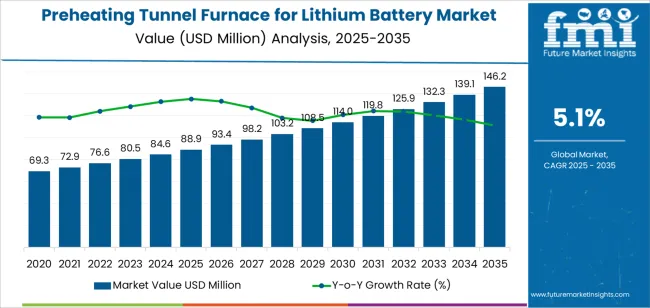

The preheating tunnel furnace for lithium battery market is valued at USD 88.9 million in 2025 and is forecasted to reach USD 146.2 million by 2035, growing at a CAGR of 5.1%. The rapid growth of lithium-ion battery production for electric vehicles, energy storage systems, and portable electronics drives market expansion. Rising demand for precise temperature control and efficient thermal processing during electrode preparation and material activation is reinforcing the adoption of advanced preheating tunnel furnaces across cell manufacturing facilities.

Hot air circulation preheating tunnel furnaces represent the leading product type due to their uniform heat distribution, stable temperature regulation, and high throughput efficiency. These systems enhance electrode coating performance and drying uniformity while reducing energy consumption and operational downtime. Continuous innovation in airflow design, heat recovery systems, and process automation supports improved consistency and reduced manufacturing costs in large-scale lithium battery production.

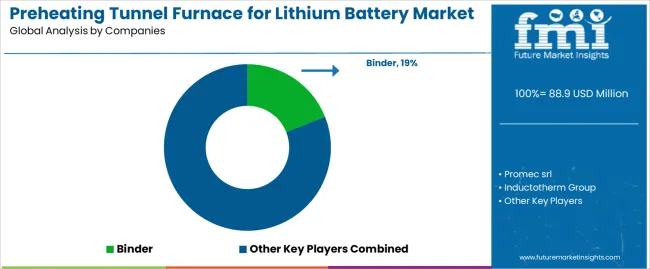

Asia Pacific dominates global market growth, supported by large-scale battery manufacturing and industrial automation in China, Japan, and South Korea. Europe and North America maintain steady adoption through investments in domestic cell production and clean energy technologies. Leading market participants include Binder, Promec srl, Inductotherm Group, Sermac, Seco Warwick, and Wuxi Leader Intelligent Equipment, emphasizing process optimization, energy efficiency, and precision thermal control.

The market’s acceleration and deceleration pattern shows an initial high-growth phase followed by a gradual stabilization as production capacity and technology adoption mature. Between 2025 and 2029, the market will experience an acceleration phase driven by rapid expansion of lithium-ion battery manufacturing for electric vehicles, energy storage systems, and portable electronics. Demand for uniform heating and improved energy efficiency in electrode drying and coating processes will further support early growth.

From 2030 to 2035, the market is expected to enter a mild deceleration phase as major production facilities achieve operational optimization and expansion projects plateau. During this stage, growth will rely more on replacement demand, process upgrades, and the introduction of high-efficiency, low-emission furnace designs. Although the rate of new installations will moderate, consistent adoption across battery gigafactories will maintain steady revenue flow. The pattern reflects a technology-driven market transitioning from rapid industrialization to sustained maturity, supported by continuous improvements in furnace efficiency and integration within advanced battery production lines.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 88.9 million |

| Market Forecast Value (2035) | USD 146.2 million |

| Forecast CAGR (2025-2035) | 5.1% |

The market for preheating tunnel furnaces used in lithium-battery manufacturing is expanding as global demand for lithium-ion cells rises in electric vehicles and energy storage systems. These furnaces are critical for electrode and cell production because they ensure controlled thermal processes that enhance material performance and uniformity. Manufacturers of battery cells require high-throughput equipment to maintain gigafactory production scales, which increases demand for advanced preheating tunnels.

Technological improvements in zone-based heating control, energy-recovery systems and material-compatible furnace design support adoption by reducing processing time and improving yields. Regulatory focus on energy efficiency and carbon-footprint reduction in industrial equipment drives buyers toward furnace models that consume less power and emit fewer pollutants. Constraints include high initial capital investment, complexity in matching furnace parameters to evolving electrode chemistries, and supply-chain risks for specialist components required in high-precision thermal equipment.

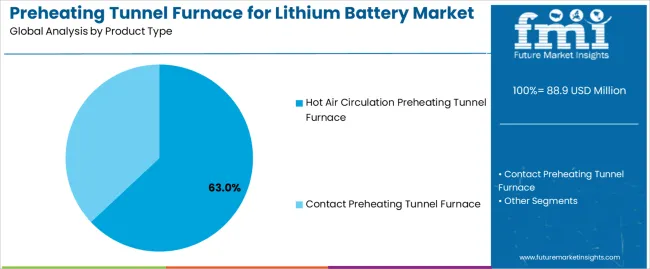

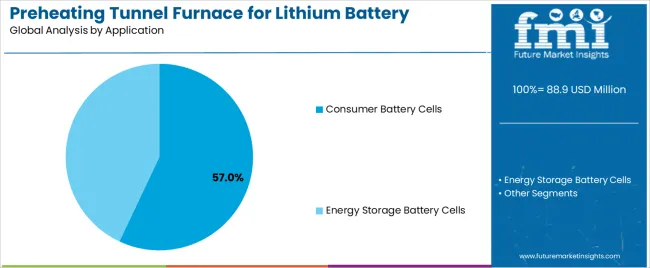

The preheating tunnel furnace for lithium battery market is segmented by product type and application. By product type, the market is divided into hot air circulation preheating tunnel furnace and contact preheating tunnel furnace. Based on application, it is categorized into consumer battery cells and energy storage battery cells. Regionally, the market is divided into Asia Pacific, Europe, North America, and other key regions.

The hot air circulation preheating tunnel furnace segment holds the leading position in the preheating tunnel furnace for lithium battery market, representing an estimated 63.0% of total market share in 2025. This type of furnace is extensively used in the lithium battery manufacturing process due to its uniform heat distribution, stable temperature control, and compatibility with large-scale continuous production lines. It ensures consistent preheating of electrodes and cell components, improving adhesion, coating uniformity, and energy density in final products.

The segment’s dominance is supported by its widespread use in both cylindrical and pouch cell production, offering high energy efficiency and reduced thermal deviation compared to contact-type furnaces. Hot air systems minimize contamination risk, enhancing production quality and yield rates in precision manufacturing environments. The contact preheating tunnel furnace segment, while smaller at an estimated 37.0%, is preferred in specific high-speed production settings where rapid localized heating and reduced cycle times are required.

Key factors supporting the hot air circulation segment include:

The consumer battery cells segment accounts for approximately 57.0% of the preheating tunnel furnace for lithium battery market in 2025. This dominance reflects the extensive use of lithium-ion batteries in portable electronics, including smartphones, laptops, and wearable devices, where uniform electrode preheating directly influences performance, cycle life, and safety. The segment benefits from continuous growth in global consumer electronics production and the increasing demand for high-efficiency battery manufacturing systems.

The energy storage battery cells segment, representing about 43.0%, is expanding rapidly with the growth of renewable energy integration and large-scale storage applications. The demand for preheating tunnel furnaces in this category is rising as manufacturers emphasize consistent electrode processing and scalability in gigafactory operations.

Primary dynamics driving demand from the consumer battery cells segment include:

Increased battery manufacturing scale, demand for higher-precision electrode processing, and stricter thermal control requirements are driving market growth.

The market for preheating tunnel furnaces in lithium battery manufacturing is propelled by rapid expansion in battery cell production across automotive, energy storage and consumer electronics segments. Preheating furnaces prepare electrodes or active materials by controlling moisture, initiating binder curing and homogenising temperature ahead of subsequent processing stages. As battery chemistries become more advanced (such as high-nickel, solid-state and silicon-based systems), tighter thermal control and uniform preheating become essential to ensure performance and reliability. This increases demand for tunnel furnaces with multi-zone control, high throughput and energy-efficient designs.

High capital cost, complex integration in manufacturing lines, and evolving material requirements limit market growth.

Preheating tunnel furnaces represent significant equipment investment and installation time within battery lines, which can delay deployment or limit upgrades in smaller manufacturing facilities. Integration into highly automated production lines, with rapid changeovers and new cell formats, often demands customisation of furnace length, conveyor speed and thermal zones, which raises project complexity. As battery material formulations evolve rapidly, furnace specifications may become obsolete or require re-engineering to accommodate new electrode coatings, moisture content or binder chemistries, reducing return on investment.

Modular automation, energy recovery systems, and regional growth of battery plants define industry trends.

Manufacturers increasingly offer modular tunnel furnace systems that can be scaled or repurposed for different cell formats, enabling faster installation and lower downtime. Energy-efficiency features, such as heat-recuperation modules and controlled atmosphere preheating, are gaining prominence to reduce operational cost and support ecofriendly goals. Geographically, regions such as Southeast Asia, India and Eastern Europe are emerging as growth hubs for battery production, which drives local demand for preheating furnace equipment and open opportunities for equipment suppliers to expand their presence in manufacturing ecosystems.

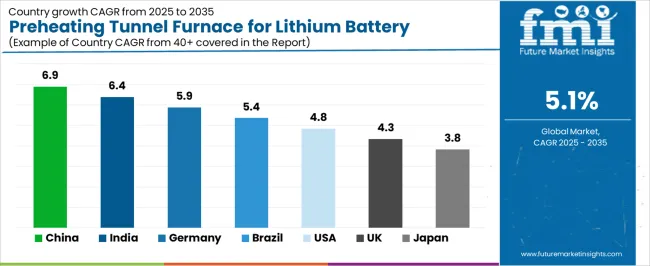

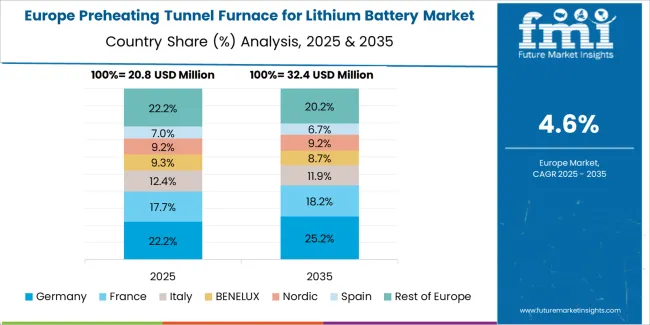

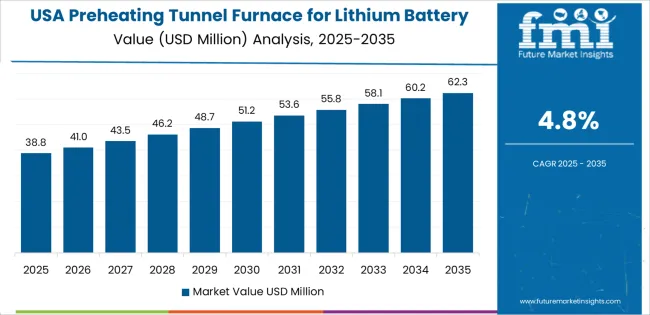

The global preheating tunnel furnace market for lithium batteries is expanding steadily through 2035, supported by the rapid growth of electric vehicle (EV) manufacturing, energy storage system (ESS) development, and advanced material processing in the battery value chain. China leads with a 6.9% CAGR, followed by India at 6.4%, reflecting large-scale investment in gigafactories and electrode production facilities. Germany grows at 5.9%, driven by energy transition initiatives and precision thermal technology. Brazil records 5.4%, supported by localized battery manufacturing and renewable energy growth. The United States posts 4.8%, driven by EV infrastructure investment, while the United Kingdom (4.3%) and Japan (3.8%) maintain consistent performance through automation and R&D-focused battery engineering.

| Country | CAGR (%) |

|---|---|

| China | 6.9 |

| India | 6.4 |

| Germany | 5.9 |

| Brazil | 5.4 |

| USA | 4.8 |

| UK | 4.3 |

| Japan | 3.8 |

China’s market grows at 6.9% CAGR, supported by large-scale battery production, EV demand, and continuous thermal equipment innovation. Domestic furnace manufacturers are supplying preheating systems optimized for electrode drying, solvent removal, and uniform coating curing in lithium-ion cell fabrication. The Made in China 2025 strategy promotes local production of energy-efficient furnaces with automated temperature control and data analytics capabilities. Strategic collaborations between battery producers and equipment firms enhance manufacturing efficiency in gigafactory environments. Expansion in solid-state and LFP (lithium iron phosphate) battery lines further increases equipment utilization rates.

Key Market Factors:

India’s market grows at 6.4% CAGR, driven by expanding EV manufacturing, local cell production initiatives, and technological partnerships. The National Electric Mobility Mission Plan (NEMMP) and PLI Scheme for ACC Battery Storage are encouraging domestic production of lithium-ion batteries and associated equipment. Indian manufacturers are adopting tunnel furnaces designed for efficient electrode coating preheating and solvent recovery. Collaborations with global furnace and thermal systems companies support process standardization and temperature optimization. Growth in energy storage projects under renewable energy expansion also contributes to market demand.

Market Development Factors:

Germany’s market grows at 5.9% CAGR, supported by strong research infrastructure, automotive industry transformation, and renewable energy development. Manufacturers are producing high-precision preheating furnaces with advanced thermal uniformity and real-time monitoring for electrode preparation lines. Integration of Industrie 4.0 systems enables predictive temperature control and defect prevention. Collaboration between furnace suppliers and European gigafactories enhances quality and process repeatability. Focus on sustainability has led to innovation in heat recovery, exhaust treatment, and energy optimization systems for large-scale battery production facilities.

Key Market Characteristics:

Brazil’s market grows at 5.4% CAGR, supported by renewable energy projects, EV component production, and industrial process modernization. Domestic firms are establishing partnerships with Asian furnace manufacturers for the installation of localized preheating lines in lithium battery assembly. Government efforts under the National Energy Plan 2050 promote battery energy storage deployment in solar and wind applications, increasing demand for electrode processing systems. The growing adoption of localized assembly and quality assurance systems enhances operational efficiency in regional gigafactories.

Market Development Factors:

The United States grows at 4.8% CAGR, supported by national clean energy policies, EV infrastructure investment, and high-efficiency furnace innovation. Manufacturers are developing intelligent preheating systems for electrode drying and uniform slurry coating performance. The Inflation Reduction Act (IRA) and DOE Advanced Manufacturing Office funding programs encourage domestic production of lithium-ion and next-generation solid-state batteries. Integration of AI and IoT-enabled sensors allows continuous temperature profiling and quality control. The market benefits from strong collaborations between furnace suppliers, national labs, and battery cell manufacturers.

Key Market Factors:

The United Kingdom’s market grows at 4.3% CAGR, driven by the Faraday Battery Challenge and increased investment in EV supply chain infrastructure. Domestic and European equipment manufacturers are producing tunnel furnaces with precise temperature zoning and efficient heat recovery systems. Research in advanced cathode and anode materials drives demand for controlled preheating environments. Collaboration between universities, battery startups, and industrial partners supports R&D in ecofriendly and modular furnace designs. The market benefits from government-backed funding for gigafactory construction under the UK Battery Industrialisation Centre (UKBIC).

Market Development Factors:

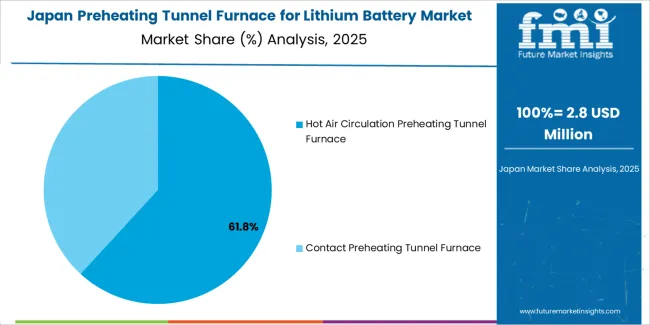

Japan’s market grows at 3.8% CAGR, reflecting technological maturity, process reliability, and precision manufacturing. Domestic companies are producing compact, energy-efficient preheating tunnel furnaces used in lithium-ion and all-solid-state battery lines. The Green Innovation Fund supports R&D in low-emission thermal systems and next-generation materials processing. Manufacturers are integrating adaptive control mechanisms to ensure uniform electrode coating and drying consistency. The country’s leading role in solid-state battery innovation and precision machinery maintains long-term market competitiveness.

Key Market Characteristics:

The preheating tunnel furnace for lithium battery market is moderately consolidated, with a limited number of specialized equipment manufacturers serving the rapidly expanding battery production sector. Binder leads the market with an estimated 19.0% global share, supported by its precision thermal processing systems, strong engineering reliability, and established relationships with major lithium-ion cell producers. Its leadership is reinforced by consistent product performance in temperature uniformity, controlled atmosphere design, and integration with automated production lines.

Promec srl, Inductotherm Group, and Seco Warwick follow as prominent competitors, each offering advanced thermal treatment and heat-processing systems adapted for electrode drying and preheating applications. Their competitiveness is grounded in high energy efficiency, custom furnace design, and compliance with process safety standards required for battery manufacturing. Sermac and Wuxi Leader Intelligent Equipment provide mid-tier solutions tailored to regional battery producers, emphasizing scalability, cost-effectiveness, and compatibility with high-throughput production environments.

Chinese manufacturers such as KEDA Industrial Group, Shenzhen HB Technology, and Leiyu Technology are rapidly expanding market presence through localized manufacturing, competitive pricing, and alignment with domestic lithium battery expansion initiatives. Henan TOP ENERGY, Tianyong Engineering (Shanghai), and Xin Jinhui & Pengli strengthen the supply base through customized furnace fabrication and technical support for gigafactory operations.

Competition in this market centers on thermal precision, operational efficiency, and system integration with automated electrode processing lines. Demand continues to accelerate as lithium battery production scales globally, driving adoption of advanced preheating tunnel furnaces designed for consistent temperature control, safety, and energy optimization.

| Items | Values |

|---|---|

| Quantitative Units | USD million |

| Product Type | Hot Air Circulation Preheating Tunnel Furnace, Contact Preheating Tunnel Furnace |

| Application | Consumer Battery Cells, Energy Storage Battery Cells |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Countries Covered | India, China, USA, Germany, South Korea, Japan, Italy, and 40+ countries |

| Key Companies Profiled | Binder, Promec srl, Inductotherm Group, Sermac, Seco Warwick, Wuxi Leader Intelligent Equipment, Tianyong Engineering (Shanghai), KEDA Industrial Group, Henan TOP ENERGY, Shenzhen HB Technology, Xin Jinhui & Pengli, Leiyu Technology |

| Additional Attributes | Dollar sales by classification and application categories; regional adoption trends across Asia Pacific, Europe, and North America; competitive landscape of furnace and heat treatment equipment manufacturers; advancements in lithium battery preheating and drying technologies; integration with automated battery production lines for energy storage and consumer electronics. |

The global preheating tunnel furnace for lithium battery market is estimated to be valued at USD 88.9 million in 2025.

The market size for the preheating tunnel furnace for lithium battery market is projected to reach USD 146.2 million by 2035.

The preheating tunnel furnace for lithium battery market is expected to grow at a 5.1% CAGR between 2025 and 2035.

The key product types in preheating tunnel furnace for lithium battery market are hot air circulation preheating tunnel furnace and contact preheating tunnel furnace.

In terms of application, consumer battery cells segment to command 57.0% share in the preheating tunnel furnace for lithium battery market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Tunnel Tray Market Size and Share Forecast Outlook 2025 to 2035

Tunneling Equipment Market Size and Share Forecast Outlook 2025 to 2035

Tunnel Visibility Monitors Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Tunnel Monitoring System Market Growth - Trends & Forecast 2025 to 2035

Tunnel Oven Market

Carpal Tunnel Release System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Shrink Tunnel Machine Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Edible Shrink Tunnel Systems Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Competitive Breakdown of Sterilization Tunnel Manufacturers

Sterilization Tunnel Market Analysis by Segments, By Belt Size, Application, End Use, and Region through 2025 to 2035.

Battery Operated Light Market Forecast and Outlook 2025 to 2035

Battery Voltage Recorder Market Size and Share Forecast Outlook 2025 to 2035

Battery Resistance Tester Market Size and Share Forecast Outlook 2025 to 2035

Battery Technology Market Size and Share Forecast Outlook 2025 to 2035

Battery Electric Vehicle (BEV) Market Size and Share Forecast Outlook 2025 to 2035

Battery Separator Paper Market Size and Share Forecast Outlook 2025 to 2035

Battery Cyclers Market Size and Share Forecast Outlook 2025 to 2035

Battery Voltage Supervisor Market Size and Share Forecast Outlook 2025 to 2035

Battery Management System Market Report – Growth & Forecast 2025-2035

Battery Binders Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA