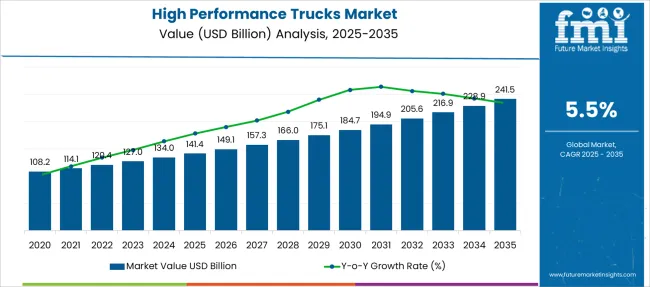

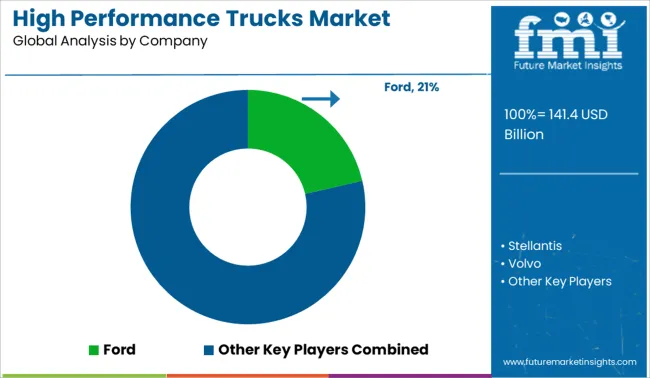

The High Performance Trucks Market is estimated to be valued at USD 141.4 billion in 2025 and is projected to reach USD 241.5 billion by 2035, registering a compound annual growth rate (CAGR) of 5.5% over the forecast period.

| Metric | Value |

|---|---|

| High Performance Trucks Market Estimated Value in (2025E) | USD 141.4 billion |

| High Performance Trucks Market Forecast Value in (2035F) | USD 241.5 billion |

| Forecast CAGR (2025 to 2035) | 5.5% |

The growth of medium and heavy-duty vehicles is driven by their ability to handle larger loads and longer distances, which are critical for supply chain optimization. Improvements in automatic transmission technology have enhanced vehicle performance, driver comfort, and fuel efficiency, contributing to greater adoption.

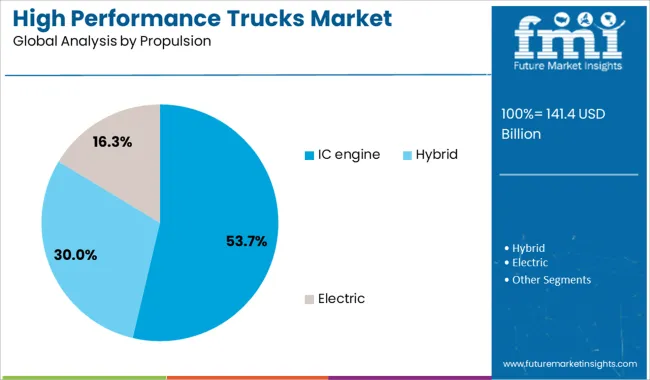

Internal combustion engine (IC engine) propulsion remains dominant due to its established infrastructure and reliability in various operating conditions. Market growth is also supported by investments in vehicle durability and compliance with evolving emission standards.

Rising infrastructure development and increasing freight transport needs are expected to sustain the market's momentum. Key segments contributing to growth include medium and heavy-duty vehicle types, automatic transmissions, and IC engine propulsion.

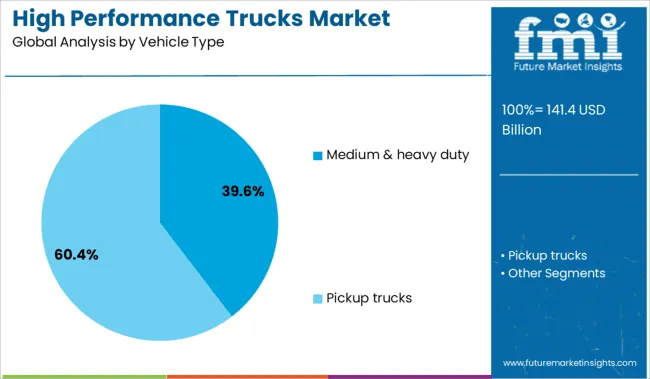

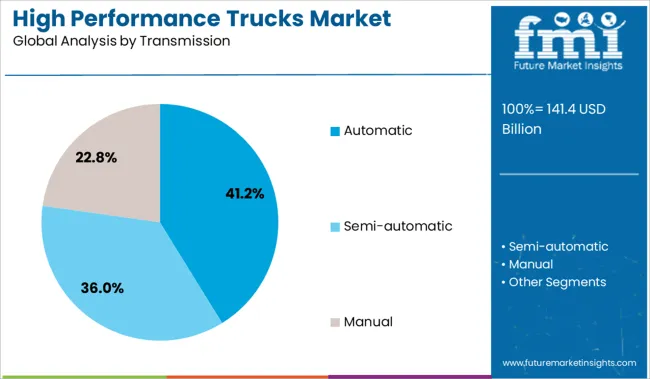

The market is segmented by Vehicle Type, Transmission, Propulsion, Power, Application and region. By Vehicle Type, the market is divided into Medium & heavy-duty and Pickup trucks. In terms of Transmission, the market is classified into Automatic, Semi-automatic, and Manual. Based on Propulsion, the market is segmented into IC engine, Hybrid, and Electric. By Power, the market is divided into 401 - 550 HP, 250 - 400 HP, and More than 550 HP. By Application, the market is segmented into Distribution, Refrigeration, Dumping, Tanker, RMC, Container, and Special application. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The medium and heavy duty vehicle segment is projected to hold 39.6% of the high performance trucks market revenue in 2025. This segment’s growth stems from the vehicles’ capacity to transport heavier loads and cover long-haul routes efficiently. These trucks are preferred in industries such as construction and freight transport where durability and power are essential.

Their robust build and adaptability to different terrains have made them indispensable for large-scale logistics operations. Increased demand for faster delivery and efficient cargo handling has reinforced the importance of medium and heavy-duty trucks in commercial fleets.

The segment’s ability to meet stringent safety and performance regulations supports its continued dominance.

The automatic transmission segment is expected to account for 41.2% of the market revenue in 2025. This segment has grown because automatic transmissions improve ease of driving and reduce driver fatigue, particularly in urban and stop-and-go traffic conditions.

Enhanced fuel efficiency and smoother gear shifts provided by modern automatic systems have increased their appeal among fleet operators and drivers alike.

The adoption of automatic transmissions has also been supported by advances in transmission technology that optimize performance and reduce maintenance needs. As comfort and efficiency become more critical, the automatic transmission segment is likely to retain its leading role in the market.

The IC engine propulsion segment is projected to represent 53.7% of the high performance trucks market revenue in 2025. This segment remains dominant due to the widespread availability of fueling infrastructure and the established reliability of internal combustion engines.

IC engines provide the necessary power and torque for heavy-duty operations, making them suitable for diverse environmental and operational conditions.

Despite the growing interest in alternative propulsion technologies, IC engines continue to be preferred for their cost-effectiveness and performance consistency. Ongoing improvements in engine design have enhanced fuel efficiency and reduced emissions, supporting the segment’s continued prominence in the high-performance trucks market.

Rugged terrain needs, lifestyle preferences, and commercial use boost demand. Opportunities include expanding premium trim options, electrified powertrains, accessory markets, and collaborations with adventure tourism and fleet rental providers.

Demand for high-performance trucks is growing as individuals and businesses require vehicles capable of towing heavy loads, managing difficult off-road conditions, and supporting recreational activities. Outdoor enthusiasts favor trucks with enhanced suspension systems, all-terrain tires, and reinforced chassis to navigate rough trails, haul trailers, and carry gear. Commercial operators in construction, agriculture, and oil & gas sectors rely on powerful diesel or hybrid powertrains for endurance and torque. Premium trim levels offering luxury interiors, advanced driver assistance, and durable exteriors attract buyers who seek both capability and comfort. The increasing popularity of weekend adventurers, coupled with professional use cases requiring long-range reliability, is solidifying high-performance trucks as a preferred segment across varied consumer profiles.

Significant business potential lies in introducing electric or hybrid high-performance trucks, which offer long-range capability, reduced operational fuel costs, and quiet cold starts appealing to both commercial and lifestyle customers. Customization options-such as modular bed accessories, roof racks, lighting packages, and performance tuning-allow brands to cater to niche segments like off-road sports, overlanding, and utility fleets. Partnerships with fleet rental companies and event organizers boost visibility and trial use. Subscription services or demo programs enable customers to test premium configurations before purchase. Cross-border expansion in emerging markets with increasing disposable income and interest in rugged vehicles also offers growth potential. Focus on reliable service infrastructure, accessory ecosystems, and flexible financing can enhance adoption and brand loyalty.

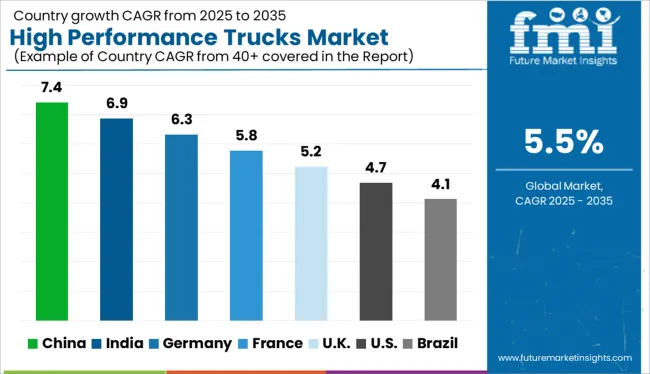

| Country | CAGR |

|---|---|

| China | 7.4% |

| India | 6.9% |

| Germany | 6.3% |

| France | 5.8% |

| UK | 5.2% |

| USA | 4.7% |

| Brazil | 4.1% |

The global high performance trucks market is expected to grow at a CAGR of 5.5% from 2025 to 2035, driven by increased infrastructure development, logistics modernization, and demand for power-dense, fuel-efficient vehicles. Within BRICS, China leads with a 7.4% CAGR, propelled by large-scale construction projects, expanding intercity freight networks, and domestic manufacturing capabilities. India follows at 6.9%, supported by road corridor upgrades, commercial fleet expansion, and Make in India initiatives.

In the OECD region, Germany shows strong growth at 6.3%, driven by technological innovation and integration of clean diesel and hybrid drivetrains. The United Kingdom (5.2%) aligns with EU efficiency standards, while the United States, at 4.7%, reflects its mature market’s shift toward autonomous and heavy-duty electric truck platforms. This report covers detailed analysis of 40+ countries, and the top countries have been shared as a reference.

From 2025 to 2035, the high performance trucks market across China is expected to expand at a CAGR of 7.4%. Booming industrial logistics and freight demand are pushing the need for more powerful, fuel-efficient trucks capable of long-distance and heavy-load operations. Local OEMs are investing in advanced turbocharged engines and hybrid drivetrains to comply with stringent emissions targets. Expansion of road infrastructure and cross-border transport projects under Belt and Road initiatives are reinforcing fleet modernization efforts across provinces.

Registering a CAGR of 6.9% between 2025 and 2035, the high performance trucks market across India is seeing steady gains, with year-over-year growth ranging from 7.7% to 8.5%. Increasing demand in construction, mining, and heavy logistics is fueling adoption of next-generation commercial vehicles. Automakers are focusing on locally manufactured engines with improved torque and efficiency, suitable for varied terrain and long-haul operations. Strong government backing for electric and hybrid truck models is gradually reshaping procurement patterns across major transport operators.

Germany is projected to experience a CAGR of 6.3% in its high performance truck sector from 2025 to 2035, with annual growth ranging between 7.1% and 7.9%. This growth is rooted in precision logistics, eco-regulation compliance, and increasing automation in commercial transportation. With a focus on decarbonization, manufacturers are rolling out performance trucks with low-emission engines and advanced telematics. The demand for high-torque powertrains in cross-border trucking continues to rise as Germany remains a central hub in European freight corridors.

Expected to expand at a CAGR of 5.2% between 2025 and 2035, the high performance trucks market across the United Kingdom is steadily evolving, with annual growth rates ranging from 5.9% to 6.5%. Fleet operators are investing in high-output trucks to meet stricter delivery timelines and navigate regional transport regulations. Lightweight materials and fuel-optimization systems are key trends shaping product development. Urban LEZ (Low Emission Zones) are accelerating adoption of hybrid and alternative-fuel trucks, particularly in densely populated logistics hubs.

The U.S. market for high performance trucks is set to grow at a CAGR of 4.7% from 2025 to 2035, with year-over-year increases ranging from 5.1% to 5.8%. E-commerce growth, long-haul freight expansion, and a focus on uptime efficiency are driving modernization of truck fleets. Manufacturers are responding with diesel-electric hybrids and optimized drivetrains to meet both EPA regulations and operator expectations. Long-range fuel economy, durability, and advanced braking systems are also gaining emphasis in North American product designs.

The competitive landscape of the high performance trucks market is defined by aggressive repositioning among legacy OEMs and new entrants, with companies reinforcing both internal combustion and electrified platforms to balance performance with compliance. Ford, Stellantis (Ram), and General Motors remain dominant in North America, with Stellantis reviving the Ram 1500 TRX and its V8 engine lineup under the relaunched SRT division to retain loyalty in the performance truck segment. GM has committed USD 4 billion to expand gasoline truck production while also partnering with Hyundai to develop hybrid and mid-size pickup platforms for Latin American markets.

Volvo and Daimler lead in Europe with aerodynamic digital trucks, such as the next-generation Volvo VNL, and investments in electric drivetrains and automated systems. Toyota, Isuzu, and Mitsubishi Fuso maintain influence across Asia, while domestic manufacturers like Ashok Leyland and Tata Motors are gaining share in India through localized, emission-compliant, high-load vehicles. Rivian and Nikola represent emerging electric-focused players pushing boundaries in the US, though adoption remains modest. Most firms are now pursuing a dual-path strategy: reviving performance-centric ICE vehicles while preparing for regulatory-compliant electric and hybrid offerings tailored by region.

| Item | Value |

|---|---|

| Quantitative Units | USD 141.4 Billion |

| Vehicle Type | Medium & heavy duty and Pickup trucks |

| Transmission | Automatic, Semi-automatic, and Manual |

| Propulsion | IC engine, Hybrid, and Electric |

| Power | 401 - 550 HP, 250 - 400 HP, and More than 550 HP |

| Application | Distribution, Refrigeration, Dumping, Tanker, RMC, Container, and Special application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Ford, Stellantis, Volvo, Toyota, Chevrolet, Nissan, and Rivian |

| Additional Attributes | Dollar sales by truck type (pickup trucks, medium-duty, heavy-duty), fuel type (diesel, gasoline, electric, hybrid), and end-use (construction, logistics, agriculture, off-road recreation); regional demand influenced by infrastructure development, fleet modernization, and emission regulations; performance benchmarks such as torque, payload, and towing capacity; advancements in drivetrain, suspension, and telematics systems; impact of EV adoption and hydrogen fuel innovations; lifecycle cost considerations including maintenance and fuel efficiency; and emerging use cases in defense, mining, and motorsports sectors. |

The global high performance trucks market is estimated to be valued at USD 141.4 billion in 2025.

The market size for the high performance trucks market is projected to reach USD 241.5 billion by 2035.

The high performance trucks market is expected to grow at a 5.5% CAGR between 2025 and 2035.

The key product types in high performance trucks market are medium & heavy duty and pickup trucks.

In terms of transmission, automatic segment to command 41.2% share in the high performance trucks market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

High Performance Permanent Magnet Market Size and Share Forecast Outlook 2025 to 2035

High Performance Liquid Chromatography-Tandem Mass Spectrometry System Market Size and Share Forecast Outlook 2025 to 2035

High-performance Dual-core Processor Market Size and Share Forecast Outlook 2025 to 2035

High Performance Magnet Market Size and Share Forecast Outlook 2025 to 2035

High Performance Random Packing Market Forecast Outlook 2025 to 2035

High Performance Composites Market Forecast Outlook 2025 to 2035

High Performance Medical Plastic Market Forecast Outlook 2025 to 2035

High Performance Epoxy Coating Market Size and Share Forecast Outlook 2025 to 2035

High Performance Fluoropolymer Market Size and Share Forecast Outlook 2025 to 2035

High-Performance Fiber Market Size and Share Forecast Outlook 2025 to 2035

High Performance Carbon Fiber Precursor Market Size and Share Forecast Outlook 2025 to 2035

High Performance Mercury Sorbent Market Size and Share Forecast Outlook 2025 to 2035

High-performance Electric Sports Cars Market Size and Share Forecast Outlook 2025 to 2035

High-Performance Computing Market Size and Share Forecast Outlook 2025 to 2035

High Performance Polyamides Market Size and Share Forecast Outlook 2025 to 2035

High Performance Data Analytics (HPDA) Market Size and Share Forecast Outlook 2025 to 2035

High Performance Pigments Market Size and Share Forecast Outlook 2025 to 2035

High Performance Barrier Films Market Size, Growth, and Forecast 2025 to 2035

High Performance Message Infrastructure Market Size, Growth, and Forecast 2025 to 2035

High-Performance Fibers for Defense Market Report – Demand, Trends & Industry Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA