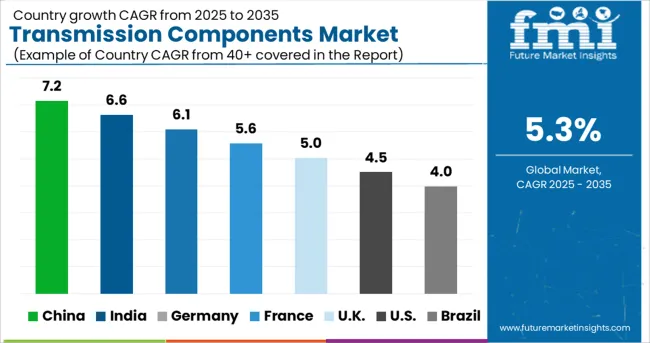

The Transmission Components Market is estimated to be valued at USD 59.0 billion in 2025 and is projected to reach USD 98.8 billion by 2035, registering a compound annual growth rate (CAGR) of 5.3% over the forecast period.

The transmission components market is being driven by the ongoing expansion of electric vehicles, automation trends in industrial machinery, and rising energy efficiency requirements across transportation and power systems. Growing demand for reduction in system weight, noise, vibration, and harshness is encouraging the adoption of advanced materials and precision-machined parts.

Investments in novel alloys, coating technologies, and precision casting are enhancing component durability and performance. Additionally, digitization of production methods such as additive manufacturing and real time quality monitoring is enabling superior customization and batch-level efficiency.

Regulatory standards targeting emissions and fuel economy are further stimulating the design and integration of optimized transmission systems. Regional growth hubs, particularly in Asia Pacific automotive sectors and Europe’s trend toward hybrid drivetrain adoption, are generating new market opportunities. The anticipated market trajectory remains upward as manufacturers continue integrating lightweight, high-strength, and digitally traceable components aligned with sustainable mobility and industrial modernization.

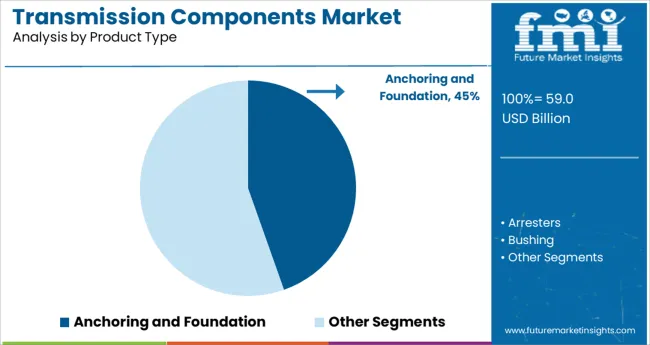

The market is segmented by Product Type and region. By Product Type, the market is divided into Anchoring and Foundation, Arresters, Bushing, Connectors, Insulators, Enclosures, Utility Measurement Systems, Grounding and Bonding, Switches, and Fuses. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

It is observed that the anchoring and foundation product type holds 44.60% of the transmission components market, establishing it as the leading product category. This status has been earned through its critical role in ensuring structural integrity, torque transmission stability, and long-term reliability. High load applications such as heavy duty vehicles, construction equipment, and industrial gear systems have necessitated robust anchoring systems capable of withstanding dynamic stresses.

Investment in high strength alloys and precision forging methods has driven improvements in fatigue resistance and dimensional accuracy. Additionally, requirements for vibration dampening, alignment retention, and noise reduction have made anchoring solutions indispensable to drivetrain performance. Manufacturer focus on modular anchor designs has also facilitated faster assembly cycles and reduced maintenance.

As OEMs pursue strategies of longer service intervals and lower lifecycle costs, this sub segment has benefitted from consistent demand for dependable, engineering-grade anchoring solutions, cementing its dominance within the broader product type category.

From 2020 to 2024, the global transmission components market exhibited growth at a 2.4% CAGR and is projected to showcase a CAGR of 5.3% in the forecast period. This increase in YOY growth in 2025 is attributed to rising energy consumption due to factors like increasing population, rapid urbanization, high industrial production, surging mining output, and progressive expansion of access to modern electricity across various geographic locations. In order to develop advanced infrastructure, each of these structures needs reliable power management facilities, which will ultimately increase the demand for transmission components.

The market for transmission components has witnessed a considerable surge in terms of demand as a result of an increasing number of rural electrification initiatives across various parts of the world. As electricity is a basic necessity in many industries, transmission components are widely utilized in electricity distribution, energy & power production, and infrastructure development projects.

Significant growth in terms of demand for electricity from various end users all over the globe, especially in developing nations along with rapid development of electrical infrastructure is expected to benefit the transmission components market in the assessment period. In contrast to the USD 47,966.7 Million recorded in 2025, the aforementioned factors are anticipated to boost the market to reach USD 80,279.2 Million by the end of 2035.

Demand for Mechanical Power Transmission Components to Surge with Development of New Power Grids

To lower overall energy losses, more innovative products should be developed and installed in transmission lines. One of the key factors influencing the demand for transmission components is the creation of new power infrastructure and the replacement of outdated power infrastructure to ensure uninterrupted and secure energy transmission from power production plants to end users. It is anticipated that there will be a considerable rise in terms of demand for transmission components as they are needed for a secure connection in commercial, residential, and industrial buildings, as well as during the transition to a new electric grid.

The development of intelligent power distribution and control networks will also increase the utilization of transmission components and propel the growth of the local economy. The market is also expected to showcase high growth due to factors like rapid expansion of the power supply networks, high investments in building new power grids, and increased transmission & distribution of power supply.

Rising Need for Electrification in the USA to Foster Sales of Transmission Assembly Parts

According to FMI, the USA is expected to hold the largest share of the transmission components market in 2025. The country is anticipated to expand significantly in the next ten years due to a considerable increase in terms of power consumption on the back of rising population and surging industrialization in the USA During the assessment period of 2025 to 2035, the transmission components market is projected to witness tremendous growth in the country due to rising need for electrification across various parts of the USA, as well as increasing concerns regarding the reduction of power losses & electricity cost.

Growing Number of Electrification Projects to Drive the Demand for Transmission Elements in China

China is considered to be one of the most profitable markets for transmission component manufacturers and suppliers. During the forecast period of 2025 to 2035, the country is expected to generate one of the largest absolute incremental opportunities. China's dominance in the global transmission components market is being bolstered by increasing demand for electrification from the industrial, as well as residential sectors.

Rising government initiatives and increasing investments to accelerate electrification projects in an effort to offer power to every resident is a key factors behind the incremental growth rate of the China transmission components market. Installation of transmission components in the industrial and infrastructure sectors in China will provide a plethora of growth potential throughout the span of the assessment period. Urbanization has expanded over time, which has increased the demand for power and fueled the market for transmission components in the country.

Replacement of Aging Infrastructure in Germany to Fuel Sales of Transmission Substation Components

According to FMI, Germany is projected to account for nearly 19.7% of the Europe transmission components market share by the end of 2025. Increased research & development spending in the country is anticipated to support market expansion by promoting the development of renewable energy sources and updating aging infrastructure. In order to increase grid stability and resilience, as well as allow smarter power networks, the government of Germany is concentrating on upgrading and replacing conventional infrastructure.

Demand for Anchoring and Foundation Power Transmission Components to Surge by 2035

By product type, the anchoring and foundation segment is estimated to dominate the global transmission components market in the evaluation period. The dominance of the segment is expected to continue throughout the forecast period and it is likely to exhibit a CAGR of 6.1% from 2025 to 2035.

Growth of the segment is mainly attributed to increasing power generation from renewable sources, which is further pushing the need for high-tech infrastructure for electricity transmission. As anchoring and foundation components are the backbones of high-tech electricity transmission structures, it is resulting in increasing demand across the globe.

The global transmission components market is projected to gain momentum in the evaluation period with the presence of several big, medium, and small-scale manufacturers and service providers. Established and emerging market participants are striving to generate new sources of revenue by developing long-term relationships with OEMs and small-scale transmission components manufacturers in countries such as India and the USA Leading industry players are also investing in new advanced technologies that will enable the future production of high-quality transmission components.

For instance,

| Attribute | Details |

|---|---|

| Estimated Market Size (2025) | USD 59.0 billion |

| Projected Market Valuation (2035) | USD 98.8 billion |

| Value-based CAGR (2025 to 2035) | 5.3% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2024 |

| Market Analysis | Value (million) |

| Key Market Segments Covered | Product Type and Region |

| Key Regions/Countries Covered | North America, United States of America, Canada, Latin America, Mexico, Brazil, Europe, Germany, France, Italy, Spain, United Kingdom, Russia, BENELUX, East Asia, China, Japan, South Korea, South Asia & Pacific, India, ASEAN, Oceania, Middle East & Africa, Turkey, South Africa, North Africa |

| Key Companies Profiled | Hitachi ABB Power Grids; Siemens Energy; General Electric (GE); Eaton; Hubbell; TE Connectivity; Toshiba |

| Report Coverage | Market Forecast, brand share analysis, competition intelligence, Drivers, Restraints, Opportunities and Threats analysis, Market Dynamics and Challenges, Strategic Growth Initiatives |

The global transmission components market is estimated to be valued at USD 59.0 billion in 2025.

It is projected to reach USD 98.8 billion by 2035.

The market is expected to grow at a 5.3% CAGR between 2025 and 2035.

The key product types are anchoring and foundation, arresters, bushing, connectors, insulators, enclosures, utility measurement systems, grounding and bonding, switches and fuses.

segment is expected to dominate with a 0.0% industry share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Transmission Overload Protectors Market Size and Share Forecast Outlook 2025 to 2035

Transmission Substation Market Size and Share Forecast Outlook 2025 to 2035

Transmission Oil Filters Market Size and Share Forecast Outlook 2025 to 2035

Transmission Towers Market Size and Share Forecast Outlook 2025 to 2035

Transmission & Distribution Electric Capacitor Market Size and Share Forecast Outlook 2025 to 2035

Transmission Fluids Market Trends & Demand 2025 to 2035

Transmission Sales Market Analysis & Forecast by Type, End Use Through 2035

Transmission Mounting Bracket Market

Transmission Oil Pump Market

Transmission Control Unit Market

EV Transmission System Market Size and Share Forecast Outlook 2025 to 2035

HVDC Transmission System Market Size and Share Forecast Outlook 2025 to 2035

Power Transmission Component Market Size and Share Forecast Outlook 2025 to 2035

Power Transmission Lines and Towers Market Analysis & Forecast by Product, Conductor, Insulation, Voltage, Current, Application, and Region Through 2035

Power Transmission Gearbox Market Growth - Trends & Forecast 2025 to 2035

Power Transmission Cables Market

Manual Transmission Market Size and Share Forecast Outlook 2025 to 2035

USA HVDC Transmission Systems Market Insights – Size, Growth & Forecast 2025-2035

Automatic Transmission Market Size and Share Forecast Outlook 2025 to 2035

Automotive Transmission Synchronizer Assembly Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA