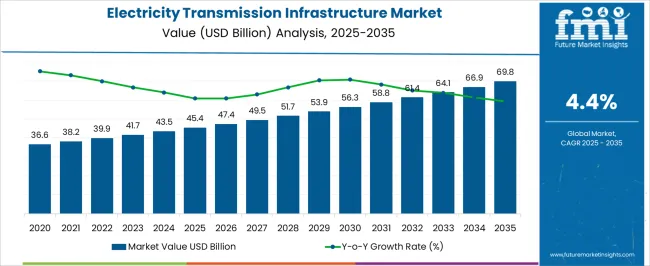

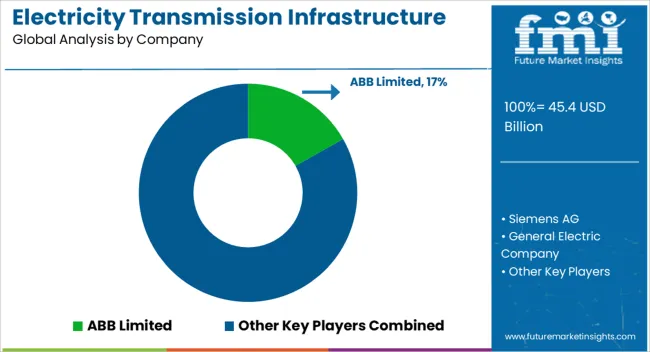

The Electricity Transmission Infrastructure Market is estimated to be valued at USD 45.4 billion in 2025 and is projected to reach USD 69.8 billion by 2035, registering a compound annual growth rate (CAGR) of 4.4% over the forecast period.

| Metric | Value |

|---|---|

| Electricity Transmission Infrastructure Market Estimated Value in (2025 E) | USD 45.4 billion |

| Electricity Transmission Infrastructure Market Forecast Value in (2035 F) | USD 69.8 billion |

| Forecast CAGR (2025 to 2035) | 4.4% |

The electricity transmission infrastructure market is experiencing significant growth, driven by increasing global energy demand, expansion of power grids, and modernization of aging transmission networks. Investments in both developed and emerging regions are being fueled by the need to improve grid reliability, reduce transmission losses, and integrate renewable energy sources such as solar and wind into national grids. Advancements in high-voltage transmission technologies, smart grid systems, and real-time monitoring are enhancing operational efficiency and grid stability.

Governments and regulatory authorities are enforcing stricter energy efficiency standards, encouraging the adoption of advanced transmission equipment and infrastructure upgrades. Rising electrification in industrial, commercial, and residential sectors is further accelerating demand for high-performance transmission systems.

The market is also being shaped by ongoing research in high-capacity transformers, power management solutions, and digital monitoring technologies As modernization initiatives and cross-border electricity interconnections expand globally, the electricity transmission infrastructure market is poised for sustained growth, supported by innovation, regulatory support, and increasing investment in efficient and resilient energy networks.

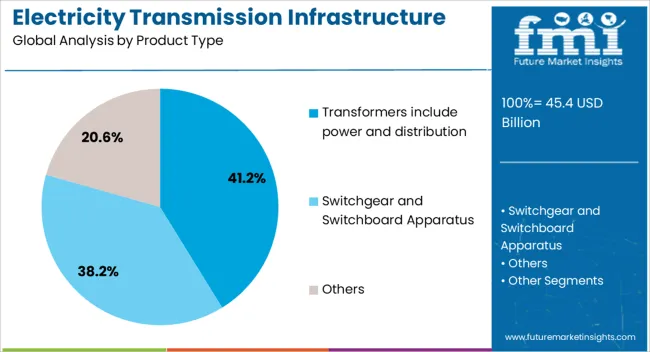

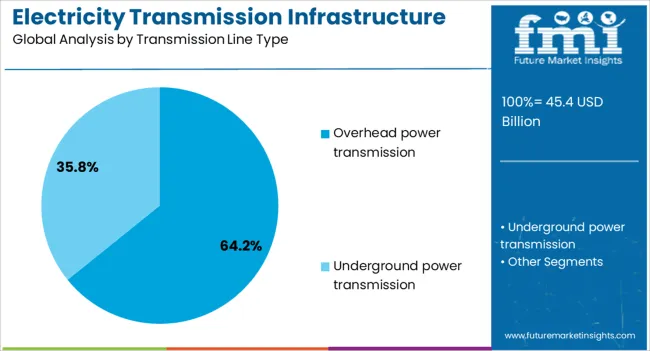

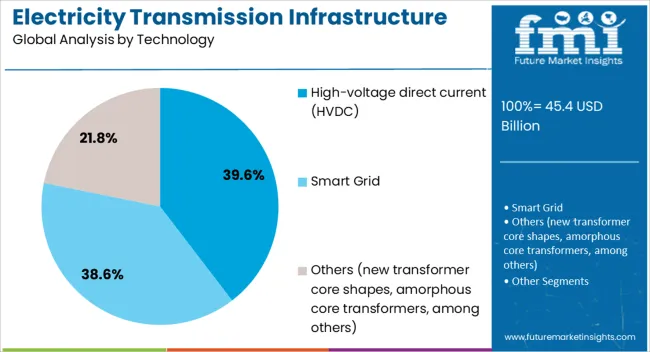

The electricity transmission infrastructure market is segmented by product type, transmission line type, technology, application, and geographic regions. By product type, electricity transmission infrastructure market is divided into Transformers include power and distribution, Switchgear and Switchboard Apparatus, and Others. In terms of transmission line type, electricity transmission infrastructure market is classified into Overhead power transmission and Underground power transmission. Based on technology, electricity transmission infrastructure market is segmented into High-voltage direct current (HVDC), Smart Grid, and Others (new transformer core shapes, amorphous core transformers, among others). By application, electricity transmission infrastructure market is segmented into Industrial, Commercial, Residential, Transportation, and Others. Regionally, the electricity transmission infrastructure industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The transformers include power and distribution product type segment is projected to account for 41.2% of the electricity transmission infrastructure market revenue share in 2025, making it the leading product type. Its dominance is being supported by the essential role it plays in efficiently converting voltage levels, reducing energy losses, and ensuring safe electricity delivery across transmission and distribution networks.

High demand is being observed due to modernization of aging infrastructure, integration of renewable energy sources, and growing requirements for reliable energy delivery in urban and industrial centers. The segment is benefiting from technological advancements in transformer design, including enhanced insulation, high-capacity cores, and smart monitoring capabilities that optimize operational performance.

Compliance with international energy efficiency and safety standards is further strengthening its adoption, while reduced maintenance requirements and long operational lifespans provide cost advantages As the global energy landscape evolves with increasing load demands and decentralized generation, the transformers include power and distribution segment is expected to maintain leadership and drive significant revenue in the electricity transmission infrastructure market.

The overhead power transmission line type segment is anticipated to hold 64.2% of the electricity transmission infrastructure market revenue share in 2025, establishing itself as the dominant line type. Its preference is being driven by its cost-effectiveness, ease of installation, and suitability for long-distance transmission, particularly across challenging terrains. The segment is benefiting from the global focus on expanding high-capacity transmission networks to connect renewable energy generation sites with load centers.

Technological improvements in conductor materials, insulation, and tower design are enhancing performance, reliability, and operational lifespan. Overhead transmission lines continue to be favored over underground alternatives in many regions due to lower capital expenditure and simpler maintenance requirements.

Additionally, growing investments in smart grid integration, monitoring sensors, and predictive maintenance solutions are further promoting adoption The ability to efficiently transmit large volumes of electricity over extended distances while maintaining high reliability has reinforced the segment’s leadership position in the electricity transmission infrastructure market.

The high-voltage direct current HVDC technology segment is expected to account for 39.6% of the electricity transmission infrastructure market revenue share in 2025, making it the leading technology. Its growth is being supported by its superior efficiency in long-distance and high-capacity electricity transmission compared with conventional alternating current systems. HVDC systems are preferred for connecting remote renewable energy generation sites, reducing energy losses, and enabling stable interconnections across regional grids.

The segment is also benefiting from technological advancements in converter stations, control systems, and power electronics, which enhance operational reliability and flexibility. Increasing cross-border electricity trade and the expansion of offshore wind and solar power projects are further reinforcing adoption.

Regulatory incentives, government-backed transmission projects, and rising demand for energy efficiency are creating a strong market pull for HVDC technology The ability to support long-distance power delivery, minimize losses, and integrate with modern smart grid infrastructure is ensuring its continued leadership as a critical technology in the electricity transmission infrastructure market.

The analysis of Electricity Transmission Infrastructure demand from 2025 to 2025 showed a historical growth rate of 4.0% CAGR, the rapidly rising demand for electricity in far-off, remote areas has historically been the main driver of market expansion.

World electricity generation and transmission were impacted negatively and somewhat positively by the COVID-19 pandemic. Due to an increase in the infection graph, the lockdown was imposed in some of the regions of the world, due to which demand and transmission of electricity increased, but supply was seen to decrease.

However, during the lockdown coal production and supply chain was restricted and electricity generation operation might get hampered in some of the regions globally, this factor also restricted the targeted market to grow in a historical period.

However, when infection curves started to decrease at the start of 2025. The surge in Electric vehicle development program, electrical and electronic sector, growth in industrial and commercial sector is result in growth of targeted market. As a result, FMI’s Global Electricity Transmission Infrastructure demand projection predicts a CAGR of 4.40% by 2035.

An increase in electricity demand, the installation of additional power production capacity, and the development of the transmission and distribution infrastructure are the main drivers of this market. The market for electric transmission and distribution equipment has prospects in the power utilities, residential, commercial, and industrial sectors, where the targeted market has a tremendous opportunity in the coming years.

The growing demand for electricity transmission infrastructure is thought to be primarily driven by factors like the need for electricity and substantial capital investments. A large portion of the market is being accounted for by investments in smart grids. Also, new transmission lines are being developed, and existing systems are being upgraded to increase capacity and provide improved monitoring facilities.

However, the increasing regulatory standards have strongly contributed to the demand for the global electricity transmission infrastructure market. The rapid population growth, increased digitalization, and the expansion of the industrial sector are also predicted to increase the production and consumption of electricity, which will help the targeted market growth.

Many obstacles significantly hinder the expansion of the global electricity transmission infrastructure market for instance, loss of electrical energy in long-distance transmission which cannot be stored and increasing pricing of transformers due to their production cost and market demand are some of the major restraints in the global electricity transmission infrastructure market.

Long-distance networks are required for the transmission of electricity from massive power plants to the end users. Losses in electricity are a result of long transmission distances These energy losses have become a major hindrance to a targeted market. Similarly, expenses associated with transmission infrastructure are likely to have a major impact on the price of electricity transmission infrastructure development.

The Middle Eastern and Asian economies are increasing and requiring more power, and the transformer demand is increasing due to an increase in electricity requirement and consumption. This raises the demand for metals like steel, copper, and Aluminum required to produce transformers in addition to rising metal prices and increased demand from other industries.

However, the aforementioned factors of loss of electricity due to long distances and costs associated with infrastructure development may hamper the targeted market in the upcoming years.

Over the forecast period, the global market for Electricity Transmission Infrastructure is anticipated to expand significantly. The region of North America and the Asia Pacific is expected to experience a relatively enormous development of Electricity Transmission Infrastructure because of the expanding population, and rise in the residential and industrial sectors in this region.

Because of the considerable presence of end-use industries, China is expected to maintain its position as one of the top countries for developing electricity transmission infrastructure. The considerable presence of big corporations, easy access to abundant resources, and increased investments in product development are only a few of the key reasons driving this market's expansion in this area.

In addition, several significant projects have just started in the country. For instance, the State Grid Corporation of China has declared that it will build a 1.1-million-volt transmission line in March 2025 that can move the output of 12 large power plants over 2,000 kilometres.

In December 2025, Energy China decided to invest $3.6 billion in an Erdos-integrated energy project. These investments is a significant driving factor behind China's electricity transmission infrastructure, which will drive the market growth of transmission infrastructure in the Asia-Pacific region.

Similarly, Numerous initiatives have recently been launched in the United States of America. The Grain Belt Express Clean Line is one of the biggest transmission projects in the United States.

About 4,000MW of less expensive wind energy produced in western Kansas will be sent over the Grain Belt Express Clean Line to Missouri, Illinois, Indiana, and other surrounding states with significant demand for dependable, clean energy. This electricity will be sent above through a 780-mile DC transmission line. These major investments in the energy sector are the main driving factor for the growth of the targeted market in the North American region.

Key players operating in the Global Electricity Transmission Infrastructure Market include ABB Limited, Alstom SA, Mitsubishi Electric, Eaton, General Electric Company, Hitachi Limited, Siemens AG, Toshiba Corporation and OSRAM Licht AG, etc.

Due to the rising electricity demand, industry participants in this market will have certain profitable growth opportunities in the future. Implementing long-term supply agreements and developing new projects are two of the most prominent strategies employed by major firms to keep up their competitiveness in the market. Owing to these factors, market participants have ample opportunities to grow their consumer bases and earnings.

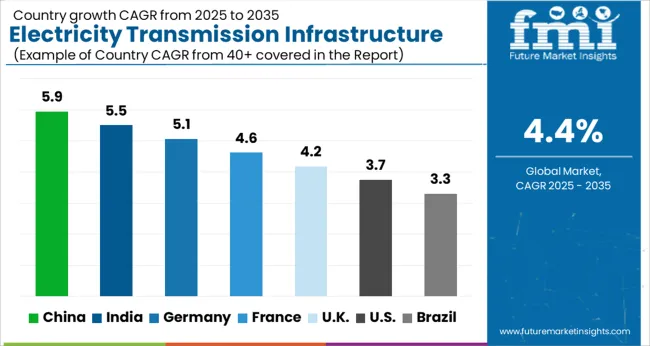

| Country | CAGR |

|---|---|

| China | 5.9% |

| India | 5.5% |

| Germany | 5.1% |

| France | 4.6% |

| UK | 4.2% |

| USA | 3.7% |

| Brazil | 3.3% |

The Electricity Transmission Infrastructure Market is expected to register a CAGR of 4.4% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 5.9%, followed by India at 5.5%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 3.3%, yet still underscores a broadly positive trajectory for the global Electricity Transmission Infrastructure Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 5.1%. The USA Electricity Transmission Infrastructure Market is estimated to be valued at USD 16.8 billion in 2025 and is anticipated to reach a valuation of USD 24.2 billion by 2035. Sales are projected to rise at a CAGR of 3.7% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 2.4 billion and USD 1.3 billion respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 45.4 Billion |

| Product Type | Transformers include power and distribution, Switchgear and Switchboard Apparatus, and Others |

| Transmission Line Type | Overhead power transmission and Underground power transmission |

| Technology | High-voltage direct current (HVDC), Smart Grid, and Others (new transformer core shapes, amorphous core transformers, among others) |

| Application | Industrial, Commercial, Residential, Transportation, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ABB Limited, Siemens AG, General Electric Company, Hitachi Limited, Mitsubishi Electric, Alstom SA, Eaton, Toshiba Corporation, and OSRAM Licht AG |

The global electricity transmission infrastructure market is estimated to be valued at USD 45.4 billion in 2025.

The market size for the electricity transmission infrastructure market is projected to reach USD 69.8 billion by 2035.

The electricity transmission infrastructure market is expected to grow at a 4.4% CAGR between 2025 and 2035.

The key product types in electricity transmission infrastructure market are transformers include power and distribution, switchgear and switchboard apparatus and others.

In terms of transmission line type, overhead power transmission segment to command 64.2% share in the electricity transmission infrastructure market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Transmission Overload Protectors Market Size and Share Forecast Outlook 2025 to 2035

Transmission Substation Market Size and Share Forecast Outlook 2025 to 2035

Transmission Oil Filters Market Size and Share Forecast Outlook 2025 to 2035

Transmission Components Market Size and Share Forecast Outlook 2025 to 2035

Transmission Towers Market Size and Share Forecast Outlook 2025 to 2035

Transmission & Distribution Electric Capacitor Market Size and Share Forecast Outlook 2025 to 2035

Transmission Fluids Market Trends & Demand 2025 to 2035

Transmission Sales Market Analysis & Forecast by Type, End Use Through 2035

Transmission Mounting Bracket Market

Transmission Oil Pump Market

Transmission Control Unit Market

EV Transmission System Market Size and Share Forecast Outlook 2025 to 2035

HVDC Transmission System Market Size and Share Forecast Outlook 2025 to 2035

Power Transmission Component Market Size and Share Forecast Outlook 2025 to 2035

Power Transmission Lines and Towers Market Analysis & Forecast by Product, Conductor, Insulation, Voltage, Current, Application, and Region Through 2035

Power Transmission Gearbox Market Growth - Trends & Forecast 2025 to 2035

Power Transmission Cables Market

Manual Transmission Market Size and Share Forecast Outlook 2025 to 2035

USA HVDC Transmission Systems Market Insights – Size, Growth & Forecast 2025-2035

Automatic Transmission Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA