing on developing modular, corrosion-resistant, and height-adjustable designs that cater to diverse outdoor applications. The transition from conventional lighting technologies to LED-based systems has further enhanced energy savings and lifespan, aligning with global sustainability goals.

Future growth is expected to be supported by continued infrastructure upgrades, rising adoption of automated control systems, and improved financing models for public lighting projects Overall, the market is positioned for consistent revenue growth supported by technological innovation, reduced maintenance costs, and expanding deployment across transportation and industrial sectors.

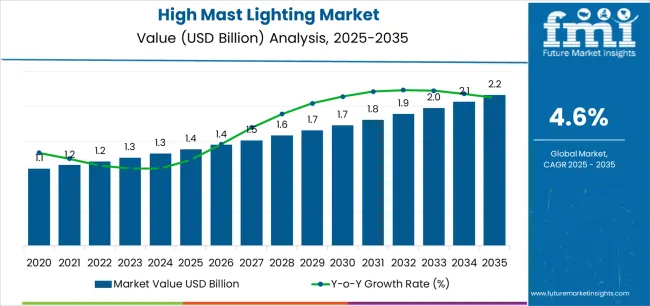

| Metric | Value |

|---|---|

| High Mast Lighting Market Estimated Value in (2025 E) | USD 1.4 billion |

| High Mast Lighting Market Forecast Value in (2035 F) | USD 2.2 billion |

| Forecast CAGR (2025 to 2035) | 4.6% |

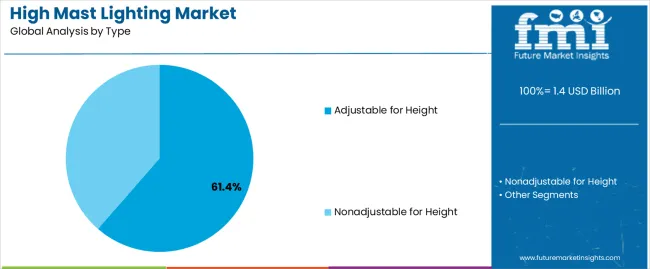

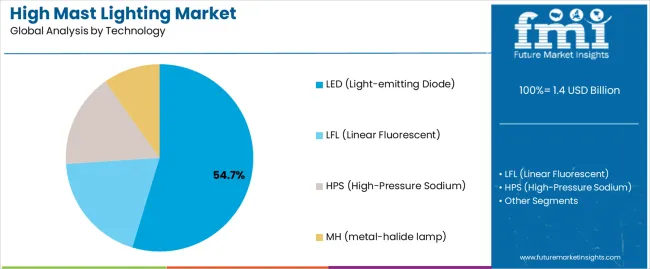

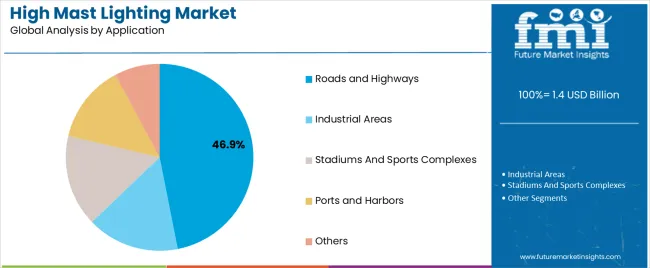

The market is segmented by Type, Technology, and Application and region. By Type, the market is divided into Adjustable for Height and Nonadjustable for Height. In terms of Technology, the market is classified into LED (Light-emitting Diode), LFL (Linear Fluorescent), HPS (High-Pressure Sodium), and MH (metal-halide lamp). Based on Application, the market is segmented into Roads and Highways, Industrial Areas, Stadiums And Sports Complexes, Ports and Harbors, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The adjustable for height segment, accounting for 61.40% of the type category, has emerged as the leading segment due to its operational flexibility, enhanced maintenance convenience, and suitability for large-area illumination. The ability to raise or lower luminaires simplifies inspection, cleaning, and replacement processes, thereby reducing downtime and maintenance costs.

Demand has been supported by increasing adoption in airports, highways, and industrial zones where consistent lighting and ease of access are critical. The segment’s growth has been further strengthened by structural innovations and the use of durable materials that withstand adverse weather conditions.

Ongoing investments in infrastructure modernization projects and public safety initiatives are expected to sustain the segment’s dominance, ensuring continued preference for height-adjustable configurations in large-scale outdoor lighting installations.

The LED (Light-emitting Diode) segment, holding 54.70% of the technology category, has maintained market leadership owing to superior energy efficiency, longer service life, and reduced environmental impact compared to conventional lighting sources. The segment’s performance has been enhanced by declining component costs and technological improvements that enable higher lumen output and better thermal management.

Adoption has been widespread across both urban and rural projects, supported by government incentives promoting energy-efficient lighting. LED systems also provide enhanced control capabilities through smart monitoring and dimming functions, contributing to lower operational costs.

The roads and highways segment, representing 46.90% of the application category, has remained dominant due to the extensive deployment of high mast lighting systems for improving visibility and traffic safety. Demand has been supported by large-scale government infrastructure programs aimed at enhancing transportation networks and reducing accident rates.

The segment’s expansion has been driven by the need for efficient illumination in high-traffic areas and the integration of advanced control systems that enable automatic operation and fault detection. Contractors and municipal authorities are increasingly prioritizing high mast lighting for its ability to cover wider areas with fewer installations, ensuring cost efficiency and operational reliability.

High Mast Lighting Market to Expand Over 2.1x through 2035

The high mast lighting market is predicted to expand over 2.1x through 2035, accompanied by a 1.0% increase in the expected CAGR compared to the historical one. High mast lighting is increasingly crucial in industries like transportation, sports, and manufacturing due to its enhanced visibility, safety, and security benefits. By 2035, the total market revenue is set to reach USD 2,109.5 million.

North America to Lead the High Mast Lighting Market

North America is expected to dominate the high mast lighting market during the forecast period. It is set to hold around 30.4% of the market share in 2035. This is attributed to the following factors:

The high mast lighting market grew at a CAGR of 3.8% between 2020 and 2025. The market reached USD 1,269.8 million in 2025.

| Historical CAGR (2020 to 2025) | 3.8% |

|---|---|

| Forecast CAGR (2025 to 2035) | 4.8% |

Urbanization and Infrastructure Development

Urbanization and increasing demand for infrastructure are driving strong growth in the market. As cities expand and modernize, there is a need for efficient lighting solutions to illuminate large areas such as road networks, public spaces, and industrial areas.

Energy Efficiency and Sustainability

The high mast lightening industry is experiencing significant expansion driven by increasing emphasis on energy efficiency and sustainability. LED's high efficiency, longevity, and reduced energy consumption align with global sustainability goals and are expected to fuel the market.

Integrating renewable energy and smart lighting solutions is driving market expansion as the industry converges toward environmentally conscious practices. High-quality mast lighting is crucial for sustainable urban development, requiring energy-efficient and eco-friendly technologies for continued growth and market profitability.

Technological Advancements

Ongoing technical improvements in the high mast lighting market, including smart lighting controls and sensors, are driving the market. These advancements provide features such as remote monitoring, adaptive lighting, and energy management, which improve operating efficiency.

As companies and municipalities seek smarter and more automated lighting systems, the high mast lighting market provides increasingly sophisticated and technologically advanced lighting options.

Initial Installation Costs

The cost associated with purchasing and installing tall columns, fixtures, and necessary electrical systems is set to be substantial. This upfront investment is expected to prevent certain budget-constrained municipalities or organizations from adopting high-end mast lighting, especially when compared to traditional lighting shell

Lack of Awareness and Education

Lack of awareness among potential users and the industry is a key challenge for the high mast lighting market. Several companies still need to learn about the benefits and efficiencies of advanced wiring technology. This lack of knowledge is set to hinder market growth.

The table below shows the estimated growth rates of the leading countries. India, China, and Turkiye are set to record high CAGRs of 4.6%, 3.5%, and 3.1% respectively, through 2035.

| Countries | Projected CAGR (2025 to 2035) |

|---|---|

| India | 4.6% |

| China | 3.5% |

| Turkiye | 3.1% |

| Mexico | 2.3% |

| Canada | 2.1% |

The high mast lighting industry in the United States is estimated to record a significant CAGR through 2035. Top factors that are propelling market growth are:

India's high mast lighting market is anticipated to expand at a CAGR of 4.6% through 2035. Key factors for continuous sales of high mast lighting are as follows:

Adopting high mast lighting in Canada is estimated to expand at a CAGR of 2.1% from 2025 to 2035. Top factors that are propelling regional growth are:

Mexico's high mast lighting industry is estimated to register a CAGR of 2.3% from 2025 to 2035. Significant influencing factors for growth of the high mast lighting industry are as follows:

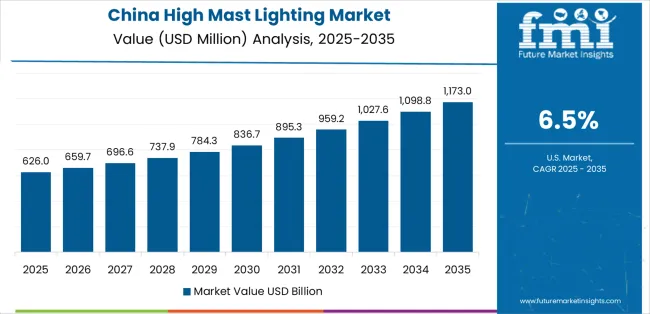

China's high mast lighting industry is projected to expand at a CAGR of 3.5% through 2035. Top factors that are propelling the market growth are:

The section below shows the LED segment dominating based on technology. It is forecast to thrive at 5.1% CAGR between 2025 and 2035.

Based on application, the roads and highways segment is anticipated to hold a dominant share through 2035. It is set to exhibit a CAGR of 5.4% during the forecast period.

| Top Segment (Technology) | LED |

|---|---|

| Predicted CAGR (2025 to 2035) | 5.1% |

| Top Segment (Application) | Roads and Highways |

|---|---|

| Projected CAGR (2025 to 2035) | 5.4% |

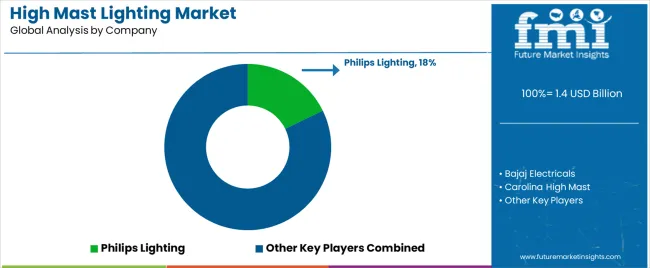

The high mast lighting market is consolidated, with leading players accounting for around 31% share. Bajaj Electricals, Carolina High Mast, Jindal Power Corporation, Philips Lighting, and Yangzhou Bright Solar Solutions are the leading manufacturers and suppliers of the high mast lighting listed in the report.

Leading high-mast lighting manufacturers are investing in continuous research to produce new products and increase their production capacity to meet end-user demand. They are directed toward adopting growth strategies to strengthen their footprint, including partnerships, mergers, acquisitions, and facility expansions.

Key Companies

The global high mast lighting market is estimated to be valued at USD 1.4 billion in 2025.

The market size for the high mast lighting market is projected to reach USD 2.2 billion by 2035.

The high mast lighting market is expected to grow at a 4.6% CAGR between 2025 and 2035.

The key product types in high mast lighting market are adjustable for height and nonadjustable for height.

In terms of technology, LED (light-emitting diode) segment to command 54.7% share in the high mast lighting market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

High-performance Dual-core Processor Market Size and Share Forecast Outlook 2025 to 2035

High Purity Magnesium Citrate Market Size and Share Forecast Outlook 2025 to 2035

High Performance Magnet Market Size and Share Forecast Outlook 2025 to 2035

High-frequency RF Evaluation Board Market Size and Share Forecast Outlook 2025 to 2035

High Viscosity Mixer Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Ionising Air Gun Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Equipment Market Forecast and Outlook 2025 to 2035

High Clear Film Market Size and Share Forecast Outlook 2025 to 2035

High Performance Random Packing Market Forecast Outlook 2025 to 2035

High Precision Microfluidic Pump Market Size and Share Forecast Outlook 2025 to 2035

High Performance Composites Market Forecast Outlook 2025 to 2035

High Performance Medical Plastic Market Forecast Outlook 2025 to 2035

High Temperature Heat Pump Dryers Market Size and Share Forecast Outlook 2025 to 2035

High Temperature Fiberglass Filter Media Market Size and Share Forecast Outlook 2025 to 2035

High Purity Tungsten Hexachloride Market Size and Share Forecast Outlook 2025 to 2035

High Purity Nano Aluminum Oxide Powder Market Size and Share Forecast Outlook 2025 to 2035

High-Protein Pudding Market Forecast and Outlook 2025 to 2035

High Voltage Ceramic Zinc Oxide Surge Arrester Market Size and Share Forecast Outlook 2025 to 2035

High-Power Microwave Source Market Size and Share Forecast Outlook 2025 to 2035

High Performance Epoxy Coating Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA