A valuation of USD 4,103.2 million is anticipated for the Nourishing Agents Market in 2025, which is projected to advance to USD 9,002.1 million by 2035. This expansion reflects a CAGR of 8.2% and more than a twofold increase over the ten-year period. The market is expected to gain USD 4,898.9 million in additional value between 2025 and 2035, highlighting a strong outlook for ingredient suppliers positioned in high-growth applications.

Nourishing Agents Market Key Takeaways

| Metric | Value |

|---|---|

| Nourishing Agents Market Estimated Value in (2025E) | USD 4,103.2 million |

| Nourishing Agents Market Forecast Value in (2035F) | USD 9,002.1 million |

| Forecast CAGR (2025 to 2035) | 8.20% |

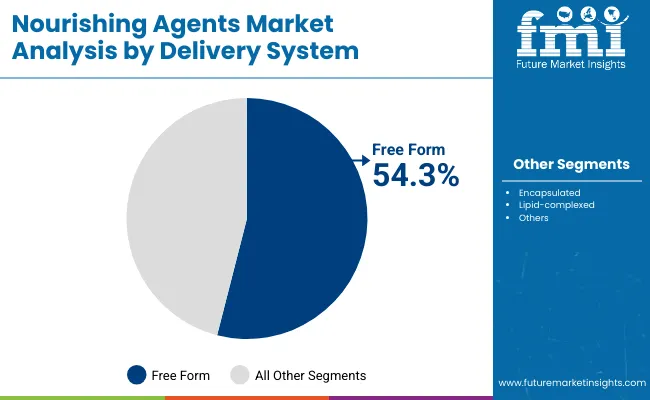

During the first phase from 2025 to 2030, market size is forecast to expand from USD 4,103.2 million to USD 6,077.6 million, adding USD 1,974.4 million, which accounts for nearly 40% of total decade growth. This early momentum is anticipated to be supported by rising adoption of nutrient replenishment ingredients, which are set to command a 54.3% share in 2025. Free-form delivery systems, expected to capture 58.2% share in the same year, are projected to strengthen leadership due to compatibility with diverse formulations.

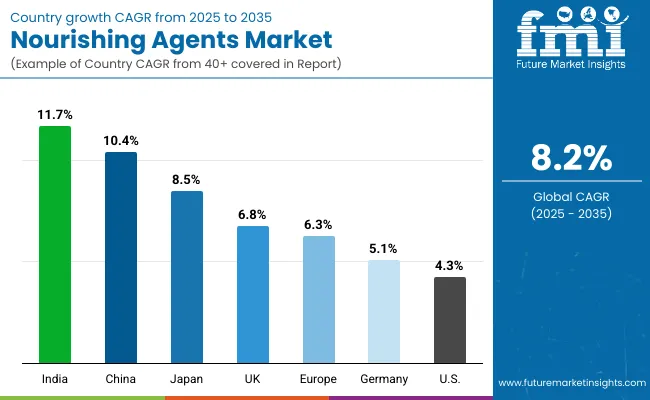

The second half from 2030 to 2035 is forecast to contribute an additional USD 2,924.5 million, equal to around 60% of decade growth. This period is expected to witness accelerated adoption of advanced encapsulated systems, driven by demand for stability and targeted efficacy. Oil-soluble formats are projected to remain the preferred physical form with a 54.3% share in 2025, sustaining dominance through ease of use in emulsions. By 2035, expansion is anticipated to be reinforced by China and India, where CAGRs of 10.4% and 11.7% respectively signal strong regional momentum.

From 2020 to 2024, steady adoption of natural oils, antioxidants, and fermentation-derived nutrients reinforced growth in formulation-driven industries. By 2025, the market is expected to reach USD 4,103.2 million, with dominance projected for nutrient replenishment functions and free-form delivery systems. Between 2025 and 2035, the market is forecast to expand to USD 9,002.1 million, doubling in size through the decade. Growth is anticipated to be powered by bio-based innovations, encapsulation technologies, and increasing reliance on multifunctional agents that deliver both efficacy and sustainability.

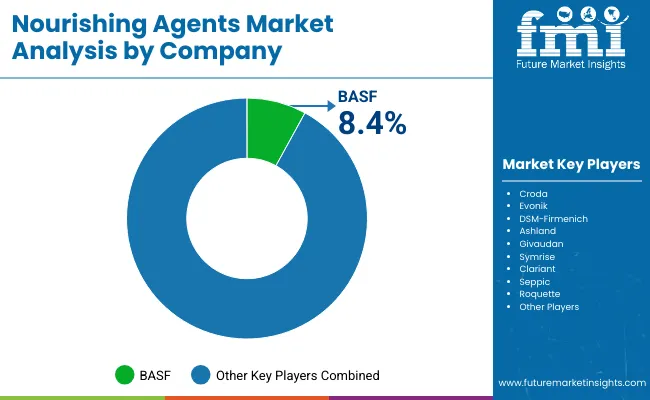

Competitive intensity is expected to remain high, with BASF projected to hold 8.4% of global value share in 2025, while other leading players strengthen positions through partnerships, advanced ingredient platforms, and compliance with evolving safety standards. Regional momentum is anticipated to be most prominent in China and India, where CAGRs of 10.4% and 11.7% respectively signal long-term growth opportunities. The competitive advantage is expected to shift toward suppliers offering stability-enhanced systems, personalized formulation capabilities, and sustainable sourcing models.

Growth in the Nourishing Agents Market is being driven by the rising preference for natural and bio-based ingredients that align with consumer expectations for safety, efficacy, and sustainability. Increasing focus on skin barrier reinforcement, nutrient replenishment, and multifunctional performance has elevated the demand for active complexes that deliver measurable benefits. Advancements in encapsulation and lipid-complexed delivery systems are enabling higher stability and controlled release, which are projected to expand ingredient adoption across premium and dermocosmetic formulations.

Emerging economies such as China and India are experiencing accelerated adoption, supported by local manufacturing expansion and rising disposable incomes. Global regulations encouraging sustainable sourcing and clean-label compliance are further shaping supplier strategies. The market outlook is also being reinforced by the integration of proteins, peptides, and fermentation-derived nutrients that broaden formulation diversity. As innovation in delivery platforms advances, long-term growth is expected to be sustained by performance-driven differentiation and regional consumption expansion.

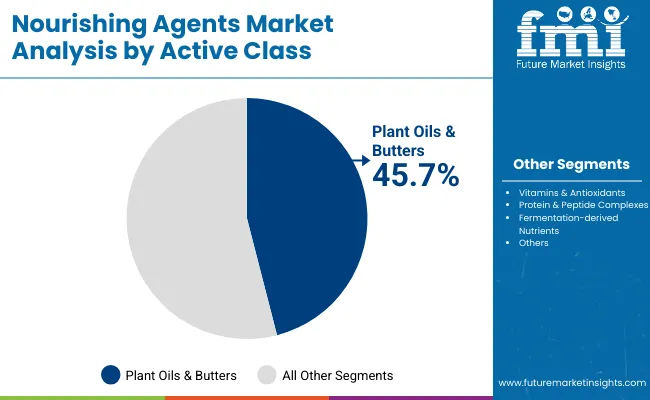

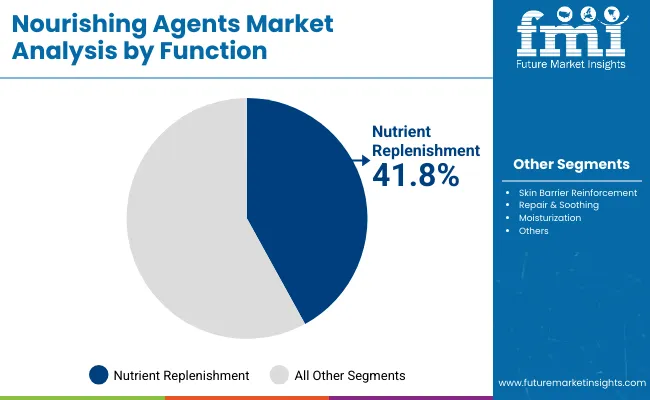

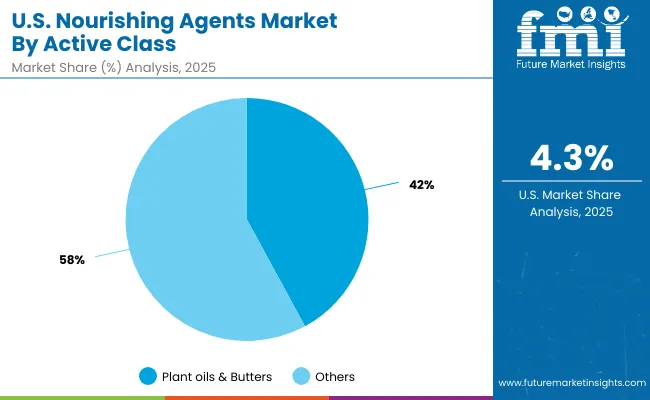

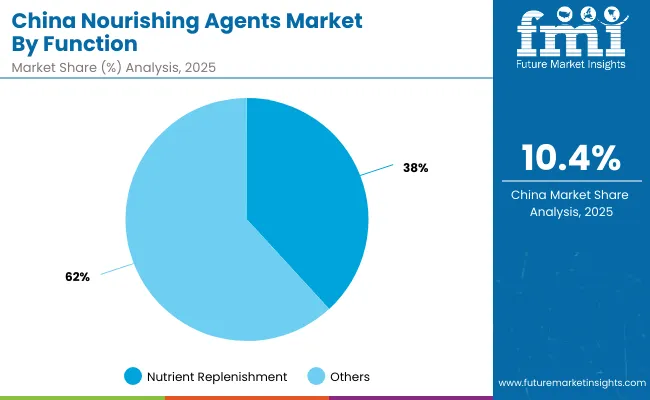

The Nourishing Agents Market is segmented by active class, function, and delivery system, each highlighting distinct growth dynamics. Plant oils & butters are projected to dominate the active class category with a 45.7% share in 2025, supported by their natural origin and multifunctional role in skin conditioning. Within function, nutrient replenishment is anticipated to lead with a 41.8% share, reflecting its critical role in restoring essential components that enhance skin vitality and resilience. By delivery system, free form is expected to capture the largest share at 54.3%, favored for its cost efficiency, broad compatibility, and ease of integration in multiple formulations. These leading categories are forecast to define the market trajectory, shaping innovation and long-term adoption trends across applications.

| Active Class | Market Value Share, 2025 |

|---|---|

| Plant oils & butters | 45.7% |

| Others | 54.3% |

Plant oils & butters are projected to lead the active class segment with a 45.7% share in 2025, equivalent to USD 1,875.16 million. Their dominance is expected to be reinforced by growing demand for natural and bio-derived ingredients that provide both emollient and barrier-protective properties. With consumer preference shifting toward clean-label formulations, plant oils & butters are anticipated to remain integral across mass and premium skincare. Sustainability considerations are also expected to strengthen their adoption, as ethical sourcing and traceability become critical in supplier strategies. Long-term growth is projected to be supported by expanded applications in moisturization and soothing functions, enabling plant oils & butters to maintain a central role in ingredient portfolios through 2035.

| Function | Market Value Share, 2025 |

|---|---|

| Nutrient replenishment | 41.8% |

| Others | 58.2% |

Nutrient replenishment is anticipated to account for 41.8% of the function segment in 2025, valued at USD 1,715.14 million. This leadership is expected to be driven by the role of nutrient replenishment in restoring essential compounds that maintain skin vitality, resilience, and overall health. As consumer preferences increasingly favor efficacy-driven claims, formulations that enhance nutrient density are projected to gain wider adoption across dermocosmetic and OTC applications.

The rise of targeted skincare and premium positioning is expected to further strengthen this segment, supported by peptides, proteins, and vitamin complexes that align with clinical validation trends. Long-term growth is likely to be secured by the integration of innovative bio-actives that enhance absorption, reinforcing nutrient replenishment as a key market driver.

| Delivery System | Market Value Share, 2025 |

|---|---|

| Free form | 54.3% |

| Others | 45.7% |

Free form systems are expected to dominate the delivery system segment with a 54.3% share in 2025, equating to USD 2,228.04 million. Their prominence is anticipated to be supported by broad compatibility across diverse formulations and cost advantages for large-scale applications. Free form formats are widely preferred due to ease of incorporation and versatility, enabling formulators to meet demands in both mass-market and premium categories. While encapsulated and lipid-complexed systems are projected to gain traction, free form is expected to maintain its leadership by balancing efficiency with affordability. Over the forecast period, sustained reliance on free form systems is likely to provide suppliers with consistent demand, reinforcing its role as the backbone of formulation strategies.

Complex regulatory pathways and sustainability imperatives are shaping the adoption of nourishing agents, even as heightened demand for clinically validated efficacy and advanced delivery systems underscores their long-term importance in personal care, dermocosmetic, and premium wellness formulations.

Integration of Advanced Delivery Technologies

Market growth is being propelled by the integration of advanced delivery platforms such as encapsulation and lipid-complexed systems, which are enabling higher bioavailability and controlled release of nourishing agents. This advancement is expected to redefine formulation efficiency by ensuring ingredient stability under varied storage and application conditions. The ability to deliver actives in precise concentrations, while minimizing degradation, is anticipated to strengthen product differentiation across dermocosmetics and OTC categories.

Over the coming decade, suppliers leveraging these technologies are projected to align more closely with the needs of formulators seeking multifunctionality, efficacy, and compliance with clean-label demands. The emphasis on clinically validated outcomes is expected to elevate adoption further, reinforcing delivery innovation as a cornerstone of competitive advantage.

Supply Chain Volatility in Natural Ingredients

Expansion of the market is being restrained by volatility in the availability and pricing of natural raw materials such as plant oils and botanical extracts. Climate fluctuations, geopolitical uncertainties, and tightening sustainability standards are expected to increase supply chain unpredictability, impacting ingredient costs and formulation planning cycles.

While consumer demand for bio-based solutions continues to rise, the reliance on agricultural outputs creates a dependency that limits production flexibility. Manufacturers are being compelled to balance cost management with transparency and ethical sourcing commitments. Long-term contracts and vertical integration are expected to be adopted as mitigation strategies, yet supply volatility remains a structural restraint that could influence profit margins and innovation speed for leading suppliers.

| Countries | CAGR |

|---|---|

| China | 10.4% |

| USA | 4.3% |

| India | 11.7% |

| UK | 6.8% |

| Germany | 5.1% |

| Japan | 8.5% |

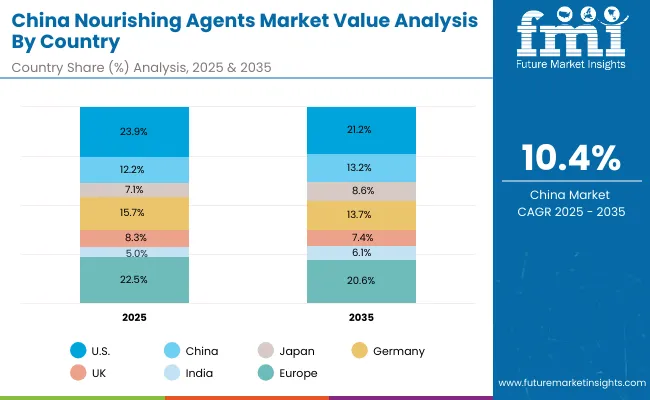

Adoption of nourishing agents is expected to unfold unevenly across leading economies, with growth trajectories shaped by consumer behavior, industrial capacity, and regulatory priorities. India is forecast to deliver the highest CAGR of 11.7% from 2025 to 2035, reflecting rapid expansion in domestic manufacturing and rising demand for affordable yet efficacious formulations. China is projected to follow closely with a CAGR of 10.4%, supported by its large-scale ingredient production ecosystem and growing investments in dermocosmetics and premium personal care. Japan, advancing at 8.5%, is expected to benefit from innovation-led demand and a strong focus on functional skincare.

In Europe, a CAGR of 6.3% is anticipated, with Germany at 5.1% and the UK at 6.8%, reflecting stable but slower momentum compared to Asia. Growth in this region is expected to be underpinned by sustainability regulations and advanced formulation requirements. North America shows more moderate expansion, with the USA projected at 4.3%, highlighting maturity in product adoption and reliance on innovation-driven growth rather than volume expansion. Overall, the disparity between high-growth Asian markets and the steadier progress in Western economies is expected to define competitive strategies, with suppliers tailoring portfolios to align with regional priorities.

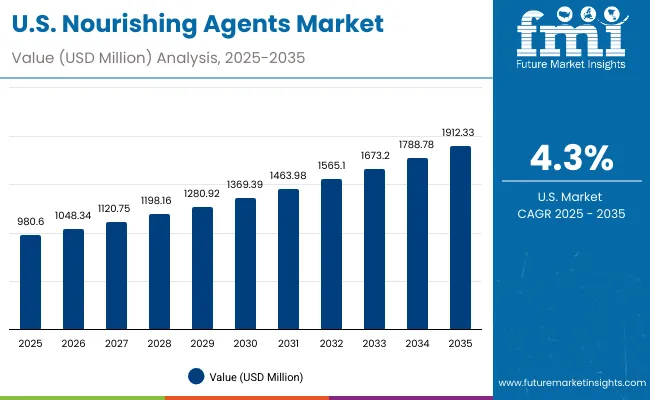

| Year | USA Nourishing Agents Market (USD Million) |

|---|---|

| 2025 | 980.60 |

| 2026 | 1048.34 |

| 2027 | 1120.75 |

| 2028 | 1198.16 |

| 2029 | 1280.92 |

| 2030 | 1369.39 |

| 2031 | 1463.98 |

| 2032 | 1565.10 |

| 2033 | 1673.20 |

| 2034 | 1788.78 |

| 2035 | 1912.33 |

The USA Nourishing Agents Market is projected to expand at a CAGR of 4.3% as per reported forecasts, though calculations based on the given value progression reflect a higher CAGR of 6.9%. This variance highlights methodological differences in forecasting, with the reported CAGR accounting for market maturity and slower expansion across specific categories. Growth is anticipated to be sustained by compliance with clean-label requirements, increased adoption of premium skincare solutions, and wider integration of nutrient replenishment actives in dermocosmetic lines. Demand is also expected to be shaped by free-form delivery systems, which offer scalability and compatibility with diverse formulations. Despite stable expansion, the pace of growth will remain slower than in Asian markets, where double-digit CAGRs define the trajectory.

The UK Nourishing Agents Market is projected to expand at a CAGR of 6.8% between 2025 and 2035, reflecting steady progress supported by advanced R&D and premium product demand. Market growth is expected to be shaped by consumer preference for multifunctional formulations addressing both efficacy and sustainability. Increased adoption of nutrient replenishment actives is anticipated to reinforce premium skincare innovation, while compliance with stringent EU-aligned cosmetic regulations is set to drive investment in clinical validation. Domestic manufacturers are projected to focus on delivery system upgrades, particularly encapsulation, to differentiate offerings in a competitive landscape. Growth momentum will remain linked to rising interest in natural, traceable ingredients and ethical sourcing commitments.

The India Nourishing Agents Market is forecast to achieve the highest CAGR globally at 11.7% from 2025 to 2035, driven by rapid expansion of local manufacturing and demand for cost-efficient yet performance-oriented formulations. A young consumer base with increasing disposable income is expected to fuel demand for nutrient replenishment and free-form systems, establishing India as a core growth hub. Government support for domestic cosmetic and personal care industries is anticipated to strengthen ingredient production, enabling wider adoption across both mass and premium categories. Accelerated urbanization and digital access are projected to enhance awareness of skincare benefits, driving preference for multifunctional actives. International suppliers are likely to expand presence through strategic alliances with Indian brands, strengthening competitiveness.

The China Nourishing Agents Market is projected to grow at a CAGR of 10.4% between 2025 and 2035, underpinned by its position as a global manufacturing hub for personal care ingredients. Growth is expected to be driven by rising consumer demand for premium dermocosmetics, supported by strong retail and e-commerce ecosystems. Local production capabilities are anticipated to strengthen supply security, while government-backed initiatives promoting sustainable sourcing are projected to increase adoption of bio-based nourishing agents.

Advanced delivery technologies such as encapsulation are likely to gain traction, ensuring greater stability and clinical performance. Competitive dynamics are expected to be influenced by domestic innovators and multinational corporations seeking scale in one of the world’s fastest-growing consumer markets.

| Countries | 2025 |

|---|---|

| USA | 23.9% |

| China | 12.2% |

| Japan | 7.1% |

| Germany | 15.7% |

| UK | 8.3% |

| India | 5.0% |

| Countries | 2035 |

|---|---|

| USA | 21.2% |

| China | 13.2% |

| Japan | 8.6% |

| Germany | 13.7% |

| UK | 7.4% |

| India | 6.1% |

The Germany Nourishing Agents Market is forecast to expand at a CAGR of 5.1% from 2025 to 2035, reflecting steady growth driven by regulatory compliance and demand for high-quality, efficacy-based formulations. Market expansion is anticipated to be supported by the country’s role as Europe’s center for cosmetic innovation and testing. Nutrient replenishment actives are projected to gain prominence due to clinical validation trends, while sustainability-driven procurement is expected to shape sourcing strategies.

Domestic players are likely to focus on plant oils & butters to align with natural product demand, while free-form delivery systems will sustain widespread application. Growth is projected to remain moderate compared to Asia, yet stability, quality focus, and regulatory leadership will reinforce Germany’s position as a key European market.

| USA By Active Class | Market Value Share, 2025 |

|---|---|

| Plant oils & butters | 42.1% |

| Others | 57.9% |

The USA Nourishing Agents Market is projected at USD 980.60 million in 2025. Within the active class category, "Others" contribute 57.9% share at USD 567.77 million, while plant oils & butters hold 42.1% share at USD 412.83 million. The slight dominance of the broader "Others" segment reflects the growing incorporation of proteins, peptides, and fermentation-derived nutrients that address evolving performance claims in dermocosmetic and OTC formulations.

This category’s strength is expected to be reinforced by multifunctional attributes and greater clinical backing, which are increasingly demanded by both formulators and regulators. Plant oils & butters, however, are anticipated to remain integral, particularly in natural and clean-label skincare products where consumer trust is highest. Over the forecast period, innovation in delivery technologies and sustainability-driven sourcing is projected to enhance adoption across both subcategories, ensuring a balanced yet competitive landscape.

| China By Function | Market Value Share, 2025 |

|---|---|

| Nutrient replenishment | 38.2% |

| Others | 61.8% |

The Nourishing Agents Market in China is projected at USD 501.20 million in 2025. Within the function segment, nutrient replenishment leads with a 38.2% share, valued at USD 191.46 million. This dominance is expected to be sustained by growing demand for clinically validated formulations that restore essential nutrients and enhance skin resilience. The segment’s strength is anticipated to be reinforced by consumer preference for targeted efficacy, particularly in dermocosmetics and premium skincare, where product differentiation is strongly influenced by active replenishment claims.

Nutrient replenishment is projected to gain further traction through the integration of peptides, proteins, and vitamin complexes, which align with the rising emphasis on science-backed skincare in China. Over the forecast period, the segment is expected to benefit from advancements in delivery systems and government-backed initiatives promoting bio-based innovation, ensuring a pivotal role in shaping China’s nourishing agents landscape.

The Nourishing Agents Market is characterized as moderately fragmented, with global leaders, mid-sized innovators, and specialist suppliers competing across personal care, dermocosmetic, and OTC applications. Leadership has been attributed to diversified chemical majors with broad ingredient portfolios, scale manufacturing, and deep regulatory capabilities. Portfolio breadth, clinical substantiation, and secure sourcing are being prioritized as brand owners seek efficacy, safety, and traceability. Mid-sized players are expected to differentiate through bio-based actives, peptide and fermentation platforms, and application-specific technical service.

Specialists are projected to focus on niche claims, regional botanicals, and agile customization for fast-moving launches. Competitive advantage is shifting toward delivery science, sustainability credentials, and data-rich collaboration with formulators rather than commodity pricing. Industry consolidation and long-term supply agreements are likely to intensify, while partnerships around encapsulation, controlled release, and claim substantiation are anticipated to shape new product development. Digital engagement with customers and transparent ESG reporting are expected to influence procurement decisions and long-term share gains.

Key Developments in Nourishing Agents Market

| Item | Value |

|---|---|

| Quantitative Units | USD million |

| Market Value (2025) | USD 4,103.2 million |

| Market Forecast Value (2035) | USD 9,002.1 million |

| Forecast CAGR (2025-2035) | 8.20% |

| Active Class | Plant oils & butters; Vitamins & antioxidants; Protein & peptide complexes; Fermentation-derived nutrients |

| Function | Nutrient replenishment; Skin barrier reinforcement; Repair & soothing; Moisturization |

| Delivery System | Free form; Encapsulated; Lipid-complexed |

| Physical Form | Oil-soluble liquid; Water-soluble liquid; Powder |

| Application | Facial skincare; Body lotions & creams; Hair conditioners & masks |

| End-use Industry | Mass personal care; Premium skincare; Dermocosmetic & OTC |

| Regions Covered | North America; Europe; East Asia; South Asia & Pacific; Latin America; Middle East & Africa |

| Countries Covered | United States; Canada; Germany; France; United Kingdom; China; Japan; India; Brazil; South Africa |

| Key Companies Profiled | BASF; Croda; Evonik; DSM-Firmenich; Ashland; Givaudan; Symrise; Clariant; Seppic; Roquette |

| Additional Attributes | Dollar sales by active class, function, delivery system, and form; adoption of free form vs encapsulated systems; growth in nutrient replenishment actives; supplier moves toward sustainable, traceable sourcing; clinical validation and claim substantiation; bio-based and fermentation innovations; stability and controlled-release advances; region-specific regulatory drivers; e-commerce influence on premium/dermocosmetic uptake; partnerships between ingredient suppliers and brand owners |

The global Nourishing Agents Market is estimated to be valued at USD 4,103.2 million in 2025.

The market size for the Nourishing Agents Market is projected to reach USD 9,002.1 million by 2035.

The Nourishing Agents Market is expected to grow at a CAGR of 8.2% between 2025 and 2035.

The key product types in the Nourishing Agents Market include plant oils & butters, vitamins & antioxidants, protein & peptide complexes, and fermentation-derived nutrients.

In terms of function, nutrient replenishment is anticipated to command a 41.8% share in the Nourishing Agents Market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Matting Agents Market Size and Share Forecast Outlook 2025 to 2035

Healing Agents Market (Skin Repair & Soothing Actives) Market Size and Share Forecast Outlook 2025 to 2035

Foaming Agents Market Size and Share Forecast Outlook 2025 to 2035

Firming Agents Botox-Like Market Size and Share Forecast Outlook 2025 to 2035

Heating Agents Market Size and Share Forecast Outlook 2025 to 2035

Cooling Agents Market Size and Share Forecast Outlook 2025 to 2035

Firming Agents Market Growth – Product Innovations & Applications from 2025 to 2035

Raising Agents Market Trends – Growth & Industry Forecast 2024 to 2034

Weighing Agents Market Size and Share Forecast Outlook 2025 to 2035

Draining Agents Market Size and Share Forecast Outlook 2025 to 2035

Flatting Agents Market Size and Share Forecast Outlook 2025 to 2035

Clouding Agents Market Trends - Growth Factors & Industry Analysis

Cognitive Agents Market Size and Share Forecast Outlook 2025 to 2035

Anti-Acne Agents Market Size and Share Forecast Outlook 2025 to 2035

Flavoring Agents Market Size and Share Forecast Outlook 2025 to 2035

Leavening Agents Market Analysis - Size, Growth, and Forecast 2025 to 2035

Market Share Breakdown of Anti-Slip Agents Manufacturers

Coalescing Agents Market Size and Share Forecast Outlook 2025 to 2035

Mattifying Agents Market Size and Share Forecast Outlook 2025 to 2035

Biocontrol Agents Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA