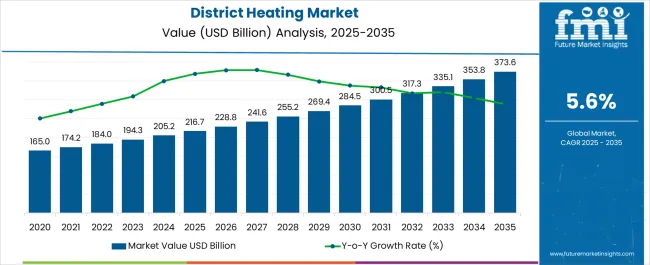

The District Heating Market is estimated to be valued at USD 216.7 billion in 2025 and is projected to reach USD 373.6 billion by 2035, registering a compound annual growth rate (CAGR) of 5.6% over the forecast period.

| Metric | Value |

|---|---|

| District Heating Market Estimated Value in (2025 E) | USD 216.7 billion |

| District Heating Market Forecast Value in (2035 F) | USD 373.6 billion |

| Forecast CAGR (2025 to 2035) | 5.6% |

The district heating market is expanding steadily as cities and municipalities focus on sustainable energy infrastructure and efficient heat distribution systems. Rising concerns regarding carbon emissions, energy security, and cost effective heating are encouraging the integration of centralized heating networks powered by renewable and low carbon sources.

Governments across Europe, Asia, and North America are supporting district heating initiatives through policy incentives, modernization funds, and technology upgrades. Combined heat and power systems, biomass, and waste to energy plants are increasingly being deployed to enhance efficiency while reducing dependence on fossil fuels.

The market outlook remains strong as urbanization and decarbonization goals continue to drive investments, making district heating a crucial element in the global transition toward sustainable energy solutions.

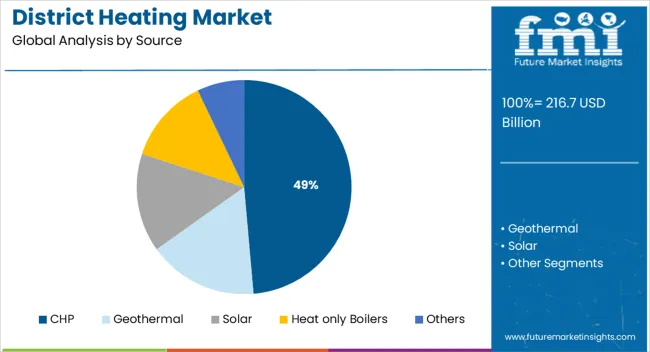

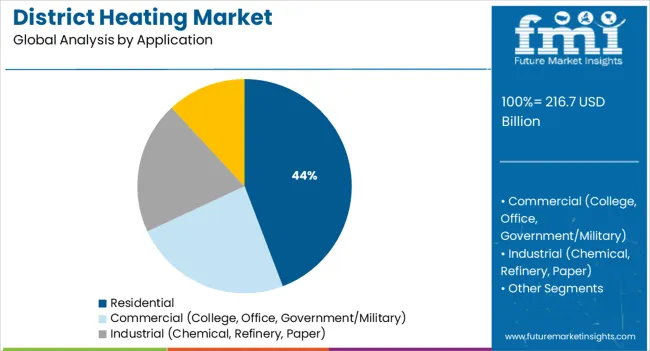

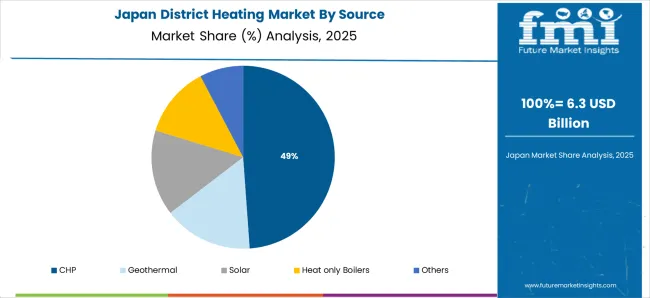

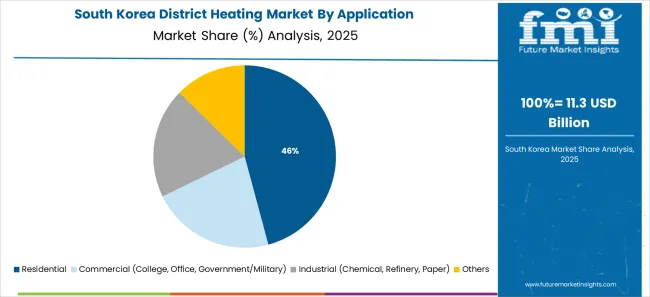

The market is segmented by Source and Application and region. By Source, the market is divided into CHP, Geothermal, Solar, Heat only Boilers, and Others. In terms of Application, the market is classified into Residential, Commercial (College, Office, Government/Military), Industrial (Chemical, Refinery, Paper), and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The CHP source segment is projected to hold 48.60% of total market revenue by 2025 within the source category, making it the dominant segment. Its leadership is driven by its dual capacity to generate both electricity and heat simultaneously, ensuring higher fuel efficiency and reduced emissions compared to conventional energy production methods.

The cost effectiveness of CHP systems, combined with their compatibility with renewable energy integration, has strengthened their adoption in district heating networks. Governments and industries are prioritizing CHP due to its ability to provide reliable baseload energy while supporting grid stability.

These benefits have positioned CHP as the leading contributor to the growth of the district heating market.

The residential application segment is expected to account for 44.20% of total market revenue by 2025, positioning it as the largest end use application. The dominance of this segment is driven by the rising demand for affordable and efficient heating solutions in densely populated urban regions.

District heating offers households stable heating services with lower maintenance costs compared to individual boilers, making it highly attractive for residential users. Increasing government initiatives to decarbonize residential heating systems and promote energy efficiency have further propelled adoption.

With urban growth and sustainability objectives at the forefront, the residential segment continues to lead, reinforcing its position as the primary application area in the district heating market.

In the current times, a lot of district heating systems operate through non-renewable sources of energy. Owing to this, lots of environment-conscious buyers are seeking suitable alternatives. There has been an increase in customers, as the urgency to achieve sustainable goals has been inculcated on a personal level as well. This can be best explained by comparing the historical CAGR with the anticipated CAGR. While the historical CAGR for the market was 8.9%, the anticipated CAGR is 5.6%. To make up for the expected dip, the manufacturers are now focusing on adopting renewable sources of energy to reduce carbon footprints.

A district heating system consists of a heat-producing unit powered by oil, gas, or wood chips, a distribution network of well-insulated pipes, and equipment such as heat exchangers. The investment is primarily to establish a production unit and distributed heating system.

The investment required for a distributed heating-producing unit varies based on its kind. For boilers and renewable heat sources, a significant investment is necessary, whereas excess heat from industries and data centers requires very little expenditure.

Pipe systems for district heating transmission and distribution are critical and need significant investment, as pipes must be of exceptional quality to minimize heat loss. However, district heating solution suppliers are hesitant to spend owing to constantly changing environmental regulations, consequently restricting the district heating market growth.

District heating companies are projected to benefit significantly from technological advancements and digitization. Digitalization is driven further by the rapid adoption of modern technology goods and solutions such as smart meters, demand-based heating systems, home automation, and smart infrastructure.

Consumers may have a role in balancing future heating demand by utilizing these options. Rapid advancements swiftly reduce heating costs with increasing efficiency. As new buildings require distributed heating systems, advanced infrastructure developments create considerable potential.

Additionally, modern district heating networks are expected to play a critical role in enabling energy-efficient district heating solutions. These procure heat from various sources, most notably excess heat from industrial processes and a variety of renewable energy sources, depending on their availability.

The new infrastructures offer substantial thermal transfer surfaces and the potential for installing modern district heating systems. Additionally, advanced district heating systems may synergize within existing heating networks to boost efficiency, dependability, and cost-efficiency. As a result, technical developments in the district heating sector are likely to generate considerable revenue for solution suppliers.

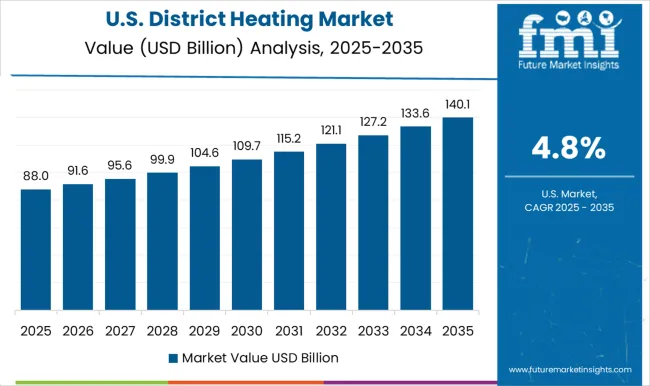

| Regions | North America |

|---|---|

| Countries | United States |

| CAGR (2025 to 2035) | 5.3% |

| Regions | Europe |

|---|---|

| Countries | United Kingdom |

| CAGR (2025 to 2035) | 4.7% |

| Regions | Asia Pacific |

|---|---|

| Countries | China |

| CAGR (2025 to 2035) | 5% |

| Regions | Asia Pacific |

|---|---|

| Countries | Japan |

| CAGR (2025 to 2035) | 4.1% |

| Regions | Asia Pacific |

|---|---|

| Countries | South Korea |

| CAGR (2025 to 2035) | 3.4% |

The companies based out in the United States are making use of green energy to operate the district heating system. Most companies are making use of solar energy to operate these devices. The systems that are being developed by them are functioning on the principle of passive solar energy systems. This technology makes use of walls, windows, and floors to collect, store, and release the sun’s energy.

| Attributes | Details |

|---|---|

| United States Market Expected Size (2035) | USD 120.5 billion |

| United States Market Absolute Dollar Growth | USD 48.9 billion |

| CAGR % 2020 to 2025 | 8.6% |

Several companies are utilizing the energy from biomass. These do not produce as much carbon dioxide as fossil fuels. These are much more affordable than other forms of non-renewable sources, as a result of which a lot of manufacturers in the market are investing in them.

The United Kingdom is meant for being under the grip of extreme cold for a major part of the year. This might surge the sales of district heating devices. The manufacturers in the region have been developing energy-efficient systems, which reduce operating costs. The authorities are incentivizing such companies, which would boost the market share.

| Attributes | Details |

|---|---|

| United Kingdom Market Expected Size (2035) | USD 14.3 billion |

| United Kingdom Market Absolute Dollar Growth | USD 5.2 billion |

| CAGR % 2020 to 2025 | 7.6% |

The government has been implementing strict regulations to reduce the emission of greenhouse gases. In fact, in most of the developed cities across the United Kingdom, heat networks are essential to achieve net-zero emissions. The low-carbon heating option has led to a lot of stakeholders investing huge amounts in this system.

China is currently the leading consumer of district energy. The country has been pursuing assertive public policy decisions to elevate cleaner, energy-efficient district energy. In 2020, the country consumed more than 185 million tonnes of coal, which was way higher than the national energy consumption of the United Kingdom. With transitions being made from coal to clean energy, the scope of the market is expected to skyrocket during the forecast period.

| Attributes | Details |

|---|---|

| China Market Expected Size (2035) | USD 24.4 billion |

| China Market Absolute Dollar Growth | USD 9.4 billion |

| CAGR % 2020 to 2025 | 8.2% |

The technological developments in the market are also expected to surge the growth. The key players are making use of artificial intelligence to regulate the operation of the district heating systems. The manufacturers are also working on developing advanced automation that would work in synchronization with Artificial Intelligence to increase efficiency and save energy.

The fourth-generation district heating makes use of a low supply temperature (50-60 0C), which increases the efficiency of the entire system. This is done by integrating renewable energy and waste heat. The diversification of heat sources, which ensures large-scale solar heat utilization and inter-seasonal heat storage, promises higher efficiency.

| Attributes | Details |

|---|---|

| Japan Market Expected Size (2035) | USD 19.9 billion |

| Japan Market Absolute Dollar Growth | USD 6.6 billion |

| CAGR % 2020 to 2025 | 7.1% |

The manufacturers are harnessing solar energy in particular, as these reduce the dependence on other forms of non-renewable energy sources, which are higher in cost. They are also investing in product innovation to make the operation user-friendly.

South Korea has been implementing massive projects that deal with district heating. Companies like General Electric have been a part of this project, which reflects the demand for this system. The Anyang district heating plant has been generating 500 megawatts of energy to support heat and power supply in the region.

| Attributes | Details |

|---|---|

| South Korea Market Expected Size (2035) | USD 11.7 billion |

| South Korea Market Absolute Dollar Growth | USD 3.3 billion |

| CAGR % 2020 to 2025 | 5.8% |

The existing infrastructures are also being upgraded. A combined CHP plant in South Korea completed a project to improve its output and overall operation. The system was updated with gas turbine technology, which would enhance the reliability of the plant.

| Segment | Source |

|---|---|

| Attributes | CHP |

| CAGR (2020 to 2025) | 8.6% |

| CAGR (2025 to 2035) | 5.4% |

| Segment | Application |

|---|---|

| Attributes | Residential |

| CAGR (2020 to 2025) | 8.4% |

| CAGR (2025 to 2035) | 5.1% |

Because of its high sustainability and cost-effectiveness, the Combined Heat and Power (CHP) segment is expected to grow significantly. Product demand is expected to be boosted by improved energy supply efficiency and the use of waste heat and low-carbon renewable energy sources.

Favorable regulatory norms for decreased carbon footprints and cost reductions may encourage growth. The industry's acceptance of cogeneration techniques is aided by a paradigm shift towards sustainable heat, power supply, and regulatory goals to improve energy efficiency.

The residential category is expected to be the leading segment. The widespread use of small heating systems and strong real estate investment have boosted the demand for district heating systems in residential buildings.

Increased application of decentralized generators and surging urban population may positively impact the business picture. The demand for district heating systems in the business sector is expected to be influenced by rapid urbanization and industrialization. Increased expenditures in the creation of new manufacturing units and facilities are also expected to surge the growth of the business segment.

The start-ups operating in the market are making use of geothermal energy systems for district heating networks at scale. They are also making use of innovative business models, which provide a holistic control and monitoring platform. These assist in carbon reductions while operating in a complex heat network environment.

Water-horizon: The start-up has been developing highly innovative renewable energy solutions for industrial heating and cooling applications. It makes use of an industrial transportable thermal battery. The system helps in recovering waste heat from industrial activities, and it stores heat with a high density without any loss of energy.

The key players operating in the market are now focusing on the more important aspects of the business. At such a time, they are streamlining the operations. Thus, they are divesting the business units, which are not fetching higher profits. Moreover, with supply chains getting affected worldwide, the manufacturers are of the view that investing in the key performance indicators is the best investment. In December 2025, Fortum completed the divestment of Uniper.

In December 2025, Fortum and KärnfulNext announced to jointly explore opportunities in Sweden for Small Modular Reactors.

In December 2025, Ewald Woste was elected the new chairman of the STEAG Gmbh supervisory board.

Dominant Players in the Market

| Company | Description |

|---|---|

| STEAG Gmbh | STEAG Gmbh was the central management company of the STEAG group till the end of 2025. After the division of the company into the black coal division and green growth division, STEAG Gmbh has been the management holding company. The company holds all the shares in STEAG Power Gmbh and Iqony Gmbh and handles the main sovereign functions. The group has been employing 5,754 workers. The company has been delivering comprehensive technical expertise for issues on energy generation and energy services. |

| Fortum | Fortum is driven by the purpose to drive change for a cleaner world. The current lifestyle demands more energy than ever before. To drive this purpose, the company has been making use of reliable production methods, like hydropower and nuclear power. The company has been providing consumer solutions and is responsible for electricity and gas retail businesses in the Nordics, Poland, and Spain. |

| Statkraft AS | Statkraft AS has been delivering clean energy solutions for more than a century. The company is currently Europe’s leading renewable energy producer, and a global company in the energy market operations. The company has been developing and operating renewable energy assets within hydropower, wind, solar, gas, and biomass, supplying district heating and buying & selling energy. The company operates across Europe, South America, and Europe. Statkraft AS employs over 5,000 employees and has a presence in over 20 countries. |

Other companies profiled: Shinryo Corporation, Ramboll Group A/S

The global district heating market is estimated to be valued at USD 216.7 billion in 2025.

The market size for the district heating market is projected to reach USD 373.6 billion by 2035.

The district heating market is expected to grow at a 5.6% CAGR between 2025 and 2035.

The key product types in district heating market are chp, geothermal, solar, heat only boilers and others.

In terms of application, residential segment to command 44.2% share in the district heating market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

District Heating and Cooling Market Size and Share Forecast Outlook 2025 to 2035

District Heating Pipeline Network Market Size and Share Forecast Outlook 2025 to 2035

Solar District Heating Market Analysis - Size, Share, and Forecast 2025 to 2035

Heating Agents Market Size and Share Forecast Outlook 2025 to 2035

Heating and Cooling Market Size and Share Forecast Outlook 2025 to 2035

District Cooling Market - Growth & Demand 2025 to 2035

Heating Pad Market

Preheating Tunnel Furnace for Lithium Battery Market Size and Share Forecast Outlook 2025 to 2035

Self Heating Food Packaging Market Size and Share Forecast Outlook 2025 to 2035

Self-Heating Butter Knife Market Size and Share Forecast Outlook 2025 to 2035

Radiant Heating And Cooling Systems Market

Infrared Heating Pad Market Size and Share Forecast Outlook 2025 to 2035

Ductless Heating & Cooling Systems Market Size and Share Forecast Outlook 2025 to 2035

Flexible Heating Element Market

Cartridge Heating Element Market Size and Share Forecast Outlook 2025 to 2035

Renewable Heating Fuels Market Size and Share Forecast Outlook 2025 to 2035

Commercial Heating Equipment Market Size and Share Forecast Outlook 2025 to 2035

Underfloor Heating Market Size and Share Forecast Outlook 2025 to 2035

EV Battery Heating System Market Size and Share Forecast Outlook 2025 to 2035

Residential Heating Equipment Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA