The transmission substation market is valued at USD 88.4 billion in 2025 and is estimated to reach USD 116.5 billion by 2035, registering a CAGR of 2.8%. Inflection point mapping highlights critical stages in the market where growth accelerates or decelerates due to changing demand dynamics, technological adoption, and regulatory influences. From 2021 to 2025, the market is projected to grow from USD 77.0 billion to USD 88.4 billion, with intermediate values of USD 79.2 billion, USD 81.4 billion, USD 83.7 billion, and USD 86.0 billion.

The first inflection point occurs around 2025, marking the transition from gradual early-stage expansion to stronger adoption driven by grid modernization, renewable energy integration, and the replacement of aging infrastructure in developed regions. Between 2026 and 2030, values advance from USD 88.4 billion to USD 101.5 billion, passing through USD 90.9 billion, USD 93.4 billion, USD 96.0 billion, and USD 98.7 billion. The second inflection point during this period reflects accelerated deployment of smart substations, advanced protection systems, and digital monitoring technologies, resulting in higher value addition and regional expansion.

From 2031 to 2035, the market progresses from USD 104.3 billion to 116.5 billion, with intermediate values of USD 107.3 billion, 110.3 billion, and 113.4 billion. This phase indicates a stabilization inflection point where growth increments moderate, reflecting matured adoption, optimized operational practices, and regulatory compliance.

| Metric | Value |

|---|---|

| Transmission Substation Market Estimated Value in (2025 E) | USD 88.4 billion |

| Transmission Substation Market Forecast Value in (2035 F) | USD 116.5 billion |

| Forecast CAGR (2025 to 2035) | 2.8% |

The transmission substation market is driven by five parent markets that collectively shape its growth, adoption, and technological advancement across the power sector. The power generation market contributes the largest share, about 25-30%, as substations are essential for stepping up electricity from power plants, managing grid connections, and ensuring efficient energy transfer to transmission networks. The high-voltage transmission network market adds approximately 20-24%, where substations enable the safe, reliable, and efficient delivery of electricity over long distances while maintaining system stability and minimizing losses. The renewable energy integration market contributes around 15-18%, with substations facilitating the connection of solar, wind, and other renewable power sources to the main grid, ensuring voltage regulation and grid reliability. The industrial and commercial energy infrastructure market accounts for roughly 12-15%, as substations support large-scale factories, industrial parks, and commercial complexes with high-capacity, reliable power supply. Finally, the smart grid and electrical automation market represents about 8-10%, where advanced substations incorporate monitoring, protection, and automation systems for real-time grid management, fault detection, and predictive maintenance.

The transmission substation market is showing steady growth, driven by the global push for grid modernization, increasing electricity demand, and the integration of renewable energy sources into transmission networks. Utilities and grid operators are prioritizing infrastructure upgrades to enhance transmission reliability and reduce downtime. Technological advancements, including automation and digital monitoring systems, have improved operational efficiency and real-time performance tracking.

Public investments in large-scale transmission projects, coupled with regulatory initiatives aimed at reducing carbon emissions, have also supported the expansion of new substation projects. Moreover, grid expansion in developing economies is fueling demand for both conventional and advanced substations.

As electrification trends accelerate across industries and urban areas, the market is expected to see further growth, with particular momentum in automation-enabled systems and newly constructed facilities.

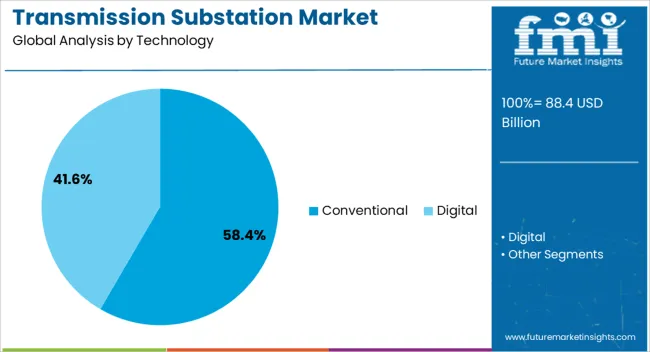

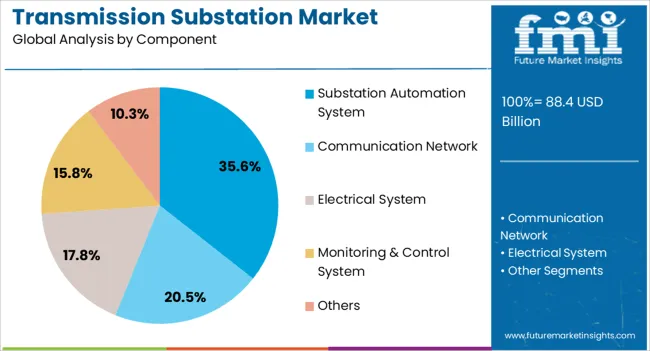

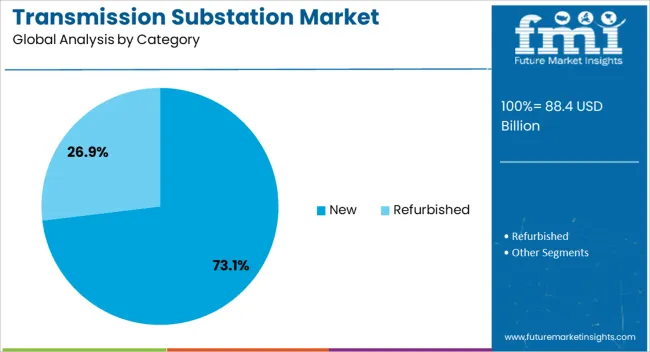

The transmission substation market is segmented by technology, component, category, voltage level, end use, and geographic regions. By technology, transmission substation market is divided into Conventional and Digital. In terms of components, the transmission substation market is classified into Substation Automation System, Communication Network, Electrical System, Monitoring & Control System, and Others. Based on category, transmission substation market is segmented into New and Refurbished.

By voltage level, transmission substation market is segmented into High, Medium, and Low. By end use, transmission substation market is segmented into Utility and Industrial. Regionally, the transmission substation industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Conventional segment is projected to contribute 58.4% of the transmission substation market revenue in 2025, retaining its position as the leading technology type. This segment’s strength comes from its established reliability, proven operational performance, and cost-effectiveness for large-scale grid applications.

Utilities continue to rely on conventional designs for their robustness, ease of maintenance, and compatibility with existing infrastructure. These systems have a long operational lifespan, making them favorable for regions where budget constraints limit the adoption of advanced automation technologies.

Additionally, conventional substations require less specialized technical expertise to operate, which supports their adoption in emerging markets. With many countries still in the process of expanding foundational grid infrastructure, the Conventional segment is expected to maintain a significant share in the foreseeable future.

The Substation Automation System segment is projected to account for 35.6% of the transmission substation market revenue in 2025, reflecting its critical role in enhancing grid reliability and efficiency. This segment’s growth is fueled by increasing adoption of digital technologies for real-time monitoring, predictive maintenance, and automated fault detection.

Utilities are deploying automation systems to reduce downtime, optimize energy distribution, and enable seamless integration of renewable energy sources. The growing complexity of modern grids, with multiple energy generation points, has increased the need for automated control and data analytics capabilities.

Moreover, regulatory bodies are promoting digitalization in energy infrastructure, further accelerating the shift toward substation automation. As utilities continue to modernize legacy systems, the Substation Automation System segment is set to gain greater prominence in the market.

The New category is projected to hold 73.1% of the transmission substation market revenue in 2025, establishing itself as the largest category. This dominance is driven by extensive grid expansion projects and the development of new power transmission corridors to meet rising electricity consumption.

The integration of renewable energy plants, such as wind and solar farms, into national grids often necessitates the construction of entirely new substations to handle additional capacity. Emerging economies are investing heavily in new substation infrastructure to support industrial growth, urbanization, and rural electrification initiatives.

Furthermore, technological innovations in design and construction have made new substations more efficient and adaptable to future upgrades, reinforcing their long-term value for grid operators. With global energy transition efforts accelerating, the New category is expected to remain the primary driver of market growth.

The transmission substation market is growing due to rising electricity demand, renewable energy integration, and urban infrastructure expansion. GIS and AIS substations play a key role in voltage transformation, grid stability, and load management. Challenges include high capital costs, complex installation, regulatory compliance, and maintenance requirements. Opportunities exist in smart grid integration, urban electrification, renewable power projects, and modular substation solutions. Manufacturers providing certified, high-performance, digitally integrated, and energy-efficient substations are best positioned to capture global market growth.

The transmission substation market is expanding as utilities and industrial operators increasingly invest in modernizing electrical grids to ensure reliable power transmission. Substations, including gas-insulated (GIS) and air-insulated (AIS) types, are essential for voltage transformation, load management, and grid stability. Growth is driven by rising electricity demand, urbanization, and renewable energy integration in Asia-Pacific, North America, and Europe. Expansion of high-voltage transmission lines, smart grid adoption, and investments in urban and rural electrification projects further fuel demand. Manufacturers focus on advanced switchgear, transformers, and protection systems to improve efficiency and safety. Technological advancements, including digital monitoring, remote operation, and predictive maintenance, enhance grid reliability. Transmission substations remain critical for uninterrupted power supply in industrial, commercial, and residential sectors worldwide.

Advanced GIS substations require specialized engineering, construction, and skilled labor, increasing project expenses. Compliance with regional electrical, safety, and environmental standards, such as IEC, ANSI, and IEEE, adds operational complexity. Supply chain constraints for transformers, circuit breakers, and control equipment may affect project timelines. Utilities demand certified, reliable, and high-performance substation equipment with proven longevity. Manufacturers investing in modular designs, process optimization, and digital monitoring technologies can reduce operational risks and installation challenges. Ensuring safety, regulatory adherence, and long-term reliability is critical to meeting the evolving power transmission needs globally.

GIS substations are increasingly preferred for space-constrained urban areas, while AIS substations are used in industrial and rural applications. Expansion of solar, wind, and hydroelectric power projects necessitates modern substation infrastructure. Asia-Pacific, led by China, India, and Japan, shows strong growth due to industrialization, electrification programs, and rising electricity consumption. Manufacturers providing modular, digitally integrated, and energy-efficient substation solutions gain a competitive advantage. Collaboration with utilities, government agencies, and EPC contractors enables project delivery and lifecycle support. Adoption of smart monitoring, automation, and predictive maintenance enhances grid reliability and operational efficiency globally.

Technological trends in the transmission substation market include digital control systems, IoT integration, predictive maintenance, and high-voltage switchgear solutions. Advanced SCADA systems, sensors, and remote monitoring improve operational efficiency, fault detection, and load management. GIS technology adoption reduces footprint and enhances safety in urban installations. Modular substation designs allow faster deployment, flexible capacity expansion, and simplified maintenance. Manufacturers focus on integrating cybersecurity, real-time monitoring, and automated operation into substation infrastructure. Collaboration with smart grid initiatives and renewable energy projects drives innovation. Providers offering certified, digitally connected, and high-performance substations are well-positioned to meet growing electricity demand and evolving industry requirements worldwide.

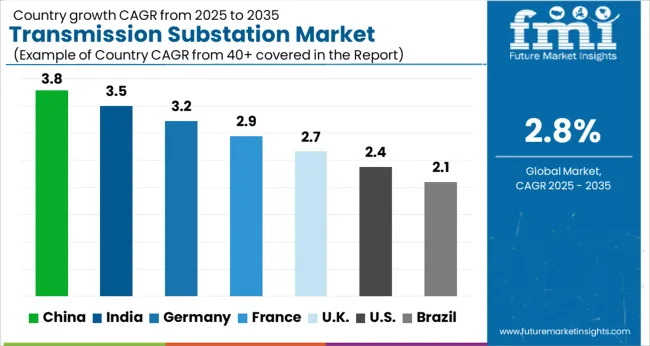

| Country | CAGR |

|---|---|

| China | 3.8% |

| India | 3.5% |

| Germany | 3.2% |

| France | 2.9% |

| UK | 2.7% |

| USA | 2.4% |

| Brazil | 2.1% |

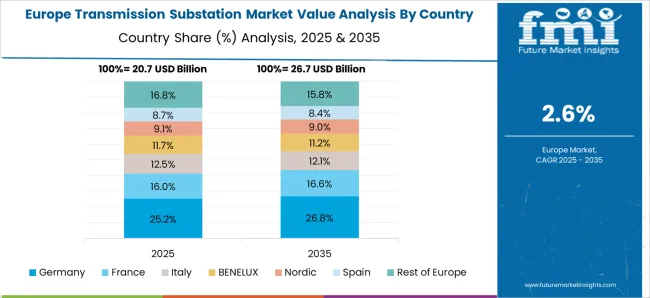

The global transmission substation market is projected to expand at a CAGR of 2.8% from 2025 to 2035. China (3.8%) and India (3.5%) are the fastest-growing markets, supported by rising electricity demand, grid modernization, and renewable energy integration. France (2.9%) emphasizes upgrading aging infrastructure and deploying smart monitoring systems, while the UK (2.7%) and USA (2.4%) show steady growth through modular substation adoption and digital control solutions. Growth drivers include urbanization, high-voltage transmission projects, public-private partnerships, and predictive maintenance implementation. The analysis includes over 40+ countries, with the leading markets detailed below.

The transmission substation market in China is projected to grow at a CAGR of 3.8% from 2025 to 2035, driven by expanding electricity demand, rapid urbanization, and large-scale grid modernization projects. The government’s focus on strengthening the national grid and integrating renewable energy sources such as solar and wind increases the need for advanced substations. Investments in high-voltage and ultra-high-voltage transmission infrastructure further accelerate growth. Local manufacturers are adopting smart substation technologies, digital monitoring systems, and automation solutions to improve reliability and operational efficiency. Partnerships with EPC contractors and utility companies are boosting project execution capacity. Retrofitting and upgrading aging substation infrastructure offer incremental growth opportunities, while innovations in modular and compact substation design enhance deployment flexibility.

The transmission substation market in India is expected to grow at a CAGR of 3.5% from 2025 to 2035, supported by grid expansion, rising power consumption, and renewable energy integration. The government’s push for rural electrification, high-voltage transmission lines, and modernization of distribution networks creates demand for new substations. Manufacturers and EPC companies are focusing on smart substation solutions, SCADA integration, and digital monitoring to improve reliability and efficiency. Private investments and public-private partnerships accelerate deployment across urban and semi-urban regions. The demand for modular and compact substations is increasing for space-constrained areas. Upgrading older substations and improving maintenance capabilities remain key market drivers.

The transmission substation market in Franceis projected to expand at a CAGR of 2.9% from 2025 to 2035, driven by modernization of aging grid infrastructure and integration of renewable energy. The country is investing in high-voltage and medium-voltage substations to support stable electricity distribution. Manufacturers focus on smart grid technologies, automation, and predictive maintenance solutions to improve operational efficiency. Partnerships with utility providers and EPC contractors enhance project delivery capabilities. Expansion of regional interconnections with neighboring countries also boosts demand. Retrofitting existing substations with advanced monitoring systems is a key growth opportunity for suppliers.

The UK transmission substation market is expected to grow at a CAGR of 2.7% from 2025 to 2035, driven by grid reliability upgrades, renewable energy integration, and urban infrastructure development. Advanced digital monitoring, SCADA systems, and smart substation solutions are increasingly deployed to optimize energy distribution. Utilities are investing in modernizing aging substations and incorporating modular designs for faster deployment. Regulatory initiatives promoting clean energy adoption and energy efficiency drive growth, while public-private partnerships support large-scale infrastructure projects. Market expansion is further enhanced by innovative technologies for remote monitoring and predictive maintenance, ensuring operational stability and reduced downtime.

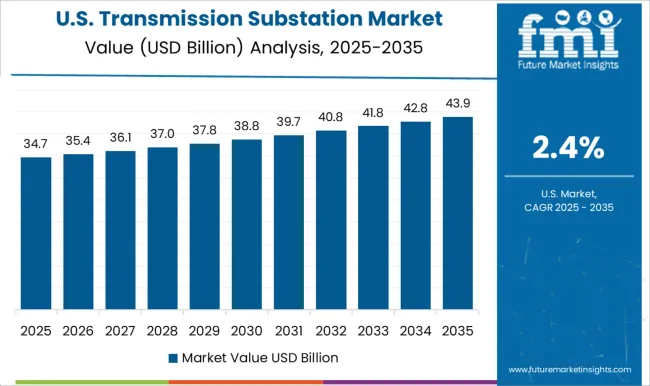

The USA transmission substation market is forecasted to grow at a CAGR of 2.4% from 2025 to 2035, supported by modernization of the aging electric grid and integration of renewable energy sources. Utilities focus on upgrading existing substations, implementing advanced protection systems, and deploying digital monitoring technologies. Investment in high-voltage and medium-voltage substations for industrial, commercial, and residential power needs is a key growth driver. Public-private partnerships and government incentives accelerate adoption of smart and modular substation solutions. Predictive maintenance and automated control systems improve operational reliability and reduce downtime. Growth is further bolstered by the need to enhance resilience against extreme weather and grid disruptions.

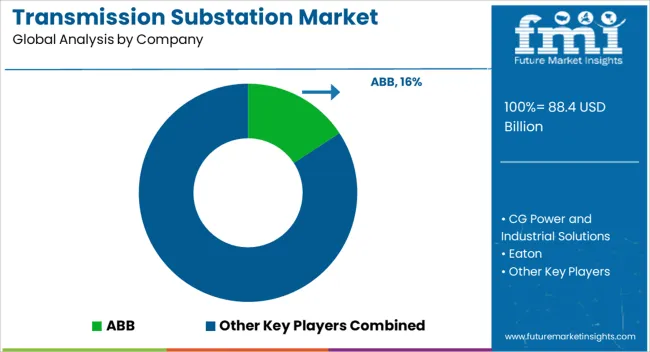

Competition in the transmission substation market is defined by technological integration, reliability, and turnkey solutions for high-voltage networks. ABB competes through advanced switchgear, protection systems, and digital substation solutions, emphasizing automation, remote monitoring, and grid stability. CG Power and Industrial Solutions focuses on medium- and high-voltage equipment with modular designs and robust local service networks. Eaton differentiates with compact substations, smart switchgear, and energy-efficient solutions suitable for industrial and utility applications. Efacec provides turnkey substations, control systems, and engineering services, targeting fast deployment and integration with renewable energy grids. General Electric delivers high-voltage equipment, protection relays, and digital monitoring platforms, emphasizing predictive maintenance and integration with smart grid infrastructure. Hitachi Energy combines HV equipment, digital control, and automation for flexible and reliable power distribution. L&T Electrical and Automation offers design, construction, and commissioning of substations with a focus on modular solutions for industrial and utility clients. Locamation and Open System International provide software-based automation, SCADA integration, and real-time monitoring solutions. Rockwell Automation emphasizes industrial substation controls, IoT connectivity, and predictive analytics. Schneider Electric and Siemens compete with end-to-end substation solutions, including digital switchgear, control systems, and energy management software for utility and industrial networks. Texas Instruments contributes through precision electronics and sensor technologies for monitoring and control. Tesco Automation focuses on customized substation automation and integrated control systems. Product brochures highlight high-voltage switchgear, transformers, control and protection systems, SCADA integration, monitoring sensors, digital automation, and modular substation designs. Strategies across the market emphasize digitalization, predictive maintenance, energy efficiency, and turnkey delivery. Collectively, these offerings illustrate a competitive landscape driven by technology, reliability, and the ability to provide fully integrated, scalable solutions for modern power transmission networks.

| Item | Value |

|---|---|

| Quantitative Units | USD 88.4 Billion |

| Technology | Conventional and Digital |

| Component | Substation Automation System, Communication Network, Electrical System, Monitoring & Control System, and Others |

| Category | New and Refurbished |

| Voltage Level | High, Medium, and Low |

| End Use | Utility and Industrial |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ABB, CG Power and Industrial Solutions, Eaton, Efacec, General Electric, Hitachi Energy, L&T Electrical and Automation, Locamation, Open System International, Rockwell Automation, Schneider Electric, Siemens, Texas Instruments, and Tesco Automation |

| Additional Attributes | Dollar sales by equipment type (transformers, switchgear, circuit breakers), service type (installation, maintenance, automation), and substation voltage rating (medium, high, ultra-high). Demand is fueled by grid modernization, renewable energy integration, and infrastructure expansion. Regional trends highlight strong growth in North America, Europe, and Asia-Pacific, supported by urbanization, increasing electricity demand, and investment in smart grid technologies. |

The global transmission substation market is estimated to be valued at USD 88.4 billion in 2025.

The market size for the transmission substation market is projected to reach USD 116.5 billion by 2035.

The transmission substation market is expected to grow at a 2.8% CAGR between 2025 and 2035.

The key product types in transmission substation market are conventional and digital.

In terms of component, substation automation system segment to command 35.6% share in the transmission substation market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Low Voltage Transmission Substation Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Transmission Substation Market Size and Share Forecast Outlook 2025 to 2035

Utility Scale Transmission Substation Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Transmission Substation Market Size and Share Forecast Outlook 2025 to 2035

Transmission Overload Protectors Market Size and Share Forecast Outlook 2025 to 2035

Transmission Oil Filters Market Size and Share Forecast Outlook 2025 to 2035

Transmission Components Market Size and Share Forecast Outlook 2025 to 2035

Transmission Towers Market Size and Share Forecast Outlook 2025 to 2035

Transmission & Distribution Electric Capacitor Market Size and Share Forecast Outlook 2025 to 2035

Transmission Fluids Market Trends & Demand 2025 to 2035

Transmission Sales Market Analysis & Forecast by Type, End Use Through 2035

Transmission Mounting Bracket Market

Transmission Oil Pump Market

Transmission Control Unit Market

EV Transmission System Market Size and Share Forecast Outlook 2025 to 2035

HVDC Transmission System Market Size and Share Forecast Outlook 2025 to 2035

Power Transmission Component Market Size and Share Forecast Outlook 2025 to 2035

Power Transmission Lines and Towers Market Analysis & Forecast by Product, Conductor, Insulation, Voltage, Current, Application, and Region Through 2035

Power Transmission Gearbox Market Growth - Trends & Forecast 2025 to 2035

Power Transmission Cables Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA