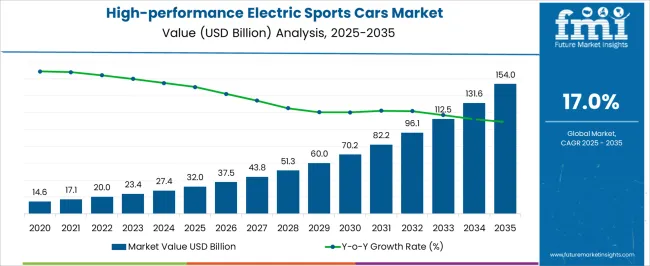

The high-performance electric sports cars market is estimated to be valued at USD 32.0 billion in 2025 and is projected to reach USD 154.0 billion by 2035, registering a compound annual growth rate (CAGR) of 17.0% over the forecast period. Battery systems, electric motors, power electronics, and integrated vehicle control systems heavily influence the contribution by technology. Among these, battery technology constitutes the largest share of value, as high-capacity lithium-ion and emerging solid-state batteries directly affect vehicle range, performance, and overall cost, accounting for a significant proportion of the total market value.

Electric motor technology, including synchronous and permanent magnet motors, also contributes substantially to the market, given its critical role in delivering acceleration, torque, and efficiency characteristics expected in high-performance sports cars. Power electronics and vehicle control units further add value through enabling advanced energy management, regenerative braking, and performance optimization, which are essential differentiators for consumer acceptance and driving experience.

The year-on-year growth pattern, from USD 32.0 billion in 2025 to USD 154.0 billion in 2035, indicates that battery innovations are likely to capture increasing shares, while complementary technologies such as motors and electronics will scale in tandem. The market’s value distribution demonstrates that while batteries dominate contribution, a synergistic integration of motors, control systems, and electronics is critical for sustaining high-performance standards, reflecting a technology-driven growth trajectory where each component’s advancement directly correlates with market expansion and adoption of electric sports vehicles.

| Metric | Value |

|---|---|

| High-performance Electric Sports Cars Market Estimated Value in (2025 E) | USD 32.0 billion |

| High-performance Electric Sports Cars Market Forecast Value in (2035 F) | USD 154.0 billion |

| Forecast CAGR (2025 to 2035) | 17.0% |

The high-performance electric sports cars market represents a specialized segment within the global automotive and electric mobility industry, emphasizing speed, advanced technology, and luxury performance. Within the broader electric vehicle sector, it accounts for about 4.9%, driven by growing demand for high-performance and environmentally friendly sports vehicles. In the luxury and premium automotive segment, its share is approximately 5.4%, reflecting consumer preference for cutting-edge design, acceleration, and brand exclusivity.

Across the high-performance vehicle market, it holds around 5.0%, supporting adoption in limited edition and specialty electric models. Within the automotive electric drivetrain and battery technology sector, it represents 4.3%, highlighting integration of high-capacity battery packs, advanced cooling systems, and torque optimization. In the overall automotive innovation and performance solutions category, the market contributes about 3.8%, emphasizing technological advancement, smart systems, and connectivity features tailored for enthusiasts and performance-driven users.

Recent developments in the market have focused on powertrain efficiency, lightweight materials, and digital integration. Innovations include high-capacity lithium-ion and solid-state battery systems, dual or tri-motor configurations, and advanced regenerative braking technologies for enhanced performance. Key players are collaborating with technology firms, materials specialists, and aerodynamics experts to optimize vehicle weight, range, and driving dynamics. Adoption of AI-assisted vehicle control, connected performance telemetry, and customizable driving modes is gaining traction to improve handling and user experience. The integration of fast-charging infrastructure and sustainable manufacturing processes is being emphasized to appeal to eco-conscious consumers. These trends demonstrate how performance, innovation, and sustainability are shaping the high-performance electric sports cars market.

The high-performance electric sports cars market is undergoing accelerated transformation as consumer preferences shift toward sustainable luxury and high-powered electric mobility. The integration of advanced battery technologies, lightweight materials, and high-efficiency electric drivetrains is enabling the development of vehicles that deliver both performance and environmental compliance. The growing focus on zero-emission transportation, combined with regulatory mandates aimed at reducing carbon emissions, is driving premium automakers to invest in electrification of their high-performance portfolios.

Technological innovations in battery management systems, regenerative braking, and vehicle aerodynamics are further enhancing range, acceleration, and overall driving dynamics. Increasing disposable income among affluent buyers, along with a rising interest in exclusive performance-oriented electric models, is contributing to market expansion.

Furthermore, strategic partnerships between automotive OEMs and battery technology firms are facilitating the development of advanced propulsion systems tailored for high-speed electric mobility As infrastructure for ultra-fast charging continues to improve, the adoption of high-performance electric sports cars is expected to grow steadily, positioning the market for sustained momentum in the coming years.

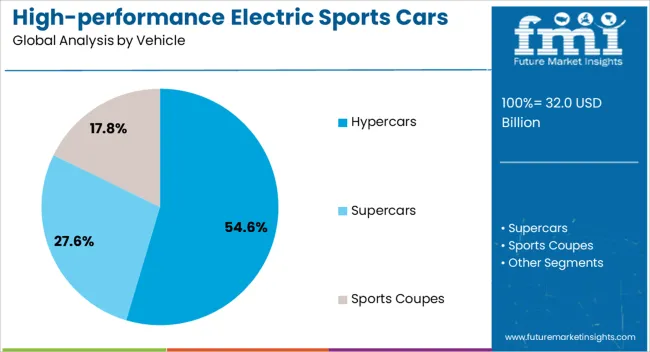

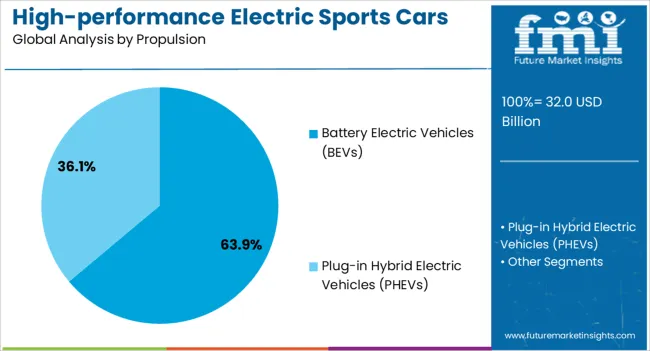

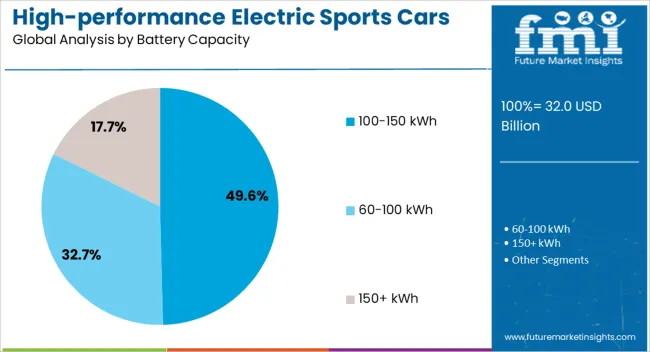

The high-performance electric sports cars market is segmented by vehicle, propulsion, battery capacity, end user, and geographic regions. By vehicle, high-performance electric sports cars market is divided into Hypercars, Supercars, and Sports Coupes. In terms of propulsion, high-performance electric sports cars market is classified into Battery Electric Vehicles (BEVs) and Plug-in Hybrid Electric Vehicles (PHEVs). Based on battery capacity, high-performance electric sports cars market is segmented into 100-150 kWh, 60-100 kWh, and 150+ kWh.

By end user, high-performance electric sports cars market is segmented into Individual Buyers, Racing Teams, and Others. Regionally, the high-performance electric sports cars industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The hypercars segment is projected to account for 54.6% of the high-performance electric sports cars market revenue share in 2025, establishing itself as the dominant vehicle category. This leadership is being driven by the increasing demand for ultra-exclusive, high-speed electric vehicles that combine cutting-edge design with superior performance. Hypercars are typically positioned at the pinnacle of automotive engineering, offering extreme acceleration, advanced aerodynamics, and state-of-the-art technologies.

The electrification of this category is being accelerated by luxury automakers seeking to redefine performance benchmarks through electric propulsion. The ability to deliver instant torque, exceptional handling, and enhanced control is making electric hypercars highly appealing to high-net-worth individuals and automotive enthusiasts.

Additionally, limited production models in this segment create scarcity value, further boosting market demand. As electric powertrains become more sophisticated and battery technologies continue to evolve, hypercars are expected to remain the flagship models for demonstrating what is technically possible in the realm of sustainable high-speed automotive engineering.

The battery electric vehicles segment is expected to capture 63.9% of the high-performance electric sports cars market revenue share in 2025, marking it as the leading propulsion type. This dominance is being driven by the superior energy efficiency, instant power delivery, and reduced mechanical complexity of BEVs compared to hybrid or internal combustion configurations. BEVs offer a clean-sheet design opportunity for manufacturers to integrate performance, design, and innovation in ways that are unachievable with traditional platforms.

The ability to house batteries along the vehicle’s floor improves weight distribution and center of gravity, which enhances stability and handling at high speeds. As emission regulations tighten globally, BEVs are gaining favor among performance automakers who seek to meet environmental targets while delivering exceptional driving experiences.

The rapid expansion of charging infrastructure and improvements in battery energy density are further accelerating adoption. Additionally, BEVs are benefiting from increasing consumer acceptance of electric powertrains in the premium and performance segments, reinforcing their leadership in this evolving market.

The 100 to 150 kWh battery capacity segment is projected to account for 49.6% of the high-performance electric sports cars market revenue share in 2025, making it the dominant battery configuration. This preference is being driven by the need to balance ultra-high performance with practical driving range, without compromising vehicle weight or dynamics. Batteries in this capacity range offer enough energy storage to support high-speed driving, rapid acceleration, and sustained power output over longer distances.

The segment is benefiting from the adoption of advanced thermal management systems and high-performance battery chemistries that allow for greater energy density and faster charging capabilities. Manufacturers are increasingly selecting this capacity range for flagship performance models to ensure a blend of endurance, agility, and real-world usability.

Additionally, this segment aligns well with emerging ultra-fast charging networks, making vehicles with 100 to 150 kWh battery packs more viable for broader usage scenarios. As consumer expectations around both performance and practicality evolve, this battery range is expected to remain a preferred choice for high-performance electric sports cars.

The market has emerged as a pivotal segment of the automotive industry, combining advanced electric powertrains with premium design and engineering. Consumer demand for sustainable yet exhilarating driving experiences has fueled the adoption of high-speed, high-torque electric vehicles in luxury and performance segments. Manufacturers are integrating cutting-edge battery technology, lightweight materials, and aerodynamics to optimize acceleration, handling, and range.

The growth of charging infrastructure, rising environmental awareness, and government incentives for zero-emission vehicles further support market expansion. Technological collaboration between automotive and electronics sectors has enhanced energy efficiency, thermal management, and in-car digital experiences.

Battery technology plays a critical role in defining the capabilities of high-performance electric sports cars. High-energy density lithium-ion cells, solid-state batteries, and modular battery packs have been adopted to increase range, reduce weight, and improve acceleration. Thermal management systems are incorporated to maintain optimal battery temperature during high-speed driving, ensuring consistent performance and longevity. Fast-charging capabilities allow for shorter downtime and increased usability for track and road applications. Continuous research in energy storage, power electronics, and regenerative braking integration has enabled higher efficiency and sustained power output. Automotive manufacturers are leveraging these battery innovations to deliver sports cars that rival conventional combustion-powered vehicles in speed, agility, and responsiveness, while also meeting sustainability goals.

High-performance electric sports cars increasingly rely on lightweight materials such as carbon fiber, aluminum alloys, and composite structures to enhance speed, agility, and range. Aerodynamic body designs reduce drag, optimize airflow, and improve battery efficiency, allowing longer distances on a single charge. Advanced chassis engineering, active aerodynamics, and suspension systems are integrated to maintain stability at high speeds. Interior and exterior components are engineered for both luxury and functional performance, balancing comfort with structural efficiency. Manufacturers are also using simulation tools and wind tunnel testing to refine designs and minimize energy loss. These innovations collectively improve vehicle dynamics, reduce energy consumption, and enhance overall driving experience, making electric sports cars competitive against high-performance combustion vehicles.

High-performance electric sports cars are increasingly equipped with advanced digital systems that enhance both performance monitoring and passenger experience. In-car connectivity, intelligent navigation, driver assistance systems, and performance tracking software allow users to optimize driving efficiency and customize vehicle behavior. Telemetry systems provide real-time feedback on battery status, torque distribution, and vehicle dynamics. Smart interfaces and over-the-air software updates ensure continuous enhancement of vehicle functionality and driver engagement. Infotainment and augmented reality displays improve navigation, safety, and entertainment, aligning with expectations of premium customers. These digital integrations have become critical differentiators in the market, allowing manufacturers to combine speed, safety, and luxury features seamlessly.

Despite technological advancements, high-performance electric sports cars face challenges related to cost, infrastructure, and maintenance. Premium pricing limits accessibility to affluent consumers, while specialized components and battery systems require skilled service and periodic maintenance. Charging infrastructure, particularly for high-speed charging, is unevenly distributed, affecting long-distance usability. Thermal management, battery degradation, and high replacement costs further contribute to the total cost of ownership. Manufacturers must address these constraints through modular designs, scalable production, and strategic partnerships with charging providers. Educating consumers on efficiency, performance benefits, and long-term value is critical to accelerating adoption and sustaining growth in this niche yet rapidly evolving market segment.

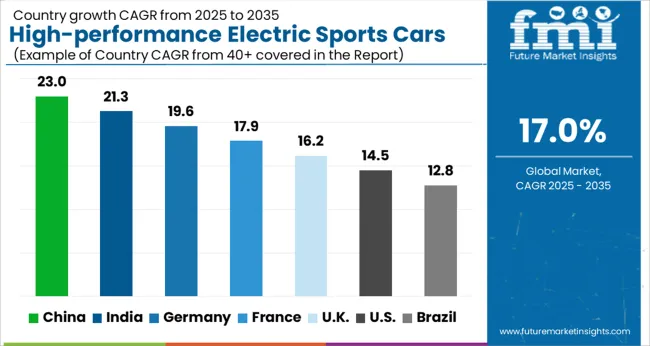

| Country | CAGR |

|---|---|

| China | 23.0% |

| India | 21.3% |

| Germany | 19.6% |

| France | 17.9% |

| UK | 16.2% |

| USA | 14.5% |

| Brazil | 12.8% |

The market is expected to register a CAGR of 17.0% from 2025 to 2035. Germany recorded 19.6%, supported by advanced automotive engineering and performance-oriented vehicle production. India reached 21.3%, reflecting the growing adoption of electric mobility and government incentives. China led with 23.0% due to aggressive investment in electric vehicle technology and luxury car manufacturing. The United Kingdom reached 16.2%, showing steady market penetration and technological integration. The United States recorded 14.5%, driven by consumer interest and performance-focused EV development. These regions are pivotal in advancing, producing, and innovating in the market. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is projected to grow at a CAGR of 23.0%, driven by the rapid adoption of premium electric vehicles and government incentives for new energy vehicles. Adoption is reinforced by growing consumer interest in high-performance EVs with advanced battery technology and smart connectivity. Domestic automakers focus on delivering vehicles with high torque, long range, and innovative design, while international luxury brands expand local assembly to capture the premium segment. Investment in charging infrastructure and high-speed supercharging networks further supports market penetration.

India is expected to grow at a CAGR of 21.3%, supported by increasing awareness of high-performance EVs and government policies promoting electric mobility. Adoption is reinforced by rising demand for luxury vehicles among affluent consumers and expanding EV charging networks in urban and metro regions. Manufacturers focus on mid-to-high segment electric sports cars, emphasizing range, acceleration, and smart connectivity. Partnerships with technology providers enhance battery efficiency and vehicle performance.

Germany is forecast to grow at a CAGR of 19.6%, driven by strong consumer preference for luxury high-performance EVs and government incentives for electric mobility. Adoption is reinforced by a focus on mid drive and dual motor configurations providing superior acceleration and handling. German automakers prioritize technological integration, battery efficiency, and high-speed performance to compete with international brands. Regulations supporting zero emission vehicles further drive adoption in both domestic and European markets.

The United Kingdom is projected to grow at a CAGR of 16.2%, supported by rising demand for luxury EVs and expansion of high-speed charging networks. Adoption is reinforced by affluent consumers seeking performance EVs with superior acceleration, innovative design, and integrated smart features. Manufacturers are emphasizing premium battery technology, lightweight chassis, and dual motor systems for enhanced driving experience. Regulatory policies promoting EV adoption contribute to market growth.

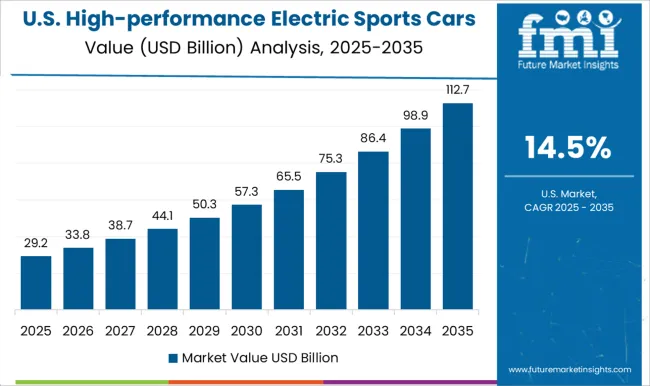

The United States is projected to grow at a CAGR of 14.5%, driven by increasing luxury EV adoption and expansion of charging infrastructure. Adoption is reinforced by high consumer preference for electric sports cars offering long range, high torque, and advanced connectivity features. Manufacturers focus on battery efficiency, dual motor drive, and lightweight materials to improve performance and acceleration. Expansion of metropolitan charging networks supports daily usability and long distance travel for premium EVs.

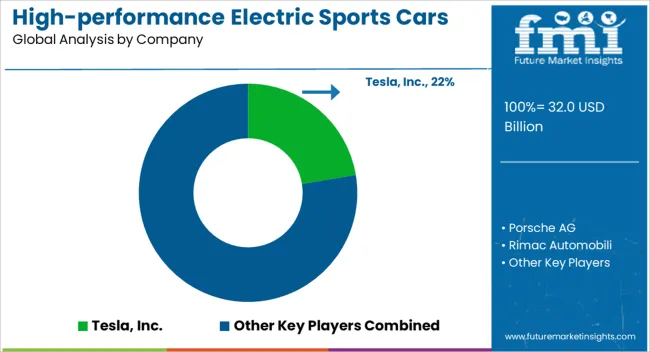

The market is dominated by leading global automotive manufacturers and emerging specialized EV sports car companies, emphasizing speed, luxury, and advanced electric powertrain technologies. Tesla, Inc. leads with high-performance models featuring long-range batteries, cutting-edge autonomous features, and over-the-air software upgrades, setting benchmarks in acceleration and technology integration.

Porsche AG and Audi AG focus on combining brand heritage with high-efficiency electric drivetrains, delivering vehicles that balance luxury, performance, and handling precision. Rimac Automobili and Lotus Cars represent niche, high-end innovators, producing limited-edition hypercars with extreme acceleration, lightweight architectures, and advanced battery management systems tailored for enthusiasts and collectors.

Ferrari N.V. and BMW AG leverage hybrid and fully electric technologies to transition their iconic sports car lineups toward electrification, maintaining brand legacy while meeting evolving regulatory and environmental requirements. Key market trends include lightweight materials, aerodynamic optimization, torque vectoring, and integrated digital driving experiences. The market is highly competitive, driven by continuous innovation in battery technology, electric motors, and software-controlled performance systems, with manufacturers differentiating through brand exclusivity, driving dynamics, and cutting-edge vehicle design.

| Item | Value |

|---|---|

| Quantitative Units | USD 32.0 Billion |

| Vehicle | Hypercars, Supercars, and Sports Coupes |

| Propulsion | Battery Electric Vehicles (BEVs) and Plug-in Hybrid Electric Vehicles (PHEVs) |

| Battery Capacity | 100-150 kWh, 60-100 kWh, and 150+ kWh |

| End User | Individual Buyers, Racing Teams, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Tesla, Inc., Porsche AG, Rimac Automobili, Lotus Cars, Audi AG, Ferrari N.V., and BMW AG |

| Additional Attributes | Dollar sales by vehicle type and powertrain, demand dynamics across luxury, performance, and limited-edition segments, regional trends in EV adoption and high-performance mobility, innovation in battery technology, motor efficiency, and lightweight materials, environmental impact of production and energy consumption, and emerging use cases in track performance, smart connectivity, and ultra-luxury automotive experiences. |

The global high-performance electric sports cars market is estimated to be valued at USD 32.0 billion in 2025.

The market size for the high-performance electric sports cars market is projected to reach USD 154.0 billion by 2035.

The high-performance electric sports cars market is expected to grow at a 17.0% CAGR between 2025 and 2035.

The key product types in high-performance electric sports cars market are hypercars, supercars and sports coupes.

In terms of propulsion, battery electric vehicles (BEVs) segment to command 63.9% share in the high-performance electric sports cars market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Electric Aircraft Onboard Sensors Market Size and Share Forecast Outlook 2025 to 2035

Electrical Label Market Size and Share Forecast Outlook 2025 to 2035

Electric Round Sprinklers Market Size and Share Forecast Outlook 2025 to 2035

Electric Cloth Cutting Scissors Market Size and Share Forecast Outlook 2025 to 2035

Electrical Insulation Materials Market Size and Share Forecast Outlook 2025 to 2035

Electric Aircraft Sensors Market Size and Share Forecast Outlook 2025 to 2035

Electric Traction Motor Market Forecast Outlook 2025 to 2035

Electric Vehicle Sensor Market Forecast and Outlook 2025 to 2035

Electric Vehicle Motor Market Forecast and Outlook 2025 to 2035

Electric Off-Road ATVs & UTVs Market Size and Share Forecast Outlook 2025 to 2035

Electric Blind Rivet Gun Market Size and Share Forecast Outlook 2025 to 2035

Electric Fireplace Market Size and Share Forecast Outlook 2025 to 2035

Electric Glider Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Battery Conditioners Market Size and Share Forecast Outlook 2025 to 2035

Electric Power Steering Motors Market Size and Share Forecast Outlook 2025 to 2035

Electric Motor Market Size and Share Forecast Outlook 2025 to 2035

Electric Gripper Market Size and Share Forecast Outlook 2025 to 2035

Electric Boat Market Size and Share Forecast Outlook 2025 to 2035

Electric Bicycle Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Transmission Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA