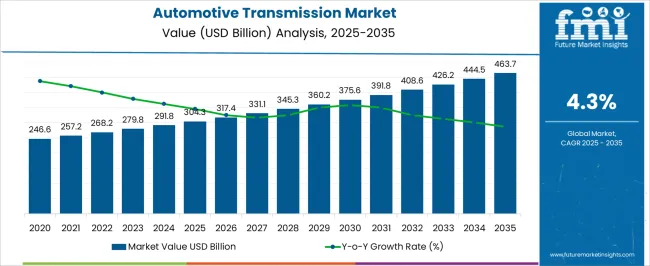

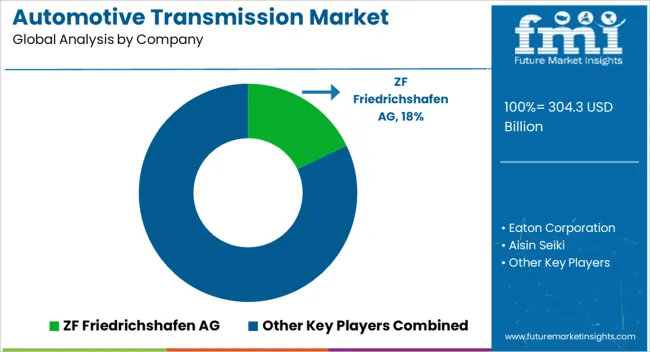

The automotive transmission market is estimated to be valued at USD 304.3 billion in 2025 and is projected to reach USD 463.7 billion by 2035, registering a compound annual growth rate (CAGR) of 4.3% over the forecast period.

Analysis of the market maturity curve indicates that the industry is positioned in the late growth stage, gradually transitioning toward maturity. Incremental improvements are being observed rather than disruptive shifts, as the market already exhibits broad adoption across vehicle categories globally. Growth is steady, reflecting replacement demand and technological upgrades rather than entirely new adoption cycles. Automatic transmissions, including conventional torque converter and dual-clutch systems, have moved into the maturity phase with widespread adoption, particularly in developed markets. Their penetration in emerging regions continues to provide incremental expansion. Manual transmissions are clearly in the decline stage, as consumer preference shifts toward automated systems and electrification reduces reliance on conventional gear-based solutions.

Continuously variable transmissions and hybrid-electric dedicated transmissions are positioned in the growth stage, benefitting from rising hybrid vehicle adoption and efficiency regulations. The adoption lifecycle suggests that electric vehicle transmissions, often simplified single-speed units, are still in the early growth phase but will capture a larger share as EV penetration accelerates post-2030. This transition underscores a shift from traditional multi-gear dominance to streamlined and efficiency-oriented architectures.

| Metric | Value |

|---|---|

| Automotive Transmission Market Estimated Value in (2025 E) | USD 304.3 billion |

| Automotive Transmission Market Forecast Value in (2035 F) | USD 463.7 billion |

| Forecast CAGR (2025 to 2035) | 4.3% |

The automotive transmission market forms a core segment of the global automotive components industry, reflecting its essential role in powertrain efficiency and driving performance. Within the overall automotive components sector, it accounts for nearly 12.6%, showing its strong contribution to vehicle functionality. In the passenger vehicle drivetrain systems market, it holds about 10.2%, driven by the rising production of both conventional and hybrid cars. Across the commercial vehicle components space, transmissions secure nearly 8.7%, while in the global powertrain solutions category, the segment commands 9.5%. Within the broader automotive manufacturing and engineering equipment sector, it accounts for 7.9%, underlining its position as a critical technology for mobility and fuel efficiency. Recent developments in this market reveal ongoing advancements in automatic, dual-clutch, and continuously variable transmission technologies.

Electrification is driving the emergence of e-transmissions designed for hybrid and battery electric vehicles, enabling higher efficiency and improved torque management. Automakers and component suppliers are investing in lightweight materials and advanced lubrication systems to enhance durability while reducing emissions. Integration of electronic control units with artificial intelligence capabilities has improved shift precision and vehicle responsiveness. Collaborations between OEMs and transmission specialists are focused on modular designs, allowing flexible adaptation across multiple vehicle platforms. Growing emphasis on fuel economy standards worldwide has accelerated demand for innovative transmission architectures, positioning the market at the center of both conventional and electrified mobility solutions.

The market is currently experiencing steady growth, driven by ongoing innovations in powertrain technologies and the rising demand for fuel-efficient and performance-oriented vehicles. The market landscape is shaped by increasing adoption of internal combustion engines in emerging economies alongside the gradual integration of hybrid and electric drivetrains.

Investments in automotive manufacturing infrastructure, coupled with advancements in vehicle automation and safety features, are supporting the expansion of transmission systems across passenger and commercial vehicles. The future outlook for this market is expected to be influenced by the focus on reducing emissions, improving fuel economy, and enhancing driving performance.

Additionally, the rising penetration of connected vehicles and smart mobility solutions is prompting the development of advanced transmission systems that can seamlessly integrate with vehicle electronics and engine management systems As consumer preference for reliable and efficient drivetrains continues to rise, the Automotive Transmission market is anticipated to maintain sustained growth, offering opportunities for both traditional and software-enhanced transmission technologies.

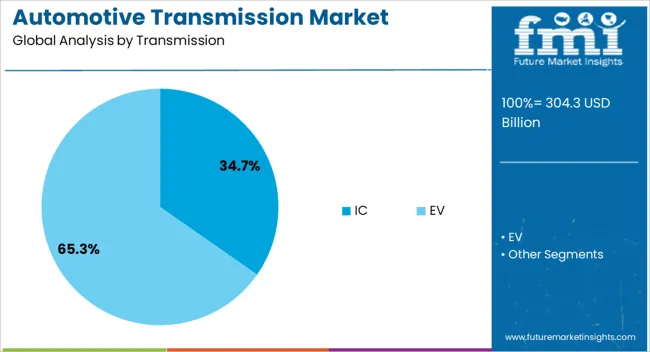

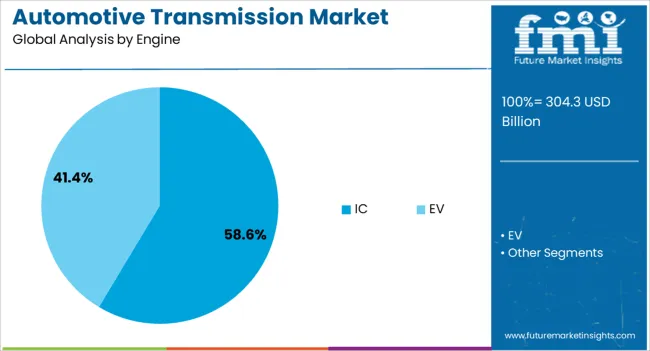

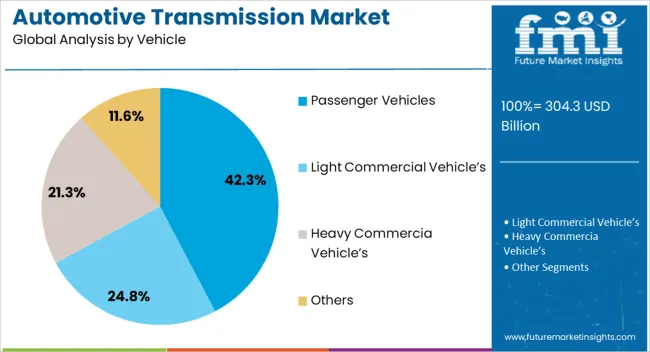

The automotive transmission market is segmented by transmission, engine, vehicle, speed transmission/gears, distribution, and geographic regions. By transmission, automotive transmission market is divided into IC and EV. In terms of engine, automotive transmission market is classified into IC and EV. Based on vehicle, automotive transmission market is segmented into passenger vehicles, light commercial vehicles, heavy commercia vehicles, and others. By speed transmission/gears, automotive transmission market is segmented into 5 to 6, less than 5, 7 to 8, and above 8. By distribution, automotive transmission market is segmented into OEM and aftermarket. Regionally, the automotive transmission industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The IC transmission subsegment is projected to hold 34.70% of the market revenue share in 2025, making it the leading subsegment within the transmission category. This dominance is being attributed to its well-established design, robustness, and compatibility with a wide range of internal combustion engines. Adoption has been accelerated by the extensive deployment of vehicles requiring durable and cost-effective drivetrain solutions, particularly in regions where traditional powertrains remain predominant. The growth of this subsegment has been reinforced by the ability of IC transmissions to handle high torque efficiently while offering long-term reliability under variable driving conditions. Furthermore, the capability to integrate with modern electronic controls and assistive technologies has enhanced performance and efficiency, contributing to their preference among automotive manufacturers The widespread production infrastructure, ease of maintenance, and proven operational stability of IC transmissions are key factors driving their continued leadership in the market.

The IC engine subsegment is anticipated to account for 58.60% of the market revenue share in 2025, emerging as the dominant engine type. This leading position has been influenced by the widespread global adoption of internal combustion engines due to their cost-effectiveness, established service networks, and reliability in a variety of climatic and road conditions. The growth of this subsegment has been further supported by continuous improvements in fuel efficiency, emission control technologies, and integration with advanced transmission systems, which together enhance vehicle performance. IC engines are particularly favored for passenger vehicles and light commercial vehicles, where balance between performance, cost, and durability remains critical. Additionally, the existing manufacturing capacity, familiarity among technicians, and consumer trust in IC technology contribute to its continued prevalence As hybrid and electrification technologies coexist with traditional powertrains, IC engines are expected to retain significant market share in 2025, supported by incremental technological enhancements and ongoing investments in automotive engine optimization.

The passenger vehicles subsegment is expected to hold 42.30% of the market revenue share in 2025, positioning it as the largest vehicle category. This prominence is being driven by the rising global demand for personal mobility solutions, urbanization trends, and increasing disposable income in emerging markets. Passenger vehicles are widely deployed across private and commercial sectors, creating strong demand for reliable and efficient transmission and engine systems. The growth of this subsegment has been reinforced by consumer preference for vehicles that offer a combination of fuel efficiency, performance, and low maintenance costs. Additionally, the integration of advanced transmission technologies and IC engines in passenger vehicles has further enhanced driving comfort and operational efficiency. The expanding production and sales of passenger vehicles in high-volume markets, along with supportive policies for automotive manufacturing and mobility infrastructure, are key factors sustaining the leadership of this subsegment Continued innovations in drivetrain technology and the rising adoption of hybrid models are expected to maintain growth momentum for passenger vehicles in the Automotive Transmission market.

The market has been evolving as automakers pursue efficiency, performance, and compliance with environmental standards. Transmissions are central to managing power delivery, fuel economy, and driving dynamics. The market is influenced by growing electrification, advanced automatic transmission technologies, and demand for smooth driving experiences. Manual systems remain relevant in certain regions due to cost advantages, but automatic and continuously variable transmissions are seeing rapid penetration globally. Hybrid and electric vehicles are reshaping transmission design, with simplified architectures and integrated electric drive modules becoming common. Innovation and regulatory influences continue to define market direction.

A major trend in the automotive transmission market has been the steady shift from manual systems to advanced automatic solutions. Consumers have increasingly valued convenience, comfort, and ease of driving, especially in urban and high-traffic environments. Automatic transmissions, including dual-clutch and continuously variable designs, have become more widely adopted due to their ability to improve efficiency and responsiveness. Automakers are standardizing automatic options in multiple vehicle segments, which is reshaping market shares. Manual transmissions continue to dominate in certain price-sensitive regions, but the global momentum clearly favors automation. This shift has transformed production strategies and supplier focus worldwide.

The rise of hybrid and electric vehicles has had a strong influence on the design and adoption of automotive transmissions. Electric vehicles typically employ simplified transmission architectures, often using single-speed gearboxes that optimize torque delivery without traditional shifting mechanisms. Hybrid vehicles, however, require more complex solutions such as e-CVT systems that blend electric and combustion power efficiently. This diversification in drivetrain technologies has created new opportunities for transmission manufacturers to innovate and supply customized solutions. As electrification accelerates, transmission designs are being adapted for compatibility with electric motors, reshaping the overall product landscape and supplier ecosystem.

Dual-clutch transmissions are gaining strong traction due to their ability to combine performance, fuel economy, and smooth gear shifting. These systems offer seamless acceleration and are being increasingly adopted in both passenger cars and commercial vehicles. Automakers in Europe and Asia have embraced dual-clutch technology for mid-range and premium models, citing performance benefits and consumer preference for dynamic driving experiences. The ability of dual-clutch systems to deliver enhanced fuel efficiency without compromising performance makes them a strong contender against traditional automatic and manual transmissions. Suppliers continue to refine designs to reduce complexity, cost, and maintenance requirements, supporting broader adoption.

Regional market trends strongly influence transmission adoption patterns. In North America and China, automatic transmissions dominate due to consumer preference for convenience and comfort. Europe has shown a strong preference for dual-clutch and efficient automatic systems, while parts of Asia and Africa maintain significant demand for manual gearboxes due to affordability. Consumer behavior, driving conditions, and cost sensitivity shape these regional dynamics. Automakers are tailoring their product portfolios to match regional preferences, creating a diversified global market. The balance between cost-driven manual demand and technology-driven automatic adoption highlights how regional variations continue to define growth strategies for suppliers.

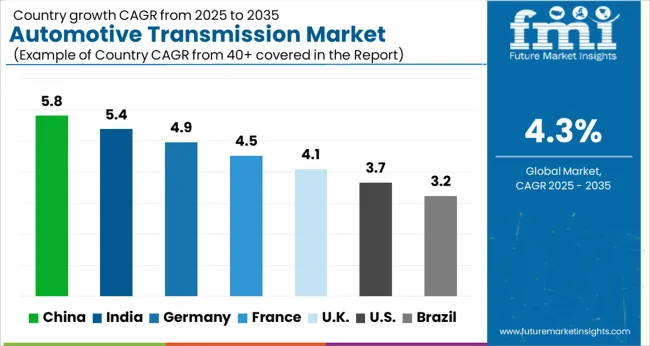

| Country | CAGR |

|---|---|

| China | 5.8% |

| India | 5.4% |

| Germany | 4.9% |

| France | 4.5% |

| UK | 4.1% |

| USA | 3.7% |

| Brazil | 3.2% |

The market is set to witness consistent expansion over the forecast horizon, with regional differences shaping its performance. China stands at 5.8%, influenced by extensive vehicle output and rising integration of automatic systems. India records 5.4%, supported by a growing automotive base and increasing preference for advanced drivetrains. Germany shows 4.9%, where emphasis on engineering excellence and hybrid transmission advancements remains strong. The United Kingdom achieves 4.1%, with developments in passenger and commercial segments enhancing system adoption. The United States secures 3.7%, driven by the popularity of automatic and dual-clutch technologies across mass and premium categories. Together, these countries underscore the evolving dynamics of the sector. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is anticipated to expand at a CAGR of 5.8%, supported by rising vehicle production and the shift toward advanced transmission technologies. The transition from manual to automatic and dual-clutch systems has been gaining momentum, particularly in passenger cars and SUVs. Consumer preference for enhanced driving comfort and fuel efficiency is encouraging automakers to integrate advanced transmissions into new models. The strong presence of domestic and international manufacturers further contributes to technological development and market penetration. With the continued expansion of electric and hybrid vehicles, transmission innovation in China is expected to remain a significant factor shaping long-term market dynamics.

India is projected to grow at a CAGR of 5.4%, influenced by increasing demand for fuel-efficient vehicles and changing consumer preferences. Although manual transmission remains dominant, the adoption of automatic and automated manual transmission is steadily increasing, particularly in urban markets. Rising sales of compact SUVs and passenger cars are creating new opportunities for transmission manufacturers. Government initiatives supporting electric mobility are also expected to influence future transmission technologies. Domestic and global automakers are investing in transmission development to meet performance, cost, and efficiency requirements, ensuring consistent market expansion.

Germany is expected to witness a CAGR of 4.9%, driven by its leadership in automotive engineering and strong demand for advanced transmission systems. German automakers are at the forefront of dual-clutch and automatic transmission technology, which is widely integrated into premium vehicles. Growing focus on energy efficiency and vehicle performance has supported continued innovation in transmission design. Electric vehicle development is reshaping transmission requirements, leading to significant R&D investments by manufacturers. With strong export demand and domestic automotive sales, Germany remains an important hub for advanced transmission systems in the global market.

The United Kingdom is forecast to grow at a CAGR of 4.1%, supported by increasing demand for automatic and semi-automatic transmissions. The rising popularity of SUVs and crossovers has contributed to the adoption of advanced transmission technologies. Government policies supporting low-emission and electric vehicles are expected to accelerate transmission system innovation. Premium automakers operating in the UK market continue to emphasize advanced powertrain integration, creating opportunities for growth. While manual transmissions are still present, the trend toward enhanced driving comfort and performance is shifting consumer preferences toward automatic alternatives.

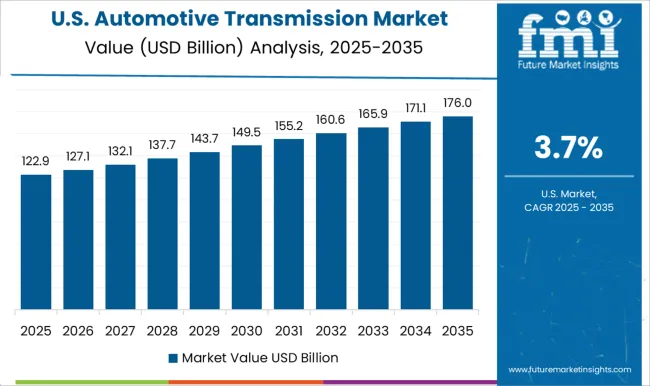

The United States is projected to expand at a CAGR of 3.7%, supported by strong demand for automatic transmissions across passenger vehicles, SUVs, and pickup trucks. The country has largely transitioned away from manual transmissions, with advanced automatic systems dominating the market. Consumer demand for comfort, convenience, and efficiency continues to drive transmission innovation. Hybrid and electric vehicle adoption is further shaping the design and integration of next-generation transmission technologies. With leading automakers and component suppliers investing in powertrain advancements, the USA remains a key contributor to the evolution of automotive transmission systems.

The market is shaped by globally recognized companies that focus on innovation, efficiency, and integration of advanced technologies in drivetrains. ZF Friedrichshafen AG plays a leading role with its extensive portfolio of automatic, manual, and hybrid transmissions that are widely adopted in both passenger and commercial vehicles. Eaton Corporation holds a strong position in the market with its specialization in heavy-duty manual and automated manual transmissions, particularly for trucks and industrial vehicles.

Continental AG contributes with intelligent electronic control systems and transmission components that enhance precision and connectivity in modern drivetrains. Allison Transmission is notable for its dominance in fully automatic transmissions for commercial vehicles, including buses, defense vehicles, and off-highway machinery. BorgWarner Inc strengthens the industry with its focus on innovative dual-clutch and continuously variable transmission technologies designed to improve energy efficiency. These companies form the backbone of the automotive transmission sector, driving advancements in efficiency, durability, and integration with hybrid and electric powertrains.

| Item | Value |

|---|---|

| Quantitative Units | USD 304.3 billion |

| Transmission | IC and EV |

| Engine | IC and EV |

| Vehicle | Passenger Vehicles, Light Commercial Vehicle’s, Heavy Commercia Vehicle’s, and Others |

| Speed Transmission/Gears | 5 to 6, Less than 5, 7 to 8, and Above 8 |

| Distribution | OEM and After Market |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ZF Friedrichshafen AG, Eaton Corporation, Continental AG, Allison Transmission, BorgWarner Inc |

| Additional Attributes | Dollar sales by transmission type and vehicle category, demand dynamics across passenger, commercial, and off-road vehicles, regional trends in automotive manufacturing adoption, innovation in efficiency, lightweight materials, and electronic control, environmental impact of production and recycling, and emerging use cases in hybrid and electric drivetrains. |

The global automotive transmission market is estimated to be valued at USD 304.3 billion in 2025.

The market size for the automotive transmission market is projected to reach USD 463.7 billion by 2035.

The automotive transmission market is expected to grow at a 4.3% CAGR between 2025 and 2035.

The key product types in automotive transmission market are ic, automatic transmission, manual transmission, automated manual transmission (amt), dual clutch transmission (dct), continuously variable transmission (cvt), ev, single speed transmission and multispeed transmission.

In terms of engine, ic segment to command 58.6% share in the automotive transmission market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Transmission Synchronizer Assembly Market Size and Share Forecast Outlook 2025 to 2035

Automotive Green Tires Market Size and Share Forecast Outlook 2025 to 2035

Automotive E-Tailing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Interior Market Forecast Outlook 2025 to 2035

Automotive Key Market Size and Share Forecast Outlook 2025 to 2035

Automotive Appearance Chemical Market Forecast and Outlook 2025 to 2035

Automotive Seating Market Forecast and Outlook 2025 to 2035

Automotive Domain Control Module Market Forecast and Outlook 2025 to 2035

Automotive Remote Diagnostic Market Forecast and Outlook 2025 to 2035

Automotive-grade Inertial Navigation System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Thin IGBT Module Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hydrogen Leak Detection Sensors Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hybrid IGBTs Market Size and Share Forecast Outlook 2025 to 2035

Automotive Exhaust Extraction Hose Reels Market Size and Share Forecast Outlook 2025 to 2035

Automotive Electroplating Service Market Size and Share Forecast Outlook 2025 to 2035

Automotive Manufacturing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Pressure Sensor Market Size and Share Forecast Outlook 2025 to 2035

Automotive Vacuum Brake Booster Market Size and Share Forecast Outlook 2025 to 2035

Automotive Smart Antenna Market Size and Share Forecast Outlook 2025 to 2035

Automotive Actuator Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA