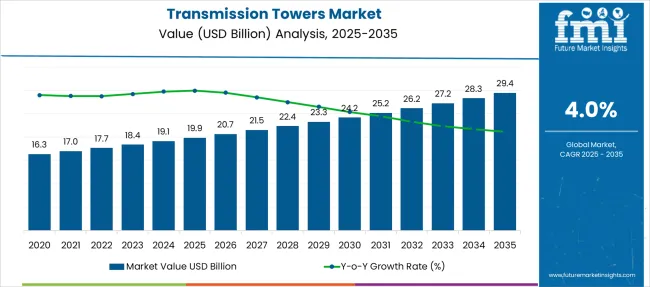

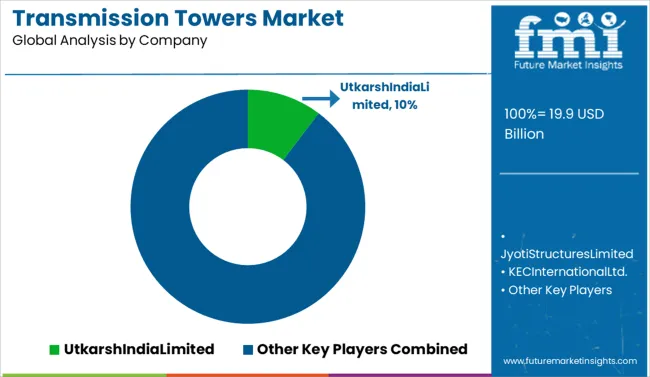

The Transmission Towers Market is estimated to be valued at USD 19.9 billion in 2025 and is projected to reach USD 29.4 billion by 2035, registering a compound annual growth rate (CAGR) of 4.0% over the forecast period. Historic estimates placed the market at USD 16.3 billion in 2020, suggesting a steady but moderate growth path. This expansion correlates with sustained investments in grid interconnection projects and renewable energy integration initiatives requiring robust overhead infrastructure. The period between 2027 and 2032 is projected to register stable momentum as nations scale up high-voltage AC and DC transmission lines to meet escalating power demand. Steel lattice towers maintain dominance, although monopole structures gain favor for urban installations due to compact footprint benefits. Market participants are expected to emphasize galvanization quality enhancements and modular configurations that allow swift on-site assembly, minimizing installation delays.

Government procurement programs focusing on rural electrification and cross-border power trading will serve as core growth enablers. The competitive field rewards vendors offering turnkey EPC solutions bundled with maintenance services, creating recurring revenue opportunities through lifecycle support contracts. Strategic leverage lies in supply chain integration and securing raw material price hedges to withstand steel cost volatility.

As electricity demand accelerates in developing regions and aging infrastructure is replaced in mature economies, the role of towers as structural backbones of high-voltage transmission becomes increasingly critical.

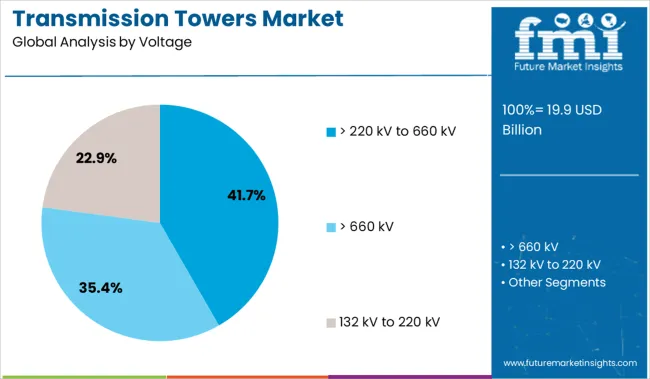

The >220 kV to 660 kV segment, accounting for 41.7% share, represents the core of capacity expansion projects, driven by cross-border interconnections and high-load corridors supporting industrial hubs. Asia-Pacific remains the strongest growth contributor due to large-scale electrification programs and renewable integration, while North America and Europe focus on grid resilience, hardening against extreme weather, and supporting offshore wind connectivity.

The next decade will introduce engineering priorities such as corrosion-resistant alloys, modular tower systems for faster assembly, and drone-based inspection to cut maintenance costs. Supply chain volatility for galvanized steel and geopolitical constraints on raw materials could reshape sourcing strategies. Competitive advantage will hinge on aligning tower design with digital grid requirements, enabling integrated monitoring for real-time load and structural health analytics.

| Metric | Value |

|---|---|

| Transmission Towers Market Estimated Value in (2025E) | USD 19.9 billion |

| Transmission Towers Market Forecast Value in (2035F) | USD 29.4 billion |

| Forecast CAGR (2025 to 2035) | 4.0% |

The transmission towers market is currently experiencing steady growth driven by rising global electricity consumption and expansion of grid infrastructure across both developed and emerging economies. Governments and private utilities are investing in large-scale power transmission projects to facilitate long-distance electricity transfer from renewable energy sources and thermal power stations to urban and industrial zones.

The integration of renewable energy into the grid, along with growing cross-border interconnection projects, is creating demand for high-capacity and resilient transmission infrastructure. Key developments include the replacement of aging grids, digital monitoring systems, and deployment of composite materials for enhanced structural performance.

As power utilities prioritize operational efficiency and energy loss reduction, transmission tower designs are becoming more modular, corrosion-resistant, and suited for diverse terrains. Future opportunities are expected to emerge from smart grid integration, intercontinental power corridors, and next-generation ultra-high voltage transmission systems which will sustain long-term market expansion.

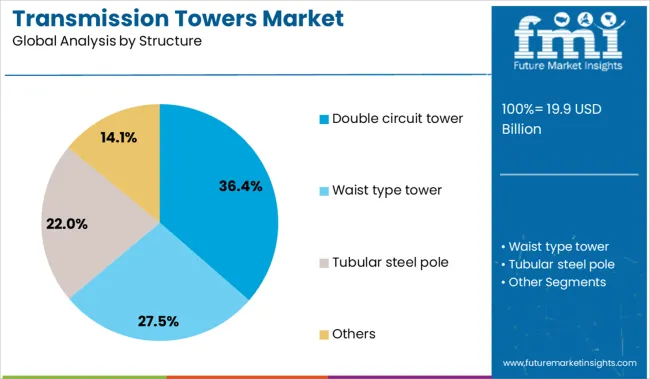

The transmission towers market is segmented by voltage, structure, and region. By voltage, it includes 132 kV to 220 kV, greater than 220 kV to 660 kV, and above 660 kV, supporting varied transmission requirements. In terms of structure, the segmentation comprises double circuit towers, waist type towers, tubular steel poles, and other structural configurations designed for high-voltage power lines. Regionally, the market spans North America, Latin America, Western and Eastern Europe, Balkan and Baltic countries, Russia and Belarus, Central Asia, East Asia, South Asia and Pacific, and the Middle East and Africa.

The voltage segment ranging from greater than 220 kV to 660 kV is projected to account for 41.7% of market revenue in 2025, making it the dominant category. This leadership is driven by the need for long-distance bulk power transmission with minimal losses, especially across regions where renewable energy generation sites are located far from consumption centers.

The segment's growth has been supported by the increasing deployment of inter-regional transmission networks which require high voltage capacity to handle fluctuating energy loads while maintaining stability and efficiency. Additionally, high voltage lines within this range are essential for grid interconnectivity projects aimed at balancing regional electricity demands.

Advancements in insulation materials and tower foundation engineering have also enabled broader deployment of these systems in diverse environmental conditions, reinforcing their importance in large-scale transmission infrastructure projects.

The double circuit tower segment is expected to hold 36.4% of market share in 2025 within the structure category, positioning it as the leading tower configuration. This preference is attributed to the tower’s ability to carry two electrical circuits simultaneously, enhancing grid reliability and redundancy without requiring parallel infrastructure development.

Double circuit towers are increasingly being deployed to optimize land usage, reduce transmission right-of-way acquisition costs, and minimize visual and environmental impact in densely populated and ecologically sensitive areas. Their structural design allows for maintenance on one circuit while the other remains operational, which has been critical in ensuring an uninterrupted power supply.

With rising demand for efficient, multi-line transmission routes capable of supporting renewable integration and smart grid expansion, the double circuit tower has emerged as the preferred structure among utilities and infrastructure developers globally.

Demand for transmission towers continues to rise due to increasing electricity demand, long-distance power delivery needs, and ongoing grid reinforcement efforts. Government-supported energy corridor expansion, renewable power linkage, and cross-border electricity trade have prioritized high-voltage infrastructure upgrades. Investment flows remain strong across Asia Pacific, North America, and Europe. Steel lattice, monopole, and hybrid tower formats are gaining traction, driven by structural performance and maintenance advantages.

The expansion of national and cross-regional electricity corridors has been prioritized to accommodate rising demand and stabilize power supply. Transmission towers are being deployed to support high-voltage alternating current (HVAC) and high-voltage direct current (HVDC) systems that transmit power from distant generation hubs to consumption centers. Aging grid infrastructure across OECD nations has triggered large-scale retrofitting programs, replacing outdated designs with corrosion-resistant and modular tower configurations.

In emerging regions, greenfield installations have gained pace under energy access mandates and public-private grid projects. Demand has also increased for towers that support fiber-optic lines for integrated data transmission, boosting dual-utility deployment. Regulatory push for grid reliability, load balancing, and integration of variable renewable energy has reinforced long-term demand for structurally efficient and low-maintenance tower solutions.

The integration of advanced materials, prefabricated tower kits, and lightweight alloys has unlocked new opportunities in transmission tower deployment. Modular components are being utilized to enable faster onsite assembly, especially in rugged terrains and time-sensitive projects. The smart tower platforms fitted with sensors for structural integrity monitoring, predictive maintenance, and automated fault alerts are being piloted across critical power lines.

Rural electrification and mini-grid connectivity efforts have supported tower deployment in off-grid and remote areas, where compact and low-footprint structures are preferred. Infrastructure funds and power utilities have shown interest in hybrid towers that accommodate both electricity and telecom lines, enabling cost-sharing and rapid deployment. Markets in Southeast Asia, Sub-Saharan Africa, and Central America are witnessing multi-utility transmission development supported by concessional financing and multilateral energy access programs.

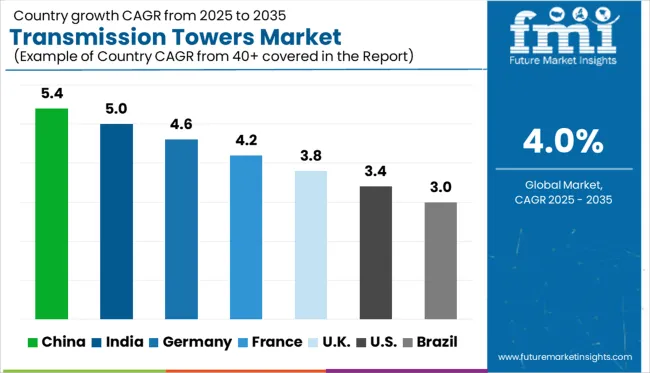

| Countries | CAGR |

|---|---|

| China | 5.4% |

| India | 5.0% |

| Germany | 4.6% |

| France | 4.2% |

| UK | 3.8% |

| USA | 3.4% |

| Brazil | 3.0% |

The global transmission towers market is expected to grow at a 4.0% CAGR from 2025 to 2035, driven by rising electricity demand, grid resilience investments, and inter-regional connectivity upgrades. China leads with a CAGR of 5.4%, supported by UHV corridor expansion, cross-province energy balancing, and rural electrification projects. India follows at 5.0%, driven by green corridor developments, renewable grid integration, and transmission upgrades in remote and high-load states.

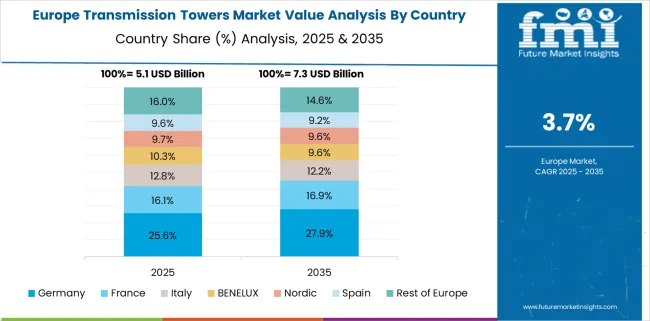

Germany grows at 4.6%, with demand shaped by onshore wind connectivity, aging tower replacements, and TSO-led modernization. France posts a 4.2% CAGR, focused on energy export capacity and climate-proof tower construction in cyclone-prone regions.

The United Kingdom, at 3.8%, sees selective deployment driven by offshore wind linkages, substation upgrades, and grid digitalization. These five nations reflect the contrasting approaches between BRICS-led capacity expansion and OECD-backed grid optimization in a 40+ country comparative study.

Demand for transmission towers in China is growing at a CAGR of 5.4%, driven by ultra-high-voltage (UHV) deployment, western grid reinforcement, and national corridor expansion. Tower installations are being accelerated by the State Grid Corporation to support eastward transmission of hydropower and coal-alternative electricity.

Advanced long-span lattice structures have been prioritized in mountainous and seismic provinces. The market in China has gained momentum due to performance-focused investment in corrosion-proof coatings and modular steel tower formats. Application in high-speed rail electrification and remote provincial circuits positions e-transmission infrastructure as a strategic backbone. Concrete tower bases and GPS-integrated installation methods are gaining acceptance for speed and reliability.

The sale of transmission towers in India is expanding at a CAGR of 5.0%, anchored in renewable energy corridor expansion, grid modernization, and long-distance interconnection projects. Power Grid Corporation and private developers have been engaged in fast-track execution of 765kV and 400kV lines, especially across solar parks in Gujarat and wind-rich pockets in Tamil Nadu.

Galvanized steel towers and monopole structures are favored for fast deployment in congested and rugged zones. Transmission projects under TBCB bidding have introduced competitive pressure to upgrade tower technologies. As inter-state transmission demand intensifies, the market in India is being viewed as a long-term volume driver with high operational variability.

Demand for transmission towers in Germany is expected to register a CAGR of 4.6%, reflecting targeted infrastructure overhaul and north-south power routing upgrades. National TSOs such as TenneT are leading investments in compact lattice towers and tubular steel poles with enhanced durability and reduced visual impact.

The German market has prioritized low-profile structures to align with federal planning regulations and landscape compatibility. Integration of wind power from northern coastal hubs into southern consumption centers has intensified tower load demands. The shift toward tower automation, BIM-based alignment, and prefabricated assembly makes the German segment technologically significant.

Sales for transmission towers in France are projected to grow at a CAGR of 4.2%, driven by interconnection reinforcement, grid flexibility, and climate-resilient tower specifications. RTE has expanded deployment along key cross-border corridors with Belgium, Spain, and Italy, using modular and cyclone-resistant tower types.

The French segment is being redefined by dual-voltage compatibility in renewable-nuclear hybrid networks. Cyclone zones in the southwest are seeing an uptake in heavy-duty foundations and weatherproof insulators. While overall tower demand appears stable, a shift toward faster assembly and environmental clearance alignment keeps France transmission tower segment competitive. Mid-sized tower suppliers continue to benefit from decentralized procurement strategies.

The United Kingdom transmission towers market is estimated to grow at a CAGR of 3.8%, with growth tied to offshore wind transmission, aging tower replacement, and power grid optimization. National Grid and regional utilities have been focused on deploying salt-resistant and high-wind load towers along eastern and northern coastlines.

The UK market reflects a preference for compact slip-joint tower formats and sensor-enabled structures that optimize line load balancing. Hybrid corridors featuring overhead and underground components are being trialed in space-restricted districts to reduce land impact. Although volume growth remains moderate, technological depth and precision deployment make the UK a critical innovation hub in this segment.

The transmission towers industry is led by Utkarsh India Limited through its strong domestic presence and turnkey capabilities in lattice and monopole tower manufacturing. KEC International and Jyoti Structures maintain extensive portfolios with cross-border EPC execution across Asia, Africa, and the Middle East.

Valmont Industries and Sabre Industries dominate North America by supplying galvanized steel towers and engineered utility structures. Companies like Quanta Services, Valard Construction, and Burns & McDonnell focus on design-build and maintenance of high-voltage transmission corridors.

European firms such as Nexans and ISA offer integrated solutions with cable infrastructure. Competitive strategies are increasingly shaped by modular tower designs, corrosion resistance, faster erection timelines, and alignment with grid innovation and renewable transmission targets.

Key Developments of the Transmission Towers Market

| Item | Value |

|---|---|

| Quantitative Units | USD 19.9 Billion |

| Voltage | > 220 kV to 660 kV, > 660 kV, and 132 kV to 220 kV |

| Structure | Double circuit tower, Waist type tower, Tubular steel pole, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | UtkarshIndiaLimited, JyotiStructuresLimited, KECInternationalLtd., QUANTASERVICES, NEXANS, ValardConstruction, Burns&McDonnell, PLHGroup, WilsonConstruction, PowerLineServices,Inc, MDUConstructionServicesGroup, ValmontIndustries,Inc., SabreIndustries,Inc., MEYERUTILITYSTRUCTURES,LLC., SAETowers, MTA, KOCAERSTEEL, SkipperLimited, GangesInternationale, and ISA |

| Additional Attributes | Dollar sales across transmission towers are segmented by tower type lattice, tubular steel monopole, and guyed, with monopoles gaining share for urban and aesthetic applications. Demand is rising for corrosion-resistant coatings, modular prefabricated designs, and smart sensor integration. OEMs and EPC contractors provide turnkey installations. Adoption is strongest in Asia‑Pacific and North America, driven by grid expansion and renewable integration. |

The global transmission towers market is estimated to be valued at USD 19.9 billion in 2025.

The market size for the transmission towers market is projected to reach USD 29.4 billion by 2035.

The transmission towers market is expected to grow at a 4.0% CAGR between 2025 and 2035.

The key product types in transmission towers market are > 220 kv to 660 kv, > 660 kv and 132 kv to 220 kv.

In terms of structure, double circuit tower segment to command 36.4% share in the transmission towers market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Power Transmission Lines and Towers Market Analysis & Forecast by Product, Conductor, Insulation, Voltage, Current, Application, and Region Through 2035

Transmission Overload Protectors Market Size and Share Forecast Outlook 2025 to 2035

Transmission Substation Market Size and Share Forecast Outlook 2025 to 2035

Transmission Oil Filters Market Size and Share Forecast Outlook 2025 to 2035

Transmission Components Market Size and Share Forecast Outlook 2025 to 2035

Transmission & Distribution Electric Capacitor Market Size and Share Forecast Outlook 2025 to 2035

Transmission Fluids Market Trends & Demand 2025 to 2035

Transmission Sales Market Analysis & Forecast by Type, End Use Through 2035

Transmission Mounting Bracket Market

Transmission Oil Pump Market

Transmission Control Unit Market

EV Transmission System Market Size and Share Forecast Outlook 2025 to 2035

HVDC Transmission System Market Size and Share Forecast Outlook 2025 to 2035

Power Transmission Component Market Size and Share Forecast Outlook 2025 to 2035

Power Transmission Gearbox Market Growth - Trends & Forecast 2025 to 2035

Power Transmission Cables Market

Manual Transmission Market Size and Share Forecast Outlook 2025 to 2035

USA HVDC Transmission Systems Market Insights – Size, Growth & Forecast 2025-2035

Automatic Transmission Market Size and Share Forecast Outlook 2025 to 2035

Automotive Transmission Synchronizer Assembly Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA