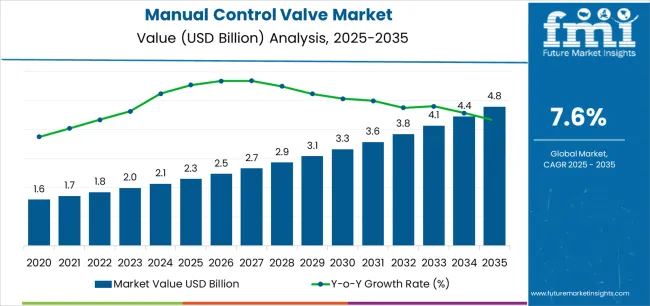

The global manual control valve market is valued at USD 2.3 billion in 2025 and is slated to reach USD 4.8 billion by 2035, recording an absolute increase of USD 2.5 billion over the forecast period. This translates into a total growth of 107.8%, with the market forecast to expand at a compound annual growth rate (CAGR) of 7.6% between 2025 and 2035. The overall market size is expected to grow by approximately 2.08X during the same period, supported by increasing demand for precision fluid control systems, growing adoption of manual valve solutions across industrial automation applications, and rising preference for reliable flow control mechanisms across manufacturing and process industries.

The manual control valve market represents a critical segment of the global industrial automation industry, characterized by consistent demand across manufacturing, automotive, and process control applications. Market dynamics are influenced by expanding industrial infrastructure development, growing emphasis on process optimization, and increasing requirements for precise fluid flow management in complex industrial environments. Traditional valve deployment patterns continue to evolve as manufacturers seek enhanced durability and operational reliability in demanding industrial conditions.

Consumer behavior in the manual control valve market reflects broader trends toward cost-effective automation solutions that provide both operational efficiency and maintenance predictability. The market benefits from the growing adoption of industrial automation systems, which require precise flow control capabilities for optimal performance. Manual control valves serve as essential components in applications where human operator control and system reliability are paramount considerations for operational success.

Regional deployment patterns vary significantly, with North American and European markets showing strong preference for precision-engineered valve solutions, while Asian markets demonstrate increasing adoption of manual control systems alongside automated industrial processes. The industrial landscape continues to expand with specialty valve configurations gaining acceptance in mainstream manufacturing operations, reflecting operator requirements for enhanced control precision and system integration capabilities.

The competitive environment features established industrial valve manufacturers alongside specialized engineering companies that focus on application-specific valve designs and precision manufacturing processes. Production efficiency and supply chain reliability remain critical factors for market participants, particularly as raw material costs and component availability continue to fluctuate. Distribution strategies increasingly emphasize direct industrial sales combined with technical support services through authorized distributor networks.

Market consolidation trends indicate that larger manufacturers are acquiring specialized valve producers to enhance their product portfolios and access niche industrial segments. Private label development has gained momentum as distributors seek to differentiate their offerings while maintaining competitive pricing for industrial customers. The emergence of application-specific valve designs, including high-pressure and corrosion-resistant variants, reflects changing industrial requirements and creates new opportunities for innovative manufacturers. Manufacturing precision improvements and quality assurance programs enable consistent production scaling while maintaining performance characteristics that industrial operators expect from established valve brands.

Between 2025 and 2030, the manual control valve market is projected to expand from USD 2.3 billion to USD 3.1 billion, resulting in a value increase of USD 0.8 billion, which represents 32.0% of the total forecast growth for the decade. This phase of development will be shaped by increasing adoption of precision valve technologies, rising demand for industrial automation components, and growing emphasis on operational reliability with enhanced performance characteristics. Industrial manufacturers are expanding their production capabilities to address the growing demand for specialized valve products, application-specific designs, and custom engineering solutions across industrial channels.

| Metric | Value |

|---|---|

| Estimated Value (2025E) | USD 2.3 billion |

| Forecast Value (2035F) | USD 4.8 billion |

| Forecast CAGR (2025-2035) | 7.60% |

From 2030 to 2035, the market is forecast to grow from USD 3.1 billion to USD 4.8 billion, adding another USD 1.7 billion, which constitutes 68.0% of the overall ten-year expansion. This period is expected to be characterized by the expansion of precision valve product lines, the integration of advanced materials and manufacturing technologies, and the development of specialized valve configurations with enhanced performance capabilities and extended operational life. The growing adoption of high-performance materials will drive demand for manual control valves with superior durability characteristics and compatibility with demanding industrial applications across manufacturing operations.

Between 2020 and 2025, the manual control valve market experienced steady growth, driven by increasing demand for reliable flow control solutions and growing recognition of manual valves as essential components for industrial process optimization across manufacturing and automation applications. The market developed as industrial operators recognized the potential for manual valve systems to provide both operational control and maintenance efficiency while enabling precise flow management protocols. Technological advancement in valve materials and precision manufacturing began emphasizing the critical importance of maintaining product reliability and performance consistency in diverse industrial environments.

Market expansion is being supported by the increasing global demand for industrial automation components and the corresponding need for precision flow control solutions that can provide superior operational characteristics and reliability benefits while enabling precise process control and extended service life across various manufacturing and industrial applications. Modern industrial operators and automation specialists are increasingly focused on implementing reliable valve technologies that can deliver precise flow control, minimize maintenance requirements, and provide consistent performance throughout complex industrial processes and diverse operational environments. Manual control valves' proven ability to deliver exceptional control precision against fluctuating process conditions, enable operator flexibility, and support industrial automation protocols make them essential components for contemporary manufacturing and process control operations.

The growing emphasis on industrial automation and process optimization is driving demand for manual control valves that can support large-scale manufacturing requirements, improve operational outcomes, and enable reliable process control systems. Industrial preference for components that combine effective flow management with operational simplicity and maintenance predictability is creating opportunities for innovative valve implementations. The rising influence of precision manufacturing trends and quality assurance requirements is also contributing to increased demand for manual control valves that can provide operational reliability, precise control characteristics, and consistent performance across extended operational periods.

The manual control valve market is poised for significant growth and transformation. As industrial operators across North America, Europe, Asia-Pacific, and emerging markets seek components that deliver exceptional control precision, operational reliability, and maintenance efficiency, manual control valves are gaining prominence not just as flow control devices but as strategic enablers of industrial automation and process optimization.

Rising industrial automation adoption in Asia-Pacific and expanding manufacturing initiatives globally amplify demand, while manufacturers are leveraging innovations in precision engineering systems, advanced materials integration, and specialized valve technologies.

Pathways like high-pressure applications, specialized materials, and precision control solutions promise strong margin uplift, especially in demanding industrial segments. Geographic expansion and product diversification will capture volume, particularly where operational reliability and precision control are critical. Regulatory support around industrial safety standards, quality certification requirements, and performance specifications give structural support.

What is the segmental analysis of the manual control valve market?

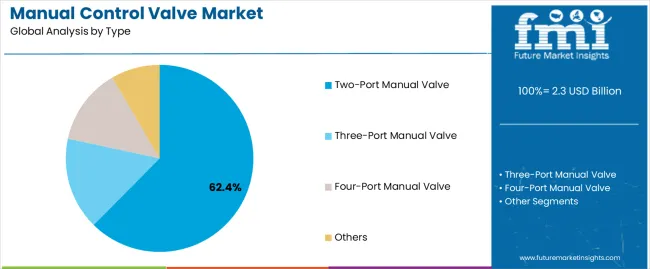

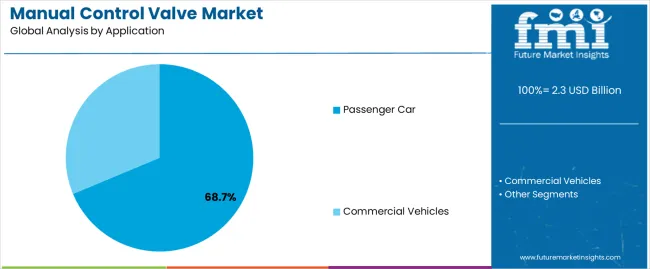

The market is segmented by type, application, material, pressure rating, distribution channel, price segment, and region. By type, the market is divided into two-port manual valve, three-port manual valve, four-port manual valve, and others categories. By application, it covers passenger car and commercial vehicles segments. By material, the market includes stainless steel, brass, carbon steel, and composite materials. By pressure rating, it comprises low pressure, medium pressure, and high pressure categories. By distribution channel, it includes direct sales, distributors, online channels, and industrial suppliers. By price segment, the market is categorized into premium, mid-range, and economy categories. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and the Middle East & Africa.

The two-port manual valve segment is projected to account for 62.4% of the manual control valve market in 2025, reaffirming its position as the leading type category. Industrial manufacturers and automation operators increasingly utilize two-port manual valve configurations for their superior flow control characteristics when operating across diverse industrial applications, excellent operational reliability properties, and widespread acceptance in applications ranging from process control to manufacturing automation operations. Two-port manual valve technology's straightforward design principles and proven operational capabilities directly address the industrial requirements for reliable flow management in complex manufacturing environments.

This type segment forms the foundation of modern industrial valve deployment patterns, as it represents the configuration with the greatest operational simplicity and established performance reliability across multiple application categories and industrial segments. Manufacturer investments in precision engineering and quality consistency continue to strengthen adoption among industrial operators and automation system integrators. With industrial operators prioritizing operational reliability and maintenance efficiency, two-port manual valves align with both performance requirements and cost considerations, making them the central component of comprehensive industrial valve strategies.

Passenger car applications are projected to represent 68.7% of manual control valve demand in 2025, underscoring their critical role as the primary deployment channel for valve products across automotive manufacturing, vehicle systems integration, and automotive component applications. Passenger car manufacturers prefer manual control valves for their exceptional reliability characteristics, precise control options, and ability to enhance system performance while ensuring consistent operational functionality throughout diverse automotive operating conditions. Positioned as essential components for modern automotive systems, manual control valves offer both flow control advantages and operational reliability benefits.

The segment is supported by continuous innovation in automotive valve technologies and the growing availability of specialized configurations that enable diverse automotive requirements with enhanced performance uniformity and extended service life capabilities. Additionally, passenger car manufacturers are investing in precision components to support large-scale production and quality assurance protocols. As automotive automation becomes more prevalent and performance requirements increase, passenger car applications will continue to represent a major deployment market while supporting advanced automotive utilization and system integration strategies.

The manual control valve market is advancing steadily due to increasing demand for industrial automation components and growing adoption of precision flow control solutions that provide superior operational characteristics and reliability benefits while enabling precise process management across diverse manufacturing and industrial applications. The market faces challenges, including fluctuating raw material costs, complex supply chain logistics, and the need for specialized manufacturing expertise and quality assurance programs. Innovation in precision engineering capabilities and advanced materials systems continues to influence product development and market expansion patterns.

The growing adoption of automated manufacturing systems, precision control protocols, and operational efficiency initiatives is enabling manufacturers to produce advanced manual control valve products with superior performance positioning, enhanced operational characteristics, and reliable functionality. Advanced manufacturing systems provide improved quality consistency while allowing more efficient production workflows and reliable performance across various industrial applications and operating conditions. Manufacturers are increasingly recognizing the competitive advantages of precision engineering capabilities for market differentiation and premium positioning.

Modern manual control valve producers are incorporating specialized materials integration, corrosion-resistant construction, and enhanced durability characteristics to improve product performance, enable demanding application compatibility, and deliver value-added solutions to industrial customers. These technologies improve operational reliability while enabling new market opportunities, including high-pressure applications, specialized environments, and extended service life characteristics. Advanced materials integration also allows manufacturers to support comprehensive industrial distribution systems and market expansion beyond traditional valve approaches.

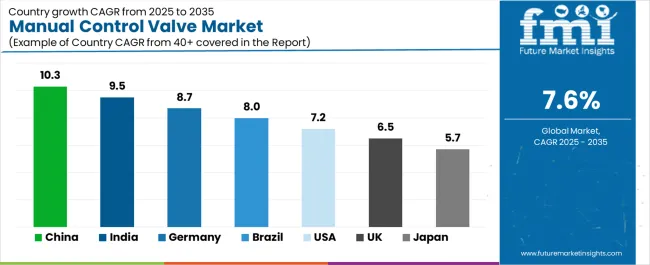

| Country | CAGR (2025-2035) |

|---|---|

| China | 10.3% |

| India | 9.5% |

| Germany | 8.7% |

| Brazil | 8.0% |

| United States (USA) | 7.2% |

| United Kingdom (UK) | 6.5% |

| Japan | 5.7% |

The manual control valve market is experiencing robust growth globally, with China leading at a 10.3% CAGR through 2035, driven by expanding industrial automation programs, growing manufacturing modernization initiatives, and significant investment in precision engineering technology development. India follows at 9.5%, supported by increasing automotive production activities, growing industrial infrastructure development, and expanding manufacturing capabilities. Germany shows growth at 8.7%, emphasizing precision engineering innovation and industrial automation advancement. Brazil records 8.0%, focusing on expanding automotive manufacturing capabilities and industrial modernization programs. The USA demonstrates 7.2% growth, prioritizing advanced manufacturing development and industrial automation trends. The UK exhibits 6.5% growth, emphasizing precision engineering adoption and industrial innovation development. Japan shows 5.7% growth, supported by advanced manufacturing initiatives and precision-focused industrial applications.

The report covers an in-depth analysis of 40+ countries, the top-performing countries are highlighted below.

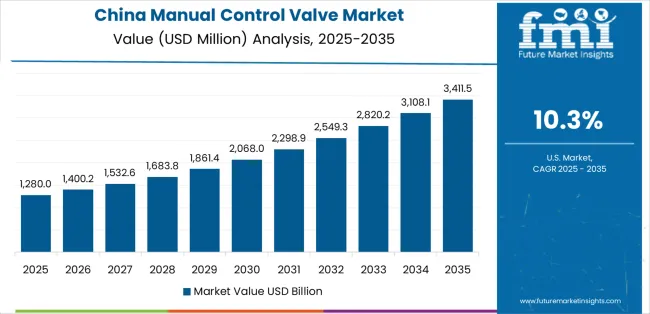

Revenue from manual control valves in China is projected to exhibit strong growth with a CAGR of 10.3% through 2035, driven by expanding industrial automation adoption and rapidly growing manufacturing modernization supported by government initiatives promoting precision engineering technology development. The country's strong position in manufacturing automation and increasing investment in industrial infrastructure are creating substantial demand for precision valve products. Major industrial manufacturers and automation facilities are establishing comprehensive production capabilities to serve both domestic manufacturing demand and expanding export markets.

Revenue from manual control valves in India is expanding at a CAGR of 9.5%, supported by the country's growing automotive manufacturing sector, expanding industrial infrastructure development, and increasing adoption of precision manufacturing technologies. The country's initiatives promoting industrial modernization and growing manufacturing capabilities are driving requirements for precision valve products. International suppliers and domestic manufacturers are establishing extensive production and distribution capabilities to address the growing demand for industrial valve components.

Revenue from manual control valves in Germany is expanding at a CAGR of 8.7%, supported by the country's precision engineering heritage, strong emphasis on manufacturing innovation, and robust demand for advanced industrial components in manufacturing and automation applications. The nation's mature industrial automation sector and precision-focused operations are driving sophisticated valve technologies throughout the manufacturing industry. Leading manufacturers and engineering companies are investing extensively in advanced production and precision technologies to serve both domestic and international markets.

Revenue from manual control valves in Brazil is growing at a CAGR of 8.0%, driven by the country's expanding automotive manufacturing sector, growing industrial development programs, and increasing investment in manufacturing technology advancement. Brazil's large automotive market and commitment to industrial advancement are supporting demand for diverse valve solutions across multiple manufacturing segments. Manufacturers are establishing comprehensive production capabilities to serve the growing domestic market and expanding industrial opportunities.

Revenue from manual control valves in the USA is expanding at a CAGR of 7.2%, supported by the country's advanced manufacturing technology sector, strategic focus on industrial automation, and established precision engineering capabilities. The USA's manufacturing innovation leadership and advanced component integration are driving demand for specialized valve products in aerospace, automotive, and precision manufacturing applications. Manufacturers are investing in comprehensive product development to serve both domestic specialty markets and international precision applications.

Revenue from manual control valves in the UK is growing at a CAGR of 6.5%, driven by the country's focus on precision engineering advancement, emphasis on manufacturing innovation, and strong position in industrial component development. The UK's established precision manufacturing capabilities and commitment to industrial innovation are supporting investment in specialized valve technologies throughout major industrial regions. Industry leaders are establishing comprehensive product integration systems to serve domestic manufacturing requirements and precision industrial applications.

Revenue from manual control valves in Japan is expanding at a CAGR of 5.7%, supported by the country's precision manufacturing initiatives, growing automation sector, and strategic emphasis on quality engineering development. Japan's advanced quality control capabilities and integrated manufacturing systems are driving demand for high-quality valve products in automotive, electronics, and precision manufacturing applications. Leading manufacturers are investing in specialized capabilities to serve the stringent requirements of quality-focused manufacturing and precision industrial industries.

How is the European manual control valve market split by country?

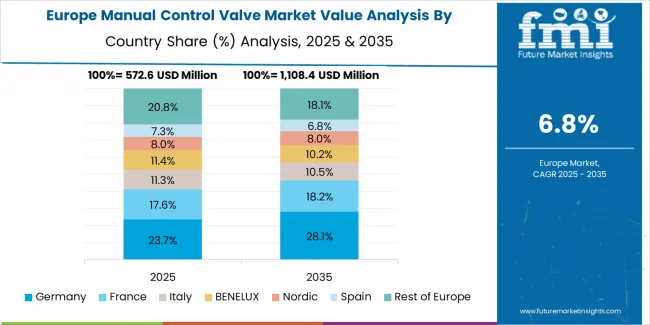

The manual control valve market in Europe is projected to grow from USD 460.0 million in 2025 to USD 932.5 million by 2035, registering a CAGR of 7.3% over the forecast period. Germany is expected to maintain its leadership position with a 41.2% market share in 2025, declining slightly to 40.8% by 2035, supported by its strong precision engineering culture, sophisticated manufacturing capabilities, and comprehensive industrial sector serving diverse manual control valve applications across Europe.

France follows with a 18.4% share in 2025, projected to reach 18.7% by 2035, driven by robust demand for precision valve products in automotive applications, advanced manufacturing programs, and industrial automation markets, combined with established engineering infrastructure and precision manufacturing expertise. The United Kingdom holds a 14.6% share in 2025, expected to reach 14.9% by 2035, supported by strong precision engineering sector and growing advanced manufacturing activities. Italy commands a 12.3% share in 2025, projected to reach 12.6% by 2035, while Spain accounts for 7.8% in 2025, expected to reach 8.1% by 2035. The Netherlands maintains a 3.5% share in 2025, growing to 3.6% by 2035. The Rest of Europe region, including Nordic countries, Eastern Europe, Belgium, Poland, and other nations, is anticipated to maintain momentum, with its collective share moving from 2.2% to 1.3% by 2035, attributed to increasing industrial modernization in Eastern Europe and growing precision manufacturing penetration in Nordic countries implementing advanced industrial programs.

The manual control valve market is characterized by competition among established industrial component manufacturers, specialized valve producers, and integrated automation system providers. Companies are investing in precision engineering research, performance optimization, advanced materials development, and comprehensive product portfolios to deliver consistent, high-quality, and application-specific manual control valve solutions. Innovation in precision manufacturing systems, materials integration, and operational reliability enhancement is central to strengthening market position and competitive advantage.

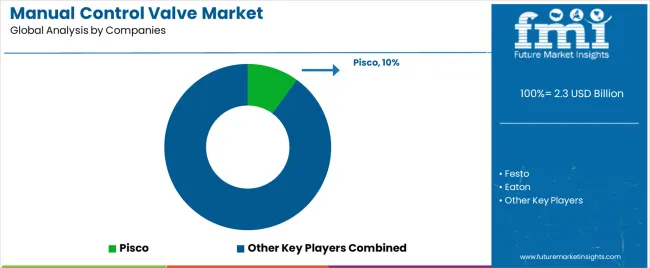

Pisco leads the market with 10% share, offering comprehensive precision valve solutions including advanced engineering and specialized manufacturing systems with a focus on industrial automation and precision control applications. Festo provides specialized automation components with an emphasis on precision valve products and innovative control solutions. Eaton delivers comprehensive industrial distribution with a focus on engineered systems and large-scale manufacturing services. Parker Hannifin specializes in precision motion and control technologies with specialized valve products for industrial applications. Ginier focuses on precision valve products and innovative engineering solutions. Camozzi offers automation components with emphasis on industrial valve systems and manufacturing applications.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.3 billion |

| Type | Two-Port Manual Valve; Three-Port Manual Valve; Four-Port Manual Valve; Others |

| Application | Passenger Car; Commercial Vehicles |

| Material | Stainless Steel; Brass; Carbon Steel; Composite Materials |

| Pressure Rating | Low Pressure; Medium Pressure; High Pressure |

| Distribution Channels | Direct Sales; Distributors; Online Channels; Industrial Suppliers |

| Price Segment | Premium; Mid-range; Economy |

| End-Use Sector | Automotive Manufacturers; Industrial Facilities; Automation Companies; Process Industries |

| Regions Covered | North America; Europe; East Asia; South Asia & Pacific; Latin America; Middle East & Africa |

| Countries Covered | China; India; Germany; Brazil; United States; United Kingdom; Japan; and 40+ additional countries |

| Key Companies Profiled | Pisco; Festo; Eaton; Parker Hannifin; Ginier; Camozzi |

| Additional Attributes | Dollar sales by type and application category; regional demand trends; competitive landscape; technological advancements in precision engineering systems; advanced materials development; performance innovation; industrial distribution integration |

The global manual control valve market is estimated to be valued at USD 2.3 billion in 2025.

The market size for the manual control valve market is projected to reach USD 4.8 billion by 2035.

The manual control valve market is expected to grow at a 7.6% CAGR between 2025 and 2035.

The key product types in manual control valve market are two-port manual valve, three-port manual valve, four-port manual valve and others.

In terms of application, passenger car segment to command 68.7% share in the manual control valve market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Manual Lifting Mobile Light Tower Market Size and Share Forecast Outlook 2025 to 2035

Manual Wafer Aligner Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Manual Lifting Light Tower Market Size and Share Forecast Outlook 2025 to 2035

Manual Bottle Opener Market Size and Share Forecast Outlook 2025 to 2035

Manual cutting equipment Market Size and Share Forecast Outlook 2025 to 2035

Manual Transmission Market Size and Share Forecast Outlook 2025 to 2035

Manual Resuscitator Market Growth – Size, Trends & Forecast 2024-2034

Instrument Detergents for Manual Cleaning Market Report – Trends & Innovations 2025 to 2035

Control Room Solution Market Size and Share Forecast Outlook 2025 to 2035

Control Knobs for Panel Potentiometer Market Size and Share Forecast Outlook 2025 to 2035

Controlled-Release Drug Delivery Technology Market Size and Share Forecast Outlook 2025 to 2035

Controlled Environment Agriculture (CEA) Market Size and Share Forecast Outlook 2025 to 2035

Control Cable Market Size and Share Forecast Outlook 2025 to 2035

Control Towers Market Size and Share Forecast Outlook 2025 to 2035

Controlled & Slow Release Fertilizers Market 2025-2035

Controlled Intelligent Packaging Market

Biocontrol Solutions Market Size and Share Forecast Outlook 2025 to 2035

Biocontrol Agents Market Size and Share Forecast Outlook 2025 to 2035

Oil Control Shampoo Market Size and Share Forecast Outlook 2025 to 2035

LED Control Unit Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA