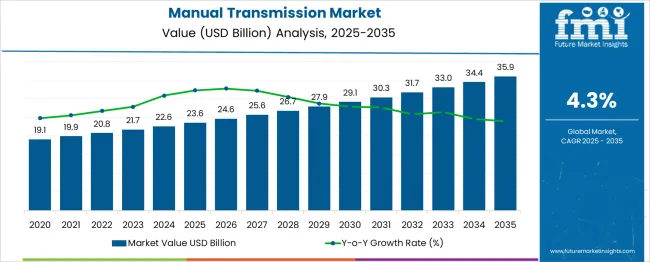

The manual transmission market is projected to grow steadily from USD 23.6 billion in 2025 to approximately USD 35.9 billion by 2035, reflecting an increase of USD 12.3 billion over the 10-year forecast period. This growth is driven by the affordability, mechanical simplicity, and fuel efficiency benefits of manual gear systems, as well as their continued preference among driving enthusiasts and in commercial vehicle applications. From 2030 to 2035, emerging markets and OEM improvements in shift quality and lightweight components support further growth, adding USD 6.1 billion as emerging markets sustain high sales volumes, and OEMs introduce advanced manual gearboxes with improved shift quality, lighter components, and better torque handling. This phase also benefits from the integration of hybrid-compatible manual systems in select vehicle categories. By 2035, niche demand in off-road, motorsport, and select regional markets maintains relevance, supported by niche demand in off-road vehicles, motorsport applications, and specific regional markets where manual transmissions remain culturally and economically favored. The manual transmission market is set for sustained growth, supported by cost advantages, targeted technological improvements, and regional demand resilience despite the global shift toward automatic and electrified drivetrains.

| Metric | Value |

|---|---|

| Manual Transmission Market Estimated Value in (2025 E) | USD 23.6 billion |

| Manual Transmission Market Forecast Value in (2035 F) | USD 35.9 billion |

| Forecast CAGR (2025 to 2035) | 4.3% |

The manual transmission market continues to hold a significant position in the global automotive landscape, driven by the preference for greater control, lower cost, and fuel efficiency among drivers. While automatic transmissions have grown in popularity, manual gearboxes remain favored in many regions due to their simpler design, reduced maintenance expenses, and better mileage performance. The market’s future outlook is influenced by evolving consumer behaviors, particularly in emerging economies where affordability and driving style favor manual options.

Additionally, regulatory pressures on fuel consumption and emissions have encouraged manufacturers to optimize manual transmission technologies for better efficiency. Market growth is also supported by sustained demand in passenger car segments, especially in compact and entry-level vehicles where cost sensitivity is high.

The integration of advanced materials and lightweight components is expected to enhance the performance and durability of manual transmissions. Despite rising electrification trends, manual transmissions are anticipated to retain a relevant share due to their continued use in certain vehicle classes and regional markets.

The manual transmission market is segmented by vehicle (Passenger Car, Commercial Vehicle), by transmission (5-speed, 6-speed, Others), by propulsion (Gasoline, Diesel, Hybrid, CNG, LPG), and by distribution channel (OEM, Aftermarket) Regionally, the manual transmission industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

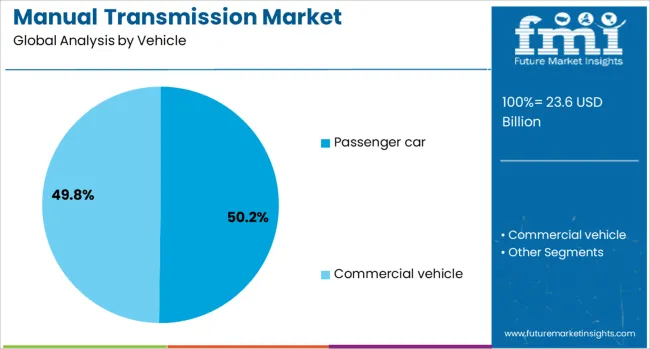

The passenger car segment is expected to command 50.2% of the manual transmission market revenue share in 2025, representing the largest vehicle category. This leadership is supported by the wide adoption of manual transmissions in affordable and compact passenger vehicles, where drivers prioritize cost savings and driving engagement. The segment benefits from the relative simplicity and lower manufacturing cost of manual gearboxes compared to automatics.

Additionally, manual transmissions provide better fuel economy in specific driving conditions, aligning with consumer demand for efficiency. Regional driving cultures where manual gear shifting is preferred also contribute to the segment’s dominance.

The availability of manual transmission variants across numerous passenger car models ensures broad market penetration. Continued improvements in shift quality and clutch durability are reinforcing the appeal of manual gearboxes within this segment.

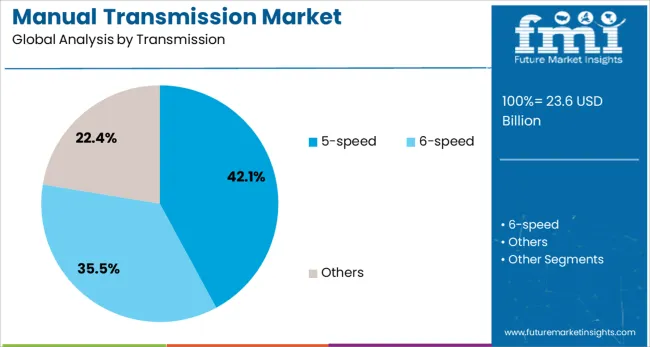

The 5-speed transmission type is projected to account for 42.1% of the market revenue share in 2025, making it the leading transmission configuration. This prevalence is attributed to the balance it offers between cost, complexity, and performance. The 5-speed manual gearbox provides an effective compromise for fuel efficiency and drivability without the added expense and mechanical intricacy of higher-speed variants.

It remains favored in many vehicle models for its reliability and ease of maintenance. The segment’s growth is further supported by its compatibility with existing vehicle architectures and the broad availability of replacement parts.

Furthermore, manufacturing processes for 5-speed transmissions are well-established, facilitating economies of scale that benefit both OEMs and consumers. These factors have contributed to its sustained dominance in the manual transmission market.

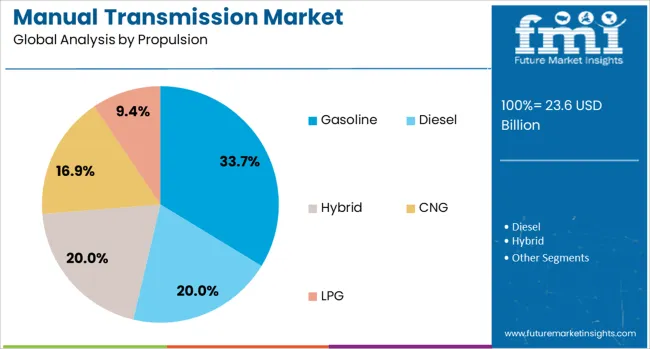

Gasoline-powered vehicles are estimated to hold 33.7% of the manual transmission market share in 2025, reflecting the largest propulsion category within this market. The prominence of gasoline propulsion is influenced by the continued global demand for gasoline engines in passenger and commercial vehicles where manual transmissions are applied.

Gasoline engines paired with manual gearboxes offer a favorable balance of performance, cost, and efficiency, appealing to price-conscious consumers. The segment is supported by a large installed base of gasoline vehicles in regions where manual transmission remains the standard offering.

Despite the growing shift toward electrification, gasoline-powered manual transmissions continue to be relevant due to lower upfront vehicle costs and simpler drivetrain mechanics. Additionally, gasoline engine compatibility with traditional manual transmissions ensures their ongoing use in various market segments.

Manual transmissions retain market strength through affordability, mechanical simplicity, and loyal niche segments. Their resilience lies in cost efficiency, enthusiast demand, and adaptability to varying regulatory and market conditions.

Manual transmissions continue to see strong adoption in emerging economies where affordability, mechanical simplicity, and lower maintenance costs influence vehicle purchase decisions. Markets in Asia, Africa, and Latin America show consistent sales due to a high proportion of entry-level cars and commercial vehicles requiring rugged, easy-to-service drivetrains. The straightforward mechanical design reduces repair expenses and allows servicing in regions with limited access to advanced diagnostic tools. Local manufacturing of manual gearboxes in these regions supports cost competitiveness for OEMs. Fleet operators and rural consumers value manual systems for their reliability in varied driving conditions. These factors ensure a stable demand base even as global trends lean toward automatic alternatives.

Despite the growing shift toward automatic transmissions, manual gearboxes maintain a loyal following among driving enthusiasts and specific vehicle categories. Performance cars, off-road vehicles, and certain sports models are offered with manual variants to cater to drivers seeking enhanced control and engagement. This preference is supported by the tactile driving experience and the ability to manage torque delivery precisely in demanding conditions. Enthusiast communities, especially in Europe, Japan, and North America, sustain aftermarket upgrades and preservation of manual models. Manufacturers often introduce limited-production runs of manual-equipped performance cars, reinforcing brand identity and appealing to customers who associate manual driving with authenticity and skill.

Manual transmissions remain attractive due to their lower initial cost compared to automatic counterparts and their reduced complexity in terms of maintenance. These systems typically require fewer components, have lower repair costs, and offer extended operational lifespans when properly maintained. In markets with budget-conscious buyers, the affordability advantage is a strong differentiator in purchase decisions. Fleet operators in delivery, logistics, and public transportation favor manual systems for their durability and ease of repair, especially in high-mileage scenarios. Availability of skilled mechanics and inexpensive spare parts further strengthens their appeal in both rural and urban areas. These economic benefits preserve their relevance in competitive market segments.

Shifts in fuel economy regulations and emission control policies impact manual transmission adoption globally. While automatics are being refined for efficiency, manual systems can still meet standards in smaller engine configurations and lightweight vehicles. Manufacturers in emerging regions integrate manual transmissions into models optimized for low-emission performance without sacrificing affordability. In markets with aggressive electric vehicle transitions, manuals see declining share, yet in transitional economies, they remain a preferred choice for balancing compliance with cost-effectiveness. Resale values for manual-equipped vehicles often remain stable in niche markets, supporting continued production. Regulatory adaptation and targeted model strategies will define their future trajectory.

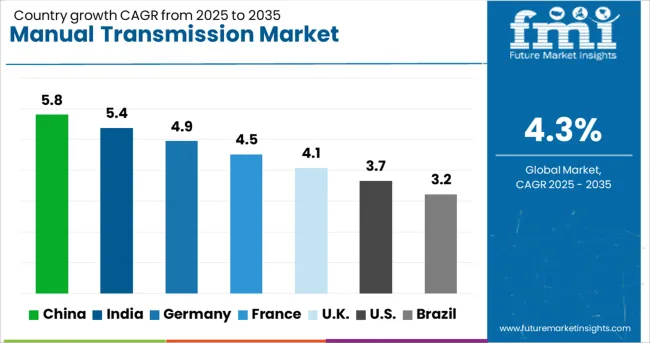

| Country | CAGR |

|---|---|

| China | 5.8% |

| India | 5.4% |

| Germany | 4.9% |

| France | 4.5% |

| UK | 4.1% |

| USA | 3.7% |

| Brazil | 3.2% |

The manual transmission market is projected to expand globally at a CAGR of 4.3% between 2025 and 2035, supported by steady demand in cost-sensitive markets, preference among driving enthusiasts, and resilience in commercial vehicle applications. China leads with a CAGR of 5.8%, driven by its strong entry-level car sales, local manufacturing capabilities, and popularity of manual gearboxes in rural and utility segments. India follows at 5.4%, benefiting from high adoption in passenger and light commercial vehicles, robust domestic production, and affordability-focused consumer preferences. France records 4.5%, with sustained demand in compact and budget-friendly vehicles alongside fleet operations. The United Kingdom achieves 4.1%, reflecting cultural preference among certain buyer groups and continued availability in small car models, while the United States posts 3.7%, sustained by specialty sports cars, pickup trucks, and specific fleet uses. The analysis spans over 40 countries, with these six serving as benchmarks for production focus, consumer trends, and strategic investment priorities in the global manual transmission industry.

China is projected to post a 5.8% CAGR during 2025–2035, above the global 4.3% path, supported by entry-level passenger cars, rural utility vehicles, and light commercial fleets where purchase price, serviceability, and control are prioritized. The 2020–2024 phase showed mid-single digit momentum as pandemic-era supply variability and model rationalization limited gearbox variants in some trims. The next leg should benefit from wider small-car launches, provincial incentives for compact fleets, and steady taxi and ride-hailing replacement needs in tier-two and tier-three cities. Dealer networks continue to emphasize low total cost of ownership messaging, while workshops remain widely skilled in clutch and gearbox service. Export programs for budget vehicles into Africa, Latin America, and the Middle East also aid line utilization and parts pull-through for manual drivetrains.

India is expected to grow at a 5.4% CAGR during 2025–2035, outpacing the global rate as compact SUVs, hatchbacks, and small pickups continue to favor manuals for price and service access. Between 2020–2024, steady growth was observed as microfinance-supported rural purchases and fleet additions offset a gradual mix shift toward automated manuals in metros. The forward view is supported by localized gearbox manufacturing, deeper supplier parks near major OEM clusters, and strong first-time buyer cohorts in tier-two cities. Goods carriers under five tons keep favoring stick shifts for gradeability and maintenance ease. Frugal buyers remain attracted to transparent lifetime costs, while dealerships highlight clutch kits and gear oil servicing as predictable expenses. Export-oriented runs to South Asia and Africa keep manual fitments economical for domestic trims.

France is projected to post a 4.5% CAGR during 2025–2035, slightly above the global average, driven by compact vehicles, car-sharing fleets, and rural commutes where operating economy and control are prized. The 2020–2024 period showed muted but positive growth as supply normalization followed semiconductor constraints and as buyers weighed automatic upcharges in entry segments. Manual take rates persist in budget trims of B- and C-segment cars, while driving schools and rural commuters maintain consistent replacement cycles. Fleet managers in municipal and utility categories often specify manuals for predictable maintenance and driver familiarity. Aftermarket parts availability and trained independent workshops keep repair times short, supporting higher vehicle utilization for tradespeople. Export of French-built small cars with manual options adds stability to production slots.

The United Kingdom is expected to post a 4.1% CAGR during 2025–2035, near but slightly below the global 4.3% path, with demand anchored in small cars, enthusiast niches, and cost-focused fleets. For 2020–2024, the UK manual transmission CAGR is estimated at about 1.9%. That earlier rate arose from subdued showroom traffic in 2020–2021, a trim rationalization that reduced manual availability, and a broader mix shift toward automatics in crossovers. The step-up to 4.1% in 2025–2035 is explained by stronger used-to-new conversion, higher replacement in driving schools, and renewed availability of manual trims in city cars and selected compact models. Aftermarket clutch and gearbox support remains dense, which lowers downtime and aids fleet utilization. A niche performance community also sustains premium stick-shift variants, helping margins on limited runs.

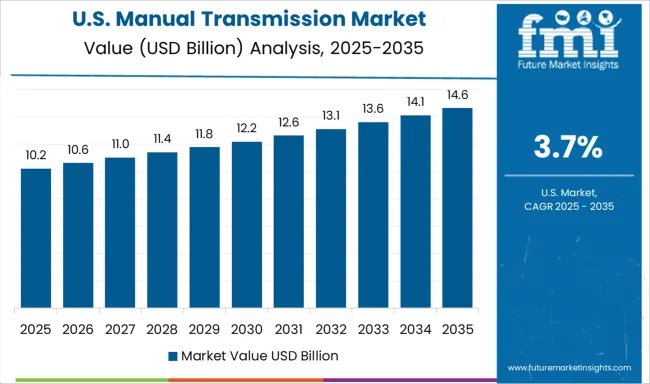

The United States is projected to record a 3.7% CAGR during 2025–2035, below the global average, yet supported by specialty sports cars, enthusiast editions, and selected pickups where control and engagement are valued. The 2020–2024 period showed low growth as inventory constraints, model consolidation, and automatic-dominant consumer preferences limited manual take rates. The next phase benefits from halo launches that keep stick-shift appeal alive, dealer allocations for enthusiast trims, and stable demand in vocational fleets that choose manuals for predictable maintenance. Parts distribution for clutch and transmission components remains wide, supporting rural and independent shop networks. Residual values for certain performance models with manuals continue to hold well, which encourages limited-run offerings and orders from collector communities.

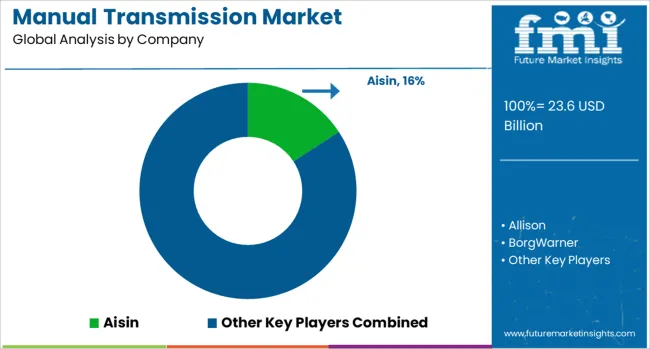

The manual transmission market features intense competition among established global drivetrain manufacturers, each leveraging engineering expertise, regional production bases, and OEM partnerships to retain market presence. Aisin is a key supplier of multi-speed manual gearboxes, emphasizing durability and fuel efficiency for passenger and light commercial vehicles. Allison focuses primarily on heavy-duty applications but maintains manual offerings in select vocational markets. BorgWarner delivers precision-engineered transmission components and synchronizer systems for improved shift quality. Divgi Torq Transfer Systems specializes in transfer cases and manual transaxles tailored for SUVs and utility vehicles. Eaton remains a leader in heavy-duty manual and automated manual solutions for commercial fleets, prioritizing torque handling and reliability.

Hyundai Transys integrates manual systems in compact and mid-segment vehicles, particularly in emerging markets. Magna develops modular transmission platforms, enabling flexible integration across OEM programs. Ricardo provides engineering consultancy and prototypes for high-performance manual gearboxes. Schaeffler supplies clutches, synchronizers, and bearings critical to manual transmission performance. ZF offers manual transmissions primarily in niche segments, combining efficiency enhancements with lightweight designs. Competitive strategies revolve around cost optimization, improving shift comfort, expanding aftermarket services, and maintaining relevance in regions with strong manual adoption.

| Item | Value |

|---|---|

| Quantitative Units | USD Billion |

| Vehicle | Passenger car and Commercial vehicle |

| Transmission | 5-speed, 6-speed, and Others |

| Propulsion | Gasoline, Diesel, Hybrid, CNG, and LPG |

| Distribution Channel | OEM and Aftermarket |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Aisin, Allison, BorgWarner, Divgi Torq Transfer Systems, Eaton, Hyundai Transys, Magna, Ricardo, Schaeffler, and ZF |

| Additional Attributes | Dollar sales, share, competitive landscape, regional demand trends, pricing analysis, OEM adoption rates, technology shifts, supply chain risks, aftermarket potential, and growth opportunities across vehicle segments. |

The global manual transmission market is estimated to be valued at USD 23.6 billion in 2025.

The market size for the manual transmission market is projected to reach USD 35.9 billion by 2035.

The manual transmission market is expected to grow at a 4.3% CAGR between 2025 and 2035.

The key product types in manual transmission market are passenger car, _hatchback, _sedan, _suv, _others, commercial vehicle, _light duty, _medium duty and _heavy duty.

In terms of transmission, 5-speed segment to command 42.1% share in the manual transmission market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA