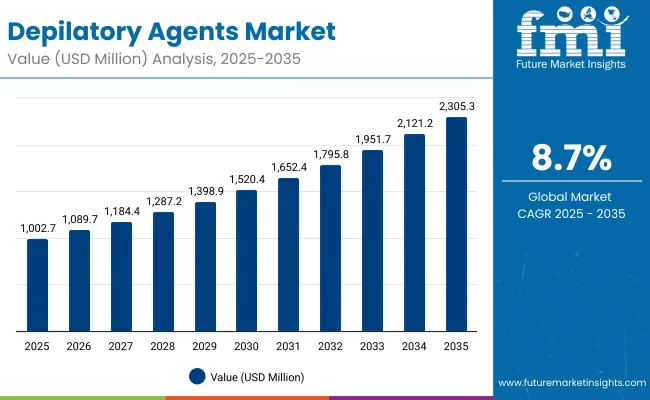

The Depilatory Agents Market is expected to record a valuation of USD 1,002.7 million in 2025 and USD 2,305.3 million in 2035, with an increase of USD 1,302.6 million, which equals a growth of ≈130% over the decade. The overall expansion represents a CAGR of 8.7% and a 2.3X increase in market size.

Depilatory Agents Market Key Takeaways

| Metric | Value |

|---|---|

| Depilatory Agents Market Estimated Value in (2025E) | USD 1,002.7 million |

| Depilatory Agents Market Forecast Value in (2035F) | USD 2,305.3 million |

| Forecast CAGR (2025 to 2035) | 8.7% |

During the first five-year period from 2025 to 2030, the market increases from USD 1,002.7 million to USD 1,520.4 million, adding USD 517.7 million, which accounts for 39.7% of the total decade growth. This phase records steady adoption in automotive prototyping, aerospace design, and healthcare imaging, driven by the need for precision. Short-range scanners dominate this period as they cater to over 50% of industrial applications requiring micron-level accuracy.

The second half from 2030 to 2035 contributes USD 784.9 million, equal to 60.3% of total growth, as the market jumps from USD 1,520.4 million to USD 2,305.3 million. This acceleration is powered by widespread deployment of digital twins, AI-based inspection systems, and robotics-driven scanning in smart factories. Long-range and mid-range scanners together capture a larger share above 50% by the end of the decade. Software-led analytics and cloud platforms add recurring revenue, increasing the software share beyond 20% in total value.

From 2020 to 2024, the Depilatory Agents Market grew steadily, with global value sales rising toward the USD 1 billion mark by 2025. During this period, the competitive landscape was dominated by chemical manufacturers and formulation specialists controlling the majority of revenue, with leaders such as Solvay, BASF, and Lubrizol focusing on keratin-breaking actives and thioglycolate systems.

Competitive differentiation relied on ingredient efficacy, skin safety, and cost efficiency, while soothing post-depilatory systems were often positioned as auxiliary offerings rather than primary revenue drivers. Service-driven models, such as subscription-based salon programs, contributed less than 10% of the total market value.

Demand for Depilatory Agents will expand to USD 1,002.7 million in 2025 and further to USD 2,305.3 million by 2035, with the revenue mix shifting as botanical inhibitors, enzyme-based systems, and soothing agents grow their share. Traditional keratin-breaking actives still lead, but face rising competition from clean-label, dermatologically tested, and men’s grooming-focused products.

Major incumbents are pivoting to hybrid strategies, integrating natural formulations, digital marketing, and personalized regimens to retain relevance. Emerging entrants specializing in sustainable sourcing, AR/VR-enabled product visualization, and AI-personalized skincare platforms are gaining share. The competitive advantage is moving away from chemical formulation strength alone toward ecosystem presence, brand partnerships, and recurring revenue models.

Consumers are increasingly shifting toward at-home depilatory products such as creams, gels, and sprays due to convenience, affordability, and time savings compared to professional salon treatments. The COVID-19 pandemic further accelerated this shift, and the trend continues as busy urban consumers prioritize DIY grooming.

Expansion of men’s grooming, product personalization, and dermatologist-tested sensitive-skin formulations have broadened adoption, creating steady demand across diverse demographics and boosting sales worldwide.

Advancements in depilatory formulationssuch as enzyme-based systems, botanical inhibitors, and post-depilatory soothing agentsare addressing consumer concerns around skin irritation, odor, and harsh chemical effects. Clean-label, vegan, and dermatologically approved claims are driving stronger adoption among health-conscious and eco-aware consumers.

Global brands are focusing on sustainable sourcing and cruelty-free certification, while regional players are tapping into natural ingredient positioning. These innovations are not only improving efficacy and safety but also enabling premiumization and higher repeat purchase rates.

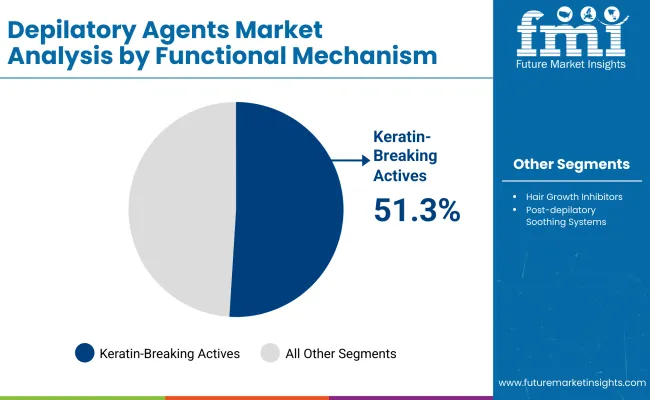

The Depilatory Agents Market is segmented by functional mechanism, ingredient type, delivery system, physical form, application, end use, and region. By functional mechanism, key categories include keratin-breaking actives, hair growth inhibitors, and post-depilatory soothing systems, addressing both hair removal and aftercare needs.

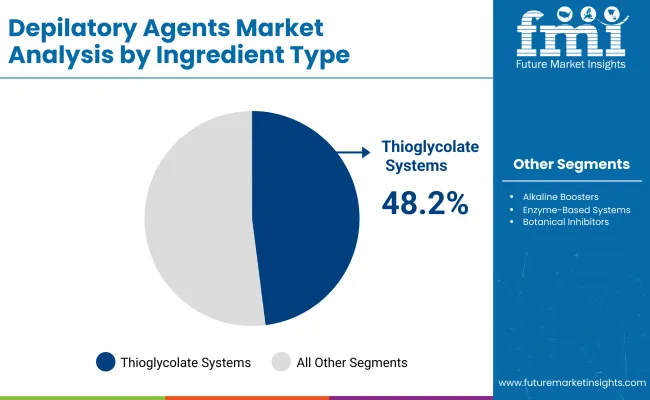

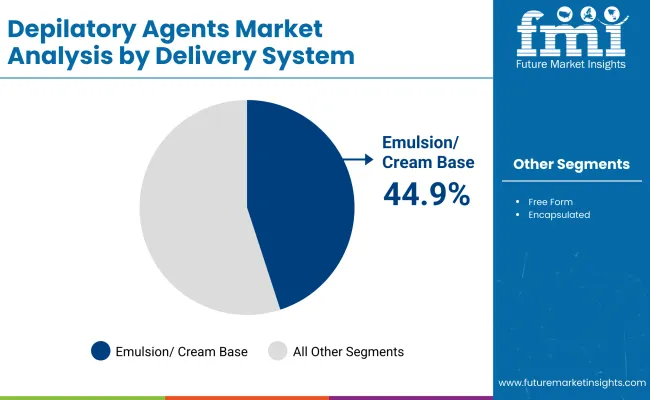

Ingredient types span thioglycolate systems, alkaline boosters, enzyme-based systems, and botanical inhibitors, reflecting innovation toward efficacy and skin safety. Delivery systems are classified into free form, emulsion/cream base, and encapsulated formats, while physical forms include creams/gels, foams/aerosols, and lotions/roll-ons.

Applications cover at-home depilatory creams, professional salon treatments, and men’s grooming, catering to diverse consumer segments. End uses range from mass personal care and dermocosmetic lines to professional salon/spa channels, driving broad market penetration. Regionally, the market spans North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa, with high growth potential in China, India, and Japan due to rising disposable incomes and evolving grooming preferences.

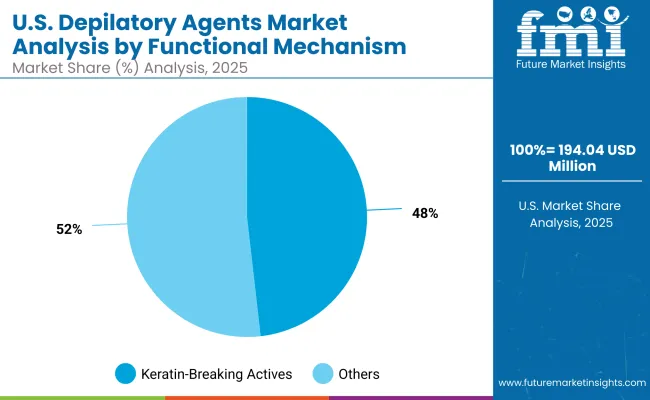

| Functional Mechanism | Value Share % 2025 |

|---|---|

| Keratin-breaking actives | 51.3% |

| Others | 48.7% |

The keratin-breaking actives segment is projected to contribute 51.3% of the Depilatory Agents Market revenue in 2025, maintaining its lead as the dominant functional mechanism category. This growth is fueled by the proven efficacy of thioglycolate-based systems, which remain widely adopted in mass personal care and professional salon products. Consumers prefer these actives for their ability to deliver fast and reliable results, supporting repeat purchases across both at-home and professional applications.

The segment’s expansion is also reinforced by innovations that reduce skin irritation and odor, making formulations more suitable for sensitive-skin users. As botanical inhibitors and enzyme-based systems gain traction, keratin-breaking actives are increasingly being combined with soothing agents to strengthen positioning in premium product lines. Despite emerging alternatives, keratin-breaking actives are expected to remain the backbone of depilatory agents due to their efficiency and established consumer trust.

| Ingredient Type | Value Share % 2025 |

|---|---|

| Thioglycolate systems | 48.2% |

| Others | 51.8% |

The thioglycolate systems segment is forecasted to hold 48.2% of the market share in 2025, driven by its effectiveness as the most widely adopted active ingredient in depilatory formulations. These systems are favored for their strong keratin-dissolving properties, enabling rapid and reliable hair removal across mass-market creams, gels, and lotions. Their long-standing presence in personal care routines has strengthened consumer trust and brand loyalty.

The segment’s growth is reinforced by advancements in stabilizing agents and pH-balanced boosters that enhance skin tolerance and minimize irritation. In addition, manufacturers are innovating with hybrid solutions that blend thioglycolate with soothing botanicals, positioning products for sensitive-skin consumers and premium segments.

While enzyme-based and botanical inhibitors are gaining momentum, thioglycolate systems remain the backbone of the depilatory industry, expected to sustain dominance due to their proven performance and scalability.

| Delivery System | Value Share % 2025 |

|---|---|

| Emulsion/cream base | 44.9% |

| Others | 55.1% |

The emulsion/cream base segment is projected to account for 44.9% of the Depilatory Agents Market revenue in 2025, establishing it as one of the leading delivery system categories. This format is preferred for its ease of application, even distribution, and compatibility with a wide range of depilatory actives, including thioglycolates and botanical inhibitors. Its ability to deliver consistent results while maintaining skin hydration has strengthened its adoption across mass personal care and salon treatments.

Developments in emulsion technology, such as encapsulated soothing agents and pH-balancing stabilizers, have enhanced user comfort by reducing irritation and odor typically associated with traditional depilatories. Furthermore, cream-based systems are highly adaptable, supporting product diversification into sensitive-skin variants and men’s grooming lines. Given their balance of performance, accessibility, and consumer familiarity, emulsion/cream bases are expected to retain a dominant role in the Depilatory Agents Market over the coming decade.

Growing Preference for At-home Grooming Solutions

Consumers are increasingly seeking convenient, affordable, and effective at-home depilatory products such as creams, gels, and sprays. Rising urbanization, busy lifestyles, and the desire to reduce reliance on professional salon treatments have fueled this trend.

The pandemic accelerated the adoption of do-it-yourself grooming, and the habit has persisted with consumers valuing privacy and cost savings. Brands are responding with dermatologist-tested, sensitive-skin friendly products, expanding accessibility across age groups and genders. This shift toward self-care routines is a key driver boosting global depilatory agent demand.

Innovation in Clean-label and Botanical Formulations

Product innovation is reshaping consumer preferences in the depilatory agents market. Shoppers increasingly prioritize clean-label, vegan, and cruelty-free products that emphasize safety and sustainability. Botanical inhibitors, enzyme-based systems, and soothing actives such as aloe vera and chamomile are gaining traction as alternatives or complements to traditional thioglycolates.

This not only addresses irritation concerns but also appeals to eco-conscious buyers. By integrating natural claims, sustainable sourcing, and dermatological approval, brands are moving up the value chain. These innovations strengthen consumer trust, enable premium pricing, and contribute significantly to long-term market growth.

Concerns over Skin Irritation and Chemical Exposure

Despite strong demand, consumer concerns over skin irritation, odor, and long-term exposure to chemicals like thioglycolates remain significant restraints. Sensitive-skin consumers, in particular, often avoid depilatory creams due to risks of redness, burning, or allergic reactions. Negative reviews and online discussions amplify these concerns, pushing some users toward mechanical hair removal or natural alternatives.

Regulatory scrutiny around ingredient safety and labeling further intensifies the challenge. Unless addressed through innovation in formulations, transparency in claims, and dermatologist-backed testing, these barriers could limit adoption and slow the pace of market penetration in certain demographics.

Expansion of Men’s Grooming and Personalization

The men’s grooming category is emerging as a significant growth trend in the depilatory agents market. Men are increasingly using depilatory creams and gels for body grooming, sports-related hair removal, and convenience compared to shaving or waxing. Brands are launching male-focused products with stronger formulations, masculine fragrances, and packaging tailored for this demographic.

At the same time, personalization through AI-driven skin assessments and subscription-based regimens is gaining traction. This dual trend of gender-specific expansion and personalized care is reshaping the competitive landscape, unlocking new revenue streams, and diversifying the traditional female-centric base of the industry.

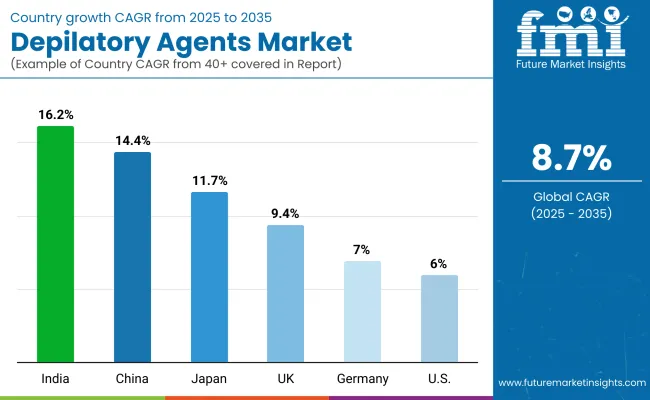

| Country | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 14.4% |

| USA | 6.0% |

| India | 16.2% |

| UK | 9.4% |

| Germany | 7.0% |

| Japan | 11.7% |

The global Depilatory Agents Market shows notable regional disparities in growth, strongly shaped by cultural grooming practices, consumer awareness, and regulatory environments. Asia-Pacific emerges as the fastest-growing region, led by India at 16.2% CAGR and China at 14.4% CAGR. India’s rapid rise reflects increasing adoption of affordable at-home depilatory creams, a booming men’s grooming segment, and growing urban middle-class spending. China’s trajectory is supported by expanding demand for premium, clean-label formulations and strong online retail penetration.

Europe maintains a robust growth profile, with the UK at 9.4% CAGR and Germany at 7.0% CAGR, driven by high grooming product penetration, strong salon cultures, and consumer demand for dermatologically tested, sustainable depilatory solutions. Stringent EU cosmetic safety regulations also boost trust and adoption of innovative formulations.

Japan demonstrates solid growth at 11.7% CAGR, reflecting a cultural preference for smooth skin, coupled with innovations in enzyme-based and sensitive-skin-friendly products. North America shows moderate expansion, with the USA at 6.0% CAGR, reflecting a mature grooming market with established consumer routines. Growth is fueled less by mass-market expansion and more by premiumization, subscription models, and digital marketing strategies. The region also sees strong demand for men’s grooming and multifunctional formulations combining hair removal with skin-soothing benefits.

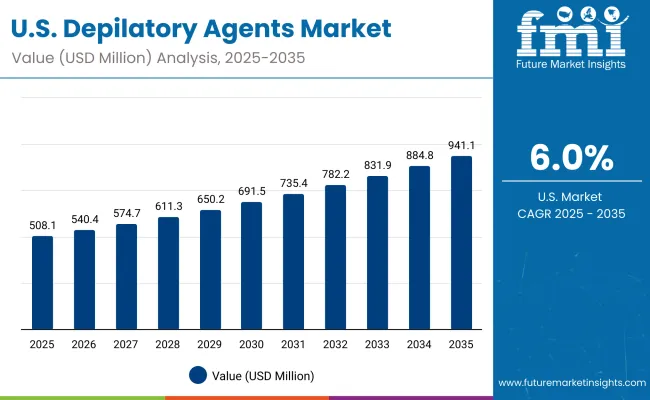

| Year | USA Depilatory Agents Market (USD Million) |

|---|---|

| 2025 | 194.04 |

| 2026 | 208.41 |

| 2027 | 223.85 |

| 2028 | 240.44 |

| 2029 | 258.25 |

| 2030 | 277.39 |

| 2031 | 297.94 |

| 2032 | 320.01 |

| 2033 | 343.72 |

| 2034 | 369.19 |

| 2035 | 396.54 |

The Depilatory Agents Market in the United States is projected to grow at a CAGR of 6.0% (2025 to 2035), supported by evolving grooming habits and increasing adoption of convenient at-home hair removal solutions. The rise of sensitive-skin friendly and dermatologist-tested formulations is broadening consumer bases, while subscription-driven direct-to-consumer models are reshaping sales channels.

Growth is further supported by the expansion of men’s grooming products, which now account for a notable share of launches. Premiumization trends, with a focus on clean-label, vegan, and multifunctional depilatory creams, are creating strong opportunities for both multinational brands and niche innovators.

The Depilatory Agents Market in the United Kingdom is expected to grow at a CAGR of 9.4% (2025 to 2035), supported by strong demand for premium grooming solutions and rising interest in dermatologically tested formulations. Consumers in the UK show high adoption of at-home depilatory creams and gels, driven by convenience and cost efficiency compared to salon treatments. Growth is further reinforced by the expansion of men’s grooming lines, reflecting changing cultural attitudes and marketing campaigns emphasizing personal care across demographics.

In addition, demand for vegan, fragrance-free, and sensitive-skin certified depilatory products is expanding rapidly, aligned with the UK’s strong preference for clean-label beauty. E-commerce platforms and subscription-based distribution models are playing a crucial role in capturing younger consumers, who value both convenience and product personalization.

India is witnessing rapid growth in the Depilatory Agents Market, which is forecast to expand at a CAGR of 16.2% through 2035, making it one of the fastest-growing markets globally. Rising urbanization, increasing disposable incomes, and the growing influence of social media are accelerating grooming adoption, particularly in tier-2 and tier-3 cities where awareness is expanding quickly. Affordable product launches by multinational and domestic brands are creating mass-market access, while demand for sensitive-skin and herbal formulations resonates strongly with Indian consumers.

The men’s grooming category is gaining traction, driven by changing cultural norms and sports or lifestyle trends. Educational campaigns around hygiene and beauty, often promoted by e-commerce platforms, are further boosting product penetration. With India’s young demographic base and openness to personal care innovations, the country is positioned as a key growth hub for depilatory agents.

The Depilatory Agents Market in China is expected to grow at a CAGR of 14.4% (2025 to 2035), the highest among leading economies. This momentum is fueled by rapid urbanization, expanding middle-class incomes, and rising beauty consciousness among both men and women. Affordable depilatory creams, gels, and sprays launched by domestic firms are enabling mass adoption across urban and semi-urban markets. The strong influence of K-beauty and J-beauty trends is shaping consumer expectations, driving demand for clean-label, fragrance-free, and sensitive-skin certified formulations.

China’s thriving e-commerce ecosystem, supported by platforms like Tmall and JD.com, is also boosting penetration by making a wide variety of depilatory products available nationwide. Younger consumers are increasingly influenced by digital marketing campaigns on Douyin (TikTok) and Xiaohongshu, which amplify brand visibility and product experimentation.

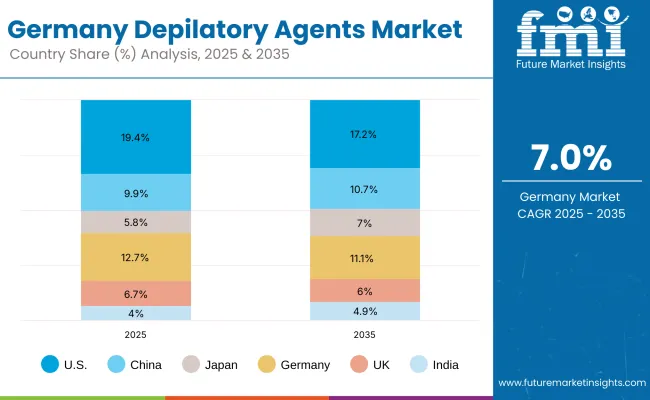

| Country | 2025 Share (%) |

|---|---|

| USA | 19.4% |

| China | 9.9% |

| Japan | 5.8% |

| Germany | 12.7% |

| UK | 6.7% |

| India | 4.0% |

| Country | 2035 Share (%) |

|---|---|

| USA | 17.2% |

| China | 10.7% |

| Japan | 7.0% |

| Germany | 11.1% |

| UK | 6.0% |

| India | 4.9% |

The Depilatory Agents Market in Germany is projected to grow at a CAGR of 7.0% (2025 to 2035), underpinned by its leadership in the European personal care and cosmetics industry. German consumers are highly quality-conscious, driving demand for dermatologist-tested, fragrance-free, and sensitive-skin depilatory formulations. Regulatory compliance under EU cosmetic safety standards ensures strong consumer trust, while sustainability initiatives are encouraging the use of eco-friendly packaging and clean-label ingredients.

The professional salon and spa sector continues to play a pivotal role, with growing use of depilatory creams and gels as quicker, less painful alternatives to waxing. At the same time, men’s grooming and premiumization trends are shaping product innovation, supported by digital campaigns and rising e-commerce penetration.

| USA By Functional Mechanism | Value Share % 2025 |

|---|---|

| Keratin-breaking actives | 48.2% |

| Others | 51.8% |

The Depilatory Agents Market in the United States is projected to grow steadily, reaching USD 194.04 million in 2025 and expanding at a CAGR of 6.0% through 2035. Growth is primarily driven by consumer demand for at-home depilatory creams and gels, with keratin-breaking actives holding a significant 48.2% share in 2025. However, the market is also experiencing a surge in demand for botanical inhibitors and sensitive-skin alternatives, which are broadening adoption beyond traditional segments.

Premiumization is accelerating, with brands emphasizing vegan, dermatologist-tested, and fragrance-free claims, while men’s grooming continues to emerge as a growth engine. E-commerce platforms and subscription-based delivery models are reshaping buying behavior, making depilatory products more accessible and personalized for USA consumers.

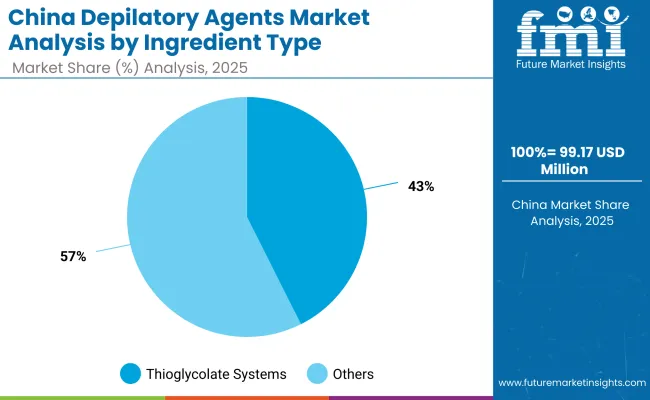

| China By Ingredient Type | Value Share % 2025 |

|---|---|

| Thioglycolate systems | 42.6% |

| Others | 57.4% |

The Depilatory Agents Market in China presents strong opportunities, projected to grow at a CAGR of 14.4% (2025 to 2035), supported by a rapidly expanding consumer base and rising disposable incomes. The dominance of thioglycolate systems at 42.6% highlights their entrenched role in fast-acting depilatory creams and gels. However, the larger 57.4% share of alternative ingredients signals growing opportunities for enzyme-based and botanical formulations, which cater to consumer demand for clean-label, sensitive-skin, and eco-friendly products.

China’s e-commerce landscape provides significant leverage for international and domestic brands to reach younger demographics, where social media platforms such as Douyin and Xiaohongshu amplify beauty trends and accelerate product adoption. Premium opportunities also exist in men’s grooming and dermatologist-endorsed sensitive-skin lines, both of which are gaining rapid traction.

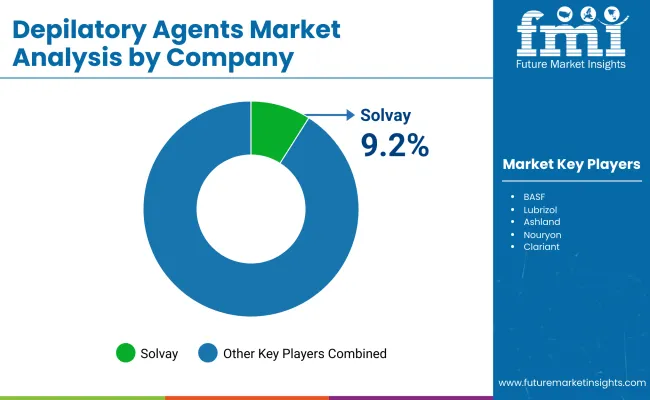

| Company | Global Value Share 2025 |

|---|---|

| Solvay | 9.2% |

| Others | 90.8% |

The Depilatory Agents Market is moderately fragmented, with multinational chemical companies, mid-sized formulation specialists, and niche-focused personal care innovators competing across diverse applications. Global leaders such as Solvay, BASF, and Lubrizol hold notable market share, driven by their strong portfolios in thioglycolate systems, alkaline boosters, and keratin-breaking actives. Their strategies increasingly emphasize clean-label formulations, botanical actives, and sustainable sourcing, aligning with consumer demand for safe and eco-friendly products.

Mid-sized players including Clariant, Croda, and Evonik are differentiating through enzyme-based depilatory systems and sensitive-skin soothing agents, targeting dermocosmetic and premium personal care lines. These firms leverage partnerships with beauty brands and retailers to accelerate adoption in both at-home and salon-based applications. Specialized providers such as Nouryon, Seppic, and Arxada focus on niche markets including men’s grooming, herbal depilatories, and dermatologically tested formulations. Their strength lies in customization, regulatory compliance, and agile innovation rather than global scale.

Competitive differentiation is shifting away from traditional thioglycolate dominance toward integrated portfolios combining natural actives, soothing complexes, and multifunctional products. Players that balance performance with safety, sustainability, and consumer trust are expected to lead market expansion.

Key Developments in Depilatory Agents Market

| Item | Value |

|---|---|

| Quantitative Units | USD 1,002.7 Million |

| Functional Mechanism | Keratin-breaking actives, Hair growth inhibitors, Post-depilatory soothing systems |

| Ingredient Type | Thioglycolate systems, Alkaline boosters, Enzyme-based systems, Botanical inhibitors |

| Delivery System | Free form, Emulsion/cream base, Encapsulated |

| Physical Form | Cream/gel, Foam/aerosol, Lotion/roll-on |

| Application | At-home depilatory creams, Professional salon treatments, Men’s grooming |

| End Use | Mass personal care, Professional salon/spa, Dermocosmetic |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Solvay, BASF, Lubrizol, Ashland, Clariant , Croda , Evonik , Nouryon , Seppic , Arxada |

| Additional Attributes | Dollar sales by functional mechanism and ingredient type, adoption trends in at-home creams and professional salon treatments, rising demand for men’s grooming depilatories, sector-specific growth in mass personal care and dermocosmetic lines, product revenue segmentation by delivery system and physical form, integration of clean-label and dermatologist-tested claims, regional trends influenced by evolving beauty standards and e-commerce penetration, and innovations in thioglycolate , enzyme-based, and botanical inhibitor formulations. |

The global Depilatory Agents Market is estimated to be valued at USD 1,002.7 million in 2025.

The market size for the Depilatory Agents Market is projected to reach USD 2,305.3 million by 2035.

The Depilatory Agents Market is expected to grow at a 8.7% CAGR between 2025 and 2035.

The key physical forms in the Depilatory Agents Market are creams/gels, foams/aerosols, and lotions/roll-ons.

In terms of ingredient type, thioglycolate systems are projected to command a 48.2% share of the Depilatory Agents Market in 2025, making them the leading segment.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Depilatory Hair Removal Creams Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Matting Agents Market Size and Share Forecast Outlook 2025 to 2035

Healing Agents Market (Skin Repair & Soothing Actives) Market Size and Share Forecast Outlook 2025 to 2035

Foaming Agents Market Size and Share Forecast Outlook 2025 to 2035

Firming Agents Botox-Like Market Size and Share Forecast Outlook 2025 to 2035

Heating Agents Market Size and Share Forecast Outlook 2025 to 2035

Cooling Agents Market Size and Share Forecast Outlook 2025 to 2035

Firming Agents Market Growth – Product Innovations & Applications from 2025 to 2035

Raising Agents Market Trends – Growth & Industry Forecast 2024 to 2034

Weighing Agents Market Size and Share Forecast Outlook 2025 to 2035

Draining Agents Market Size and Share Forecast Outlook 2025 to 2035

Flatting Agents Market Size and Share Forecast Outlook 2025 to 2035

Clouding Agents Market Trends - Growth Factors & Industry Analysis

Cognitive Agents Market Size and Share Forecast Outlook 2025 to 2035

Anti-Acne Agents Market Size and Share Forecast Outlook 2025 to 2035

Flavoring Agents Market Size and Share Forecast Outlook 2025 to 2035

Leavening Agents Market Analysis - Size, Growth, and Forecast 2025 to 2035

Market Share Breakdown of Anti-Slip Agents Manufacturers

Coalescing Agents Market Size and Share Forecast Outlook 2025 to 2035

Mattifying Agents Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA