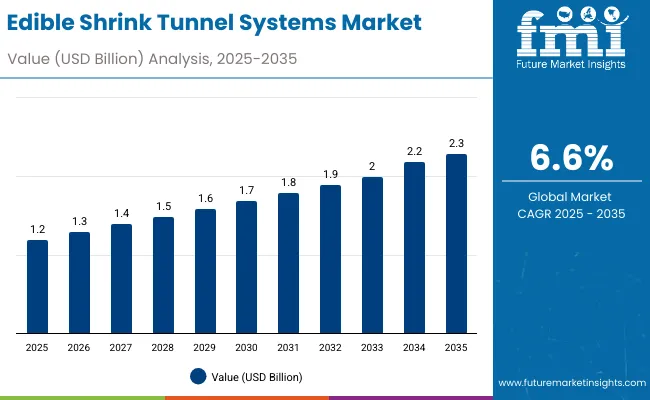

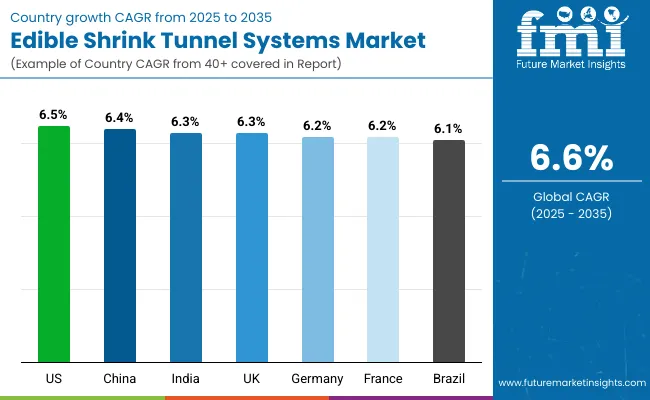

The edible shrink tunnel systems market will grow from USD 1.2 billion in 2025 to USD 2.3 billion by 2035, reflecting a CAGR of 6.6%. Growth is propelled by the food, bakery, and pharmaceutical industries adopting sustainable shrink packaging for edible coatings. Steam tunnel systems dominate due to uniform heat distribution and high-speed sealing.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 1.2 billion |

| Industry Value (2035F) | USD 2.3 billion |

| CAGR (2025 to 2035) | 6.6% |

Between 2025 and 2030, the market will add USD 0.4 billion, driven by snack and bakery automation. From 2030 to 2035, technological upgrades in film compatibility and system efficiency will drive an additional USD 0.7 billion. Asia-Pacific will remain the fastest-growing region, led by strong food manufacturing infrastructure.

Between 2020 and 2024, edible shrink tunnel systems gained momentum as eco-friendly packaging became central to manufacturing. Automation and food-grade biopolymer films strengthened adoption across bakery, dairy, and pharmaceutical applications.

By 2035, the market will reach USD 2.3 billion with increasing integration of smart heating control, flexible tunnel design, and hybrid power systems. Asia-Pacific and Europe will drive eco-friendly packaging upgrades, while the USA focuses on throughput and food safety compliance.

Rising consumer demand for biodegradable and edible packaging materials drives growth. Edible shrink tunnels are gaining traction for sealing and coating food items with safe, heat-responsive films.

Food manufacturers prioritize packaging that maintains freshness while reducing waste. The integration of electric and steam heating systems improves performance while meeting sustainability mandates, promoting adoption globally.

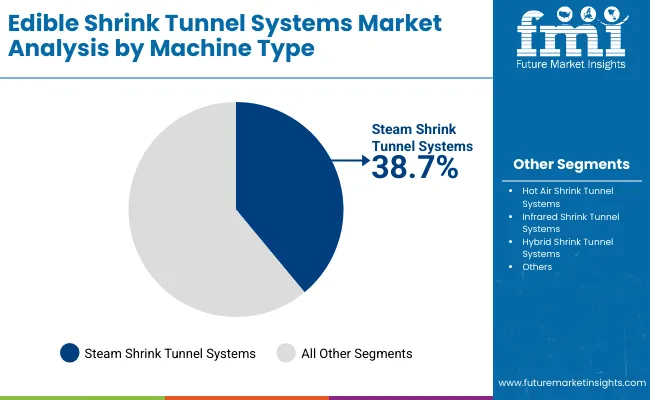

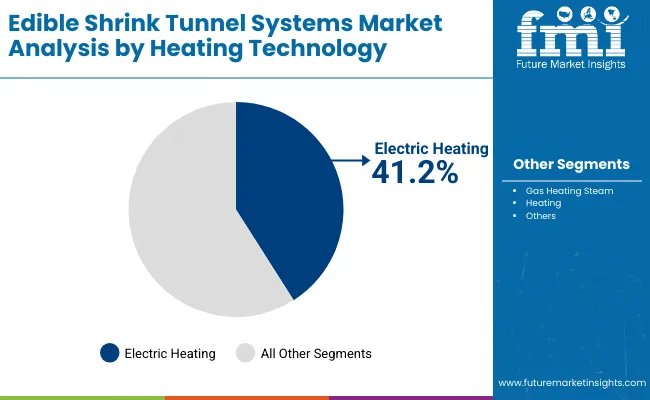

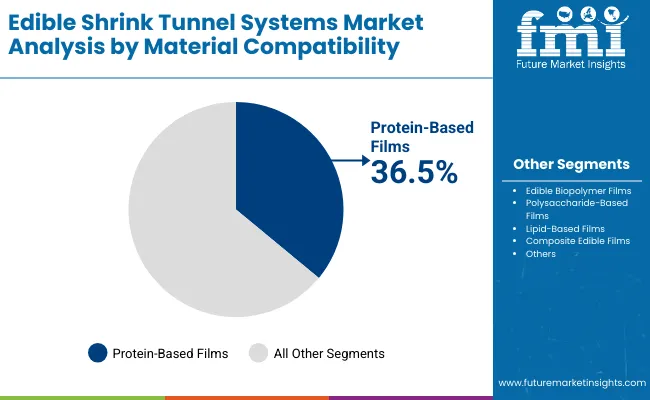

The market is segmented by machine type, heating technology, material compatibility, end-use industry, and region. Machine types include steam, hot air, infrared, and hybrid tunnel systems. Heating technologies comprise electric, gas, and steam heating. Material compatibility covers edible biopolymers, proteins, polysaccharides, and composite films. Key end-use industries are food and beverages, pharmaceuticals, bakery, and dairy.

Steam shrink tunnels will hold a 38.7% share in 2025 due to their uniform sealing efficiency and versatility across edible films. These systems reduce product deformation and ensure consistent shrink quality.

By 2035, automation, digital temperature control, and hybrid tunnel design will enhance steam systems’ precision for small-scale and industrial users alike.

Electric heating will capture a 41.2% share in 2025, favored for energy efficiency and environmental compliance. It eliminates combustion emissions while providing accurate heat control for edible coatings.

Ongoing developments in smart sensor integration and renewable power compatibility will strengthen electric heating’s dominance.

Protein-based films will account for 36.5% share in 2025, used widely for edible coatings in bakery and confectionery applications. These films offer superior flexibility and shrink performance.

Future innovations in biodegradable blends and allergen-free formulations will expand adoption across pharmaceutical and food sectors.

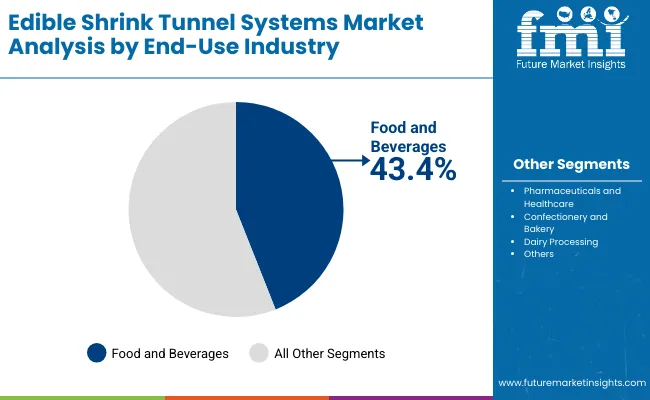

The food and beverage segment will dominate with a 43.4% share in 2025, driven by edible coating applications in meat, bakery, and confectionery.

Automation in food packaging lines and hygiene compliance will accelerate deployment across major production facilities by 2035.

Increased sustainability regulations and adoption of biodegradable packaging propel demand. Manufacturers focus on edible coatings that enhance shelf life while eliminating plastic waste.

High system costs and limited awareness among small manufacturers hinder penetration in developing economies.

Rising demand for automated shrink tunnels compatible with biodegradable and edible films creates major growth potential.

Key trends include hybrid heating systems, edible polymer innovations, and IoT-based shrink control systems. Companies are developing compact tunnels for small-batch production lines.

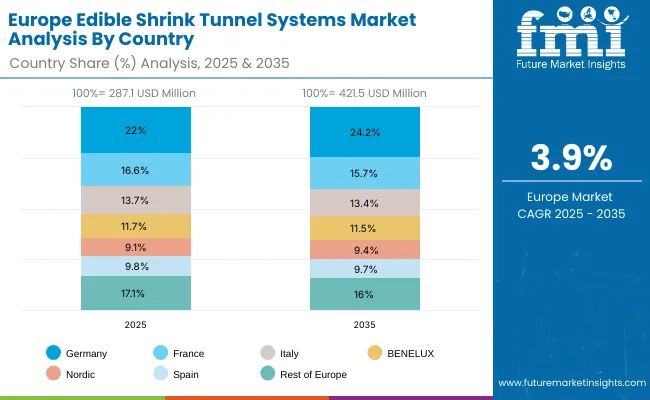

The global edible shrink tunnel systems market is expanding rapidly as sustainable food packaging practices gain traction across major economies. Asia-Pacific leads adoption, supported by modernization in food processing and the use of biodegradable films, while North America prioritizes automation and efficiency upgrades. Europe focuses on R&D and sustainable material innovation under strict regulatory standards. Global manufacturers are investing in edible film technologies, energy-efficient designs, and smart automation to enhance productivity and reduce environmental impact.

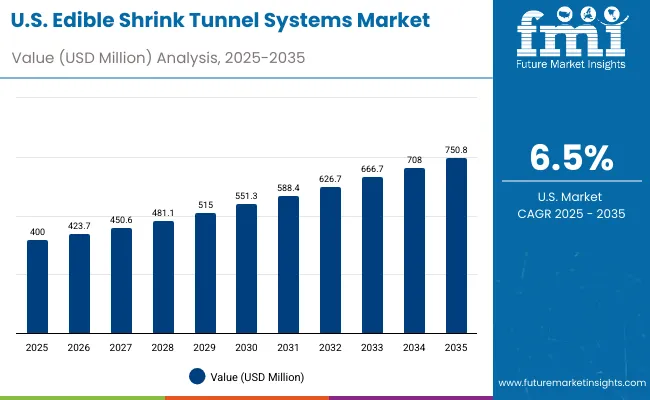

The USA market will grow at a CAGR of 6.5% from 2025 to 2035, driven by rising adoption of smart automation in the food packaging industry. Increasing demand for eco-friendly coating and edible shrink film equipment is boosting market expansion. The bakery, dairy, and processed food sectors are key growth drivers, integrating advanced shrink systems to improve efficiency and compliance. FDA packaging standards are further reinforcing investment in sustainable, precision-engineered tunnel systems.

Germany will expand at a CAGR of 6.2%, supported by its global leadership in packaging machinery exports. Rapid adoption of biopolymer and edible films is enhancing the transition toward sustainable shrink systems. R&D initiatives in edible shrink material innovation are accelerating, while automation and sensor-based process control are improving output consistency. Germany’s emphasis on eco-friendly manufacturing strengthens its market position in the European edible packaging sector.

The UK market will grow at a CAGR of 6.3%, with a strong focus on biodegradable packaging solutions for ready meals and bakery products. Clean-label and sustainability initiatives are stimulating demand for edible shrink tunnel systems. Automation in bakery and convenience food packaging is rising as labour efficiency gains priority. Local R&D efforts, supported by government sustainability incentives, are fostering innovation in edible film integration and equipment design.

China will grow at a CAGR of 6.4%, driven by extensive upgrades in food manufacturing and packaging facilities. The government’s focus on sustainable production and circular economy policies is increasing investment in edible shrink film technology. Dairy, meat, and beverage sectors are emerging as key adopters of automated tunnel systems. Domestic manufacturers are expanding their presence through cost-efficient, energy-saving, and digitally controlled machinery.

India will grow at a CAGR of 6.3%, propelled by the rapid modernization of food processing and dairy packaging facilities. Energy-efficient shrink tunnels are gaining popularity among mid-scale producers aiming to reduce operational costs. Government initiatives promoting sustainable packaging and export competitiveness are driving market development. Local machinery manufacturers are investing in automation and edible film integration to strengthen export capabilities in the global packaging equipment market.

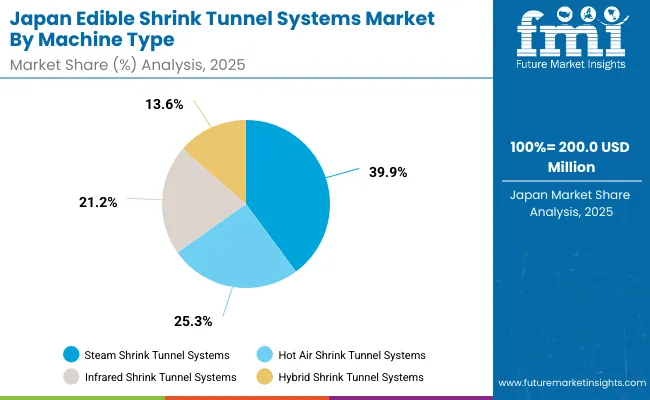

Japan will grow at a CAGR of 6.9%, driven by technological innovation, high-precision automation, and advanced edible film research. Compact, space-efficient tunnel systems are favored in Japan’s urban production facilities. Development of next-generation edible films for bakery and confectionery products is intensifying. Local manufacturers are expanding exports of small-scale tunnel systems optimized for hygiene, energy savings, and precision control.

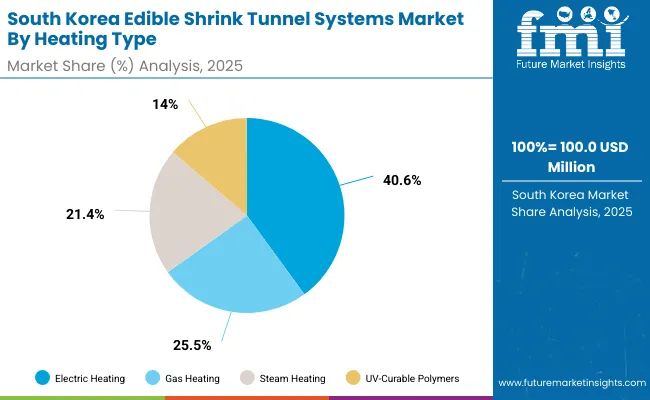

South Korea will lead with a CAGR of 7.0%, supported by automation in food, cosmetics, and confectionery packaging. The rise of high-speed hybrid shrink systems with smart control features is enhancing operational performance. Integration of edible coating technology is expanding in both domestic and export packaging applications. The focus on smart energy management and sustainable packaging materials positions South Korea as a regional innovator in shrink tunnel system development.

Japan’s edible shrink tunnel systems market, valued at USD 200.0 million in 2025, is led by steam shrink tunnel systems favoured for precision, uniform heat distribution, and suitability for biodegradable films. Hot air shrink systems follow, driven by efficiency and adaptability across food-grade packaging lines. Infrared shrink systems support rapid heating applications, while hybrid shrink tunnels integrate multiple heating methods for performance optimization. Japan’s focus on automation and eco-packaging technologies underpins this segment’s steady advancement.

South Korea’s edible shrink tunnel systems market, valued at USD 100.0 million in 2025, is dominated by electric heating solutions due to energy efficiency and clean operation. Gas heating remains vital for large-scale production requiring higher thermal throughput. Steam heating is adopted in applications demanding gentle yet consistent heat for edible film sealing. South Korea’s rising investment in food-grade machinery and adoption of sustainable packaging drive technological integration and precision control within the heating systems market.

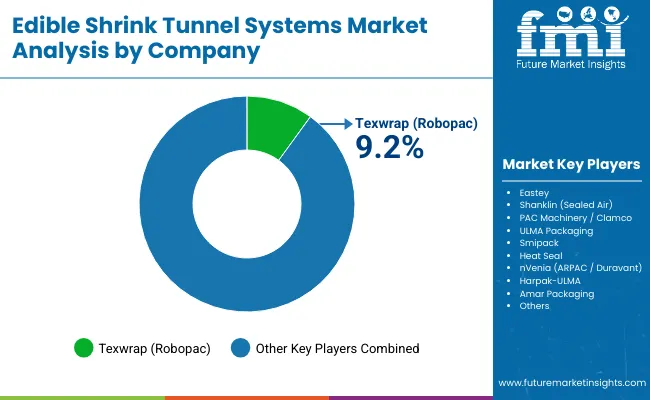

The market is moderately fragmented, with key players Texwrap (Robopac), Eastey, Shanklin (Sealed Air), PAC Machinery, ULMA Packaging, Smipack, Heat Seal, nVenia (ARPAC/Duravant), Harpak-ULMA, and Amar Packaging.

Texwrap and Shanklin dominate through global presence and continuous innovation. nVenia (Duravant) focuses on automation and hybrid heating. Amar Packaging and Smipack cater to compact edible packaging systems in Asia. Competitive priorities include sustainability, operational precision, and integration flexibility.

Key Developments of Edible Shrink Tunnel Systems Market

| Item | Value |

|---|---|

| Quantitative Units | USD 1.2 Billion |

| By Machine Type | Steam, Hot Air, Infrared, Hybrid Shrink Tunnel Systems |

| By Heating Technology | Electric, Gas, Steam Heating |

| By Material Compatibility | Biopolymers, Protein, Polysaccharide, Lipid, Composite Films |

| By End-Use Industry | Food & Beverages, Pharmaceuticals, Bakery, Dairy |

| Key Companies Profiled | Texwrap (Robopac), Eastey, Shanklin (Sealed Air), PAC Machinery, ULMA Packaging, Smipack, Heat Seal, nVenia (ARPAC/ Duravant), Harpak -ULMA, Amar Packaging |

| Additional Attributes | Growth driven by biodegradable edible packaging trends, automation upgrades, and hybrid heating systems. |

The market will be valued at USD 1.2 billion in 2025.

The market will reach USD 2.3 billion by 2035.

The market will grow at a CAGR of 6.6% during 2025-2035.

Steam shrink tunnel systems will lead with a 38.7% share in 2025.

Electric heating will dominate with a 41.2% share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Shrink Tunnel Machine Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Shrink Wrapping Machines Market Size and Share Forecast Outlook 2025 to 2035

Shrink Wrapper Market Size and Share Forecast Outlook 2025 to 2035

Edible Oil Cans Market Size and Share Forecast Outlook 2025 to 2035

Shrink Sleeve Label Applicator Market Size and Share Forecast Outlook 2025 to 2035

Tunnel Tray Market Size and Share Forecast Outlook 2025 to 2035

Edible Animal Fat Market Size and Share Forecast Outlook 2025 to 2035

Edible Water Pods Market Size and Share Forecast Outlook 2025 to 2035

Edible Cups Market Size and Share Forecast Outlook 2025 to 2035

Edible Beauty Infusions Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Shrink Sleeve Labeling Machine Size and Share Forecast Outlook 2025 to 2035

Edible Nuts Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Tunneling Equipment Market Size and Share Forecast Outlook 2025 to 2035

Shrink - Sleeve Wrapping Machinery Market Size and Share Forecast Outlook 2025 to 2035

Edible Collagen Casing Market Size and Share Forecast Outlook 2025 to 2035

Shrink Label Machine Market Size and Share Forecast Outlook 2025 to 2035

Systems Administration Management Tools Market Size and Share Forecast Outlook 2025 to 2035

Tunnel Visibility Monitors Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Edible Seaweed Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Edible Oils and Fats Market Analysis by Product Type, Source, and Distribution Channel Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA