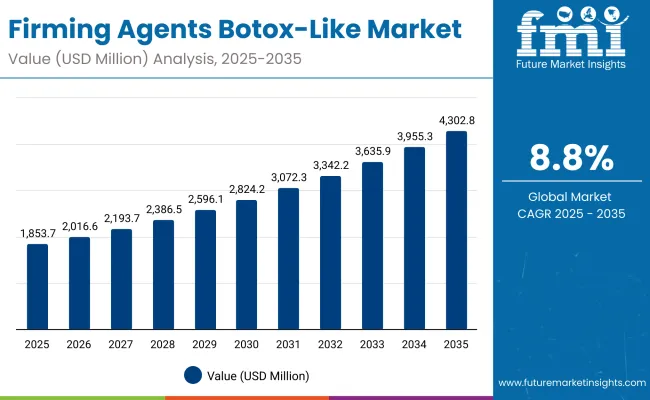

A valuation of USD 1,853.7 million has been projected for the global Firming Agents Botox-like market in 2025, which is forecasted to reach USD 4,302.8 million by 2035. This expansion reflects an absolute growth of USD 2,449.1 million over the decade, corresponding to a CAGR of 8.8%. A near 2.3X increase in market value is anticipated during this period, underscoring the rising adoption of functional raw materials across advanced cosmetic and cosmeceutical formulations.

Firming Agents Botox-Like Market Key Takeaways

| Metric | Value |

|---|---|

| Firming Agents Botox-Like Market Estimated Value in (2025E) | USD 1,853.7 million |

| Firming Agents Botox-Like Market Forecast Value in (2035F) | USD 4,302.8 million |

| Forecast CAGR (2025 to 2035) | 8.80% |

Between 2025 and 2030, the market is expected to grow from USD 1,853.7 million to USD 2,824.2 million, generating USD 970.5 million in incremental revenue. This first phase is projected to account for nearly 40% of the decade’s total growth, highlighting steady uptake as skincare formulators integrate clinically validated anti-aging actives.

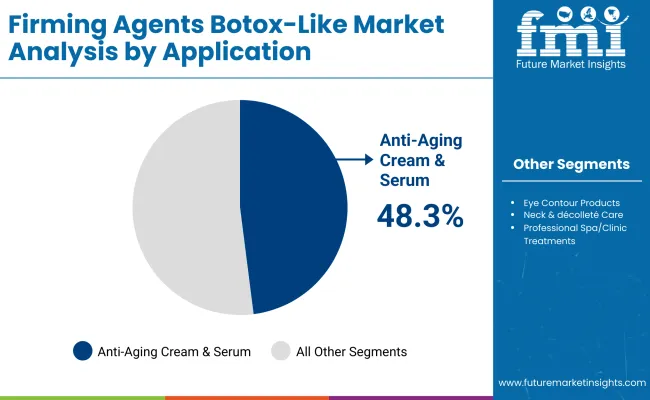

Muscle relaxation mechanisms are set to dominate with a 57.6% share in 2025, reinforcing their relevance in formulations offering rapid wrinkle-smoothing claims. Anti-aging creams and serums are anticipated to capture 48.3% of demand in 2025, reflecting strong consumer preference for multifunctional daily-use solutions.

The second half of the decade, from 2030 to 2035, is expected to add USD 1,478.6 million, equivalent to 60% of total growth, with the market advancing from USD 2,824.2 million to USD 4,302.8 million. This acceleration is projected to be supported by premium skincare adoption across emerging economies, increased penetration of encapsulated actives for enhanced bioavailability, and strong traction in China and India, which together will drive the highest CAGR levels globally.

From 2020 to 2024, the firming agents and botox-like market was shaped by the steady inclusion of functional peptides and bioactive compounds in cosmeceutical and professional formulations. Growth during this phase was anchored by ingredient-driven innovation, with suppliers focusing on efficacy validation and delivery system improvements. Competitive advantage was maintained by early movers leveraging proprietary peptides and collagen-boosting actives, while encapsulation and biotech-based solutions were emerging as differentiators.

By 2025, demand for firming agents is projected at USD 1,853.7 million, setting the stage for accelerated adoption. Between 2025 and 2035, the market is expected to more than double, reaching USD 4,302.8 million. Expansion will be powered by premium skincare adoption in Asia-Pacific, the proliferation of encapsulated serum-grade formats, and the rising role of muscle relaxation actives.

The competitive landscape is projected to shift toward suppliers offering clinically backed efficacy, bioavailability enhancements, and sustainability-driven ingredient sourcing. Ecosystem strength, regulatory compliance, and global brand partnerships are expected to define leadership positions in the coming decade.

Growth in the firming agents and botox-like market is being fueled by rising consumer demand for clinically validated anti-aging solutions that deliver visible skin-firming results. Advances in peptide complexes, marine collagen derivatives, and biotech elastin boosters are being leveraged to enhance efficacy and improve bioavailability.

Strong momentum is being observed as cosmeceutical and premium skincare brands increasingly rely on functional raw materials to differentiate product portfolios. Demand is further being supported by professional aesthetics, where formulations mimicking botox-like effects are integrated into spa and clinic treatments.

Encapsulation technologies are being deployed to improve stability and targeted delivery, reinforcing adoption in high-value serum and cream applications. Rapid expansion across Asia, particularly in China and India, is expected to accelerate growth, supported by rising disposable incomes and greater skincare awareness. Regulatory emphasis on clean-label and safe bioactives is anticipated to sustain long-term demand while driving innovation in natural and plant-based firming actives.

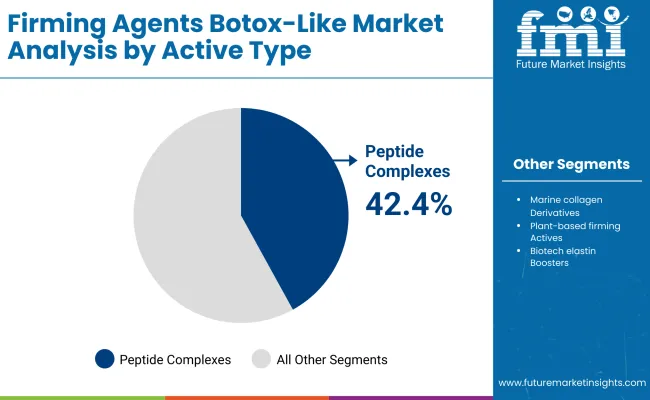

The Firming Agents Botox-like market has been segmented on the basis of active type, mechanism, and application, each reflecting distinct growth drivers and consumer preferences. Active type analysis highlights the role of peptide complexes alongside other bioactive formulations that strengthen skin structure and deliver targeted anti-aging benefits.

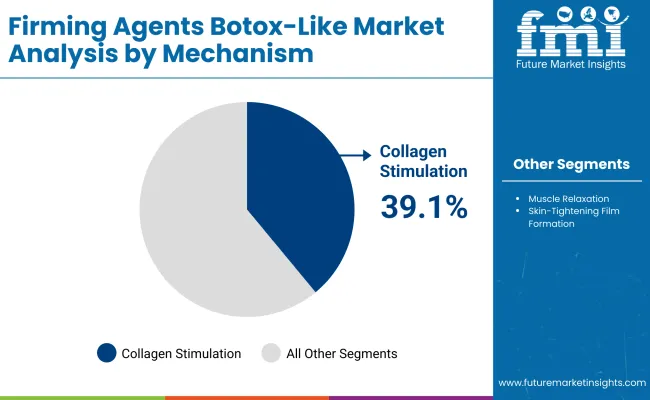

Mechanism-based segmentation emphasizes collagen stimulation and botox-mimic pathways, both of which address different consumer priorities for long-term resilience and rapid wrinkle reduction. Application segmentation underscores the dominance of anti-aging creams and serums, while specialized categories such as eye contour and professional spa treatments continue to expand opportunities. By examining these core segments, the evolving demand landscape and formulation strategies shaping this market can be better understood.

| Active Type | Market Value Share, 2025 |

|---|---|

| Peptide complexes | 42.4% |

| Others | 57.6% |

Peptide complexes are projected to dominate the active type segment with 42.4% share in 2025, valued at USD 785.97 million. This dominance is being reinforced by their proven capacity to stimulate collagen production, reduce fine lines, and enhance firmness, which directly aligns with consumer demand for clinically validated anti-aging actives.

Their incorporation is being prioritized in premium skincare formulations, where differentiation increasingly relies on scientifically backed efficacy. Strong adoption is expected in cosmeceuticals and professional aesthetics, supported by continuous advancements in peptide engineering and delivery systems. The sustained growth of peptide complexes is anticipated to position them as the backbone of firming agent formulations throughout the forecast period.

| Mechanism | Market Value Share, 2025 |

|---|---|

| Collagen stimulation | 39.1% |

| Others | 60.9% |

Collagen stimulation is anticipated to lead the mechanism segment with 39.1% share in 2025, equal to USD 724.80 million. Its importance is being driven by its ability to rebuild dermal structure, improve elasticity, and ensure long-term skin resilience. Growing consumer demand for sustainable anti-aging benefits is reinforcing its role as the preferred mechanism, even as short-term wrinkle-reducing effects gain traction.

Continued R&D investments in collagen-boosting peptides and biotech-based enhancers are expected to accelerate adoption, particularly in formulations targeting deep-layer skin regeneration. By meeting the rising preference for clinically proven outcomes, collagen stimulation is projected to maintain its leadership across mechanisms over the forecast horizon.

| Application | Market Value Share, 2025 |

|---|---|

| Anti-aging creams & serums | 48.3% |

| Others | 51.7% |

Anti-aging creams and serums are expected to dominate the application segment with 48.3% share in 2025, generating USD 895.34 million. This segment’s strength is being reinforced by its role as the most widely used skincare format, integrating seamlessly into daily routines.

Consumers are seeking multifunctional formulations that combine hydration, wrinkle reduction, and visible firming, making creams and serums the preferred carriers for firming agents. Adoption is being driven by premium skincare brands, which emphasize clinically proven performance to enhance consumer trust. With steady innovation in delivery systems and ingredient stability, anti-aging creams and serums are projected to remain the largest contributor to firming agent consumption across both retail and professional channels..

High-performance peptide innovation and advanced delivery technologies are reshaping the Firming Agents Botox-like market, even as sustainability pressures and clean-label standards redefine formulation priorities, creating both opportunities and challenges for ingredient suppliers and premium skincare manufacturers worldwide.

Advancements in Encapsulation and Bioavailability Enhancement

The adoption of firming agents is being accelerated by advancements in encapsulation and bioavailability optimization, which ensure that active ingredients reach target skin layers with improved stability and potency. Traditional peptide and collagen derivatives have historically faced degradation challenges, limiting their long-term performance in formulations.

With novel encapsulation systems, such as lipid-based nanocarriers and polymeric microspheres, active delivery is being refined to achieve sustained release and greater consumer-visible outcomes. This dynamic is anticipated to encourage premium brand adoption, particularly in serums and medical-aesthetic formulations where consistent efficacy is critical. The driver underscores a transformation in how ingredient functionality is being engineered, shifting the market toward high-value innovations that deliver quantifiable improvements in clinical performance.

Integration of Biotechnology-Derived Actives in Premium Skincare

A key trend shaping this market is the increasing use of biotechnology-derived actives, which are being developed through precision fermentation and bioengineering. These solutions enable formulators to access rare elastin boosters and collagen analogs without reliance on traditional animal or marine sources, aligning with sustainability and ethical sourcing requirements.

Beyond environmental benefits, biotech-based actives offer improved reproducibility, scalability, and molecular customization, allowing suppliers to tailor bioactives with specific wrinkle-reduction or firming properties. This trend is expected to redefine competitive differentiation, as ingredient producers integrate biotech pipelines with clinical validation frameworks, enabling cosmeceutical brands to market advanced, eco-conscious solutions that resonate with evolving consumer values. The shift toward biotechnology represents not only a pathway to innovation but also a safeguard against resource volatility in conventional raw materials.

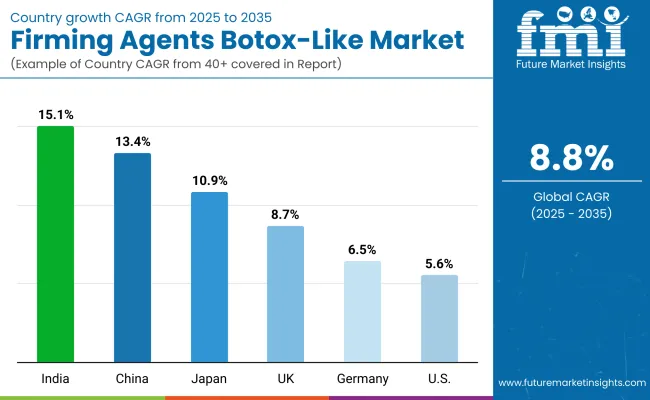

| Country | CAGR |

|---|---|

| China | 13.4% |

| USA | 5.6% |

| India | 15.1% |

| UK | 8.7% |

| Germany | 6.5% |

| Japan | 10.9% |

The global Firming Agents Botox-like market is displaying varied growth trajectories across regions, shaped by regulatory frameworks, consumer sophistication, and the pace of premium skincare adoption. Asia is anticipated to be the fastest-growing region, anchored by India at a CAGR of 15.1% and China at 13.4% between 2025 and 2035.

India’s rapid expansion is being driven by increased consumer awareness of professional-grade skincare, alongside a manufacturing ecosystem that is adapting to biotech-driven ingredient production. China’s strong momentum is expected to be reinforced by the country’s advanced cosmeceutical sector and an expanding base of local premium skincare brands, supported by clinical innovation and domestic sourcing of actives.

Japan is projected to maintain a 10.9% CAGR, reflecting a balance of traditional cosmeceutical strengths and new investment in biotechnology-based formulations. Europe is forecasted to grow at 8.1%, led by the UK at 8.7% and Germany at 6.5%, where regulatory compliance and demand for high-quality, safe actives are sustaining ingredient integration in both cosmeceuticals and professional aesthetics.

The USA is expected to register a steady 5.6% CAGR, reflecting a mature yet innovation-driven market where clinical validation and consumer trust shape adoption. This regional landscape indicates that Asia will remain the global growth engine.

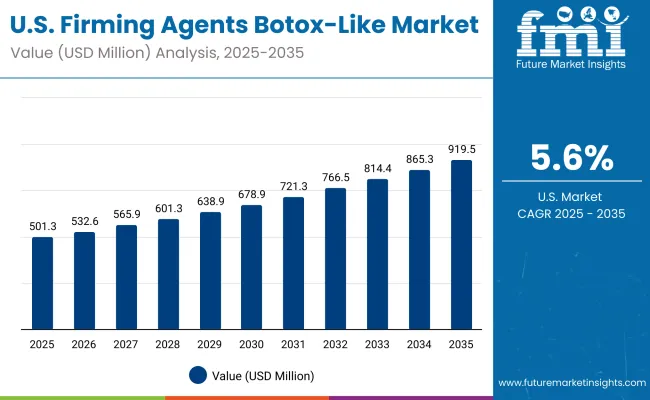

| Year | USA Firming Agents Botox-Like Market (USD Million) |

|---|---|

| 2025 | 501.30 |

| 2026 | 532.65 |

| 2027 | 565.96 |

| 2028 | 601.36 |

| 2029 | 638.97 |

| 2030 | 678.93 |

| 2031 | 721.39 |

| 2032 | 766.51 |

| 2033 | 814.45 |

| 2034 | 865.39 |

| 2035 | 919.51 |

The Firming Agents Botox-like market in the United States is projected to grow at a CAGR of 6.4% from 2025 to 2035. Market expansion is being shaped by the rising prioritization of peptide complexes in cosmeceuticals, where scientifically validated efficacy is increasingly demanded by consumers. Anti-aging creams and serums are expected to remain the leading application segment, supported by multifunctional performance requirements.

Professional aesthetics are being recognized as an important growth area, where botox-mimic mechanisms provide fast-action results in spa and clinic settings. Encapsulation technologies are being adopted to improve ingredient stability and delivery, reinforcing consumer trust in long-term efficacy. Partnerships between premium skincare brands and ingredient suppliers are anticipated to intensify, creating opportunities for deeper market penetration.

The Firming Agents Botox-like market in the United Kingdom is projected to expand at a CAGR of 8.7% from 2025 to 2035. Growth is expected to be reinforced by high consumer awareness of dermatology-driven skincare and the widespread adoption of premium cosmeceutical brands. The UK market is anticipated to benefit from strong regulatory emphasis on ingredient transparency and safety, which is aligning well with clean-label innovation trends.

Local demand is being fueled by professional aesthetics, as clinic-based treatments increasingly incorporate botox-mimic actives for visible, short-term wrinkle reduction. With premium positioning already established, future adoption is likely to be driven by advanced peptide complexes and encapsulated actives that support clinically proven outcomes.

The Firming Agents Botox-like market in India is forecasted to grow at the fastest CAGR of 15.1% between 2025 and 2035. Expansion is being fueled by increasing awareness of anti-aging solutions, coupled with rising disposable incomes and the premiumization of skincare consumption. Domestic skincare brands are incorporating firming agents at a higher rate, supported by demand from a younger demographic with growing interest in preventive skincare.

India’s manufacturing ecosystem is advancing rapidly, with investments in biotechnology and encapsulation technologies anticipated to create localized production advantages. Professional-grade formulations are also gaining ground, as demand from clinics and spas strengthens across metropolitan areas.

The Firming Agents Botox-like market in China is expected to record a CAGR of 13.4% from 2025 to 2035. Market growth is being supported by a robust cosmeceutical industry and expanding local premium skincare brands that integrate clinically validated actives. Government backing for biotechnology and ingredient innovation is projected to accelerate domestic production capacity, creating competitive advantages for Chinese suppliers.

Consumers are demonstrating a strong preference for products with fast-action wrinkle reduction effects, reinforcing the demand for botox-mimic mechanisms. International and local brand collaborations are expected to deepen market penetration, with advanced peptides and encapsulation technologies being positioned as premium differentiators.

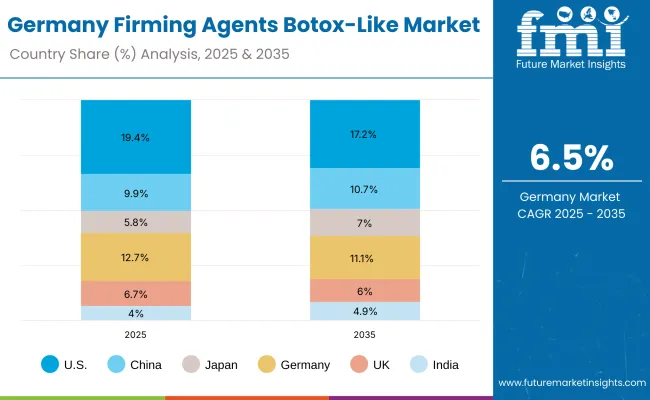

| Country | 2025 |

|---|---|

| USA | 19.4% |

| China | 9.9% |

| Japan | 5.8% |

| Germany | 12.7% |

| UK | 6.7% |

| India | 4.0% |

| Country | 2035 |

|---|---|

| USA | 17.2% |

| China | 10.7% |

| Japan | 7.0% |

| Germany | 11.1% |

| UK | 6.0% |

| India | 4.9% |

The Firming Agents Botox-like market in Germany is projected to grow at a CAGR of 6.5% during 2025 to 2035. The country’s strong skincare tradition and established cosmeceutical sector are expected to ensure steady ingredient adoption. Germany’s highly regulated market environment is reinforcing the role of clinically validated actives, as consumers increasingly prioritize safety and proven efficacy.

Growth is anticipated to be supported by professional aesthetics, where botox-mimic mechanisms are being integrated into advanced treatment portfolios. Sustainability-driven sourcing and biotechnology-based solutions are projected to gain traction, aligning with the broader European preference for eco-conscious formulations. The market outlook suggests consistent growth, sustained by innovation, compliance, and professional demand.

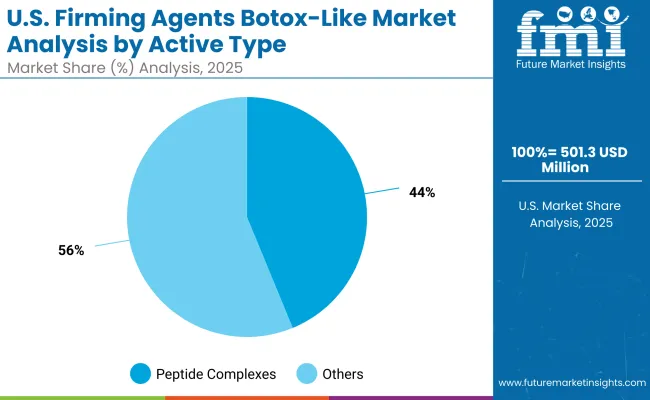

| USA By Active Type | Market Value Share, 2025 |

|---|---|

| Peptide complexes | 43.8% |

| Others | 56.2% |

The Firming Agents Botox-like market in the United States is projected at USD 501.30 million in 2025. Peptide complexes contribute 43.8%, while other active ingredients hold 56.2%, reflecting a broader reliance on diverse actives beyond core peptides. This balance is being shaped by the growing use of marine collagen derivatives, elastin boosters, and novel biotech-driven solutions that complement traditional peptide applications.

Peptide complexes remain vital due to their proven role in stimulating collagen and improving elasticity, yet formulators are expanding toward multifunctional actives that provide both immediate and long-term skin-firming outcomes.

Rising sophistication in consumer preferences is expected to accelerate the adoption of hybrid formulations combining peptides with new-generation bioactives. Strategic partnerships between suppliers and premium brands are likely to further enhance the role of peptides while ensuring that the broader category of advanced actives sustains overall market leadership.

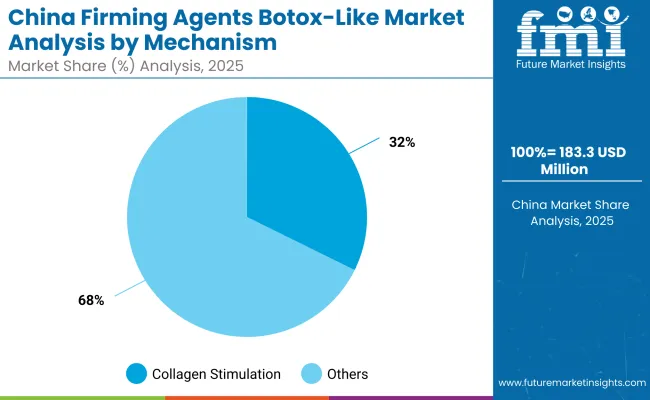

| China By Mechanism | Market Value Share, 2025 |

|---|---|

| Collagen stimulation | 32.3% |

| Others | 67.7% |

The Firming Agents Botox-like market in China is projected at USD 183.34 million in 2025. Collagen stimulation contributes 32.3%, equivalent to USD 59.22 million, while other mechanisms hold 67.7%, valued at USD 124.12 million. The leadership of broader mechanisms is being reinforced by the growing preference for botox-mimic actives that deliver immediate wrinkle-reducing results.

Collagen stimulation, while smaller in share, remains strategically important as long-term skin resilience and structural support continue to influence brand positioning. Market growth is expected to be supported by government-backed biotechnology investments and the expansion of premium domestic skincare brands that emphasize clinical validation.

Hybrid approaches combining collagen-stimulating peptides with fast-acting botox-like ingredients are anticipated to emerge as a key formulation trend, ensuring balanced outcomes across both immediate and sustainable anti-aging needs.

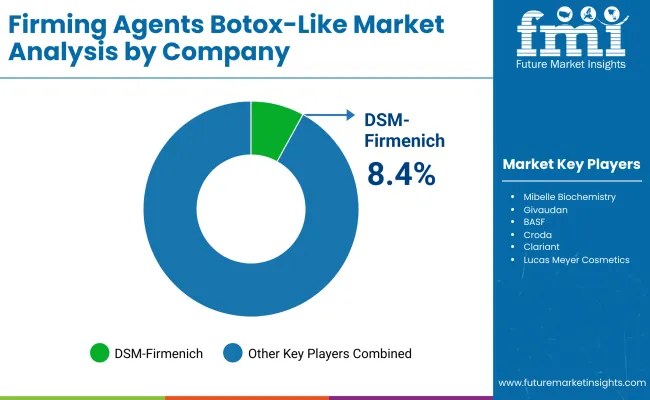

| Company | Global Value Share 2025 |

|---|---|

| DSM-Firmenich | 8.4% |

| Others | 91.6% |

The Firming Agents Botox-like market is moderately fragmented, with global leaders, mid-sized innovators, and specialized suppliers competing across both cosmeceuticals and professional aesthetics. DSM-Firmenich is holding the largest single-company position with an 8.4% global value share in 2025, reflecting its scale in peptides, biotech-driven actives, and advanced formulation technologies. Its competitive strength is being reinforced by extensive R&D pipelines, sustainability commitments, and strong brand partnerships.

Mid-sized players such as Mibelle Biochemistry, Givaudan, BASF, Croda, and Clariant are actively shaping market growth by leveraging biotechnology and encapsulation expertise. These companies are expected to deepen their relevance by providing multifunctional solutions that meet regulatory and clean-label demands. Their strategies are increasingly focused on supplying clinically validated actives that align with the premiumization of skincare.

Specialized providers including Lipotec, Seppic, Ashland, and Lucas Meyer Cosmetics are catering to niche opportunities, emphasizing flexibility, customization, and regional adaptability. Their advantage lies in the ability to supply targeted actives for specific applications, including anti-aging serums and spa-grade formulations.

Competitive differentiation is shifting away from single-ingredient performance toward integrated platforms combining bioavailability, encapsulation, and regulatory compliance. Partnerships with premium skincare brands are projected to determine leadership, while sustainability and biotechnology adoption are set to emerge as key long-term growth levers.

Key Developments in Firming Agents Botox-Like Market

| Item | Value |

|---|---|

| Value (Quantitative) | Global Market Size (2025): USD 1,853.7 million; Forecast (2035): USD 4,302.8 million; Forecast CAGR (2025 to 2035): 8.8% |

| Component (Active Type) | Peptide complexes; Others |

| Range (Mechanism) | Collagen stimulation; Muscle relaxation (botox-mimic); Skin-tightening film formation |

| Technology (Application) | Anti-aging creams & serums; Eye contour products; Neck & décolleté care; Professional spa/clinic treatments |

| Type (Form) | Liquid concentrate; Encapsulated serum-grade; Powdered peptide blends |

| End-use Industry | Cosmeceuticals; Premium skincare brands; Professional aesthetics |

| Regions Covered | North America; Europe; Asia-Pacific; Latin America; Middle East & Africa |

| Country Covered | United States; Canada; Germany; France; United Kingdom; China; Japan; India; Brazil; South Africa |

| Key Companies Profiled | DSM-Firmenich; Mibelle Biochemistry; Givaudan; BASF; Croda; Clariant; Lipotec; Seppic; Ashland; Lucas Meyer Cosmetics |

| Additional Attributes | 2025 leader segments identified (peptide complexes; collagen stimulation; anti-aging creams & serums); country CAGRs (India 15.1%, China 13.4%, Japan 10.9%, UK 8.7%, Europe 8.1%, Germany 6.5%, USA 5.6%); USA 2025 value: USD 501.30 million; China 2025 value: USD 183.34 million; growth expected from encapsulation/bioavailability advances, clinical validation demands, and premiumization across cosmeceuticals and professional aesthetics. |

The global Firming Agents Botox-like Market is estimated to be valued at USD 1,853.7 million in 2025.

The market size for the Firming Agents Botox-like Market is projected to reach USD 4,302.8 million by 2035.

The Firming Agents Botox-like Market is expected to grow at a CAGR of 8.8% between 2025 and 2035.

The key product types in the Firming Agents Botox-like Market include peptide complexes, liquid concentrates, encapsulated serum-grade actives, and powdered peptide blends.

In terms of application, anti-aging creams and serums are expected to command a 48.3% share of the Firming Agents Botox-like Market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Firming Creams and Serums Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Firming Agents Market Growth – Product Innovations & Applications from 2025 to 2035

Body Firming Creams Market Growth & Forecast 2025-2035

Peptide-Enhanced Firming Creams Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Matting Agents Market Size and Share Forecast Outlook 2025 to 2035

Healing Agents Market (Skin Repair & Soothing Actives) Market Size and Share Forecast Outlook 2025 to 2035

Foaming Agents Market Size and Share Forecast Outlook 2025 to 2035

Heating Agents Market Size and Share Forecast Outlook 2025 to 2035

Cooling Agents Market Size and Share Forecast Outlook 2025 to 2035

Raising Agents Market Trends – Growth & Industry Forecast 2024 to 2034

Weighing Agents Market Size and Share Forecast Outlook 2025 to 2035

Draining Agents Market Size and Share Forecast Outlook 2025 to 2035

Flatting Agents Market Size and Share Forecast Outlook 2025 to 2035

Clouding Agents Market Trends - Growth Factors & Industry Analysis

Cognitive Agents Market Size and Share Forecast Outlook 2025 to 2035

Anti-Acne Agents Market Size and Share Forecast Outlook 2025 to 2035

Flavoring Agents Market Size and Share Forecast Outlook 2025 to 2035

Leavening Agents Market Analysis - Size, Growth, and Forecast 2025 to 2035

Market Share Breakdown of Anti-Slip Agents Manufacturers

Coalescing Agents Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA