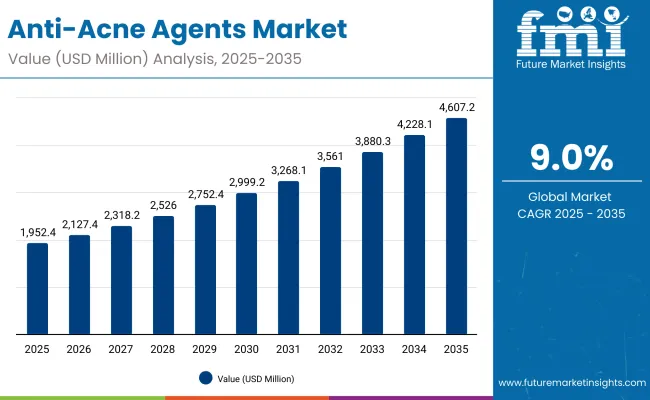

The anti-acne agents market is projected to be valued at USD 1,952.4 million in 2025, reaching USD 4,607.2 million by 2035, which reflects an absolute gain of USD 2,654.8 million over the period. This growth equates to a 193% increase in size across the decade, with a compound annual growth rate (CAGR) of 9.0%. During the initial phase from 2025 to 2030, expansion from USD 1,952.4 million to USD 2,999.2 million is anticipated, contributing USD 1,046.8 million, which represents nearly 39% of total decade growth. Market momentum in this interval is expected to be driven by increased formulator reliance on active raw materials with validated efficacy, alongside accelerating uptake in dermocosmetic and OTC pipelines.

Anti-Acne Agents Market Key Takeaways

| Metric | Value |

|---|---|

| Anti-Acne Agents Market Estimated Value in (2025E) | USD 1,952.4 million |

| Anti-Acne Agents Market Forecast Value in (2035F) | USD 4,607.2 million |

| Forecast CAGR (2025 to 2035) | 9.00% |

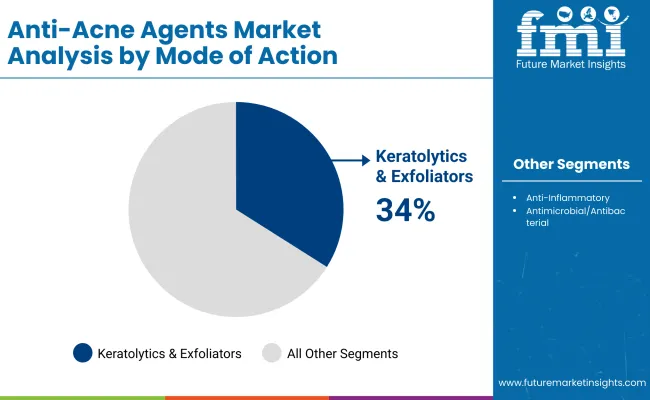

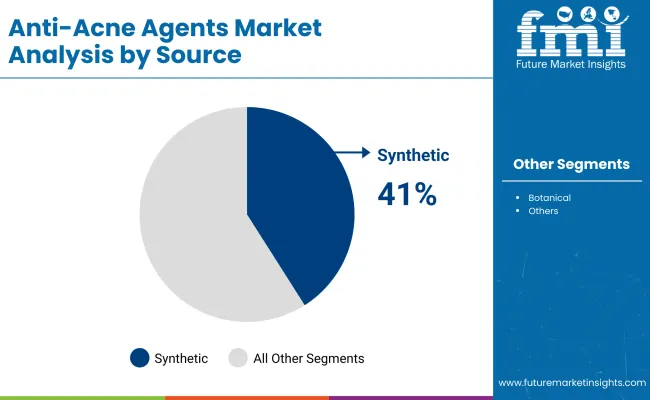

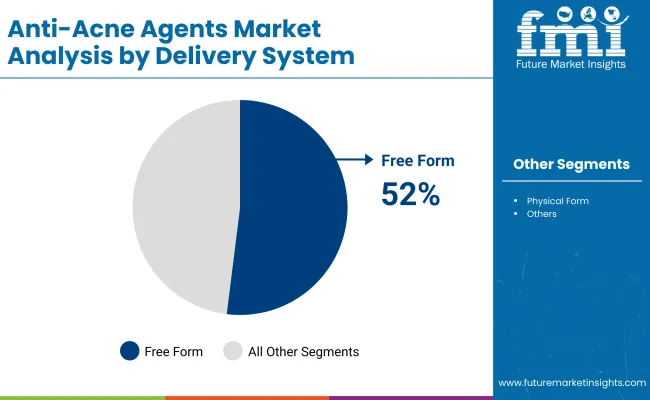

The second phase between 2030 and 2035 is projected to deliver a sharper increase, rising from USD 2,999.2 million to USD 4,607.2 million, equating to USD 1,608.0 million, or around 61% of total growth. This acceleration is likely to be powered by greater penetration of premium anti-acne formulations, regulatory harmonization in Asia, and heightened consumer demand for natural and multifunctional actives. Segment-wise, keratolytics & exfoliators are forecasted to dominate with a 34.0% share in 2025, while solutions and concentrates are expected to lead the physical form category at 52.0% share. Synthetics will remain influential with a 41.0% contribution, though botanical sources are anticipated to gain prominence over time. By 2035, competitive dynamics are expected to intensify as suppliers with advanced delivery technologies and sustainability-driven portfolios secure stronger market positions.

From 2020 to 2024, the anti-acne agents market steadily expanded, with growth underpinned by heightened demand for science-backed active ingredients. During this period, procurement decisions were primarily influenced by synthetic actives that offered stability and consistent quality, accounting for a significant share of raw material supply. Competitive intensity was shaped by multinational chemical companies holding strong regulatory dossiers and broad distribution networks. Innovation pipelines were largely directed toward irritation reduction and compatibility with multifunctional formulations, while botanical ingredients remained in the early adoption phase.

By 2025, demand for anti-acne actives is expected to consolidate at USD 1,952.4 million, supported by dermocosmetic and OTC channels. The revenue mix is projected to evolve by 2035, as encapsulated and nature-based actives increase their share within product development pipelines. Traditional leaders such as BASF and Evonik are expected to pivot toward hybrid portfolios that combine synthetic reliability with sustainable alternatives. Competitive advantage is projected to shift from volume-driven supply toward differentiated delivery technologies, verified clinical data, and sustainability credentials that align with brand and regulatory expectations.

Growth in the anti-acne agents market is being driven by the rising prioritization of dermatological health and the increasing integration of advanced actives in skincare formulations. Demand is being reinforced by greater consumer awareness of long-term skin wellness and the preference for clinically validated solutions. Expanding dermocosmetic and OTC product pipelines are expected to accelerate the use of active raw materials, with formulators emphasizing efficacy, safety, and multifunctionality. Shifts toward sustainable and naturally derived ingredients are projected to influence sourcing strategies, particularly in Asia-Pacific and Europe where regulatory and consumer pressure is intensifying. Delivery innovations such as encapsulation and complexing are being adopted to enhance stability, reduce irritation risks, and optimize bioavailability, creating stronger value propositions for brands. Expansion of premium skincare portfolios, coupled with rapid uptake in emerging markets, is anticipated to strengthen procurement cycles. Competitive differentiation is expected to be anchored in clinical data, sustainability credentials, and supply reliability.

The anti-acne agents market has been segmented across multiple parameters, including mode of action, source, and delivery system, each offering distinct growth drivers and strategic opportunities for suppliers. In terms of mode of action, keratolytics & exfoliators are projected to maintain a strong foothold, supported by proven clinical benefits and wide application versatility. From a sourcing perspective, synthetic ingredients are expected to retain prominence due to cost stability and reliability, though gradual momentum is anticipated for alternatives aligned with clean-label and sustainability trends. Delivery systems are also shaping procurement priorities, with free-form actives holding majority share while encapsulated and advanced systems begin to gain attention for their role in irritation reduction and improved bioavailability.

| Mode of Action | Market Value Share, 2025 |

|---|---|

| Keratolytics & exfoliators | 34% |

| Others | 66.0% |

Keratolytics & exfoliators are projected to command 34.0% of the mode of action segment in 2025, valued at USD 588.9 million, while others account for 66.0%. Their established role in cell turnover and acne lesion reduction is anticipated to keep demand elevated. Broader applications in both leave-on and rinse-off products are supporting this leadership, particularly in formulations designed for sensitive skin. The segment’s strength is expected to be reinforced by growing consumer preference for visible results within shorter application cycles. In addition, investments by suppliers in generating clinical data to substantiate claims are projected to secure sustained adoption, ensuring keratolytics & exfoliators remain the backbone of anti-acne actives.

| Source | Market Value Share, 2025 |

|---|---|

| Synthetic | 41% |

| Others | 59.0% |

Synthetic ingredients are projected to hold 41.0% of the source segment in 2025, generating USD 566.7 million, while others contribute 59.0%. Reliability in production, cost competitiveness, and regulatory approvals are anticipated to keep synthetic actives at the forefront of large-scale formulation strategies. Multinational brand owners are expected to continue sourcing synthetic grades to ensure quality consistency across global markets. However, pressure from sustainability regulations and consumer preferences is likely to redirect partial demand toward botanical alternatives, creating long-term opportunities in natural innovation. Until scale and stability challenges are addressed for natural actives, synthetics are forecasted to retain a vital role, providing a balance of efficacy, availability, and predictable pricing.

| Delivery System | Market Value Share, 2025 |

|---|---|

| Free form | 52% |

| Others | 48.0% |

Free-form delivery systems are expected to lead with 52.0% share of the delivery system segment in 2025, valued at USD 533.3 million, while others account for 48.0%. Their versatility in formulation and ability to blend seamlessly with other ingredients are anticipated to ensure strong demand from contract manufacturers and brand owners alike. While encapsulated and advanced delivery systems are gaining traction for their irritation-reduction benefits, free-form formats are expected to dominate due to ease of scaling and cost advantages. Over the forecast period, incremental gains are anticipated for novel delivery systems, though free form is projected to remain the preferred choice for rapid product launches, especially in mass-market categories where speed to shelf is a key priority.

Complex regulatory pathways and formulation stability challenges continue to shape the anti-acne agents market, even as growing demand from dermocosmetic and OTC brands reinforces the strategic importance of clinically validated, irritation-reducing actives across global supply chains.

Regulatory Harmonization Unlocking Market Access

Global regulatory harmonization is expected to act as a significant growth catalyst, as alignment across regions such as the USA, Europe, and Asia-Pacific will simplify dossier preparation and accelerate time-to-market for active ingredients. Streamlined safety assessments and reduced duplication of testing are projected to lower costs for suppliers while enhancing speed of adoption for brand partners. As a result, ingredient developers with proactive engagement in international standard-setting are anticipated to gain a first-mover advantage. This alignment is also likely to encourage greater cross-border investments in clinical trials and product innovation, securing market entry for novel botanical and biotechnology-derived actives.

Supply Chain Fragility of Specialty Intermediates

Vulnerability in sourcing specialty intermediates is expected to restrain growth, particularly for advanced delivery systems and high-purity grades used in acne formulations. Dependency on limited geographies for raw materials exposes suppliers to risks from geopolitical disruptions, logistics bottlenecks, and environmental compliance crackdowns. Rising scrutiny over solvent use and chemical footprints may further challenge continuity in supply, particularly for synthetic grades requiring stringent impurity control. To mitigate such risks, dual sourcing and backward integration are being pursued, though smaller players may face disproportionate hurdles. Without resilient supply frameworks, brand owners may increasingly favor established suppliers with transparent sourcing, limiting opportunities for newer entrants.

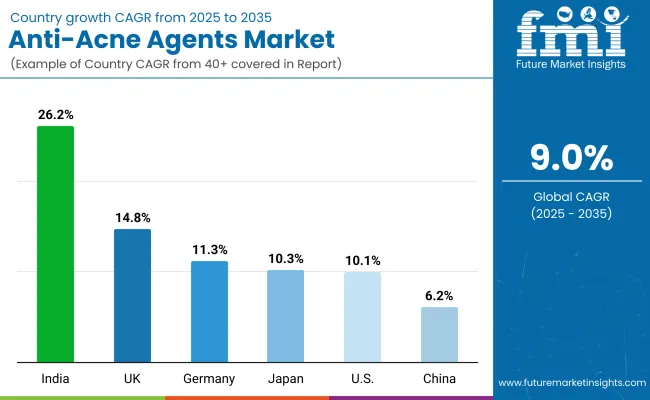

| Country | CAGR |

|---|---|

| China | 6.2% |

| USA | 10.1% |

| India | 26.2% |

| UK | 14.8% |

| Germany | 11.3% |

| Japan | 10.3% |

The anti-acne agents market exhibits clear variations in country-level growth trajectories, reflecting differences in consumer awareness, dermatological infrastructure, and regulatory frameworks. India is projected to record the fastest expansion, advancing at a CAGR of 26.2% between 2025 and 2035. This rapid pace is expected to be fueled by rising disposable incomes, urbanization-driven lifestyle changes, and the proliferation of local skincare brands sourcing active raw materials for affordable formulations. USA growth at 10.1% CAGR is likely to remain robust, supported by strong dermocosmetic adoption, advanced formulation capabilities, and sustained investments in innovation pipelines from leading multinational corporations.

China, expanding at 6.2% CAGR, is projected to deliver steady growth, with demand anchored in mass-market categories, though supply resilience and regulatory compliance will remain critical. European markets such as the UK (14.8% CAGR) and Germany (11.3% CAGR) are anticipated to benefit from stringent safety standards and a rising preference for natural and multifunctional ingredients. Japan, at 10.3% CAGR, is expected to retain importance through premium skincare positioning and consumer preference for high-efficacy formulations with minimal irritation. Overall, a combination of regulatory harmonization, rising dermocosmetic adoption, and localized production ecosystems is projected to reinforce growth across these leading economies.

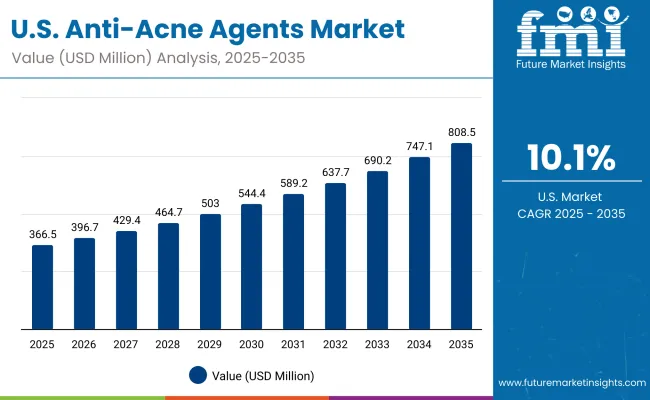

| Year | USA Anti-Acne Agents Market (USD Million) |

|---|---|

| 2025 | 366.59 |

| 2026 | 396.77 |

| 2027 | 429.43 |

| 2028 | 464.78 |

| 2029 | 503.04 |

| 2030 | 544.45 |

| 2031 | 589.26 |

| 2032 | 637.77 |

| 2033 | 690.27 |

| 2034 | 747.09 |

| 2035 | 808.58 |

The Anti-Acne Agents Market in the United States is projected to expand at a CAGR of 8.4% between 2025 and 2035, driven by advanced dermocosmetic adoption, strong OTC penetration, and consumer preference for clinically validated skincare actives. Demand is anticipated to intensify as formulators prioritize irritation-reducing solutions and multifunctional ingredients that deliver visible results.

A CAGR of 14.8% is projected for the UK anti-acne agents market through 2035. Growth is expected to be propelled by dermatologist-led brands, retailer clean-beauty scorecards, and rigorous substantiation standards that favor dossier-rich actives. Local contract manufacturers are anticipated to prioritize clinically proven irritation mitigation and compatibility with retinoids and acids. Evidence-backed claims, transparent sourcing, and microplastic restrictions are likely to shape specifications toward stable, low-residue grades. Digital dermatology and pharmacist counseling are expected to accelerate premium OTC adoption, supporting value capture for delivery technologies that reduce sting while maintaining efficacy.

A CAGR of 26.2% is forecast for India, positioning the market as the fastest-growing among key countries. Expansion is expected to be anchored by masstige and dermatology-endorsed brands that require scalable, cost-efficient actives with visible results at low use levels. Contract manufacturing ecosystems are anticipated to deepen, creating pull for standardized synthetic grades while opening pilot opportunities for botanical actives that meet stability and microbiological criteria. Dermatology clinics and e-commerce marketplaces are projected to amplify adoption through education-led funnels and frequent reformulation cycles. Price sensitivity is expected to coexist with rising willingness to pay for irritation-reducing delivery systems in humid, pollution-exposed urban centers.

A CAGR of 6.2% is projected for China, indicating steady but disciplined growth. Market development is expected to be influenced by evolving cosmetic supervision requirements and intensified scrutiny of safety, claims, and online marketing. Mass-to-premium brand portfolios are anticipated to prioritize stability, low-odor profiles, and irritation control suited to sensitive-skin positioning. Synthetic grades are expected to remain foundational while nature-forward variants gain share where supply reliability and standardization are proven. Cross-border e-commerce is likely to sustain demand for internationally harmonized dossiers and rapid technical service. Delivery technologies that balance efficacy with mildness are projected to see increased specification in serums and ampoules.

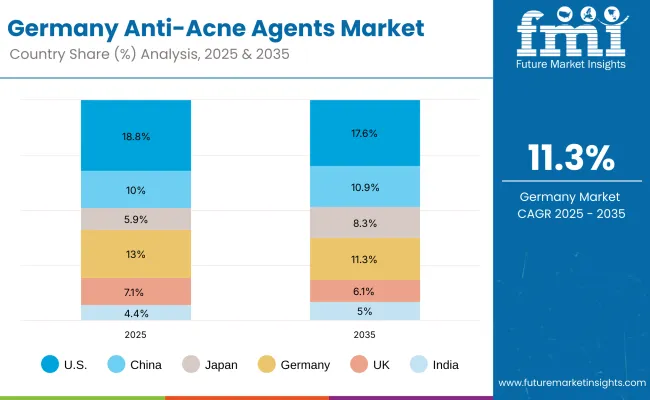

| Country | 2025 |

|---|---|

| USA | 18.8% |

| China | 10.0% |

| Japan | 5.9% |

| Germany | 13.0% |

| UK | 7.1% |

| India | 4.4% |

| Country | 2035 |

|---|---|

| USA | 17.6% |

| China | 10.9% |

| Japan | 8.3% |

| Germany | 11.3% |

| UK | 6.1% |

| India | 5.0% |

A CAGR of 11.3% is forecast for Germany, reflecting resilient demand in a quality-driven market. Procurement is expected to be guided by stringent safety documentation, REACH conformity, and sustainability reporting embedded in retailer frameworks. Dermocosmetic brands and pharmacy channels are anticipated to prefer actives with reproducible clinical endpoints and strong tolerance profiles. Formulators are expected to test encapsulation and polymer-complexed systems that deliver controlled release while maintaining minimalist INCI counts. Interest in microbiome-respectful and fragrance-reduced solutions is projected to support premiumization, while private-label programs favor cost-in-use efficiency and dependable supply.

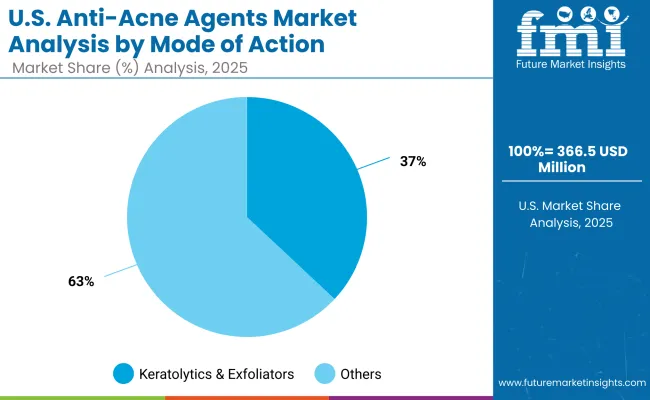

| USA by Mode of Action | Market Value Share, 2025 |

|---|---|

| Keratolytics & exfoliators | 37% |

| Others | 63.0% |

The Anti-Acne Agents Market in the USA is projected at USD 366.59 million in 2025. Within mode of action, keratolytics & exfoliators account for 37% share (USD 135.6 million), while other mechanisms dominate at 63% (USD 230.95 million). This dominance of broader categories highlights diversified demand across antimicrobial, antibacterial, and anti-inflammatory agents, reflecting consumer preference for multi-active formulations that deliver comprehensive acne care. The strength of keratolytics & exfoliators is expected to remain resilient as exfoliation benefits are closely aligned with dermatologist recommendations and supported by strong clinical validation. Other mechanisms are projected to gain further ground, particularly through advanced delivery systems that mitigate irritation while extending efficacy.

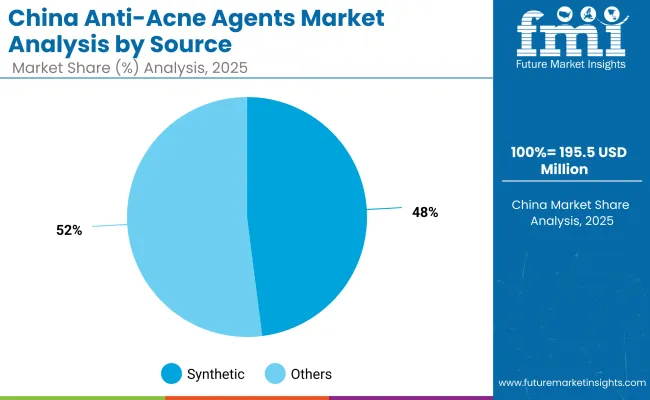

| China by Source | Market Value Share, 2025 |

|---|---|

| Synthetic | 48% |

| Others | 52.0% |

The Anti-Acne Agents Market in China is projected at USD 195.56 million in 2025. Within source categories, synthetic ingredients contribute 48% share (USD 93.9 million), while others slightly lead with 52% share (USD 101.69 million). The preference for non-synthetic options reflects rising consumer awareness of natural and botanical-based actives, reinforced by regulatory momentum toward cleaner formulations. Synthetic grades, however, are expected to retain a significant role owing to cost efficiency, consistent quality, and global registrations that support cross-border expansion. Competitive positioning is anticipated to hinge on the ability to deliver stable, irritation-controlled natural alternatives that meet evolving safety standards without compromising performance.

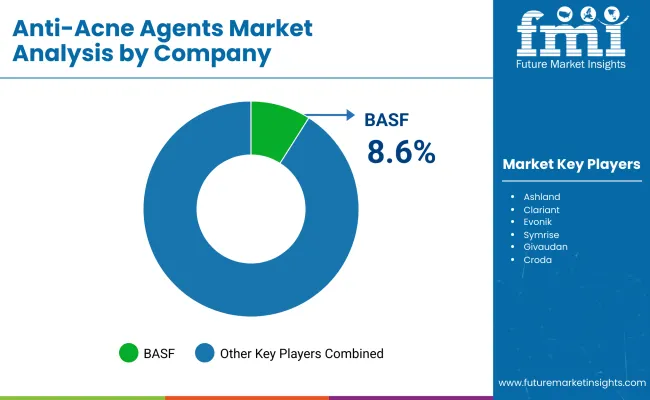

| Company | Global Value Share 2025 |

|---|---|

| BASF | 8.6% |

| Others | 91.4% |

The Anti-Acne Agents Market is moderately consolidated, with global leaders, diversified chemical innovators, and niche-focused specialists competing across raw material supply for dermocosmetic and OTC formulations. Global leaders such as BASF hold a significant presence, with an estimated 8.6% share of the global market in 2025. This dominance is expected to be reinforced by the company’s extensive dermatology-aligned portfolio, strong R&D pipelines, and regulatory expertise across key regions. Their strategies are projected to emphasize sustainability certifications, dossier-ready actives, and innovation in irritation-reducing solutions, ensuring long-term relevance for formulators.

Mid-sized innovators such as Ashland, Clariant, Evonik, Symrise, and Croda are expected to remain highly competitive, offering differentiated botanical actives, encapsulation technologies, and multifunctional blends. These players are anticipated to strengthen their positions through flexible manufacturing, customer co-development programs, and clinical data integration tailored for dermocosmetic brands.

Specialist ingredient suppliers including Givaudan Active Beauty, DSM-Firmenich, Roquette, and Lubrizol are projected to focus on highly customized solutions, targeting premium and natural-positioned segments. Their strength is likely to lie in application-specific performance, consumer sensorials, and sustainability credentials rather than global scale.

Competitive differentiation is shifting away from commodity supply toward integrated ingredient ecosystems, where regulatory readiness, delivery innovation, and sustainability-driven sourcing are expected to define long-term success.

Key Developments in Anti-Acne Agents Market

| Item | Value |

|---|---|

| Quantitative units | USD 1,952.4 million (2025); USD 4,607.2 million (2035); CAGR 9.0% (2025 to 2035) |

| Component | Mode of Action (keratolytics & exfoliators; anti-inflammatory; antimicrobial/antibacterial); Source (synthetic; botanical/others); Delivery System (free form; encapsulated/complexed); Physical Form (solutions/concentrates; powders; suspensions) |

| Application | Leave-on face care; rinse-off cleansers; spot treatments & patches; scalp care |

| End-use industry | Dermocosmetic brands; OTC skincare; contract manufacturers (CMOs/CDMOs); private label retail |

| Regions covered | North America; Europe; Asia-Pacific; Latin America; Middle East & Africa |

| Countries covered | United States; China; India; United Kingdom; Germany; Japan |

| Key companies profiled | BASF; Ashland; Clariant; Evonik; Symrise; Givaudan; Croda; DSM-Firmenich; Roquette; Lubrizol |

| Additional attributes | Segment shares: keratolytics & exfoliators 34.0% (USD 588.9 million, 2025); synthetic source 41.0% (USD 566.7 million, 2025); free-form delivery 52.0% (USD 533.3 million, 2025). Evidence requirements (clinical dossiers), irritation-mitigation delivery systems, sustainability/traceability documentation, regulatory harmonization, and supply-resilience strategies drive specifications and procurement decisions. |

By Delivery System:

The global Anti-Acne Agents Market is estimated to be valued at USD 1,952.4 million in 2025.

The market size for the Anti-Acne Agents Market is projected to reach USD 4,607.2 million by 2035.

The Anti-Acne Agents Market is expected to grow at a CAGR of 9.0% between 2025 and 2035.

The key product types in the Anti-Acne Agents Market include keratolytics & exfoliators, anti-inflammatory agents, and antimicrobial/antibacterial agents.

In terms of delivery system, free-form actives are projected to command 52.0% share of the Anti-Acne Agents Market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Matting Agents Market Size and Share Forecast Outlook 2025 to 2035

Healing Agents Market (Skin Repair & Soothing Actives) Market Size and Share Forecast Outlook 2025 to 2035

Foaming Agents Market Size and Share Forecast Outlook 2025 to 2035

Firming Agents Botox-Like Market Size and Share Forecast Outlook 2025 to 2035

Heating Agents Market Size and Share Forecast Outlook 2025 to 2035

Cooling Agents Market Size and Share Forecast Outlook 2025 to 2035

Firming Agents Market Growth – Product Innovations & Applications from 2025 to 2035

Raising Agents Market Trends – Growth & Industry Forecast 2024 to 2034

Weighing Agents Market Size and Share Forecast Outlook 2025 to 2035

Draining Agents Market Size and Share Forecast Outlook 2025 to 2035

Flatting Agents Market Size and Share Forecast Outlook 2025 to 2035

Clouding Agents Market Trends - Growth Factors & Industry Analysis

Cognitive Agents Market Size and Share Forecast Outlook 2025 to 2035

Flavoring Agents Market Size and Share Forecast Outlook 2025 to 2035

Leavening Agents Market Analysis - Size, Growth, and Forecast 2025 to 2035

Market Share Breakdown of Anti-Slip Agents Manufacturers

Coalescing Agents Market Size and Share Forecast Outlook 2025 to 2035

Mattifying Agents Market Size and Share Forecast Outlook 2025 to 2035

Biocontrol Agents Market Size and Share Forecast Outlook 2025 to 2035

Autonomous Agents Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA