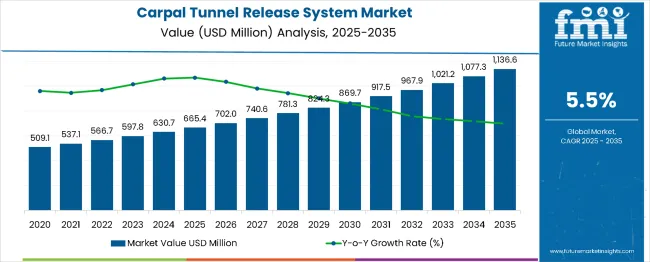

The global carpal tunnel release system market is projected to grow from USD 665.4 million in 2025 to approximately USD 1,147.7 million by 2035, recording an absolute increase of USD 482.3 million over the forecast period. This translates into a total growth of 72.5%, with the market forecast to expand at a compound annual growth rate (CAGR) of 5.5% between 2025 and 2035. The overall market size is expected to grow by nearly 1.72X during the same period, supported by increasing demand for minimally invasive procedures, rising prevalence of carpal tunnel syndrome among working populations, and growing awareness of repetitive strain injuries.

Between 2025 and 2030, the carpal tunnel release system market is projected to expand from USD 665.4 million to USD 877.5 million, resulting in a value increase of USD 212.1 million, which represents 44% of the total forecast growth for the decade. This phase of growth will be shaped by rising consumer awareness about minimally invasive surgical options, increasing healthcare expenditure in emerging markets, and growing penetration of advanced endoscopic systems in ambulatory surgical centers. Medical device manufacturers are expanding their product portfolios to address the growing demand for outpatient surgical solutions and faster patient recovery options.

| Metric | Value |

|---|---|

| Industry Size (2025) | USD 665.4 million |

| Industry Size (2035) | USD 1,147.7 million |

| Global CAGR (2025 to 2035) | 5.5% |

From 2030 to 2035, the market is forecast to grow from USD 877.5 million to USD 1,147.7 million, adding another USD 270.2 million, which constitutes 56% of the overall ten-year expansion. This period is expected to be characterized by expansion of ambulatory surgical centers, integration of robotic-assisted surgical systems, and development of next-generation endoscopic instruments. The growing adoption of value-based healthcare models and enhanced reimbursement policies will drive demand for cost-effective carpal tunnel release systems with improved patient outcomes and reduced recovery times.

Between 2020 and 2025, the carpal tunnel release system market experienced steady expansion, driven by increasing prevalence of work-related musculoskeletal disorders and growing awareness of carpal tunnel syndrome. The market developed as healthcare providers recognized the need for effective surgical interventions to address the rising burden of repetitive strain injuries. Regulatory approvals for advanced endoscopic systems and surgeon training programs began emphasizing the benefits of minimally invasive approaches in reducing patient recovery times and improving surgical outcomes.

Market expansion is being supported by the increasing prevalence of carpal tunnel syndrome among working-age populations and the corresponding demand for effective surgical interventions. Modern healthcare systems are increasingly focused on outpatient procedures that can reduce hospital stays, minimize recovery times, and improve patient satisfaction. The proven efficacy of both open and endoscopic carpal tunnel release procedures in providing long-term symptom relief makes them preferred treatment options for patients with severe or persistent symptoms.

The growing emphasis on minimally invasive surgical techniques is driving demand for advanced endoscopic systems that offer reduced scarring, faster recovery, and improved cosmetic outcomes. Healthcare provider preference for cost-effective procedures that enable same-day discharge is creating opportunities for innovative surgical instruments and techniques. The rising influence of workplace ergonomic initiatives and occupational health programs is also contributing to increased early diagnosis and surgical intervention across different industries and demographics.

The market is segmented by product type, end user, and region. By product type, the market is divided into open CTR system and endoscopic CTR system. Based on end user, the market is categorized into hospitals, ambulatory surgical centers, and specialty clinics. Regionally, the market is divided into North America, Latin America, Western Europe, South Asia, East Asia, Eastern Europe, and Middle East & Africa.

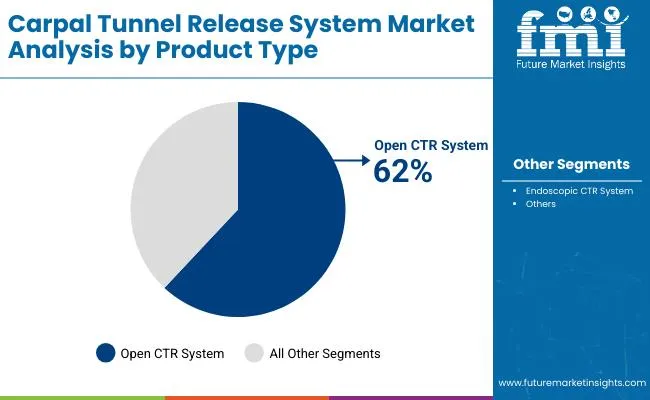

The open CTR system is projected to account for 62% of the carpal tunnel release system market in 2025, reaffirming its position as the dominant surgical approach. Surgeons increasingly rely on open procedures for their established track record, superior visualization capabilities, and ability to address complex anatomical variations during surgery. Open CTR systems provide direct access to the carpal tunnel, enabling comprehensive decompression and optimal tactile feedback for precise surgical execution.

This segment forms the foundation of most surgical training programs, as it represents the most widely taught and practiced technique in orthopedic and hand surgery residencies. The proven clinical outcomes and cost-effectiveness of open procedures continue to strengthen surgeon confidence and patient acceptance. With healthcare systems prioritizing reliable surgical solutions that minimize complications, open CTR systems align with both established surgical protocols and risk management considerations. Their broad applicability across different patient populations ensures sustained market dominance, making them the central revenue driver of carpal tunnel release system demand.

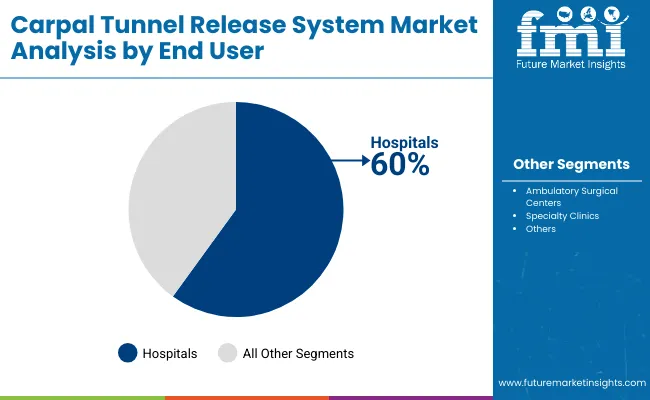

Hospitals are projected to represent 60% of carpal tunnel release system demand in 2025, underscoring their role as the primary centers for surgical care delivery. Healthcare facilities gravitate toward hospitals for their comprehensive surgical infrastructure, advanced anesthesia capabilities, and ability to manage potential complications during carpal tunnel procedures. Positioned as full-service surgical centers, hospitals offer both inpatient and outpatient carpal tunnel release procedures with complete perioperative care and specialized hand surgery expertise.

The segment is supported by hospitals' established relationships with orthopedic surgeons, comprehensive insurance coverage acceptance, and ability to handle complex cases requiring specialized equipment. Additionally, hospitals serve as training centers for surgical residents and fellows, reinforcing their central role in advancing carpal tunnel release techniques and maintaining clinical expertise. As healthcare systems continue to emphasize surgical excellence and patient safety, hospitals will maintain their dominant position while adapting to increased demand for outpatient procedures and minimally invasive approaches.

The carpal tunnel release system market is advancing steadily due to increasing prevalence of repetitive strain injuries and growing demand for minimally invasive surgical options. However, the market faces challenges including healthcare budget constraints, surgeon training requirements for new technologies, and competition from non-surgical treatment alternatives. Innovation in endoscopic techniques and robotic-assisted surgery continues to influence product development and market expansion patterns.

Expansion of Ambulatory Surgical Centers and Outpatient Procedures

The growing adoption of ambulatory surgical centers is enabling healthcare providers to offer cost-effective carpal tunnel procedures with reduced overhead costs and improved patient convenience. Outpatient facilities provide specialized environments optimized for same-day surgical procedures, offering patients shorter wait times, personalized care, and faster recovery in familiar settings. This trend is driving demand for portable and user-friendly surgical instruments designed for ambulatory settings.

Integration of Advanced Surgical Technologies and Minimally Invasive Techniques

Modern carpal tunnel release manufacturers are incorporating advanced technologies such as endoscopic visualization systems, ultrasonic cutting devices, and computer-assisted surgical navigation to enhance procedural precision and patient outcomes. These technologies improve surgical accuracy while reducing tissue trauma and accelerating patient recovery. Advanced surgical platforms also enable surgeons to perform procedures with smaller incisions and improved visualization of critical anatomical structures.

| Country | CAGR (2025-2035) |

|---|---|

| India | 6.5% |

| China | 6.1% |

| South Korea | 5.6% |

| Germany | 5.7% |

| France | 5.4% |

| UK | 5.3% |

| United States | 5.2% |

| Brazil | 5.3% |

| Canada | 5.0% |

| Japan | 5.0% |

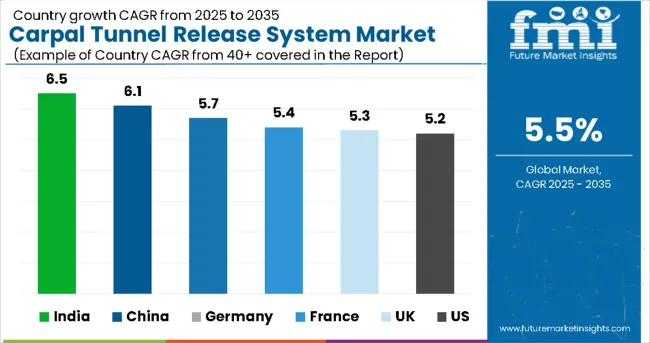

The carpal tunnel release system market is experiencing steady growth globally, with India leading at a 6.5% CAGR through 2035, driven by expanding healthcare infrastructure, rising awareness of occupational health issues, and increasing adoption of modern surgical techniques. China follows closely at 6.1%, supported by healthcare modernization initiatives, growing middle-class population, and increased investment in ambulatory surgical facilities. South Korea shows strong growth at 5.6%, emphasizing advanced surgical technologies and comprehensive healthcare coverage. Germany records 5.7% growth, prioritizing clinical excellence and evidence-based surgical practices.

The report covers an in-depth analysis of 40+ countries; six top-performing countries are highlighted below.

Revenue from carpal tunnel release systems in India is expanding at a CAGR of 6.5%, supported by rapid healthcare infrastructure development, increasing prevalence of repetitive strain injuries in IT and manufacturing sectors, and growing awareness of surgical treatment options. The country's expanding healthcare system and rising disposable income are creating significant demand for advanced surgical instruments. Major international medical device companies are establishing distribution networks to serve the growing population of patients requiring carpal tunnel surgical intervention.

Revenue from carpal tunnel release systems in China is projected to exhibit strong growth with a CAGR of 6.1% through 2035, driven by healthcare system modernization, aging population demographics, and increasing prevalence of work-related musculoskeletal disorders. The country's expanding healthcare infrastructure and growing middle-class population are creating significant demand for quality surgical interventions. Major medical device manufacturers are establishing comprehensive service networks to serve the growing market for orthopedic surgical procedures.

Demand for carpal tunnel release systems in the U.S. is projected to grow at a CAGR of 5.2%, supported by healthcare system emphasis on outpatient procedures, advanced surgical technologies, and comprehensive insurance coverage for carpal tunnel treatments. American healthcare providers are increasingly focused on cost-effective surgical solutions that minimize hospital stays while maximizing patient outcomes. The market is characterized by strong adoption of both open and endoscopic techniques based on surgeon preference and patient characteristics.

Revenue from carpal tunnel release systems in Germany is projected to grow at a CAGR of 5.7% through 2035, driven by the country's commitment to clinical excellence, comprehensive healthcare coverage, and advanced medical device manufacturing capabilities. German healthcare providers consistently demand high-quality surgical instruments that deliver predictable clinical outcomes while maintaining strict safety standards.

Revenue from carpal tunnel release systems in the UK is projected to grow at a CAGR of 5.3% through 2035, supported by National Health Service focus on efficient surgical care delivery and evidence-based treatment protocols. British healthcare providers prioritize cost-effective surgical solutions that reduce waiting times while maintaining high clinical standards, positioning carpal tunnel release procedures as essential components of orthopedic care pathways.

Revenue from carpal tunnel release systems in France is projected to grow at a CAGR of 5.4% through 2035, supported by the country's universal healthcare system, emphasis on surgical innovation, and commitment to patient-centered care delivery. French healthcare providers prioritize advanced surgical technologies that improve patient outcomes while maintaining cost-effectiveness within the national healthcare framework.

The carpal tunnel release systems market in Japan is poised to grow at a 5% CAGR during the study period due to the country’s rapidly aging population, which faces a higher prevalence of musculoskeletal and nerve-related disorders, including carpal tunnel syndrome. Increasing awareness among patients and healthcare providers about early diagnosis and minimally invasive treatment options is driving adoption. Japan’s strong healthcare infrastructure and reimbursement support further encourage the use of advanced surgical systems. Additionally, rising demand for faster recovery, reduced hospital stays, and improved patient outcomes has accelerated the shift toward endoscopic and minimally invasive carpal tunnel release procedures, supporting steady market expansion in the region.

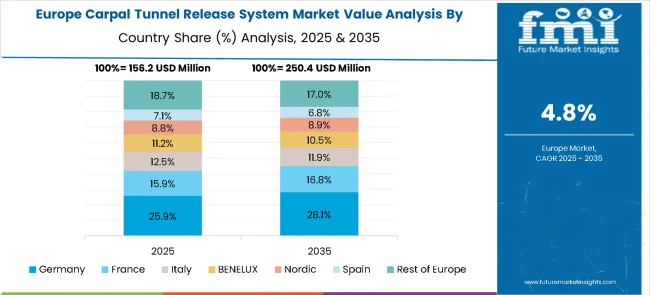

The carpal tunnel release system market in Europe is projected to grow from USD 245.7 million in 2025 to USD 423.5 million by 2035, registering a CAGR of 5.6% over the forecast period. Germany is expected to maintain its leadership position with a 27.1% market share in 2025, slightly declining to 26.3% by 2035, supported by its advanced surgical infrastructure, comprehensive healthcare coverage, and strong investment in medical device R&D.

France follows with a 19.0% share in 2025, projected to increase to 19.5% by 2035, driven by its universal healthcare system and ongoing innovation in minimally invasive and endoscopic surgical techniques. The United Kingdom holds a 17.4% share in 2025, expected to decrease marginally to 16.9% by 2035 due to NHS cost-containment measures, although growth will continue to be supported by its emphasis on standardized and evidence-based surgical care.

Italy commands a 13.8% share in 2025, while Spain accounts for 11.5% in 2025, with both countries expanding adoption through specialized orthopedic centers focused on surgical efficiency and patient satisfaction. The rest of Europe region including BENELUX, Nordic countries, and Eastern Europe is anticipated to gain momentum, expanding its collective share from 11.2% in 2025 to 12.0% by 2035, attributed to rising healthcare investment, healthcare technology integration models, and expanding access to advanced surgical interventions across emerging markets.

The carpal tunnel release system market is characterized by moderate consolidation among established medical device manufacturers, specialty surgical instrument companies, and emerging technology developers. Companies are investing in advanced surgical technologies, surgeon training programs, regulatory compliance, and strategic partnerships to deliver effective, safe, and accessible carpal tunnel release solutions. Product innovation, clinical evidence generation, and market expansion are central to strengthening competitive positions and market presence.

Stryker Corporation, U.S.-based, leads the market with 26% global value share, offering comprehensive carpal tunnel release systems with focus on surgical precision and clinical outcomes. Smith & Nephew plc, U.K., provides advanced surgical instruments with emphasis on minimally invasive techniques and surgeon education. CONMED Corporation, U.S., delivers specialized endoscopic systems with focus on outpatient procedures and cost-effectiveness. Arthrex Inc., U.S., focuses on innovative surgical instruments that combine precision engineering with enhanced surgical visualization.

Integra LifeSciences, MicroAire Surgical Instruments LLC, and other established players provide targeted solutions for specific market segments and geographic regions. Smaller companies like S.E.G-WAY Orthopaedics Inc., A.M. Surgical Inc., Sonex Health LLC, and Innomed Inc. compete through specialized product offerings, competitive pricing, and regional market focus.

| Items | Values |

|---|---|

|

Quantitative Units (2025) |

USD 665.4 Million |

|

Product Types |

Open CTR System, Endoscopic CTR System |

|

End User |

Hospitals, Ambulatory Surgical Centers, Specialty Clinics |

|

Regions Covered |

North America, Latin America, Western Europe, South Asia, East Asia, Eastern Europe, Middle East & Africa |

|

Countries Covered |

United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia, Spain, Netherlands, Saudi Arabia, Switzerland and 40+ countries |

|

Key Companies Profiled |

Stryker Corporation, Smith & Nephew plc, CONMED Corporation, Arthrex Inc., Integra LifeSciences, MicroAire Surgical Instruments LLC, S.E.G-WAY Orthopaedics Inc., A.M. Surgical Inc., Sonex Health LLC, and Innomed Inc. |

|

Additional Attributes |

Dollar sales by product type and end user segment, regional demand trends, competitive landscape, surgeon preferences for open versus endoscopic techniques, integration with ambulatory surgical center growth, innovations in minimally invasive technologies, robotic-assisted surgery, and evidence-based surgical training programs |

The industry is poised to reach USD 665.4 million in 2025.

The industry is projected to register USD 1,147.7 million by 2035.

Endoscopic CTR systems are the most widely used due to faster patient recovery times, reduced scarring, and growing preference for minimally invasive procedures.

India, slated to grow at a 6.5% CAGR during the study period, is poised for the fastest growth in the industry.

Key companies in the industry include Stryker Corporation, Smith & Nephew plc, CONMED Corporation, Arthrex, Inc., Integra LifeSciences, MicroAire Surgical Instruments, LLC, S.E.G-WAY Orthopaedics Inc., A.M. Surgical Inc., Sonex Health, LLC, and Innomed, Inc.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Tunnel Tray Market Size and Share Forecast Outlook 2025 to 2035

Tunneling Equipment Market Size and Share Forecast Outlook 2025 to 2035

Tunnel Visibility Monitors Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Tunnel Oven Market

Tunnel Monitoring System Market Growth - Trends & Forecast 2025 to 2035

Shrink Tunnel Machine Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Competitive Breakdown of Sterilization Tunnel Manufacturers

Sterilization Tunnel Market Analysis by Segments, By Belt Size, Application, End Use, and Region through 2025 to 2035.

Edible Shrink Tunnel Systems Market Analysis - Size and Share Forecast Outlook 2025 to 2035

System-On-Package Market Size and Share Forecast Outlook 2025 to 2035

Systems Administration Management Tools Market Size and Share Forecast Outlook 2025 to 2035

Systemic Sclerosis Treatment Market - Trends & Forecast 2025 to 2035

System on Module Market Growth – Trends & Forecast 2025 to 2035

SLE Drugs Market Insights - Growth & Forecast 2025 to 2035

Systemic Mastocytosis Treatment Market

Systemic Infection Treatment Market

5G System Integration Market Insights - Demand & Growth Forecast 2025 to 2035

VRF Systems Market Growth - Trends & Forecast 2025 to 2035

Rail System Dryer Market Size and Share Forecast Outlook 2025 to 2035

HVAC System Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA