The biocontrol agents market is forecast to grow from USD 7 billion in 2025 to USD 30.4 billion by 2035, with a robust compound annual growth rate (CAGR) of 15.9%. The rapid expansion of this market indicates a strong shift toward eco-friendly and chemical-free agricultural practices. As demand for organic produce rises, farmers and agricultural companies are increasingly turning to biocontrol agents to combat pests and diseases.

This growth is also being driven by regulatory pressures that limit the use of chemical pesticides and encourage the adoption of safer, more sustainable alternatives. The preference for biological control mechanisms over traditional chemical methods is expected to remain a major market trend in the coming years. The biocontrol agents market will experience significant expansion as key sectors, such as crop protection, evolve to meet the growing demand for more natural and effective pest management solutions. In this environment, there will likely be an increase in the variety and effectiveness of biocontrol agents, tailored to specific agricultural needs. With rising consumer awareness about the environmental impact of synthetic pesticides, market players are likely to increase their focus on developing and marketing products that are not only effective but also environmentally benign. The market’s long-term trajectory is therefore expected to be strongly influenced by a broader shift in consumer and regulatory preferences for biological alternatives.

| Metric | Value |

|---|---|

| Biocontrol Agents Market Estimated Value in (2025 E) | USD 7.0 billion |

| Biocontrol Agents Market Forecast Value in (2035 F) | USD 30.4 billion |

| Forecast CAGR (2025 to 2035) | 15.9% |

The biocontrol agents market has established a growing presence within its parent industries, driven by the increasing demand for eco-friendly and sustainable solutions in agriculture. Within the agricultural chemicals market, biocontrol agents account for approximately 10–12% share, as they are increasingly incorporated as an alternative to chemical pesticides. In the crop protection market, the segment contributes around 18–20%, reflecting the adoption of biocontrol agents as part of integrated pest management strategies. Within the organic farming inputs market, biocontrol agents hold a significant share of about 30–35%, as organic farming standards often prioritize natural pest control methods over synthetic chemicals. In the broader pesticides market, biocontrol agents represent around 8–10% share, as they become an increasingly popular choice due to their targeted action and lower environmental impact. Within the biological crop protection market, the segment holds nearly 20–22%, given the growing shift towards natural, non-toxic crop protection solutions. While factors like scalability and efficacy in various environments may affect broader adoption, the biocontrol agents market is steadily expanding due to increasing consumer demand for sustainable agriculture practices. From my perspective, biocontrol agents are moving beyond niche applications to becoming mainstream solutions in pest management, reinforcing their long-term viability in global crop protection strategies.

The biocontrol agents market is expanding steadily, driven by the increasing shift towards sustainable agriculture and the global reduction in chemical pesticide usage. Agricultural policy frameworks, consumer demand for residue-free produce, and environmental protection initiatives have accelerated the adoption of biocontrol solutions.

Industry publications and agri-tech reports have emphasized the growing importance of integrated pest management (IPM) practices, where biocontrol agents play a critical role in reducing ecological impact while maintaining crop yields. Technological advancements in microbial formulation, improved shelf-life stability, and targeted delivery systems have broadened the range of crops and pests that can be effectively managed.

Additionally, the rise in organic farming acreage and export-oriented production of fruits, vegetables, and specialty crops has boosted demand for certified, eco-friendly pest control solutions. Strategic partnerships between agri-biotech companies and farmer cooperatives are enhancing distribution and adoption rates. In the coming years, market growth is expected to be supported by microbials as the dominant active substance, strong uptake in fruits and vegetables, and the increasing prevalence of on-field applications to ensure crop health from early growth stages.

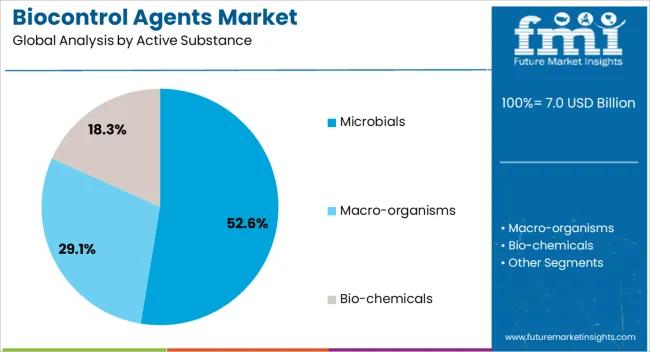

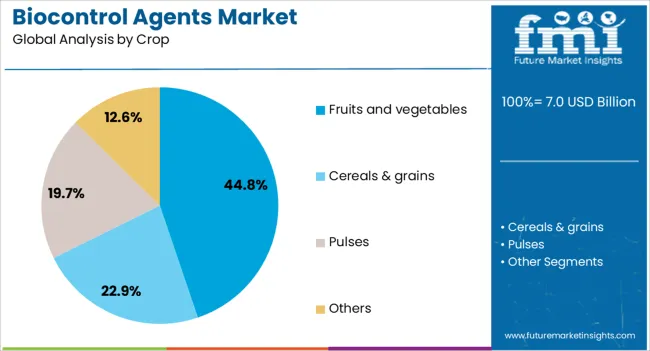

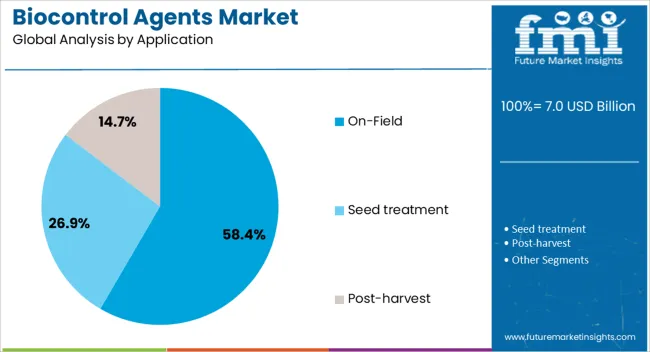

The biocontrol agents market is segmented by active substance, crop, application, and geographic regions. By active substance, biocontrol agents market is divided into Microbials, Macro-organisms, and Bio-chemicals. In terms of crop, biocontrol agents market is classified into Fruits and vegetables, Cereals & grains, Pulses, and Others. Based on application, biocontrol agents market is segmented into On-Field, Seed treatment, and Post-harvest. Regionally, the biocontrol agents industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The microbials segment is projected to account for 52.6% of the biocontrol agents market revenue in 2025, maintaining its position as the leading active substance category. This dominance has been driven by the broad-spectrum pest control capability of microbial agents, including bacteria, fungi, and viruses, which target specific pests without harming beneficial organisms or the environment.

Advances in strain selection, fermentation technologies, and formulation processes have improved the efficacy and stability of microbial products, enabling their use across diverse climatic conditions. Regulatory approvals for microbials have generally been faster and less complex than for synthetic chemicals, accelerating their commercial availability.

Furthermore, microbials have gained strong acceptance among organic and conventional farmers seeking to integrate biological solutions into IPM programs. With ongoing research into novel microbial strains and delivery systems, this segment is expected to sustain its growth and market leadership.

The fruits and vegetables segment is projected to contribute 44.8% of the biocontrol agents market revenue in 2025, holding the largest share among crop categories. This growth has been influenced by the high economic value of these crops and their sensitivity to pest infestations, which can significantly reduce yield and quality.

Consumer demand for pesticide-free and organic produce has further strengthened the adoption of biocontrol agents in this segment. Export-oriented fruit and vegetable production requires compliance with stringent residue limits, making biological pest control an essential practice.

Research and extension programs have promoted the targeted use of biocontrol agents to address crop-specific pest challenges, improving farmer confidence in their effectiveness. With the increasing cultivation of high-value horticultural crops globally, the fruits and vegetables segment is expected to remain a primary driver of demand for biocontrol solutions.

The on-field segment is projected to represent 58.4% of the biocontrol agents market revenue in 2025, establishing itself as the dominant application mode. This segment’s strength is attributed to the preventive and curative role of biocontrol agents in managing pests during the active growth cycle of crops.

Application methods such as foliar sprays, soil treatments, and seed coatings have been widely adopted to maximize pest suppression and crop resilience. On-field use enables timely intervention, reducing the need for post-harvest treatments and chemical inputs.

Government-supported training programs and farmer awareness initiatives have encouraged the integration of biocontrol agents into routine agricultural practices. Additionally, the scalability and adaptability of on-field applications across varied farm sizes and geographies have enhanced their adoption. As sustainability pressures and pest resistance challenges intensify, the on-field segment is expected to remain the preferred application approach for biocontrol agents.

The biocontrol agents market is experiencing significant growth driven by the demand for organic farming practices and integrated pest management systems. Opportunities are abundant in regions promoting organic agriculture, while trends highlight a shift toward sustainable pest control solutions. However, challenges such as high costs and limited awareness remain. The market is set to expand as more farmers adopt biocontrol agents for their environmentally friendly and cost-effective pest management capabilities, aligning with global shifts towards healthier and safer agricultural practices.

The biocontrol agents market is expanding due to the increasing demand for organic and chemical-free agricultural practices. As consumers demand safer, pesticide-free food, farmers are turning to biocontrol agents as an effective solution to combat pests and diseases. These agents, including natural predators, parasites, and microbial products, provide targeted, eco-friendly pest management, reducing the reliance on synthetic chemicals. This shift in farming practices is fueling the market, especially in regions with growing awareness about the health and environmental impact of conventional pesticides.

Significant opportunities exist in markets with expanding organic agriculture initiatives. With rising consumer preference for organic produce, the demand for biocontrol agents is poised for rapid growth. In particular, regions like North America, Europe, and parts of Asia are focusing on transitioning to organic farming methods, creating a lucrative market for biocontrol solutions. Partnerships between biocontrol manufacturers and farming cooperatives are enabling broader adoption, addressing the challenges of pest management in organic crop production. The market is expected to thrive as organic farming initiatives expand globally.

A clear trend in the biocontrol agents market is the shift towards integrated pest management (IPM) systems. These systems combine biocontrol agents with other sustainable farming practices, enhancing pest control while reducing the environmental footprint of agriculture. Farmers are adopting these IPM systems for their long-term effectiveness, cost savings, and improved crop yields. As regulatory frameworks tighten around chemical pesticide use, the trend towards biocontrol agents integrated within IPM strategies is expected to grow, promoting widespread adoption across diverse agricultural sectors.

The biocontrol agents market faces challenges such as high production costs and limited awareness among farmers, especially in developing regions. While biocontrol agents offer long-term benefits, their initial cost can be higher than traditional chemical pesticides, posing a barrier for budget-conscious farmers. Furthermore, a lack of knowledge about biocontrol methods and their benefits in pest management hinders their widespread adoption. Manufacturers are working to address these challenges by offering cost-effective solutions and increasing educational outreach to farmers, promoting the long-term advantages of biocontrol agents.

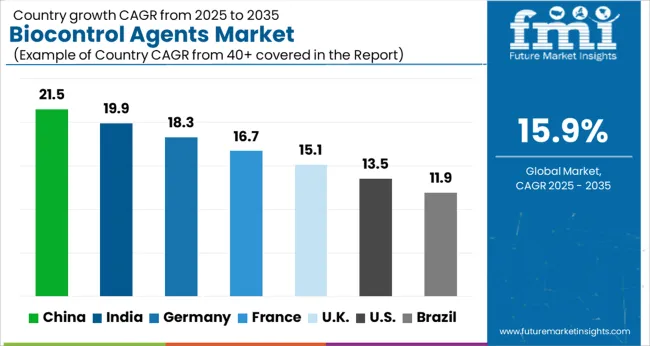

| Country | CAGR |

|---|---|

| China | 21.5% |

| India | 19.9% |

| Germany | 18.3% |

| France | 16.7% |

| UK | 15.1% |

| USA | 13.5% |

| Brazil | 11.9% |

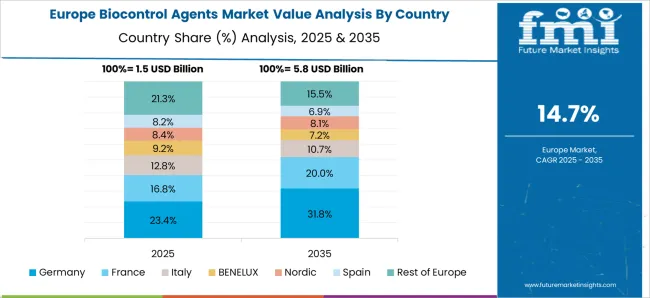

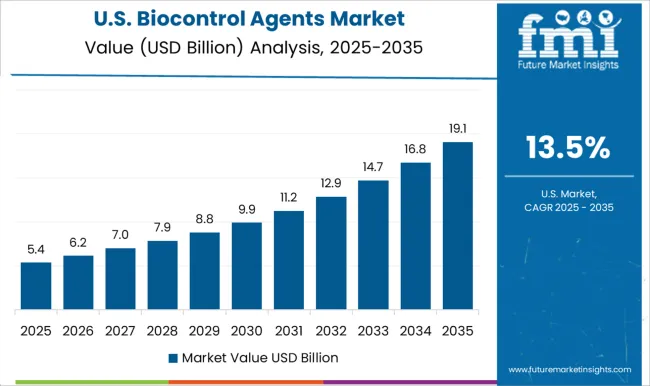

The global biocontrol agents market is projected to grow at a CAGR of 15.9% from 2025 to 2035. China leads with a growth rate of 21.5%, followed by India at 19.9% and Germany at 18.3%. The United Kingdom records a growth rate of 15.1%, while the United States shows the slowest growth at 13.5%. The growth of the market is fueled by the increasing demand for organic farming practices, government regulations promoting sustainable pest control solutions, and consumer preference for eco-friendly products. Emerging economies like China and India are experiencing higher growth due to rapid agricultural expansion and government support for sustainable agriculture practices, while developed markets such as the USA, UK, and Germany focus on innovation, regulatory compliance, and increased adoption of biocontrol agents in agriculture. This report includes insights on 40+ countries; the top markets are shown here for reference.

The biocontrol agents market in China is projected to grow at a CAGR of 21.5%. China’s agricultural sector is witnessing a rapid shift toward sustainable farming practices, with biocontrol agents being increasingly adopted for pest management. Government policies supporting eco-friendly agricultural solutions and growing concerns over pesticide residues are accelerating the adoption of biocontrol agents. With expanding farming operations and increasing demand for organic produce, China is witnessing a surge in demand for natural pest control products. This trend is further driven by advancements in biotechnology and the growing preference for non-chemical solutions in crop protection.

The biocontrol agents market in India is expected to grow at a CAGR of 19.9%. India’s agricultural sector is increasingly adopting biocontrol agents as part of the broader movement toward sustainable and organic farming practices. With the country’s large agricultural base and focus on increasing productivity, the demand for natural pest management solutions is growing. The government’s initiatives promoting organic farming and the rising awareness about the harmful effects of chemical pesticides are key factors driving the adoption of biocontrol agents in India. Additionally, growing exports of organic produce are boosting market growth.

The biocontrol agents market in Germany is projected to grow at a CAGR of 18.3%. Germany’s strong commitment to sustainability and eco-friendly agricultural practices is driving the demand for biocontrol agents. The growing popularity of organic farming and strict regulations regarding pesticide usage in the country are contributing to market expansion. German farmers are increasingly adopting biocontrol agents to manage pests while meeting consumer demand for chemical-free produce. Research and innovation in biotechnology, along with government subsidies for sustainable agriculture, are expected to further support the adoption of biocontrol agents in the country.

The biocontrol agents market in the United Kingdom is expected to grow at a CAGR of 15.1%. The UK is witnessing an increasing shift toward organic farming, with a growing preference for biocontrol agents as part of integrated pest management (IPM) systems. Strong consumer demand for pesticide-free food products and rising concerns over the environmental impact of traditional pest control methods are driving market expansion. Furthermore, government regulations and subsidies for organic farming are expected to support the adoption of biocontrol agents in the coming years.

The biocontrol agents market in the United States is projected to grow at a CAGR of 13.5%. The USA market is supported by increasing awareness of the environmental and health risks associated with chemical pesticides. The demand for biocontrol agents is growing as farmers seek sustainable, chemical-free pest control solutions. The country’s regulatory environment, which encourages the adoption of sustainable agricultural practices, along with increasing demand for organic products, further drives the market. Research and development in biotechnology, along with the integration of biocontrol solutions in precision agriculture, are expected to support market growth in the USA

The biocontrol agents market is highly competitive, with leading players focusing on effective pest control solutions that are both environmentally friendly and economically viable. Andermatt Biocontrol, BASF, and Biobest dominate with brochures highlighting their innovative biocontrol products for integrated pest management. Their marketing materials emphasize natural pest suppression, minimal chemical residues, and compatibility with organic farming. Bioworks, CBC, and Certis stand out by offering advanced microbial and biochemical formulations tailored for various crops, with brochures showcasing their products' ability to reduce pest populations while supporting plant health and soil biodiversity. Other players like Cropscience Bayer, Isagro, Koppert Biological Systems, and Marrone Bio Innovations focus on region-specific solutions, highlighting the effectiveness of their products in local farming conditions and their commitment to sustainability. Brochures from these companies emphasize high efficiency, regulatory compliance, and integration into current farming practices. The competition is driven by product efficacy, formulation flexibility, and eco-friendliness, with brochures serving as essential tools for educating distributors and farmers on the benefits of biocontrol agents. Through their brochures, these companies differentiate themselves by positioning their products as safer, more sustainable alternatives to traditional chemical pesticides, while also enhancing crop yields.

| Item | Value |

|---|---|

| Quantitative Units | USD 7.0 Billion |

| Active Substance | Microbials, Macro-organisms, and Bio-chemicals |

| Crop | Fruits and vegetables, Cereals & grains, Pulses, and Others |

| Application | On-Field, Seed treatment, and Post-harvest |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Andermatt Biocontrol, Basf, Biobest, Bioworks, Cbc, Certis, Cropscience Bayer, Isagro, Koppert Biological Systems, Marrone Bio Innovations, Novozymes, Nufarm, Syngenta, and Valent Bioscience |

| Additional Attributes | Dollar sales by agent type (microbial, biochemical, natural enemies) and application (agriculture, horticulture, forestry, turf management) are key metrics. Trends include rising demand for sustainable pest management solutions, growth in organic farming, and increasing adoption of eco-friendly alternatives to chemical pesticides. Regional adoption, regulatory approvals, and technological innovations are driving market growth. |

The global biocontrol agents market is estimated to be valued at USD 7.0 billion in 2025.

The market size for the biocontrol agents market is projected to reach USD 30.4 billion by 2035.

The biocontrol agents market is expected to grow at a 15.9% CAGR between 2025 and 2035.

The key product types in biocontrol agents market are microbials, _bacteria, _fungi, _virus, _protozoa, _yeast, _others, macro-organisms, _insects, _mites, _nematodes, _others, bio-chemicals, _semio-chemicals, _plant extracts, _plant growth regulators, _organic acids and _minerals.

In terms of crop, fruits and vegetables segment to command 44.8% share in the biocontrol agents market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA