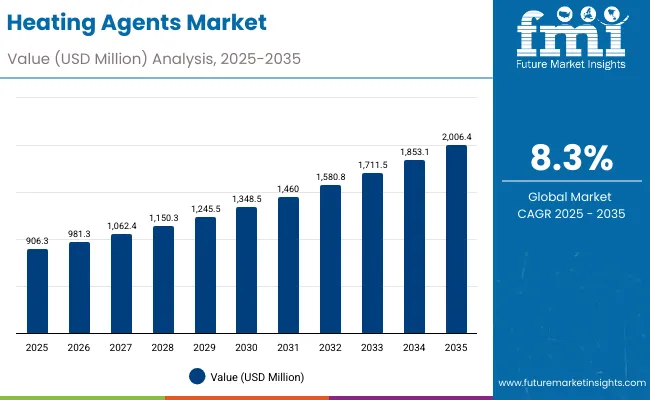

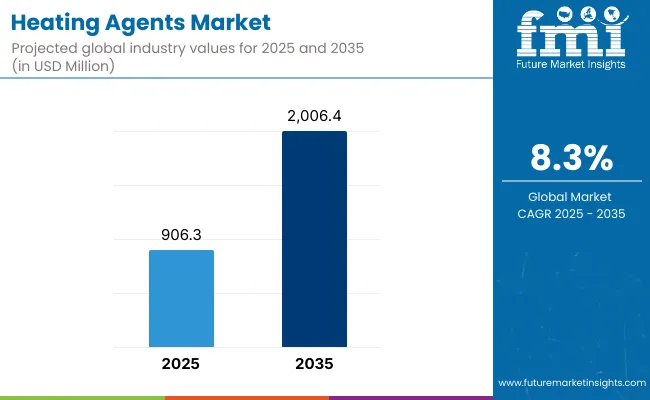

The Global Heating Agents Market is expected to record a valuation of USD 906.3 million in 2025 and USD 2,006.4 million in 2035, with an increase of USD 1,100.1 million, which equals a growth of 193% over the decade. The overall expansion represents a CAGR of 8.3% and a 2X increase in market size.

Global Heating Agents Market Key Takeaways

| Metric | Value |

|---|---|

| Global Heating Agents Market Estimated Value in (2025E) | USD 906.3 million |

| Global Heating Agents Market Forecast Value in (2035F) | USD 2,006.4 million |

| Forecast CAGR (2025 to 2035) | 8.30% |

During the first five-year period from 2025 to 2030, the market increases from USD 906.3 million to USD 1,348.5 million, adding USD 442.2 million, which accounts for 40.2% of the total decade growth. This phase records steady adoption in personal care, dermocosmetic formulations, and spa/sports applications, driven by the rising demand for sensory-driven formulations that improve consumer experiences.

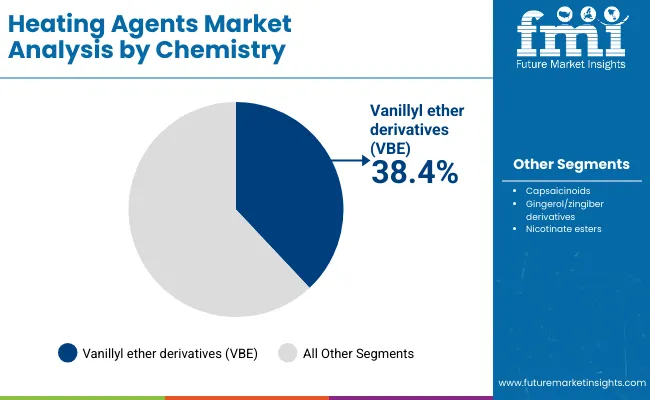

Vanillyl ether derivatives (VBE) dominate this period as they cater to more than 38% of global demand, due to their stability, reliable warming profile, and regulatory acceptability in cosmetics. Long-lasting warming actives also gain strong traction in this stage as they fit well with product claims around sustained effects in slimming gels, lip plumpers, and muscle balms.

The second half from 2030 to 2035 contributes USD 657.9 million, equal to 59.8% of total growth, as the market jumps from USD 1,348.5 million to USD 2,006.4 million. This acceleration is powered by increased deployment of thermo-sensory blends in multifunctional products such as anti-aging serums, scalp treatments, and advanced spa therapies.

Encapsulated and bead-based delivery systems expand rapidly, allowing better stability and controlled release. Regional growth is particularly strong in Asia-Pacific, led by China and India with double-digit CAGRs above 12%, where beauty and wellness consumer bases are expanding rapidly. The rising demand for professional spa-grade products and dermocosmetic innovations further enhances uptake. By 2035, free-form systems retain strong presence but encapsulated formats gain higher market share as brands seek differentiation in delivery technologies.

From 2020 to 2024, the Global Heating Agents Market grew steadily as sensory actives became a core differentiator in personal care and wellness formulations. During this period, the competitive landscape was dominated by leading flavor & fragrance houses and specialty ingredient suppliers, with market leaders such as Symrise and Givaudan pushing innovations in warming sensates.

Competitive differentiation relied on intensity, sensory balance, safety profile, and regulatory compliance, while advanced delivery systems were only emerging. Encapsulation was niche, and free-form actives dominated more than 70% of formulations.

Demand for heating agents will expand to USD 906.3 million in 2025, and the revenue mix will evolve as encapsulated and pre-blended sensate systems grow to capture rising formulation needs in both premium and mass-market products.

Traditional raw material suppliers face increasing competition from formulation specialists offering advanced sensate systems tailored to end-use applications. Major suppliers are shifting from pure chemistry innovation toward integrated sensorial platforms that combine heating, cooling, and tingling actives in synergistic blends. The competitive advantage is moving beyond ingredient availability to expertise in controlled release, multifunctional claims, and consumer experience delivery.

Advances in thermo-sensory actives have enhanced product performance, enabling consistent warming sensations across diverse applications such as lip plumpers, body slimming gels, muscle recovery balms, and scalp stimulants.

Vanillyl ether derivatives have become the leading chemistry due to their reliable warming intensity, safety record, and compatibility with both leave-on and rinse-off formulations. Long-lasting warming agents are gaining adoption as consumers increasingly prefer products with extended efficacy, especially in sports recovery and professional spa categories.

The market is also expanding due to the evolution of delivery systems. Free-form actives continue to dominate due to cost efficiency and ease of formulation, but encapsulated and bead formats are seeing rapid growth as they provide controlled release, enhanced stability, and differentiation in premium products. This trend is aligned with the rise of dermocosmetics and professional-grade formulations.

Asia-Pacific is leading growth, particularly India and China, where rising disposable incomes, demand for sensorial beauty products, and rapid uptake in hair and body care drive double-digit CAGRs. North America and Europe remain mature but stable markets, where innovation in spa therapies, sustainable raw materials, and regulatory compliance drive steady demand.

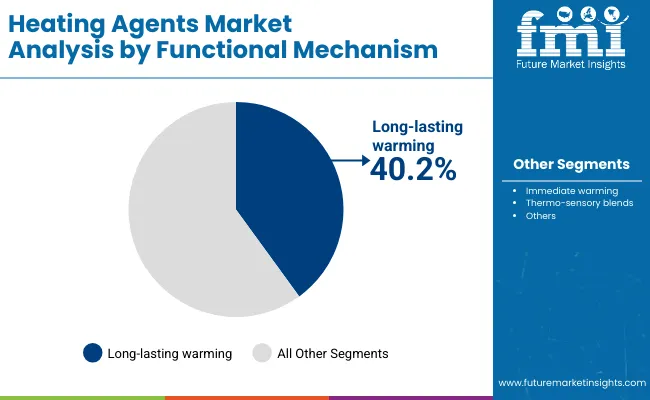

The market is segmented by chemistry, functional mechanism, delivery system, physical form, application, end use, and region. Chemistry segmentation covers vanillyl ether derivatives, capsaicinoids, gingerol/zingiber derivatives, and nicotinate esters, highlighting the sensory diversity of heating actives. Functional mechanisms include immediate warming, long-lasting warming, and thermo-sensory blends that provide varied temporal effects.

Delivery systems encompass free form, encapsulated, and pre-blended sensate systems, reflecting technological advancement in active delivery. Physical forms include solution/concentrate, powder, and beads/encapsulates for different formulation compatibilities. Applications span lip plumpers, body slimming and massage gels, muscle warming balms, and scalp stimulating tonics.

End use sectors comprise personal care, professional spa and sports topicals, and dermocosmetic applications. Regionally, the scope spans North America, Europe, East Asia, South Asia & Pacific, Latin America, and the Middle East & Africa.

| Chemistry | Value Share % 2025 |

|---|---|

| Vanillyl ether derivatives (VBE) | 38.4% |

| Others | 61.6% |

The vanillyl ether derivatives (VBE) segment is projected to contribute 38.4% of the Global Heating Agents Market revenue in 2025, maintaining its lead as the dominant chemistry category. This leadership is attributed to VBE’s reliable warming intensity, safety profile, and versatility across multiple applications ranging from lip plumpers to muscle balms. The stability and consistent performance of VBE in both rinse-off and leave-on formulations make it highly preferred by formulators targeting predictable consumer experiences.

The segment’s growth is further reinforced by regulatory acceptance and its ability to provide uniform warming without causing irritation at controlled dosages. In addition, ongoing product innovation in personal care and spa products increasingly highlights VBE as a trusted active. As consumer demand for sensorial cosmetics expands, VBE is expected to remain the chemistry backbone of the Heating Agents Market through 2035.

| Functional Mechanism | Value Share % 2025 |

|---|---|

| Long-lasting warming | 40.2% |

| Others | 59.8% |

The long-lasting warming segment is forecasted to hold 40.2% of the market share in 2025, reflecting its rising importance in applications where sustained efficacy drives product differentiation. Consumers increasingly seek prolonged warming effects in slimming gels, recovery balms, and professional spa treatments, making this functional mechanism critical for premium positioning.

Formulators leverage long-lasting warming actives to align with claims such as extended muscle relaxation, enduring lip plumping, and lasting scalp stimulation. The segment’s expansion is further enabled by technological innovations in controlled-release systems that enhance durability without compromising comfort. With the ongoing shift toward products that deliver experiential and lasting benefits, the long-lasting warming segment is expected to retain its dominance across multiple application areas.

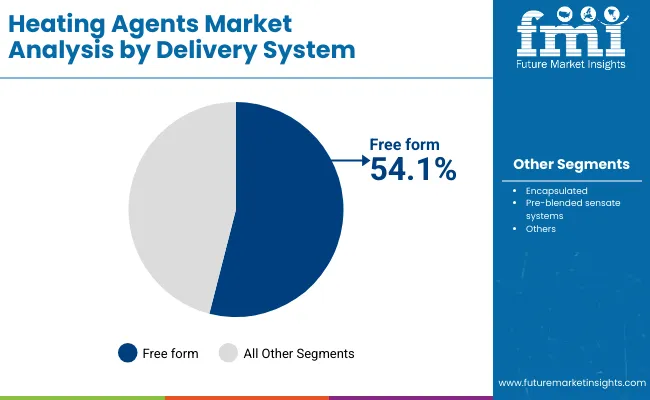

| Delivery System | Value Share % 2025 |

|---|---|

| Free form | 54.1% |

| Others | 45.9% |

The free-form delivery system segment is projected to contribute 54.1% of the Global Heating Agents Market revenue in 2025, making it the leading mode of incorporation. Its dominance stems from simplicity, cost-effectiveness, and ease of blending into diverse cosmetic and personal care formulations. Free-form actives offer manufacturers flexibility in formulation development while reducing production complexities

This segment continues to gain traction as it is widely compatible with creams, gels, oils, and serums used across personal care and professional spa applications. Although encapsulated and pre-blended systems are growing, free-form delivery remains the most accessible format for mainstream brands and mass-market launches. Its sustained adoption is supported by its affordability and established familiarity in the industry, ensuring that free form remains the preferred delivery system in the near term.

Growing Demand for Sensorial Cosmetics in Emerging Economies

In markets like China and India, double-digit growth (12-14% CAGR) in heating agents is fueled by rising disposable incomes and a preference for experiential beauty and wellness products. Consumers increasingly associate warming sensations with efficacy in lip plumpers, slimming gels, and spa treatments. Local brands in Asia-Pacific are aggressively formulating with warming actives to differentiate themselves, boosting demand for vanillyl ether derivatives and sensate blends.

Shift Toward Long-lasting and Controlled-release Formulations

The functional mechanism segment highlights that long-lasting warming already accounts for 40.2% of global share. This is being reinforced by the adoption of encapsulated delivery systems, which offer stability, reduce irritation risks, and provide sustained heating effects. Demand is especially strong in professional spa and sports recovery topicals, where consumers expect prolonged performance. This driver is pushing suppliers to invest in encapsulation technologies and sensate system innovations.

Skin Sensitivity and Regulatory Limitations

Heating actives, particularly capsaicinoids and nicotinate esters, are prone to causing irritation or redness at higher dosages. Strict safety thresholds limit their inclusion levels, restricting flexibility for formulators. Regulatory oversight in markets such as Europe also requires extensive testing, which increases time-to-market and deters experimentation with newer chemistries.

High Cost of Advanced Delivery Systems

While encapsulated and bead-based heating actives are gaining traction, their production costs remain significantly higher than free-form alternatives. This restricts adoption in mass-market products, where price sensitivity is high. As a result, encapsulated delivery is still concentrated in premium dermocosmetics and spa lines, slowing its wider penetration despite its performance benefits.

Rise of Thermo-sensory Blends Combining Heating, Cooling, and Tingling

Brands are increasingly experimenting with sensate blends that combine heating actives with cooling agents (like menthol) or tingling molecules to deliver layered consumer experiences. These blends are trending in lip care, scalp stimulants, and sports topicals, where multi-sensory effects enhance product appeal and brand differentiation.

Integration of Heating Agents into Scalp and Haircare Formulations

Scalp-stimulating tonics are emerging as a high-growth niche application, particularly in East Asia. Heating actives are being marketed as circulation-boosting ingredients that support scalp health and hair growth. With rising consumer interest in holistic hair wellness, this trend is set to create a strong pull for controlled and mild warming actives that deliver efficacy without irritation.

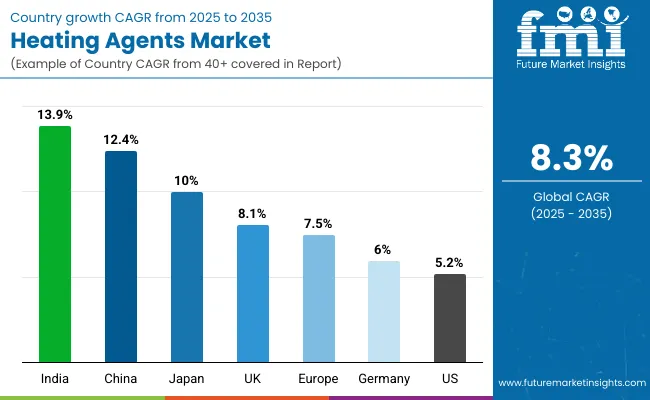

| Country | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 12.4% |

| USA | 5.2% |

| India | 13.9% |

| UK | 8.1% |

| Germany | 6.0% |

| Japan | 10.0% |

| Europe | 7.5% |

Asia is emerging as the fastest-growing region in the Global Heating Agents Market, led by India with an impressive CAGR of 13.9% and China at 12.4% between 2025 and 2035. Rising disposable incomes, expanding middle-class populations, and increased awareness of premium beauty and wellness products are fueling demand for sensorial actives.

In India, the popularity of body slimming gels, scalp stimulants, and lip plumpers is surging as consumers seek multifunctional cosmetics with visible effects. China, on the other hand, benefits from its large beauty market and the rapid uptake of professional spa and dermocosmetic formulations. Japan also demonstrates strong momentum with a CAGR of 10.0%, supported by innovation-driven consumer preferences and the integration of warming agents in scalp and anti-aging care. These Asian markets together are reshaping the growth trajectory of the global industry.

In contrast, mature markets such as the USA and Europe are expanding at a steadier pace, with the USA recording a CAGR of 5.2% and Europe averaging 7.5%. The USA remains the single-largest contributor in value terms due to its established personal care and wellness industries, though its growth is relatively moderate compared to Asia.

Europe is supported by key countries like Germany (6.0%) and the UK (8.1%), where dermocosmetic and spa-grade formulations continue to drive adoption. These markets are more regulated, with emphasis on safety and efficacy, favoring ingredients like vanillyl ether derivatives that deliver consistent warming without irritation. While growth rates are slower than Asia, North America and Europe will remain essential for high-value, premium formulations that shape global innovation trends.

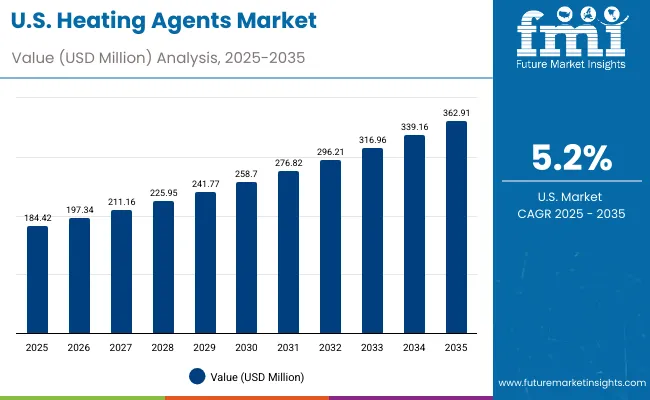

| Year | USA Heating Agents Market (Thermo-sensory Actives) Market (USD Million) |

|---|---|

| 2025 | 184.42 |

| 2026 | 197.34 |

| 2027 | 211.16 |

| 2028 | 225.95 |

| 2029 | 241.77 |

| 2030 | 258.70 |

| 2031 | 276.82 |

| 2032 | 296.21 |

| 2033 | 316.96 |

| 2034 | 339.16 |

| 2035 | 362.91 |

The Heating Agents Market in the United States is projected to grow at a CAGR of 5.2%, led by rising demand in personal care and sports recovery formulations. Vanillyl ether derivatives (VBE) account for over 35% of the USA market, supported by strong adoption in lip plumpers, slimming gels, and spa-grade massage products.

Professional athletes and fitness enthusiasts are driving steady uptake of muscle-warming balms, while dermocosmetic brands are formulating long-lasting warming agents to enhance consumer perception of product efficacy. Although the USA growth rate is moderate compared to Asia, its value base remains the largest, providing a strong platform for premium product innovation.

The Heating Agents Market in the United Kingdom is expected to grow at a CAGR of 8.1%, supported by innovation in spa-grade formulations, dermocosmetics, and professional massage products. The UK consumer base values efficacy and safety, with long-lasting warming agents and encapsulated delivery systems gaining popularity for sustained effects and reduced irritation.

High-end salons and spas are driving adoption of warming sensates in treatments that combine circulation-boosting and relaxation benefits. Meanwhile, dermocosmetic firms are introducing scalp-stimulating tonics and advanced warming serums targeting niche consumer needs.

India is witnessing rapid growth in the Heating Agents Market, which is forecast to expand at a CAGR of 13.9% through 2035, the fastest among leading economies. A surge in demand for body-slimming and toning gels, scalp-stimulating formulations, and wellness products is driving market penetration beyond metro cities into tier-2 and tier-3 regions.

Rising disposable incomes and increasing adoption of beauty and personal care routines are propelling usage in both mass-market and premium product categories. MSMEs are actively formulating with vanillyl ether derivatives and sensate blends to meet local preferences, while multinational firms are targeting India with tailored launches in warming cosmetics.

The Heating Agents Market in China is expected to grow at a CAGR of 12.4%, one of the highest among major economies. This momentum is fueled by the strong uptake of long-lasting warming agents, which already hold 32.8% share of the Chinese market, and rising demand for professional spa and dermocosmetic products. Chinese consumers are increasingly drawn to multifunctional sensorial products that combine warmth with visible efficacy claims, such as circulation-boosting scalp tonics and anti-aging serums. Local beauty brands are competing aggressively with international players, driving innovation in encapsulated delivery and thermo-sensory blends tailored for sensitive skin.

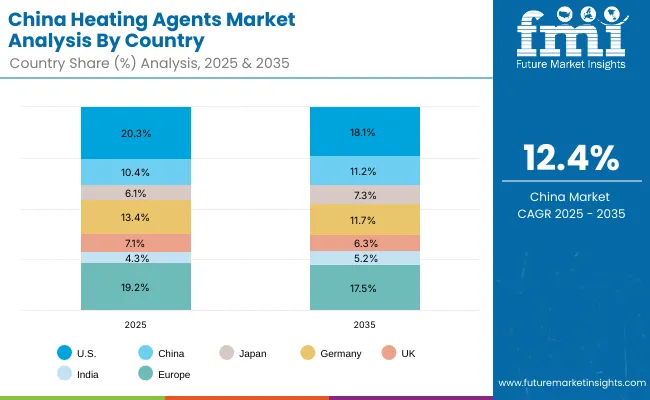

| Country | 2025 Share (%) |

|---|---|

| USA | 20.3% |

| China | 10.4% |

| Japan | 6.1% |

| Germany | 13.4% |

| UK | 7.1% |

| India | 4.3% |

| Europe | 19.2% |

| Country | 2035 Share (%) |

|---|---|

| USA | 18.1% |

| China | 11.2% |

| Japan | 7.3% |

| Germany | 11.7% |

| UK | 6.3% |

| India | 5.2% |

| Europe | 17.5% |

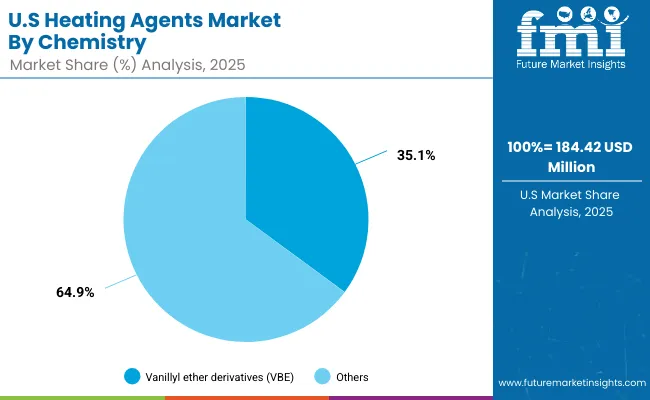

| Value Share % 2025 | USA By Chemistry |

|---|---|

| Vanillyl ether derivatives (VBE) | 35.1% |

| Others | 64.9% |

The Heating Agents Market in the United States is projected at USD 184.42 million in 2025. Vanillyl ether derivatives contribute 35.1%, while other chemistries, including capsaicinoids and gingerol derivatives, make up the remaining 64.9%.

This highlights the continuing dominance of VBE as the safest and most versatile option for personal care and dermocosmetic formulations. Its stable warming effect and controlled irritation profile give it an edge over more aggressive heating actives, especially under stringent USA regulatory oversight.

The strong presence of spa and sports recovery applications supports the demand for warming balms, while lip plumpers and body-slimming products maintain steady adoption in the personal care segment. Dermocosmetic brands are increasingly exploring encapsulated systems to enhance performance, but cost-sensitive mainstream products continue to rely on free-form VBE solutions. While the overall growth rate is moderate at 5.2% CAGR, the USA remains a high-value market that rewards ingredient suppliers offering safety-compliant, performance-driven warming actives.

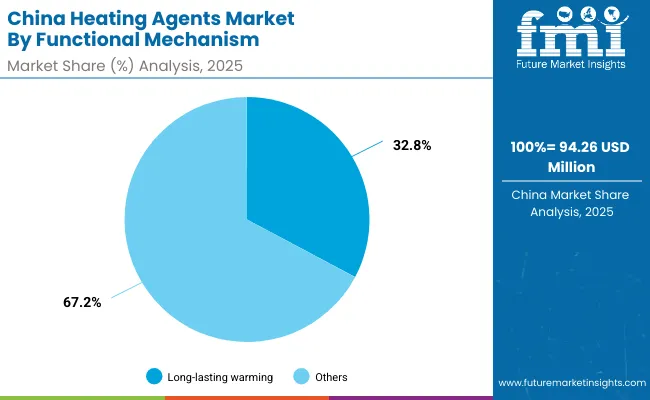

| China By Functional Mechanism | Value Share % 2025 |

|---|---|

| Long-lasting warming | 32.8% |

| Others | 67.2% |

The Heating Agents Market in China is projected at USD 94.26 million in 2025, with long-lasting warming agents contributing 32.8%. This reflects Chinese consumers’ preference for efficacy-oriented cosmetics and wellness solutions, where extended heating effects are perceived as superior in performance. The rising adoption of thermo-sensory blends in professional spa therapies and dermocosmetic scalp treatments highlights how local demand is shifting toward multifunctional, long-duration experiences.

China’s growth outlook is exceptionally strong, with a forecast CAGR of 12.4%, driven by urban wellness trends, premium product adoption, and innovation from both domestic and global suppliers. Encapsulated and pre-blended sensate systems are gaining traction, especially in premium product lines, while free-form agents continue to dominate mass-market formulations. Competitive innovation by local firms focusing on affordability and rapid scaling is further accelerating adoption across personal care, haircare, and body treatment categories.

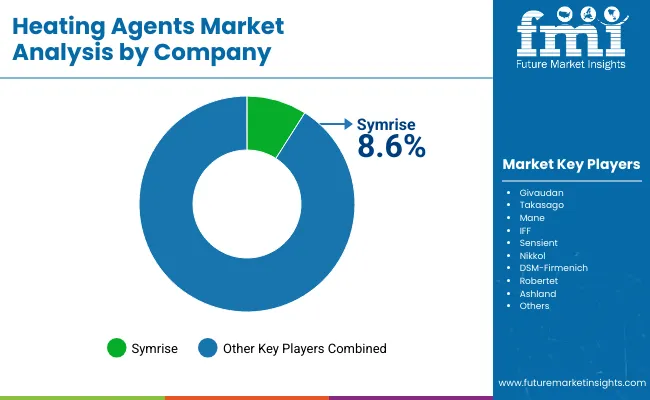

| Company | Global Value Share 2025 |

|---|---|

| Symrise | 8.6% |

| Others | 91.4% |

The Global Heating Agents Market is moderately concentrated, with leading fragrance & flavor houses and specialty ingredient suppliers competing to capture demand across personal care, spa, and dermocosmetic applications.

Symrise holds the highest individual share at 8.6%, reflecting its strong portfolio of sensorial actives and integrated delivery solutions. Other global leaders such as Givaudan, Takasago, IFF, and Mane are also active in the space, leveraging their expertise in sensates and multifunctional cosmetic ingredients.

Mid-sized innovators, including Sensient, Nikkol, and Robertet, are strengthening their presence with cost-effective warming agents and regional customization strategies. DSM-Firmenich and Ashland are focusing on broader dermocosmetic and wellness applications, integrating heating actives with multifunctional systems that enhance efficacy, stability, and consumer appeal.

Competitive differentiation is moving away from pure chemistry toward ecosystem-driven offerings, where delivery technology, controlled release, and sensate blends (heating + cooling + tingling) define long-term success. Companies that can combine regulatory compliance, safety assurance, and advanced delivery systems are expected to capture greater market share in the coming decade.

Key Developments in Global Heating Agents Market

| Item | Value |

|---|---|

| Quantitative Units | USD Million |

| Chemistry | Vanillyl ether derivatives (VBE), Capsaicinoids, Gingerol / zingiber derivatives, and Nicotinate esters |

| Functional Mechanism | Immediate warming, Long-lasting warming, and Thermo-sensory blends |

| Delivery System | Free form, Encapsulated, and Pre-blended sensate systems |

| Physical Form | Solution/concentrate, Powder, and Beads/encapsulates |

| Application | Lip plumpers, Body slimming & massage gels, Muscle warming balms, and Scalp stimulating tonics |

| End Use | Personal care, Professional spa/sports topicals, and Dermocosmetic |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Symrise, Givaudan, Takasago, Mane, IFF, Sensient, Nikkol, DSM- Firmenich, Robertet, Ashland |

| Additional Attributes | Dollar sales by chemistry, functional mechanism, and delivery system; adoption trends in dermocosmetics and spa therapies; rising demand for long-lasting and encapsulated actives; sector-specific growth in personal care, haircare, and slimming products; integration with multi-sensory blends (warming + cooling + tingling); regional trends driven by beauty & wellness demand in Asia-Pacific; innovations in safe and irritation-free warming actives such as next-gen VBE derivatives and bead encapsulation systems. |

The Global Heating Agents Market is estimated to be valued at USD 906.3 million in 2025.

The market size for the Global Heating Agents Market is projected to reach USD 2,006.4 million by 2035.

The Global Heating Agents Market is expected to grow at a CAGR of 8.3% between 2025 and 2035.

The key chemistry segments are Vanillyl ether derivatives (VBE), Capsaicinoids, Gingerol/zingiber derivatives, and Nicotinate esters.

In terms of functional mechanism, the Long-lasting warming segment is projected to command 40.2% share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Heating and Cooling Market Size and Share Forecast Outlook 2025 to 2035

Heating Pad Market

Self Heating Food Packaging Market Size and Share Forecast Outlook 2025 to 2035

Self-Heating Butter Knife Market Size and Share Forecast Outlook 2025 to 2035

Radiant Heating And Cooling Systems Market

Infrared Heating Pad Market Size and Share Forecast Outlook 2025 to 2035

District Heating and Cooling Market Size and Share Forecast Outlook 2025 to 2035

District Heating Market Size and Share Forecast Outlook 2025 to 2035

District Heating Pipeline Network Market Size and Share Forecast Outlook 2025 to 2035

Ductless Heating & Cooling Systems Market Size and Share Forecast Outlook 2025 to 2035

Flexible Heating Element Market

Renewable Heating Fuels Market Size and Share Forecast Outlook 2025 to 2035

Commercial Heating Equipment Market Size and Share Forecast Outlook 2025 to 2035

Underfloor Heating Market Size and Share Forecast Outlook 2025 to 2035

EV Battery Heating System Market Size and Share Forecast Outlook 2025 to 2035

Residential Heating Equipment Market Size and Share Forecast Outlook 2025 to 2035

Cooling and Heating as a Service Market Growth – Trends & Forecast 2025-2035

Europe Wood Pellet Heating System Market Growth – Trends & Forecast 2024-2034

Cast Aluminum Heating Board Market Size and Share Forecast Outlook 2025 to 2035

Solar District Heating Market Analysis - Size, Share, and Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA