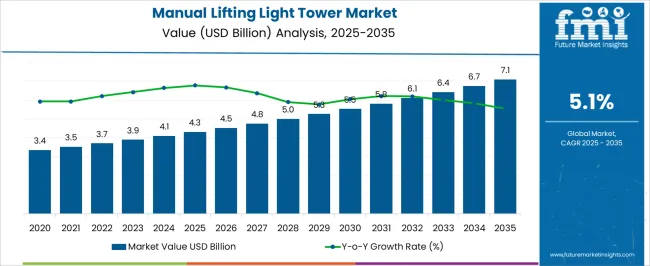

The manual lifting light tower market is estimated to be valued at USD 4.3 billion in 2025 and is projected to reach USD 7.1 billion by 2035, registering a compound annual growth rate (CAGR) of 5.1% over the forecast period.

This growth represents an absolute dollar opportunity of USD 2.8 billion over the decade. Annual growth shows steady expansion, starting from USD 4.3 billion in 2025, reaching USD 4.8 billion in 2028, USD 5.5 billion in 2031, and progressing to USD 6.7 billion by 2034. The consistent upward trend highlights strong market potential, providing manufacturers and suppliers with opportunities to expand production, optimize distribution, and capture a larger share of industrial lighting solutions.

The absolute dollar opportunity emphasizes the increasing value within the manual lifting light tower market over the next ten years. Incremental growth from USD 4.3 billion in 2025 to USD 7.1 billion in 2035 underscores a cumulative increase of USD 2.8 billion. Key years such as USD 5.0 billion in 2029 and USD 6.1 billion in 2033 indicate periods of accelerated adoption. This growth trajectory allows stakeholders to strategically plan capacity expansion, scale operations, and enhance service offerings, ensuring they capture a meaningful portion of the expanding market value throughout the 2025–2035 period.

| Metric | Value |

|---|---|

| Manual Lifting Light Tower Market Estimated Value in (2025 E) | USD 4.3 billion |

| Manual Lifting Light Tower Market Forecast Value in (2035 F) | USD 7.1 billion |

| Forecast CAGR (2025 to 2035) | 5.1% |

The manual lifting light tower market is a segment of the broader construction and industrial lighting equipment market, which includes trailer-mounted light towers, telescopic light towers, and portable lighting solutions. In 2025, manual lifting light towers account for approximately 18% of the total industrial lighting equipment market, reflecting their importance in temporary and remote site operations. With the parent market projected to grow from around USD 23.9 billion in 2025 to USD 39.4 billion in 2035, the manual lifting segment’s growth from USD 4.3 billion in 2025 to USD 7.1 billion in 2035 at a CAGR of 5.1% represents roughly 20% of the total incremental growth in the parent market.

Within the parent market, trailer-mounted light towers hold about 35% of total value, telescopic light towers account for 25%, and portable lighting solutions contribute approximately 22%. The manual lifting light tower segment, with its CAGR of 5.1%, demonstrates steady growth, emphasizing its relevance in cost-effective and flexible lighting solutions. The absolute growth of USD 2.8 billion over the decade represents nearly 18–20% of total parent market expansion. This trend provides manufacturers and suppliers opportunities to scale production, expand distribution channels, and capture a larger share of the growing global industrial lighting equipment market.

The manual lifting light tower market is demonstrating steady growth, supported by rising demand for portable and cost-effective lighting solutions across construction, mining, infrastructure, and emergency response sectors. The ease of deployment and lower maintenance requirements of manual lifting models are making them a preferred choice in small to medium-scale operations where flexibility and affordability are key.

Increasing infrastructure development projects and outdoor event activities in emerging markets are contributing to the market’s expansion. Technological advancements in lighting systems, such as improved energy efficiency and longer operational lifespans, are enhancing performance and reducing operational costs.

The growing adoption of LED lighting technology within these towers is further increasing their value proposition by delivering higher illumination output with reduced power consumption As industries seek reliable and mobile lighting solutions that can be quickly set up in challenging environments, the manual lifting light tower market is expected to maintain consistent growth, driven by its balance of portability, operational efficiency, and affordability.

The manual lifting light tower market is segmented by channel, product, lighting, power source, application, and geographic regions. By channel, manual lifting light tower market is divided into sales and rental. In terms of product, manual lifting light tower market is classified into mobile and stationary. Based on lighting, manual lifting light tower market is segmented into LED, metal halide, electric, and others. By power source, manual lifting light tower market is segmented into diesel, solar, direct, and others. By application, manual lifting light tower market is segmented into construction, infrastructure & development, oil & gas, mining, military & defense, emergency & disaster relief, and others. Regionally, the manual lifting light tower industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

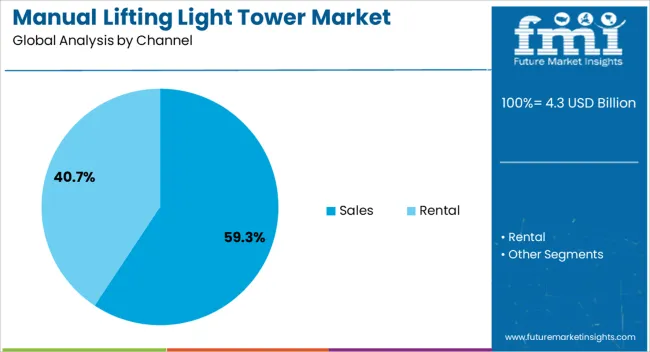

The sales channel segment is projected to account for 59.3% of the manual lifting light tower market revenue share in 2025, making it the leading distribution mode. This leadership is being supported by the increasing preference of customers to directly purchase units for long-term use rather than relying solely on rentals. Sales channels provide end users with the ability to customize specifications, select preferred lighting technologies, and ensure full ownership benefits, which is appealing for industries with ongoing operational requirements.

The growing number of infrastructure projects and large-scale construction activities is driving the need for permanently available lighting solutions, further boosting sales. Manufacturers are expanding their sales networks through both physical dealerships and online platforms, improving product accessibility in domestic and international markets.

Additionally, bulk purchasing by contractors and industrial operators is contributing to higher sales volumes The ability to amortize the purchase cost over multiple projects is reinforcing the preference for outright purchases, sustaining the sales segment’s dominance in the market.

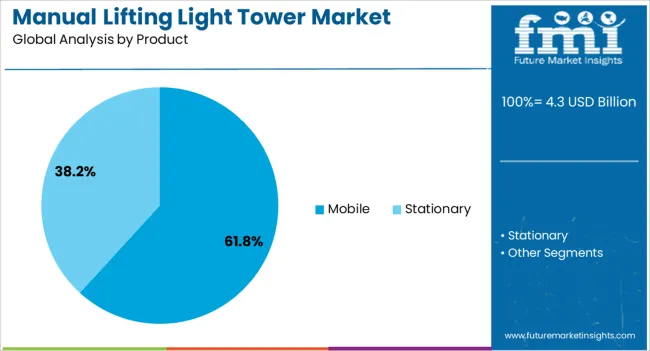

The mobile product segment is anticipated to capture 61.8% of the manual lifting light tower market revenue share in 2025, positioning it as the leading product category. Its dominance is being driven by the operational flexibility and portability it offers, enabling quick relocation across different job sites without extensive setup requirements. Mobile light towers are particularly valued in construction, mining, and event management sectors where work locations frequently change.

The segment is benefiting from advancements in design, including lightweight yet durable frames, enhanced stability systems, and more efficient power sources. Manufacturers are focusing on integrating features such as telescopic masts, quick-lift mechanisms, and compatibility with both conventional and renewable power inputs, enhancing their adaptability.

The ability to deploy lighting solutions rapidly in remote or emergency locations is also supporting increased adoption As industries place greater emphasis on operational efficiency and reduced downtime, mobile manual lifting light towers are expected to remain the preferred choice for projects requiring reliable and movable illumination solutions.

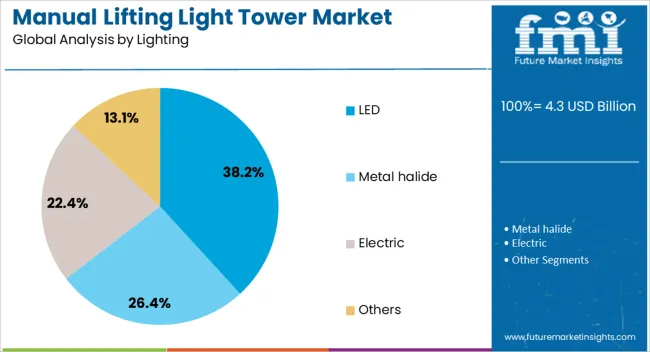

The LED lighting segment is expected to hold 38.2% of the manual lifting light tower market revenue share in 2025, making it the leading lighting technology. This leadership is being reinforced by the superior energy efficiency, extended operational lifespan, and low maintenance requirements of LED lighting systems. LEDs provide higher lumen output per watt, enabling improved illumination while reducing fuel consumption and operating costs.

The segment is gaining momentum as industries increasingly prioritize sustainable solutions that meet environmental regulations and reduce carbon footprints. The durability and shock resistance of LEDs make them highly suitable for demanding job site conditions, where vibration and exposure to the elements are common.

Advancements in LED technology are also delivering improved light distribution, color rendering, and adaptability to varying power sources With the ability to significantly lower total cost of ownership while providing consistent, high-quality lighting, the LED segment is expected to maintain its leadership in the manual lifting light tower market, driven by both economic and environmental considerations.

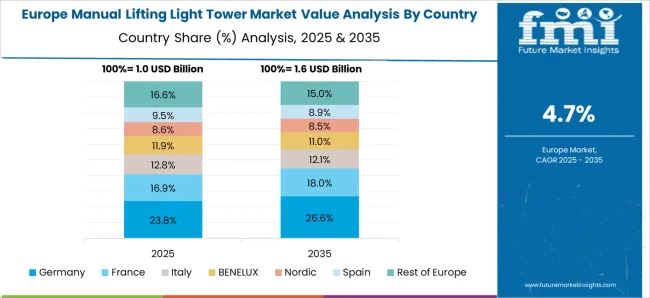

The manual lifting light tower market is expanding due to rising demand for portable, reliable, and cost-effective lighting solutions in construction, mining, and outdoor events. North America and Europe lead adoption with advanced, durable designs and ergonomic manual lifting mechanisms. Asia-Pacific shows rapid growth driven by urbanization, infrastructure development, and temporary lighting needs in remote areas. Manufacturers differentiate through mast height, lamp efficiency, and portability. Regional differences in project scale, labor availability, and regulatory safety standards strongly influence adoption, operational efficiency, and global competitiveness.

Manual lifting light towers are increasingly adopted to provide temporary, portable lighting in construction, mining, and civil infrastructure projects. North America and Europe focus on high-durability towers with ergonomic manual lifting mechanisms and reliable lamp systems for large-scale construction sites. Asia-Pacific markets prioritize cost-effective, portable towers suitable for smaller urban projects and remote job sites. Differences in project duration, lighting intensity requirements, and labor availability influence tower design, mast height, and illumination range. Leading suppliers provide compact, robust light towers with corrosion-resistant materials and easy mast operation, while regional players offer economical, locally sourced solutions. Infrastructure development contrasts shape adoption, operational flexibility, and competitiveness across global manual lifting light tower markets.

Portability, ease of handling, and ergonomic design are key factors in manual lifting light tower adoption. North America and Europe emphasize lightweight, foldable, and easy-to-assemble towers that allow single-person operation while ensuring stability and safety. Asia-Pacific markets adopt practical, cost-efficient towers suitable for high-volume deployment in temporary construction zones or disaster relief operations. Differences in deployment frequency, labor skill levels, and mobility requirements affect mast design, base stability, and handling features. Leading suppliers provide towers with adjustable mast heights, compact storage, and durable lamp heads, while regional manufacturers focus on affordable, simple designs. Portability and ergonomic contrasts drive adoption, operational efficiency, and market differentiation globally.

Energy efficiency and lamp technology are critical in determining market adoption. North America and Europe prioritize LED or hybrid lighting systems for long lifespan, reduced power consumption, and lower operational costs. Asia-Pacific markets often adopt conventional lamps or LED systems with simpler designs to balance cost and performance. Differences in energy availability, operational hours, and sustainability regulations influence lighting type, power source, and battery storage options. Leading suppliers integrate efficient LED systems, solar-assisted power, and durable wiring, while regional players provide reliable, low-cost lighting units with standard power requirements. Lamp technology and efficiency contrasts shape adoption, operational cost savings, and competitiveness globally.

Compliance with safety standards and regulations significantly affects adoption of manual lifting light towers. North America and Europe enforce occupational safety regulations, requiring secure mast mechanisms, anti-tilt features, and stable bases. Asia-Pacific markets vary; developed regions adopt similar safety norms, while emerging markets rely on practical, locally enforced standards. Differences in regulatory rigor, deployment conditions, and worker safety expectations influence tower design, construction material, and operational protocols. Leading suppliers offer certified, tested towers with safety locks and emergency handling mechanisms, while regional manufacturers focus on cost-effective, compliant designs. Safety and regulatory contrasts drive adoption, reliability, and competitive positioning across global manual lifting light tower markets.

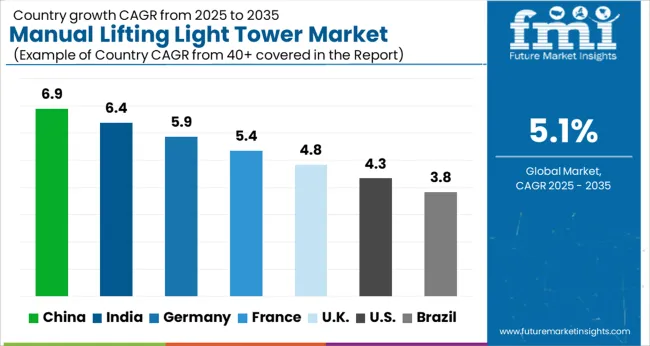

| Country | CAGR |

|---|---|

| China | 6.9% |

| India | 6.4% |

| Germany | 5.9% |

| France | 5.4% |

| UK | 4.8% |

| USA | 4.3% |

| Brazil | 3.8% |

The global manual lifting light tower market is projected to grow at a 5.1% CAGR through 2035, driven by demand in construction sites, industrial operations, and outdoor events. Among BRICS nations, China led with 6.9% growth as large-scale manufacturing and deployment across construction and industrial projects were executed, while India at 6.4% expanded production and utilization to meet rising regional lighting requirements. In the OECD region, Germany at 5.9% maintained steady adoption under strict safety and operational regulations, while the United Kingdom at 4.8% implemented manual lifting light towers across commercial and industrial applications. The USA, growing at 4.3%, advanced deployment in construction and industrial operations while adhering to federal and state-level safety standards. This report includes insights on 40+ countries; the top countries are shown here for reference.

The manual lifting light tower market in China is projected to grow at a CAGR of 6.9%, driven by adoption in construction sites, mining operations, and outdoor event management. Demand is being encouraged by towers that offer portability, reliability, and ease of operation. Manufacturers are being urged to supply cost effective, durable, and user friendly solutions. Distribution through construction equipment suppliers, industrial distributors, and rental companies is being strengthened. Research in design optimization, durability improvement, and operational efficiency is being conducted. Growing construction activity, infrastructure development, and increasing adoption of mobile lighting solutions are considered key factors driving the manual lifting light tower market in China.

In India, the manual lifting light tower market is expected to grow at a CAGR of 6.4%, supported by usage in construction, outdoor events, and industrial operations. Emphasis is being placed on towers that provide reliability, portability, and cost effectiveness. Local manufacturers are being encouraged to enhance production and offer high quality, durable solutions. Distribution through construction equipment suppliers, rental companies, and industrial distributors is being expanded. Awareness programs highlighting operational ease and safety are being promoted. Rising construction activities, infrastructure projects, and demand for mobile lighting solutions are recognized as primary drivers of the manual lifting light tower market in India.

Germany is witnessing steady growth in the manual lifting light tower market at a CAGR of 5.9%, driven by adoption in industrial facilities, construction sites, and outdoor maintenance operations. Adoption is being encouraged by towers that offer portability, operational reliability, and efficient lighting. Manufacturers are being urged to supply advanced, durable, and user friendly solutions. Distribution through industrial suppliers, construction equipment providers, and rental companies is being optimized. Research in durability, lightweight designs, and operational efficiency is being pursued. Industrial growth, infrastructure maintenance, and increasing use of mobile lighting solutions are considered key factors driving the manual lifting light tower market in Germany.

The manual lifting light tower market in the United Kingdom is projected to grow at a CAGR of 4.8%, supported by adoption in construction, industrial, and outdoor event applications. Adoption is being emphasized for towers that ensure portability, reliability, and ease of operation. Manufacturers are being encouraged to supply cost effective, durable, and high quality products. Distribution through construction equipment suppliers, rental companies, and industrial distributors is being strengthened. Demonstrations and pilot programs are being conducted to promote adoption of mobile lighting solutions. Construction and infrastructure projects, industrial maintenance, and event management activities are recognized as major contributors to the manual lifting light tower market in the United Kingdom.

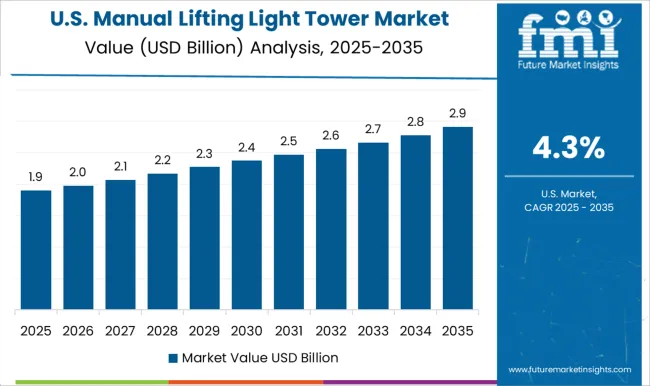

The manual lifting light tower market in the United States is projected to grow at a CAGR of 4.3%, driven by adoption in construction sites, outdoor events, and industrial facilities. Adoption is being encouraged by towers that provide portability, operational reliability, and ease of use. Manufacturers are being urged to develop durable, cost effective, and user friendly solutions. Distribution through rental companies, construction equipment suppliers, and industrial distributors is being maintained. Research in durability, operational efficiency, and lightweight designs is being pursued. Expansion of infrastructure projects, industrial maintenance activities, and demand for mobile lighting solutions are considered key drivers of the manual lifting light tower market in the United States.

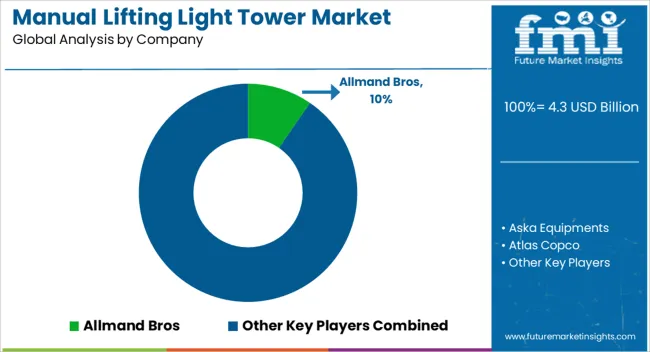

The manual lifting light tower market is dominated by several key suppliers that provide reliable and efficient lighting solutions for construction sites, outdoor events, and emergency applications. Prominent companies in this market include Allmand Bros, Aska Equipments, Atlas Copco, Caterpillar, Chicago Pneumatic, Colorado Standby, DMI, Doosan Portable Power, Generac Power Systems, and HIMOINSA. These suppliers are recognized for manufacturing durable, high-performance light towers that offer easy mobility, rapid deployment, and robust lighting for demanding outdoor environments. Their products are designed to meet the needs of both industrial and commercial users.

Additional notable suppliers, such as Inmesol Gensets, J C Bamford Excavators, LARSON Electronics, Light Boy, LTA Projects, Multiquip, Olikara Lighting Towers, and Progress Solar Solutions, further strengthen the market by offering innovative and versatile solutions. The Will Burt Company, Trime, United Rentals, Wacker Neuson, and Youngman Richardson also contribute significantly, providing advanced lighting systems with energy-efficient technologies and enhanced safety features. These suppliers cater to a wide range of applications, from temporary construction lighting to large-scale outdoor events, ensuring consistent performance in challenging environments.

Collectively, these market leaders drive growth in the manual lifting light tower sector by focusing on product reliability, innovation, and customer-centric solutions. Investments in research and development enable suppliers to introduce light towers with improved fuel efficiency, LED lighting technology, and modular designs that enhance portability and ease of use. By addressing industry demands for energy-efficient, cost-effective, and durable lighting solutions, these leading companies play a pivotal role in expanding the adoption of manual lifting light towers across various sectors, supporting operational efficiency and safety.

| Item | Value |

|---|---|

| Quantitative Units | USD 4.3 billion |

| Channel | Sales and Rental |

| Product | Mobile and Stationary |

| Lighting | LED, Metal halide, Electric, and Others |

| Power Source | Diesel, Solar, Direct, and Others |

| Application | Construction, Infrastructure & development, Oil & gas, Mining, Military & defense, Emergency & disaster relief, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Allmand Bros, Aska Equipments, Atlas Copco, Caterpillar, Chicago Pneumatic, Colorado Standby, DMI, Doosan Portable Power, Generac Power Systems, HIMOINSA, Inmesol gensets, J C Bamford Excavators, LARSON Electronics, Light Boy, LTA Projects, Multiquip, Olikara Lighting Towers, Progress Solar Solutions, The Will Burt Company, Trime, United Rentals, Wacker Neuson, and Youngman Richardson |

| Additional Attributes | Dollar sales vary by product type, including diesel-powered, hybrid, and electric light towers; by application, such as construction sites, mining operations, emergency response, and outdoor events; by end-use, spanning construction companies, mining firms, government agencies, and event organizers; by region, led by North America, Europe, and Asia-Pacific. Growth is driven by demand for portable, easy-to-operate lighting solutions and off-grid illumination needs. |

The global manual lifting light tower market is estimated to be valued at USD 4.3 billion in 2025.

The market size for the manual lifting light tower market is projected to reach USD 7.1 billion by 2035.

The manual lifting light tower market is expected to grow at a 5.1% CAGR between 2025 and 2035.

The key product types in manual lifting light tower market are sales and rental.

In terms of product, mobile segment to command 61.8% share in the manual lifting light tower market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Manual Lifting Mobile Light Tower Market Size and Share Forecast Outlook 2025 to 2035

Manual Control Valve Market Size and Share Forecast Outlook 2025 to 2035

Manual Wafer Aligner Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Manual Bottle Opener Market Size and Share Forecast Outlook 2025 to 2035

Manual cutting equipment Market Size and Share Forecast Outlook 2025 to 2035

Manual Transmission Market Size and Share Forecast Outlook 2025 to 2035

Manual Resuscitator Market Growth – Size, Trends & Forecast 2024-2034

Instrument Detergents for Manual Cleaning Market Report – Trends & Innovations 2025 to 2035

Lifting Columns Market Size and Share Forecast Outlook 2025 to 2035

Cow Lifting Harness Market – Industry Insights & Growth 2025-2035

Heavy Lifting Equipment Market Size and Share Forecast Outlook 2025 to 2035

Hydraulic Lifting Light Tower Market Size and Share Forecast Outlook 2025 to 2035

Hydraulic Lifting Mobile Light Tower Market Size and Share Forecast Outlook 2025 to 2035

Submucosal Lifting Agent Market Segmentation based on Product Type, End Use, Application and Region: A Forecast for 2025 and 2035

Fully Automatic Hydraulic Lifting Column Market Size and Share Forecast Outlook 2025 to 2035

Tower Crane Rental Market Growth – Trends & Forecast 2025 to 2035

Tower Crane Market Growth - Trends & Forecast 2025 to 2035

Tower Mounted Amplifier Market by Type, by Technology, by End User & Region Forecast till 2035

Analyzing Tower Mounted Amplifier Market Share & Industry Leaders

UK Tower Mounted Amplifier Market Trends – Size, Share & Growth 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA