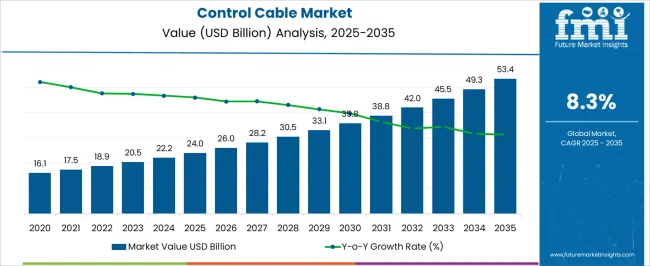

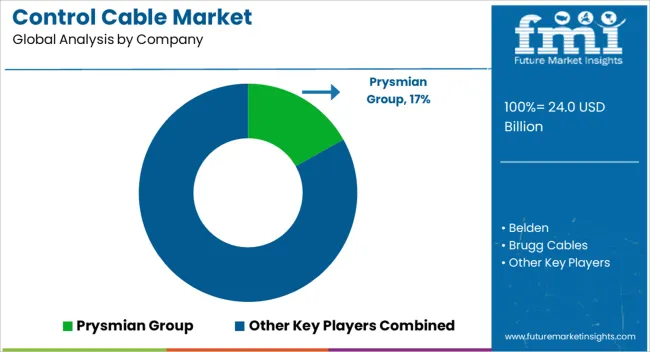

The global control cable market is projected to reach 24.0 USD billion in 2025 and expand to 53.4 USD billion by 2035, reflecting a CAGR of 8.3% over the forecast period. Breakpoint analysis indicates that the market is set to witness steady growth, with significant acceleration observed in the mid-2020s as industrial automation, automotive electrification, and infrastructure development drive demand. The estimated market value in 2025 is primarily supported by the rising adoption of control cables in sectors such as transportation, manufacturing, and energy, where reliable signal transmission and mechanical control are critical.

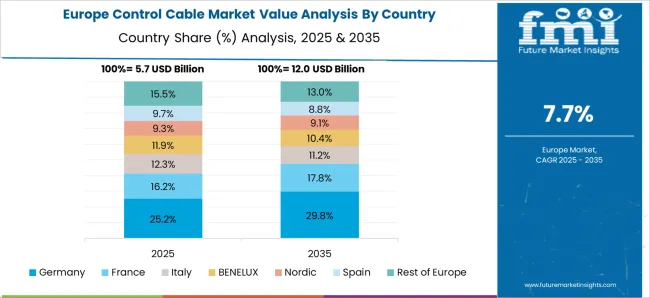

By 2035, the market is anticipated to gain momentum from the increasing need for advanced control systems in smart factories, electric vehicles, and renewable energy installations. Intermediate breakpoints show progressive growth from 16.1 USD billion in 2024 to 38.8 USD billion by 2030, highlighting consistent expansion driven by technological advancements and regulatory support for safer and more efficient cabling solutions. Regional dynamics play a crucial role, with North America and Europe leading in high-performance cable applications, while Asia-Pacific demonstrates rapid adoption due to industrialization and infrastructure projects.

Market share is expected to shift gradually toward manufacturers offering innovative, durable, and eco-friendly control cables. Breakpoint analysis shows a steady rise in dollar sales and growing market share across key regions, making this an attractive space for both established players and new entrants.

| Metric | Value |

|---|---|

| Control Cable Market Estimated Value in (2025 E) | USD 24.0 billion |

| Control Cable Market Forecast Value in (2035 F) | USD 53.4 billion |

| Forecast CAGR (2025 to 2035) | 8.3% |

The control cable market is strongly influenced by its parent industries and end-use sectors. The automotive industry holds the largest share at 40%, as control cables are essential for throttle, brake, clutch, and transmission systems, ensuring precise mechanical and electronic signal transmission, safety, and operational reliability in vehicles. The industrial machinery and automation sector contributes 25%, with control cables widely used in robotics, factory automation, conveyor systems, and process control applications, where accuracy, durability, and efficiency are critical for optimized production. The construction and infrastructure market accounts for 15%, driven by the need for control cables in elevators, cranes, HVAC systems, and building automation, supporting safe and effective operation in large-scale projects. The energy and power transmission sector holds a 10% share, as control cables are employed in substations, renewable energy installations, and power plants to ensure reliable control and monitoring of equipment.

The transportation and marine sector represents 10%, using control cables in ships, railways, and public transport systems to maintain operational safety, precision, and performance. Collectively, the automotive and industrial machinery segments account for 65% of the overall demand, highlighting that mobility, mechanization, and automation remain the primary drivers of market growth. Meanwhile, construction, energy, and transport applications provide supplementary opportunities, supporting incremental adoption of advanced control cable solutions across global markets and enhancing dollar sales and market share expansion over the forecast period.

The control cable market is experiencing stable expansion, supported by robust demand in manufacturing, automation, and infrastructure projects. Increasing reliance on precise control and signal transmission in industrial machinery has been a key growth driver, while advancements in cable materials and shielding technologies are enhancing performance and durability. Global supply chains for raw materials are being optimized to address cost fluctuations, with manufacturers focusing on operational efficiency and compliance with stringent safety regulations.

Emerging economies are contributing significantly to market growth due to rising investments in factory automation, transportation infrastructure, and energy projects. Meanwhile, mature markets are witnessing steady replacement demand and upgrades to meet evolving technical standards.

The integration of smart monitoring systems and improved resistance to mechanical stress and environmental factors are expected to strengthen the long-term market outlook Strategic expansions, product innovation, and a shift toward customized cable solutions are anticipated to position industry participants for sustained revenue growth over the forecast period.

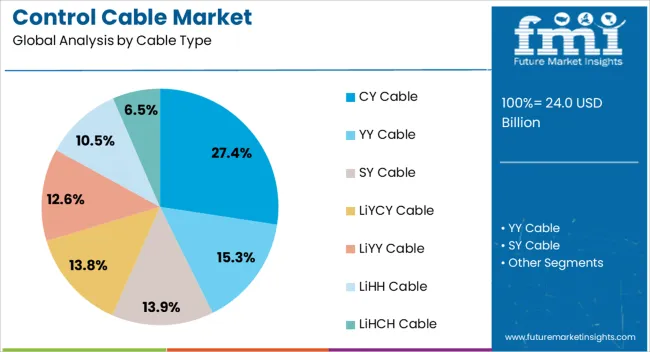

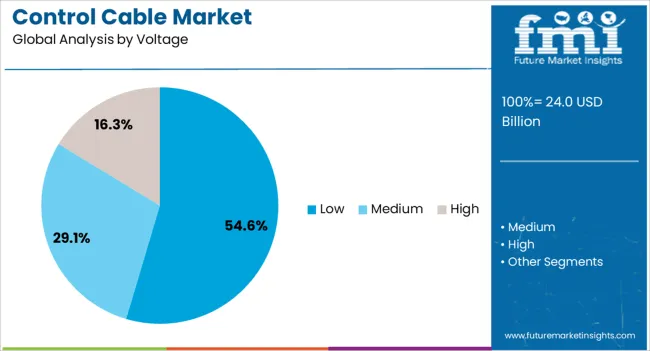

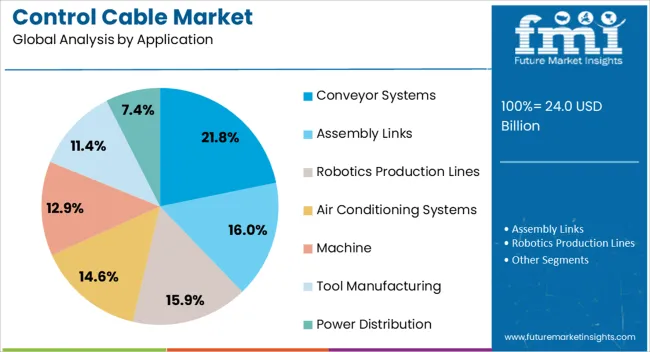

The control cable market is segmented by cable type, voltage, application, and geographic regions. By cable type, control cable market is divided into CY Cable, YY Cable, SY Cable, LiYCY Cable, LiYY Cable, LiHH Cable, and LiHCH Cable. In terms of voltage, control cable market is classified into Low, Medium, and High. Based on application, control cable market is segmented into Conveyor Systems, Assembly Links, Robotics Production Lines, Air Conditioning Systems, Machine, Tool Manufacturing, and Power Distribution. Regionally, the control cable industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The CY cable type, holding 27.4% of the cable type category, has been leading the market due to its high flexibility, strong shielding properties, and reliability in minimizing signal interference. Its suitability for dynamic applications in machinery and automation systems has ensured consistent demand across industrial environments.

Enhanced protection against electromagnetic interference has made it a preferred choice for precision equipment, maintaining operational stability in high-noise environments. Manufacturers have optimized production processes to improve insulation quality and durability, supporting extended service life and reduced maintenance requirements.

Competitive pricing, combined with adherence to international safety and performance standards, has reinforced its position in both domestic and export markets. As industrial automation continues to expand and demand for efficient control systems increases, the CY cable segment is expected to sustain growth momentum, driven by its adaptability to diverse applications and proven performance in challenging operational conditions.

The low voltage category, accounting for 54.6% of the voltage segment, has maintained dominance due to its extensive use in machinery control, building automation, and various industrial equipment connections. Its share has been strengthened by widespread adoption in applications requiring safety, energy efficiency, and reliable short-distance power and signal transmission.

Advances in insulation technology and flame-retardant materials have enhanced product performance, meeting stringent industry and regulatory requirements. The segment’s cost-effectiveness, ease of installation, and compatibility with a wide range of systems have further cemented its leadership position.

Manufacturers are increasingly offering customized low-voltage control cables to address specific operational needs, supporting broader market penetration. With growing investments in manufacturing modernization and automation, coupled with infrastructure development in emerging markets, low-voltage control cables are expected to continue as the preferred option for diverse control system applications.

The conveyor systems application, representing 21.8% of the application category, has secured its leading position owing to the critical role control cables play in ensuring smooth, efficient, and safe material handling operations. Demand stability has been underpinned by the expansion of manufacturing, warehousing, and distribution facilities globally.

The segment benefits from the need for reliable signal and power transmission in environments subject to constant movement, mechanical stress, and variable operating conditions. Enhanced cable flexibility, abrasion resistance, and shielding against electrical noise have contributed to consistent performance and reduced downtime in conveyor operations.

Producers have focused on developing cables tailored for high-cycle performance, supporting industries such as automotive, food processing, and e-commerce logistics. As automation and throughput optimization remain key priorities across industries, the requirement for specialized control cables in conveyor systems is projected to grow steadily, reinforcing the segment’s importance in the overall control cable market.

Control cables are primarily driven by automotive, industrial machinery, infrastructure, and transportation sectors. Consistent demand across these industries ensures steady dollar sales and growing market share globally.

The automotive sector continues to drive significant demand for control cables, accounting for the largest share of the market. Increasing production of passenger vehicles, commercial trucks, and electric vehicles necessitates high-performance control cables for throttle, brake, clutch, and transmission systems. OEMs are prioritizing reliability, flexibility, and precision in cable solutions to meet stringent safety and performance standards. Growth in the electric vehicle segment, in particular, boosts the need for specialized control cables capable of handling electronic signals alongside mechanical operations. This trend is further strengthened by aftermarket replacements and retrofitting in older vehicles, ensuring consistent dollar sales and market share for manufacturers who offer durable and certified control cable solutions across regional markets.

Industrial machinery and automation remain critical contributors to control cable market growth, representing a substantial portion of overall demand. Control cables are essential in robotics, conveyor systems, CNC machines, and process control operations, where accurate signal transmission and mechanical reliability are crucial. Increasing industrial production, along with rising investments in mechanization, has led to higher adoption of control cables across manufacturing facilities. Maintenance and replacement cycles also contribute to sustained dollar sales, while high-performance cables enhance operational efficiency and reduce downtime. Companies providing robust, long-life control cables can capture significant market share by catering to the growing demand for industrial applications, particularly in regions with strong manufacturing bases and expanding production capacities.

The construction and infrastructure segment plays a pivotal role in the adoption of control cables, particularly in elevators, cranes, HVAC systems, and building automation projects. As urban infrastructure grows, construction firms increasingly rely on reliable control cables to ensure safety, smooth operation, and compliance with industry standards. Government and private sector investments in large-scale infrastructure projects also stimulate demand. Replacement and retrofitting in existing infrastructure create additional revenue opportunities, contributing to consistent dollar sales. Manufacturers that provide customized, robust, and certified cables for complex construction environments gain an advantage in market share. This sector’s growth highlights the need for resilient solutions capable of withstanding mechanical stress and long-term operational cycles.

The transportation and energy sectors further support market expansion, utilizing control cables in railways, marine vessels, and power transmission systems. In these sectors, cables must withstand harsh environmental conditions, high stress, and continuous operation, necessitating premium quality products. Increasing investment in power plants, renewable energy installations, and advanced transportation networks drives the adoption of specialized control cables. Maintenance, upgrades, and replacements in existing infrastructure provide ongoing dollar sales opportunities. Manufacturers offering versatile, high-performance cables that meet industry safety and reliability standards can capture a significant portion of market share. These sectors represent steady incremental growth and reinforce the global demand for control cable solutions across diverse industrial applications.

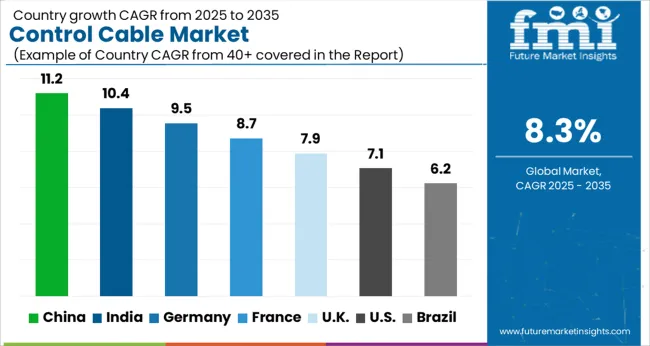

| Country | CAGR |

|---|---|

| China | 11.2% |

| India | 10.4% |

| Germany | 9.5% |

| France | 8.7% |

| UK | 7.9% |

| USA | 7.1% |

| Brazil | 6.2% |

The global control cable market is projected to grow at a CAGR of 8.3% from 2025 to 2035. China leads the market with 11.2%, followed by India at 10.4%, Germany at 9.5%, the UK at 7.9%, and the USA at 7.1%. Growth is driven by increasing demand in automotive applications, industrial machinery, infrastructure projects, and energy transmission systems, where control cables are essential for precise mechanical and signal operations. China and India exhibit rapid adoption due to industrial expansion, automotive production, and large-scale infrastructure projects. Developed markets, including Germany, the UK, and the USA, focus on high-quality, durable, and regulatory-compliant control cable solutions. The analysis spans over 40+ countries, with the leading markets shown below.

The hydrolyzed vegetable proteins market in China is projected to expand at a CAGR of 9.9% from 2025 to 2035, driven by increasing demand from food processing, convenience foods, sauces, snacks, and meat alternatives. Rising urbanization and changing dietary patterns are fueling the need for flavor enhancers and protein fortification in packaged foods. Manufacturers are focusing on introducing HVPs with enhanced solubility, taste, and aroma to cater to local culinary preferences. E-commerce and modern retail channels are expanding product accessibility, while foodservice sectors, including restaurants and quick-service outlets, contribute to significant volume demand. Domestic producers are investing in process optimization and quality certification to meet stringent safety and labeling standards. Innovations in low-salt, clean-label, and allergen-free formulations are attracting health-conscious consumers.

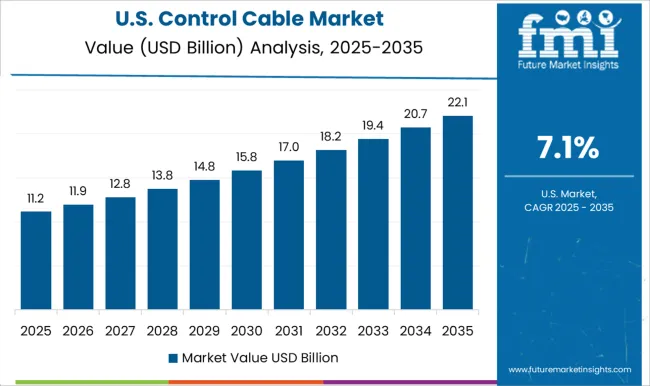

The control cable market in the USA is projected to expand at a CAGR of 7.1% from 2025 to 2035, driven by industrial automation, infrastructure upgrades, and growing construction activity. Oil & gas, power transmission, and manufacturing sectors are key end users, requiring flame-retardant, heat-resistant, and halogen-free cables. Smart factories, IoT-enabled machinery, and automation initiatives are promoting adoption of high-performance cables. Imports of specialized cables are supplementing domestic production to meet advanced technical standards. Regulatory compliance with OSHA, NEC, and environmental guidelines is influencing design and material selection. Strategic partnerships and technology transfers are enhancing quality, reliability, and accessibility of control cables, contributing to significant dollar sales and increasing market share.

The control cable market in India is expected to grow at a CAGR of 10.4% from 2025 to 2035, driven by rising industrial clusters, urbanization, and infrastructure projects. Power transmission, renewable energy, and industrial automation sectors are fueling adoption of control and instrumentation cables. Manufacturers are focusing on PVC, XLPE, and halogen-free cable variants to comply with safety and environmental regulations. Domestic production is complemented by imports of high-quality cables to meet technical standards. Industrial applications in manufacturing, oil & gas, and construction sectors are contributing to strong dollar sales. Collaboration between Indian companies and international technology providers is improving innovation and product reliability. Government initiatives supporting smart factories, renewable energy, and electric vehicle infrastructure are expected to further stimulate market expansion.

Germany’s control cable market is projected to grow at a CAGR of 9.5% from 2025 to 2035, supported by advanced manufacturing, automotive production, and renewable energy infrastructure. Industrial automation is increasing the need for high-performance control cables that offer flexibility, durability, and thermal stability. Fire-resistant and environmentally compliant cables are becoming standard requirements. Manufacturers are investing in process innovation to deliver low-smoke, halogen-free, and high-precision cable solutions. Export demand is also influencing production strategies, particularly for specialized industrial applications. Integration of predictive maintenance and smart manufacturing systems is raising the demand for reliable control and instrumentation cables. Companies are focusing on R&D to enhance performance under challenging industrial conditions and maintain competitiveness in both domestic and international markets.

The control cable market in the UK is expected to grow at a CAGR of 7.9% from 2025 to 2035, influenced by the adoption of renewable energy, rail electrification, and industrial modernization. Flame-retardant, halogen-free, and low-smoke cable solutions are being increasingly deployed to comply with local and EU safety standards. Industrial automation and process control in manufacturing, data centers, and energy facilities are driving consistent market demand. Imports of specialized cables complement domestic production to meet technical and performance requirements. Strategic collaborations with global technology providers are improving product reliability and market reach. Smart building applications and modernization of industrial facilities are anticipated to contribute to strong sales growth and expanded market share in the coming years.

Competition in the control cable market is defined by reliability, electrical performance, fire resistance, and compliance with international safety standards. Prysmian Group leads with advanced industrial and energy-grade control cables, emphasizing low-smoke, halogen-free, and flame-retardant solutions for power transmission, railways, and manufacturing sectors. Belden focuses on flexible, high-performance cables suitable for industrial automation, data centers, and process control applications, while Brugg Cables offers specialized solutions for energy and telecommunication infrastructure, highlighting durability and precision. Eland Cables and Furukawa Electric compete through process optimization and material innovation, providing heat-resistant and long-life control cables tailored for industrial machinery and energy facilities.

Regional and mid-sized players such as KEC International, KEI Industries, Klaus Faber, LS Cable & System, Nexans, NKT, RR Kabel, Southwire Company, Sumitomo Electric Industries, and Universal Cables differentiate through customer-centric offerings, cost-effective solutions, and customized cable designs. Strategies emphasize compliance with local and international electrical safety standards, adoption of halogen-free and flame-retardant materials, and innovations in thermal and mechanical stability. Partnerships with industrial manufacturers and energy companies are leveraged to ensure reliable supply, technical support, and large-scale deployment.

| Item | Value |

|---|---|

| Quantitative Units | USD 24.0 Billion |

| Cable Type | CY Cable, YY Cable, SY Cable, LiYCY Cable, LiYY Cable, LiHH Cable, and LiHCH Cable |

| Voltage | Low, Medium, and High |

| Application | Conveyor Systems, Assembly Links, Robotics Production Lines, Air Conditioning Systems, Machine, Tool Manufacturing, and Power Distribution |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Prysmian Group, Belden, Brugg Cables, Eland Cables, Furukawa Electric, KEC International, KEI Industries, Klaus Faber, LS Cable & System, Nexans, NKT, RR Kabel, Southwire Company, Sumitomo Electric Industries, and Universal Cables |

| Additional Attributes | Dollar sales, share by region and application, competitive landscape, pricing, emerging technologies, regulatory standards, end-user demand, and supply chain dynamics. |

The global control cable market is estimated to be valued at USD 24.0 billion in 2025.

The market size for the control cable market is projected to reach USD 53.4 billion by 2035.

The control cable market is expected to grow at a 8.3% CAGR between 2025 and 2035.

The key product types in control cable market are cy cable, yy cable, sy cable, liycy cable, liyy cable, lihh cable and lihch cable.

In terms of voltage, low segment to command 54.6% share in the control cable market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Power and Control Cable Market Growth – Trends & Forecast 2025 to 2035

Automotive Control Cables Market Growth – Trends & Forecast 2025-2035

Control Room Solution Market Size and Share Forecast Outlook 2025 to 2035

Control Knobs for Panel Potentiometer Market Size and Share Forecast Outlook 2025 to 2035

Controlled-Release Drug Delivery Technology Market Size and Share Forecast Outlook 2025 to 2035

Controlled Environment Agriculture (CEA) Market Size and Share Forecast Outlook 2025 to 2035

Control Towers Market Size and Share Forecast Outlook 2025 to 2035

Controlled & Slow Release Fertilizers Market 2025-2035

Controlled Intelligent Packaging Market

Biocontrol Solutions Market Size and Share Forecast Outlook 2025 to 2035

Biocontrol Agents Market Size and Share Forecast Outlook 2025 to 2035

Oil Control Shampoo Market Size and Share Forecast Outlook 2025 to 2035

LED Control Unit Market Size and Share Forecast Outlook 2025 to 2035

Sun Control Films Market Size and Share Forecast Outlook 2025 to 2035

CNC Controller Market Size and Share Forecast Outlook 2025 to 2035

PID Controller Market Size and Share Forecast Outlook 2025 to 2035

Market Share Breakdown of Sun Control Films Manufacturers

PLC Controlled Packing Machine Market Trends – Forecast 2024-2034

HVAC Control System Market Size and Share Forecast Outlook 2025 to 2035

Dust Control System Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA