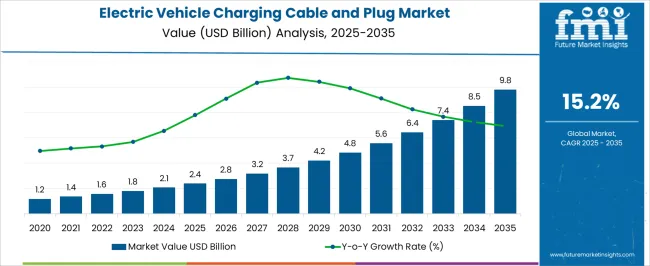

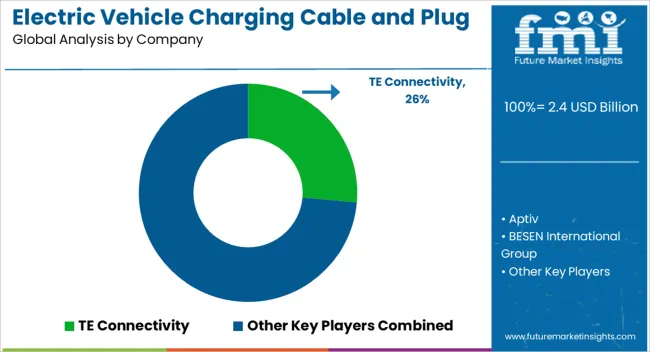

The electric vehicle charging cable and plug market is projected at USD 2.4 billion in 2025 and anticipated to reach USD 9.8 billion by 2035, expanding at a CAGR of 15.2%. Growth Rate Volatility Index analysis indicates that this market experiences accelerating momentum in the early phase before stabilizing into steady double-digit growth toward 2035.

Between 2025 and 2030, increments reflect rapid scaling, with annual additions moving from USD 0.3 to 0.6 billion, fueled by rising EV adoption, infrastructure rollouts, and policy-driven incentives in key regions. Post-2030, growth accelerates even further, as consumer acceptance and grid integration become mainstream, pushing annual additions above USD 1 billion.

The volatility index suggests limited downside fluctuations since the regulatory push and OEM commitments create strong structural support. However, competitive reshaping among cable standards, charging formats, and safety compliance could redistribute market share across providers. The Growth Rate Volatility Index demonstrates a market where volatility is not erratic but driven by stepwise leaps linked to infrastructure milestones, ensuring consistent long-term opportunity for manufacturers, suppliers, and service providers.

| Metric | Value |

|---|---|

| Electric Vehicle Charging Cable and Plug Market Estimated Value in (2025 E) | USD 2.4 billion |

| Electric Vehicle Charging Cable and Plug Market Forecast Value in (2035 F) | USD 9.8 billion |

| Forecast CAGR (2025 to 2035) | 15.2% |

The electric vehicle charging cable and plug market is shaped by several interconnected parent markets, each contributing differently to overall demand and expansion. The automotive OEM integration segment holds the largest share at 40%, as automakers incorporate standardized charging solutions into new electric vehicle models, ensuring compatibility and consumer convenience. The public charging infrastructure segment contributes 30%, driven by government-backed projects, private investments, and urban mobility requirements that necessitate fast-charging networks with durable cables and high-capacity plugs. The residential charging market accounts for 15%, where homeowners adopt AC charging cables and wall-mounted plugs for overnight charging solutions, emphasizing safety, affordability, and ease of use. The commercial fleet and logistics sector represents 10%, with rising adoption of dedicated charging stations for delivery vans, ride-hailing fleets, and corporate EV users. Finally, the specialty and industrial applications segment holds 5%, including charging solutions for buses, heavy-duty vehicles, and specialized mobility projects. Collectively, automotive OEM integration and public charging infrastructure account for 70% of total market demand, underscoring their dominant role in shaping growth. Dollar sales and share analyses reveal that while residential and fleet adoption continues to rise steadily, large-scale OEM adoption and infrastructure deployment remain the primary catalysts for long-term global market expansion.

The electric vehicle charging cable and plug market is experiencing rapid expansion driven by the accelerating adoption of electric vehicles worldwide. The growing emphasis on sustainable transportation and supportive government policies has spurred the deployment of charging infrastructure across residential, commercial, and public sectors.

Increasing investments in charging networks and advancements in cable and connector technologies are enabling faster and safer charging experiences. The shift toward standardized and interoperable charging solutions is further fostering market growth.

Moreover, the rising demand for longer and more flexible cables to accommodate various vehicle and charger configurations is shaping future opportunities. As electric vehicle penetration deepens and charging infrastructure evolves, the market is expected to witness continuous innovation in cable design, plug compatibility, and performance efficiency.

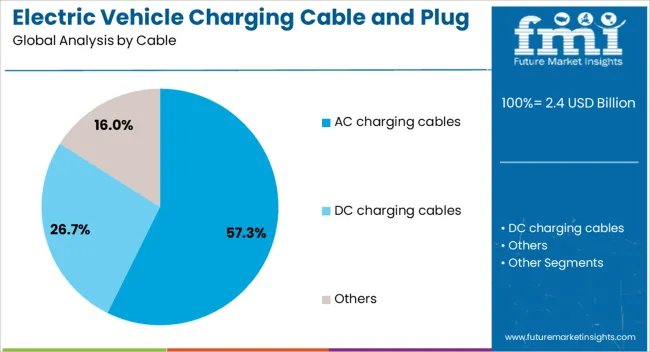

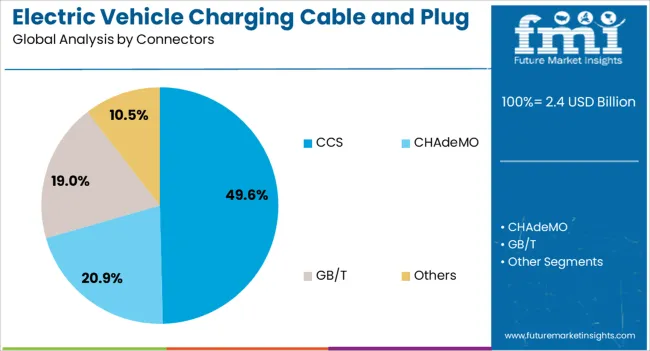

The electric vehicle charging cable and plug market is segmented by cable, connectors, length, sales channel, end user, and geographic regions. By cable, electric vehicle charging cable and plug market is divided into AC charging cables, DC charging cables, and Others. In terms of connectors, electric vehicle charging cable and plug market is classified into CCS, CHAdeMO, GB/T, and Others.

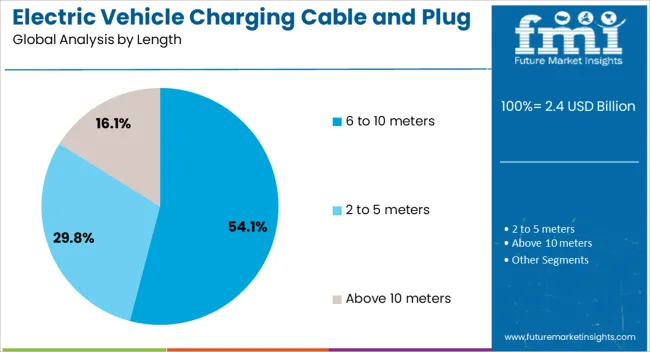

Based on length, electric vehicle charging cable and plug market is segmented into 6 to 10 meters, 2 to 5 meters, and Above 10 meters. By sales channel, electric vehicle charging cable and plug market is segmented into Distributor sales, Direct sales, and Online retail. By end user, electric vehicle charging cable and plug market is segmented into Public infrastructure, Residential, Commercial, and Fleet operators. Regionally, the electric vehicle charging cable and plug industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The AC charging cables segment is estimated to hold 57.3% of the revenue share in the Electric Vehicle Charging Cable and Plug market in 2025, making it the dominant cable type. This position is attributed to the widespread use of alternating current charging in residential and commercial settings, where cost efficiency and ease of installation are prioritized.

The growth has been supported by the increased production of electric vehicles compatible with AC charging and the expansion of Level 2 charging infrastructure. The flexibility and safety features offered by AC cables, along with their adaptability to various charging speeds, have reinforced their preference among manufacturers and end users.

Additionally, the segment benefits from compatibility with existing electrical grids, facilitating smoother adoption and scaling of charging networks.

The CCS connector segment is projected to account for 49.6% of the market revenue share in 2025, leading among connector types. This leadership stems from the CCS standard’s broad acceptance as a fast charging solution compatible with numerous electric vehicle models.

Its ability to support both AC and DC charging modes through a single interface simplifies charging infrastructure and vehicle design. The connector’s fast charging capabilities are critical for reducing charging times, which is a key factor influencing consumer adoption of electric vehicles.

Additionally, the interoperability offered by CCS connectors enhances user convenience and encourages widespread deployment at public and commercial charging stations, thus driving the segment’s growth.

The 6 to 10 meters cable length segment is anticipated to hold 54.1% of the revenue share in 2025, making it the most preferred cable length category. This preference is driven by the balance it offers between flexibility and manageability for end users, allowing effective connection between charging stations and vehicles in various environments.

The length caters well to common charging scenarios such as home garages, workplace parking lots, and public stations where moderate reach is required without excessive cable bulk. The segment’s growth has been facilitated by increasing attention to user convenience and safety, ensuring cables are long enough for practical use but not so long as to pose storage or handling challenges.

As infrastructure evolves to accommodate diverse charging settings, this cable length range is expected to maintain its leading position.

The electric vehicle charging cable and plug market is driven by EV adoption, evolving standards, fast-charging needs, and strict compliance. Safety, adaptability, and reliability remain the decisive factors shaping long-term growth.

Rising electric vehicle adoption has become a central driver for charging cable and plug demand. Automakers are scaling EV production, while governments and private operators invest in public charging points to match growing usage. This has created a need for durable, high-capacity cables and universal plug designs that ensure reliability and safety. The surge in residential charging installations also adds momentum, with homeowners opting for compact and easy-to-use solutions. The integration of EV growth with parallel infrastructure development ensures that cable and plug manufacturers experience consistent demand, as charging hardware remains a foundational requirement for fleet operators, individual consumers, and large-scale mobility networks worldwide.

Compatibility has emerged as a defining factor in the charging cable and plug market, as multiple standards exist across regions and manufacturers. Type 2 connectors, CCS, and CHAdeMO formats continue to coexist, creating complexity for infrastructure providers. Cable producers are increasingly focusing on flexibility and cross-standard designs to address this fragmentation. Fast-charging demands also require cables capable of handling higher currents without safety risks. Companies that anticipate evolving standards and deliver multi-compatible solutions will capture incremental share. This highlights that beyond performance, adaptability to changing regulations and interoperability expectations defines long-term competitiveness for market players.

Fast-charging infrastructure is shaping product demand, as consumers prioritize shorter charging times for convenience. This creates strong momentum for liquid-cooled, high-capacity cables capable of supporting ultra-fast charging stations. Logistics fleets and intercity EV users prefer high-power connectors to minimize downtime, further strengthening this segment. While residential charging remains important, it is slower in terms of cable revenue contribution compared to commercial fast-charging solutions. Fast-charging infrastructure provides not only higher dollar sales but also greater differentiation opportunities for manufacturers that can engineer cables for reliability, safety, and long-term durability under frequent usage conditions.

Strict regulatory frameworks influence how charging cables and plugs are designed, tested, and deployed. Fire resistance, insulation quality, durability, and electromagnetic safety are non-negotiable standards that manufacturers must meet. Governments in Europe, North America, and Asia are tightening certification protocols, making compliance a prerequisite for market entry. As charging infrastructure scales, safety failures could undermine consumer trust, which makes high compliance crucial for competitive advantage. Companies that emphasize reliability and secure certifications will build stronger reputations, allowing them to expand their footprint and secure large-scale contracts with automakers and infrastructure providers.

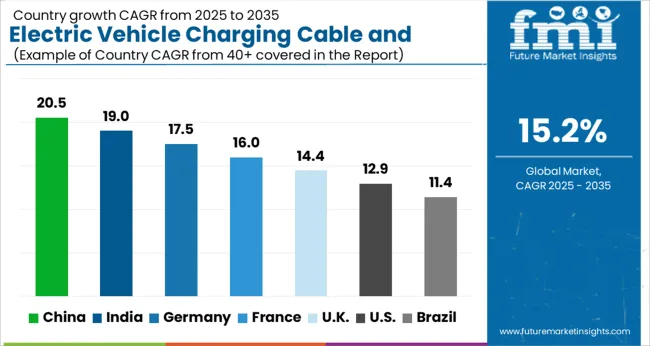

| Country | CAGR |

|---|---|

| China | 20.5% |

| India | 19.0% |

| Germany | 17.5% |

| France | 16.0% |

| UK | 14.4% |

| USA | 12.9% |

| Brazil | 11.4% |

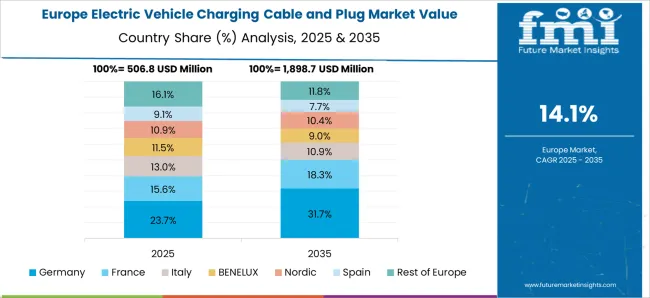

The global electric vehicle charging cable and plug market is projected to grow at a CAGR of 15.2% from 2025 to 2035. China leads with 20.5%, followed by India at 19.0%, Germany at 17.5%, France at 16.0%, the UK at 14.4%, and the USA at 12.9%. Growth is driven by large-scale EV adoption, expansion of public charging infrastructure, and regulatory incentives supporting standardized and safe charging solutions. Asia, particularly China and India, demonstrates the fastest expansion due to strong EV manufacturing capacity, government-backed charging infrastructure, and rapid consumer adoption. Germany and France highlight Europe’s focus on high-quality connectors, premium charging cables, and integration with advanced fast-charging networks. The UK emphasizes efficiency, affordability, and last-mile charging solutions for both residential and public use, while the USA shows steady growth backed by federal funding and automotive OEM collaborations. Dollar sales, share, and adoption trends point to Asia-Pacific leading the market, with Europe and North America contributing significantly through premium solutions and compliance-driven infrastructure rollouts. The analysis spans over 40 countries, with the leading performers detailed above.

The electric vehicle charging cable and plug market in China is projected to grow at a CAGR of 20.5% from 2025 to 2035, driven by the country’s dominance in EV production and strong government-backed infrastructure expansion. Public charging networks are rapidly expanding, with major cities rolling out ultra-fast charging corridors supported by liquid-cooled, high-capacity cables. Domestic suppliers are scaling output, while international companies form partnerships to comply with Chinese standards. Dollar sales and share growth are concentrated in fast-charging cables and DC plugs, reflecting the nation’s commitment to high-volume, high-speed charging solutions. China’s leadership is built on integration of policy incentives, large-scale EV adoption, and vertically integrated supply chains.

The electric vehicle charging cable and plug market in India is expected to expand at a CAGR of 19.0% from 2025 to 2035, supported by rising EV penetration, government subsidies, and urban electrification initiatives. Public-private partnerships are driving installation of charging stations in metropolitan areas, while rural projects are emerging to improve adoption beyond cities. Domestic manufacturers focus on affordability, developing durable cables and standardized plug systems that meet diverse consumer needs. Dollar sales and share growth highlight accelerated demand for AC charging in residential spaces alongside rapid uptake of fast-charging systems in commercial hubs. India’s trajectory reflects a mix of affordability, infrastructure push, and regulatory momentum.

The electric vehicle charging cable and plug market in Germany is projected to grow at a CAGR of 17.5% from 2025 to 2035, led by premium EV adoption, strict EU emission mandates, and rapid charging corridor development. German manufacturers focus on engineering excellence, producing cables with superior durability, efficiency, and compliance with safety standards. Dollar sales and share are dominated by Type 2 and CCS-compatible plugs, which are widely deployed across Europe. Integration of renewable energy into EV charging hubs further accelerates adoption of advanced cable solutions. Germany’s position reflects its blend of regulatory pressure, engineering strength, and strong consumer preference for premium EVs.

The electric vehicle charging cable and plug market in the UK is expected to grow at a CAGR of 14.4% from 2025 to 2035, driven by last-mile delivery electrification, residential charging demand, and government-backed emission targets. Public charging operators are expanding coverage in cities and highways, emphasizing reliable and cost-efficient solutions. Manufacturers are targeting compact and easy-to-install residential systems alongside high-capacity public charging cables. Dollar sales and share growth reflect balanced adoption across private, commercial, and municipal networks. The UK market shows steady expansion with a clear tilt toward affordability and accessibility, ensuring widespread charging access.

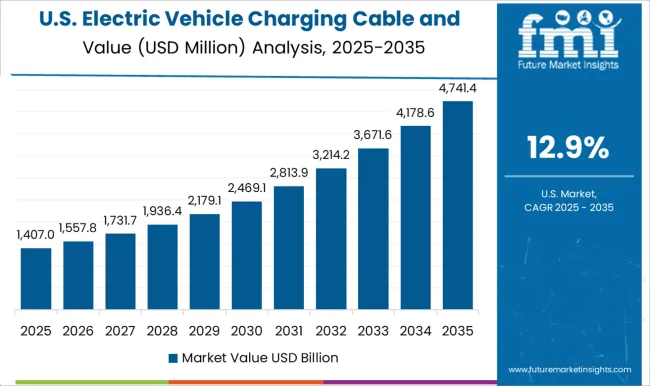

The electric vehicle charging cable and plug market in the USA is projected to grow at a CAGR of 12.9% from 2025 to 2035, moderate yet stable expansion. Growth is supported by federal funding for charging corridors, automotive OEM partnerships, and rising consumer interest in EVs. Dollar sales and share are concentrated in high-capacity fast-charging cables, particularly in urban centers and along interstate highways. However, regional disparities exist, with adoption strongest in states like California and New York. The USA market is slower compared to Asia but remains essential due to its scale, premium demand, and policy-driven support for nationwide charging infrastructure.

Competition in the electric vehicle charging cable and plug market is shaped by reliability, durability, and compatibility with global charging standards. TE Connectivity leads through advanced engineering and high-performance connectors designed for automotive applications, supported by strong OEM collaborations. Aptiv differentiates by focusing on lightweight designs, thermal management, and scalable solutions for fast-charging infrastructure. BESEN International Group emphasizes affordability and wide product variety, catering to both household and commercial installations across multiple regions. Chengdu Khous Technology Co. Ltd. and Coroflex compete with cost-effective production and specialized insulation technologies that ensure safety under varying grid conditions. Dyden Corporation has established a strength in offering high-voltage and industrial-grade solutions that support rapid energy transfer. General Cable (Prysmian Group) leverages its global cable manufacturing footprint and expertise in advanced materials to maintain strong partnerships with automakers and charging station developers.

Leoni AG holds a competitive edge through precision engineering, integration of charging cables with harness systems, and widespread adoption by European automakers. Phoenix Contact invests in modular charging connectors and smart interfaces that enable efficient power delivery, supported by its expertise in industrial automation. TPC Wire & Cable Corp. differentiates by focusing on ruggedized designs suited for extreme environments, ensuring long lifecycle performance in both residential and commercial contexts. The competitive strategies across players emphasize compatibility with global standards, fast-charging capability, and safety certifications. Partnerships with automakers, charging infrastructure providers, and regulatory bodies remain critical for market penetration.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.4 Billion |

| Cable | AC charging cables, DC charging cables, and Others |

| Connectors | CCS, CHAdeMO, GB/T, and Others |

| Length | 6 to 10 meters, 2 to 5 meters, and Above 10 meters |

| Sales Channel | Distributor sales, Direct sales, and Online retail |

| End User | Public infrastructure, Residential, Commercial, and Fleet operators |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | TE Connectivity, Aptiv, BESEN International Group, Chengdu Khous Technology Co. Ltd., Coroflex, Dyden Corporation, General Cable (Prysmian Group), Leoni AG, Phoenix Contact, and TPC Wire & Cable Corp. |

| Additional Attributes | Dollar sales, share, and competitive positioning across regions, alongside growth in fast-charging infrastructure and connector standards. |

The global electric vehicle charging cable and plug market is estimated to be valued at USD 2.4 billion in 2025.

The market size for the electric vehicle charging cable and plug market is projected to reach USD 9.8 billion by 2035.

The electric vehicle charging cable and plug market is expected to grow at a 15.2% CAGR between 2025 and 2035.

The key product types in electric vehicle charging cable and plug market are ac charging cables, dc charging cables and others.

In terms of connectors, ccs segment to command 49.6% share in the electric vehicle charging cable and plug market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Electric Aircraft Sensors Market Size and Share Forecast Outlook 2025 to 2035

Electric Traction Motor Market Forecast Outlook 2025 to 2035

Electric Off-Road ATVs & UTVs Market Size and Share Forecast Outlook 2025 to 2035

Electric Blind Rivet Gun Market Size and Share Forecast Outlook 2025 to 2035

Electric Fireplace Market Size and Share Forecast Outlook 2025 to 2035

Electric Glider Market Size and Share Forecast Outlook 2025 to 2035

Electric Power Steering Motors Market Size and Share Forecast Outlook 2025 to 2035

Electric Motor Market Size and Share Forecast Outlook 2025 to 2035

Electric Gripper Market Size and Share Forecast Outlook 2025 to 2035

Electric Boat Market Size and Share Forecast Outlook 2025 to 2035

Electric Bicycle Market Size and Share Forecast Outlook 2025 to 2035

Electrical Enclosure Market Size and Share Forecast Outlook 2025 to 2035

Electrical Sub Panels Market Size and Share Forecast Outlook 2025 to 2035

Electric Cargo Bike Market Size and Share Forecast Outlook 2025 to 2035

Electrical Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Electric Sub-meter Market Size and Share Forecast Outlook 2025 to 2035

Electrical Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Electrically Conductive Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Electrically-Driven Heavy-Duty Aerial Work Platforms Market Size and Share Forecast Outlook 2025 to 2035

Electrically Actuated Micro Robots Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA